Professional Documents

Culture Documents

A Company's Menu of Strategy Options: Beyond Competitive Strategy Other Important

A Company's Menu of Strategy Options: Beyond Competitive Strategy Other Important

Uploaded by

Mohtasimul Islam TipuCopyright:

Available Formats

You might also like

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (25)

- Manajemen StrategiDocument57 pagesManajemen StrategiRaihan AdiprimaNo ratings yet

- Communications Plan and TemplateDocument6 pagesCommunications Plan and TemplateBrittani Bell100% (1)

- NAP Form 1 Inventory AppraisalDocument1 pageNAP Form 1 Inventory AppraisalDeborah Grace Apilado100% (4)

- Raw Materials Analyst ReportDocument6 pagesRaw Materials Analyst ReportGaurav ChandelNo ratings yet

- Supplementing The Chosen Competitive Strategy: Strategic ManagementDocument49 pagesSupplementing The Chosen Competitive Strategy: Strategic Managementjunaid_kkhan2157No ratings yet

- 6 Chosen Competitive Strategy-UpdatedDocument46 pages6 Chosen Competitive Strategy-UpdatedAmmarah KhanNo ratings yet

- Strategic Alliances and Collaborative PartnershipsDocument33 pagesStrategic Alliances and Collaborative PartnershipscgurbaniNo ratings yet

- SM Mod 05Document60 pagesSM Mod 05Kavi_3788No ratings yet

- Beyond Competitive Strategy: Other Important Strategy ChoicesDocument48 pagesBeyond Competitive Strategy: Other Important Strategy ChoiceskimsrNo ratings yet

- Supplementing The Chosen Competitive Strategy: Chapter TitleDocument31 pagesSupplementing The Chosen Competitive Strategy: Chapter TitleAarti JNo ratings yet

- Chapter 4 - Global Business-Level Strategies - Choosing Competitive Strategies in A Single IndustryDocument17 pagesChapter 4 - Global Business-Level Strategies - Choosing Competitive Strategies in A Single IndustryHà Nhi LêNo ratings yet

- Chap 10Document30 pagesChap 10manojbhatia1220No ratings yet

- Beyond Competitive Strategy Beyond Competitive StrategyDocument48 pagesBeyond Competitive Strategy Beyond Competitive StrategyPrasaad TayadeNo ratings yet

- Strat I GiesDocument11 pagesStrat I GiesYousab KaldasNo ratings yet

- Chap 008Document50 pagesChap 008Thao P NguyenNo ratings yet

- Supplementing The Chosen Competitive Strategy: Other Important Strategy ChoicesDocument43 pagesSupplementing The Chosen Competitive Strategy: Other Important Strategy Choicessahu_samNo ratings yet

- Supplementing Competitive StrategyDocument50 pagesSupplementing Competitive StrategynidalitNo ratings yet

- Beyond Competitive Strategy: Other Important Strategy ChoicesDocument30 pagesBeyond Competitive Strategy: Other Important Strategy ChoicesatiquearifkhanNo ratings yet

- Chapter 6Document57 pagesChapter 6hammadNo ratings yet

- Beyond Competitive Strategy Beyond Competitive StrategyDocument42 pagesBeyond Competitive Strategy Beyond Competitive Strategyruchipatel20No ratings yet

- Chapter 5 - Global Corporate-Level Strategies: Choosing Competitive Strategies in Multiple Industries and Multiple Countries or RegionsDocument40 pagesChapter 5 - Global Corporate-Level Strategies: Choosing Competitive Strategies in Multiple Industries and Multiple Countries or RegionsBảo ChâuuNo ratings yet

- Supplementing The Chosen Competitive Strategy: Chapter TitleDocument50 pagesSupplementing The Chosen Competitive Strategy: Chapter TitlenidalitNo ratings yet

- Module II A Strategy Formulation at The Business LevelDocument35 pagesModule II A Strategy Formulation at The Business Levelmacs emsNo ratings yet

- Chap 7Document34 pagesChap 7Darshini RamtohulNo ratings yet

- STRATEGY2013 PreCLASS 9Document29 pagesSTRATEGY2013 PreCLASS 9SanjibNo ratings yet

- Answers CorporateDocument31 pagesAnswers CorporateledemtaamanyisyeNo ratings yet

- MGNT428 Ch09 Cooperative Strategies Lecture - LachowiczDocument36 pagesMGNT428 Ch09 Cooperative Strategies Lecture - LachowiczinvaapNo ratings yet

- Strategic Management 07Document20 pagesStrategic Management 07Mayur ParvaniNo ratings yet

- Chap - 6 NewDocument56 pagesChap - 6 NewAtique Arif KhanNo ratings yet

- Module 6 Part 2Document55 pagesModule 6 Part 2Shrutit21No ratings yet

- IPPTChap 008Document81 pagesIPPTChap 008Nia ニア MulyaningsihNo ratings yet

- Diversification & Porters Generic StategiesDocument11 pagesDiversification & Porters Generic StategiesvaryushNo ratings yet

- Session Xii (Chapter 6)Document31 pagesSession Xii (Chapter 6)JemmyEKONo ratings yet

- Assignments & Quizzes - SM CourseDocument10 pagesAssignments & Quizzes - SM CourseSIM SpeaksNo ratings yet

- International StrategyDocument23 pagesInternational StrategySumeet SaxenaNo ratings yet

- Corporatestrpart 1Document15 pagesCorporatestrpart 1api-228377429No ratings yet

- Chap006 Merged PDFDocument132 pagesChap006 Merged PDFEnith ArriagaNo ratings yet

- Core Competencies and Capabilities-2Document33 pagesCore Competencies and Capabilities-2Ranjith PNo ratings yet

- Business Strategy: Mcgraw-Hill/Irwin Strategic Management, 10/EDocument30 pagesBusiness Strategy: Mcgraw-Hill/Irwin Strategic Management, 10/EGandhesNo ratings yet

- DiversificationDocument18 pagesDiversificationVinod PandeyNo ratings yet

- Chapter 6Document1 pageChapter 6Eika BorjaNo ratings yet

- Generic StrategiesDocument7 pagesGeneric StrategiesMagnus ColacoNo ratings yet

- Strategic ManagementDocument17 pagesStrategic ManagementKECEBONG ALBINONo ratings yet

- Chap 006Document23 pagesChap 006heavenfire21No ratings yet

- Strengthening A Company'S Competitive Position:: Strategic Moves, Timing, and Scope of OperationsDocument36 pagesStrengthening A Company'S Competitive Position:: Strategic Moves, Timing, and Scope of OperationsFarhana MituNo ratings yet

- Sap (STRATEGIC ADVANTAGE PROFILE.)Document9 pagesSap (STRATEGIC ADVANTAGE PROFILE.)Shubhajit Nandi83% (12)

- Sm. - 4Document29 pagesSm. - 4Pratham SharmaNo ratings yet

- Hitt AISECh 09Document36 pagesHitt AISECh 09JoseyyyNo ratings yet

- Ch.6 Strategy FormulationDocument34 pagesCh.6 Strategy Formulationahmed abd elmaboudNo ratings yet

- Diversification:: Strategies For Managing A Group of BusinessesDocument20 pagesDiversification:: Strategies For Managing A Group of BusinessesParth ShingalaNo ratings yet

- Tailoring Strategy To Fit Specific Industry and CompanyDocument34 pagesTailoring Strategy To Fit Specific Industry and CompanyAhmedNo ratings yet

- Tailoring Strategy To Fit Specific Industry and Company SituationsDocument68 pagesTailoring Strategy To Fit Specific Industry and Company SituationsBill Kashif100% (1)

- Chapter 5Document7 pagesChapter 5ERICKA MAE NATONo ratings yet

- Subsidiary Level Strategy: Global Strategic DevelopmentDocument33 pagesSubsidiary Level Strategy: Global Strategic DevelopmentAbraham ZeusNo ratings yet

- ComprehensiveDocument175 pagesComprehensiveSUSHANTO MUKHERJEENo ratings yet

- INB-480 8-Subsidiary Level StrategyDocument31 pagesINB-480 8-Subsidiary Level StrategymyhellonearthNo ratings yet

- Corporatestrpart 2Document20 pagesCorporatestrpart 2api-228377429No ratings yet

- Strategies in Action: Hundreds of Companies TodayDocument71 pagesStrategies in Action: Hundreds of Companies TodayNishant SinhaNo ratings yet

- Global Business Strategy: E Xplanatory Session 7: Strategy Formulation: Situation Analysis and Business StrategyDocument45 pagesGlobal Business Strategy: E Xplanatory Session 7: Strategy Formulation: Situation Analysis and Business StrategyAstridNo ratings yet

- Ism Module - 2newDocument141 pagesIsm Module - 2newMaria U DavidNo ratings yet

- Generic Startegies: Name of InstitutionDocument21 pagesGeneric Startegies: Name of InstitutionNikita SangalNo ratings yet

- Tailoring Strategy To Fit Specific Industry and Company SituationsDocument60 pagesTailoring Strategy To Fit Specific Industry and Company SituationsDr. J. V. BalasubramanianNo ratings yet

- Competitive Advantage & Competitive Strategy: The Five Generic Competitive StrategiesDocument5 pagesCompetitive Advantage & Competitive Strategy: The Five Generic Competitive StrategiesMohtasimul Islam TipuNo ratings yet

- LEC:: 03 The Strategy-Making, Strategy-Executing ProcessDocument6 pagesLEC:: 03 The Strategy-Making, Strategy-Executing ProcessMohtasimul Islam TipuNo ratings yet

- LEC:: 05 Understanding The Factors That Determine A Company's SituationDocument6 pagesLEC:: 05 Understanding The Factors That Determine A Company's SituationMohtasimul Islam TipuNo ratings yet

- Defining Strategic ManagementDocument5 pagesDefining Strategic ManagementMohtasimul Islam TipuNo ratings yet

- JD - Aaj Enterprises Private LimitedDocument2 pagesJD - Aaj Enterprises Private LimitedAnkit SinghNo ratings yet

- Corporate Governance CourseworkDocument8 pagesCorporate Governance Courseworkbcqv1trr100% (2)

- Case A HRIS For Mid TermDocument4 pagesCase A HRIS For Mid Termwaqasfarooq75_396423No ratings yet

- BS en PD 5500 2015Document6 pagesBS en PD 5500 2015Sanket Kare0% (1)

- Director VP Business Development Capture Proposal Manager Resume in Washington DC VA MD - Zack SionakidesDocument3 pagesDirector VP Business Development Capture Proposal Manager Resume in Washington DC VA MD - Zack SionakidesZack SionakidesNo ratings yet

- UNIT 4 AccountingDocument6 pagesUNIT 4 AccountingMukulNo ratings yet

- Cost Acc - ScrapDocument2 pagesCost Acc - ScrapChni GalsNo ratings yet

- Successful Project ManagementDocument35 pagesSuccessful Project Managementandrew LBKNo ratings yet

- Business Plan My Bee FixDocument94 pagesBusiness Plan My Bee FixMovie ShareNo ratings yet

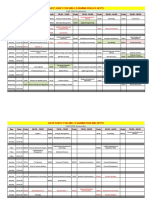

- Date Sheet For Mid-1 Examination (Cs Dept) : Fall 2020 SemesterDocument4 pagesDate Sheet For Mid-1 Examination (Cs Dept) : Fall 2020 SemesterAbu HureraNo ratings yet

- Chapter 11 IS Auditing Standards, Guidelines and Best PracticesDocument9 pagesChapter 11 IS Auditing Standards, Guidelines and Best PracticesMuriithi MurageNo ratings yet

- Marketing Plan CDocument5 pagesMarketing Plan CAsep KurniaNo ratings yet

- CMA Short QuestionsDocument16 pagesCMA Short QuestionsAman Jot Kaur NagiNo ratings yet

- MKT4020Document13 pagesMKT4020RWETUTE RAMADHANNo ratings yet

- Taco Bell: The Breakfast OpportunitiesDocument14 pagesTaco Bell: The Breakfast OpportunitiesQudsia NourasNo ratings yet

- Unit03 Job Analysis - 3 - STDocument20 pagesUnit03 Job Analysis - 3 - STThùy TrangNo ratings yet

- Developing Modern Applications With Agile OutsourcingDocument17 pagesDeveloping Modern Applications With Agile OutsourcingPaweł PanowiczNo ratings yet

- STADIO Flyer AMN FULLDocument2 pagesSTADIO Flyer AMN FULLBoogy GrimNo ratings yet

- Why Agile Project Management Is Better Than Waterfall?Document3 pagesWhy Agile Project Management Is Better Than Waterfall?Enock0% (1)

- Definition of Strategic Human Resource ManagementDocument9 pagesDefinition of Strategic Human Resource ManagementAnkush RanaNo ratings yet

- Fundamental Test ProcessDocument4 pagesFundamental Test ProcessKamir ShahbazNo ratings yet

- Tools For Human ResourcesDocument2 pagesTools For Human ResourcesMeghaDivakarNo ratings yet

- PM Interview Questions & AnswerDocument36 pagesPM Interview Questions & AnswerKavin Kothandapani100% (4)

- Mbs Global MbaDocument25 pagesMbs Global MbaNyoka RobinsonNo ratings yet

- Dato JamilusDocument58 pagesDato JamilusChuah Mystrious SeriousNo ratings yet

- EntrepreneurshipDocument17 pagesEntrepreneurshipSrinivas Reddy100% (3)

A Company's Menu of Strategy Options: Beyond Competitive Strategy Other Important

A Company's Menu of Strategy Options: Beyond Competitive Strategy Other Important

Uploaded by

Mohtasimul Islam TipuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Company's Menu of Strategy Options: Beyond Competitive Strategy Other Important

A Company's Menu of Strategy Options: Beyond Competitive Strategy Other Important

Uploaded by

Mohtasimul Islam TipuCopyright:

Available Formats

Lesson Plan Information

Lecture: 10 & 11 Lesson: 06

Course Title & Code: Strategic Management, MGT - 593 Faculty: Md. Shahidur Rahman Khan

Program: MBA/EMBA Date: Time:

Topic: Beyond Competitive Strategy Other Important Length of Period: 3 x 2 = 6 Hrs

Strategy Choices

Learning Objectives:

Collaborative Strategies: Alliances and Partnerships

Merger and Acquisition Strategies

Vertical Integration Strategies: Operating Across More Stages of the Industry Value Chain

Outsourcing Strategies: Narrowing the Boundaries of the Business

Offensive Strategies: Improving Market Position and Building Competitive Advantage

Defensive Strategies: Protecting Market Position and Competitive Advantage

Contents :

LEC:: 10

A Company’s Menu of Strategy Options

Collaborative Strategies: Alliances and Partnerships

Companies sometimes use strategic alliances or collaborative partnerships to complement their own

strategic initiatives and strengthen their competitiveness. Such cooperative strategies go beyond

normal company-to-company dealings but fall short of merger or full joint venture partnership.

Alliances Can Enhance a Firm’s Competitiveness

Alliances and partnerships can help companies cope with two demanding competitive challenges -

Racing against rivals to build a market presence in many different national markets

Racing against rivals to seize opportunities on the frontiers of advancing technology

Collaborative arrangements can help a company lower its costs and/or gain access to needed expertise and capabilities.

Characteristics of a Strategic Alliance

Strategic alliance – A formal agreement between two or more separate companies where there is

o Strategically relevant collaboration of some sort

o Joint contribution of resources

o Shared risk

o Shared control

o Mutual dependence

Alliances often involve

o Joint marketing

o Joint sales or distribution

o Joint production

o Design collaboration

o Joint research

o Projects to jointly develop new technologies or products

What Factors Make an Alliance Strategic?

-It is critical to a company’s achievement of an important objective

-It helps build, sustain, or enhance a core competence or competitive advantage

-It helps block a competitive threat

-It helps open up important market opportunities

-It mitigates a significant risk to a company’s business

Why Are Strategic Alliances Formed?

-To collaborate on technology development or new product development

-To fill gaps in technical or manufacturing expertise

-To create new skill sets and capabilities

-To improve supply chain efficiency

-To gain economies of scale in production and/or marketing

-To acquire or improve market access via joint marketing agreements

Potential Benefits of Alliances to Achieve Global and Industry Leadership

-Get into critical country markets quickly to accelerate process of building a global presence

-Gain inside knowledge about unfamiliar markets and cultures

-Access valuable skills and competencies concentrated in particular geographic locations

-Establish a beach head to participate in target industry

-Master new technologies and build new expertise faster than would be possible internally

-Open up expanded opportunities in target industry by combining firm’s capabilities with resources of partners

LEC:: 11

Why Alliances Fail

Ability of an alliance to endure depends on

o How well partners work together

o Success of partners in responding and adapting to changing conditions

o Willingness of partners to renegotiate the bargain

Reasons for alliance failure

o Diverging objectives and priorities of partners

o Inability of partners to work well together

o Changing conditions rendering purpose of alliance obsolete

o Emergence of more attractive technological paths

o Marketplace rivalry between one or more allies

Merger and Acquisition Strategies

Merger – Combination and pooling of equals, with newly created firm often taking on a new name.

Acquisition – One firm, the acquirer, purchases and absorbs operations of another, the acquired

Merger-acquisition strategy:

-Much-used strategic option

-Especially suited for situations where alliances do not provide a firm with needed capabilities or cost-reducing

opportunities

-Ownership allows for tightly integrated operations, creating more control and autonomy than alliances

Objectives of Mergers and Acquisitions

o To create a more cost-efficient operation

o To expand a firm’s geographic coverage

o To extend a firm’s business into new product categories or international markets

o To gain quick access to new technologies or competitive capabilities

o To invent a new industry and lead the convergence of industries whose boundaries are blurred by changing

technologies and new market opportunities

Pitfalls of Mergers and Acquisitions

-Resistance from rank-and-file employees

-Hard-to-resolve conflicts in management styles and corporate cultures

-Tough problems of integration

-Greater-than-anticipated difficulties in

o Achieving expected cost-savings

o Sharing of expertise

o Achieving enhanced competitive capabilities

Vertical Integration Strategies

Extend a firm’s competitive scope within same industry-

-Backward into sources of supply

-Forward toward end-users of final product

It can aim at either full or partial integration.

Strategic Advantages of Backward Integration

-Generates cost savings only if volume needed is big enough to capture efficiencies of suppliers

-Potential to reduce costs exists when

o Suppliers have sizable profit margins

o Item supplied is a major cost component

o Resource requirements are easily met

-Can produce a differentiation-based competitive advantage when it results in a better quality part

-Reduces risk of depending on suppliers of crucial raw materials / parts / components

Strategic Advantages of Forward Integration

-To gain better access to end users and better market visibility

-To compensate for undependable distribution channels which undermine steady operations

-To offset the lack of a broad product line, a firm may sell directly to end users

-To bypass regular distribution channels in favor of direct sales and Internet retailing which may

o Lower distribution costs

o Produce a relative cost advantage over rivals

o Enable lower selling prices to end users

Strategic Disadvantages of Vertical Integration

-Boosts resource requirements

-Locks firm deeper into same industry

-Results in fixed sources of supply and less flexibility in accommodating buyer demands for product variety

-Poses all types of capacity-matching problems

-May require radically different skills / capabilities

-Reduces flexibility to make changes in component parts which may lengthen design time and ability to introduce new

products

Outsourcing Strategies

Outsourcing involves withdrawing from certain value chain activities and relying on outsiders to supply needed products,

support services, or functional activities.

Internally

Performed

Activities Functional

Suppliers

Activities

Support Distributors

Services or Retailers

When Does Outsourcing Make Strategic Sense?

-Activity can be performed better or more cheaply by outside specialists

-Activity is not crucial to achieve a sustainable competitive advantage

-Risk exposure to changing technology and/or changing buyer preferences is reduced

-It improves firm’s ability to innovate

-Operations are streamlined to

o Improve flexibility

o Cut time to get new products into the market

-It increases firm’s ability to assemble diverse kinds of expertise speedily and efficiently

-Firm can concentrate on “core” value chain activities that best suit its resource strengths

Offensive and Defensive Strategies

Offensive Strategies- Used to build new or stronger market position and/or create competitive advantage.

Defensive Strategies- Used to protect competitive advantage (rarely lead to creating advantage.

Principles of Offensive Strategies

-Focus relentlessly on

Building competitive advantage and

Striving to convert it into decisive advantage

-Employ the element of surprise as opposed to doing what rivals expect

-Apply resources where rivals are least able to defend themselves

-Be impatient with the status quo and display a strong bias for swift, decisive actions to boost a firm’s competitive

position vis-à-vis rivals

Types of Offensive Strategy Options

1.Offer an equally good or better product at a lower price

2. Leapfrog competitors by being

First adopter of next-generation technologies or

First to market with next-generation products

3. Pursue continuous product innovation to draw sales and market share away from less innovative rivals

4. Adopt and improve on the good ideas of other companies

Learning Outcomes:

1. a) State the underlying characteristics of a strategic alliance.

b) Why is strategic alliance so important to successful competitive advantage?

2. a) What are the advantages to firms and their stakeholders of developing backward and forward Integrations?

b) Select an organization that competes in an industry and determine the problems it will face after integrating

vertically.

3. a) Identify the objectives of mergers and acquisitions.

b) When does outsourcing make strategic sense?

You might also like

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (25)

- Manajemen StrategiDocument57 pagesManajemen StrategiRaihan AdiprimaNo ratings yet

- Communications Plan and TemplateDocument6 pagesCommunications Plan and TemplateBrittani Bell100% (1)

- NAP Form 1 Inventory AppraisalDocument1 pageNAP Form 1 Inventory AppraisalDeborah Grace Apilado100% (4)

- Raw Materials Analyst ReportDocument6 pagesRaw Materials Analyst ReportGaurav ChandelNo ratings yet

- Supplementing The Chosen Competitive Strategy: Strategic ManagementDocument49 pagesSupplementing The Chosen Competitive Strategy: Strategic Managementjunaid_kkhan2157No ratings yet

- 6 Chosen Competitive Strategy-UpdatedDocument46 pages6 Chosen Competitive Strategy-UpdatedAmmarah KhanNo ratings yet

- Strategic Alliances and Collaborative PartnershipsDocument33 pagesStrategic Alliances and Collaborative PartnershipscgurbaniNo ratings yet

- SM Mod 05Document60 pagesSM Mod 05Kavi_3788No ratings yet

- Beyond Competitive Strategy: Other Important Strategy ChoicesDocument48 pagesBeyond Competitive Strategy: Other Important Strategy ChoiceskimsrNo ratings yet

- Supplementing The Chosen Competitive Strategy: Chapter TitleDocument31 pagesSupplementing The Chosen Competitive Strategy: Chapter TitleAarti JNo ratings yet

- Chapter 4 - Global Business-Level Strategies - Choosing Competitive Strategies in A Single IndustryDocument17 pagesChapter 4 - Global Business-Level Strategies - Choosing Competitive Strategies in A Single IndustryHà Nhi LêNo ratings yet

- Chap 10Document30 pagesChap 10manojbhatia1220No ratings yet

- Beyond Competitive Strategy Beyond Competitive StrategyDocument48 pagesBeyond Competitive Strategy Beyond Competitive StrategyPrasaad TayadeNo ratings yet

- Strat I GiesDocument11 pagesStrat I GiesYousab KaldasNo ratings yet

- Chap 008Document50 pagesChap 008Thao P NguyenNo ratings yet

- Supplementing The Chosen Competitive Strategy: Other Important Strategy ChoicesDocument43 pagesSupplementing The Chosen Competitive Strategy: Other Important Strategy Choicessahu_samNo ratings yet

- Supplementing Competitive StrategyDocument50 pagesSupplementing Competitive StrategynidalitNo ratings yet

- Beyond Competitive Strategy: Other Important Strategy ChoicesDocument30 pagesBeyond Competitive Strategy: Other Important Strategy ChoicesatiquearifkhanNo ratings yet

- Chapter 6Document57 pagesChapter 6hammadNo ratings yet

- Beyond Competitive Strategy Beyond Competitive StrategyDocument42 pagesBeyond Competitive Strategy Beyond Competitive Strategyruchipatel20No ratings yet

- Chapter 5 - Global Corporate-Level Strategies: Choosing Competitive Strategies in Multiple Industries and Multiple Countries or RegionsDocument40 pagesChapter 5 - Global Corporate-Level Strategies: Choosing Competitive Strategies in Multiple Industries and Multiple Countries or RegionsBảo ChâuuNo ratings yet

- Supplementing The Chosen Competitive Strategy: Chapter TitleDocument50 pagesSupplementing The Chosen Competitive Strategy: Chapter TitlenidalitNo ratings yet

- Module II A Strategy Formulation at The Business LevelDocument35 pagesModule II A Strategy Formulation at The Business Levelmacs emsNo ratings yet

- Chap 7Document34 pagesChap 7Darshini RamtohulNo ratings yet

- STRATEGY2013 PreCLASS 9Document29 pagesSTRATEGY2013 PreCLASS 9SanjibNo ratings yet

- Answers CorporateDocument31 pagesAnswers CorporateledemtaamanyisyeNo ratings yet

- MGNT428 Ch09 Cooperative Strategies Lecture - LachowiczDocument36 pagesMGNT428 Ch09 Cooperative Strategies Lecture - LachowiczinvaapNo ratings yet

- Strategic Management 07Document20 pagesStrategic Management 07Mayur ParvaniNo ratings yet

- Chap - 6 NewDocument56 pagesChap - 6 NewAtique Arif KhanNo ratings yet

- Module 6 Part 2Document55 pagesModule 6 Part 2Shrutit21No ratings yet

- IPPTChap 008Document81 pagesIPPTChap 008Nia ニア MulyaningsihNo ratings yet

- Diversification & Porters Generic StategiesDocument11 pagesDiversification & Porters Generic StategiesvaryushNo ratings yet

- Session Xii (Chapter 6)Document31 pagesSession Xii (Chapter 6)JemmyEKONo ratings yet

- Assignments & Quizzes - SM CourseDocument10 pagesAssignments & Quizzes - SM CourseSIM SpeaksNo ratings yet

- International StrategyDocument23 pagesInternational StrategySumeet SaxenaNo ratings yet

- Corporatestrpart 1Document15 pagesCorporatestrpart 1api-228377429No ratings yet

- Chap006 Merged PDFDocument132 pagesChap006 Merged PDFEnith ArriagaNo ratings yet

- Core Competencies and Capabilities-2Document33 pagesCore Competencies and Capabilities-2Ranjith PNo ratings yet

- Business Strategy: Mcgraw-Hill/Irwin Strategic Management, 10/EDocument30 pagesBusiness Strategy: Mcgraw-Hill/Irwin Strategic Management, 10/EGandhesNo ratings yet

- DiversificationDocument18 pagesDiversificationVinod PandeyNo ratings yet

- Chapter 6Document1 pageChapter 6Eika BorjaNo ratings yet

- Generic StrategiesDocument7 pagesGeneric StrategiesMagnus ColacoNo ratings yet

- Strategic ManagementDocument17 pagesStrategic ManagementKECEBONG ALBINONo ratings yet

- Chap 006Document23 pagesChap 006heavenfire21No ratings yet

- Strengthening A Company'S Competitive Position:: Strategic Moves, Timing, and Scope of OperationsDocument36 pagesStrengthening A Company'S Competitive Position:: Strategic Moves, Timing, and Scope of OperationsFarhana MituNo ratings yet

- Sap (STRATEGIC ADVANTAGE PROFILE.)Document9 pagesSap (STRATEGIC ADVANTAGE PROFILE.)Shubhajit Nandi83% (12)

- Sm. - 4Document29 pagesSm. - 4Pratham SharmaNo ratings yet

- Hitt AISECh 09Document36 pagesHitt AISECh 09JoseyyyNo ratings yet

- Ch.6 Strategy FormulationDocument34 pagesCh.6 Strategy Formulationahmed abd elmaboudNo ratings yet

- Diversification:: Strategies For Managing A Group of BusinessesDocument20 pagesDiversification:: Strategies For Managing A Group of BusinessesParth ShingalaNo ratings yet

- Tailoring Strategy To Fit Specific Industry and CompanyDocument34 pagesTailoring Strategy To Fit Specific Industry and CompanyAhmedNo ratings yet

- Tailoring Strategy To Fit Specific Industry and Company SituationsDocument68 pagesTailoring Strategy To Fit Specific Industry and Company SituationsBill Kashif100% (1)

- Chapter 5Document7 pagesChapter 5ERICKA MAE NATONo ratings yet

- Subsidiary Level Strategy: Global Strategic DevelopmentDocument33 pagesSubsidiary Level Strategy: Global Strategic DevelopmentAbraham ZeusNo ratings yet

- ComprehensiveDocument175 pagesComprehensiveSUSHANTO MUKHERJEENo ratings yet

- INB-480 8-Subsidiary Level StrategyDocument31 pagesINB-480 8-Subsidiary Level StrategymyhellonearthNo ratings yet

- Corporatestrpart 2Document20 pagesCorporatestrpart 2api-228377429No ratings yet

- Strategies in Action: Hundreds of Companies TodayDocument71 pagesStrategies in Action: Hundreds of Companies TodayNishant SinhaNo ratings yet

- Global Business Strategy: E Xplanatory Session 7: Strategy Formulation: Situation Analysis and Business StrategyDocument45 pagesGlobal Business Strategy: E Xplanatory Session 7: Strategy Formulation: Situation Analysis and Business StrategyAstridNo ratings yet

- Ism Module - 2newDocument141 pagesIsm Module - 2newMaria U DavidNo ratings yet

- Generic Startegies: Name of InstitutionDocument21 pagesGeneric Startegies: Name of InstitutionNikita SangalNo ratings yet

- Tailoring Strategy To Fit Specific Industry and Company SituationsDocument60 pagesTailoring Strategy To Fit Specific Industry and Company SituationsDr. J. V. BalasubramanianNo ratings yet

- Competitive Advantage & Competitive Strategy: The Five Generic Competitive StrategiesDocument5 pagesCompetitive Advantage & Competitive Strategy: The Five Generic Competitive StrategiesMohtasimul Islam TipuNo ratings yet

- LEC:: 03 The Strategy-Making, Strategy-Executing ProcessDocument6 pagesLEC:: 03 The Strategy-Making, Strategy-Executing ProcessMohtasimul Islam TipuNo ratings yet

- LEC:: 05 Understanding The Factors That Determine A Company's SituationDocument6 pagesLEC:: 05 Understanding The Factors That Determine A Company's SituationMohtasimul Islam TipuNo ratings yet

- Defining Strategic ManagementDocument5 pagesDefining Strategic ManagementMohtasimul Islam TipuNo ratings yet

- JD - Aaj Enterprises Private LimitedDocument2 pagesJD - Aaj Enterprises Private LimitedAnkit SinghNo ratings yet

- Corporate Governance CourseworkDocument8 pagesCorporate Governance Courseworkbcqv1trr100% (2)

- Case A HRIS For Mid TermDocument4 pagesCase A HRIS For Mid Termwaqasfarooq75_396423No ratings yet

- BS en PD 5500 2015Document6 pagesBS en PD 5500 2015Sanket Kare0% (1)

- Director VP Business Development Capture Proposal Manager Resume in Washington DC VA MD - Zack SionakidesDocument3 pagesDirector VP Business Development Capture Proposal Manager Resume in Washington DC VA MD - Zack SionakidesZack SionakidesNo ratings yet

- UNIT 4 AccountingDocument6 pagesUNIT 4 AccountingMukulNo ratings yet

- Cost Acc - ScrapDocument2 pagesCost Acc - ScrapChni GalsNo ratings yet

- Successful Project ManagementDocument35 pagesSuccessful Project Managementandrew LBKNo ratings yet

- Business Plan My Bee FixDocument94 pagesBusiness Plan My Bee FixMovie ShareNo ratings yet

- Date Sheet For Mid-1 Examination (Cs Dept) : Fall 2020 SemesterDocument4 pagesDate Sheet For Mid-1 Examination (Cs Dept) : Fall 2020 SemesterAbu HureraNo ratings yet

- Chapter 11 IS Auditing Standards, Guidelines and Best PracticesDocument9 pagesChapter 11 IS Auditing Standards, Guidelines and Best PracticesMuriithi MurageNo ratings yet

- Marketing Plan CDocument5 pagesMarketing Plan CAsep KurniaNo ratings yet

- CMA Short QuestionsDocument16 pagesCMA Short QuestionsAman Jot Kaur NagiNo ratings yet

- MKT4020Document13 pagesMKT4020RWETUTE RAMADHANNo ratings yet

- Taco Bell: The Breakfast OpportunitiesDocument14 pagesTaco Bell: The Breakfast OpportunitiesQudsia NourasNo ratings yet

- Unit03 Job Analysis - 3 - STDocument20 pagesUnit03 Job Analysis - 3 - STThùy TrangNo ratings yet

- Developing Modern Applications With Agile OutsourcingDocument17 pagesDeveloping Modern Applications With Agile OutsourcingPaweł PanowiczNo ratings yet

- STADIO Flyer AMN FULLDocument2 pagesSTADIO Flyer AMN FULLBoogy GrimNo ratings yet

- Why Agile Project Management Is Better Than Waterfall?Document3 pagesWhy Agile Project Management Is Better Than Waterfall?Enock0% (1)

- Definition of Strategic Human Resource ManagementDocument9 pagesDefinition of Strategic Human Resource ManagementAnkush RanaNo ratings yet

- Fundamental Test ProcessDocument4 pagesFundamental Test ProcessKamir ShahbazNo ratings yet

- Tools For Human ResourcesDocument2 pagesTools For Human ResourcesMeghaDivakarNo ratings yet

- PM Interview Questions & AnswerDocument36 pagesPM Interview Questions & AnswerKavin Kothandapani100% (4)

- Mbs Global MbaDocument25 pagesMbs Global MbaNyoka RobinsonNo ratings yet

- Dato JamilusDocument58 pagesDato JamilusChuah Mystrious SeriousNo ratings yet

- EntrepreneurshipDocument17 pagesEntrepreneurshipSrinivas Reddy100% (3)