Professional Documents

Culture Documents

Bir Ruling No. 039-97

Bir Ruling No. 039-97

Uploaded by

MysajadeJaoMejica0 ratings0% found this document useful (0 votes)

88 views3 pagesThe Bureau of Internal Revenue (BIR) ruled that the transfer of legal title to outstanding shares of stock from stockholders to the Philippine Central Depository, Inc.'s (PCD) nominee, PCD Nominee Corp., and vice versa, without a transfer of beneficial title, is not subject to capital gains tax, stock transaction tax, or documentary stamp tax. The BIR confirmed that conveying legal title to a trustee or nominee without consideration does not involve an actual transfer of ownership. However, transfers of beneficial ownership would be subject to applicable taxes.

Original Description:

Original Title

BIR RULING NO. 039-97.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Bureau of Internal Revenue (BIR) ruled that the transfer of legal title to outstanding shares of stock from stockholders to the Philippine Central Depository, Inc.'s (PCD) nominee, PCD Nominee Corp., and vice versa, without a transfer of beneficial title, is not subject to capital gains tax, stock transaction tax, or documentary stamp tax. The BIR confirmed that conveying legal title to a trustee or nominee without consideration does not involve an actual transfer of ownership. However, transfers of beneficial ownership would be subject to applicable taxes.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

88 views3 pagesBir Ruling No. 039-97

Bir Ruling No. 039-97

Uploaded by

MysajadeJaoMejicaThe Bureau of Internal Revenue (BIR) ruled that the transfer of legal title to outstanding shares of stock from stockholders to the Philippine Central Depository, Inc.'s (PCD) nominee, PCD Nominee Corp., and vice versa, without a transfer of beneficial title, is not subject to capital gains tax, stock transaction tax, or documentary stamp tax. The BIR confirmed that conveying legal title to a trustee or nominee without consideration does not involve an actual transfer of ownership. However, transfers of beneficial ownership would be subject to applicable taxes.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

April 3, 1997

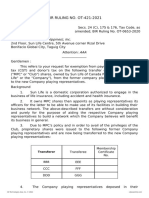

BIR RULING NO. 039-97

21 (d) 24 (e) (2) 000-00 039-97

Romulo, Mabanta, Buenaventura

Sayoc & De Los Angeles

30/F Citibank Tower

Paseo de Roxas, Makati City

Attention: Edmundo P. Guevarra

and

Priscilla B. Valer

Gentlemen :

This refers to your letter dated February 20, 1997 requesting, in

behalf of your client, the Philippine Central Depository, Inc. ("PCD"), for

confirmation of your opinion that the transfer of legal title to outstanding

shares of stock, without a transfer of beneficial title, from stockholders to

the PCD Nominee Corp., as nominee, and vice-versa, is not subject to the

capital gains tax imposed under Sections 21 (d), 22(a) (3), 24(e) (2) and 25(a)

(6) (C) of the Tax Code or the stock transaction tax imposed under Section

124-A of the Tax Code and the documentary stamp tax imposed under

Section 176 of the Tax Code.

It is represented that PCD is an entity licensed by the Securities and

Exchange Commission ("SEC") as a depository of, among others,

shares of stock listed and traded in the Philippine Stock Exchange ("PSE");

that its primary mandate is, among others, to introduce a scripless book-entry

system for the settlement of PSE trades, in order to address the

problem of delay, inefficiency and even fraud attending the existing paper-

based settlement procedure; that for PCD to carry out this mandate, the

shares of stock of the PSE-listed companies must first be "lodged" into

the PCD System for "immobilization"; that lodgment is the process by which

stockholders of the PSE-listed company transfer the legal title over their

shares of stock in favor of PCD Nominee Corp. ("PCD Nominee"), a

corporation wholly owned by PCD whose sole purpose is to act

as nominee and legal title holder of all shares of stock lodged

into PCD (beneficial title to the "lodged" shares remains with the lodging

stockholders); that immobilization is the process by which the share

certificates of lodging stockholders are cancelled by the Transfer Agent and a

new stock certificate covering all the shares lodged ("Jumbo Certificate")

issued in the name of PCD Nominee, in order that settlement of PSE

trades of the PSE-listed company can be effected by mere book-entry

transfer of beneficial title in the PCD System without the transfer of stock

certificates covering the traded shares; and that no consideration is paid for

the transfer of legal title to PCD Nominee.

The Corporation Code requires that all shares of stock of a corporation

must be evidenced by a certificate and a stockholder who has fully paid his

subscription has the right to demand such certificate. Thus, it is also

represented that if a stockholder wishes to withdraw his stockholdings from

the PCD System, the PCD has a procedure of "upliftment", under

which PCD Nominee will now transfer back to the stockholder the legal title to

the shares lodged in order that legal and beneficial title will once again be

consolidated in the stockholder; that under this process, the Jumbo Certificate

is surrendered to the Transfer Agent, which then issues a new stock

certificate in the name of the uplifting stockholder and a new Jumbo

Certificate for the balance; and that again, no consideration is paid for the

transfer of legal title back to the beneficial owner.

In reply, please be informed that the conveyance of the legal title over

the shares to a trustee or nominee without transfer of beneficial title and

without any consideration does not involve an actual transfer of ownership

over the shares, hence, not subject to the capital gains tax and documentary

stamp tax. Thus, your opinion that the transfer of legal title over the shares

from the lodging stockholders to PCD Nominee Corp., or

from PCD Nominee Corp. to the uplifting stockholders, is not subject to capital

gains tax or stock transaction tax and documentary stamp tax because there

is no actual transfer of ownership over the aforementioned shares of stock is

hereby confirmed. (BIR Ruling Nos. UN-258-95, 123-93, 124-93, 125-93, 127-

93, 128-93 and 129-93) However, the transfers of beneficial ownership over

the lodged shares shall be subject to capital gains tax or stock transaction tax,

as the case may be, and to documentary stamp tax.

Moreover, under Section 191 of the Documentary Stamp Tax

Regulations (Revenue Regulations No. 26), the conveyance of property to a

trustee is exempt from documentary stamp tax. Section 191 of said

Regulations provides:

"Section 191. Conveyance to trustees or from trustee to cestui

que trust, without consideration. Conveyances to a trustee without

valuable consideration, or from a trustee to a cestui que trust without

valuable consideration are not subject to tax."

Thus, your opinion that the conveyance of the shares from the

stockholders to the nominee — PCD Nominee Corporation and versa, is not

subject to documentary stamp tax pursuant to Section

191 of Revenue Regulations No. 26, otherwise known as The Documentary

Stamp Tax Regulations, is likewise hereby confirmed.

Accordingly, the Transfer Agents of the publicly listed companies may

cancel the outstanding shares certificate in the name of the stockholders and

issue the Jumbo Certificate in the name of PCD Nominee Corporation for

immobilization. Likewise, in the event a shareholder withdraws his

stockholdings from the PCD System, the Transfer Agents shall likewise issue

a new stock certificate in the name of the uplifting stockholder and a new

Jumbo Certificate for the balance upon surrender of the original Jumbo

Certificate in order that the legal and beneficial title will once again be

consolidated in the stockholder.

This ruling is being issued on the basis of the foregoing facts as

represented. However, if upon investigation, it will be disclosed that the facts

are different, then this ruling shall be considered null and void.

aisadc

Very truly yours,

LIWAYWAY VINZONS-CHATO

Commissioner of Internal Revenue

(Transfer of Legal Title to Outstanding Shares of Stock, Without a Transfer of

|||

Beneficial Title, from Stockholders to the Nominee, and Vice-Versa, Not Subject

to Capital Gains Tax Nor to the Stock Transaction Tax and the Documentary

Stamp Tax , BIR Ruling No. 039-97, [April 3, 1997])

You might also like

- Chattel MortgageDocument1 pageChattel MortgageNabby Mendoza0% (1)

- Plaintiff's Original Petition FiledDocument22 pagesPlaintiff's Original Petition FiledCBS 11 NewsNo ratings yet

- Jurisprudence: I. Nature, Forms, KindsDocument13 pagesJurisprudence: I. Nature, Forms, KindsGenevieve Bermudo100% (2)

- US-DoT: Acknowledgement and Acceptance of ComplaintDocument2 pagesUS-DoT: Acknowledgement and Acceptance of ComplaintcallertimesNo ratings yet

- FORM 9 Consent To Act As Designated Partner of LLPDocument1 pageFORM 9 Consent To Act As Designated Partner of LLPGirver Singh Khangarot100% (2)

- Registration of Titles ActDocument126 pagesRegistration of Titles ActDebbian Livingstone100% (1)

- Land Title and DeedsDocument4 pagesLand Title and DeedsAndré BragaNo ratings yet

- SEC Opinion 11-41Document5 pagesSEC Opinion 11-41Tina Reyes-BattadNo ratings yet

- Terms and Conditions Governing Deposit AccountsDocument2 pagesTerms and Conditions Governing Deposit AccountsKap MPNo ratings yet

- Securities and Exchange Commission (SEC) - Formn-54aDocument2 pagesSecurities and Exchange Commission (SEC) - Formn-54ahighfinanceNo ratings yet

- LTD Serrano Lecture 1Document4 pagesLTD Serrano Lecture 1Pinky VelosoNo ratings yet

- BAHIN v. HUGHES. (1882 B. 6701.) - (1886) 31Document8 pagesBAHIN v. HUGHES. (1882 B. 6701.) - (1886) 31Anna Ahmad100% (1)

- Johnston v. JohnstonDocument11 pagesJohnston v. Johnstonlenard5100% (1)

- HM Attorney General V KingDocument8 pagesHM Attorney General V KingDikephorosNo ratings yet

- CA Foreclosure Law - Civil Code 2924Document44 pagesCA Foreclosure Law - Civil Code 2924api-22112682No ratings yet

- Warehouse ReceiptDocument4 pagesWarehouse ReceiptJames Ibrahim AlihNo ratings yet

- AssignmentDocument11 pagesAssignmentapple jade licuananNo ratings yet

- Atiko Trans vs. PgaDocument2 pagesAtiko Trans vs. PgaKat MirandaNo ratings yet

- General Banking LawDocument31 pagesGeneral Banking LawMonalizts D.No ratings yet

- Explain The Principle of Executive Privilege?Document6 pagesExplain The Principle of Executive Privilege?arellano lawschoolNo ratings yet

- General Power of AttorneyDocument5 pagesGeneral Power of AttorneyDikshagoyal123No ratings yet

- Chapter 11 Taxation of Estates and Trusts LlamadoDocument7 pagesChapter 11 Taxation of Estates and Trusts LlamadoLiana Monica LopezNo ratings yet

- Imperfect GiftsDocument2 pagesImperfect GiftsAdam 'Fez' FerrisNo ratings yet

- Habeas Corpus, Writ of Amparo, and Habeas Data Distinguished: Habeas Corpus Writ of Amparo Habeas DataDocument3 pagesHabeas Corpus, Writ of Amparo, and Habeas Data Distinguished: Habeas Corpus Writ of Amparo Habeas DataErlindaNo ratings yet

- Bank Secrecy LawDocument35 pagesBank Secrecy LawGee GuevarraNo ratings yet

- G.R. No. L-43082 June 18, 1937 PABLO LORENZO, As Trustee of The Estate of Thomas Hanley, Deceased, Plaintiff-Appellant, JUAN POSADAS, JR., Collector of Internal Revenue, DefendantDocument8 pagesG.R. No. L-43082 June 18, 1937 PABLO LORENZO, As Trustee of The Estate of Thomas Hanley, Deceased, Plaintiff-Appellant, JUAN POSADAS, JR., Collector of Internal Revenue, DefendantDaphne Jade Estandarte PanesNo ratings yet

- JurisprudenceDocument10 pagesJurisprudenceKarlaAlexisAfableNo ratings yet

- Of The Trust: Express TrustsDocument6 pagesOf The Trust: Express TrustsJoyce Fe Egsaen MagannonNo ratings yet

- Land Titles and DeedsDocument30 pagesLand Titles and DeedsmariaceciliassantiagNo ratings yet

- Sec 39conditio Nal IndorsementDocument10 pagesSec 39conditio Nal IndorsementgoerginamarquezNo ratings yet

- Complaint - Eminent DomainDocument1 pageComplaint - Eminent DomainJsimNo ratings yet

- Tax Admin and EnforcementDocument5 pagesTax Admin and EnforcementPeanutButter 'n JellyNo ratings yet

- Transfer and Conveyance StandardsDocument10 pagesTransfer and Conveyance Standardsab boNo ratings yet

- Articles of IncorporationDocument11 pagesArticles of IncorporationLaurel LinmayogNo ratings yet

- Severino V SeverinoDocument6 pagesSeverino V SeverinoJorela TipanNo ratings yet

- 04 Letter of SubrogationDocument1 page04 Letter of SubrogationVidhyasagar BsNo ratings yet

- Agency and TrustDocument32 pagesAgency and TrustZina Caidic100% (1)

- Writ of Habeas CorpusDocument31 pagesWrit of Habeas CorpusRoe DirectoNo ratings yet

- Digest 3Document2 pagesDigest 3Edmund Pulvera Valenzuela IINo ratings yet

- Case Digest AccountingDocument2 pagesCase Digest AccountingMinerva Vallejo AlvarezNo ratings yet

- Land Titles and DeedsDocument21 pagesLand Titles and DeedsJess MonterasNo ratings yet

- Report in Land Titles and DeedsDocument22 pagesReport in Land Titles and DeedstynajoydelossantosNo ratings yet

- Country Bankers Insurance Corporation: Indemnity AgreementDocument2 pagesCountry Bankers Insurance Corporation: Indemnity AgreementAngelo PuraNo ratings yet

- Habeas CorpusDocument44 pagesHabeas CorpusAnonymous Q0KzFR2i100% (1)

- Succession Prelim Reviewer 1Document18 pagesSuccession Prelim Reviewer 1PAMELA PARCENo ratings yet

- Agasen Vs CADocument2 pagesAgasen Vs CAChelle OngNo ratings yet

- Sample NODDocument3 pagesSample NODSteve Mun GroupNo ratings yet

- Land Titles and DeedsDocument16 pagesLand Titles and DeedsNoel RemolacioNo ratings yet

- Case Digest ATP (58-64)Document7 pagesCase Digest ATP (58-64)Domie AbataNo ratings yet

- In The United States District Court For The Western District of TennesseeDocument12 pagesIn The United States District Court For The Western District of TennesseeJacob Gallant100% (1)

- (NEGO) Sec. 5. Additional Provisions Not AffectingDocument7 pages(NEGO) Sec. 5. Additional Provisions Not AffectingBobby ParksNo ratings yet

- Legal Forms in Civil LawDocument15 pagesLegal Forms in Civil LawFrancis Puno100% (1)

- Lease of Personal PropertyDocument2 pagesLease of Personal PropertyRudolph AlcazarenNo ratings yet

- Title 5 RepresentationDocument4 pagesTitle 5 RepresentationMakoy MolinaNo ratings yet

- Public Notice PDFDocument3 pagesPublic Notice PDFHarsh ChaudharyNo ratings yet

- Agency CasesDocument162 pagesAgency Casesshayne martirezNo ratings yet

- BIR RULING NO. OT-421-2021: Sun Life of Canada (Philippines), IncDocument6 pagesBIR RULING NO. OT-421-2021: Sun Life of Canada (Philippines), IncCarlota VillaromanNo ratings yet

- Civil Forfeiture Proceedings in The Philippines PDFDocument28 pagesCivil Forfeiture Proceedings in The Philippines PDFArjane Aram Samaniego100% (1)

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1972.From EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1972.No ratings yet

- BIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Document3 pagesBIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Hailin QuintosNo ratings yet

- Strictly Confidential - : Regional DirectorDocument2 pagesStrictly Confidential - : Regional DirectorMysajadeJaoMejicaNo ratings yet

- Business Permit RequirementsDocument1 pageBusiness Permit RequirementsMysajadeJaoMejicaNo ratings yet

- Sec Cert 1:2Document1 pageSec Cert 1:2MysajadeJaoMejicaNo ratings yet

- ShowcauseDocument1 pageShowcauseMysajadeJaoMejicaNo ratings yet

- Authorized (XXX) .": SUBSCRIBED AND SWORN TO Before Me This - Day ofDocument2 pagesAuthorized (XXX) .": SUBSCRIBED AND SWORN TO Before Me This - Day ofMysajadeJaoMejicaNo ratings yet

- PDF ComplaintDocument4 pagesPDF ComplaintMysajadeJaoMejicaNo ratings yet

- 18 - Objections To Offer (Crim)Document2 pages18 - Objections To Offer (Crim)MysajadeJaoMejicaNo ratings yet

- Central Bank v. CitytrustDocument2 pagesCentral Bank v. CitytrustAnjNo ratings yet

- Transfer of Property ActDocument8 pagesTransfer of Property ActJyoti MauryaNo ratings yet

- Overtime Wages Under Factories Act 1948Document6 pagesOvertime Wages Under Factories Act 1948shikhawidge86% (7)

- Wix License NoteDocument2 pagesWix License NoteRodrigo CruzNo ratings yet

- Accounting For Partnership Firm - FundamentalsDocument15 pagesAccounting For Partnership Firm - FundamentalsYutika DoshiNo ratings yet

- CIVIL LAW I (2022) : 1. Noel Is The Son of Spouses Marie and BenedictDocument19 pagesCIVIL LAW I (2022) : 1. Noel Is The Son of Spouses Marie and BenedictTannie Lyn Ebarle BasubasNo ratings yet

- Albofera AvoidingcollisionDocument6 pagesAlbofera AvoidingcollisionALBOFERA, PRAISE GEE L.No ratings yet

- Mansoor Ijaz Credit ReportDocument10 pagesMansoor Ijaz Credit ReportArshad SharifNo ratings yet

- Emil Interactive Lawsuit Against Ken HorrellDocument12 pagesEmil Interactive Lawsuit Against Ken HorrellChad HollowayNo ratings yet

- Dwnload Full Traffic Engineering 4th Edition Roess Solutions Manual PDFDocument30 pagesDwnload Full Traffic Engineering 4th Edition Roess Solutions Manual PDFnubilegoggler.i8cm100% (11)

- Law On Negotiable Instruments (Workbook) : QuestionsDocument4 pagesLaw On Negotiable Instruments (Workbook) : QuestionsAnonymous rkKMyy7No ratings yet

- Ection 11. Interpretation of A Writing According To Its Legal Meaning. - The Language of A WritingDocument3 pagesEction 11. Interpretation of A Writing According To Its Legal Meaning. - The Language of A WritingPrincess Helen Grace BeberoNo ratings yet

- Accident Waiver and Release Liability Form: Printed Name & SignatureDocument1 pageAccident Waiver and Release Liability Form: Printed Name & SignatureNNobSaibotNo ratings yet

- Learnovate E-CommerceDocument7 pagesLearnovate E-CommerceEswar Sai VenkatNo ratings yet

- OlDocument5 pagesOlArun KumarNo ratings yet

- Eastern Shipping Lines v. BPI MSI InsuranceDocument2 pagesEastern Shipping Lines v. BPI MSI InsurancedelayinggratificationNo ratings yet

- Discharge of A Guarantor or SuretyDocument7 pagesDischarge of A Guarantor or Suretykaweesa mosesNo ratings yet

- 40 - Francisco vs. MejiaDocument8 pages40 - Francisco vs. MejiajannahNo ratings yet

- Bureau of Patents, Trademarks and Technology Transfer Internal Rules of ProcedureDocument30 pagesBureau of Patents, Trademarks and Technology Transfer Internal Rules of ProcedurejoNo ratings yet

- FA 2 PresentationDocument15 pagesFA 2 PresentationDylaan RajNo ratings yet

- 2018 Civil LawDocument5 pages2018 Civil LawmichaelargabiosoNo ratings yet

- CSLDocument4 pagesCSLEnriqueNo ratings yet

- RFBT03-11 - Law On Sales - Supplemental QuizzerDocument7 pagesRFBT03-11 - Law On Sales - Supplemental QuizzerElaine Joyce GarciaNo ratings yet

- Berkshire Lawsuit Docs.Document2 pagesBerkshire Lawsuit Docs.Ian MartinNo ratings yet

- FinalsDocument11 pagesFinalsAlexandrea SagutinNo ratings yet

- BUSINESS FINANCIAL ADVISORY SERVICES AGREEMENT v1Document6 pagesBUSINESS FINANCIAL ADVISORY SERVICES AGREEMENT v1Carlos MurilloNo ratings yet

- 30th Vis Moot Analysis For ArbitratorsDocument20 pages30th Vis Moot Analysis For ArbitratorsAdarsh TripathiNo ratings yet

- Credit TransactionsDocument12 pagesCredit TransactionsMark Tano100% (3)

- Psychological Empowerment in The WorkplaceDocument24 pagesPsychological Empowerment in The WorkplaceAndhika Putra KresnanditoNo ratings yet