Professional Documents

Culture Documents

Monk Company A Dealer in Machinery and Equipment Leased Equipment

Monk Company A Dealer in Machinery and Equipment Leased Equipment

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monk Company A Dealer in Machinery and Equipment Leased Equipment

Monk Company A Dealer in Machinery and Equipment Leased Equipment

Uploaded by

trilocksp SinghCopyright:

Available Formats

Monk Company a dealer in machinery and equipment

leased equipment

Monk Company a dealer in machinery and equipment leased equipment

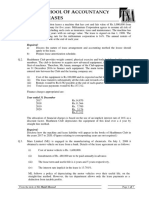

Monk Company, a dealer in machinery and equipment, leased equipment with a 10-year life

to Leland Inc. on July 1, 2017. The lease is appropriately accounted for as a sale by Monk and

as a purchase by Leland. The lease is for an eight-year period, expiring June 30, 2025. The first

of eight equal payments of $300,000 is due on June 30, 2018. Leland has an option to purchase

the equipment on June 30, 2025, for $100,000 even though the expected residual value at that

time is $600,000. Leland's incremental borrowing rate is 7%, and it uses straightline

depreciation. The equipment is expected to have a salvage value of zero at June 30, 2027.

Required:

1. At what amount should Leland record the leased equipment on July 1, 2017?

2. Prepare Leland's amortization table for the leased equipment.

3. What is the amount of depreciation and interest expense that Leland should record for the

year ended December 31, 2017, and for the year ended December 31, 2018?

4. Answer questions 1-3, except that the payments are made at the beginning of the period

(July 1, 2017) instead of the end of the rental period (June 30, 2018).

Monk Company a dealer in machinery and equipment leased equipment

SOLUTION-- http://solutiondone.online/downloads/monk-company-a-dealer-in-machinery-and-

equipment-leased-equipment/

Unlock answers here solutiondone.online

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CH 21 Answer To in Class Diiscussion ProblemsDocument20 pagesCH 21 Answer To in Class Diiscussion ProblemsJakeChavezNo ratings yet

- Use The Following Information To Answer Items 1 To 4Document4 pagesUse The Following Information To Answer Items 1 To 4Chris Jay LatibanNo ratings yet

- SPQ 003 Employee Benefits, Leases, and Other LiabilitiesDocument3 pagesSPQ 003 Employee Benefits, Leases, and Other LiabilitiesmarygraceomacNo ratings yet

- Info 1Document28 pagesInfo 1Veejay Soriano Cuevas0% (1)

- Seatwork #1 - PreliminaryDocument1 pageSeatwork #1 - PreliminaryJelwin Enchong BautistaNo ratings yet

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- Sales Type LeaseDocument2 pagesSales Type Leasejano_art21No ratings yet

- Wk7-9 Leases AssignmentsDocument2 pagesWk7-9 Leases AssignmentsScarlett ManNo ratings yet

- FR QB 1Document14 pagesFR QB 1Tanya AgarwalNo ratings yet

- Paper - 1: Financial Reporting Questions: ST ST STDocument30 pagesPaper - 1: Financial Reporting Questions: ST ST STSamaj BasnetNo ratings yet

- Harter Company Leased Machinery To Stine Company On July 1Document2 pagesHarter Company Leased Machinery To Stine Company On July 1Chris Tian FlorendoNo ratings yet

- Far Project PrefiDocument16 pagesFar Project PrefiMarjorie PagsinuhinNo ratings yet

- Assignment Problems On LeasesDocument4 pagesAssignment Problems On LeasesEllah Sharielle SantosNo ratings yet

- Tutorial 11 (Exercise)Document2 pagesTutorial 11 (Exercise)Vidya IntaniNo ratings yet

- S - Adjusting Entry ProblemsDocument4 pagesS - Adjusting Entry ProblemsYusra PangandamanNo ratings yet

- SEATWORK - Chapter 11 - 16Document8 pagesSEATWORK - Chapter 11 - 16Kheajoy99 KimNo ratings yet

- AC3202 - 20202021B - Exam PaperDocument9 pagesAC3202 - 20202021B - Exam PaperlawlokyiNo ratings yet

- As - 7 and As - 9 As 10 As 6 As 28 - IdealDocument7 pagesAs - 7 and As - 9 As 10 As 6 As 28 - IdealLalit JhaNo ratings yet

- Elec 4 Final ExaminationDocument4 pagesElec 4 Final ExaminationHatdogNo ratings yet

- Intermediate Accounting 2 Finals SolvingsDocument24 pagesIntermediate Accounting 2 Finals SolvingsColeen BiocalesNo ratings yet

- PDF Info 1 DLDocument28 pagesPDF Info 1 DLEdrickLouise DimayugaNo ratings yet

- Leases PS GoodsDocument4 pagesLeases PS GoodsDissentNo ratings yet

- Adjusting Entries HandoutDocument3 pagesAdjusting Entries HandoutTrang LeNo ratings yet

- If The Lease Were NonrenewableDocument2 pagesIf The Lease Were NonrenewableChris Tian FlorendoNo ratings yet

- FE QuestionsDocument2 pagesFE Questionsviedereen12No ratings yet

- Hitech CompanyDocument1 pageHitech CompanyAnne Liezel PradoNo ratings yet

- ALL Quiz Ia 3Document29 pagesALL Quiz Ia 3julia4razoNo ratings yet

- On January 1, 2-WPS OfficeDocument4 pagesOn January 1, 2-WPS OfficeSanta-ana Jerald JuanoNo ratings yet

- Quiz 1 Leases PDFDocument4 pagesQuiz 1 Leases PDFken aysonNo ratings yet

- Lessor Sample ProbDocument24 pagesLessor Sample ProbCzarina Jean ConopioNo ratings yet

- AK 2 _ Exercise Session 10Document2 pagesAK 2 _ Exercise Session 10Blue WhileNo ratings yet

- FAR-II Test IFRS-16 (AB)Document2 pagesFAR-II Test IFRS-16 (AB)Waseim khan Barik zaiNo ratings yet

- Lease AccountingDocument8 pagesLease AccountingrevangelistaNo ratings yet

- Chapter 21Document18 pagesChapter 21Ardilla Noor Paramashanti Wirahadikusuma100% (1)

- Tutorial 10 (Exercise)Document1 pageTutorial 10 (Exercise)Vidya IntaniNo ratings yet

- Guided Exercise1Document2 pagesGuided Exercise1Kim Nicole ReyesNo ratings yet

- Accounting For Leases Handouts FinalDocument5 pagesAccounting For Leases Handouts FinalMichael BongalontaNo ratings yet

- IFRS-16 LeasesDocument7 pagesIFRS-16 LeasesHuzaifa WaseemNo ratings yet

- Unit Vi - Audit of Leases - Final - T11415 PDFDocument4 pagesUnit Vi - Audit of Leases - Final - T11415 PDFSed ReyesNo ratings yet

- Leases: Lease Part 1Document10 pagesLeases: Lease Part 1ZyxNo ratings yet

- Lease Accounting 2021Document5 pagesLease Accounting 2021Just JhexNo ratings yet

- Assignment 02 Leases - Solution - OportoDocument4 pagesAssignment 02 Leases - Solution - OportoDevina OportoNo ratings yet

- Tutorial 11Document2 pagesTutorial 11Vidya IntaniNo ratings yet

- PP Facr - Apr'24updatedDocument17 pagesPP Facr - Apr'24updatedrihanna.bhatti07No ratings yet

- Lease Financing Final NotesDocument2 pagesLease Financing Final NotesGLOBUS CYBERNo ratings yet

- Accounting For LeasesDocument4 pagesAccounting For LeasesSebastian MlingwaNo ratings yet

- Intermediate Financial Accounting II LeaseDocument6 pagesIntermediate Financial Accounting II LeaseDanoNo ratings yet

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- Soal Latihan Sewa - RahmaDocument3 pagesSoal Latihan Sewa - RahmaAlya DRNo ratings yet

- Fa2 Tut 3Document5 pagesFa2 Tut 3Truong Thi Ha Trang 1KT-19No ratings yet

- NAS 23 QuestionsDocument9 pagesNAS 23 Questionsmagratidipesh395No ratings yet

- TVM QuizDocument18 pagesTVM Quizmonty6630No ratings yet

- Modaud2 Unit 6 Audit of Leases t31516 FinalDocument3 pagesModaud2 Unit 6 Audit of Leases t31516 Finalmimi96No ratings yet

- Sales&leasebackDocument15 pagesSales&leasebackeulhiemae arong0% (1)

- CD 2Document3 pagesCD 2Kath LeynesNo ratings yet

- Quizzes Midterm To Finals OnlyDocument40 pagesQuizzes Midterm To Finals OnlyMikasa MikasaNo ratings yet

- IA2Document14 pagesIA2Sitio BayabasanNo ratings yet

- Quiz Far LeaseDocument2 pagesQuiz Far Leasefrancis dungcaNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet