Professional Documents

Culture Documents

Chapter 12, Problem 1COMP: (To Record Issuance of 4,000 Preferred Shares in Excess of Par)

Chapter 12, Problem 1COMP: (To Record Issuance of 4,000 Preferred Shares in Excess of Par)

Uploaded by

Varun SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 12, Problem 1COMP: (To Record Issuance of 4,000 Preferred Shares in Excess of Par)

Chapter 12, Problem 1COMP: (To Record Issuance of 4,000 Preferred Shares in Excess of Par)

Uploaded by

Varun SharmaCopyright:

Available Formats

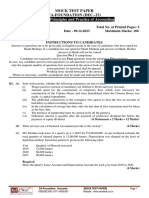

10/13/2020 Selected transactions completed by Equinox Products Inc.

roducts Inc. during the fiscal year ended December 31, 20Y8, were as follows: a. Iss…

Search for textbooks, step-by-step explanations to home… Ask an Expert Sign in

Chapter 12, Problem 1COMP

Paid-in Capital in Excess of Par value –

80,000

Preferred Stock ($400,000 − $320,000)

(To record issuance of 4,000 preferred shares in excess of par)

Table (2)

Cash is an asset account. The amount is increased, because cash is received upon stock issued. Therefore, debit Cash account with

the amount of cash received.

Preferred Stock is a stockholders’ equity account and the amount is increased due to issuance of common stock. Therefore, credit

Preferred Stock account with the value of common stock.

Paid-in Capital in Excess of Stated Value is a stockholders’ equity account and the amount is increased due to increase in capital.

Therefore, credit Paid-in Capital in Excess of Stated Value account with the amount of cash received in excess of Preferred Stock

value.

c.

Record the issuance of par value preferred stock.

Date Account Titles and Explanation Debit ($) Credit ($)

Cash ($500,000 × 1.04) 520,000

Bonds payable 500,000

Premium on bonds payable ($520,000 − $500,000) 20,000

(To record issuance of bond at premium)

Table (3)

Cash is a current asset, and increased. Therefore, debit cash account with $520,000.

Bonds payable is a long-term liability, and increased on issuance of bond. Therefore, credit bonds payable account with $500,000.

Premium on bonds payable is adjunct liability, and increased. Therefore, credit premium on bonds payable for $20,000.

d.

Record the declaration of cash dividend on common stock and preferred stock.

Date Account Titles and Explanation Post Ref. Debit ($) Credit ($)

Cash Dividends (100,000 shares × $0.50 per share) 50,000

Cash Dividends Payable 50,000

(To record declaration of dividends on common stock)

Table (4)

Date Account Titles and Explanation Post Ref. Debit ($) Credit ($)

Cash Dividends (20,000 shares × $1 per share) 20,000

Cash Dividends Payable 20,000

(To record declaration of dividends on preferred stock)

Table (5)

Declaration date: The date on which the board of directors of a corporation announces of cially to distribute the dividends to its

shareholders is referred as declaration date.

Cash Dividends is a temporary stockholders’ equity account. The account is debited as the cash dividends are declared and eventually

be transferred to Retained Earnings account. Therefore, Cash Dividends account is debited

Cash Dividends Payable is a liability account and the amount owed to the stockholders is increased. Therefore, Cash Dividends

Payable account is credited.

e.

Record the payment of cash dividend declared in (d).

Record the journal entry for the payment of cash dividends.

Date Account Titles and Explanation Post Ref. Debit ($) Credit ($)

C h Di id d P bl 70 000

https://www.bartleby.com/solution-answer/chapter-12-problem-1comp-financial-and-managerial-accounting-15th-edition/9781337902663/selected-… 1/1

You might also like

- Matheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following inform... - HomeworkLibDocument1 pageMatheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following inform... - HomeworkLibVarun Sharma0% (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- CH 10Document32 pagesCH 10Gaurav KarkiNo ratings yet

- KasdanPiutang 4B Kelompok1Document11 pagesKasdanPiutang 4B Kelompok1Estin TasyaNo ratings yet

- DocxDocument5 pagesDocxChy BNo ratings yet

- MT Telfer PaperDocument8 pagesMT Telfer PaperVarun SharmaNo ratings yet

- Multinational Business Finance 10th Edition Solution ManualDocument8 pagesMultinational Business Finance 10th Edition Solution ManualrspkamalgmailcomNo ratings yet

- Ey Companies Amendment Act 2017Document48 pagesEy Companies Amendment Act 2017Payal AggarwalNo ratings yet

- Project (Air India)Document81 pagesProject (Air India)Amulay Oberoi100% (2)

- Expert Solution: To DetermineDocument1 pageExpert Solution: To DetermineVarun SharmaNo ratings yet

- Financial Accounting Rajesh PathakDocument25 pagesFinancial Accounting Rajesh PathakJHANVI LAKRANo ratings yet

- Chap 23 Retained Earnings Dividends Fin Acct 2 - Barter Summary Team PDFDocument3 pagesChap 23 Retained Earnings Dividends Fin Acct 2 - Barter Summary Team PDFSuper JhedNo ratings yet

- Retained Earnings DividendsDocument3 pagesRetained Earnings DividendsLyka Faye AggabaoNo ratings yet

- Lec 2Document5 pagesLec 2ahmedgalalabdalbaath2003No ratings yet

- CHAPTER 14 Non. 14Document6 pagesCHAPTER 14 Non. 14Ahmed AymanNo ratings yet

- IFRS Chap 2Document42 pagesIFRS Chap 2Yousef Abdullah GhundulNo ratings yet

- Accounting Transaction Processing Chapter 3Document73 pagesAccounting Transaction Processing Chapter 3Rupesh PolNo ratings yet

- Accounting For Ordinary Share Capital IssueDocument6 pagesAccounting For Ordinary Share Capital Issueraj shahNo ratings yet

- 12 Accountancy Notes CH07 Company Accounts Issue of Shares 01Document20 pages12 Accountancy Notes CH07 Company Accounts Issue of Shares 01zainab.xf77No ratings yet

- Accounting 12Document4 pagesAccounting 12Breathe ArielleNo ratings yet

- Chapter 2 - Financial AnalysisDocument66 pagesChapter 2 - Financial AnalysisRAHKAESH NAIR A L UTHAIYA NAIR100% (1)

- 4 Chapter 4 Consolidated Financial StatementDocument17 pages4 Chapter 4 Consolidated Financial StatementfghhnnnjmlNo ratings yet

- Business Combinations: Answers To Questions 1Document14 pagesBusiness Combinations: Answers To Questions 1MUFC SupporterNo ratings yet

- ACCT1111 Chapter 2 LectureDocument61 pagesACCT1111 Chapter 2 LectureWky Jim100% (1)

- Solution Manual For Advanced Accounting 11th Edition by Beams 3 PDF FreeDocument14 pagesSolution Manual For Advanced Accounting 11th Edition by Beams 3 PDF Freeluxion bot100% (1)

- Camtasia Comprehensive Review Problem 4-1Document30 pagesCamtasia Comprehensive Review Problem 4-1AC ConNo ratings yet

- Intermediate Accounting IIDocument10 pagesIntermediate Accounting IILexNo ratings yet

- Debits and Credits HandoutsDocument8 pagesDebits and Credits Handoutsr8286105No ratings yet

- Statement of Financial Position (SFP) : TNHS Main - SHS - Accountancy, Business and ManagementDocument10 pagesStatement of Financial Position (SFP) : TNHS Main - SHS - Accountancy, Business and ManagementPedana RañolaNo ratings yet

- Accounting For Special Transactions - Module 4Document9 pagesAccounting For Special Transactions - Module 4Jcel JcelNo ratings yet

- Chapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsDocument11 pagesChapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsMondy MondyNo ratings yet

- SOAL AkuntansiDocument13 pagesSOAL AkuntansiArum MashitoNo ratings yet

- Acctg-3226 Chapter-6 SupplementalDocument23 pagesAcctg-3226 Chapter-6 SupplementalZea Kate EspedionNo ratings yet

- Online Ass Advance Acc NEWDocument6 pagesOnline Ass Advance Acc NEWRara Rarara30No ratings yet

- Beams Aa13e SM 01Document14 pagesBeams Aa13e SM 01jiajiaNo ratings yet

- Notas Contabilidad para Trabajos 3 y 4Document12 pagesNotas Contabilidad para Trabajos 3 y 4jorgeNo ratings yet

- Excercise Sheet Lectures 1 and 2 Spring 2022Document16 pagesExcercise Sheet Lectures 1 and 2 Spring 2022Mohamed ZaitoonNo ratings yet

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Document6 pagesChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Minh HuyyNo ratings yet

- Answers-Accounting CB 2nd Ed CambridgeDocument119 pagesAnswers-Accounting CB 2nd Ed Cambridgebk4t7j8g92No ratings yet

- Accounts Textbook AnswersDocument84 pagesAccounts Textbook AnswersVidhi Patel100% (4)

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- Master of Accountancy - by SlidesgoDocument73 pagesMaster of Accountancy - by SlidesgoPhan Anh TúNo ratings yet

- Chapter 2 LectureDocument60 pagesChapter 2 LectureAlex Lau100% (1)

- Chapter 11 SummaryDocument3 pagesChapter 11 SummaryAreeba QureshiNo ratings yet

- Chapter 13Document11 pagesChapter 13Maya HamdyNo ratings yet

- Business Combinations: Answers To Questions 1Document12 pagesBusiness Combinations: Answers To Questions 1Sin TungNo ratings yet

- MyacccheatDocument5 pagesMyacccheatraygains23No ratings yet

- FINMA - Tools of Financial Analysis and ControlDocument15 pagesFINMA - Tools of Financial Analysis and ControlChloekurtj DelNo ratings yet

- Business Transactions and Their Analysis As Applied To Service BusinessDocument57 pagesBusiness Transactions and Their Analysis As Applied To Service BusinessRhona Primne ServañezNo ratings yet

- Partnership FormationDocument16 pagesPartnership FormationKian BarredoNo ratings yet

- Chapter 09 - Partnerships - Formation, Operatios, and Changes in Ownership InterestsDocument53 pagesChapter 09 - Partnerships - Formation, Operatios, and Changes in Ownership Interestsgracerich20No ratings yet

- Lecture No 2Document4 pagesLecture No 2Avia Chelsy DeangNo ratings yet

- Partnership Liquidation: Steps Involved in LiquidationDocument13 pagesPartnership Liquidation: Steps Involved in LiquidationCharles TuazonNo ratings yet

- Unit 6Document19 pagesUnit 6Eco FacileNo ratings yet

- Contemporary Financial Management 10th Edition Moyer Solutions Manual 1Document15 pagesContemporary Financial Management 10th Edition Moyer Solutions Manual 1carlo100% (47)

- ACCA - F3 Chapter-12-1Document15 pagesACCA - F3 Chapter-12-1Nile NguyenNo ratings yet

- Advanced Accounting Week 4Document3 pagesAdvanced Accounting Week 4rahmaNo ratings yet

- Financial StatementDocument12 pagesFinancial StatementCecilia CajipoNo ratings yet

- Q1: HSBC: Homework Questions Solutions For Topic 5Document5 pagesQ1: HSBC: Homework Questions Solutions For Topic 5iwhy_No ratings yet

- ACC101 Chapter1newDocument16 pagesACC101 Chapter1newtazebachew birkuNo ratings yet

- Af210 WeekDocument30 pagesAf210 WeekAvisha SinghNo ratings yet

- Cash Flows From Financing ActivitiesDocument1 pageCash Flows From Financing Activitiesarmor.coverNo ratings yet

- Trial Balance Lesson NotesDocument16 pagesTrial Balance Lesson NotesJada ThompsonNo ratings yet

- PERMALINO - Learning Activity 19. Working Capital ManagementDocument3 pagesPERMALINO - Learning Activity 19. Working Capital ManagementAra Joyce PermalinoNo ratings yet

- Wharton Consulting Club 06-07 PDFDocument36 pagesWharton Consulting Club 06-07 PDFVarun SharmaNo ratings yet

- Valuation: Packet 2 Relative Valuation, Asset-Based Valuation and Private Company ValuationDocument52 pagesValuation: Packet 2 Relative Valuation, Asset-Based Valuation and Private Company ValuationVarun SharmaNo ratings yet

- Acquisition Based LearningsDocument32 pagesAcquisition Based LearningsVarun SharmaNo ratings yet

- Expert Solution: To DetermineDocument1 pageExpert Solution: To DetermineVarun SharmaNo ratings yet

- To Determine: Chapter 8, Problem 3CEDocument1 pageTo Determine: Chapter 8, Problem 3CEVarun SharmaNo ratings yet

- Expert Solution: To DetermineDocument1 pageExpert Solution: To DetermineVarun SharmaNo ratings yet

- Date Particular Debit Credit: (To Record Net Income of $265,000)Document1 pageDate Particular Debit Credit: (To Record Net Income of $265,000)Varun SharmaNo ratings yet

- Admit Letter For Online PREVENTION OF CYBER CRIMES AND FRAUD MANAGEMENT Examination - Jan 2018 Candidate DetailsDocument2 pagesAdmit Letter For Online PREVENTION OF CYBER CRIMES AND FRAUD MANAGEMENT Examination - Jan 2018 Candidate DetailsVarun SharmaNo ratings yet

- Exam Enrolment AcknowledgementDocument1 pageExam Enrolment AcknowledgementVarun SharmaNo ratings yet

- CeISB PDFDocument1 pageCeISB PDFVarun SharmaNo ratings yet

- 9 Marketing PDFDocument29 pages9 Marketing PDFVarun SharmaNo ratings yet

- At 2017 Valuation For Bank and Financial InstitutionsDocument78 pagesAt 2017 Valuation For Bank and Financial InstitutionsKojiro FuumaNo ratings yet

- Research Insight-1: Company Name - Avenue Supermarts LTDDocument2 pagesResearch Insight-1: Company Name - Avenue Supermarts LTDSaksham KalraNo ratings yet

- Case StudyDocument21 pagesCase StudyRakshitaNo ratings yet

- Saving & Investment Pattern of People in India: A Study OnDocument29 pagesSaving & Investment Pattern of People in India: A Study OnBARKHA TILWANINo ratings yet

- (Solved) Respond To The Following Question in Your Textbook C - 2-26 - Carl... - Course HeroDocument3 pages(Solved) Respond To The Following Question in Your Textbook C - 2-26 - Carl... - Course HeroJdkrkejNo ratings yet

- Q: 1 - Ratio Analysis - May 2008 - # 6: Ial As Accounting - Unit 1 Question BankDocument54 pagesQ: 1 - Ratio Analysis - May 2008 - # 6: Ial As Accounting - Unit 1 Question BankMohammad AshrafulNo ratings yet

- Final Project Report - Gourav SharmaDocument77 pagesFinal Project Report - Gourav SharmaGourav Sharma100% (1)

- 7 - RCBC V Banco de OroDocument30 pages7 - RCBC V Banco de OroJacob PalafoxNo ratings yet

- Hsslive Xii Acc 5 Dissolution of A Partnership Firm QNDocument6 pagesHsslive Xii Acc 5 Dissolution of A Partnership Firm QN6E13 ALMubeenNo ratings yet

- DMCI Financial AssesmentDocument61 pagesDMCI Financial AssesmentRinna Jane Rivera BolandresNo ratings yet

- 7-Aug - 2019Document5 pages7-Aug - 2019V.K. JoshiNo ratings yet

- Amazon Financial AnalysisDocument6 pagesAmazon Financial Analysisapi-315180958No ratings yet

- BSTR Revision SheetDocument4 pagesBSTR Revision Sheetyifabec473No ratings yet

- Value Investing and Risk ManagementDocument32 pagesValue Investing and Risk Managementadib_motiwala0% (1)

- 2024 05 03 PH e BdoDocument9 pages2024 05 03 PH e Bdophilnabank1217No ratings yet

- Sharekhan Satisfaction LevelDocument116 pagesSharekhan Satisfaction LevelamericaspaydayloansNo ratings yet

- Acctg7-MIDTERM REVIERDocument9 pagesAcctg7-MIDTERM REVIERDave Manalo100% (1)

- Course Outlines (BS-Commerce 3) : Subject: Business Law) Bscom-4301 (Course ContentDocument10 pagesCourse Outlines (BS-Commerce 3) : Subject: Business Law) Bscom-4301 (Course ContentAhsan ShabirNo ratings yet

- Qus. MTP Accounts - 09.12.23Document5 pagesQus. MTP Accounts - 09.12.23karann021003No ratings yet

- STO With Delivery Via ShippingDocument52 pagesSTO With Delivery Via ShippingJonnalagadda Lakshman100% (1)

- Solution Manual For Fundamentals of Corporate Finance 12th Edition Stephen Ross Randolph Westerfield Bradford JordanDocument38 pagesSolution Manual For Fundamentals of Corporate Finance 12th Edition Stephen Ross Randolph Westerfield Bradford Jordandepartbuildatm8100% (15)

- Section X336Document7 pagesSection X336mjpjoreNo ratings yet

- C1 - M4 - Organization of Financial Markets and Securities Trading - Answer KeyDocument4 pagesC1 - M4 - Organization of Financial Markets and Securities Trading - Answer KeytfdsgNo ratings yet

- Foundations of Multinational Financial Management 6th Edition Shapiro Solutions ManualDocument11 pagesFoundations of Multinational Financial Management 6th Edition Shapiro Solutions Manualdextrermachete4amgqgNo ratings yet

- Does The Stock Market Drive The Philippine Economy?Document6 pagesDoes The Stock Market Drive The Philippine Economy?RENJiiiNo ratings yet

- Accounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsDocument14 pagesAccounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsJoel Christian MascariñaNo ratings yet

- Pranav Kapse SIPDocument61 pagesPranav Kapse SIPAGRIFORCE SALESNo ratings yet