Professional Documents

Culture Documents

Proposal Form For Private Car/Two Wheeler Package: We at MAGMA HDI Prefer Receiving Premium Amount Through Cheque

Proposal Form For Private Car/Two Wheeler Package: We at MAGMA HDI Prefer Receiving Premium Amount Through Cheque

Uploaded by

lalitbhushan gotanCopyright:

Available Formats

You might also like

- Aa Car Buyers Sellers ContractDocument1 pageAa Car Buyers Sellers ContractDenisa AnghelacheNo ratings yet

- English IIQE Paper 3 Pass Paper Question Bank (QB)Document11 pagesEnglish IIQE Paper 3 Pass Paper Question Bank (QB)Tsz Ngong Ko40% (5)

- Home Contents Claim FormDocument3 pagesHome Contents Claim FormHihiNo ratings yet

- Chapter 3 Income Taxation Tabag 2019 Sol ManDocument21 pagesChapter 3 Income Taxation Tabag 2019 Sol ManFMM50% (2)

- Citroen Maintenance and Warranty GuideDocument40 pagesCitroen Maintenance and Warranty Guide00polvo00No ratings yet

- Reliance Communications Limited: Car Lease Policy: To Hire/OwnDocument28 pagesReliance Communications Limited: Car Lease Policy: To Hire/OwnleeladonNo ratings yet

- Appointment of ExaminersDocument2 pagesAppointment of Examinerslalitbhushan gotanNo ratings yet

- TraditionlDocument10 pagesTraditionlOmar sarmientoNo ratings yet

- Application For Vehicle Sticker - 494a9Document1 pageApplication For Vehicle Sticker - 494a9Patrick Lanz Molo FameroNo ratings yet

- Safari HD - DAF - Warranty - ManualDocument58 pagesSafari HD - DAF - Warranty - ManualAssistência CarbusNo ratings yet

- Motor Claim Form National Insurance Co. Ltd.Document3 pagesMotor Claim Form National Insurance Co. Ltd.rajiv.surveyor7145No ratings yet

- CGL Prop FormDocument8 pagesCGL Prop FormOmkar ChavanNo ratings yet

- Future Secure Private Car Package Policy Proposal FormDocument7 pagesFuture Secure Private Car Package Policy Proposal Formkajay183879No ratings yet

- Request For Proposal (RFP) : District Administration Mandi BahauddinDocument30 pagesRequest For Proposal (RFP) : District Administration Mandi BahauddinSheraz azamNo ratings yet

- Most Important TNC PLDocument4 pagesMost Important TNC PL9463684355No ratings yet

- Lenskart Appliction FormDocument6 pagesLenskart Appliction FormEr Mayank UppalNo ratings yet

- Technical & Commercial BidDocument46 pagesTechnical & Commercial BidnareshpaneruNo ratings yet

- Motor Insurance Proposal New IndiaDocument2 pagesMotor Insurance Proposal New IndiaabhishekkurilNo ratings yet

- Man 12000 Combine Header Trailer Ops ManDocument147 pagesMan 12000 Combine Header Trailer Ops ManИВАН85No ratings yet

- Motor Claim Form NEW INDIA ASSURANCE CO. LTD.Document4 pagesMotor Claim Form NEW INDIA ASSURANCE CO. LTD.rajiv.surveyor7145No ratings yet

- Application Form DD1 For Tax ReliefDocument3 pagesApplication Form DD1 For Tax ReliefChazMichaelmichaelsNo ratings yet

- dd2 PDFDocument3 pagesdd2 PDFChazMichaelmichaelsNo ratings yet

- dd1 PDFDocument3 pagesdd1 PDFChazMichaelmichaelsNo ratings yet

- Motor Claim Form United India Insurance Co. Ltd.Document4 pagesMotor Claim Form United India Insurance Co. Ltd.rajiv.surveyor7145No ratings yet

- LD - Warranty ManualDocument36 pagesLD - Warranty ManualAssistência CarbusNo ratings yet

- Form 20 Registration of Motor VehicleDocument4 pagesForm 20 Registration of Motor Vehicleapi-19912235No ratings yet

- US Internal Revenue Service: I2290Document10 pagesUS Internal Revenue Service: I2290IRSNo ratings yet

- MD7 - Manutençao e GarantiaDocument104 pagesMD7 - Manutençao e GarantiaAssistência Carbus100% (1)

- FORM NO: U/014/130 Excel Insurance Company LTD: Proposal For Private Vehicles InsuranceDocument2 pagesFORM NO: U/014/130 Excel Insurance Company LTD: Proposal For Private Vehicles Insuranceraymond ssegawaNo ratings yet

- Disbursal Request Form drf-0095749001552896143Document1 pageDisbursal Request Form drf-0095749001552896143Arbaz KhanNo ratings yet

- Incident Report Form Moto039r829rDocument3 pagesIncident Report Form Moto039r829rCassie BellaNo ratings yet

- Duo Financial SLNS LTDDocument4 pagesDuo Financial SLNS LTDobajik ambroseNo ratings yet

- Driver Questionnaire PDFDocument2 pagesDriver Questionnaire PDFAman Trivedi0% (1)

- CarManual Spark PetrolDocument179 pagesCarManual Spark PetrolSunderraj PrabakaranNo ratings yet

- Spark ManualDocument208 pagesSpark Manualirfankaushar50% (2)

- Q241923914 (2)Document4 pagesQ241923914 (2)disharajput0204No ratings yet

- Letter of Authorisation (Agency) : Change of Servicing Agent (Private and Commercial Vehicles)Document1 pageLetter of Authorisation (Agency) : Change of Servicing Agent (Private and Commercial Vehicles)llllNo ratings yet

- TVS JupiterDocument7 pagesTVS JupiterAnand TatteNo ratings yet

- Caryaire Precommissioning Format 2019 PDFDocument1 pageCaryaire Precommissioning Format 2019 PDFMUHAMMED SHAFEEQNo ratings yet

- Motor Claim Form THE ORIENTAL INSURANCE CO. LTD.Document4 pagesMotor Claim Form THE ORIENTAL INSURANCE CO. LTD.rajiv.surveyor7145No ratings yet

- Section 1.1: General Information - Inspection, Delivery, Service and Warranty FormsDocument8 pagesSection 1.1: General Information - Inspection, Delivery, Service and Warranty FormsFelipe HidalgoNo ratings yet

- Dealership Application Form: PhotoDocument4 pagesDealership Application Form: Photoyashwant chavanNo ratings yet

- ASP Application Form Wef 01 Jan 2019Document12 pagesASP Application Form Wef 01 Jan 2019XYZNo ratings yet

- GH-03, Sector-2, Greater Noida West: Nirala Projects Pvt. LTDDocument6 pagesGH-03, Sector-2, Greater Noida West: Nirala Projects Pvt. LTDmanugeorgeNo ratings yet

- 2015 Jeep Generic Warranty 1stDocument44 pages2015 Jeep Generic Warranty 1stSandeep SakpalNo ratings yet

- Panvel Indiabulls Greens Mega Mall Application FormDocument24 pagesPanvel Indiabulls Greens Mega Mall Application FormsharmaabhayNo ratings yet

- Ker Form30Document3 pagesKer Form30Krunal PatadiyaNo ratings yet

- Fitness FormDocument1 pageFitness Formroauflone19No ratings yet

- Change Request Form - Motor 2017Document2 pagesChange Request Form - Motor 2017nylx chxNo ratings yet

- MD9 LE - WarratyDocument38 pagesMD9 LE - WarratyAssistência CarbusNo ratings yet

- 2016 BMW I3 SWDocument35 pages2016 BMW I3 SWMichaela KubaNo ratings yet

- Contrato Con GarantiaDocument1 pageContrato Con GarantiaCristian Kubat Castro Low CostNo ratings yet

- Form 171 Immigrants Declaration and Undertakingof Motor VehiclesDocument2 pagesForm 171 Immigrants Declaration and Undertakingof Motor VehiclesaaronNo ratings yet

- Form 47 (See Rules 83 (2) and 87 (2) ) Authorisation For Tourist Permit or National PermitDocument2 pagesForm 47 (See Rules 83 (2) and 87 (2) ) Authorisation For Tourist Permit or National PermitSomnath DanNo ratings yet

- CVT2Document4 pagesCVT2captvijaycantNo ratings yet

- 721 User Manual AixamDocument51 pages721 User Manual Aixammalykel100% (3)

- Application For Registration of Vehicle Form 20Document4 pagesApplication For Registration of Vehicle Form 20Malsawmsanga RalteNo ratings yet

- DownloadFormsIndia Govt 142Document4 pagesDownloadFormsIndia Govt 142Bipin SPNo ratings yet

- Non Owned Hired Auto Supplement InsuranceDocument2 pagesNon Owned Hired Auto Supplement InsuranceJohn RossNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- American Credit Repair: Everything U Need to Know About Raising Your Credit ScoreFrom EverandAmerican Credit Repair: Everything U Need to Know About Raising Your Credit ScoreRating: 3 out of 5 stars3/5 (3)

- Buying Your First New Car: How To Find Your Very First Car And Be Satisfied With It.From EverandBuying Your First New Car: How To Find Your Very First Car And Be Satisfied With It.No ratings yet

- Central University of HaryanaDocument7 pagesCentral University of Haryanalalitbhushan gotanNo ratings yet

- The New Seven Wonders of The WorldDocument4 pagesThe New Seven Wonders of The Worldlalitbhushan gotanNo ratings yet

- Insturction of AppointmentDocument3 pagesInsturction of Appointmentlalitbhushan gotanNo ratings yet

- Quality Education Is An Essential Requisite in Todays Competitive EnvironmentDocument4 pagesQuality Education Is An Essential Requisite in Todays Competitive Environmentlalitbhushan gotanNo ratings yet

- Subhash Chandra Bose The WarrierDocument2 pagesSubhash Chandra Bose The Warrierlalitbhushan gotanNo ratings yet

- Provisional Cum Character CertificateDocument3 pagesProvisional Cum Character Certificatelalitbhushan gotan100% (1)

- Gandhi and Education in IndiaDocument4 pagesGandhi and Education in Indialalitbhushan gotanNo ratings yet

- EDUCATION (B.Ed. 2 Year Course)Document5 pagesEDUCATION (B.Ed. 2 Year Course)lalitbhushan gotanNo ratings yet

- Revised Qualifications of B.Ed. Teachers - 250917Document4 pagesRevised Qualifications of B.Ed. Teachers - 250917lalitbhushan gotanNo ratings yet

- (Subjectwise) B. ED - SemYr-1 - 03122020 - 221757Document60 pages(Subjectwise) B. ED - SemYr-1 - 03122020 - 221757lalitbhushan gotanNo ratings yet

- Chaudhary Ranbir Singh University, Jind: Examination Form For Regular Candidates SessionDocument2 pagesChaudhary Ranbir Singh University, Jind: Examination Form For Regular Candidates Sessionlalitbhushan gotanNo ratings yet

- Detailed Summary of ExpencesDocument4 pagesDetailed Summary of Expenceslalitbhushan gotanNo ratings yet

- BEd New1 PDFDocument630 pagesBEd New1 PDFlalitbhushan gotanNo ratings yet

- Affidavit: Stream Name Subject NameDocument1 pageAffidavit: Stream Name Subject Namelalitbhushan gotanNo ratings yet

- Baba Mungipa Vidya Peeth Education College, Bushan Tosham (Bhiwani)Document2 pagesBaba Mungipa Vidya Peeth Education College, Bushan Tosham (Bhiwani)lalitbhushan gotanNo ratings yet

- Bus DrivingDocument1 pageBus Drivinglalitbhushan gotanNo ratings yet

- EncyclopediaDocument2 pagesEncyclopedialalitbhushan gotanNo ratings yet

- Subject: Resignation From The Post of Lecture in Teaching of Social Studies'Document1 pageSubject: Resignation From The Post of Lecture in Teaching of Social Studies'lalitbhushan gotanNo ratings yet

- Baba Mungipa Vidya Peeth Education College, Bushan Tosham (Bhiwani)Document2 pagesBaba Mungipa Vidya Peeth Education College, Bushan Tosham (Bhiwani)lalitbhushan gotanNo ratings yet

- Exam Centre Code: 1022: Baba Mungipa Vidya Peeth Education College, BushanDocument1 pageExam Centre Code: 1022: Baba Mungipa Vidya Peeth Education College, Bushanlalitbhushan gotanNo ratings yet

- One-Way ANOVA in SPSS Statistics: Assumption #1Document5 pagesOne-Way ANOVA in SPSS Statistics: Assumption #1lalitbhushan gotanNo ratings yet

- Harsh BB - 6semDocument52 pagesHarsh BB - 6semPaul MeshramNo ratings yet

- Sem. - Vi ( 2019 Pattern)Document115 pagesSem. - Vi ( 2019 Pattern)Anil Arun JayshreeNo ratings yet

- Laws & Ethics: Cma InterDocument120 pagesLaws & Ethics: Cma InterNayanNo ratings yet

- Additional Income and Adjustments To IncomeDocument2 pagesAdditional Income and Adjustments To IncomeConner BeckerNo ratings yet

- Guide To Applying For Expenses For Jury Service - Digital Expenses ClaimDocument2 pagesGuide To Applying For Expenses For Jury Service - Digital Expenses ClaimptwhabfqnsgqfcodwmNo ratings yet

- Misc 1Document16 pagesMisc 1azaz mohammedNo ratings yet

- Garage Feasibility StudyDocument66 pagesGarage Feasibility StudyJAGADESH. RNo ratings yet

- Smart Scholar: Best Investment Plan For Children's EducationDocument1 pageSmart Scholar: Best Investment Plan For Children's EducationTricolor C ANo ratings yet

- Kashish KewalramaniDocument36 pagesKashish Kewalramanipriyanshu kesarwaniNo ratings yet

- CALI Whitepaper June 2020Document14 pagesCALI Whitepaper June 2020CYNo ratings yet

- First Billing Attachments UpdateDocument2 pagesFirst Billing Attachments UpdateCelene Pia NgoNo ratings yet

- Insurance LC 2023Document5 pagesInsurance LC 2023zulma7866925No ratings yet

- Marine Insurance (Sections 101-122)Document56 pagesMarine Insurance (Sections 101-122)Noel Ephraim AntiguaNo ratings yet

- The Motor Vehicles Act, 1988 - History, ObjectDocument17 pagesThe Motor Vehicles Act, 1988 - History, ObjectAISHWARYA SURENDRAN VNo ratings yet

- Wealth Management Unit 1Document34 pagesWealth Management Unit 1ANAM AFTAB 22GSOB2010404No ratings yet

- Construction Law Senet Fall 2020Document64 pagesConstruction Law Senet Fall 2020Rhyzan CroomesNo ratings yet

- 2600+ NichesDocument59 pages2600+ NichesAkNo ratings yet

- Advanced - Fire - and - Allie - Peril - Insurance - WorkshopDocument17 pagesAdvanced - Fire - and - Allie - Peril - Insurance - WorkshopArshad BashirNo ratings yet

- Product Disclosure SheetDocument3 pagesProduct Disclosure SheetshamsulNo ratings yet

- Business Finance Q3 Module 5Document23 pagesBusiness Finance Q3 Module 5Ella BarotNo ratings yet

- Please Quote This Reference Number in All Future CorrespondenceDocument2 pagesPlease Quote This Reference Number in All Future CorrespondenceKrishna ManchiNo ratings yet

- DD 2656 (Mar 2022)Document9 pagesDD 2656 (Mar 2022)Catalina PachecoNo ratings yet

- Affidavit of IndemnityDocument2 pagesAffidavit of Indemnityailyn rentaNo ratings yet

- Member Data Record: Philippine Health Insurance CorporationDocument1 pageMember Data Record: Philippine Health Insurance CorporationDiane MaryNo ratings yet

- Salary Increase Refusal Appendix Document, Salary Increase Refusal LetterDocument2 pagesSalary Increase Refusal Appendix Document, Salary Increase Refusal LetterVipin Kumar ParasharNo ratings yet

- Deed of Sale of Motor VehicleDocument4 pagesDeed of Sale of Motor VehicleChayms De Lara-San JuanNo ratings yet

Proposal Form For Private Car/Two Wheeler Package: We at MAGMA HDI Prefer Receiving Premium Amount Through Cheque

Proposal Form For Private Car/Two Wheeler Package: We at MAGMA HDI Prefer Receiving Premium Amount Through Cheque

Uploaded by

lalitbhushan gotanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proposal Form For Private Car/Two Wheeler Package: We at MAGMA HDI Prefer Receiving Premium Amount Through Cheque

Proposal Form For Private Car/Two Wheeler Package: We at MAGMA HDI Prefer Receiving Premium Amount Through Cheque

Uploaded by

lalitbhushan gotanCopyright:

Available Formats

We at MAGMA HDI prefer receiving premium amount through cheque

No. Pvt./

Call Us : 1800 3002 3202

(Information for fields marked with asterisk [*] is mandatory)

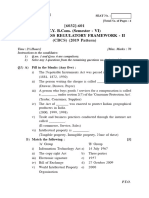

Proposal Form for Private Car/Two Wheeler Package

Customer ID........................................................................................ Policy No........................................................................................

*Proposal For: New Policy Roll- Over Renewal Endorsement

*Type of Vehicle : Two Wheeler Private Car Three Wheeler *Vehicle Insured is : New Used

*Coverage Comprehensive Package Cover Third Party Liability only Cover Third Party, fire & theft only Cover

Required: Third Party and Fire only Cover Third Party and Theft only Cover

Intermediary Code : Intermediary Name :

* Period of Insurance: ______/______/______ Time: ______/______ , To Midnight of______/______/______

(Note: Cover shall not commence earlier than the date and time of acceptance of risk and/or issuance of cover note and subsequent to payment of premium)

1. *Proposer Details:

Name (Registered Owner of the Vehicle): Mr Ms M/s.

First Name Middle Name Last Name

PAN No: _____________________*DOB: _____ /______ /________*Gender: M F *Occupation: ____________________ *Marital Status: ___________________

Bank Name...............................................................................................Branch Name................................................................... A/c Type- Saving Curent

Account No. ................................................................................. MICR..................................................................................IFSC.........................................................................

2. *Address where Vehicle Registered and Based

Flat/Building: ____________________________Road/ Street/Sector ____________________________________Area____________________________________________

Taluka/Village/District/City: _____________________________Pin Code: _______________State: ____________________Country: ________________________________

Tele No. (Resi): ___________________________ Mobile No: ____________________________ E-Mail ID: ___________________________@________________________

3. *Communication Address (For policy dispatch)

Flat/Building: ____________________________Road/ Street/Sector ____________________________________Area____________________________________________

Taluka/Village/District/City: _____________________________Pin Code: _______________State: ____________________Country: ________________________________

4. City where the vehicle will primarily be used:......................................................................................................................................................................................................

5. Have you been previously insured in respect of this vehicle? Yes No Policy No.________________________________

If so, are you entitled to No Claim Bonus from your previous Insurer? Yes No

If Yes, Kindly indicate the percentage: 20%; 25%; 35%; 45%; 50%; 55%

I/We hereby declare that the rate of NCB claimed by me/us is correct and that NO CLAIM has arisen in the expiring policy period (Copy of Policy enclosed). I/We further

undertake that if this declaration is found incorrect, all benefits under the Policy in respectof Section1 of the Policy will stand forfeited.

………..………...........……………….

Signature of Proposer

6. About the Motor Vehicle to be Insured

*Make _____________________________ *Chassis No_______________________________________ Speedometer reading as on date_________________________

*Model____________________________ RTO where vehicle will be registered___________________ *Vehicle IDV `________________________________________

*Year of Manufacture_________________ Date of Registration /Purchase________________________ Trailer(s) Identification No. 1____________________________

*CC/GVW__________________________ Licensed Carrying Capacity __________________________ 2____________________________

*Registration No.____________________ (No of Passengers Including driver) 3____________________________

Type of Body________________________ Colour of the vehicle_______________________________ 4____________________________

*Engine No._________________________ Vehicle Make (Indigenous or Imported)________________

Note: Either Registration no or Engine and Chassis Number is mandatory)

*Vehicle Rate Under: Zone -A Zone - B

*Fuel Used: Petrol Diesel Bi Fuel CNG LPG Electric Hybrid Others (please specify).......................................

*Type of Permit: Express Way National/State Highways City/Town Road District Roads Private Road

* Average Monthly usage : Less Than 50 Kms Between 50 and 100 Kms Between 101 and 250 Above 251 Kms

Whether any modification or conversion has been done in the vehicle from the maker’s standard specification? Yes No

If Yes, please give details of such modifications/conversions...............................................................

Is the vehicle in good state of repair? Yes No If No, please furnish details.............................................. .....................................................

Where will the vehicle be generally parked?

Roadside Public Parking Road Outside Parking lot open or covered Within compound of residence open

Within compound of residence covered

7. Financier Details: Hypothecation Hire Purchase Lease Financier Name :________________________________________________________

8. Nominee Details : Nominee Name: __________________________________________ DOB _____________ Relationship ____________________________________

Appointee Name & age __________________________________ *If Nominee is minor (below 18 yrs) Appointee Name is mandatory.

9. Insured Declared value of the Vehicle:

The IDV of the vehicle will be deemed to be the Sum-Insured for the purpose of the Policy and will be fixed on the basis of the manufacturer’s listed selling price of the brand and

model as the vehicle proposed for insurance at the time of commencement of insurance / renewal and adjusted for depreciation as per the schedule specified below.

Age of the Vehicle % of Depreciation *Vehicle Chassis Value `

Not exceeding 6 months 5% Vehicle Body Value `

Exceeding 6 months but not exceeding 1 year 15% Non- Electrical Accessories (Other than factory fitted): Details `

Exceeding 1 year but not exceeding 2 years 20% Electrical Accessories (Other than factory fitted) Details `

Exceeding 2 years but not exceeding 3 years 30% Bi- Fuel/ CNG/LPG Kit `

Exceeding 3 years but not exceeding 4 years 40% Trailer(s)/ Side Car Value (only for 2 wheelers): `

Exceeding 4 years but not exceeding 5 years 50% Total IDV: `

Note – For vehicles more than 5 years old, please contact the Company for fixing the IDV

We at MAGMA HDI prefer receiving premium amount through cheque

10. Extended Covers/ Extra Benefits at Additional Premium:

Extension of Geographical Area: Vehicle is fitted with Fibre Glass Fuel Tank Yes No

Bangladesh Bhutan Nepal Vehicle will be used for Driving Tuitions Yes No

Maldives Pakistan Sri Lanka Imported vehicle without payment of customs duty Yes No

Compulsory Personal Accident (If owner has a valid driving license) Yes No

Is the vehicle Company Maintained? Yes No Will the vehicle be let out on occasional Hire? Yes No

Whether the vehicle is certified as Vintage Car by

Vintage and Classic Car Club of India ? Yes No Vehicle used for commercial purposes : Yes No

Do you want to opt for wider legal liability to Paid Driver Yes No Do you wish to include Personal Accident cover for unnamed occupants of the

vehicle in excess of the compulsory Personal Accident cover for the Owner/Driver?

Yes No

Other employees Yes No Sum Insured per person to be Rs................................../-

(If Yes, No. of persons tobe covered..........) Nominee Details : Name.............................................................................................

Age..................... Relationship........................................

Do you want to cover loss of accessories due to burglary, If yes, please indicate the Sum-Insured per person (In multiples of Rs.10000/- for a

housebreaking or theft? Yes No maximum of Rs.1 lakh per person for Two Wheelers and Rs. 2 lakhs per person for

(Applicable only for Two-Wheelers) Private Cars. The number of persons to be covered for the purpose of this Add-on

will be equivalent to the registered carrying capacity of the vehicle)

Do you wish to have an enhanced Personal accident cover for Yourself/ Do you wish to cover Hospital Cash for hospitalisation arising out of accident

Your Driver/Unnamed occupants of the vehicle? Yes No for Yourself/Your Driver/Unnamed occupants of the vehicle?

If Yes, please provide the Sum Insured per person........................... Yes No

Do you wish to include Personal Accident cover for named persons? Yes No

If YES, give name and Capital Sum Insured (CSI) opted for :

Name CSI Opted (Rs.) Nominee Nominee Age/DOB Relationship

1)

2)

3)

(Note : The maximum CSI available per person is Rs. 2 lakhs in case of Private Cars and Rs.1 Lakh in the case of motorized Two wheeler)

11. Add On Coverage at additional :

Add On Plan Type Opted: ………………………………….. Amount in (INR) .................................................................................................................................................................

Additional Add On covers Opted: 1……………………………………………. 2. ………………………………………………. 3…………………………………………………. 4………………………………………………….

Amount in (INR)…………...............................................................................................................................................................................................................................…………

12. Restrictions of Cover/ Discounts:

Vehicle fitted with Anti-theft device approved by ARAI : Yes No Is the vehicle designed for use of Blind / Handicapped/Mentally challenged persons

Vehicle will be used within own premises : Yes No and duly endorsed as such by RTA ? Yes No

Third Party Property Damage cover restricted to `6000 Yes No Are you a member of Automobile Association of India? Yes No

(Third Party Property Damage cover of Rs 1 lakh for 2 wheelers and Rs 7.5 lakhs for Private cars)

If yes, please state

a. Name of Association ___________________

b. Membership No. ___________________c. Date of expiry ___________________

*Voluntary Deductible :

Private Car : None 2,500/- 5,000/- 7,500/- 15,000/- Two Wheeler : None 500/- 750/- 1,000/- 1,500/- 3,000/-

13. Previous Insurance Details: Signature of Proposer

Previous Insurer Name: Type of cover:

Policy/ Cover note number: Period of Insurance: From …………….........…………… To ……………………….......…………

Has any Insurance Company ever: Claims reported in last 5 years

1) Declined the proposal Year 1 2 3 4 5

2) Cancelled & Refused to renew Type of Claims (OD/TP)

3) Required an increase in Premium No. of Claims

4) Imposed special conditions or excess Amount

14. Driver Details: (Mention the details in below for any condition)

a. Age & Date of Birth of the Owner : Age______________Yrs DOB : _____________/_____________/_____________

b. Age & Date of Birth of the Driver : Age______________Yrs DOB : _____________/_____________/_____________

c. Dose the driver suffer from defective

vision or hearing or any physical infirmity? Yes No

If YES, please give details of such infirmity

d. Has the driver ever been involved / convicted Yes No

for causing any accident of loss?

If YES, give details as under including the pending prosecutions :

- Driver’s Name :

- Date of Accident :

- Loss / Cost (Rs.) :

- Circumstances of Accident / Loss

15.Premium Details

Total Premium (Including S Tax) :`....................................................... Payment Mode : Cash Cheque DD

Cheque/DD, Cheque No.............................................. Bank/Branch.................................................................................... Date..........................

Declaration: I/We hereby declare that the statements made by me/us in this Proposal Form are true to the best of my / our knowledge and belief and I/We hereby agree that this declaration shall form thebasis

of the contract between me/us and the Magma HDI General Insurance Co. Ltd.

I/We also declare that any additions or alterations carried out after the submission of this Proposal Form would be conveyed to Magma HDI General Insurance Co. Ltd immediately.

I/We hereby agree to receive a One Page Motor Insurance Policy in Physical Form, to be read along with the detailed Terms and Conditions available on the website www.magma-hdi.co.in YES NO.

I/We further confirm that the existing damages as per the pre inspection report, if any, have duly been shared with me & my consent has been obtained for the same.

I/We hereby declare and undertake that the amount paid by me/us as premium for the aforementioned vehicle is out of my/our lawful and declared source of Income.

Place: Date: __________________________________

INSURANCE ACT 1938, SECTION 41 – PROHIBITION OF REBATES Signature of Proposer

1.No person shall allow or offer to allow, either directly or indirectly as an inducement to any person to take out or renew or continue an insurance in respect of any kind or risk relating to lives or property in India, any

rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy, accept any rebate except such rebate as

may be allowed in accordance with the prospectus or tables of the Insurer

2. Any person making default in complying with the provisions of this section shall be punishable with fine, which may extend to five hundred rupees.

You might also like

- Aa Car Buyers Sellers ContractDocument1 pageAa Car Buyers Sellers ContractDenisa AnghelacheNo ratings yet

- English IIQE Paper 3 Pass Paper Question Bank (QB)Document11 pagesEnglish IIQE Paper 3 Pass Paper Question Bank (QB)Tsz Ngong Ko40% (5)

- Home Contents Claim FormDocument3 pagesHome Contents Claim FormHihiNo ratings yet

- Chapter 3 Income Taxation Tabag 2019 Sol ManDocument21 pagesChapter 3 Income Taxation Tabag 2019 Sol ManFMM50% (2)

- Citroen Maintenance and Warranty GuideDocument40 pagesCitroen Maintenance and Warranty Guide00polvo00No ratings yet

- Reliance Communications Limited: Car Lease Policy: To Hire/OwnDocument28 pagesReliance Communications Limited: Car Lease Policy: To Hire/OwnleeladonNo ratings yet

- Appointment of ExaminersDocument2 pagesAppointment of Examinerslalitbhushan gotanNo ratings yet

- TraditionlDocument10 pagesTraditionlOmar sarmientoNo ratings yet

- Application For Vehicle Sticker - 494a9Document1 pageApplication For Vehicle Sticker - 494a9Patrick Lanz Molo FameroNo ratings yet

- Safari HD - DAF - Warranty - ManualDocument58 pagesSafari HD - DAF - Warranty - ManualAssistência CarbusNo ratings yet

- Motor Claim Form National Insurance Co. Ltd.Document3 pagesMotor Claim Form National Insurance Co. Ltd.rajiv.surveyor7145No ratings yet

- CGL Prop FormDocument8 pagesCGL Prop FormOmkar ChavanNo ratings yet

- Future Secure Private Car Package Policy Proposal FormDocument7 pagesFuture Secure Private Car Package Policy Proposal Formkajay183879No ratings yet

- Request For Proposal (RFP) : District Administration Mandi BahauddinDocument30 pagesRequest For Proposal (RFP) : District Administration Mandi BahauddinSheraz azamNo ratings yet

- Most Important TNC PLDocument4 pagesMost Important TNC PL9463684355No ratings yet

- Lenskart Appliction FormDocument6 pagesLenskart Appliction FormEr Mayank UppalNo ratings yet

- Technical & Commercial BidDocument46 pagesTechnical & Commercial BidnareshpaneruNo ratings yet

- Motor Insurance Proposal New IndiaDocument2 pagesMotor Insurance Proposal New IndiaabhishekkurilNo ratings yet

- Man 12000 Combine Header Trailer Ops ManDocument147 pagesMan 12000 Combine Header Trailer Ops ManИВАН85No ratings yet

- Motor Claim Form NEW INDIA ASSURANCE CO. LTD.Document4 pagesMotor Claim Form NEW INDIA ASSURANCE CO. LTD.rajiv.surveyor7145No ratings yet

- Application Form DD1 For Tax ReliefDocument3 pagesApplication Form DD1 For Tax ReliefChazMichaelmichaelsNo ratings yet

- dd2 PDFDocument3 pagesdd2 PDFChazMichaelmichaelsNo ratings yet

- dd1 PDFDocument3 pagesdd1 PDFChazMichaelmichaelsNo ratings yet

- Motor Claim Form United India Insurance Co. Ltd.Document4 pagesMotor Claim Form United India Insurance Co. Ltd.rajiv.surveyor7145No ratings yet

- LD - Warranty ManualDocument36 pagesLD - Warranty ManualAssistência CarbusNo ratings yet

- Form 20 Registration of Motor VehicleDocument4 pagesForm 20 Registration of Motor Vehicleapi-19912235No ratings yet

- US Internal Revenue Service: I2290Document10 pagesUS Internal Revenue Service: I2290IRSNo ratings yet

- MD7 - Manutençao e GarantiaDocument104 pagesMD7 - Manutençao e GarantiaAssistência Carbus100% (1)

- FORM NO: U/014/130 Excel Insurance Company LTD: Proposal For Private Vehicles InsuranceDocument2 pagesFORM NO: U/014/130 Excel Insurance Company LTD: Proposal For Private Vehicles Insuranceraymond ssegawaNo ratings yet

- Disbursal Request Form drf-0095749001552896143Document1 pageDisbursal Request Form drf-0095749001552896143Arbaz KhanNo ratings yet

- Incident Report Form Moto039r829rDocument3 pagesIncident Report Form Moto039r829rCassie BellaNo ratings yet

- Duo Financial SLNS LTDDocument4 pagesDuo Financial SLNS LTDobajik ambroseNo ratings yet

- Driver Questionnaire PDFDocument2 pagesDriver Questionnaire PDFAman Trivedi0% (1)

- CarManual Spark PetrolDocument179 pagesCarManual Spark PetrolSunderraj PrabakaranNo ratings yet

- Spark ManualDocument208 pagesSpark Manualirfankaushar50% (2)

- Q241923914 (2)Document4 pagesQ241923914 (2)disharajput0204No ratings yet

- Letter of Authorisation (Agency) : Change of Servicing Agent (Private and Commercial Vehicles)Document1 pageLetter of Authorisation (Agency) : Change of Servicing Agent (Private and Commercial Vehicles)llllNo ratings yet

- TVS JupiterDocument7 pagesTVS JupiterAnand TatteNo ratings yet

- Caryaire Precommissioning Format 2019 PDFDocument1 pageCaryaire Precommissioning Format 2019 PDFMUHAMMED SHAFEEQNo ratings yet

- Motor Claim Form THE ORIENTAL INSURANCE CO. LTD.Document4 pagesMotor Claim Form THE ORIENTAL INSURANCE CO. LTD.rajiv.surveyor7145No ratings yet

- Section 1.1: General Information - Inspection, Delivery, Service and Warranty FormsDocument8 pagesSection 1.1: General Information - Inspection, Delivery, Service and Warranty FormsFelipe HidalgoNo ratings yet

- Dealership Application Form: PhotoDocument4 pagesDealership Application Form: Photoyashwant chavanNo ratings yet

- ASP Application Form Wef 01 Jan 2019Document12 pagesASP Application Form Wef 01 Jan 2019XYZNo ratings yet

- GH-03, Sector-2, Greater Noida West: Nirala Projects Pvt. LTDDocument6 pagesGH-03, Sector-2, Greater Noida West: Nirala Projects Pvt. LTDmanugeorgeNo ratings yet

- 2015 Jeep Generic Warranty 1stDocument44 pages2015 Jeep Generic Warranty 1stSandeep SakpalNo ratings yet

- Panvel Indiabulls Greens Mega Mall Application FormDocument24 pagesPanvel Indiabulls Greens Mega Mall Application FormsharmaabhayNo ratings yet

- Ker Form30Document3 pagesKer Form30Krunal PatadiyaNo ratings yet

- Fitness FormDocument1 pageFitness Formroauflone19No ratings yet

- Change Request Form - Motor 2017Document2 pagesChange Request Form - Motor 2017nylx chxNo ratings yet

- MD9 LE - WarratyDocument38 pagesMD9 LE - WarratyAssistência CarbusNo ratings yet

- 2016 BMW I3 SWDocument35 pages2016 BMW I3 SWMichaela KubaNo ratings yet

- Contrato Con GarantiaDocument1 pageContrato Con GarantiaCristian Kubat Castro Low CostNo ratings yet

- Form 171 Immigrants Declaration and Undertakingof Motor VehiclesDocument2 pagesForm 171 Immigrants Declaration and Undertakingof Motor VehiclesaaronNo ratings yet

- Form 47 (See Rules 83 (2) and 87 (2) ) Authorisation For Tourist Permit or National PermitDocument2 pagesForm 47 (See Rules 83 (2) and 87 (2) ) Authorisation For Tourist Permit or National PermitSomnath DanNo ratings yet

- CVT2Document4 pagesCVT2captvijaycantNo ratings yet

- 721 User Manual AixamDocument51 pages721 User Manual Aixammalykel100% (3)

- Application For Registration of Vehicle Form 20Document4 pagesApplication For Registration of Vehicle Form 20Malsawmsanga RalteNo ratings yet

- DownloadFormsIndia Govt 142Document4 pagesDownloadFormsIndia Govt 142Bipin SPNo ratings yet

- Non Owned Hired Auto Supplement InsuranceDocument2 pagesNon Owned Hired Auto Supplement InsuranceJohn RossNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- American Credit Repair: Everything U Need to Know About Raising Your Credit ScoreFrom EverandAmerican Credit Repair: Everything U Need to Know About Raising Your Credit ScoreRating: 3 out of 5 stars3/5 (3)

- Buying Your First New Car: How To Find Your Very First Car And Be Satisfied With It.From EverandBuying Your First New Car: How To Find Your Very First Car And Be Satisfied With It.No ratings yet

- Central University of HaryanaDocument7 pagesCentral University of Haryanalalitbhushan gotanNo ratings yet

- The New Seven Wonders of The WorldDocument4 pagesThe New Seven Wonders of The Worldlalitbhushan gotanNo ratings yet

- Insturction of AppointmentDocument3 pagesInsturction of Appointmentlalitbhushan gotanNo ratings yet

- Quality Education Is An Essential Requisite in Todays Competitive EnvironmentDocument4 pagesQuality Education Is An Essential Requisite in Todays Competitive Environmentlalitbhushan gotanNo ratings yet

- Subhash Chandra Bose The WarrierDocument2 pagesSubhash Chandra Bose The Warrierlalitbhushan gotanNo ratings yet

- Provisional Cum Character CertificateDocument3 pagesProvisional Cum Character Certificatelalitbhushan gotan100% (1)

- Gandhi and Education in IndiaDocument4 pagesGandhi and Education in Indialalitbhushan gotanNo ratings yet

- EDUCATION (B.Ed. 2 Year Course)Document5 pagesEDUCATION (B.Ed. 2 Year Course)lalitbhushan gotanNo ratings yet

- Revised Qualifications of B.Ed. Teachers - 250917Document4 pagesRevised Qualifications of B.Ed. Teachers - 250917lalitbhushan gotanNo ratings yet

- (Subjectwise) B. ED - SemYr-1 - 03122020 - 221757Document60 pages(Subjectwise) B. ED - SemYr-1 - 03122020 - 221757lalitbhushan gotanNo ratings yet

- Chaudhary Ranbir Singh University, Jind: Examination Form For Regular Candidates SessionDocument2 pagesChaudhary Ranbir Singh University, Jind: Examination Form For Regular Candidates Sessionlalitbhushan gotanNo ratings yet

- Detailed Summary of ExpencesDocument4 pagesDetailed Summary of Expenceslalitbhushan gotanNo ratings yet

- BEd New1 PDFDocument630 pagesBEd New1 PDFlalitbhushan gotanNo ratings yet

- Affidavit: Stream Name Subject NameDocument1 pageAffidavit: Stream Name Subject Namelalitbhushan gotanNo ratings yet

- Baba Mungipa Vidya Peeth Education College, Bushan Tosham (Bhiwani)Document2 pagesBaba Mungipa Vidya Peeth Education College, Bushan Tosham (Bhiwani)lalitbhushan gotanNo ratings yet

- Bus DrivingDocument1 pageBus Drivinglalitbhushan gotanNo ratings yet

- EncyclopediaDocument2 pagesEncyclopedialalitbhushan gotanNo ratings yet

- Subject: Resignation From The Post of Lecture in Teaching of Social Studies'Document1 pageSubject: Resignation From The Post of Lecture in Teaching of Social Studies'lalitbhushan gotanNo ratings yet

- Baba Mungipa Vidya Peeth Education College, Bushan Tosham (Bhiwani)Document2 pagesBaba Mungipa Vidya Peeth Education College, Bushan Tosham (Bhiwani)lalitbhushan gotanNo ratings yet

- Exam Centre Code: 1022: Baba Mungipa Vidya Peeth Education College, BushanDocument1 pageExam Centre Code: 1022: Baba Mungipa Vidya Peeth Education College, Bushanlalitbhushan gotanNo ratings yet

- One-Way ANOVA in SPSS Statistics: Assumption #1Document5 pagesOne-Way ANOVA in SPSS Statistics: Assumption #1lalitbhushan gotanNo ratings yet

- Harsh BB - 6semDocument52 pagesHarsh BB - 6semPaul MeshramNo ratings yet

- Sem. - Vi ( 2019 Pattern)Document115 pagesSem. - Vi ( 2019 Pattern)Anil Arun JayshreeNo ratings yet

- Laws & Ethics: Cma InterDocument120 pagesLaws & Ethics: Cma InterNayanNo ratings yet

- Additional Income and Adjustments To IncomeDocument2 pagesAdditional Income and Adjustments To IncomeConner BeckerNo ratings yet

- Guide To Applying For Expenses For Jury Service - Digital Expenses ClaimDocument2 pagesGuide To Applying For Expenses For Jury Service - Digital Expenses ClaimptwhabfqnsgqfcodwmNo ratings yet

- Misc 1Document16 pagesMisc 1azaz mohammedNo ratings yet

- Garage Feasibility StudyDocument66 pagesGarage Feasibility StudyJAGADESH. RNo ratings yet

- Smart Scholar: Best Investment Plan For Children's EducationDocument1 pageSmart Scholar: Best Investment Plan For Children's EducationTricolor C ANo ratings yet

- Kashish KewalramaniDocument36 pagesKashish Kewalramanipriyanshu kesarwaniNo ratings yet

- CALI Whitepaper June 2020Document14 pagesCALI Whitepaper June 2020CYNo ratings yet

- First Billing Attachments UpdateDocument2 pagesFirst Billing Attachments UpdateCelene Pia NgoNo ratings yet

- Insurance LC 2023Document5 pagesInsurance LC 2023zulma7866925No ratings yet

- Marine Insurance (Sections 101-122)Document56 pagesMarine Insurance (Sections 101-122)Noel Ephraim AntiguaNo ratings yet

- The Motor Vehicles Act, 1988 - History, ObjectDocument17 pagesThe Motor Vehicles Act, 1988 - History, ObjectAISHWARYA SURENDRAN VNo ratings yet

- Wealth Management Unit 1Document34 pagesWealth Management Unit 1ANAM AFTAB 22GSOB2010404No ratings yet

- Construction Law Senet Fall 2020Document64 pagesConstruction Law Senet Fall 2020Rhyzan CroomesNo ratings yet

- 2600+ NichesDocument59 pages2600+ NichesAkNo ratings yet

- Advanced - Fire - and - Allie - Peril - Insurance - WorkshopDocument17 pagesAdvanced - Fire - and - Allie - Peril - Insurance - WorkshopArshad BashirNo ratings yet

- Product Disclosure SheetDocument3 pagesProduct Disclosure SheetshamsulNo ratings yet

- Business Finance Q3 Module 5Document23 pagesBusiness Finance Q3 Module 5Ella BarotNo ratings yet

- Please Quote This Reference Number in All Future CorrespondenceDocument2 pagesPlease Quote This Reference Number in All Future CorrespondenceKrishna ManchiNo ratings yet

- DD 2656 (Mar 2022)Document9 pagesDD 2656 (Mar 2022)Catalina PachecoNo ratings yet

- Affidavit of IndemnityDocument2 pagesAffidavit of Indemnityailyn rentaNo ratings yet

- Member Data Record: Philippine Health Insurance CorporationDocument1 pageMember Data Record: Philippine Health Insurance CorporationDiane MaryNo ratings yet

- Salary Increase Refusal Appendix Document, Salary Increase Refusal LetterDocument2 pagesSalary Increase Refusal Appendix Document, Salary Increase Refusal LetterVipin Kumar ParasharNo ratings yet

- Deed of Sale of Motor VehicleDocument4 pagesDeed of Sale of Motor VehicleChayms De Lara-San JuanNo ratings yet