Professional Documents

Culture Documents

Asian Terminals Inc. v. Malayan Insurance

Asian Terminals Inc. v. Malayan Insurance

Uploaded by

Nino Louis BelarmaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asian Terminals Inc. v. Malayan Insurance

Asian Terminals Inc. v. Malayan Insurance

Uploaded by

Nino Louis BelarmaCopyright:

Available Formats

Case principle: The right of subrogation accrues simply upon payment by the insurance

company of the insurance claim. Once the insurer pays the insured, equity demands

reimbursement as no one should benefit at the expense of another.

Shandong Weifang Soda Ash Plant (SWSAP) shipped on board MV Jinlian I 60,000 plastic

bags of soda ash dense from China to Manila. The shipment was insured with respondent

Malayan Insurance Company, Inc. (Malayan Insurance).

Upon arrival at Manila, the stevedores of petitioner, Asian Terminals, Inc. (ATI) unloaded the

bags and brought them to the open storage area of ATI. When the unloading was completed,

2,702 bags were found to be in bad order condition. The stevedores of ATI began loading the

bags in trucks of MEC Customs Brokerage for transport and delivery to consignee. After all

bags were unloaded in the warehouses of consignee, a total of 2,881 bags were in bad order.

Malayan Insurance, as insurer, paid the value of the lost/damaged cargoes to the consignee.

Malayan Insurance, as subrogee of the consignee, filed before the RTC a complaint for

damages against ATI.

ATI contends that Malayan Insurance is not entitled to relief granted as it failed to establish its

cause of action against ATI since, as the alleged subrogee, it never presented any valid,

existing, enforceable insurance policy or any copy thereof in court.

Issue: Whether or not the non-presentation of the insurance contract or policy is fatal to

respondent’s cause of action

Ruling:

NO. Non-presentation of the insurance contract or policy is not fatal in the instant case.

In Delsan Transport v. CA, the SC ruled that the presentation in evidence of the marine

insurance policy is not indispensable in this case before the insurer may recover from the

common carrier the insured value of the lost cargo in the exercise of its subrogatory right. The

subrogation receipt, by itself, is sufficient to establish not only the relationship of herein private

respondent as insurer and Caltex, as the assured shipper of the lost cargo of industrial fuel oil,

but also the amount paid to settle the insurance claim. The right of subrogation accrues simply

upon payment by the insurance company of the insurance claim.

Similarly, in this case, the presentation of the insurance contract or policy was not necessary.

Although petitioner objected to the admission of the Subrogation Receipt in its Comment to

respondent's formal offer of evidence on the ground that respondent failed to present the

insurance contract or policy, a perusal of petitioner's Answer and Pre-Trial Brief shows that

petitioner never questioned respondent's right to subrogation, nor did it dispute the coverage of

the insurance contract or policy. Since there was no issue regarding the validity of the insurance

contract or policy, or any provision thereof, respondent had no reason to present the insurance

contract or policy as evidence during the trial.

You might also like

- Notes On 114K Use of Internet in Legal Edu - V1.2 - by Ketan BhattDocument25 pagesNotes On 114K Use of Internet in Legal Edu - V1.2 - by Ketan Bhattketan.bhatt.iitb79% (14)

- Ethics in InsuranceDocument19 pagesEthics in InsuranceDruti Jaiswal80% (5)

- Respondent Memorial Corrected OneDocument20 pagesRespondent Memorial Corrected OneSamriti Narang100% (1)

- Comparison of Rules 45, 64, and 65 by Belarma, Nino LouisDocument3 pagesComparison of Rules 45, 64, and 65 by Belarma, Nino LouisNino Louis Belarma100% (2)

- Ancient WeddingsDocument32 pagesAncient WeddingsNatalia Figueroa100% (1)

- Explain/Distinguish Grandfather Rule and Control Test. 2. Explain The Trust Fund DoctrineDocument2 pagesExplain/Distinguish Grandfather Rule and Control Test. 2. Explain The Trust Fund DoctrineRyan Emmanuel MangulabnanNo ratings yet

- Saludo Vs CaDocument1 pageSaludo Vs CaMarivic Asilo Zacarias-LozanoNo ratings yet

- Labor Law Jul Dec2016Document16 pagesLabor Law Jul Dec2016Ronald Allan MorenoNo ratings yet

- Cangco vs. Manila RailroadDocument10 pagesCangco vs. Manila Railroadcarol anneNo ratings yet

- Section 11, Art. XII of The 1987 ConstitutionDocument22 pagesSection 11, Art. XII of The 1987 ConstitutionowenNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument3 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledlexxNo ratings yet

- Republic of The Philippines Manila: Philippine Airlines, Inc. v. Ligan G.R. No. 146408Document8 pagesRepublic of The Philippines Manila: Philippine Airlines, Inc. v. Ligan G.R. No. 146408Jopan SJNo ratings yet

- Rendell-Baker v. Kohn, 457 U.S. 830 (1982)Document19 pagesRendell-Baker v. Kohn, 457 U.S. 830 (1982)Scribd Government DocsNo ratings yet

- IRR Limited Portability LawDocument12 pagesIRR Limited Portability LawLou StellarNo ratings yet

- Labor Law II Cases A & BDocument19 pagesLabor Law II Cases A & Bproyouthactive01No ratings yet

- Case DigestDocument11 pagesCase DigestDiana Mae Liban CordovaNo ratings yet

- Standard Vacuum Oil vs. Luzon Stevedoring G.R. No. L-5203, April 18, 1956 DoctrineDocument23 pagesStandard Vacuum Oil vs. Luzon Stevedoring G.R. No. L-5203, April 18, 1956 DoctrineFaye de LeonNo ratings yet

- Garcia Vs ThioDocument3 pagesGarcia Vs ThioBruce WayneNo ratings yet

- G.R. No. 191525 IAME Vs LittonDocument6 pagesG.R. No. 191525 IAME Vs LittonJoovs JoovhoNo ratings yet

- Casupanan Vs LaroyaDocument8 pagesCasupanan Vs LaroyaRhenfacel ManlegroNo ratings yet

- Transpo Reviewer 1-5Document5 pagesTranspo Reviewer 1-5Zaira Gem GonzalesNo ratings yet

- Brentwood Academy v. Tennessee Secondary School Athletic Assn., 531 U.S. 288 (2001)Document20 pagesBrentwood Academy v. Tennessee Secondary School Athletic Assn., 531 U.S. 288 (2001)Scribd Government DocsNo ratings yet

- Trans NotesDocument21 pagesTrans NotesJon JamoraNo ratings yet

- Chapter 2 - Obligation of The Common CarrierDocument60 pagesChapter 2 - Obligation of The Common CarrierAdrian KitNo ratings yet

- NATIONAL POWER CORPORATION v. CADocument18 pagesNATIONAL POWER CORPORATION v. CAKhate AlonzoNo ratings yet

- Wilgen Loon, Et. Al. vs. Power Master, Inc., Tri-C General Services and Sps. AlumisinDocument2 pagesWilgen Loon, Et. Al. vs. Power Master, Inc., Tri-C General Services and Sps. AlumisinDennis Jay Dencio Paras100% (1)

- Corporal SR Vs NLRC PDF FreeDocument3 pagesCorporal SR Vs NLRC PDF FreeKeyan MotolNo ratings yet

- People vs. BagistaDocument7 pagesPeople vs. BagistaJohn Ludwig Bardoquillo PormentoNo ratings yet

- Pedro de Guzman vs. CaDocument3 pagesPedro de Guzman vs. CaMhali100% (1)

- February Jurisprudence On Labor LawDocument13 pagesFebruary Jurisprudence On Labor LawKim Marie AquinoNo ratings yet

- Delsan Transport Lines, Inc. vs. American Home Assurance CorporationDocument5 pagesDelsan Transport Lines, Inc. vs. American Home Assurance CorporationjafernandNo ratings yet

- Shell Philippines Exploration B.V. v. Efren JalosDocument4 pagesShell Philippines Exploration B.V. v. Efren Jalosrhodz 88No ratings yet

- GMMSWM V JancomDocument2 pagesGMMSWM V JancomDebroah Faith PajarilloNo ratings yet

- 4 - Reyes V NLRCDocument12 pages4 - Reyes V NLRCLax ConcepcionNo ratings yet

- Admin Law DigestDocument5 pagesAdmin Law DigestKlaire EsdenNo ratings yet

- Perla Compania V RamoleteDocument2 pagesPerla Compania V Ramoletecmv mendozaNo ratings yet

- Spec ProDocument14 pagesSpec ProMary Grace Dionisio-RodriguezNo ratings yet

- Digest - Agan, Jr. v. Philippine International Air Terminals Co., Inc., 450 Phil. 744Document9 pagesDigest - Agan, Jr. v. Philippine International Air Terminals Co., Inc., 450 Phil. 744zacNo ratings yet

- Aladdin F. Trinidad For Petitioner. The Trial Attorney III For Private RespondentsDocument5 pagesAladdin F. Trinidad For Petitioner. The Trial Attorney III For Private RespondentsHaniyyah FtmNo ratings yet

- Laguna Lake Development Authority - Government MandateDocument10 pagesLaguna Lake Development Authority - Government MandateSummerNo ratings yet

- Jackson v. Metropolitan Edison Co., 419 U.S. 345 (1974)Document23 pagesJackson v. Metropolitan Edison Co., 419 U.S. 345 (1974)Scribd Government DocsNo ratings yet

- Apoe Digest PoolDocument143 pagesApoe Digest PoolZachary SiayngcoNo ratings yet

- Research Paper On Preliminary InvestigationDocument3 pagesResearch Paper On Preliminary InvestigationDomi EsnarNo ratings yet

- 85-MAGELLAN MANUFACTURING MARKETING CORPORATION Vs CADocument3 pages85-MAGELLAN MANUFACTURING MARKETING CORPORATION Vs CALawrence EsioNo ratings yet

- 5 - Cokaliong Shipping vs. UCPBDocument2 pages5 - Cokaliong Shipping vs. UCPBJuvial Guevarra BostonNo ratings yet

- Chap 5 and Aviation Law CasesDocument15 pagesChap 5 and Aviation Law CasesCarlaVercelesNo ratings yet

- 33 - Philippines Singapore Transit Vs NLRCDocument6 pages33 - Philippines Singapore Transit Vs NLRCArthur YamatNo ratings yet

- LaborDocument11 pagesLaborRafael AquinoNo ratings yet

- Fisher v. Yangco Steamship CoDocument3 pagesFisher v. Yangco Steamship CosakaskajbNo ratings yet

- Top 10 Bar Exam Passers For September 2008Document1 pageTop 10 Bar Exam Passers For September 2008Erwin AmpoloquioNo ratings yet

- VAT Digest PDFDocument31 pagesVAT Digest PDFangelicaNo ratings yet

- Tolentino V SecretaryDocument1 pageTolentino V SecretaryKate MontenegroNo ratings yet

- Air France Vs CarrascosoDocument2 pagesAir France Vs CarrascosoAnonymous f5oeCOW0cLNo ratings yet

- Tablarin Vs GutierrezDocument5 pagesTablarin Vs GutierrezElle MichNo ratings yet

- PHILAM Life v. PaternoDocument2 pagesPHILAM Life v. PaternoPatricia SulitNo ratings yet

- SSS V City of BacolodDocument2 pagesSSS V City of BacolodChery Sheil ValenzuelaNo ratings yet

- #42 - Ador v. Jamila and Co.Document1 page#42 - Ador v. Jamila and Co.Kê MilanNo ratings yet

- New World International vs. Nyk-Filjapan Shipping Corp. G.R. No. 171468, Aug. 24, 2011, FactsDocument2 pagesNew World International vs. Nyk-Filjapan Shipping Corp. G.R. No. 171468, Aug. 24, 2011, FactsBob VillanuevaNo ratings yet

- G.R. No. L-8967. May 31, 1956.Document4 pagesG.R. No. L-8967. May 31, 1956.Michelle Dulce Mariano CandelariaNo ratings yet

- Calvo v. UCPBDocument1 pageCalvo v. UCPBJovelan V. EscañoNo ratings yet

- Teekay Shipping v. Concha To Mawanay v. Phil. Transmarine CaseDocument11 pagesTeekay Shipping v. Concha To Mawanay v. Phil. Transmarine CaseMishal OisinNo ratings yet

- White Gold Marine Vs Pioneer Insurance G.R. No. 154514 July 28, 2005Document2 pagesWhite Gold Marine Vs Pioneer Insurance G.R. No. 154514 July 28, 2005Emrico CabahugNo ratings yet

- National Transmission Corp. v. de Jesus PDFDocument4 pagesNational Transmission Corp. v. de Jesus PDFJerald Oliver Macabaya0% (1)

- Asia Lighterage and Shipping Inc. v. Court Of20210424-12-1w9na5iDocument10 pagesAsia Lighterage and Shipping Inc. v. Court Of20210424-12-1w9na5iGina RothNo ratings yet

- Asian Terminals, Inc. vs. Malayan Insurance, Co., IncDocument52 pagesAsian Terminals, Inc. vs. Malayan Insurance, Co., IncrollanekimNo ratings yet

- Heirs of Zoleta v. Landbank DigestDocument2 pagesHeirs of Zoleta v. Landbank DigestNino Louis BelarmaNo ratings yet

- Motion To Withdraw As CounselDocument3 pagesMotion To Withdraw As CounselNino Louis BelarmaNo ratings yet

- Absentee (Petition For Presumptive Death)Document3 pagesAbsentee (Petition For Presumptive Death)Nino Louis BelarmaNo ratings yet

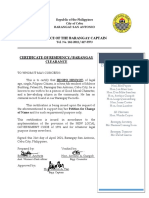

- Barangay Officials: Office of The Barangay CaptainDocument1 pageBarangay Officials: Office of The Barangay CaptainNino Louis BelarmaNo ratings yet

- PALE Belarma Notes 2021 MidtermDocument52 pagesPALE Belarma Notes 2021 MidtermNino Louis BelarmaNo ratings yet

- PALE Belarma Notes 2021 FinalsDocument53 pagesPALE Belarma Notes 2021 FinalsNino Louis BelarmaNo ratings yet

- Intestate Estate of Vito Borromeo v. BorromeoDocument7 pagesIntestate Estate of Vito Borromeo v. BorromeoNino Louis BelarmaNo ratings yet

- Transpo Midterm Notes 2020 - BelarmaDocument46 pagesTranspo Midterm Notes 2020 - BelarmaNino Louis BelarmaNo ratings yet

- Corpo Belarma Notes 2021 MidtermDocument1 pageCorpo Belarma Notes 2021 MidtermNino Louis BelarmaNo ratings yet

- Pretty v. United Kingdom DigestDocument4 pagesPretty v. United Kingdom DigestNino Louis BelarmaNo ratings yet

- Belarma - Special Civil Actions Compiled NotesDocument7 pagesBelarma - Special Civil Actions Compiled NotesNino Louis BelarmaNo ratings yet

- Barangay Protection Order (BPO) : G.R. No. 181489, (April 19, 2017), 809 PHIL 24-64)Document2 pagesBarangay Protection Order (BPO) : G.R. No. 181489, (April 19, 2017), 809 PHIL 24-64)Nino Louis BelarmaNo ratings yet

- Transpo Finals Notes 2020 - BelarmaDocument29 pagesTranspo Finals Notes 2020 - BelarmaNino Louis Belarma100% (1)

- De Papa v. Camacho DigestDocument3 pagesDe Papa v. Camacho DigestNino Louis BelarmaNo ratings yet

- Rodelas v. Aranza DigestDocument2 pagesRodelas v. Aranza DigestNino Louis BelarmaNo ratings yet

- Estate of Hemady v. Luzon Surety Co. DigestDocument2 pagesEstate of Hemady v. Luzon Surety Co. DigestNino Louis Belarma75% (4)

- Chi Ming Tsoi Vs Court of Appeals and Gina LaoDocument4 pagesChi Ming Tsoi Vs Court of Appeals and Gina Laocarmzy_ela24No ratings yet

- 72 PagesDocument72 pages72 PagesJaylou BobisNo ratings yet

- Software Reseller AgreementDocument8 pagesSoftware Reseller AgreementgaurangNo ratings yet

- Progress Report Card: Republic of The PhilippinesDocument2 pagesProgress Report Card: Republic of The PhilippinesElsie RubioNo ratings yet

- Luna v. PlazaDocument6 pagesLuna v. PlazaSarah RosalesNo ratings yet

- Election LawDocument18 pagesElection LawharshitaNo ratings yet

- Ryland Vs Fletcher JudgementDocument2 pagesRyland Vs Fletcher JudgementAnshulNo ratings yet

- Epg Construction Vs CADocument2 pagesEpg Construction Vs CAMike Llamas100% (1)

- STATEMENT BY SPEAKER OF Uganda PARLIAMENTDocument6 pagesSTATEMENT BY SPEAKER OF Uganda PARLIAMENTThe New VisionNo ratings yet

- POLITICAL SYSTEM in The United KingdomDocument5 pagesPOLITICAL SYSTEM in The United KingdomM279No ratings yet

- Pertinent Labor Law Provisions in The Kingdom of Saudi ArabiaDocument3 pagesPertinent Labor Law Provisions in The Kingdom of Saudi ArabiaLindsay MillsNo ratings yet

- Contract For The Manufacture and Sale of GoodsDocument2 pagesContract For The Manufacture and Sale of GoodsTricia Tolentino MendozaNo ratings yet

- Labor Digests Batch 4Document2 pagesLabor Digests Batch 4specialsectionNo ratings yet

- Worksheet 5 & 6Document2 pagesWorksheet 5 & 6Omega SpectrumNo ratings yet

- Fibernation Rent AgreementDocument3 pagesFibernation Rent AgreementHoney SinghNo ratings yet

- Sunlife Canada v. CA Case DigestDocument2 pagesSunlife Canada v. CA Case DigestYodh Jamin Ong100% (1)

- Administrative Law - Project TopicsDocument12 pagesAdministrative Law - Project TopicsHemanth Rao100% (4)

- CRS Report For Congress - The First Day of A New Congress: A Guide To Proceedings On The Senate FloorDocument6 pagesCRS Report For Congress - The First Day of A New Congress: A Guide To Proceedings On The Senate FloorSunlight FoundationNo ratings yet

- C Art4 and D Art5Document82 pagesC Art4 and D Art5Austine Clarese VelascoNo ratings yet

- Note Surrogacy in California: Replacing Section 7962 of The California Family Code With A Two-Part Hybrid Best Interests TestDocument31 pagesNote Surrogacy in California: Replacing Section 7962 of The California Family Code With A Two-Part Hybrid Best Interests Testmeltwithsnow163.comNo ratings yet

- Foundations of The Principles of Business EthicsDocument18 pagesFoundations of The Principles of Business EthicsCPAREVIEWNo ratings yet

- 2009 DARAB Rules of ProcedureDocument37 pages2009 DARAB Rules of Procedurejeckleandjerry100% (6)

- Wedding ProposalDocument3 pagesWedding Proposalxxsquishy99No ratings yet

- Beltran Vs Paic Finance Corp - ToraynoDocument2 pagesBeltran Vs Paic Finance Corp - ToraynoKC ToraynoNo ratings yet

- United States v. Zabriskie (Dean), 415 F.3d 1139, 10th Cir. (2005)Document21 pagesUnited States v. Zabriskie (Dean), 415 F.3d 1139, 10th Cir. (2005)Scribd Government DocsNo ratings yet

- United States v. Pettaway, 4th Cir. (2011)Document5 pagesUnited States v. Pettaway, 4th Cir. (2011)Scribd Government DocsNo ratings yet