Professional Documents

Culture Documents

Share Based Compensation Cheat Sheet

Share Based Compensation Cheat Sheet

Uploaded by

JaneCopyright:

Available Formats

You might also like

- Powered by Koffee (EOQ + ROP)Document2 pagesPowered by Koffee (EOQ + ROP)Abeer SaadedineNo ratings yet

- Investment in Debt SecuritiesDocument31 pagesInvestment in Debt SecuritiesJohn Francis Idanan100% (1)

- Lums Accounting & Finance (Acct 370) : Autumn Session (2021)Document4 pagesLums Accounting & Finance (Acct 370) : Autumn Session (2021)Ahmed SamadNo ratings yet

- Costco AnswerDocument12 pagesCostco Answeryoutube2301100% (1)

- CRM in Sustainable Customer Loyalty Cathay PacificDocument19 pagesCRM in Sustainable Customer Loyalty Cathay PacificHTMi Switzerland100% (2)

- Share Based Compensation LectureDocument2 pagesShare Based Compensation LectureKimberly AsuncionNo ratings yet

- Chapter 12 - Revenue Recognition: Revenue From Contracts With CustomerDocument21 pagesChapter 12 - Revenue Recognition: Revenue From Contracts With CustomerCruxzelle BajoNo ratings yet

- Advanced Acctg & Financial ReportingDocument6 pagesAdvanced Acctg & Financial ReportingMa. Cristy BroncateNo ratings yet

- Module 12 - Relevant Costing and Short-Term Decision MakingDocument8 pagesModule 12 - Relevant Costing and Short-Term Decision MakingAndrea ValdezNo ratings yet

- Pfrs For Smes Full PFRS: Same Same Same SameDocument14 pagesPfrs For Smes Full PFRS: Same Same Same SameAnthon GarciaNo ratings yet

- Pas 2Document2 pagesPas 2MMBRIMBAPNo ratings yet

- Chapter 18Document3 pagesChapter 18PATRICIA PEREZNo ratings yet

- FAR 006 Summary Notes - Property, Plant & EquipmentDocument9 pagesFAR 006 Summary Notes - Property, Plant & EquipmentMarynelle Labrador SevillaNo ratings yet

- IFRS 02 (Self Notes - MI)Document4 pagesIFRS 02 (Self Notes - MI)Mujahid IqbalNo ratings yet

- Differential-Cost-Analysis FinalDocument5 pagesDifferential-Cost-Analysis FinalRoshane Deil PascualNo ratings yet

- MAS-04 Relevant CostingDocument10 pagesMAS-04 Relevant CostingPaupauNo ratings yet

- Afar - Revenue RecognitionDocument3 pagesAfar - Revenue Recognitionfarah mae raquinioNo ratings yet

- IND As 16 Revision Notes HWDocument6 pagesIND As 16 Revision Notes HWSuman SharmaNo ratings yet

- Share Based PatmentDocument36 pagesShare Based PatmentHimanshu GaurNo ratings yet

- Lesson 08. Franchising - Sample ProblemsDocument7 pagesLesson 08. Franchising - Sample ProblemsHayes HareNo ratings yet

- Sme VS PFRSDocument17 pagesSme VS PFRSDesai SarvidaNo ratings yet

- PFRS 15Document2 pagesPFRS 15Astronomy SpacefieldNo ratings yet

- Chap 13Document48 pagesChap 13Đỗ Thụy Minh ThưNo ratings yet

- Module 008 Relevant CostingDocument22 pagesModule 008 Relevant CostinggagahejuniorNo ratings yet

- AC 2102 Intermediate Accounting 2Document5 pagesAC 2102 Intermediate Accounting 2conniNo ratings yet

- Concept of Variable Unit-Linked PDFDocument38 pagesConcept of Variable Unit-Linked PDFKae DNo ratings yet

- Afar.2905 Business Combination Mergers PDFDocument5 pagesAfar.2905 Business Combination Mergers PDFCyrille Keith FranciscoNo ratings yet

- Differential Accounting InformationDocument13 pagesDifferential Accounting InformationEfi Setia NingsihNo ratings yet

- IntangiblesDocument4 pagesIntangiblesasjadzakirNo ratings yet

- AttachmentDocument23 pagesAttachmentAbegail Cabero100% (1)

- Risk in Financial Services Ch3Document29 pagesRisk in Financial Services Ch3Shilpi JainNo ratings yet

- Afar Notes by DR Ferrer Summary Bs AccountancyDocument22 pagesAfar Notes by DR Ferrer Summary Bs AccountancyAnne Echavez Pasco100% (2)

- AS 10 - Property Plant and Equipment: Recognition CriteriaDocument5 pagesAS 10 - Property Plant and Equipment: Recognition CriteriaAshutosh shriwasNo ratings yet

- Learning Packet 4 EditedDocument7 pagesLearning Packet 4 EditedNatalie SerranoNo ratings yet

- Chapter 05Document18 pagesChapter 05Muhammad IrfanNo ratings yet

- Audit 2 - Concept Map For InvestmentsDocument4 pagesAudit 2 - Concept Map For InvestmentsPrecious Recede100% (1)

- Types of Financial Instrument: Corporate Financial Strategy 4th Edition DR Ruth BenderDocument16 pagesTypes of Financial Instrument: Corporate Financial Strategy 4th Edition DR Ruth BenderAin roseNo ratings yet

- Revenue (Quiz)Document4 pagesRevenue (Quiz)Nguyen Lam SonNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WaskathpremsNo ratings yet

- AFA - 4e - PPT - Chap13 (For Students)Document23 pagesAFA - 4e - PPT - Chap13 (For Students)Cẩm Tú NguyễnNo ratings yet

- Module 15 - Share-Based PaymentDocument4 pagesModule 15 - Share-Based PaymentLui100% (3)

- Accounting For Investment in O/SDocument4 pagesAccounting For Investment in O/SchinchangeNo ratings yet

- Incremental Analysis/Relevant Costing: Page - 35Document2 pagesIncremental Analysis/Relevant Costing: Page - 35colNo ratings yet

- COSTCON - Cost - Concepts, Classifications, and Cost Behavior AnalysisDocument2 pagesCOSTCON - Cost - Concepts, Classifications, and Cost Behavior AnalysisHoney MuliNo ratings yet

- Remuneration System ProblemsDocument5 pagesRemuneration System Problemsrajukumar908512No ratings yet

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAPDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAPishakc20070% (1)

- Afar Notes by DR FerrerpdfDocument21 pagesAfar Notes by DR FerrerpdfDan danNo ratings yet

- Accounting For Bonds PayableDocument31 pagesAccounting For Bonds PayableJon Christian Miranda100% (2)

- Intacc NotesDocument10 pagesIntacc NotesIris FenelleNo ratings yet

- Seminar 1 - SBP & Employee BenefitsDocument66 pagesSeminar 1 - SBP & Employee BenefitsCeline LowNo ratings yet

- Ias 16: Poperty, Plant, and Equipment Objective:: Measurement at RecognitionDocument1 pageIas 16: Poperty, Plant, and Equipment Objective:: Measurement at RecognitionJenne LeeNo ratings yet

- 12.concepts of Benefits and Deductibles - 1436525122Document6 pages12.concepts of Benefits and Deductibles - 1436525122nic315No ratings yet

- ACCTG 025 Module 1Document3 pagesACCTG 025 Module 1Yuan Kyle SantosNo ratings yet

- Ind AS 102Document86 pagesInd AS 102Deepika GuptaNo ratings yet

- Business Combinations: The New Basis, No Longer The PFRS 3Document7 pagesBusiness Combinations: The New Basis, No Longer The PFRS 3Live LoveNo ratings yet

- 04 Relevant CostingDocument5 pages04 Relevant CostingMarielle CastañedaNo ratings yet

- MEC 44 - Chapter 3 ReviewerDocument2 pagesMEC 44 - Chapter 3 ReviewerEg CachaperoNo ratings yet

- Joint Products / by Products: Accounting Decision MakingDocument16 pagesJoint Products / by Products: Accounting Decision MakingKaran KashyapNo ratings yet

- Nas 16Document33 pagesNas 16bhattag283No ratings yet

- FR Concept Book - Indas 102Document12 pagesFR Concept Book - Indas 102Shivaji hariNo ratings yet

- IFRS Vs GAAP 1Document12 pagesIFRS Vs GAAP 1Saad ElNo ratings yet

- Ia Notes-PayableDocument2 pagesIa Notes-PayableJhunnie LoriaNo ratings yet

- Handout AP 2301Document13 pagesHandout AP 2301Dyosa MeNo ratings yet

- Executive's Guide to Fair Value: Profiting from the New Valuation RulesFrom EverandExecutive's Guide to Fair Value: Profiting from the New Valuation RulesNo ratings yet

- Cheat Sheet Earnings Per ShareDocument2 pagesCheat Sheet Earnings Per ShareJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Going Concern"Document1 pageIntermediate Accounting 3 Reflection Paper: "Going Concern"JaneNo ratings yet

- Cheat Sheet BVPS: Lower RateDocument1 pageCheat Sheet BVPS: Lower RateJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Change"Document1 pageIntermediate Accounting 3 Reflection Paper: "Change"JaneNo ratings yet

- Intermediate Accounting 3 Reflection PaperDocument1 pageIntermediate Accounting 3 Reflection PaperJaneNo ratings yet

- Prior Period Error Effect in The Current Period AdjustmentDocument2 pagesPrior Period Error Effect in The Current Period AdjustmentJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Matching and Recognition"Document1 pageIntermediate Accounting 3 Reflection Paper: "Matching and Recognition"JaneNo ratings yet

- Activity On Religion DiscussionDocument2 pagesActivity On Religion DiscussionJaneNo ratings yet

- Buddhism: Submitted byDocument3 pagesBuddhism: Submitted byJaneNo ratings yet

- PPSA SummaryDocument18 pagesPPSA SummaryJane100% (1)

- Cost of Capital of ITCDocument24 pagesCost of Capital of ITCAyeesha K.s.No ratings yet

- Total Excess of Cost Over Book Value Acquired $4,000,000Document5 pagesTotal Excess of Cost Over Book Value Acquired $4,000,000SAHRINDA YUNIAWATINo ratings yet

- Auctions and The Price of ArtDocument25 pagesAuctions and The Price of ArtJonathan FeldmanNo ratings yet

- The Social Order of Markets - BeckertDocument32 pagesThe Social Order of Markets - BeckertVictor N. UrzuaNo ratings yet

- 43 - Trading With Candlesticks Supplementary Ebook PDFDocument169 pages43 - Trading With Candlesticks Supplementary Ebook PDFvisa707100% (4)

- Live: Exam Questions (Asset Disposal) 12 November 2014 Lesson DescriptionDocument5 pagesLive: Exam Questions (Asset Disposal) 12 November 2014 Lesson DescriptionsandiekaysNo ratings yet

- Jeff Bezoss FailureDocument4 pagesJeff Bezoss FailureMinh Thuy NguyenNo ratings yet

- E - Commerce Project PDFDocument33 pagesE - Commerce Project PDFniharika.nigam.2805100% (1)

- 2 - Revenue, Costs and Break EvenDocument3 pages2 - Revenue, Costs and Break EvenHadeel DossaNo ratings yet

- The Market Vendor Selling Strategies and Their Income Status in Poblacion Wet MarketDocument10 pagesThe Market Vendor Selling Strategies and Their Income Status in Poblacion Wet MarketEbyang LadishNo ratings yet

- Bollinger Bands RulesDocument2 pagesBollinger Bands RulesBalajii RangarajuNo ratings yet

- Will Mccafe Be The Next Starbucks 161206183147Document31 pagesWill Mccafe Be The Next Starbucks 161206183147Tariq KhanNo ratings yet

- Managerial Accounting 5Th Edition Jiambalvo Test Bank Full Chapter PDFDocument64 pagesManagerial Accounting 5Th Edition Jiambalvo Test Bank Full Chapter PDFNicholasJohnswjpn100% (17)

- Eco CH 1 BookDocument14 pagesEco CH 1 BookKhushi BothraNo ratings yet

- Technical TradingDocument9 pagesTechnical Tradingviníciusg_65No ratings yet

- Ichimoku Cloud Definition and UsesDocument9 pagesIchimoku Cloud Definition and Usesselozok1No ratings yet

- Chapter 461Document17 pagesChapter 461anithaivaturiNo ratings yet

- GBJRKDocument3 pagesGBJRKbakingcraft1No ratings yet

- 04ratio Question (Homework 3)Document7 pages04ratio Question (Homework 3)Nur AthirahNo ratings yet

- EY - NASSCOM - M&A Trends and Outlook - Technology Services VF - 0Document35 pagesEY - NASSCOM - M&A Trends and Outlook - Technology Services VF - 0Tejas JosephNo ratings yet

- Chapter 26 Acctg For Derivatives Hedging Transactions Part 3 Afar Part 2Document13 pagesChapter 26 Acctg For Derivatives Hedging Transactions Part 3 Afar Part 2Kathrina Roxas100% (1)

- Claim Ticket Voucher: NUMBER 002873270Document1 pageClaim Ticket Voucher: NUMBER 002873270Suzanne ThompsonNo ratings yet

- Financial Ratio AnalysisDocument10 pagesFinancial Ratio AnalysisSehat TanNo ratings yet

- C4 - Advanced Taxation - SyllabusDocument6 pagesC4 - Advanced Taxation - SyllabusEmmaNo ratings yet

- Placement Class - 2 (Math) Dharmendra SirDocument10 pagesPlacement Class - 2 (Math) Dharmendra SirJason WestNo ratings yet

- Chapter 16: Fixed Income Portfolio ManagementDocument20 pagesChapter 16: Fixed Income Portfolio ManagementSilviu TrebuianNo ratings yet

Share Based Compensation Cheat Sheet

Share Based Compensation Cheat Sheet

Uploaded by

JaneOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Share Based Compensation Cheat Sheet

Share Based Compensation Cheat Sheet

Uploaded by

JaneCopyright:

Available Formats

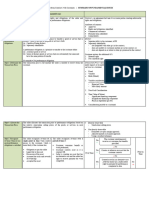

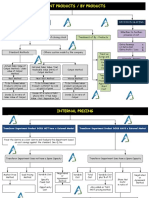

Share Based Payments Cheat Sheet

Share Options Share Based Appreciation

Applicable Standard PFRS 2

Fair Value Definition The amount for which an asset could be exchanged, a liability settled

or an equity instrument granted could be exchanged, between

knowledgeable, willing parties in an arm`s length transaction

(this definition is different from the FV definition in PFRS 13)

Initial Measurement and Hierarchy Hierarchy

Subsequent Measurement 1. Fair Value 1. Fair Value

2. Similar 2. Similar

3. Pricing Models 3. Pricing Models

4. Intrinsic Value (Market Price – Option 4. Intrinsic Value (Market

Price) Price – Predetermined

Price)

Note:

1. Intrinsic Value Method

is Predominantly Used

because the Value of the

Compensation is difficult

to determine

2. If silent the

predetermined price is

the price at grant date

If Vest Immediately Recognize Everything as Expense

If subject to Vesting Conditions Allocate, and use your prior knowledge for Accounting Changes in

Estimates (Account Prospectively)

When the vesting period has Intrinsic Value Fair Value Method Whether Intrinsic or Fair

been met, and the company Method Value Method

uses Not Applicable,

Differences because the FV of The changes in the

between intrinsic the Share Based appreciation of the rights

value x Compensation is might reduce the accrued

outstanding share determined salaries payable to 0

options shall be @grant date, amount causing reversal

recognized as subsequent of the previous salaries

either expense or changes is ignored recognized

reversal unless there is

depending on the modification and

changes in intrinsic the same is

value beneficial

If Vesting was Accelerated Recognize all remaining salaries to be recognized

Modification Beneficial – Account Separately

Not Beneficial – Ignore

There will be 2 entries here

1. For the original Share Options

2. For the Modifications (provided beneficial)

Cancellation The accumulated share options Close the Accrued

outstanding will be closed to Share Salaries account

Premium

Exercise of Right Share Premium Determination Close the Accrued

if Share Options If Share Cancelled Salaries Account and

Exercised A. Cancel the Share Credit the Cash, in case

Options the payment exceeds the

1. FV Method Outstanding Accrued Salaries

(Accumulated B. Any Excess of Account the balance will

Share Options Cash paid from the be closed to the Salaries

Outstanding + Share Options Expense

(Exercise Price - Outstanding will be

Par Value) x Share treated as

Options Additional Salaries

Outstanding

2. Intrinsic Value

Method

(Market Value –

Par Value) Share

Options

Outstanding

Share and Cash Alternative

A. If the entity has choice – no special accounting needed because the entity will either treat is

as liability or asset but not both

B. Other party has choice – the liability must be separated from the equity component, the

equity component is the residual amount

1. Separate the equity component and allocate over the vesting period

2. The accrued salaries will be re-measured each year depending on the intrinsic

value (Market Value – Predetermined Rate)

Share Based Payment Transaction

Hierarchy

1. FV of Asset Acquired

2. FV of Equity Instrument

3. PAR of Equity Instrument

You might also like

- Powered by Koffee (EOQ + ROP)Document2 pagesPowered by Koffee (EOQ + ROP)Abeer SaadedineNo ratings yet

- Investment in Debt SecuritiesDocument31 pagesInvestment in Debt SecuritiesJohn Francis Idanan100% (1)

- Lums Accounting & Finance (Acct 370) : Autumn Session (2021)Document4 pagesLums Accounting & Finance (Acct 370) : Autumn Session (2021)Ahmed SamadNo ratings yet

- Costco AnswerDocument12 pagesCostco Answeryoutube2301100% (1)

- CRM in Sustainable Customer Loyalty Cathay PacificDocument19 pagesCRM in Sustainable Customer Loyalty Cathay PacificHTMi Switzerland100% (2)

- Share Based Compensation LectureDocument2 pagesShare Based Compensation LectureKimberly AsuncionNo ratings yet

- Chapter 12 - Revenue Recognition: Revenue From Contracts With CustomerDocument21 pagesChapter 12 - Revenue Recognition: Revenue From Contracts With CustomerCruxzelle BajoNo ratings yet

- Advanced Acctg & Financial ReportingDocument6 pagesAdvanced Acctg & Financial ReportingMa. Cristy BroncateNo ratings yet

- Module 12 - Relevant Costing and Short-Term Decision MakingDocument8 pagesModule 12 - Relevant Costing and Short-Term Decision MakingAndrea ValdezNo ratings yet

- Pfrs For Smes Full PFRS: Same Same Same SameDocument14 pagesPfrs For Smes Full PFRS: Same Same Same SameAnthon GarciaNo ratings yet

- Pas 2Document2 pagesPas 2MMBRIMBAPNo ratings yet

- Chapter 18Document3 pagesChapter 18PATRICIA PEREZNo ratings yet

- FAR 006 Summary Notes - Property, Plant & EquipmentDocument9 pagesFAR 006 Summary Notes - Property, Plant & EquipmentMarynelle Labrador SevillaNo ratings yet

- IFRS 02 (Self Notes - MI)Document4 pagesIFRS 02 (Self Notes - MI)Mujahid IqbalNo ratings yet

- Differential-Cost-Analysis FinalDocument5 pagesDifferential-Cost-Analysis FinalRoshane Deil PascualNo ratings yet

- MAS-04 Relevant CostingDocument10 pagesMAS-04 Relevant CostingPaupauNo ratings yet

- Afar - Revenue RecognitionDocument3 pagesAfar - Revenue Recognitionfarah mae raquinioNo ratings yet

- IND As 16 Revision Notes HWDocument6 pagesIND As 16 Revision Notes HWSuman SharmaNo ratings yet

- Share Based PatmentDocument36 pagesShare Based PatmentHimanshu GaurNo ratings yet

- Lesson 08. Franchising - Sample ProblemsDocument7 pagesLesson 08. Franchising - Sample ProblemsHayes HareNo ratings yet

- Sme VS PFRSDocument17 pagesSme VS PFRSDesai SarvidaNo ratings yet

- PFRS 15Document2 pagesPFRS 15Astronomy SpacefieldNo ratings yet

- Chap 13Document48 pagesChap 13Đỗ Thụy Minh ThưNo ratings yet

- Module 008 Relevant CostingDocument22 pagesModule 008 Relevant CostinggagahejuniorNo ratings yet

- AC 2102 Intermediate Accounting 2Document5 pagesAC 2102 Intermediate Accounting 2conniNo ratings yet

- Concept of Variable Unit-Linked PDFDocument38 pagesConcept of Variable Unit-Linked PDFKae DNo ratings yet

- Afar.2905 Business Combination Mergers PDFDocument5 pagesAfar.2905 Business Combination Mergers PDFCyrille Keith FranciscoNo ratings yet

- Differential Accounting InformationDocument13 pagesDifferential Accounting InformationEfi Setia NingsihNo ratings yet

- IntangiblesDocument4 pagesIntangiblesasjadzakirNo ratings yet

- AttachmentDocument23 pagesAttachmentAbegail Cabero100% (1)

- Risk in Financial Services Ch3Document29 pagesRisk in Financial Services Ch3Shilpi JainNo ratings yet

- Afar Notes by DR Ferrer Summary Bs AccountancyDocument22 pagesAfar Notes by DR Ferrer Summary Bs AccountancyAnne Echavez Pasco100% (2)

- AS 10 - Property Plant and Equipment: Recognition CriteriaDocument5 pagesAS 10 - Property Plant and Equipment: Recognition CriteriaAshutosh shriwasNo ratings yet

- Learning Packet 4 EditedDocument7 pagesLearning Packet 4 EditedNatalie SerranoNo ratings yet

- Chapter 05Document18 pagesChapter 05Muhammad IrfanNo ratings yet

- Audit 2 - Concept Map For InvestmentsDocument4 pagesAudit 2 - Concept Map For InvestmentsPrecious Recede100% (1)

- Types of Financial Instrument: Corporate Financial Strategy 4th Edition DR Ruth BenderDocument16 pagesTypes of Financial Instrument: Corporate Financial Strategy 4th Edition DR Ruth BenderAin roseNo ratings yet

- Revenue (Quiz)Document4 pagesRevenue (Quiz)Nguyen Lam SonNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WaskathpremsNo ratings yet

- AFA - 4e - PPT - Chap13 (For Students)Document23 pagesAFA - 4e - PPT - Chap13 (For Students)Cẩm Tú NguyễnNo ratings yet

- Module 15 - Share-Based PaymentDocument4 pagesModule 15 - Share-Based PaymentLui100% (3)

- Accounting For Investment in O/SDocument4 pagesAccounting For Investment in O/SchinchangeNo ratings yet

- Incremental Analysis/Relevant Costing: Page - 35Document2 pagesIncremental Analysis/Relevant Costing: Page - 35colNo ratings yet

- COSTCON - Cost - Concepts, Classifications, and Cost Behavior AnalysisDocument2 pagesCOSTCON - Cost - Concepts, Classifications, and Cost Behavior AnalysisHoney MuliNo ratings yet

- Remuneration System ProblemsDocument5 pagesRemuneration System Problemsrajukumar908512No ratings yet

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAPDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAPishakc20070% (1)

- Afar Notes by DR FerrerpdfDocument21 pagesAfar Notes by DR FerrerpdfDan danNo ratings yet

- Accounting For Bonds PayableDocument31 pagesAccounting For Bonds PayableJon Christian Miranda100% (2)

- Intacc NotesDocument10 pagesIntacc NotesIris FenelleNo ratings yet

- Seminar 1 - SBP & Employee BenefitsDocument66 pagesSeminar 1 - SBP & Employee BenefitsCeline LowNo ratings yet

- Ias 16: Poperty, Plant, and Equipment Objective:: Measurement at RecognitionDocument1 pageIas 16: Poperty, Plant, and Equipment Objective:: Measurement at RecognitionJenne LeeNo ratings yet

- 12.concepts of Benefits and Deductibles - 1436525122Document6 pages12.concepts of Benefits and Deductibles - 1436525122nic315No ratings yet

- ACCTG 025 Module 1Document3 pagesACCTG 025 Module 1Yuan Kyle SantosNo ratings yet

- Ind AS 102Document86 pagesInd AS 102Deepika GuptaNo ratings yet

- Business Combinations: The New Basis, No Longer The PFRS 3Document7 pagesBusiness Combinations: The New Basis, No Longer The PFRS 3Live LoveNo ratings yet

- 04 Relevant CostingDocument5 pages04 Relevant CostingMarielle CastañedaNo ratings yet

- MEC 44 - Chapter 3 ReviewerDocument2 pagesMEC 44 - Chapter 3 ReviewerEg CachaperoNo ratings yet

- Joint Products / by Products: Accounting Decision MakingDocument16 pagesJoint Products / by Products: Accounting Decision MakingKaran KashyapNo ratings yet

- Nas 16Document33 pagesNas 16bhattag283No ratings yet

- FR Concept Book - Indas 102Document12 pagesFR Concept Book - Indas 102Shivaji hariNo ratings yet

- IFRS Vs GAAP 1Document12 pagesIFRS Vs GAAP 1Saad ElNo ratings yet

- Ia Notes-PayableDocument2 pagesIa Notes-PayableJhunnie LoriaNo ratings yet

- Handout AP 2301Document13 pagesHandout AP 2301Dyosa MeNo ratings yet

- Executive's Guide to Fair Value: Profiting from the New Valuation RulesFrom EverandExecutive's Guide to Fair Value: Profiting from the New Valuation RulesNo ratings yet

- Cheat Sheet Earnings Per ShareDocument2 pagesCheat Sheet Earnings Per ShareJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Going Concern"Document1 pageIntermediate Accounting 3 Reflection Paper: "Going Concern"JaneNo ratings yet

- Cheat Sheet BVPS: Lower RateDocument1 pageCheat Sheet BVPS: Lower RateJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Change"Document1 pageIntermediate Accounting 3 Reflection Paper: "Change"JaneNo ratings yet

- Intermediate Accounting 3 Reflection PaperDocument1 pageIntermediate Accounting 3 Reflection PaperJaneNo ratings yet

- Prior Period Error Effect in The Current Period AdjustmentDocument2 pagesPrior Period Error Effect in The Current Period AdjustmentJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Matching and Recognition"Document1 pageIntermediate Accounting 3 Reflection Paper: "Matching and Recognition"JaneNo ratings yet

- Activity On Religion DiscussionDocument2 pagesActivity On Religion DiscussionJaneNo ratings yet

- Buddhism: Submitted byDocument3 pagesBuddhism: Submitted byJaneNo ratings yet

- PPSA SummaryDocument18 pagesPPSA SummaryJane100% (1)

- Cost of Capital of ITCDocument24 pagesCost of Capital of ITCAyeesha K.s.No ratings yet

- Total Excess of Cost Over Book Value Acquired $4,000,000Document5 pagesTotal Excess of Cost Over Book Value Acquired $4,000,000SAHRINDA YUNIAWATINo ratings yet

- Auctions and The Price of ArtDocument25 pagesAuctions and The Price of ArtJonathan FeldmanNo ratings yet

- The Social Order of Markets - BeckertDocument32 pagesThe Social Order of Markets - BeckertVictor N. UrzuaNo ratings yet

- 43 - Trading With Candlesticks Supplementary Ebook PDFDocument169 pages43 - Trading With Candlesticks Supplementary Ebook PDFvisa707100% (4)

- Live: Exam Questions (Asset Disposal) 12 November 2014 Lesson DescriptionDocument5 pagesLive: Exam Questions (Asset Disposal) 12 November 2014 Lesson DescriptionsandiekaysNo ratings yet

- Jeff Bezoss FailureDocument4 pagesJeff Bezoss FailureMinh Thuy NguyenNo ratings yet

- E - Commerce Project PDFDocument33 pagesE - Commerce Project PDFniharika.nigam.2805100% (1)

- 2 - Revenue, Costs and Break EvenDocument3 pages2 - Revenue, Costs and Break EvenHadeel DossaNo ratings yet

- The Market Vendor Selling Strategies and Their Income Status in Poblacion Wet MarketDocument10 pagesThe Market Vendor Selling Strategies and Their Income Status in Poblacion Wet MarketEbyang LadishNo ratings yet

- Bollinger Bands RulesDocument2 pagesBollinger Bands RulesBalajii RangarajuNo ratings yet

- Will Mccafe Be The Next Starbucks 161206183147Document31 pagesWill Mccafe Be The Next Starbucks 161206183147Tariq KhanNo ratings yet

- Managerial Accounting 5Th Edition Jiambalvo Test Bank Full Chapter PDFDocument64 pagesManagerial Accounting 5Th Edition Jiambalvo Test Bank Full Chapter PDFNicholasJohnswjpn100% (17)

- Eco CH 1 BookDocument14 pagesEco CH 1 BookKhushi BothraNo ratings yet

- Technical TradingDocument9 pagesTechnical Tradingviníciusg_65No ratings yet

- Ichimoku Cloud Definition and UsesDocument9 pagesIchimoku Cloud Definition and Usesselozok1No ratings yet

- Chapter 461Document17 pagesChapter 461anithaivaturiNo ratings yet

- GBJRKDocument3 pagesGBJRKbakingcraft1No ratings yet

- 04ratio Question (Homework 3)Document7 pages04ratio Question (Homework 3)Nur AthirahNo ratings yet

- EY - NASSCOM - M&A Trends and Outlook - Technology Services VF - 0Document35 pagesEY - NASSCOM - M&A Trends and Outlook - Technology Services VF - 0Tejas JosephNo ratings yet

- Chapter 26 Acctg For Derivatives Hedging Transactions Part 3 Afar Part 2Document13 pagesChapter 26 Acctg For Derivatives Hedging Transactions Part 3 Afar Part 2Kathrina Roxas100% (1)

- Claim Ticket Voucher: NUMBER 002873270Document1 pageClaim Ticket Voucher: NUMBER 002873270Suzanne ThompsonNo ratings yet

- Financial Ratio AnalysisDocument10 pagesFinancial Ratio AnalysisSehat TanNo ratings yet

- C4 - Advanced Taxation - SyllabusDocument6 pagesC4 - Advanced Taxation - SyllabusEmmaNo ratings yet

- Placement Class - 2 (Math) Dharmendra SirDocument10 pagesPlacement Class - 2 (Math) Dharmendra SirJason WestNo ratings yet

- Chapter 16: Fixed Income Portfolio ManagementDocument20 pagesChapter 16: Fixed Income Portfolio ManagementSilviu TrebuianNo ratings yet