Professional Documents

Culture Documents

What Is Financial Leverage

What Is Financial Leverage

Uploaded by

JORKOS1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is Financial Leverage

What Is Financial Leverage

Uploaded by

JORKOS1Copyright:

Available Formats

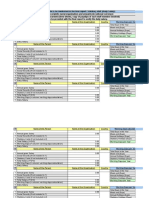

What is financial leverage?

Definition of Financial Leverage

Financial leverage which is also known as leverage or trading on equity, refers to the use of debt

to acquire additional assets.

The use of financial leverage to control a greater amount of assets (by borrowing money) will

cause the returns on the owner's cash investment to be amplified. That is, with financial leverage:

an increase in the value of the assets will result in a larger gain on the owner's cash,

when the loan interest rate is less than the rate of increase in the asset's value

a decrease in the value of the assets will result in a larger loss on the owner's cash

Examples of Financial Leverage

Mary uses $500,000 of her cash to purchase 40 acres of land with a total cost of $500,000. Mary

is not using financial leverage.

Sue uses $500,000 of her cash and borrows $1,000,000 to purchase 120 acres of land having a

total cost of $1,500,000. Sue is using financial leverage to own/control $1,500,000 of property

with only $500,000 of her own money. Let's also assume that the interest on Sue's loan is

$50,000 per year and it is paid at the beginning of each year.

Effects of Using Financial Leverage

For our examples let's assume that after one year, the land owned by Mary and the land owned

by Sue increased in value by 20% and both Mary and Sue sold their land investments at the

market values. As a result:

Mary's land will sell for $600,000 which results in a gain of $100,000 (selling price of

$600,000 minus the land's cost of $500,000). The $100,000 gain on Mary's cash of $500,000

results in a gain of 20% on Mary's $100,000

Sue's land will sell for $1,800,000 which results in a gain of $250,000 (selling price of

$1,800,000 minus $1,550,000, which is the land's cost of $1,500,000 and interest of $50,000).

The $250,000 gain on Sue's $550,000 of cash is a gain of 45% instead of a gain of 20%

without the use of leverage

Now let's assume that after one year, the land owned by Mary and and the land owned by

Sue decreased in value by 20% and that both Mary and Sue sold their land investments at the

market values. As a result:

Mary's land will sell for $400,000 which means a $100,000 loss on the land's cost of

$500,000. The $100,000 loss on Mary's cash of $500,000 results in a 20% loss on Mary's

money

Sue's land will sell for $1,200,000 which results in a loss of $350,000 (selling price of

$1,200,000 minus the land's cost of $1,500,000 and interest of $50,000). The $350,000 loss on

Sue's cash of $550,000 results in a 63.6% loss on Sue's money instead of a loss of 20%

without the use of leverage

Free Financial Statements

You might also like

- Book Abstract ICDEMOS 2014Document70 pagesBook Abstract ICDEMOS 201423045566No ratings yet

- EviewsDocument26 pagesEviewsJORKOS1No ratings yet

- Stock ExchangeDocument30 pagesStock Exchangemansavi bihaniNo ratings yet

- Of Trading: The Psychology of Trading. 7 or 8 of Every 10 OperationsDocument4 pagesOf Trading: The Psychology of Trading. 7 or 8 of Every 10 OperationsjoseluisvazquezNo ratings yet

- Squares and Square RootsDocument8 pagesSquares and Square RootsJessica RamerNo ratings yet

- Stock Market IndicesDocument3 pagesStock Market IndicesNatural agroNo ratings yet

- CFDs Trading Explained For BeginnersDocument2 pagesCFDs Trading Explained For BeginnersCMS PrimeNo ratings yet

- Stock Exchange IndicesDocument19 pagesStock Exchange IndicesBunu MarianaNo ratings yet

- Seat Material PDFDocument2 pagesSeat Material PDFkrisNo ratings yet

- ERIKS - O-Ring Datasheet - FKM 75-Compound 514322 BlackDocument1 pageERIKS - O-Ring Datasheet - FKM 75-Compound 514322 Blackseeralan_1986No ratings yet

- Stock Market IndicesDocument13 pagesStock Market IndicesilyasNo ratings yet

- 03 - Traffic and Equivalent Axle Loads (Updated)Document88 pages03 - Traffic and Equivalent Axle Loads (Updated)Besim QelajNo ratings yet

- Canusa Pipeline Repair Products Installation GuideDocument2 pagesCanusa Pipeline Repair Products Installation GuideLewoski100% (1)

- Non-Intrusive Magnetic Pig SignallerDocument2 pagesNon-Intrusive Magnetic Pig SignallerAndresNo ratings yet

- C - Evaluation Selection of Directional Drill Pipe Coatings - 2023 - P9Document51 pagesC - Evaluation Selection of Directional Drill Pipe Coatings - 2023 - P9Pammy JainNo ratings yet

- Dynamic Swing Trader Position Size CalculatorDocument3 pagesDynamic Swing Trader Position Size CalculatorHicham HasnaouiNo ratings yet

- Angel Numbers and Meanings PDFDocument20 pagesAngel Numbers and Meanings PDFÅsa Linnéa CollinNo ratings yet

- Forex Pip CountDocument1 pageForex Pip CountLab RatNo ratings yet

- The Meaning of Angel Number 1111 Is A Question That Many People Ask Every DayDocument2 pagesThe Meaning of Angel Number 1111 Is A Question That Many People Ask Every DayAsim Bashir100% (1)

- Difference Between Izod and Charpy MethodsDocument2 pagesDifference Between Izod and Charpy Methodsvasudeva yasasNo ratings yet

- Datasheet - Pig Signallers: Product Description and FunctionsDocument2 pagesDatasheet - Pig Signallers: Product Description and FunctionsMurli ramchandranNo ratings yet

- Fracture Toughness TestingDocument2 pagesFracture Toughness TestingArghadeep RoyNo ratings yet

- MISC Materials ListDocument10 pagesMISC Materials ListWaqas WaqasNo ratings yet

- Crack Opening DisplacementDocument2 pagesCrack Opening Displacementsqaiba_gNo ratings yet

- What Is Leverage in Financial Management?Document13 pagesWhat Is Leverage in Financial Management?majidNo ratings yet

- Tables of Flange PDFDocument5 pagesTables of Flange PDFAngel AngeleyeNo ratings yet

- Corrosion Coupon Rack: Installation & Operation ManualDocument7 pagesCorrosion Coupon Rack: Installation & Operation ManualVania Nicol Arapa YugarNo ratings yet

- Alignment SheetDocument1 pageAlignment Sheetkhalid ahmedNo ratings yet

- Technical Analysis: Chart Patterns: Justin KuepperDocument9 pagesTechnical Analysis: Chart Patterns: Justin KuepperBùi Công LộcNo ratings yet

- UCM Ball ValvesDocument22 pagesUCM Ball ValvesBalakrishna BisoyiNo ratings yet

- Product Data Booklet Fibertec Ultimate HDD Coating SystemDocument8 pagesProduct Data Booklet Fibertec Ultimate HDD Coating Systemmkash028No ratings yet

- Surveying 2Document81 pagesSurveying 2زبیر شاہNo ratings yet

- Index Investing Tutorial: (Page 1 of 10)Document10 pagesIndex Investing Tutorial: (Page 1 of 10)vivsencuNo ratings yet

- Testing and Analysis of Pipeline Ball Valves Part 1 PDFDocument3 pagesTesting and Analysis of Pipeline Ball Valves Part 1 PDFNovianto Rachmad100% (1)

- Stock Market: An Index of Economic GrowthDocument51 pagesStock Market: An Index of Economic GrowthishanjandNo ratings yet

- Meliadine Brine Project DescriptionDocument22 pagesMeliadine Brine Project DescriptionNunatsiaqNewsNo ratings yet

- 24-84-83-1648 - 0 Attachment-III PDFDocument5 pages24-84-83-1648 - 0 Attachment-III PDFSabu Abdul NoorNo ratings yet

- Recovering Gas From Low Pressure Gas Wells PDFDocument9 pagesRecovering Gas From Low Pressure Gas Wells PDFAZZAF ChannelNo ratings yet

- An Introduction To Stock Market IndicesDocument3 pagesAn Introduction To Stock Market IndicesGopi KrishnaNo ratings yet

- Better Than Candlestick Patterns - Part OneDocument4 pagesBetter Than Candlestick Patterns - Part Onearan singhNo ratings yet

- For Ex CalculatorDocument5 pagesFor Ex CalculatorArvind ChaudharyNo ratings yet

- Fundamental Analysis Redux-3Document25 pagesFundamental Analysis Redux-3Mantu KumarNo ratings yet

- Margin TradingDocument5 pagesMargin TradingGeorgeNo ratings yet

- Thermoplastic Seals & Components For The Oil & Gas IndustryDocument20 pagesThermoplastic Seals & Components For The Oil & Gas Industrya100acom100% (1)

- tb2 Articulo 1 PDFDocument9 pagestb2 Articulo 1 PDFKaty Milagros Pacheco CalderonNo ratings yet

- A High Performance, Damage Tolerant Fusion Bonded Epoxy CoatingDocument15 pagesA High Performance, Damage Tolerant Fusion Bonded Epoxy CoatingpaimpillyNo ratings yet

- MPRWA DEIR Review 3 Brine DisposalDocument37 pagesMPRWA DEIR Review 3 Brine DisposalL. A. PatersonNo ratings yet

- Printer Friendly - Module 5 - Trade Management & PsychologyDocument78 pagesPrinter Friendly - Module 5 - Trade Management & PsychologyOguz ErdoganNo ratings yet

- Basics of TradingDocument6 pagesBasics of Tradingfor SaleNo ratings yet

- Analyzing Chart Patterns: - The Resource For Investing and Personal Finance EducationDocument31 pagesAnalyzing Chart Patterns: - The Resource For Investing and Personal Finance EducationReview PhimNo ratings yet

- Husain Al Muslim Saudi Aramco PDFDocument34 pagesHusain Al Muslim Saudi Aramco PDFravi00098No ratings yet

- Stock Market IndicesDocument15 pagesStock Market IndicesSIdhu SimmiNo ratings yet

- Account: Mini Balance: $ 10,000.00 Currency: USD: Trade # Pair Base Pip Value Actual Pip Value Lots Pos Size Status PosDocument12 pagesAccount: Mini Balance: $ 10,000.00 Currency: USD: Trade # Pair Base Pip Value Actual Pip Value Lots Pos Size Status PosfullpersonNo ratings yet

- What Is The The Significance of Being Born On An Angel NumberDocument3 pagesWhat Is The The Significance of Being Born On An Angel NumberAsim BashirNo ratings yet

- Criteria For The Selection of Metallic Pipelines CoatingsDocument10 pagesCriteria For The Selection of Metallic Pipelines CoatingsVinicius CarvalhoNo ratings yet

- Cs - Ad Crude Oil VFDocument1 pageCs - Ad Crude Oil VFKommu RohithNo ratings yet

- Ultimate Guide Toforex Trading EbookDocument24 pagesUltimate Guide Toforex Trading Ebookief zzieNo ratings yet

- What Is Financial LeverageDocument1 pageWhat Is Financial LeverageMckoy MarcosNo ratings yet

- Assignment 1 PDFDocument5 pagesAssignment 1 PDFThomasNo ratings yet

- Fin ManDocument3 pagesFin ManDonna Mae HernandezNo ratings yet

- Lesson 8 Case BriefDocument3 pagesLesson 8 Case BriefMonis KhanNo ratings yet

- whc12 36com 19eDocument246 pageswhc12 36com 19eJORKOS1No ratings yet

- The Non-Performing Loans: Some Bank-Level EvidencesDocument34 pagesThe Non-Performing Loans: Some Bank-Level EvidencesJORKOS1No ratings yet

- Dogovor Za Kupoprodazba Na VoziloDocument1 pageDogovor Za Kupoprodazba Na VoziloJORKOS1No ratings yet

- Ofi GDPG Money Bankgdp Penetra Penzija Short Stock Spread Fdi Dum Dum1Document2 pagesOfi GDPG Money Bankgdp Penetra Penzija Short Stock Spread Fdi Dum Dum1JORKOS1No ratings yet

- 1 Da Se ProveritDocument14 pages1 Da Se ProveritJORKOS1No ratings yet

- SPISANIJADocument1 pageSPISANIJAJORKOS1No ratings yet

- KosovoDocument5 pagesKosovoJORKOS1No ratings yet

- GDPG CGD Trade PG Inf FdiDocument7 pagesGDPG CGD Trade PG Inf FdiJORKOS1No ratings yet

- For Peer Review Only: Macroeconomic and Bank-Specific Determinants of Non-Performing Loans: The Case of Baltic StatesDocument29 pagesFor Peer Review Only: Macroeconomic and Bank-Specific Determinants of Non-Performing Loans: The Case of Baltic StatesJORKOS1No ratings yet

- Non Performing Loans in Baltic States Determinants and Macroeconomic EffectsDocument21 pagesNon Performing Loans in Baltic States Determinants and Macroeconomic EffectsJORKOS1No ratings yet

- Marjan Petreski CVDocument9 pagesMarjan Petreski CVJORKOS1No ratings yet

- Urnek Za EmpirijaDocument191 pagesUrnek Za EmpirijaJORKOS1No ratings yet

- 6 Investment Appraisal: Project ViabilityDocument7 pages6 Investment Appraisal: Project ViabilityLodhi IsmailNo ratings yet

- Foreign Currency ValuationDocument21 pagesForeign Currency Valuationneelam618No ratings yet

- Lewis-Palmer Board 7-15-99Document6 pagesLewis-Palmer Board 7-15-99Anonymous kprzCiZNo ratings yet

- EconomicsDocument13 pagesEconomicsmarkanthonycorpinNo ratings yet

- Volume PriceDocument57 pagesVolume PriceRohan PatilNo ratings yet

- Post Pay Installment Request Form: Cardholder InformationDocument1 pagePost Pay Installment Request Form: Cardholder InformationYui RecintoNo ratings yet

- Legal Tool Calculate Daily Salary enDocument10 pagesLegal Tool Calculate Daily Salary enLeads guruNo ratings yet

- CapitalMarketandSecuritesLaw 8368253282294136246.PDF 1Document5 pagesCapitalMarketandSecuritesLaw 8368253282294136246.PDF 1Jitendra RavalNo ratings yet

- Tuition, Education, and Textbook Amounts Certificate: Protected BDocument2 pagesTuition, Education, and Textbook Amounts Certificate: Protected BGuillermo Rodriguez LopezNo ratings yet

- Quiz 1Document1 pageQuiz 1geraldabubopaduaNo ratings yet

- 43rd GST Council MeetingDocument15 pages43rd GST Council MeetingShaik NoorshaNo ratings yet

- Accounting Standard (AS) 10Document16 pagesAccounting Standard (AS) 10Priyanka MishraNo ratings yet

- 10000000301Document92 pages10000000301Chapter 11 DocketsNo ratings yet

- Sword RequestDocument1 pageSword RequestmikecrofthomesNo ratings yet

- Ckra Citra Kebun Raya Agri TBK.: Company Report: January 2012Document3 pagesCkra Citra Kebun Raya Agri TBK.: Company Report: January 2012Djohan HarijonoNo ratings yet

- Individual Assignment Acct 232 Management Accounting 2Document3 pagesIndividual Assignment Acct 232 Management Accounting 2pfungwaNo ratings yet

- Monthly Reports 01-05-16Document32 pagesMonthly Reports 01-05-16L. A. PatersonNo ratings yet

- Foundations in Accountancy FFA/ACCA FDocument45 pagesFoundations in Accountancy FFA/ACCA FTuyết Anh ĐồngNo ratings yet

- C695-19 (Sme)Document13 pagesC695-19 (Sme)Willie NgNo ratings yet

- Impacts of The World Recession and Economic Crisis On Tourism North AmericaDocument11 pagesImpacts of The World Recession and Economic Crisis On Tourism North AmericairohsabNo ratings yet

- Business Chinese Words PDF FreeDocument6 pagesBusiness Chinese Words PDF Free文杰No ratings yet

- Asset Based FinancingDocument2 pagesAsset Based Financinggeoraw9588No ratings yet

- Basis of Difference Balance of Trade (BOT)Document3 pagesBasis of Difference Balance of Trade (BOT)johann_747No ratings yet

- NHTM - BTDocument16 pagesNHTM - BTNguyễn Hải Thanh100% (1)

- Financial and Management Accounting Excercise 1Document2 pagesFinancial and Management Accounting Excercise 1LemiNo ratings yet

- Chapter 1. Introduction (300 Words) : MassaDocument5 pagesChapter 1. Introduction (300 Words) : MassaAbhinav P KrishnaNo ratings yet

- ACC 100 - Chapter 4 - Financial StatementsDocument4 pagesACC 100 - Chapter 4 - Financial StatementsTasnim SheikhNo ratings yet

- G.R. No. 161135. April 8, 2005 Swagman Hotels and Travel, Inc., Petitioners, Hon. Court of Appeals, and Neal B. Christian, RespondentsDocument12 pagesG.R. No. 161135. April 8, 2005 Swagman Hotels and Travel, Inc., Petitioners, Hon. Court of Appeals, and Neal B. Christian, RespondentszNo ratings yet

- B&H CH 3 SolutinsDocument26 pagesB&H CH 3 SolutinsCharmaine de GuzmanNo ratings yet

- Guide To Corporate Ecosystem ValuationDocument76 pagesGuide To Corporate Ecosystem ValuationfarichaNo ratings yet