Professional Documents

Culture Documents

The Low Volatility Anomaly in Equity Sectors - 10 Years Later!

The Low Volatility Anomaly in Equity Sectors - 10 Years Later!

Uploaded by

James MitchellOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Low Volatility Anomaly in Equity Sectors - 10 Years Later!

The Low Volatility Anomaly in Equity Sectors - 10 Years Later!

Uploaded by

James MitchellCopyright:

Available Formats

The low volatility anomaly in equity sectors – 10 years later!

Benoit Bellone

is a quant researcher in the Quant Research Group at

BNP Paribas Asset Management in Paris, France.

benoit.bellone@bnpparibas.com, +33 (0)1 58 97 28 42

Raul Leote de Carvalho

is deputy head of the Quant Research Group at

BNP Paribas Asset Management in Paris, France.

raul.leotedecarvalho@bnpparibas.com, +33 (0)1 58 97 21 83

11 August 2020

Keywords: Low Volatility, Low Risk Anomaly, Minimum Variance, Minimum Volatility, Factor

Investing, Equities, Smart Beta, Sectors

JEL Classification: G11, G12, G14, E44

Introduction

At BNP Paribas Asset Management, we are heading for 10 years since the release of our Global Low

Volatility Equity strategy1, which is based on the proprietary research on low risk stocks that we carried

out prior to launching it.

One key result of our research was the evidence that the least volatile stocks from every activity sector

had a higher Sharpe ratio than those of their respective riskier peers. This indicated that the low volatility

anomaly did not appear to be found only in typically less volatile sectors such as utilities, consumer

staples or healthcare. From the point of view of risk-adjusted returns, the least volatile stocks from every

sector of activity appeared to be equally good candidates for a low volatility portfolio designed to deliver

higher risk-adjusted returns and lower volatility than achieved by the market capitalisation index used

to benchmark the strategy.

The strategy we opted for thus invests in the least volatile stocks from all sectors to build a well-

diversified portfolio with below-benchmark volatility and a moderate level of tracking error compared

to those of typical active equity managers.

Almost a decade later, we decided it would be instructive to revisit our research and review the 10 years

of out-of-sample results. Were the least volatile stocks from each sector actually more attractive than

their riskier peers were from the point of view of risk-adjusted returns, as we had found in our initial

research?

As we explain below, the answer is a resounding ‘yes’. If anything, the results were even stronger in

this 10-year out-of-sample period. This runs contrary to the commonly perceived notion that once an

anomaly is discovered it tends to be arbitraged away.

1

The strategy was launched on 31st March 2011

Electronic copy available at: https://ssrn.com/abstract=3697914

The low volatility anomaly

The ‘low volatility anomaly’ refers to the fact that less volatile stocks tend to generate returns that are

higher than would be expected from their level of risk. Robert Haugen and James Heins provided the

first evidence of this anomaly in 1972. They used the history of stock returns to show that, between 1926

and 1969, portfolios investing systematically in the least volatile US stocks would have delivered much

higher returns than could be expected from their low level of risk. Conversely, they showed that

portfolios invested in the most volatile stocks would have significantly disappointed in terms of

performance.

The academic community did not immediately accept their results as they refuted the basic principle in

finance that higher risk should be rewarded with higher return, as advocated by Jack Treynor in 1962

with the Capital Asset Pricing Model. However, this low volatility anomaly has since been confirmed

empirically by many other research studies.

In explaining what started out – and still is referred to – as an anomaly at variance with the basics of

finance, one needs to take into account that the hypotheses used in the formulation of basic financial

theory are statistical simplifications. They have not been, nor will they be, verified in real world

conditions.

First, contrary to prior assumptions, investors do in fact face numerous constraints when investing such

as on the amount of leverage they may use or how much they can rely on short-selling techniques to

arbitrage pricing anomalies.

Second, many investors do not actually seek to maximise absolute returns and reduce volatility. For

example, most professional fund managers are assessed on the relative returns and risk they create

against benchmark indices defined for the purpose.

Third, the assumptions that investors face no transaction costs or taxes, and that markets are perfectly

divisible and perfectly liquid are, as we all know, incorrect.

Fourth, and again contrary to prior assumptions, not all investors have the same investment horizon.

To understand this, one only needs to consider the difference in the time available to a young saver,

relative to his elder peer.

Finally, the idea that information is complete and rationally processed has been challenged by

behavioural theory. Indeed, we know that investors are simply human, so the vast majority is affected

by the same cognitive biases that affect everyone, such as those relating to representativeness,

overconfidence or a preference for lotteries.

All these misconceptions in the assumptions behind basic financial theory can, in ways that have been

discussed by researchers, lead to the low volatility anomaly and the finding that higher risk is not always

compensated with higher return.

Low volatility investing

Low volatility investing has by now become an investment style in its own right with the launch of

numerous low volatility equity funds, in particular since the Global Financial Crisis of 2008. Such funds

invest in low risk stocks and use different risk measures to identify the stocks the fund can buy.

Some of these funds simply aim at being less risky than traditional cap-weighted benchmark indices

while promising higher risk-adjusted returns over the medium to long term. Others aim to outperform

Electronic copy available at: https://ssrn.com/abstract=3697914

these same benchmarks over the medium to long term despite being less risky. However, all these funds

have one thing in common: they assume that the low volatility anomaly will continue to meet their

objectives of higher returns despite lower risk, or just simply of higher risk-adjusted returns than their

respective benchmarks.

On the 31st March 2011, we launched our Global low Volatility Equity strategy. Much like other low

risk equity strategies, ours was tailored to benefit from the low volatility anomaly to deliver on its

objectives. These objectives were defined as outperforming the global market cap-weighted benchmark

over the medium to long term (typically over one or more full business cycles) with less volatile returns

than the benchmark.

The importance of avoiding sector biases

One main difference between our equity low volatility strategy and its peers is the way in which sectors

are considered. Low volatility equity strategies tend to have strong sector biases because the stocks with

the least volatile returns are usually found in sectors such as utilities, healthcare or consumer staples.

This could lead one to believe that the low volatility anomaly is simply a long-term effect arising from

biases towards sectors that are less volatile. This is not the case.

In 2011, we demonstrated empirically that the low volatility anomaly can be observed in every sector of

activity and, as such, it is not a sector effect. The least volatile stocks of every sector have had higher

returns than should be expected from their level of risk, and the most volatile stocks of every sector have

had lower returns than should be expected. These results were eventually updated and published in our

2015 paper, “Low-risk anomaly everywhere: Evidence from equity sectors”, published as a chapter in

the book “Risk-Based and Factor Investing”, ISTE and Elsevier,

Accordingly, the low volatility anomaly is even observed in more volatile sectors such as information

technology or industrials. Given that the least volatile stocks from different sectors have different

absolute levels of volatility, it is important to construct a diversified portfolio invested in the least

volatile stocks of each sector. Simply selecting those stocks with the lowest absolute level of volatility

would result in a non-diversified portfolio, concentrated in stocks from those sectors with the lowest

absolute level of volatility.

Indeed, investing in the least volatile stocks from all sectors adds diversification and delivers higher

risk-adjusted returns than relying solely on a portfolio strongly biased towards the least volatile sectors.

Low volatility strategies that invest across all sectors tend to be more robust in terms of risk-adjusted

returns, even if they may be somewhat more volatile than those that focus only on the least volatile

sectors.

It is perhaps not difficult to understand why creating a permanent sector bias is not a good idea. With

the benefit of hindsight, we know that economically sensitive sectors such as financials, consumer

discretionary, information technology, industrials and materials tend to outperform in the early phase

of the cycle. When activity rebounds, policy is still accommodative, credit and profits start to grow, and

inventories are low and sales improve. More defensive sectors such as healthcare, utilities and energy

tend to underperform in this phase.

Later, in mid-cycle, when activity and profit growth peaks, credit growth is too strong and policy is

neutral, sectors such as information technology and industrials tend to do well, while materials and

utilities usually perform poorly.

Electronic copy available at: https://ssrn.com/abstract=3697914

In turn, late in the cycle, when activity moderates, policy is tight, credit tightens, earnings come under

pressure and inventories grow as sales growth fades, defensive and inflation-resistant sectors such as

materials, consumer staples, healthcare, energy and utilities tend to perform better. In this phase, more

cyclical sectors such as consumer discretionary or information technology typically do poorly.

During the recession phase, with equity markets performing poorly, activity falling, credit drying up,

profits declining, inventories and sales falling and policy easing, consumer staples, utilities and

healthcare tend to do well, while information technology and industrials usually underperform.

While not all cycles are equal, sector rotation has on average been following this pattern for decades.

What makes it difficult to profit from sector rotation is being able to forecast or even nowcast the

changes in the business cycle itself accurately enough.

Low volatility anomaly intra-sectors: global stocks

Ten years after researching this topic, we thought it appropriate to revisit it: how have our research

results held up? Has the low volatility anomaly in each sector been as strong as we found it to be a

decade ago?

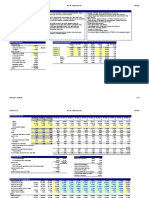

Exhibit 1A charts the results of 2011. These were used to develop and promote our global low volatility

strategy. This chart was shown to many investors to help explain why we built our strategy in the way

that we did.

For each sector, we calculated the performance and volatility of two portfolios: one invested in the 10%

least volatile stocks of a given sector and the other invested in the 10% most volatile stocks of the same

sector, picked from the MSCI World index. Both portfolios were rebalanced monthly and the stocks

were grouped into deciles based on their volatility over the preceding three years.

Exhibit 1A shows the Sharpe ratio of such portfolios based on USD net monthly returns. The results

were produced for the first time on 28 January 2011 and were based on a simulation with data from 31

December 1994 through to 31 December 2010.

In exhibit 1B, we show results comparable to those in exhibit 1A, but now calculated on 28 July 2020

using the out-of-sample period from 31 December 2010 through to 30 June 2020.

Electronic copy available at: https://ssrn.com/abstract=3697914

Exhibit 1: Sharpe ratio for the 10% least volatile stocks in each sector and the 10% most volatile stocks

in each sector of the MSCI World index, based on monthly net returns in USD. A: calculated on 28 Jan

2011 based on data from 31 Dec 1994 through 31 Dec 2010. B: calculated on 28 Jul 2020 based on

data from 31 Dec 2010 through 30 Jun 2020. Transaction costs were not included. Source: BNP Paribas

Asset Management, MSCI and Exshare

Both exhibit 1A and 1B show that over both periods, the Sharpe ratio of the least volatile stocks in a

given sector was higher than that of their most volatile peers, almost everywhere. In fact, our 2011

results had one exception, the materials sector. Our out-of-sample results of 2020 had no exceptions.

Another difference is the dispersion of Sharpe ratios across sectors. This is larger in the most recent

period. While our results for the 25-year period used in 2011 span more or less two US business cycles,

our 2020 results are based on a 10-year period that may not yet span one complete cycle. This most

likely explains the larger differences in Sharpe ratio dispersion across sectors in the most recent period.

In exhibit 2, we include the returns in excess of cash and the volatility of each decile portfolio of exhibit

1. What seems clear is that sector dispersion can have a serious effect on the performance of low

volatility strategies strongly biased towards utilities, consumer staples and healthcare.

While the low volatility anomaly is found in each sector in the first set of results running through 2010,

such strategies would have missed out on the performance of the least volatile stocks from the energy

sector. These actually had the highest Sharpe ratio, even though they were not the least volatile of the

investment universe.

In the second set of results, running through 2020, strategies with such a bias would have missed out on

the performance of the least volatile stocks from the information technology sector. These had the

highest returns across the universe and the highest Sharpe ratio.

It is interesting to look at the returns in exhibit 2. In the first period running through 2010, we see that

in consumer staples, energy, financials, industrials, information technology and communication services,

the least volatile stocks delivered higher absolute returns with lower volatility than their most volatile

sector peers did. In the period running through 2020, this is the case for all sectors except for consumer

staples, where there was little difference in returns, and for consumer discretionary.

Electronic copy available at: https://ssrn.com/abstract=3697914

MSCI World Index universe

31-Dec-1994 through 31-Dec-2010 31-Dec-2010 through 30-Jun-2020

calculated on 28-Jan-2011. calculated on 28-Jul-2020.

Deciles by Sharpe Excess return Volatility Sharpe Excess return Volatility

volatility ratio over cash (%) (%) ratio over cash (%) (%)

Low 0.40 6.3 15.7 0.37 4.5 12.2

Cons. Discr

High 0.22 7.0 31.8 0.34 8.5 25.2

Low 0.77 9.3 12.0 0.88 9.0 10.3

Cons. Staples

High 0.29 6.6 23.0 0.56 9.2 16.4

Low 0.86 13.9 16.2 -0.09 -1.7 17.8

Energy

High 0.48 19.0 39.2 -0.31 -17.8 56.6

Low 0.56 8.3 14.7 0.31 4.3 13.9

Financials

High 0.14 5.8 40.3 -0.16 -4.4 27.2

Low 0.70 10.0 14.4 1.10 12.3 11.2

Health Care

High 0.31 10.7 34.5 0.12 2.7 23.0

Low 0.63 9.0 14.4 0.67 7.6 11.3

Industrials

High 0.15 4.9 33.3 0.13 2.9 22.3

Low 0.57 11.0 19.3 1.13 15.2 13.4

Technology

High 0.18 9.4 51.5 0.18 4.5 24.9

Low 0.54 9.2 16.9 0.60 8.2 13.7

Materials

High 0.54 19.4 36.1 -0.27 -10.4 38.5

Low 0.64 11.2 17.7 0.28 3.2 11.3

Com. Services

High 0.07 3.6 50.0 -0.03 -0.8 25.8

Low 0.70 9.4 13.4 0.67 7.0 10.4

Utilities

High 0.41 14.4 35.3 0.15 3.8 25.7

Exhibit 2: Sharpe ratio, excess returns over cash and volatility for the 10% least volatile stocks in each

sector and the 10% most volatile stocks in each sector of the MSCI World index, based on monthly net

returns in USD. Left: calculated on 28 Jan 2011 based on data from 31 Dec 1994 through 31 Dec 2010.

Right: calculated on 28 Jul 2020 based on data from 31 Dec 2010 through 30 Jun 2020. Transaction

costs were not included. Source: BNP Paribas Asset Management, MSCI and Exshare

Low volatility strategies that diversify by investing in the least volatile stocks of all sectors can more

easily avoid being over-exposed to business cycle rotation in sector returns. They also profit from the

robust finding that the highest risk-adjusted returns, and most often even the highest absolute returns,

can be found in the least volatile stocks of all sectors relative to their respective sector peers.

Low volatility anomaly intra-sectors: Europe

In our 2015 paper, “Low-risk anomaly everywhere: Evidence from equity sectors” mentioned before,

we also found that the results shown in exhibit 1 can in fact be found worldwide. Indeed, in this paper,

we showed similar results for the US, Europe, Japan, Canada, emerging markets, China, Brazil, South

Korea and Taiwan.

In exhibit 3, we revisit the results for Europe calculated over our out-of-sample 10-year period from 31

December 2010 through to 30 June 2020, and we compare them with the results for global stocks.

Because of the smaller number of stocks in the MSCI Europe index (about 450), we now prefer to use

quintiles instead of deciles to provide robust comparisons for both the Europe and World indices.

Exhibit 3 shows that for Europe, the quintile of least volatile stocks in each sector, with the exception

of consumer discretionary, has a higher Sharpe ratio than the quintile with their most volatile sector

peers. For the World index, the use of quintiles instead of deciles does not significantly change the

results shown in exhibit 1. What we find is that, in this 10-year period, the sector dispersion is

comparable for Europe and World stocks. The energy sector and communication services did much less

well than other sectors on a risk-adjusted basis.

Electronic copy available at: https://ssrn.com/abstract=3697914

Exhibit 3: Sharpe ratio for the 20% least volatile stocks in each sector and the 20% most volatile stocks

in each sector, calculated on 28 Jul 2020, based on data from 31 Dec 2010 through 30 Jun 2020. A: for

stocks in the MSCI Europe index, based on monthly net returns in EUR. B: for stocks in the MSCI World

index, based on monthly net returns in USD. Transaction costs were not included. Source: BNP Paribas

Asset Management, MSCI and Exshare

In exhibit 4, we show the Sharpe ratio, returns and volatility of each quintile of stocks behind the results

in exhibit 3. Again, for all sectors with the sole exception of consumer discretionary, the absolute returns

for the quintile of least volatile stocks were higher than for the quintile of their most volatile sector peers.

Another finding is the small differences between the Sharpe ratio, returns and volatility of the quintiles

of European stocks when compared to World stocks in the same sectors. The differences were much

larger when comparing quintiles of different volatility levels in the same sector or comparing results

across sectors in the same region.

Electronic copy available at: https://ssrn.com/abstract=3697914

MSCI Europe Index universe MSCI World Index universe

31-Dec-2010 through 30-Jun-2020 31-Dec-2010 through 30-Jun-2020

calculated on 28-Jul-2020. calculated on 28-Jul-2020.

Quintiles by Sharpe Excess return Volatility Sharpe Excess return Volatility

volatility ratio over cash (%) ratio over cash (%)

Low 0.42 6.0 14.3 0.44 5.5 12.6

Cons. Discr

High 0.55 13.5 24.5 0.34 8.0 23.5

Low 1.03 11.5 11.2 0.87 8.4 9.7

Cons. Staples

High 0.45 6.6 14.6 0.59 7.8 13.3

Low -0.02 -0.5 18.7 -0.16 -2.9 17.8

Energy

High -0.39 -12.8 32.8 -0.31 -14.3 46.6

Low 0.48 6.5 13.5 0.37 4.7 12.8

Financials

High -0.30 -9.2 30.7 -0.09 -2.1 24.3

Low 0.95 11.3 12.0 1.17 13.4 11.4

Health Care

High 0.65 11.9 18.4 0.48 9.1 18.8

Low 0.75 9.2 12.2 0.59 6.9 11.7

Industrials

High 0.19 3.9 21.1 0.07 1.5 21.0

Low 0.51 9.4 18.5 1.04 14.0 13.5

Technology

High 0.05 1.4 29.9 0.38 8.7 22.7

Low 0.74 10.8 14.6 0.50 7.1 14.1

Materials

High -0.02 -0.5 27.8 -0.19 -6.0 31.7

Low 0.03 0.3 12.3 0.24 2.5 10.8

Com. Services

High -0.08 -1.6 21.2 -0.03 -0.7 20.3

Low 0.70 8.2 11.7 0.53 5.8 10.9

Utilities

High -0.01 -0.3 22.8 0.00 0.0 19.5

Exhibit 4: Sharpe ratio, excess returns over cash and volatility for the 20% least volatile stocks in each

sector and the 20% most volatile stocks in each sector, calculated on 28 Jul 2020, based on data from

31 Dec 2010 through 30 Jun 2020. Left: for stocks in the MSCI Europe index, based on monthly net

returns in EUR. Right: for stocks in the MSCI World index, based on monthly net returns in USD.

Transaction costs were not included. Source: BNP Paribas Asset Management, MSCI and Exshare

From theory to practice

One important point to bear in mind is that portfolios designed to capture the low volatility anomaly are

necessarily constrained in one form or another. Examples of constraints include capping the weight of

stocks, capping portfolio turnover, constraining beta or constraining the tracking error in the case of

benchmarked low volatility strategies.

While important to ensure the portfolios meet investment objectives and to reduce implementation costs

and slippage, constraints can introduce biases that at times may affect performance. The results

presented here serve only as confirmation that the low volatility anomaly is alive and well. The best low

volatility strategies are the ones that find the best compromise to balancing the negative and the positive

impact of constraints when capturing results.

Low volatility investing over short horizons

While our results strongly suggest that the foundations of low volatility investing in the form we

presented 10 years ago remain in place, it is important to include a word about what may be expected

when instead of looking at longer horizons, as done above, the focus turns to the short term.

Predicting the returns of low volatility portfolios over short horizons, e.g. over a month or a quarter, is

not easy, even assuming that portfolio constraints have no impact and that the portfolio is well balanced,

investing in the least volatile stocks of all sectors.

Because of the defensive beta, we can say that low volatility stock portfolios are likely to outperform

the market capitalisation index when market returns are negative, but it is not certain that they will.

Even if the alpha of low volatility stocks is positive on average over the medium and long term, which

explains their higher Sharpe ratios since the alpha is by definition fully uncorrelated with market returns,

Electronic copy available at: https://ssrn.com/abstract=3697914

the occasional negative short-term alpha during a market fall may lead to underperformance. This is

almost inevitable. Similarly, episodes of outperformance of low volatility stock portfolios even when

the market rises, as explained by the positive alpha of low volatility stocks, should not be a surprise.

Takeaways

It is reassuring to see the foundations of our low volatility investment philosophy, based on the research

out more than 10 years ago, being confirmed out-of-sample. Ten years after showing that the low

volatility anomaly in the performance of stocks is a phenomenon that should be considered in each sector

as opposed to on an absolute basis ignoring sectors, we now show that in the last decade, this observation

has held up well, and that if anything, it has become even more valid.

Our results again show how important it is for a low volatility equity portfolio to be diversified and

invested in the least volatile stocks of all sectors. The objective of blindly minimising volatility, resulting

in strong biases towards only a small number of the least volatile sectors, should not be the aim of a low

volatility equity strategy. As an example, in the last 10 years, such strategies would have avoided the

least volatile stocks from the information technology sector. These turned out to have some of the

highest risk-adjusted returns despite not being the least volatile on an absolute basis.

Disclaimer

The views and opinions expressed herein are those of the authors and do not necessarily reflect

the views of BNP Paribas Asset Management, its affiliates or employees.

Electronic copy available at: https://ssrn.com/abstract=3697914

You might also like

- The Shadow Banker's Market Crash Survival Guide PDFDocument16 pagesThe Shadow Banker's Market Crash Survival Guide PDFFelipe Campuzano OchoaNo ratings yet

- Investment Consulting Business PlanDocument9 pagesInvestment Consulting Business Planbe_supercoolNo ratings yet

- Investment Risk ManagementDocument20 pagesInvestment Risk Managementthink12345No ratings yet

- Project Report On Portfolio ConstructionDocument37 pagesProject Report On Portfolio ConstructionMazhar Zaman67% (3)

- DB Handbook of Portfolio Construction Part 1Document108 pagesDB Handbook of Portfolio Construction Part 1Kenan Cinar75% (4)

- Momentum Factor Basics and Robeco SolutionDocument7 pagesMomentum Factor Basics and Robeco Solutionbodo0% (1)

- Sketchy Pharmacology RuntimesDocument1 pageSketchy Pharmacology RuntimesJustine Val RevalidaNo ratings yet

- 2000 MSB Magazine WinterDocument40 pages2000 MSB Magazine Wintertmm53No ratings yet

- Demystifying Equity Risk-Based StrategiesDocument20 pagesDemystifying Equity Risk-Based Strategiesxy053333No ratings yet

- Strategies LOW VOLATILITYDocument8 pagesStrategies LOW VOLATILITYbla blaNo ratings yet

- Hedge FundsDocument59 pagesHedge FundsjinalvikamseyNo ratings yet

- Out-Performing Corporate Bonds Indices With Factor InvestingDocument11 pagesOut-Performing Corporate Bonds Indices With Factor InvestingJames MitchellNo ratings yet

- A Study On The Power of DiversificationDocument20 pagesA Study On The Power of Diversificationroselyn cortezNo ratings yet

- 4 Steps To Building A Profitable Portfolio: Chris Gallant Portfolio Asset AllocationDocument5 pages4 Steps To Building A Profitable Portfolio: Chris Gallant Portfolio Asset AllocationRuhulAminNo ratings yet

- Four Steps To Building A Profitable PortfolioDocument6 pagesFour Steps To Building A Profitable Portfoliojojie dador0% (1)

- Risk RetnDocument11 pagesRisk RetnnareshdagraNo ratings yet

- Chapter - 1 Introduction 1.1 Meaning of Risk and Return RelationshipDocument31 pagesChapter - 1 Introduction 1.1 Meaning of Risk and Return RelationshipMamta SolankiNo ratings yet

- Investment Guide: Structured Products: Last Updated: 03 Jun 2015 First Published: 03 Jun 2015 Feature byDocument3 pagesInvestment Guide: Structured Products: Last Updated: 03 Jun 2015 First Published: 03 Jun 2015 Feature bymadalinaNo ratings yet

- Cia - 3a PDFDocument8 pagesCia - 3a PDFAyush SarawagiNo ratings yet

- Yasir Bhai ProjectDocument71 pagesYasir Bhai ProjectFaizan Sir's TutorialsNo ratings yet

- Advancement in Portfolio Construction: P/E RatioDocument7 pagesAdvancement in Portfolio Construction: P/E RatioAyush SarawagiNo ratings yet

- Four Steps to Building a Profitable PortfolioDocument5 pagesFour Steps to Building a Profitable PortfolioRaul MarquilleroNo ratings yet

- Investment Strategy For The Long TermDocument4 pagesInvestment Strategy For The Long Termthomakis68No ratings yet

- Traditional Portfolio TheoryDocument5 pagesTraditional Portfolio Theorykritigupta.may1999No ratings yet

- Title:: Duarte, Jefferson Longstaff, Francis A. Yu, FanDocument53 pagesTitle:: Duarte, Jefferson Longstaff, Francis A. Yu, FanawylegalskiNo ratings yet

- PortfolioConstruction & RealEstateDocument18 pagesPortfolioConstruction & RealEstateVamsi TarunNo ratings yet

- How Efficient Is Your FrontierDocument16 pagesHow Efficient Is Your FrontierDANNo ratings yet

- 4 Steps To Building A Profitable PortfolioDocument4 pages4 Steps To Building A Profitable PortfolioZaki KhateebNo ratings yet

- 2 Capital Market FAQs - For Covid-19Document1 page2 Capital Market FAQs - For Covid-19UDAYAN SHAHNo ratings yet

- Corporate Portfolio Analysis TechniquesDocument24 pagesCorporate Portfolio Analysis TechniquesSanjay DhageNo ratings yet

- Week 2 DAY1-2Document27 pagesWeek 2 DAY1-2Maricris AbundoNo ratings yet

- Chapter 1 The Portifolio Management Process Chapte 1Document9 pagesChapter 1 The Portifolio Management Process Chapte 1Panashe MachekepfuNo ratings yet

- Alternative InvestmentsDocument2 pagesAlternative InvestmentskautiNo ratings yet

- Issues With Hedge Fund PerformanceDocument27 pagesIssues With Hedge Fund PerformanceEzra ZaskNo ratings yet

- Portfolio MGT Mutual FundsDocument21 pagesPortfolio MGT Mutual Funds✬ SHANZA MALIK ✬No ratings yet

- Institutional Investment Management NotesDocument13 pagesInstitutional Investment Management NotesFineman TlouNo ratings yet

- Smart BetaDocument24 pagesSmart BetaAbhishek GuptaNo ratings yet

- Diversifying DiversificationDocument19 pagesDiversifying DiversificationRickardNo ratings yet

- Portfolio Management 1,2,3 Chapter PDFDocument53 pagesPortfolio Management 1,2,3 Chapter PDFSri LekhaNo ratings yet

- Spam Unit 1-5Document84 pagesSpam Unit 1-5kaipulla1234567No ratings yet

- Conservative Formula by Pim Van VlietDocument21 pagesConservative Formula by Pim Van VlietEric John JutaNo ratings yet

- The Dark Side of Passive Investing: White PaperDocument11 pagesThe Dark Side of Passive Investing: White PaperMohamed HussienNo ratings yet

- Investment PhilosophyDocument5 pagesInvestment PhilosophyDan KumagaiNo ratings yet

- Portfolio Advice For A Multifactor WorldDocument20 pagesPortfolio Advice For A Multifactor Worldasilvestre19807No ratings yet

- 1242 4912 1 PBDocument13 pages1242 4912 1 PBPriya DharshiniNo ratings yet

- Portfolio Diversification: Presented By:-Mudassar Husain Roll No. 19mbak23 Asim Abid Roll No. 19mbak61Document18 pagesPortfolio Diversification: Presented By:-Mudassar Husain Roll No. 19mbak23 Asim Abid Roll No. 19mbak61scribd2No ratings yet

- Logica Funds Etf Problemi ValutazioneDocument14 pagesLogica Funds Etf Problemi ValutazioneMassimo AcetiNo ratings yet

- Risk and ReturnDocument7 pagesRisk and Returnshinobu kochoNo ratings yet

- FXCM - Online Currency Trading Free $50,000 Practice AccountDocument3 pagesFXCM - Online Currency Trading Free $50,000 Practice Accountanilnair88No ratings yet

- FINA3324 MSE Potential QuestionsDocument10 pagesFINA3324 MSE Potential QuestionsrcrmNo ratings yet

- Investment Portfolio Management Research PaperDocument8 pagesInvestment Portfolio Management Research Papermoykicvnd100% (1)

- Summary On An Intelligent Investor by Benjamin GrahamDocument30 pagesSummary On An Intelligent Investor by Benjamin GrahamvssrjNo ratings yet

- AQR - Chasing Your Own Tail RiskDocument9 pagesAQR - Chasing Your Own Tail RiskTimothy IsgroNo ratings yet

- Individualization of Robo-AdviceDocument8 pagesIndividualization of Robo-AdviceDaniel Lee Eisenberg JacobsNo ratings yet

- Portfolio 8Document4 pagesPortfolio 8Saloni NeelamNo ratings yet

- Research Papers On Risk and ReturnDocument6 pagesResearch Papers On Risk and ReturnqzafzzhkfNo ratings yet

- Chapter 12 - Hand-Out 11Document9 pagesChapter 12 - Hand-Out 11Mahbub AlamNo ratings yet

- Theamag: The Best of (Both) Worlds..Document6 pagesTheamag: The Best of (Both) Worlds..freemind3682No ratings yet

- Week 2 QRTR 2Document16 pagesWeek 2 QRTR 2Jennifer De LeonNo ratings yet

- Free Cash Flow and DCF PresentationDocument3 pagesFree Cash Flow and DCF PresentationJames MitchellNo ratings yet

- Valuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsDocument89 pagesValuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsJames MitchellNo ratings yet

- Retail Company With Simple DCFDocument51 pagesRetail Company With Simple DCFJames Mitchell100% (1)

- The Analyst Matrix Profiting From Sell Side Analysts Coverage NetworksDocument20 pagesThe Analyst Matrix Profiting From Sell Side Analysts Coverage NetworksJames MitchellNo ratings yet

- SSRN Id3696676Document58 pagesSSRN Id3696676James MitchellNo ratings yet

- Talent Talent and Compensation Trends in Institutional Asset Managementand Compensation Trends in Institutional Asset Management Distribution 2017Document52 pagesTalent Talent and Compensation Trends in Institutional Asset Managementand Compensation Trends in Institutional Asset Management Distribution 2017James MitchellNo ratings yet

- How Market Ecology Explains Market Malfunction: Maarten P. Scholl, Anisoara Calinescu, and J. Doyne FarmerDocument9 pagesHow Market Ecology Explains Market Malfunction: Maarten P. Scholl, Anisoara Calinescu, and J. Doyne FarmerJames MitchellNo ratings yet

- Out-Performing Corporate Bonds Indices With Factor InvestingDocument11 pagesOut-Performing Corporate Bonds Indices With Factor InvestingJames MitchellNo ratings yet

- Investor Behaviour in Manager Selection: Impact On PerformanceDocument8 pagesInvestor Behaviour in Manager Selection: Impact On PerformanceJames MitchellNo ratings yet

- Predictive Equity Analytics: Portfolio Crisis Proofing and Superior ReturnsDocument34 pagesPredictive Equity Analytics: Portfolio Crisis Proofing and Superior ReturnsJames MitchellNo ratings yet

- A Report On: Application of Big Data and Business Analytics in Fashion IndustryDocument9 pagesA Report On: Application of Big Data and Business Analytics in Fashion IndustryAadarsh MahajanNo ratings yet

- The Lion RoarsDocument115 pagesThe Lion RoarsLuzuko Ngqaneka100% (1)

- Geno GramDocument6 pagesGeno GramTricia BautistaNo ratings yet

- Lung Abscess in Adults - UpToDateDocument32 pagesLung Abscess in Adults - UpToDateAntonela Esther Quijada BenitoNo ratings yet

- Apology in MediationDocument18 pagesApology in MediationRahilHakimNo ratings yet

- Morphology - The Words of LanguageDocument28 pagesMorphology - The Words of LanguageAthirah Md YunusNo ratings yet

- Pleistocene Rewilding Oliviera y FernandezDocument3 pagesPleistocene Rewilding Oliviera y FernandezUriel CamposNo ratings yet

- Daily Lesson Log 7Document4 pagesDaily Lesson Log 7SofiaNo ratings yet

- 8816625Document44 pages8816625Tharangini GudlapuriNo ratings yet

- Colossus: Presence 1Document4 pagesColossus: Presence 1Enrique Fernandez TorreblancaNo ratings yet

- EVoting SDS DocumentDocument58 pagesEVoting SDS DocumentKahfulwara MuhammadNo ratings yet

- German Expressionism An Analysis Through The FilmDocument13 pagesGerman Expressionism An Analysis Through The FilmDevanshiNo ratings yet

- Homework Sounds of The TrailDocument6 pagesHomework Sounds of The Trailafmtjaifb100% (1)

- Nursing Chart For All Nursing Boards 2010cllientDocument4 pagesNursing Chart For All Nursing Boards 2010cllientshooestNo ratings yet

- Channel Coding of A Quantum MeasurementDocument10 pagesChannel Coding of A Quantum MeasurementShujja AhmedNo ratings yet

- Knjiga 07Document578 pagesKnjiga 07laridzomicNo ratings yet

- Osslt Admin Guide 2011Document13 pagesOsslt Admin Guide 2011padosdaNo ratings yet

- Biography KH Hasyim Ashari Founder NU and Tebuireng: Bahasa IndonesiaDocument2 pagesBiography KH Hasyim Ashari Founder NU and Tebuireng: Bahasa IndonesiaSunnatul KhoiriyahNo ratings yet

- Bai Tap Tieng Anh Lop 8 Unit 12 Life On Other PlanetsDocument6 pagesBai Tap Tieng Anh Lop 8 Unit 12 Life On Other PlanetsThủy TrầnNo ratings yet

- How To Pass MRCP Part 1 (Complete Guidelines) - Passing MRCP Part 1Document1 pageHow To Pass MRCP Part 1 (Complete Guidelines) - Passing MRCP Part 1Kendra GreyNo ratings yet

- Genuino Vs NLRCDocument2 pagesGenuino Vs NLRCJessy Francis100% (1)

- AncientRuins1 FAQDocument2 pagesAncientRuins1 FAQsg 85No ratings yet

- Chapter 6 TestDocument10 pagesChapter 6 TestJasonNo ratings yet

- Issues and Problems in Decentralization and Local Autonomy in The PhilippinesDocument19 pagesIssues and Problems in Decentralization and Local Autonomy in The PhilippinesHannah Barrantes0% (1)

- 0905PPCDocument39 pages0905PPCsamir samiraNo ratings yet

- TURBID: A Routine For Generating Random Turbulent Inflow DataDocument21 pagesTURBID: A Routine For Generating Random Turbulent Inflow DataPeterNo ratings yet

- ANTONYMSDocument22 pagesANTONYMSCarla Ann ChuaNo ratings yet

- Ice Breaking AIS655 OCT2020: Ir DR Mohd Badrulhisham IsmailDocument10 pagesIce Breaking AIS655 OCT2020: Ir DR Mohd Badrulhisham IsmailFirdaus YahyaNo ratings yet