Professional Documents

Culture Documents

23 004 F 307 Powerpoint PDF

23 004 F 307 Powerpoint PDF

Uploaded by

Farzana Fariha Lima0 ratings0% found this document useful (0 votes)

22 views8 pagesThis document analyzes and values Northern Jute Manufacturing Company Ltd. It begins with an overview of factors influencing the jute manufacturing industry such as global economics, government policies, and Porter's Five Forces model. It then evaluates the company's operating performance using metrics like EBIT, EBIT(1-tax rate), depreciation, capital expenditures, and free cash flow over several years. Two valuation models are used: a free cash flow model that results in an enterprise value of Rs. 13,088 crores and an equity value of Rs. 12,928 crores. A dividend discount model is also used that values the company at Rs. 2.936 crores based on projected dividend payments over many years.

Original Description:

Original Title

23-004-F-307-Powerpoint.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document analyzes and values Northern Jute Manufacturing Company Ltd. It begins with an overview of factors influencing the jute manufacturing industry such as global economics, government policies, and Porter's Five Forces model. It then evaluates the company's operating performance using metrics like EBIT, EBIT(1-tax rate), depreciation, capital expenditures, and free cash flow over several years. Two valuation models are used: a free cash flow model that results in an enterprise value of Rs. 13,088 crores and an equity value of Rs. 12,928 crores. A dividend discount model is also used that values the company at Rs. 2.936 crores based on projected dividend payments over many years.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

22 views8 pages23 004 F 307 Powerpoint PDF

23 004 F 307 Powerpoint PDF

Uploaded by

Farzana Fariha LimaThis document analyzes and values Northern Jute Manufacturing Company Ltd. It begins with an overview of factors influencing the jute manufacturing industry such as global economics, government policies, and Porter's Five Forces model. It then evaluates the company's operating performance using metrics like EBIT, EBIT(1-tax rate), depreciation, capital expenditures, and free cash flow over several years. Two valuation models are used: a free cash flow model that results in an enterprise value of Rs. 13,088 crores and an equity value of Rs. 12,928 crores. A dividend discount model is also used that values the company at Rs. 2.936 crores based on projected dividend payments over many years.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

Company Analysis and Valuation

(Northern Jute Manufacturing Company Ltd.)

Global Economic Influences

Tax Credit

Government Expenditure

Industry Influences on Jute manufacturing Industry

Porter`s Five Forces Model

Supplier Buyer Entry

Substitutes Competitor

power Power barriers

Company Analysis

Evaluating Operating Performanc

Evaluating Internal liquidity

e

Assumptions

01 Perpetual growth is 3%

02 Tax rate 17.52%

03 Weighted Average Cost of

Capital(WACC) 7.97%

Capital expenditure will be

04 financed from Long term loan.

Long term loan will be repaid in

05 next two years by equal

installments.

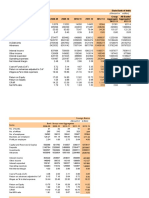

Free Cash Flow Model

Particulars 2020 2021 2022 2023 2024

EBIT 308,494,750 471,475,310 720,579,684 1,101,330,053 1,683,317,149

EBIT (1-tax rate) 254458609.8 388891389.4 594362479.9 908420367.7 1388466227

Depreciation 25,853,661 39,488,882 60,315,319 92,125,618 140,712,669

Capital expenditure 31,404,272 34,230,657 37,311,416 40,669,443 44,329,693

Change in NWC -87,508,040 202,255,779 308,925,477 471,852,773 720,707,925

Free cash flow 399224582.8 260355149.4 383063737.9 569362655.7 852800664.1

87,8384,684

Present value discount factor 0.9139 0.8352 0.7633 0.6976 0.6378

Present value of free cashflow 364851346.2 217448620.8 292392551.2 397187388.6 543916263.6

Terminal value 1,127,2308,883

Enterprise value 13,088,105,053

Cash 2,529,179

Interest-bearing debt 162,705,381

Equity value 12,927,928,851

Value per share 6035.447643

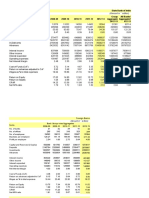

Dividend Discount Model

Year Growth rate Dividend 8% Factor PV

2019 0.00645

2020 31% 0.0084495 0.9259 0.0078234

2021 31% 0.011068845 0.8573 0.0094893

2022 31% 0.014500187 0.7938 0.0115102

2023 29% 0.018705241 0.735 0.0137484

2024 27% 0.023755656 0.6806 0.0161681

2025 25% 0.02969457 0.6302 0.0187135

2026 23% 0.036524322 0.5835 0.0213119

2027 21% 0.044194429 0.5402 0.0238738

2028 19% 0.052591371 0.5002 0.0263062

SUM 0.1489449

Constant growth period 2.78734264

Present value of high growth period dividends 0.028823

present value of declining growth period dividend 0.1201219

Present value of constant growth period dividends 2.787342

Total present value of dividends 2.9362869

Thank you

You might also like

- Jolly Grammar Programme P1-6Document8 pagesJolly Grammar Programme P1-6Mandy Whorlow100% (3)

- Chapter 6 StressDocument9 pagesChapter 6 StressSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Tata MotorsDocument24 pagesTata MotorsApurvAdarshNo ratings yet

- Bullying, Stalking and ExtortionDocument17 pagesBullying, Stalking and ExtortionJLafge83% (6)

- TEMLDocument57 pagesTEMLANNA BABU KOONAMAVU RCBSNo ratings yet

- Financial Analysis and ControlDocument7 pagesFinancial Analysis and ControlabhikNo ratings yet

- 2Document1 page2Ameti SrinidhiNo ratings yet

- My Assignment (LMT) - Corporate FinanceDocument13 pagesMy Assignment (LMT) - Corporate Financeesmailkarimi456No ratings yet

- 5Document1 page5Ameti SrinidhiNo ratings yet

- Fin 301 Final Assignment Group Name G 1Document26 pagesFin 301 Final Assignment Group Name G 1Avishake SahaNo ratings yet

- Valuation Task 20 - SUPRITHA.KDocument14 pagesValuation Task 20 - SUPRITHA.KSupritha HegdeNo ratings yet

- 1Document1 page1Ameti SrinidhiNo ratings yet

- Consolidated Balance SheetDocument8 pagesConsolidated Balance Sheetನಂದನ್ ಎಂ ಗೌಡNo ratings yet

- Public Sector Banks Comparative Analysis 3QFY24Document10 pagesPublic Sector Banks Comparative Analysis 3QFY24Sujay AnanthakrishnaNo ratings yet

- AnalysisDocument3 pagesAnalysisMohamed MamdouhNo ratings yet

- Contoh Simple FCFFDocument5 pagesContoh Simple FCFFFANNY KRISTIANTINo ratings yet

- Hotel Sector AnalysisDocument39 pagesHotel Sector AnalysisNishant DhakalNo ratings yet

- Alk SidoDocument2 pagesAlk SidoRebertha HerwinNo ratings yet

- 4Document1 page4Ameti SrinidhiNo ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Tugas Metode Common SizeDocument9 pagesTugas Metode Common SizeDS ReishenNo ratings yet

- At Tahur LimitedDocument24 pagesAt Tahur Limitedcristiano ronaldooNo ratings yet

- Act WorkDocument10 pagesAct WorkAsad Uz JamanNo ratings yet

- Financial Management Report Spring 2021Document7 pagesFinancial Management Report Spring 2021Haider AbbasNo ratings yet

- Buy DecisionDocument11 pagesBuy Decisionismat arteeNo ratings yet

- Nestle Financial Statements - Keystone BankDocument15 pagesNestle Financial Statements - Keystone Bankemmanuelleonard54No ratings yet

- Profit For The Year: Income Statement 2019 - DG CementDocument10 pagesProfit For The Year: Income Statement 2019 - DG CementHAMMAD AliNo ratings yet

- Samsung ProjectDocument18 pagesSamsung ProjectSehar IrfanNo ratings yet

- Appendices Financial RatiosDocument3 pagesAppendices Financial RatiosCristopherson PerezNo ratings yet

- Investment 2024Document3 pagesInvestment 2024amjadNo ratings yet

- Afs - QTLDocument6 pagesAfs - QTLKashif SaleemNo ratings yet

- Financial Statement Analysis Zoom Session 3Document7 pagesFinancial Statement Analysis Zoom Session 3MANSOOR AHMEDNo ratings yet

- Cherat Cement AnalysisDocument16 pagesCherat Cement Analysismustafafaysal03No ratings yet

- Tata SteelDocument66 pagesTata SteelSuraj DasNo ratings yet

- Financial Management Slides 3.3Document7 pagesFinancial Management Slides 3.3honathapyarNo ratings yet

- PofDocument6 pagesPofAmeera AsifNo ratings yet

- Income Statement of Mercantile Bank Limited and NRB Commercial BankDocument4 pagesIncome Statement of Mercantile Bank Limited and NRB Commercial BankmahadiparvezNo ratings yet

- Indus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsDocument12 pagesIndus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsSaad NaeemNo ratings yet

- Indus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsDocument12 pagesIndus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsSaad NaeemNo ratings yet

- Add Dep Less Tax OCF Change in Capex Change in NWC FCFDocument5 pagesAdd Dep Less Tax OCF Change in Capex Change in NWC FCFGullible KhanNo ratings yet

- DCF Trident 2Document20 pagesDCF Trident 2Jayant JainNo ratings yet

- Home Depot DCFDocument16 pagesHome Depot DCFAntoni BallaunNo ratings yet

- Book 1Document1 pageBook 1api-324903184No ratings yet

- ForecastingDocument9 pagesForecastingQuỳnh'ss Đắc'ssNo ratings yet

- AssetsDocument4 pagesAssetsdefby candieraNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisMohammad Abid MiahNo ratings yet

- Vertical Analysis of Income Statement 0F Blessed TextileDocument208 pagesVertical Analysis of Income Statement 0F Blessed TextileB SNo ratings yet

- Apb 30091213 FDocument9 pagesApb 30091213 FNehal Sharma 2027244No ratings yet

- Performance at A GlanceDocument7 pagesPerformance at A GlanceLima MustaryNo ratings yet

- 3Document1 page3Ameti SrinidhiNo ratings yet

- ProjectDocument3 pagesProjectTouseef RizviNo ratings yet

- EREGL DCF ModelDocument10 pagesEREGL DCF ModelKevser BozoğluNo ratings yet

- APB30091213FDocument9 pagesAPB30091213FMoorthy EsakkyNo ratings yet

- APB30091213FDocument9 pagesAPB30091213FAshaNo ratings yet

- Corpfin Case 2Document5 pagesCorpfin Case 2rthakkar97No ratings yet

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaNo ratings yet

- Financial Modelling ExcelDocument6 pagesFinancial Modelling ExcelAanchal Mahajan100% (1)

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Ghandhara NissanDocument7 pagesGhandhara NissanShamsuddin SoomroNo ratings yet

- 5.1 Financial Performance of Square Pharmaceuticals LTDDocument20 pages5.1 Financial Performance of Square Pharmaceuticals LTDMizanur Rahman Emon100% (1)

- Weighted Average Cost of Capital (WACC) - 2017 Value Weight Required Rate of ReturnDocument4 pagesWeighted Average Cost of Capital (WACC) - 2017 Value Weight Required Rate of ReturnravinyseNo ratings yet

- BUsiness AnalysisDocument21 pagesBUsiness AnalysisFarzana Fariha LimaNo ratings yet

- Valuation of SAIF POWERTEC Limited: Analysis of Financial Investment Course Code: F-307Document23 pagesValuation of SAIF POWERTEC Limited: Analysis of Financial Investment Course Code: F-307Farzana Fariha LimaNo ratings yet

- Company Valuation: Navana CNG Limited: Analysis of Financial Investment Course Code: F-307Document20 pagesCompany Valuation: Navana CNG Limited: Analysis of Financial Investment Course Code: F-307Farzana Fariha LimaNo ratings yet

- Valuation of Singer Bangladesh LTDDocument22 pagesValuation of Singer Bangladesh LTDFarzana Fariha LimaNo ratings yet

- Report On Valuation of Rangpur Dairy & Food Product LTDDocument31 pagesReport On Valuation of Rangpur Dairy & Food Product LTDFarzana Fariha LimaNo ratings yet

- An Analysis and Valuation of Heidelberg Cement Bangladesh LTDDocument45 pagesAn Analysis and Valuation of Heidelberg Cement Bangladesh LTDFarzana Fariha LimaNo ratings yet

- 23 118 (F 307) Report PDFDocument39 pages23 118 (F 307) Report PDFFarzana Fariha LimaNo ratings yet

- An Analysis and Valuation Of: Rak Ceramics (Bangladesh) LTDDocument30 pagesAn Analysis and Valuation Of: Rak Ceramics (Bangladesh) LTDFarzana Fariha LimaNo ratings yet

- Valuation of GBB Power LimitedDocument22 pagesValuation of GBB Power LimitedFarzana Fariha LimaNo ratings yet

- 23-037 Slides PDFDocument46 pages23-037 Slides PDFFarzana Fariha LimaNo ratings yet

- Investment AnalysisDocument31 pagesInvestment AnalysisFarzana Fariha LimaNo ratings yet

- Investment AnalysisDocument36 pagesInvestment AnalysisFarzana Fariha LimaNo ratings yet

- Investment AnalysisDocument28 pagesInvestment AnalysisFarzana Fariha LimaNo ratings yet

- Investment AnalysisDocument57 pagesInvestment AnalysisFarzana Fariha LimaNo ratings yet

- Investment AnalysisDocument47 pagesInvestment AnalysisFarzana Fariha LimaNo ratings yet

- ) % (Ambee PharmaDocument28 pages) % (Ambee PharmaFarzana Fariha LimaNo ratings yet

- Valuation of Meghna GroupDocument23 pagesValuation of Meghna GroupFarzana Fariha Lima0% (1)

- Course - 307, LINDEBD VALUATION REPORT PDFDocument26 pagesCourse - 307, LINDEBD VALUATION REPORT PDFFarzana Fariha LimaNo ratings yet

- Report On Company ValuationDocument22 pagesReport On Company ValuationFarzana Fariha LimaNo ratings yet

- An Analysis On Fu Wang Food Limited PDFDocument29 pagesAn Analysis On Fu Wang Food Limited PDFFarzana Fariha LimaNo ratings yet

- Report On Company ValuationDocument37 pagesReport On Company ValuationFarzana Fariha LimaNo ratings yet

- Report On Company ValuationDocument23 pagesReport On Company ValuationFarzana Fariha Lima100% (1)

- Valuation of IFAD Autos Limited: Course Code: F-307 Course Title: Analysis of Financial InvestmentDocument33 pagesValuation of IFAD Autos Limited: Course Code: F-307 Course Title: Analysis of Financial InvestmentFarzana Fariha LimaNo ratings yet

- 23-043 Daffdil Com Report PDFDocument42 pages23-043 Daffdil Com Report PDFFarzana Fariha LimaNo ratings yet

- Valuation of United Power Generation & Distribution Company LimitedDocument28 pagesValuation of United Power Generation & Distribution Company LimitedFarzana Fariha LimaNo ratings yet

- Major Landforms of The Earth NotesDocument3 pagesMajor Landforms of The Earth NotesSIMMA SAI PRASANNANo ratings yet

- Teacher Newsletter TemplateDocument1 pageTeacher Newsletter TemplateHart LJNo ratings yet

- ANALE - Stiinte Economice - Vol 2 - 2014 - FinalDocument250 pagesANALE - Stiinte Economice - Vol 2 - 2014 - FinalmhldcnNo ratings yet

- Usb MSC Boot 1.0Document19 pagesUsb MSC Boot 1.0T.h. JeongNo ratings yet

- Referee Report TemplateDocument2 pagesReferee Report TemplateAna Jufriani100% (1)

- The Child and Adolescent LearnersDocument12 pagesThe Child and Adolescent LearnersGlen ManatadNo ratings yet

- Ferdinando Carulli - Op 121, 24 Pieces - 4. Anglaise in A MajorDocument2 pagesFerdinando Carulli - Op 121, 24 Pieces - 4. Anglaise in A MajorOniscoidNo ratings yet

- Ia 2 Compilation of Quiz and ExercisesDocument16 pagesIa 2 Compilation of Quiz and ExercisesclairedennprztananNo ratings yet

- The 40 Verse Hanuman Chalisa English Translation - From Ajit Vadakayil BlogDocument4 pagesThe 40 Verse Hanuman Chalisa English Translation - From Ajit Vadakayil BlogBharat ShahNo ratings yet

- Birinci Pozisyon Notalar Ve IsimleriDocument3 pagesBirinci Pozisyon Notalar Ve IsimleriEmre KözNo ratings yet

- How To Cook Pork AdoboDocument3 pagesHow To Cook Pork AdoboJennyRoseVelascoNo ratings yet

- ReportDocument9 pagesReportshobhaNo ratings yet

- Clinical Emergency Management Program: Advanced WorkshopDocument4 pagesClinical Emergency Management Program: Advanced WorkshopNataraj ThambiNo ratings yet

- SOPDocument3 pagesSOPShreya BonteNo ratings yet

- PBL KaleidoscopeDocument3 pagesPBL KaleidoscopeWilson Tie Wei ShenNo ratings yet

- PROCERA: A New Way To Achieve An All-Ceramic CrownDocument12 pagesPROCERA: A New Way To Achieve An All-Ceramic CrownCúc Phương TrầnNo ratings yet

- 'Deus Caritas Est' - Pope Benedict and 'God Is Love'Document5 pages'Deus Caritas Est' - Pope Benedict and 'God Is Love'Kym JonesNo ratings yet

- Accounting For Managers: S. No. Questions 1Document5 pagesAccounting For Managers: S. No. Questions 1shilpa mishraNo ratings yet

- HCI634K - Technical Data SheetDocument8 pagesHCI634K - Technical Data SheetQuynhNo ratings yet

- T-Systems CPNI Policy Statement - Final 022717 PDFDocument2 pagesT-Systems CPNI Policy Statement - Final 022717 PDFFederal Communications Commission (FCC)No ratings yet

- Past Simple Weekend.m4aDocument7 pagesPast Simple Weekend.m4aCarmen Victoria Niño RamosNo ratings yet

- Plyometric Training - Part I by Juan Carlos SantanaDocument2 pagesPlyometric Training - Part I by Juan Carlos SantanaPedro SilvaNo ratings yet

- Engine Throttle ControlDocument14 pagesEngine Throttle Controltiago100% (1)

- Deed of DonationDocument2 pagesDeed of DonationMary RockwellNo ratings yet

- Power Point Skripsi UmarDocument12 pagesPower Point Skripsi UmarMuchamad Umar Chatab NasserieNo ratings yet

- Human Resource Management PrelimsDocument2 pagesHuman Resource Management PrelimsLei PalumponNo ratings yet

- Emu LinesDocument22 pagesEmu LinesRahul MehraNo ratings yet