Professional Documents

Culture Documents

Wilkerson Case

Wilkerson Case

Uploaded by

Chiara RibeiroOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wilkerson Case

Wilkerson Case

Uploaded by

Chiara RibeiroCopyright:

Available Formats

Wilkerson Company Case

a. On what counts the three products of Wilkerson are different?

Same equipment and labour were used for all the three products i.e. Valves, Pumps and Flow Controllers. The differences are listed below in a

table format. The products were produced to match customer shipping requirements.

Valves Pumps Flow Controllers

Components 4 different 5 components, but 10 components and

components, similar more labour

machined manufacturing compared to Valves

automatically process like valves and Pumps

Type of Product Standard, produced Shipped to Industrial More variety,

and shipped in large Product Distributors therefore more

lots production runs and

shipments

Market Higher Quality, Forced to match Prices recently were

Performance competitors did not prices of raised by 10%, this

engage in price competitors, Gross did not cause any

cutting, gross margins fell below change in Demand

margins maintained 20% (Company

at 35% planned for 30%)

b. Estimate the cost of three products as ABC method.

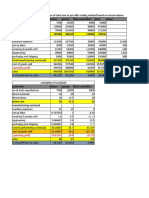

Exhibit 1: Operating Results

Sales $ 2,152,500.00

Direct Labour Expense $ 271,250.00

Direct Materials Expense $ 458,000.00

Manufacturing Overhead

Machine-related Expenses $ 336,000.00

Set up Labour $ 40,000.00

Receiving and Production Control $ 180,000.00

Engineering $ 100,000.00

Packaging and Shipping $ 150,000.00

Total Manufacturing Overhead $ 806,000.00

Gross Margin $ 617,250.00 29%

General, Selling & Admin Expense $ 559,650.00

Operating Income (pre-tax) $ 57,600.00 3%

Exhibit 2: Product Profitability Analysis (March 2000)

Valves Pumps Flow Controllers

Direct Labour Cost $ 10.00 $ 12.50 10

Exhibit 1: Operating Results

Sales $ 2,152,500.00

Direct Labour Expense $ 271,250.00

Direct Materials Expense $ 458,000.00

Manufacturing Overhead

Machine-related Expenses $ 336,000.00

Set up Labour $ 40,000.00

Receiving and Production Control $ 180,000.00

Engineering $ 100,000.00

Packaging and Shipping $ 150,000.00

Total Manufacturing Overhead $ 806,000.00

Gross Margin $ 617,250.00 29%

General, Selling & Admin Expense $ 559,650.00

Operating Income (pre-tax) $ 57,600.00 3%

Exhibit 2: Product Profitability Analysis (March 2000)

c. Why are cost estimates different?

The first estimate used is Traditional Costing method, which allocated the indirect costs as a percentage of labour costs. It did not take into

account the differences in producing the three different products but rather pools the indirect costs and allocates it to all products. In the ABC

method, every indirect cost is distributed according a criteria (mentioned in the above table) amongst the products. Therefore the cost estimates

for each product differ.

d. What limitations does the ABC estimates have?

Despite being one of the more accurate methods of cost estimation,

ABC is harder to implement and more resource and time consuming.

It requires more data to calculate which may not be readily available

It may not be as widely accepted as Traditional Costing methods

You might also like

- Math 101 WK 10 Case Study 1Document18 pagesMath 101 WK 10 Case Study 1api-532525221100% (1)

- Group 7B - Wilkerson Case SubmissionDocument5 pagesGroup 7B - Wilkerson Case SubmissionHardik Sanghavi100% (1)

- Wilkerson Company ABCDocument4 pagesWilkerson Company ABCrajyalakshmiNo ratings yet

- Case Pricing Options AtlanticDocument5 pagesCase Pricing Options Atlanticilltutmish100% (2)

- How Does Wilkerson's Existing Cost System Operate? Develop A Diagram To Show How Costs Flow From Factory Expense Accounts To ProductsDocument4 pagesHow Does Wilkerson's Existing Cost System Operate? Develop A Diagram To Show How Costs Flow From Factory Expense Accounts To ProductsKunal DhageNo ratings yet

- Anagene - Final Case AssignmentDocument19 pagesAnagene - Final Case AssignmentSantiago Fernandez Moreno100% (1)

- Business Accounting & Finance - A2 Assignment - Value Measurement - Workshop Presentation Assignment InstructionsDocument3 pagesBusiness Accounting & Finance - A2 Assignment - Value Measurement - Workshop Presentation Assignment InstructionsFebri AndikaNo ratings yet

- Group 8Document20 pagesGroup 8nirajNo ratings yet

- WilkDocument3 pagesWilkMohammed Maaz GabburNo ratings yet

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentRamalu Dinesh ReddyNo ratings yet

- Vyaderm Caseanalysis PDFDocument6 pagesVyaderm Caseanalysis PDFSahil Azher RashidNo ratings yet

- BerkshireDocument12 pagesBerkshireShubhangi Satpute50% (2)

- Hankuk Electronics Started Production On A Sophisticated New Smartphone Running The Android Operating System in January 2017Document3 pagesHankuk Electronics Started Production On A Sophisticated New Smartphone Running The Android Operating System in January 2017Elliot RichardNo ratings yet

- Seligram 2Document4 pagesSeligram 2Yvette YuanNo ratings yet

- Balakrishnan MGRL Solutions Ch14Document36 pagesBalakrishnan MGRL Solutions Ch14Aditya Krishna100% (1)

- Wilkerson Company Full ReportDocument9 pagesWilkerson Company Full ReportFatihahZainalLim100% (1)

- China Aviation Oil's Collapse - BEDocument20 pagesChina Aviation Oil's Collapse - BEBableen Johar100% (1)

- Business Plan PDFDocument20 pagesBusiness Plan PDFMarien100% (1)

- Wilkerson Case Study Final1Document5 pagesWilkerson Case Study Final1Swapan Kumar Saha100% (1)

- Wilkerson Company - Class PracticeDocument5 pagesWilkerson Company - Class PracticeYAKSH DODIANo ratings yet

- 05 Wilkerson Company Solution - StudentsDocument9 pages05 Wilkerson Company Solution - StudentsVinyabhooshan Bajpai PGP 2022-24 Batch100% (1)

- Wilkerson CompanyDocument2 pagesWilkerson CompanyAnkit VermaNo ratings yet

- Wilkerson Case Assignment Questions Part 1Document1 pageWilkerson Case Assignment Questions Part 1gangster91No ratings yet

- Wilkerson Company 3Document2 pagesWilkerson Company 3Mohammad RakivNo ratings yet

- Case AnalysisDocument3 pagesCase AnalysisBadri100% (2)

- Wilkerson - Case Study1 PDFDocument2 pagesWilkerson - Case Study1 PDFPavanNo ratings yet

- Berkshire Toy CompanyDocument25 pagesBerkshire Toy CompanyrodriguezlavNo ratings yet

- Case4 - Wilkerson CompanyDocument24 pagesCase4 - Wilkerson CompanyCik Beb Gojes100% (1)

- Bridgeton CaseDocument8 pagesBridgeton Casealiraza100% (2)

- Wilkerson CompanyDocument4 pagesWilkerson Companyabab1990No ratings yet

- Practice Exam 2020Document11 pagesPractice Exam 2020ana gvenetadzeNo ratings yet

- Wilkerson CaseDocument1 pageWilkerson CaseAna100% (1)

- Owens Minor Template - 2Document3 pagesOwens Minor Template - 2ckkuteesaNo ratings yet

- WilkersonDocument4 pagesWilkersonmayurmachoNo ratings yet

- Midwest Office Products - AHMDocument4 pagesMidwest Office Products - AHMMSINS SDEDNo ratings yet

- Case Case:: Colorscope, Colorscope, Inc. IncDocument4 pagesCase Case:: Colorscope, Colorscope, Inc. IncBalvinder SinghNo ratings yet

- Chemical Bank FinalDocument21 pagesChemical Bank FinalMonisha SharmaNo ratings yet

- Wilkerson Company ABC Cost System Exhibit 1.a Cost Pool Cost DriverDocument2 pagesWilkerson Company ABC Cost System Exhibit 1.a Cost Pool Cost DriverLeonardoGomez100% (1)

- Group 7 - Excel - Destin BrassDocument9 pagesGroup 7 - Excel - Destin BrassSaumya SahaNo ratings yet

- Management Accounting Wilkerson Company CasestudyDocument3 pagesManagement Accounting Wilkerson Company CasestudysamacsterNo ratings yet

- Plysar Case Team 8Document4 pagesPlysar Case Team 8atefzouariNo ratings yet

- Balakrishnan MGRL Solutions Ch12Document30 pagesBalakrishnan MGRL Solutions Ch12iluvumiNo ratings yet

- Dentin Brass Case Study3Document13 pagesDentin Brass Case Study3Hosein Rahmati100% (2)

- Seligram Summary DetailsDocument6 pagesSeligram Summary DetailsSachin MailareNo ratings yet

- FRI 7AM Final PPT DR ZalehaDocument16 pagesFRI 7AM Final PPT DR Zalehamanjoi74100% (1)

- International Accounting Group Assignment WilkersonDocument27 pagesInternational Accounting Group Assignment WilkersonToshimichi ItoNo ratings yet

- Wilkerson Case Study FinalDocument5 pagesWilkerson Case Study Finalmayer_oferNo ratings yet

- Analysis of PolysarDocument84 pagesAnalysis of PolysarParthMairNo ratings yet

- Balakrishnan MGRL Solutions Ch05Document67 pagesBalakrishnan MGRL Solutions Ch05deeNo ratings yet

- EX 1 - WilkersonDocument8 pagesEX 1 - WilkersonDror PazNo ratings yet

- Destin BrassDocument5 pagesDestin Brassdamanfromiran100% (1)

- Bridgeton HWDocument3 pagesBridgeton HWravNo ratings yet

- Berkshire ToysDocument11 pagesBerkshire ToysSeth CabreraNo ratings yet

- Management Control Systems, Transfer Pricing, and Multinational Considerations 22Document30 pagesManagement Control Systems, Transfer Pricing, and Multinational Considerations 22Martinus WarsitoNo ratings yet

- Sneaker Excel Sheet For Risk AnalysisDocument11 pagesSneaker Excel Sheet For Risk AnalysisSuperGuyNo ratings yet

- Software Associate SolutionDocument6 pagesSoftware Associate SolutionAnupam SinghNo ratings yet

- BSE Case StudyDocument2 pagesBSE Case Studykowshik moyyaNo ratings yet

- Dave BrothersDocument6 pagesDave BrothersSangtani PareshNo ratings yet

- 06 Cost Accounting System FTDocument18 pages06 Cost Accounting System FTnsm2zmvnbbNo ratings yet

- MODULE 6 Mid-Term Exam Review Exercises - F23Document6 pagesMODULE 6 Mid-Term Exam Review Exercises - F23pratibhaNo ratings yet

- Activity Based Costing ER - NewDocument14 pagesActivity Based Costing ER - NewFadillah LubisNo ratings yet

- Chapter 5 ABC System For StudentsDocument14 pagesChapter 5 ABC System For StudentsNour Al Kaddah100% (1)

- Managerial Accounting Review Problems - Activity Based Costing Name: Problem 1 ScoreDocument3 pagesManagerial Accounting Review Problems - Activity Based Costing Name: Problem 1 ScoreVivienne Rozenn LaytoNo ratings yet

- Sippican A Case Study PDF OCRDocument9 pagesSippican A Case Study PDF OCRjps.caldasNo ratings yet

- Final Examination of Management Economics: Trade FrictionDocument16 pagesFinal Examination of Management Economics: Trade FrictionMaryam ali KazmiNo ratings yet

- The Cost of Capital: Multiple Choice QuestionsDocument26 pagesThe Cost of Capital: Multiple Choice QuestionsRodNo ratings yet

- Ecn 232Document158 pagesEcn 232adeniyimustapha46No ratings yet

- Inventory MangementDocument58 pagesInventory MangementRazita RathoreNo ratings yet

- Practice Questions (Micoreconomics)Document18 pagesPractice Questions (Micoreconomics)Jing YingNo ratings yet

- Discounts: Prepared By: Rotap, Chrizell Celis, GlendaDocument15 pagesDiscounts: Prepared By: Rotap, Chrizell Celis, GlendaChrizell RotapNo ratings yet

- Managerial Accounting 1st Edition Balakrishnan Test BankDocument33 pagesManagerial Accounting 1st Edition Balakrishnan Test Bankfidelmanhangmhr100% (23)

- IPM ReviewerDocument8 pagesIPM ReviewerPaul Jancen ConcioNo ratings yet

- Security Analysis Portfolio Management AssignmentDocument4 pagesSecurity Analysis Portfolio Management AssignmentNidhi ShahNo ratings yet

- Hangyo ProjectDocument31 pagesHangyo ProjectJessica GlennNo ratings yet

- Day Trading Strategies The Complete Guide 1 @exceltradeDocument477 pagesDay Trading Strategies The Complete Guide 1 @exceltradeJey Buhion86% (14)

- Exercises Lecture3Document3 pagesExercises Lecture3LizzyNo ratings yet

- FINS2624 Quiz BankDocument368 pagesFINS2624 Quiz BankRaymond WingNo ratings yet

- Maths-Discount (New)Document7 pagesMaths-Discount (New)Karnail KumarNo ratings yet

- BBA 312 Managerial Economics Assignment 2 SibongileDocument9 pagesBBA 312 Managerial Economics Assignment 2 SibongileLukiyo OwuorNo ratings yet

- Monopoly, Monopolistic Competition, OligopolyDocument11 pagesMonopoly, Monopolistic Competition, OligopolySS CreationsNo ratings yet

- ExamplesDocument7 pagesExamplesWaseim khan Barik zaiNo ratings yet

- Numericals EcoDocument2 pagesNumericals EcoGhalib HussainNo ratings yet

- Industrial Organization 03: CollusionDocument40 pagesIndustrial Organization 03: Collusionheh92No ratings yet

- ADVANCED MARKETING - TeoriaDocument54 pagesADVANCED MARKETING - Teoriasarabozzi103No ratings yet

- Slides 9Document32 pagesSlides 9Cagla SaribayrakdarogluNo ratings yet

- Black Monday 1987: Ajmal Roshan E P201701 CutnDocument8 pagesBlack Monday 1987: Ajmal Roshan E P201701 CutnAjmal RoshanNo ratings yet

- Demo Script: SAP ACM: Agricultural Commodity Purchase ScenarioDocument31 pagesDemo Script: SAP ACM: Agricultural Commodity Purchase ScenarioJoule974No ratings yet

- Lesson 4 Mastering Technical Analysis: by Adam KhooDocument57 pagesLesson 4 Mastering Technical Analysis: by Adam Khoosesilya 14No ratings yet

- Article 1594Document2 pagesArticle 1594MarkNo ratings yet

- Percentage Change - KS3 Walkthrough WorksheetDocument4 pagesPercentage Change - KS3 Walkthrough WorksheetNhlNo ratings yet