Professional Documents

Culture Documents

IHP Customer Information Sheet - 0 PDF

IHP Customer Information Sheet - 0 PDF

Uploaded by

Aswin NandaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- safe-work-procedure-HEAT STRESSDocument3 pagessafe-work-procedure-HEAT STRESSmanoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Moot Proposition 2019Document4 pagesMoot Proposition 2019Aswin NandaNo ratings yet

- SOP Emp Health Hygiene Rev4 10Document3 pagesSOP Emp Health Hygiene Rev4 10Hanna SeftianaNo ratings yet

- GramDocument3 pagesGramAswin NandaNo ratings yet

- Ea 1128 PDFDocument1 pageEa 1128 PDFAswin NandaNo ratings yet

- Judicial Review of Administrative Discretion in India (Part A)Document14 pagesJudicial Review of Administrative Discretion in India (Part A)Aswin NandaNo ratings yet

- 5 5 54 839 PDFDocument4 pages5 5 54 839 PDFAswin NandaNo ratings yet

- In The High Court of Delhi at New Delhi: Date of Judgment: 02 December, 2020Document6 pagesIn The High Court of Delhi at New Delhi: Date of Judgment: 02 December, 2020Aswin NandaNo ratings yet

- SJRCT: (The (Sazette of 3ndiaDocument2 pagesSJRCT: (The (Sazette of 3ndiaAswin NandaNo ratings yet

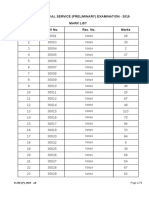

- Kerala Judicial Service (Preliminary) Examination - 2019 Mark ListDocument79 pagesKerala Judicial Service (Preliminary) Examination - 2019 Mark ListAswin NandaNo ratings yet

- Rules and RegulationsDocument3 pagesRules and RegulationsAswin NandaNo ratings yet

- Kerala Judicial Service Main (Written) Examination - 2017 (Nca & Regular Recruitments) Mark ListDocument15 pagesKerala Judicial Service Main (Written) Examination - 2017 (Nca & Regular Recruitments) Mark ListAswin NandaNo ratings yet

- CPR-Legal and EthicalDocument4 pagesCPR-Legal and EthicalariesblackNo ratings yet

- Fetal Growth RestrictionDocument56 pagesFetal Growth RestrictionKanika VermaNo ratings yet

- The Effectiveness of Slow Deep Breathing To Decrease Blood Pressure in Hypertension - A Systematic ReviewDocument4 pagesThe Effectiveness of Slow Deep Breathing To Decrease Blood Pressure in Hypertension - A Systematic ReviewThalia NadiraNo ratings yet

- The Prefrontal Cortex and Obesity A Health Neuroscience PerspectiveDocument13 pagesThe Prefrontal Cortex and Obesity A Health Neuroscience PerspectiveIgnacio DuqueNo ratings yet

- Immunization Programme and Preventive Immunization: Presented By: Kanchan MSC 1 YRDocument53 pagesImmunization Programme and Preventive Immunization: Presented By: Kanchan MSC 1 YRArchanaNo ratings yet

- INFOSAN User Guide FinalDocument17 pagesINFOSAN User Guide FinalJorge Gregorio SeguraNo ratings yet

- HascvdDocument92 pagesHascvdbatangas_ynad_29900% (1)

- Zuqiaoyin Gb-44: Yin Portals of The FootDocument2 pagesZuqiaoyin Gb-44: Yin Portals of The Footray72roNo ratings yet

- Syllabus MD Siddha - Pura Maruthuvam 2017Document23 pagesSyllabus MD Siddha - Pura Maruthuvam 2017RajeshKothanNo ratings yet

- Binge Eating Disorder PDFDocument4 pagesBinge Eating Disorder PDFIsidora KesićNo ratings yet

- 10 Symptoms of Vitamin D DeficiencyDocument2 pages10 Symptoms of Vitamin D Deficiencysearching1_2No ratings yet

- Ethinylestradiol 0.03mg + Drospirenone 3mg (Yasmin)Document18 pagesEthinylestradiol 0.03mg + Drospirenone 3mg (Yasmin)asdwasdNo ratings yet

- Pulmonary Hypertension: Introduction To Cor PulmonaleDocument16 pagesPulmonary Hypertension: Introduction To Cor PulmonaleJisha JanardhanNo ratings yet

- COVID-19 Pandemic in Pakistan: CommentaryDocument13 pagesCOVID-19 Pandemic in Pakistan: CommentaryMalik HammadNo ratings yet

- Communicable Disease Post TestDocument7 pagesCommunicable Disease Post TestJaezee RamosNo ratings yet

- Wobblers SyndromeDocument37 pagesWobblers SyndromeSazzle CakeNo ratings yet

- 2 Respiratory TractDocument39 pages2 Respiratory TractnanxtoyahNo ratings yet

- 12 Blood VesselsDocument26 pages12 Blood VesselsBalaji DNo ratings yet

- Interview Script: Biographical Data You: Andrea Patient: NicoleDocument6 pagesInterview Script: Biographical Data You: Andrea Patient: NicoleNICOLE KAYE MANALANGNo ratings yet

- Fecal ColiformDocument8 pagesFecal Coliformapi-357361328No ratings yet

- Pressure Ulcers - Prevention and Management of Pressure Ulcers StrategyDocument38 pagesPressure Ulcers - Prevention and Management of Pressure Ulcers StrategyAlex Alexandra AlexNo ratings yet

- Test Bank For Medical Genetics 4th Edition Lynn B JordeDocument8 pagesTest Bank For Medical Genetics 4th Edition Lynn B Jorderoytuyenbau100% (1)

- Sexually Transmitted DiseasesDocument120 pagesSexually Transmitted DiseasesGliza Jane100% (4)

- Drug Study (Lactulose, Zynapse, Simvastatin) and HTP - CVD Prob CardioembolismDocument9 pagesDrug Study (Lactulose, Zynapse, Simvastatin) and HTP - CVD Prob CardioembolismRene John FranciscoNo ratings yet

- SarcoidosisDocument7 pagesSarcoidosisJohn SmithNo ratings yet

- Pediadrills& Ob Drill - Line, Shella Mae BSNIII-LEVINEDocument31 pagesPediadrills& Ob Drill - Line, Shella Mae BSNIII-LEVINEShella Mae LineNo ratings yet

- 2Document6 pages2muiNo ratings yet

- Anemia Secondary To Hemmorhagia: Presented byDocument21 pagesAnemia Secondary To Hemmorhagia: Presented byEsmareldah Henry SirueNo ratings yet

IHP Customer Information Sheet - 0 PDF

IHP Customer Information Sheet - 0 PDF

Uploaded by

Aswin NandaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IHP Customer Information Sheet - 0 PDF

IHP Customer Information Sheet - 0 PDF

Uploaded by

Aswin NandaCopyright:

Available Formats

Individual Health Insurance Policy – Customer Information Sheet

United India Insurance Company Limited

CIN: U93090TN1938GOI000108

UIN NO: UIIHLIP19116V021819

Customer Information Sheet

Description is illustrative and not exhaustive

Sr. Title Description Refer to

No Policy

Clause No.

Page 1 of

Product Individual Health Insurance Policy

1 Policy

Name Plans – Platinum/Gold/Senior Citizen

Document

Medical Expenses

1. Hospitalisation Expenses: Policy covers hospitalisation expenses 1.1

incurred as an in-patient for more than 24 hours, due to illness or injury

during the policy period, on the advice of a qualified medical

practitioner 1.2A

a) Room Rent/Boarding and Nursing expenses, not exceeding 1%

of the SI per day. 1.2B

b) ICU/ICCU expenses not exceeding 2% of SI per day. 1.2C, D

c) Surgeon, Anaesthetist, Consultant, Specialist fees, OT charges,

Chemotherapy, X-ray, etc. and other expenses that are

medically necessary (exhaustive list given in policy document). 1.2E

d) All expenses incurred for donor in respect of organ transplant.

Expenses in respect of Cataract, Hernia, Hysterectomy and Major surgeries 1.2.1

will be restricted according to the limits specified in the policy document.

(applicable only for Gold plan & Senior Citizen plan)

2. Pre and Post–Hospitalisation Expenses: Policy covers expenses

incurred for the same illness/injury that caused hospitalisation, during

What am I the period upto 30 days prior to hospitalisation and during the period 1.3

2 upto 60 days after discharge from the hospital.

covered for

3. Day Care Procedures: The “more than 24 hours’ time limit” for

hospitalisation is not applicable on day care procedures, provided the 1.4;

procedures are taken as an in-patient. Annexure–

I

The list of 140+ day care procedures is given in Annexure – I of Policy.

4. Domiciliary Hospitalisation: Expenses under this head where

treatment exceeds 3 days, are covered provided that:

a) Insured’s condition would ordinarily require treatment at a

hospital, AND 1.5;

b) Insured is not in a condition to be moved to a hospital OR Annexure

c) Insured takes treatment at home on account of non-availability – III

of a room in a hospital.

Liability under this clause is restricted as given in Annexure – III of Policy.

1.6

5. Ayurvedic Treatment: Expenses on Ayurvedic treatment are

reimbursed only when treatment is taken in defined hospitals, as

specified in the Policy document.

2 What am I Optional Covers

UIN NO: UIIHLIP19116V021819

Page 1 of 6

Individual Health Insurance Policy – Customer Information Sheet

covered for 1. Ambulance Charges: On payment of additional premium of Rs 100/-, 8.1

the company will cover road ambulance charges incurred up to a

maximum of Rs 2500 per policy period.

2. Hospital Daily Cash Benefit: On payment of additional premium of Rs.

8.2

150/300, a Daily Cash Allowance of Rs. 250/500 per day, from the third

day onwards for the period of hospitalisation subject to a maximum of

Rs. 2500/ Rs. 5000 is payable.

NOTE: All above coverages are subject to Limits, Terms and Conditions and

Exclusions contained in the Policy document.

General Exclusions applicable to all Plans

1. Congenital Internal Diseases or Defects or anomalies. However, if not

known to the insured as pre-existing at the time of inception of first

policy with us, these diseases will be covered after 24 months of

continuous coverage. If the insured is aware of the existence of 4.5a

congenital internal disease before inception of the policy, the same will

be covered after 48 months.

2. Congenital External Disease or Defect or anomalies. 4.5b

3. Illness/Injury caused directly/indirectly as a result of War, Invasion, Act

4.6

of Foreign Enemy, and War like operations.

4. A) Circumcision unless necessary for treatment of a disease not 4.7 a

excluded or as may be necessitated due to an accident.

B) Vaccination or Inoculation of any kind unless it is post animal bite. 4.7 b

C) Change of life or cosmetic or aesthetic treatment of any description. 4.7 c

D) Correction of eyesight due to refractive error. 4.7 d

E) Plastic surgery other than as may be necessitated due to 4.7e

What are disease/injury.

the major 5. Cost of spectacles, contact lenses and hearing aids, cochlear implants. 4.8

3 exclusions 6. Dental treatment or surgery of any kind unless necessitated by 4.9

in the accident and requiring hospitalisation.

policy?

7. A) Convalescence, general debility; run-down condition or rest cure. 4.10 a

B) Treatment for obesity or condition arising therefrom (including 4.10 b

morbid obesity) and any other weight control and management

programmes/services/supplies or treatment.

C) Infertility/sub fertility, sterility, assisted conception procedures 4.10 c

D) Venereal disease, Sexually Transmitted Diseases. 4.10 d

E) Treatment of illness/injury arising out of misuse or abuse of 4.10 e

drugs/alcohol or use of intoxicating substances.

F) Bodily Injury due to willful or deliberate exposure to danger (except 4.10 f

in an attempt to save human life), intentional self-inflicted Injury,

attempted suicide.

G) Treatment of injury/illness sustained as a result of committing or 4.10 g

attempting to commit breach of law with criminal intent.

8. Charges incurred at Hospital/Nursing Home primarily for diagnosis, X- 4.11

ray or Laboratory examinations or other diagnostic studies not

consistent with or incidental to the diagnosis and treatment of

positive existence or presence of any ailment, sickness or injury, for

which confinement is required at a Hospital/Nursing Home.

9. Expenses on vitamins and tonics unless they form part of treatment 4.12

for injury/diseases as certified by the attending physician.

UIN NO: UIIHLIP19116V021819

Page 2 of 6

Individual Health Insurance Policy – Customer Information Sheet

10. Injury/Disease directly or indirectly caused by/contributed to by 4.13

nuclear weapon/materials.

11. Treatment arising from pregnancy, childbirth, miscarriage, abortion or 4.14

complications of any of these including caesarean section, except

abdominal operation for extra uterine pregnancy (Ectopic Pregnancy).

12. Naturopathy Treatment, acupressure, acupuncture, magnetic 4.15

therapies, experimental and unproven treatments/therapies.

13. External and or durable Medical/Non-medical equipment of any kind 4.16

used for diagnosis and/or treatment and/or monitoring and/or

maintenance and/or support including CPAP, Infusion pump, Oxygen

concentrator etc., Ambulatory devices and also any medical

equipment, which are subsequently used at home.

This is indicative; please refer to Annexure–II in the Policy for the Annexure

complete list of non-payable items – II

14. Stem cell implantation/surgery 4.17

15. Change of treatment from one system of medicine to another system 4.18

unless recommended by the consultant/hospital under whom the

treatment is taken

16. Use of intravitreal injections for treatment of all diseases including Age 4.19

What are Related Macular Degeneration and Retinal vein occlusion; treatments

3 the major such as Rotational Field Quantum Magnetic Resonance, External

exclusions Counter Pulsation, Enhanced External Counter Pulsation, Hyperbaric

in the Oxygen Therapy and Continuous Peritoneal Ambulatory Dialysis.

policy?

17. All non-medical expenses including convenience items for personal 4.20

comfort such as charges for telephone, television, ayah, private

nursing/barber or beauty services, diet charges, baby food, etc.

Refer to Annexure – II in the Policy Document for detailed list.

18. Any kind of Service charges, Surcharges, Admission Fees/Registration 4.21

Charges, Luxury tax and similar charges levied by the hospital.

Refer to Annexure – II in the Policy Document for detailed list.

Exclusions applicable to Gold plan & Senior Citizen plan

1. Any pre-existing condition(s) until 48 months of continuous coverage of 4.1

such insured person have elapsed. Any complication arising from pre-

existing disease shall be considered as part of the pre-existing disease.

2. Any disease contracted within the first 30 days from the 4.2

commencement of first policy

3. Unless the Insured has 24 months of continuous coverage, expenses on 4.3

treatment of Cataract, Benign Prostatic Hypertrophy,

Menorrhagia/Fibromyoma/Myoma and prolapse of uterus, Hernia of

all types, Hydrocele, Fistula in anus, piles, Sinusitis and related

disorders, Gout & Rheumatism, Calculus Diseases are not payable.

NOTE: Even after twenty-four months of continuous coverage, the above

mentioned diseases will not be covered if they arise from a pre-existing condition,

until 48 months of continuous coverage have elapsed, since inception of the first

policy with the Company

4. Unless the Insured has 48 months of continuous coverage, expenses 4.4

related to treatment of Joint Replacement due to Degenerative

Condition & age-related Osteoarthritis & Osteoporosis are not payable

Waiting 30 days waiting period from the commencement date of first policy 4.2

4

Period (only 48 months waiting period applicable for:

UIN NO: UIIHLIP19116V021819

Page 3 of 6

Individual Health Insurance Policy – Customer Information Sheet

for Gold a) Any pre-existing condition. Any complication arising from pre-existing 4.1

plan and disease shall be treated as part of the pre-existing disease.

Senior b) Expenses related to treatment of Joint Replacement due to 4.4

Citizen Degenerative Condition and age-related Osteoarthritis & Osteoporosis.

plan) c) Congenital Internal Diseases or Defects or anomalies, if insured is 4.5 a

aware of the existence of disease prior to inception of the policy.

24 months waiting period applicable for:

a) Expenses related to treatment of Cataract, Benign Prostatic 4.3

Hypertrophy, Treatment for Menorrhagia/Fibromyoma/Myoma and

prolapse of uterus, Hernia of all types, Hydrocele, Fistula in anus, piles,

Sinusitis and related disorders, Gout & Rheumatism, Calculus Diseases.

If the above conditions are pre-existing at the time of inception of

policy, 48 months waiting period will apply.

b) Congenital Internal Diseases or Defects or anomalies, if not known to 4.5 a

the insured as pre-existing at the time of inception of policy.

Cashless facility for treatment in network hospitals if insured has opted 5.6.2 (i)

for claim processing by TPA.

Claims for treatment in non-network hospitals or on policies opted 5.6.3

Payout without TPA, are reimbursed upon submission of necessary documents

5

Basis to TPA/Company

Claims for pre–hospitalisation and post–hospitalisation will be settled 5.6.2

on a reimbursement basis on production of cash receipts.

Expenses exceeding the following Sub-limits:

a) Room charges beyond 1% of Sum Insured per day 1.2A

b) ICU/ICCU charges beyond 2% of Sum Insured per day. 1.2B

c) All expenses (1.2C&D as per policy) incurred at the Hospital, with 1.2, Note

the exception of cost of medicines, drugs & implants, shall be 1

effected in the same proportion as the admissible rate per day

bears to the actual rate per day of Room Rent/ICU/ICCU charges.

Applicable only for Gold Plan and Senior Citizen Plan:

Cost

6 Other sub-limits: 1.2.1

Sharing

a) Cataract– Actual expenses or 25% of Sum Insured whichever is less,

subject to a maximum of Rs. 40000 only

b) Hernia & Hysterectomy– Actual expenses or 25% of Sum Insured

whichever is less, subject to a maximum of Rs. 100000 only.

c) Major surgeries- Actual expenses or 70% of the SI whichever is less.

Pre & Post Hospitalisation is limited to actual expenses incurred subject 1.3.1

to maximum of 10% of Sum Insured

Note: Above limits are applicable per hospitalisation/surgery

The policy can be renewed annually throughout the lifetime of the 5.11 (i, ii)

insured person by mutual consent.

The policy will be renewed upon remittance of the requisite premium 5.11 (iv)

Renewal to the company prior to expiry of the policy period

7

Condition A grace period of 30 days is allowed in case of break in policy; claims 5.11 (vii)

incurred during the break in period are not payable

Company can decline renewal on grounds of fraud, misrepresentation, 5.11 (vi)

non-co-operation, suppression by the insured.

Reimbursement for a medical checkup, at the end of block of every three 3

Renewal

8 claim free years, up to 1% of the average SI for the preceding three policy

Benefits

periods subject to a maximum of Rs 5000/-

UIN NO: UIIHLIP19116V021819

Page 4 of 6

Individual Health Insurance Policy – Customer Information Sheet

We may at any time cancel the Policy on grounds of fraud, 5.10

misrepresentation, non-disclosure of material fact, by sending you 15

days’ notice, in which case the policy shall become void and all

premium paid thereon shall be forfeited.

In case of non-cooperation by the Insured person/s, the policy shall be 5.10

cancelled and the ratable proportion of the premium paid shall be

refunded corresponding to the unexpired period of insurance if no

claim has been reported/paid under the policy.

The insured may cancel the policy at any time and if no claim has been 5.10

9 Cancellation made up to the date of cancellation, then the company shall allow

refund of premium at our short period rate table given below:

RATE OF PREMIUM TO BE

PERIOD ON RISK

CHARGED

Upto one month 1/4th of the annual rate

Upto three months 1/2 of the annual rate

Upto six months 3/4th of the annual rate

Exceeding six months Full annual rate

Cashless: available if treatment taken in network provider/PPN hospital 5.6.2

subject to preauthorization by TPA. Updated list of network

provider/PPN hospitals is available at:

(https://uiic.co.in/en/tpa-ppn-network-hospitals)

a) In case of planned hospitalisation, TPA must be informed at least 5.6.1

72 hours prior to admission in hospital

b) In case of emergency hospitalisation, TPA must be informed within 5.6.1

24 hours of admission in hospital

Reimbursement Service: Available for treatment in non-network 5.6.3

hospitals or on policies opted without TPA, are reimbursed upon

submission of necessary documents to TPA/Company.

10 Claims a) Same notification timelines as above apply for reimbursement

b) Documents must be submitted within the following prescribed 5.6.5

deadlines:

Type of claim Time limit for submission of documents

to company/TPA

Reimbursement of hospitalisation Within 15 days of date of discharge from

and pre hospitalisation expenses hospital

(limited to 30 days)

Reimbursement of post Within 15 days from completion of post

hospitalisation expenses (limited to hospitalisation treatment

60 days)

Reimbursement of health checkup Within 7 days of health checkup

expenses (as per Section 3.9 A)

1. Company:

a) Policy issuing Office,

b) Registered & Head Office: 24, Whites Road, Chennai – 600014

Policy c) Company website: www.uiic.co.in

Servicing/ d) customercare@uiic.co.in

11

Grievance/ 2. IRDAI (IGMS/Call Centre): 6

Complaints a) www.irdai.gov.in

b) complaints@irda.gov.in

3. Ombudsman: http://www.gbic.co.in/ombudsman.html 6

UIN NO: UIIHLIP19116V021819

Page 5 of 6

Individual Health Insurance Policy – Customer Information Sheet

1. Free Look: You are allowed a period of at least 15 days from the date 5.15

of receipt of first policy to review the terms and conditions and return

the same if not acceptable.

2. Renewability: The policy can be renewed annually throughout the 5.11

lifetime of the insured. In the event of break in the policy a grace

period of 30 days is allowed.

3. Migration: The insured can opt for migration of policy to our other 5.20

similar or closely similar products at the time of renewal.

4. Portability: This policy is subject to the Guidelines of IRDAI on 5.17

Insured’s Portability of Health Insurance Policies, as amended from time to time.

12

Rights 5. Enhancement of Sum Insured: The Insured member can apply for 5.12

enhancement of Sum Insured at the time of renewal by submitting a

fresh proposal form/written request to the company. The acceptance

of the enhancement would be at the discretion of the company.

All waiting periods as defined in the Policy shall apply for this enhanced

Sum Insured limit from the effective date of the enhancement

considering such Policy Period as the first Policy with the Company.

6. Turn Around Time (TAT): In case of reimbursement, company shall 5.7

offer a settlement of the claim within 30 days from the date of receipt

of final document.

1. Insured must disclose all pre-existing disease(s)/condition(s) before 5.1

buying the policy. This policy is issued on the basis of the truth and

accuracy of statements in the Proposal. Any misrepresentation or non-

Insured’s disclosure, will make the policy void.

13 2. The due observance of and fulfillment of the terms & conditions of the 5.2

Obligations

policy by the insured person shall be the condition precedent to any

liability of the company to make any payment under the policy.

3. Insured must disclose all material information during the policy period. 5.5 (iii)

LEGAL DISCLAIMER: The information must be read in conjunction with the product brochure and policy

document. In case of any conflict between the Customer Information sheet and

policy document the terms and conditions mentioned in the policy document shall

prevail.

UIN NO: UIIHLIP19116V021819

Page 6 of 6

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- safe-work-procedure-HEAT STRESSDocument3 pagessafe-work-procedure-HEAT STRESSmanoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Moot Proposition 2019Document4 pagesMoot Proposition 2019Aswin NandaNo ratings yet

- SOP Emp Health Hygiene Rev4 10Document3 pagesSOP Emp Health Hygiene Rev4 10Hanna SeftianaNo ratings yet

- GramDocument3 pagesGramAswin NandaNo ratings yet

- Ea 1128 PDFDocument1 pageEa 1128 PDFAswin NandaNo ratings yet

- Judicial Review of Administrative Discretion in India (Part A)Document14 pagesJudicial Review of Administrative Discretion in India (Part A)Aswin NandaNo ratings yet

- 5 5 54 839 PDFDocument4 pages5 5 54 839 PDFAswin NandaNo ratings yet

- In The High Court of Delhi at New Delhi: Date of Judgment: 02 December, 2020Document6 pagesIn The High Court of Delhi at New Delhi: Date of Judgment: 02 December, 2020Aswin NandaNo ratings yet

- SJRCT: (The (Sazette of 3ndiaDocument2 pagesSJRCT: (The (Sazette of 3ndiaAswin NandaNo ratings yet

- Kerala Judicial Service (Preliminary) Examination - 2019 Mark ListDocument79 pagesKerala Judicial Service (Preliminary) Examination - 2019 Mark ListAswin NandaNo ratings yet

- Rules and RegulationsDocument3 pagesRules and RegulationsAswin NandaNo ratings yet

- Kerala Judicial Service Main (Written) Examination - 2017 (Nca & Regular Recruitments) Mark ListDocument15 pagesKerala Judicial Service Main (Written) Examination - 2017 (Nca & Regular Recruitments) Mark ListAswin NandaNo ratings yet

- CPR-Legal and EthicalDocument4 pagesCPR-Legal and EthicalariesblackNo ratings yet

- Fetal Growth RestrictionDocument56 pagesFetal Growth RestrictionKanika VermaNo ratings yet

- The Effectiveness of Slow Deep Breathing To Decrease Blood Pressure in Hypertension - A Systematic ReviewDocument4 pagesThe Effectiveness of Slow Deep Breathing To Decrease Blood Pressure in Hypertension - A Systematic ReviewThalia NadiraNo ratings yet

- The Prefrontal Cortex and Obesity A Health Neuroscience PerspectiveDocument13 pagesThe Prefrontal Cortex and Obesity A Health Neuroscience PerspectiveIgnacio DuqueNo ratings yet

- Immunization Programme and Preventive Immunization: Presented By: Kanchan MSC 1 YRDocument53 pagesImmunization Programme and Preventive Immunization: Presented By: Kanchan MSC 1 YRArchanaNo ratings yet

- INFOSAN User Guide FinalDocument17 pagesINFOSAN User Guide FinalJorge Gregorio SeguraNo ratings yet

- HascvdDocument92 pagesHascvdbatangas_ynad_29900% (1)

- Zuqiaoyin Gb-44: Yin Portals of The FootDocument2 pagesZuqiaoyin Gb-44: Yin Portals of The Footray72roNo ratings yet

- Syllabus MD Siddha - Pura Maruthuvam 2017Document23 pagesSyllabus MD Siddha - Pura Maruthuvam 2017RajeshKothanNo ratings yet

- Binge Eating Disorder PDFDocument4 pagesBinge Eating Disorder PDFIsidora KesićNo ratings yet

- 10 Symptoms of Vitamin D DeficiencyDocument2 pages10 Symptoms of Vitamin D Deficiencysearching1_2No ratings yet

- Ethinylestradiol 0.03mg + Drospirenone 3mg (Yasmin)Document18 pagesEthinylestradiol 0.03mg + Drospirenone 3mg (Yasmin)asdwasdNo ratings yet

- Pulmonary Hypertension: Introduction To Cor PulmonaleDocument16 pagesPulmonary Hypertension: Introduction To Cor PulmonaleJisha JanardhanNo ratings yet

- COVID-19 Pandemic in Pakistan: CommentaryDocument13 pagesCOVID-19 Pandemic in Pakistan: CommentaryMalik HammadNo ratings yet

- Communicable Disease Post TestDocument7 pagesCommunicable Disease Post TestJaezee RamosNo ratings yet

- Wobblers SyndromeDocument37 pagesWobblers SyndromeSazzle CakeNo ratings yet

- 2 Respiratory TractDocument39 pages2 Respiratory TractnanxtoyahNo ratings yet

- 12 Blood VesselsDocument26 pages12 Blood VesselsBalaji DNo ratings yet

- Interview Script: Biographical Data You: Andrea Patient: NicoleDocument6 pagesInterview Script: Biographical Data You: Andrea Patient: NicoleNICOLE KAYE MANALANGNo ratings yet

- Fecal ColiformDocument8 pagesFecal Coliformapi-357361328No ratings yet

- Pressure Ulcers - Prevention and Management of Pressure Ulcers StrategyDocument38 pagesPressure Ulcers - Prevention and Management of Pressure Ulcers StrategyAlex Alexandra AlexNo ratings yet

- Test Bank For Medical Genetics 4th Edition Lynn B JordeDocument8 pagesTest Bank For Medical Genetics 4th Edition Lynn B Jorderoytuyenbau100% (1)

- Sexually Transmitted DiseasesDocument120 pagesSexually Transmitted DiseasesGliza Jane100% (4)

- Drug Study (Lactulose, Zynapse, Simvastatin) and HTP - CVD Prob CardioembolismDocument9 pagesDrug Study (Lactulose, Zynapse, Simvastatin) and HTP - CVD Prob CardioembolismRene John FranciscoNo ratings yet

- SarcoidosisDocument7 pagesSarcoidosisJohn SmithNo ratings yet

- Pediadrills& Ob Drill - Line, Shella Mae BSNIII-LEVINEDocument31 pagesPediadrills& Ob Drill - Line, Shella Mae BSNIII-LEVINEShella Mae LineNo ratings yet

- 2Document6 pages2muiNo ratings yet

- Anemia Secondary To Hemmorhagia: Presented byDocument21 pagesAnemia Secondary To Hemmorhagia: Presented byEsmareldah Henry SirueNo ratings yet