Professional Documents

Culture Documents

Growth+of+a+Seed+by+ZFT+Eternus Final+

Growth+of+a+Seed+by+ZFT+Eternus Final+

Uploaded by

Jan Reindonn MabanagCopyright:

Available Formats

You might also like

- Case 29 Milwaukee Regional Health System - XLSX 3Document14 pagesCase 29 Milwaukee Regional Health System - XLSX 3codyabner1986No ratings yet

- Umar Ashraf PDFDocument1 pageUmar Ashraf PDFEngr Umar AshrafNo ratings yet

- The Araujo Report: Institutional Position Analysis and ForecastDocument7 pagesThe Araujo Report: Institutional Position Analysis and ForecastHoratiuBogdanNo ratings yet

- RP Moving Average Compedium The First WeaponDocument50 pagesRP Moving Average Compedium The First WeaponUserNo ratings yet

- ZF Apr 2015 To 2018 PDFDocument592 pagesZF Apr 2015 To 2018 PDFcarlpiao0% (1)

- V25 C10 193vervDocument10 pagesV25 C10 193vervandre313No ratings yet

- AMG RobotDocument33 pagesAMG RobotShanNo ratings yet

- Black Drama Results: Act 1, Scene 1: Imprisonment of A ShadowDocument15 pagesBlack Drama Results: Act 1, Scene 1: Imprisonment of A Shadowjohn7tago100% (2)

- Moving Average: A Reaction Paper by Francine Grad Monleon TI49Document21 pagesMoving Average: A Reaction Paper by Francine Grad Monleon TI49UserNo ratings yet

- AOTSDocument167 pagesAOTSMark Rasonabe100% (2)

- Spyfrat KISS OF MA50Document1 pageSpyfrat KISS OF MA50Blu KurakaoNo ratings yet

- 2011 08 05 Migbank Daily Technical Analysis Report+Document15 pages2011 08 05 Migbank Daily Technical Analysis Report+migbankNo ratings yet

- SFP PDFDocument12 pagesSFP PDFمحمد مصطفى100% (1)

- AOTS in TradingDocument1 pageAOTS in TradingKhrychelle AgasNo ratings yet

- USD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James FournierDocument5 pagesUSD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James Fournierapi-100874888No ratings yet

- Mang Kanor Trading Blueprint (10!19!15)Document237 pagesMang Kanor Trading Blueprint (10!19!15)Getto Pangandoyon0% (1)

- PSE New Trading RulesDocument3 pagesPSE New Trading RulesknightshaloNo ratings yet

- Daily Morning Update 30 Sept 2011Document2 pagesDaily Morning Update 30 Sept 2011Devang VisariaNo ratings yet

- Day 1 Session 1Document72 pagesDay 1 Session 1msamala09No ratings yet

- Mzpack 3 User Guide (En)Document60 pagesMzpack 3 User Guide (En)Ravi Varakala100% (1)

- Fxpro Ctrader ManualDocument31 pagesFxpro Ctrader ManualKesari Vijay ReddyNo ratings yet

- VanessaFX Advanced SystemsDocument25 pagesVanessaFX Advanced SystemspetefaderNo ratings yet

- Thesis - Boboss PDFDocument26 pagesThesis - Boboss PDFEngr Lando100% (1)

- Vol 2 Three Days To KillDocument6 pagesVol 2 Three Days To KillKhrychelle AgasNo ratings yet

- Odin ManualDocument37 pagesOdin ManualChathura Jayashan100% (1)

- Swing Failure PatternDocument6 pagesSwing Failure PatternAmoniNo ratings yet

- Trading Psychology: 30 Revealing Tips That Will Make You A Confident Millionaire TraderDocument28 pagesTrading Psychology: 30 Revealing Tips That Will Make You A Confident Millionaire TraderDevin HickmanNo ratings yet

- Master-Class On Stop LossDocument12 pagesMaster-Class On Stop Lossimad aliNo ratings yet

- Trader Personality Super Hybrid Type 135Document6 pagesTrader Personality Super Hybrid Type 135Sakura2709No ratings yet

- FX101 - Introduction To ForexDocument43 pagesFX101 - Introduction To ForexHASSAN MRADNo ratings yet

- The Scavenger Hunt NieDocument47 pagesThe Scavenger Hunt NieSubathara PindayaNo ratings yet

- Session 11-WTC PPT (Mar 18, 2019)Document19 pagesSession 11-WTC PPT (Mar 18, 2019)MtashuNo ratings yet

- ForexSignals Naked Trading CheatSheetDocument15 pagesForexSignals Naked Trading CheatSheetKennedy ObaroaraNo ratings yet

- Successful Traders Size Their PositionsDocument73 pagesSuccessful Traders Size Their PositionsLờ Trương100% (1)

- FX VOLCANO ManualDocument18 pagesFX VOLCANO ManualKamoheloNo ratings yet

- ForexScannerSpikeDetective PDFDocument17 pagesForexScannerSpikeDetective PDFthucpwcNo ratings yet

- Traders EdgeDocument5 pagesTraders Edgeartus14100% (1)

- BeanFX Boom Et Crash Scalper - Blog Des Traders FXDocument22 pagesBeanFX Boom Et Crash Scalper - Blog Des Traders FXRomi Carter L'impérialNo ratings yet

- COL Summit Position TradingDocument44 pagesCOL Summit Position TradingJedson VizcaynoNo ratings yet

- BearingdownontheshortsideDocument4 pagesBearingdownontheshortsideapi-3763249No ratings yet

- Trade PlanDocument14 pagesTrade PlanMr DiNo ratings yet

- Forex Mastery: Smart Strategies by The MastersDocument4 pagesForex Mastery: Smart Strategies by The MastersjjaypowerNo ratings yet

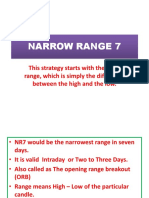

- NR7Document18 pagesNR7RAGHU S100% (1)

- Eazy Forex: DisadvantagesDocument2 pagesEazy Forex: Disadvantagesnathaniel ekaikoNo ratings yet

- NasdaqDocument4 pagesNasdaqTamjid AhsanNo ratings yet

- The Logical Trader Applying A Method To The Madness PDFDocument137 pagesThe Logical Trader Applying A Method To The Madness PDFJose GuzmanNo ratings yet

- How To Use IG Client SentimentDocument7 pagesHow To Use IG Client SentimentRJ Zeshan AwanNo ratings yet

- MPDocument4 pagesMPJohn BestNo ratings yet

- Funded Trader Program 2020Document8 pagesFunded Trader Program 2020JonasDispersynNo ratings yet

- Institutional Trading UrviDocument4 pagesInstitutional Trading UrviSunil JatharNo ratings yet

- Pre Webinar Presentation 4th 5th JanDocument11 pagesPre Webinar Presentation 4th 5th JanJenny JohnsonNo ratings yet

- Most Common Mistakes Traders Make - OANDADocument9 pagesMost Common Mistakes Traders Make - OANDAGideonNo ratings yet

- TA SampleDocument6 pagesTA SampleAlbert John100% (1)

- Income Methods SummaryDocument2 pagesIncome Methods Summarykvel2005No ratings yet

- Certif Ied Program On Intraday Trading StratagiesDocument4 pagesCertif Ied Program On Intraday Trading StratagiesAshish SinghNo ratings yet

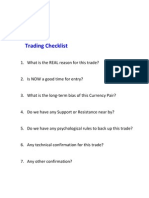

- Trading ChecklistDocument1 pageTrading ChecklistniatsanNo ratings yet

- Diamond MembershipDocument14 pagesDiamond MembershipPURCHASING DEPARTMENTNo ratings yet

- Montana Quarterly Fall 2016 Full IssueDocument84 pagesMontana Quarterly Fall 2016 Full IssueMontana QuarterlyNo ratings yet

- Stop Loss (How To Define)Document1 pageStop Loss (How To Define)jubert raymundoNo ratings yet

- The Empowered Forex Trader: Strategies to Transform Pains into GainsFrom EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNo ratings yet

- BGP (Border Gateway Protocol) - Port 179: Gateway Protocols (IGP's)Document32 pagesBGP (Border Gateway Protocol) - Port 179: Gateway Protocols (IGP's)Nitesh MulukNo ratings yet

- Floyd Electrical StatementDocument5 pagesFloyd Electrical Statementshane.ramirez1980No ratings yet

- Techniques & Structure PDFDocument6 pagesTechniques & Structure PDFfrank sinatraaNo ratings yet

- Accomplishment Report Pinagtigasan KinderDocument12 pagesAccomplishment Report Pinagtigasan KinderMay Anne AlmarioNo ratings yet

- Tong Hop Bai Tap So Sanh Hon Va So Sanh Nhat Co Dap AnDocument14 pagesTong Hop Bai Tap So Sanh Hon Va So Sanh Nhat Co Dap AnGia HuyNo ratings yet

- Analytical ExpositionDocument9 pagesAnalytical Expositionkeira raishaNo ratings yet

- Weekly Home Learning Plan Quarter 3 Week 1 Tle Agri-6 MARCH 1-5, 2021Document1 pageWeekly Home Learning Plan Quarter 3 Week 1 Tle Agri-6 MARCH 1-5, 2021Mariano CañadaNo ratings yet

- Model QuestionsDocument27 pagesModel Questionskalyan555No ratings yet

- Broadcast Equipment Radio EditedDocument35 pagesBroadcast Equipment Radio EditedMBURU MARTIN KARIUKINo ratings yet

- 07 Hawt and VawtDocument10 pages07 Hawt and Vawtthisisanonymous6254No ratings yet

- Transmission Structures and Foundations:: CourseDocument8 pagesTransmission Structures and Foundations:: CoursejulianobiancoNo ratings yet

- Puzzles: The Question: There Is Only One Correct Answer To This Question. Which Answer Is This? AnsDocument7 pagesPuzzles: The Question: There Is Only One Correct Answer To This Question. Which Answer Is This? AnsSk Tausif ShakeelNo ratings yet

- A Bad Workman Always Blames His ToolsDocument6 pagesA Bad Workman Always Blames His ToolsTimothy BrownNo ratings yet

- People Vs OandasanDocument2 pagesPeople Vs OandasanAdoha Lei T Blanco100% (1)

- GCC - Lesson Plan 2020Document35 pagesGCC - Lesson Plan 2020henaNo ratings yet

- Module 4 Lesson 3Document5 pagesModule 4 Lesson 3Ludivina Lajot75% (4)

- SUVAT LoopDocument1 pageSUVAT LoopAhmed ZakiNo ratings yet

- BS 2782-10 Method 1005 1977Document13 pagesBS 2782-10 Method 1005 1977Yaser ShabasyNo ratings yet

- Early DwellingsDocument33 pagesEarly DwellingsVasudha UNo ratings yet

- Damper Valve - Technical Data SheetDocument1 pageDamper Valve - Technical Data SheetPinakin PatelNo ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- Math in Focus 4A WorksheetDocument9 pagesMath in Focus 4A WorksheetBobbili PooliNo ratings yet

- Practice Quiz - Managing CollaborationDocument2 pagesPractice Quiz - Managing CollaborationMohamed RahalNo ratings yet

- Some, No, Any, EveryDocument2 pagesSome, No, Any, Everyvivadavid100% (1)

- Game Master's Kit: An Accessory For The Dragon Age RPGDocument32 pagesGame Master's Kit: An Accessory For The Dragon Age RPGLuiz Fernando Rodrigues CarrijoNo ratings yet

- Noteskarts Hospital Clinical Pharmacy Sample Paper by NoteskartsDocument21 pagesNoteskarts Hospital Clinical Pharmacy Sample Paper by Noteskartsarshu98172No ratings yet

- Overview of Flexfields 58987177.doc Effective Mm/dd/yy Page 1 of 24 Rev 1Document24 pagesOverview of Flexfields 58987177.doc Effective Mm/dd/yy Page 1 of 24 Rev 1sudharshan79No ratings yet

- 7.3-7.4 Electric Field and Potential Difference TemplateDocument11 pages7.3-7.4 Electric Field and Potential Difference TemplateAyman HalimeNo ratings yet

Growth+of+a+Seed+by+ZFT+Eternus Final+

Growth+of+a+Seed+by+ZFT+Eternus Final+

Uploaded by

Jan Reindonn MabanagOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Growth+of+a+Seed+by+ZFT+Eternus Final+

Growth+of+a+Seed+by+ZFT+Eternus Final+

Uploaded by

Jan Reindonn MabanagCopyright:

Available Formats

ZFT

ETERNUS

©

2018

ZFT ETERNUS © 2018 1

We are group of people, who share a passion for trading in the market.

Our members are driven by the same principles:

Learning and improving as traders, being profitable in the trading mar-

ket, and being socially responsible.

We help the community by: knowledge transfers to aspiring traders via

ZFT

formal programs (Subasta, Project Seed, and Spark), as well as informal

ZEEFREAKS TRIBE

channels (vlogs, blogs, and social media); and outreach work through the

group’s Random Acts of Kindness (RAK) campaign, which encourages

ETERNUS

members to help people in need outside of the trading community.

Project Seed is a formal course for aspiring traders, who want to im-

©

prove their craft and contribute to the trading community by serv-

ing as teachers and mentors for the next batches of aspiring trad-

2018

ers. In addition, members of Project Seed are encouraged to serve

as inspirations for social responsibility by continually engaging

themselves in acts of kindness for people around them.

To know more about us:

https://www.facebook.com/pg/ZFT.ProjectSeed

The contributors of this book are students from Eternus Batch -

who recently completed ZFT's Project Seed Program.

ZFT ETERNUS © 2018 2

ZFT

ETERNUS

©

2018

ZFT ETERNUS © 2018 3

Belief is much more palpable when shared with a community, and trading is a pro-

fession that will require you to stubbornly believe long before you start reaping.

In the Philippines, trading remains ambiguous. In fact, only a handful of the entire

population has even heard of the stock market. If you don’t believe me, try telling

ZFT

some of your friends and loved ones that you’re a trader—chances are, it won’t

draw the right questions or even arouse any curiosity.

ETERNUS

©

So, what do you trade? Most people would associate it with bartering, an ancient

market system, and would leave it at that. You can try your best to explain, but it’s

2018

likely that it would still leave them confused. It’s as if the more you try to explain,

the less interesting it gets for people on the other side of the conversation.

But you can’t help but wish there was someone to share your journey with. Some-

one who would tell you things you wish you knew, things you still don't know, or at

the very least, feel the same way you do.

If only you could talk to them: traders who made it somehow; ones who are still

struggling; and those who are only just beginning.

ZFT ETERNUS © 2018 4

This book is for those who wish they had a trader companion—not one that teaches you

technical analysis, no. One that shares rich, insightful conversations.

ZFT

It will feel as if you shared a drink with fellow traders, along with an unedited talk about

the art and science that is trading. They will tell you stories, share advice, talk about cau-

tionary tales, and discuss everything else between life and trading.

ETERNUS

©

Trading is an art, with very few artists. In this long and arduous journey, our book is

2018

meant to keep you company—a much-needed reminder that there are people walking the

same path. And if some of them made it, then who’s to say you can’t?

www.rootingforceleste.com

ZFT ETERNUS © 2018 5

Abishai Mishil Alkaia

Aristodemus Panday Pira

Bjorn Ironside Rey Kalipulako

ZFT

Hannibal Barca Sun Tzu

ETERNUS

Isabella de Castile Simo Häyhä

Jumong Sun Wukong

Kawakami Gensai Valentino

©

2018

ZFT ETERNUS © 2018 6

Outlook / Perspective

Time is the Most Valuable Commodity …………………………………….………… 12

That Elusive Golden Ticket ……………………………………………….……………… 16

ZFT

Trading is a Marathon, Not A Sprint ………………………………………….……… 19

ETERNUS

Look at the Overall Portfolio ……………………………………………..……………… 22

My Window of Opportunity ……………………………………………………………… 26

©

The Road Less Travelled …………………………………………………...……………... 29

2018

Trading is a War. The Stock Market is a Battlefield. ……………..…………….. 33

Trading as a Fair Game ……………………………………………………………...……... 38

Perseverance is a Prerequisite ……………………………………………………..…… 44

What are your Whys in Trading? ………………………………………………………. 50

Beyond your Targets ………………………………………………………………………… 54

Art and Science with a Twist ……………………………………………………………. 59

Losses are Part of the Journey ………………………………………………………….. 63

Real Talk ………………………………..………………………………………………………… 66

ZFT ETERNUS © 2018 7

Take on Technicals

Your Edge …………………………………………………………………………………………. 13

Overrated ………………………………………………………………………………………… 16

ZFT

Adjust Accordingly …………………………………………………………………………… 19

ETERNUS

The Art of The Chart …………………………………………………………………………. 23

Just the Tip of The Iceberg ………………………………………………………………… 26

©

Mindset Matters ……………………………………………………………………………….. 29

2018

Building and Mastering a System ………………………………………………………. 34

Learn Before You Earn ……………………………………………………………………… 39

The Holy Grail …………………………………………………………………………………... 45

Rules or Guts? ………………………………………………………………………………….. 51

The 'Aha'nalysis ……………………………………………………………………………….. 55

Simplicity Works ………………………………………………………………………………. 60

Price is King …………………………………………………………………………………….. 63

Technicals: Your Map to Success ……………………………………………………….. 67

ZFT ETERNUS © 2018 8

Process / Strategies

Focus on the process ………………………………………………………………………… 14

Hope is Not a strategy ……………………………………………………………………….. 17

ZFT

Managing Risk ………………………………………………………………………………….. 20

ETERNUS

Own the Process ……………………………………………………………………………….. 23

Do Not Gamble ………………………………………………………………………………….. 26

©

Trust the Process ………………………………………………………………………………. 30

2018

Paper Trading and Backtesting: The 10,000 Kicks of Trading …...…………. 35

Journaling – The Power of Writing your Reflection for Each Trade….……. 41

Tech or Funda? …………………………………………………………………………………. 47

Always a Student ………………………………………………………………………………. 52

Consistent Repetition …………………………………………………………………………56

Respect the Process ………………………………………………………………………….. 60

It’s a Simple Process …………………………………………………………………………. 64

Follow a System, Results Will Follow …………………………………………………. 68

ZFT ETERNUS © 2018 9

Opinions on Emotions

Keeping Your Emotional Capital Intact ………………………………………………. 14

Master Your Emotions ………………………………………………………………………. 17

ZFT

Understanding FOMO ……………………………………………………………………….. 20

ETERNUS

Keep Emotions in Check ……………………………………………………………………. 24

Be Objective ……………………………………………………………………………………… 26

©

Emotions Make or Break a Trader …………………………………………………….. 31

2018

Less Noise, Less Trading Mistakes …………………………………………………….. 36

Conquering Thyself is Winning Half the Battle ...………………………………… 42

Anything Can Happen ……………………………………………………………………….. 48

Control Your Worst-Case Scenario …………………………………………………….. 52

Scope and Trigger …………………………………………………………………………….. 57

Preserve Your Emotional Capital ……………………………………………………….. 61

Execution Trumps Emotion ………………………………………………………………. 64

ZFT ETERNUS © 2018 10

Our Views about Mentoring

The Beauty of Having One ………………………………………………………………… 15

A Practical Approach to Learning ……………………………………………………… 18

ZFT

A Learning Process …………………………………………………………………………… 21

ETERNUS

Mentors Were Once Students …………………………………………………………….. 25

Share Your Journey and Save Yourself Some Time ……………………………... 28

©

Follow a Lion ………………………………………………………………………………….… 32

2018

Mentor: The Blacksmith to Mold and Sharpen You ……………………………… 37

Mentors: More Than Just Teachers …………………………………………………….. 43

Find A Lion’s Den ……………………………………………………………………………… 49

Finding Guidance Through Mentors …………………………………………………… 53

The One Thing I Should've Had from The Start …………………………………… 58

Knowledge ROI …………………………………………………………………………………. 61

The Rule of 33 Percent ………………………………………………………………………. 65

Mentors Get You There Faster ……………………………………………………………. 68

ZFT ETERNUS © 2018 11

Abishai

ZFT

ETERNUS

I never saw myself as a 50 year-old, working an 8-5 job dealing with the tremendous

amounts of pressure and stress that come with a corporate career. Nevertheless, such was

the path I was initially on.

I spent most of my time in the office, doing overtime work even during weekends. Then I re-

alized I had lost so much time to my job. Time I could’ve spent with the people I love, but

there was no way to get this time back.

©

2018

I asked myself, “When would I be able to retire from the corporate world so I could spend

more time with my family?” I could always answer this with a date, but it was always fol-

lowed up by the question of “how am I going to achieve that?”

At the time, I was a long-term investor with a shaky portfolio at best—subscribed to a paid

group and constantly getting hyped by another group. It struck me, “until when am I going to

be dependent on others for my profitability?

As the saying goes, “love your neighbors as you love yourself.” This was why I pursued a full-

time career in trading. I wanted to make time for the people that mattered the most for me.

This included my wife, my daughter, my parents, my siblings and friends.

My trading performance needed improvement, so I started reading up on basic technical

analysis, talking to some traders, and attending seminars. Then, finally, I was fortunate

enough to be able to join the program and be mentored by proven and experienced traders.

ZFT ETERNUS © 2018 12

People keep asking me: “why do you keep spending so much on trading?” To which I answer,

this is my chosen career path and I see it as an investment. Apart from that, it’s not always

about money and tangible rewards. For me, it’s about the passion. I love what I am doing. I

am learning new things, and I have the opportunity to share these lessons with others.

Again, it’s not always about the money. Yes, profit is the main goal of trading, but—for me—it

is the most effective way to fulfill my higher purpose in life.

You can multiply your money and wealth in whatever way, but never your time. You can nev-

er measure success by the amount of money you have.

ZFT

ETERNUS

Technical analysis is your edge over other traders in the market. It helps you identify good

©

stocks, find your entries, exits, cut points, and stops. It familiarizes you with high-probability

setups, as well as the pros and cons of each trade—their risks and potential rewards.

2018

Still, technical analysis is not the be all and end all of trading. Consider this: you find a room

filled with gold, laced with trap bombs all over. To get the gold, you have to navigate through

the bombs. You’re leaving the room either filthy rich or dead broke. Technical analysis isn’t

how to get the gold. It’s how to find the room.

Taking the gold home is a different story—taking into account your objectives and knowing

your risks and rewards. But how about the pressure you feel and your mindset during the

trade? They are whole other thing altogether.

Technical analysis is not the only ingredient to our success as traders, but it is one of the

most important ones. You can be well versed in technicals, but without proper execution and

management of emotions, it would be useless.

ZFT ETERNUS © 2018 13

After studying technical analysis, I thought trading would be much easier. I started back trad-

ing and looking at the potential rewards of a given trade. I skipped steps, and focused on earn-

ing and making X amount of money.

While I had gains sometimes, my trading skills didn’t improve—I couldn’t replicate winning

trades and failed to understand why I won some trades in the first place. Worst of all, I ended

up having a net loss.

ZFT

The lesson: when you are too focused on earning, you tend to overlook everything else—

including your process. When this happens, you lose and you lose a lot. Not just money, but

ETERNUS

self-confidence, morale, and sanity as well.

©

You have to understand that it’s never going to be a fire-free trading experience. The most we

can do is make it fire-proof, and that’s what the technicals are for.

2018

There will always be losses and selldowns, but they shouldn’t stop you. They are part of the

process and we cannot escape or skip that process. Focus on the process and you’ll come clos-

er to success and consistency.

Cut-loss is life. I am in the market to milk it. My mindset is on maximizing its rewards. But I

reached a point when I almost lost my mind because of losses. I overlooked risks, and didn’t

focus on protecting my capital.

Whenever I was in a losing streak, my immediate recourse was to allocate more money on the

trade on the hopes that this was the quickest way to get my money back. Again, I was too fo-

cused on maximizing rewards and—consequently—ended up piling more losses.

Stop loss is lifer. Mistakes came with both wins and losses. Whenever a winning trade broke

my losing streak, I secured profit right away without being objective. I stepped out of the

trades blindly, thinking that the market would only penalize me for staying too long.

ZFT ETERNUS © 2018 14

Strategies like position size scaling were alien to me. My mentor introduced it to me and it was

an "aha" moment. It involves reducing your position size to manage risk, especially in high-risk

trades.

Starting small is wisdom. After learning all the technicals, one advice I took is this: don’t go big.

And a question popped into my mind after few weeks: what if I did not take that advice? My

portfolio would have suffered a tremendous loss.

In trading, the devil is always in the details. If you don’t apply the basics in trading and you suc-

ceed, hats off to you. Otherwise, I suggest you start with the basics, start small, and build up.

ZFT

ETERNUS

Trading is a journey of ups and downs and it always helps to have a mentor to share it with. I

have an outlet; someone who understands my struggles and situations; someone and who is

willing to share his time and walk with me in this path.

©

I am very grateful for having mentors who correct me when I make mistakes, guide me when I

am unsure, and teach me when I do not know. I am afraid of committing mistakes; however,

2018

my mentor assured me that they are unavoidable in the market because we are trading the

probabilities.

My two cents on having a mentor? Be open and let your mentor appraise your skills as a trad-

er. There’s no room for pride. Be teachable. Be humble. Be respectful.

While Abishai has been an engineer for over 7 years now, as a young man he

dreamt of being a musician.

He pursued trading because he wanted to spend more time with his family—

to travel and do random acts of kindness whenever they can.

ZFT ETERNUS © 2018 15

A ristodemus

ZFT

I see trading as my ticket to financial independence.

ETERNUS

I remember my first day in the corporate world. I was an IT professional, but I wanted to leave

as soon as I got there. From the first day I started working, I planned on saving my money with

the goal of setting up my own business someday. I would work 12 to 16 hours a day just to save

money for future capital.

©

2018

Trading has given me that opportunity. Now, I am my own boss. I am a business owner, control-

ling my own capital, risks, and expenses.

Most traders tend to focus too much on the technical part of their game. While definitely essen-

tial, the technical aspect is easy to learn and often overrated. So much so that traders often

blame their losses on lack of technical know-how.

If you’ve done your part studying and are still failing, try to focus on your execution and manag-

ing your emotions. After all, you may be poorly executing a well-laid-out plan. Who knows? This

might change your game.

Even the most rudimentary techniques can work if executed properly. Nicholas Darvas only had

boxes to work with! And he did it via telegrams while dancing his way around the world! What’s

your excuse?

ZFT ETERNUS © 2018 16

We traders have heard it thousands of times before. Always, always look to refine and improve

your system and execution. Embrace the process. Do not focus on the money. The profits will

come in later.

One thing that can help you vastly improve is a trading journal. With it, you will be able to re-

ZFT

view your trades, see your mistakes, and find areas of improvement. With it, you will also be

able to build statistics.

ETERNUS

What plays are you good at? What plays do you need to work on? What signals work for you?

What don’t? If you are unable to answer these questions with certainty, maybe it’s time you start

journaling your trades.

©

2018

This is one of the most underrated, overlooked, and often even unknown, aspects of trading. To

master your trading, you have to master your emotions. Did you buy because of greed? Were

you unable to buy because of fear? Were you unable to sell because of greed? Did you sell too

early because of fear?

As traders, this is the aspect we want to minimize, if not totally eliminate. Trading should be as

mechanical as possible. We buy when we see buy signals. We sell when we see sell signals. Rinse.

Repeat.

That’s why a predetermined trading plan is absolutely necessary. Prepare for the battle so you

could win the war.

Trading is a game of emotions—like greed and fear. We buy on greed and sell on fear.

ZFT ETERNUS © 2018 17

In trading, having a mentor isn’t just essential—it’s practical. It will save you thousands of

hours studying; it will help you avoid countless mistakes. A mentor can point you in the right

direction. With his/her knowledge and experience, a mentor adds perspective, allowing you

to avoid mistakes that he/she already made.

ZFT

ETERNUS

©

2018

Aristodemus has a passion for music.

In fact, he used to dream about building a life as a musician.

.

These days, he busies himself by building a business through trading—which he

sees as a reliable source of steady and passive income.

ZFT ETERNUS © 2018 18

Bjorn Ironside

ZFT

Most new traders see trading as a quick money-making scheme. Nothing could be farther from the truth.

ETERNUS

One of the most common questions people ask me is “Magkano ba kinikita mo dyan?” (How much are

©

you earning on that?). I always answer with a subtle “Sakto lang.” (Just enough). This is because no

2018

trader is actually sure of how much he will be earning. For some it can be as high as 200 percent,

for others it can be an outright loss.

The right question is “Is trading sustainable?” It is consistent? Can it feed me if I quit my day job?

The answer is both yes and no. Yes, if you put significant effort and focus to it. Otherwise, don’t quit

your day job.

As one of my mentors always says,

“Kung tamad ka (if you’re lazy), don’t expect the market to reward you.”

When analyzing charts, I always consider both sides of the coin so to speak.

Whenever a chart points in a particular direction, I do not discount the possibility that it could

go the opposite direction in an instant. In these cases, it is important to know the overall health

of the stock, and adjust accordingly.

Don’t focus on a single indicator or form-fit your analysis based on your position on that partic-

ular stock.

ZFT ETERNUS © 2018 19

I believe a good chunk of success in trading is based on good risk management. I see trading as a

game of probabilities. And since we cannot guarantee whether a stock will rise or fall, a good risk

management system should be in place.

ZFT

ETERNUS

©

2018

Fear of Missing Out or FOMO is a common emotion among traders. This happens when a particu-

lar stock rises and a trader regrets not having to enter the stock prior. This causes emotional dis-

tress, leading to hesitation when it comes to trading other stocks or, worse, overtrading different

stocks in hopes of finding the same payoff.

For a trader to succeed, it is essential to always keep FOMO in check.

To deal with FOMO, I remind myself that the market will always give us plays. Missing out on

one trade doesn’t mean that you can’t enter a trade in that stock again when the opportunity

presents itself.

Those entries will be dictated by your trading approach, which is based on your technical analy-

sis methods and setups.

ZFT ETERNUS © 2018 20

For me, trading is a learning process.

I went into trading without prior knowledge on technical analysis. Initially, I relied on recom-

mendations from friends who made money in the market.

Like any learning process, the most valuable lessons are born from mistakes. I committed vir-

tually every trading error when I was starting, from overtrading to buying a down trending

stock. And I lost real money.

ZFT

Fortunately, simple errors can be avoided if you have a proper mentor.

ETERNUS

Before I joined Seed, I thought I knew enough about technical analysis to make money. I was

dreadfully wrong. There are nuances that only a mentor can teach you.

©

2018

Don’t look for ones who post green ports every time. Find those who post even their losses. I

believe they are the ones who can truly weather the best and worst market conditions.

And most importantly, they can help you overcome the most challenging obstacle in trading:

your own emotions.

Bjorn Ironside intends to travel the world.

For him, trading is an avenue to financial freedom

and his ultimate dreams.

ZFT ETERNUS © 2018 21

Hannibal Barca

ZFT

What attracted me to trading was the unconventional setup. No need to be trapped inside a con-

fined office space for the whole day. You can execute trades from anywhere, as long as you have a

laptop and a good internet connection.

ETERNUS

Second, it was the compensation. You get what you deserve:

©

2018

Lastly, the idea of earning while being in control of your time – this was really my main motivation

in learning how to trade.

As a student in this program, one important thing I realized was: the basic purpose of trading is

not to get the most out of every single trade, but to grow one’s portfolio. While this is a common

principle among traders, it took me awhile to get a full grasp of it.

I used to dwell on the performance of each trade I made. In fact, I’d hold onto losing positions

hoping that it would fix itself. And when I finally gain a winning position, instead of taking the

profit, I would also hold—hoping that the gains would cancel out my losses from other trades. In

the end, this kind of thinking was useless.

Today, I’m more mindful of the overall health of my portfolio. I see trades working together to

benefit the entire account. Learning about risk management taught me to focus on the overall

portfolio performance, instead of single trades.

ZFT ETERNUS © 2018 22

After learning techincal analysis from this course,

As the class moved from one lesson to the next, I began reviewing my charts prior to Project Seed.

ZFT

While I already saw these charts, it was like seeing them for the first time and understanding—

clearly—what they meant.

ETERNUS

Reading and analyzing charts is very important. It’s a skill that beginners are encouraged to devel-

op before buying their first stock. It should be approached with a positive attitude to avoid being

overwhelmed by its different components.

©

As you study more and more, you’ll be able to determine the most essential parts. This will keep

2018

your charts simple, but complete.

I used to have a very disorganized way of trading. I would try out different strategies, leaving

plenty of room for second guessing and what-ifs.

With the ZFT system, the challenge is focusing on the process and, at the same time, adapting the

system to my personal preference. As traders, our task is to learn a system and make it our own.

Taking a closer look at yourself will help you determine your risk appetite and the specific trader

profile you can grow into. Knowing so will stop us from forcing trades or trading setups we can-

not monitor.

My goal is to be disciplined not just in actual trades but also in paper trades. I document them in

my journal, so I can be aware of the kind of setups I can manage. With constant practice, the trad-

ing process becomes second nature.

ZFT ETERNUS © 2018 23

ZFT

In my trading journal, I make it a point to note my emotions upon entering and exiting a trade.

ETERNUS

My mentor told me that there will come a time when I will no longer need to do so, because I

will eventually learn how to be an ‘emotionless’ trader—which is the ideal.

I think it will take a lot of discipline to get there: following trade rules strictly and sticking to

©

the plan without being influenced by emotions.

2018

Our mentor taught us to consider possible results from a given trade and plan accordingly. Ac-

counting for different scenarios beforehand allows us to become mentally prepared to act as

the trade unfolds. Should the trade go against our expectations, at least we already know what

moves to execute. Minimizing emotions enables us to objectively manage each trade we make.

ZFT ETERNUS © 2018 24

Having a mentor goes a long way in fast-tracking the learning process.

Since I started trading, I’ve always been looking for a mentor. Through the Project Seed pro-

gram, I was fortunate enough to receive direct mentoring. I actually learned more from the

three-month course compared to the entire two years I was self-studying.

ZFT

ETERNUS

Always remember to be humble enough to receive criticism, especially coming from people

who have more knowledge and experience. Be humble enough to ask questions—you can nev-

er have too many.

©

2018

Remember: before becoming mentors, they were once students too, in the same position you

are in today. So if anybody can understand you, it’s likely them.

Hannibal Barca is a dentist by profession and a trader by heart.

He believes trading is the key to achieving financial freedom

—which is the dream he fights for day in and day out.

ZFT ETERNUS © 2018 25

Isabella de Castile

ZFT

Although I was hesitant at first, I knew that joining Project Seed was the window of opportunity I

ETERNUS

was waiting for to improve my trading skills. I immediately prayed and I distinctly remember say-

ing, “Lord, if this is for me, let Your will be done. The second half of the year is usually a very busy

year for me at work, can I do this? There is always next year.”

Eventually, I decided to give it a shot. A few weeks after posting my RAK activity, I was notified that

©

I got in. Everything still seems surreal. I still cannot believe I survived the course with only 2-4

2018

hours of sleep almost every day. Despite the physical struggle, my whys kept me going and I am still

eager to learn more from my mentors.

I learned more than expected in 3 months with Project Seed. Every class was mind blowing. I have

never been with a set of students so hungry to learn under mentors so dedicated to share their

knowledge. My perspective changed drastically, I did not just learn technicals but even the im-

portance of trading psychology. More than just a group composed of students and mentors, this

community is a family and I am honored to be part of it.

Technical analysis is often said to be the Holy Grail in trading—meaning that once you have a firm

grasp of its concepts, you are good to go. Contrary to this, however, is that this is just the tip of the

iceberg. The technicals merely serve as your weapons in trading.

Don’t get me wrong, I am not saying it isn’t important at all, it definitely is. A trader must master this

to give him an edge but there are deeper aspects to know within yourself to be able to execute your

trades better.

ZFT ETERNUS © 2018 26

Just when you think you know everything about trading, a loss reminds you that you still have

much to learn. You will go through many trades but always remember to focus on the process

and execution. Plan your trades beforehand, do paper trading as often as possible, and do not

ever let your losses run.

ZFT

When I was starting, I made a lot of mistakes: I never paper traded and I never started small.

My mindset was focused on “high risk, high reward” when unbeknownst to me, this was my

ETERNUS

form of gambling.

Always make sure to follow your plans and manage your risks—your ability to do so is essen-

©

tial to your success as a trader.

2018

Losses are part of trading, so you’d do well to accept that as you are dealing with probabili-

ties and uncertainties. Consecutive and big losses, however, are things you can prevent. If

you ever you go through them, remember to remain objective.

If on the other hand, you are winning consecutively, the same rule applies—be objective. Do

not assume nor expect that the uptrend will go on forever and remember to take those prof-

its as planned.

ZFT ETERNUS © 2018 27

If there is one thing I appreciate the most, it is having a mentor to guide me every step of the

way. Yes, you can forgo the idea of having a mentor and go through the entire learning pro-

cess on your own. However, you will subject yourself to a cycle of trial and error. Hence, you

ZFT

may still find yourself back at phase 1 even after many months or even years of studying.

ETERNUS

At the same time, make it your goal to be as good as your mentor. At the end of the day, this

would then push you to put in the work to become a better trader.

©

2018

Ever since she started working , Isabella de Castile always wanted to be

a full-time trader even before.

Her goal is to be financially free and to have enough time

and capital to put her ideas into motion.

Along her journey, she plans to help as many people as she can.

ZFT ETERNUS © 2018 28

Jumong

ZFT

Have you ever heard a kid say ‘I want to be a trader when I grow up’? Unlikely. Most children

dream of being firefighters, doctors, lawyers, or engineers. Trading is not a possibility you see

ETERNUS

when you’re younger, because it’s rarely discussed in school.

Only recently have Filipinos started talking about investments (e.g. stock market, foreign ex-

change or cryptocurrency). In fact, only 1 percent of Filipinos know how to invest. Needless to

say, when I was first introduced to trading I was very curious. You could say I was drawn to it like

©

love at first sight.

2018

For me, trading is an essential step to achieving one of my personal goals: financial freedom. I also

see it as a great opportunity to be profitable without having to hire and manage people, invest

capital for expansion, and pay rent.

Like any business, trading requires hardwork. I believe, however, once you master trading, your

journey to financial freedom becomes faster. All you need are know-how, a laptop, a reliable in-

ternet connection—and you’re good to go!

Building a system grounded on technicals gives you an edge in trading.

While there are different books about different indicators (e.g. moving averages, RSI, Ichimoku

Kinko Hyo, harmonics, and many more), a lot of traders still have problems implementing them.

Recognizing patterns can only get you so far. Indicators can tell you if a stock is bullshit or not. It

will tell you your entry and exit. But why do some traders keep on incurring losses despite these?

In my opinion, this is all about mindset. This pertains to mastering your emotions and maintain-

ing neutrality, as well as analyzing previous trades. I believe mindset can make or break your

trading performance.

ZFT ETERNUS © 2018 29

You may know of many success stories of traders and are eager to follow in their footsteps.

What you don’t know is that it takes a lot of sacrifice and struggle to get there. These traders

likely incurred huge losses before mastering their craft.

ZFT

ETERNUS

For a trader to earn, he/she must build a trading system and proceed to mastering it. This

takes a lot of hard work, but it’s worth it. First, focus on the process and not the profit. The

gains are only the result of completing the process—which entails discovering a system that

works for you. And finding the right system is really a matter of personal preference.

©

2018

I’ve been given advice to only trade when my personal schedule permits. I focus on trend-

following plays. So, when I’m planning my trades, I make sure my schedule allows me to moni-

tor the trade.

I believe in learning to crawl before walking and running. Run your own race, at your own

pace. While the market will always give us plays, always consider that funds are limited. Start

small. Try to master a few plays, then go from there.

How? Start with paper trades then go to small-volume trades. When you are consistently prof-

iting from certain plays, you can proceed to conviction trades with bigger volumes that you

can handle.

‘

Log every play you make in a journal and revisit them to assess which plays work best for you.

Reflect on your emotions when you enter or exit a certain trade. Find your niche. If you profit

from only one type of play, then—by all means—focus on that play.

ZFT ETERNUS © 2018 30

As traders, how we handle emotions can make or break us. Even if we have a concrete trading

plan, emotions can cause us to deviate from it.

Greed can compel us to allocate even more money to a stock that already has 30 percent of our

ZFT

overall port. Fear of Missing Out (FOMO) can make us chase stocks despite technicals showing

that it has already hit the resistance point. Pride can force us to hold on to a downtrending

stock, because we don’t want to admit that we made a mistake.

ETERNUS

These are just a few examples of how emotions can force us to deviate from our plans.

©

Personally, I compare trading to a woman enamored by one man. While she can be aggressive

2018

in pursuing the man, strategy tells her to position herself as the prize—thus, the man should

be the one to initiate the chase.

The same goes for trading. You shouldn’t chase any moving stock. Moreover, let the stock tell

you if the uptrend is real. You do this by checking the charts for signs of bullishness.

ZFT ETERNUS © 2018 31

As the old saying goes: to become a lion, you should surround yourself with lions.

This is particularly true in trading. Given a chance, you should seek out a mentor—one with cre-

dentials to come with the title. I am very fortunate to have one that is not only a teacher, but a

friend as well.

Mentors guide you and point out your mistakes. They share valuable lessons, so you come pre-

ZFT

pared for different situations in trading.

When I started trading, I did it on my own. I incurred a lot of losses. To this day, they serve as

ETERNUS

painful lessons. With the help of a mentor, my trading performance greatly improved. He gave

me advice on trading pyschology, executing plays, and how to approach trading in general.

When interacting with your mentor, keep an open mind. Be humble enough to trust a different

perspective. A mentor can identify which areas you need to work on. Also, don’t be shy—ask as

©

many questions as you can.

2018

And, lastly, always be grateful,

because they are sharing insight and time that they will never get back.

Jumong consider trading as a way

to reach financial freedom,

see the world, and do more charitable acts.

ZFT ETERNUS © 2018 32

Kawakami Gensai

ZFT

ETERNUS

Did that scare you? Well, it should. But that shouldn’t stop you.

Many people enter the stock market without even knowing how it works. In fact, some of my

friends opened trading accounts without even knowing how to buy stocks. All they want is to

earn without even giving the smallest bit of effort, like reading the FAQs of their online broker

©

on how to make transactions. They want to win without giving a single ounce of sweat. That’s

not how the market works.

2018

Imagine you wake up tomorrow and all of a sudden you find out that you’re being deployed to

war. What do you think would happen? If you’re unprepared, you’d likely die the moment you

stepped in the battlefield, or if you’re lucky enough, you’d last a few days.

That is no different from entering the stock market without having the proper knowledge—

your money would be wiped out in an instant. Why enter trading when you don’t even know

how the market works? You think a soldier would go to war without knowing how to fire a

gun?

Trading is a war and the stock market is the battlefield. And if you want to win this war, you’ve

got to come prepared. Learn the tricks of the trade. Have the right mindset. And since this is a

war, you need a weapon.

ZFT ETERNUS © 2018 33

Your system. This is your weapon. This is what will keep you alive in battle. It could even win

you the war.

I will not tell you what weapon to choose. It’s your journey to find that out.

I can give you the best weapon in the world. But if you’re not comfortable handling it, if you

ZFT

don’t know how to use it, then—for all intensive purposes—the best for me could easily be

the worst for you.

ETERNUS

©

I have been trading for five years. I have failed a lot of times, and while I’ve had my share of

2018

success, I believe I am still learning. I am constantly embarking on new journeys to learn new

things. My life as a trader is always evolving.

Now, I’ve had a lot of trading mistakes, but the biggest of them all is trying to learn everything.

I’ve always known that I need to study to be a successful trader. So I studied. And I studied a

lot. But the problem is I was studying without any direction, without any goal. I studied for the

sake of knowing. I learned about different indicators, and once I knew how to plot them, I

went on to the next ones. I never focused on a few. There was no mastery. And that is my big-

gest regret.

Ang technical analysis parang babae, mas simple mas maganda. Keep things simple. You don’t

need to know them all. Find that indicator you’re most comfortable with and master it. Build a

system around it. Know it by heart and trust it like your life depends on it.

As Bruce Lee said,

“I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced

one kick 10,000 times.”

ZFT ETERNUS © 2018 34

What do Bruce Lee, Michael Jordan, Muhammad Ali, Tiger Woods, and Michael Phelps have in

common? They’re all universally regarded as the greatest in their fields. So how did they

reach that level of greatness? Were they just born with it? Of course not. They spent hours of

ZFT

rigorous training and sacrifices to be who they are today. They perfected their skill not in live

games but through thousands and thousands of hours of practice.

ETERNUS

But how do we really do practice in trading? Through back testing and paper trading.

Back testing is simulating your system based on previous data to see how it performs. With

this, you can gather sufficient data to evaluate your system and apply necessary tweaks for

©

improvement. Paper trading is just live trading through either a virtual portfolio or logging

2018

trades on paper—in any case, it doesn’t use actual money.

These two are often neglected by most traders because they think they’re just wasting their

time and possible gains. I once had the same misguided sentiment on back testing and paper

trading. I used to apply what I learned on my actual trading portfolio, and I lost real money.

Paper trading does not only save you from losing your hard-earned money, it also gives you

the confidence to trade your system.

This is how you master your 10,000 kicks. Don’t feel bad when you’ve spotted a bagger on

your paper trade and did not trade the stock on your real account. Remember, we are here for

the long run. The stock market is not a sprint, it’s a marathon.

ZFT ETERNUS © 2018 35

What is market noise? For me, market noise is anything that distracts you from following your

trading plan and causes you to act on impulse.

ZFT

There are a lot of noises in the market, but the good thing is it’s easy to muffle them.

ETERNUS

Do you follow a lot of stock market gurus giving different stock recommendations? Unfollow

them.

Are you a member of various stock market trading groups? Leave while you can.

Do you know people who constantly hype and bash stocks? Don’t pay attention.

©

2018

We can also find noises from within us, based on our personalities. For example, the default

candlestick charts are colored red and green. Whenever I see that the current candle is red,

this tells me that I should get away from these stocks because they’re about to go down, even if

the setup is still in play. In contrast, when I see the candle is green, I instinctively think the

stocks are already shooting up.

These noises made it hard for me to follow my trading plans. So I changed the candle colors to

black and white. Yes, I know it’s rather simple but I would always encourage traders to do

what’s comfortable and effective for them.

These are small details that traders often overlook, but could have huge impact on their trades.

Find those noises. Mute them. You’d be surprised how these small details can improve your

decision making—for both your trades and emotional status.

ZFT ETERNUS © 2018 36

I have always seen myself as a lone wolf. I love doing things on my own and learning on my

own.

For five years, I traded alone but it did not get me to where I wanted to be. I lost money I didn’t

have to lose and credited it to experience. In the end, I found out the wolf is only as strong as

the pack.

ZFT

Mentors guide us, and help us win our battles.

A good mentor is passionate about teaching you and dedicated to helping you grow, not just as

ETERNUS

a trader, but as a person as well.

My advice? Find a mentor that is willing to share his mistakes so you won’t repeat them. Make

sure your mentor can walk the talk and is not just after your money. If you find a mentor who

©

is willing to teach you all that he knows and is happy to see you become better than he is,

you’ve found yourself a rare treasure.

2018

Kawakami Gensai is a Frustrated Mountaineer.

His ultimate dream is to climb at least one mountain

in all the provinces of the Philippines.

Kawakami also wants to travel the world and learn its different cultures.

He wanted to became a trader to have full control of his time.

ZFT ETERNUS © 2018 37

Mishil Alkaia

ZFT

Trading is considered a profession—yes. And one must understand that taking the road to-

wards it is not easy. Definitely not easy.

ETERNUS

People might see it as a way to earn big. Who wouldn’t be attracted to the idea of making money

out of money, right? But little do they know, trading is not only about watching prices on your

computer screen and clicking the buy and sell buttons.

Moreover, it is about what happens when you are not watching the prices. It’s about all that time

©

studying, scanning stocks, charting, backtesting, paper trading, journaling, reviewing trades, keep-

ing yourself in the zone, having the correct mindset and proper trading psyche. These are the

2018

things that epitomize trading.

When you come to think of it, what are the risks involved when you enter the corporate world?

The biggest risk is probably getting fired for breaking company rules. But aside from that, what are

the other things which can impact your salary? Other than under times, your salary in the corpo-

rate world rarely gets deductions. For missing certain job functions, the likely penalties are a

memo from your manager, a conversation with HR or a note in your employee record. In case you

get laid-off or fired, you can always find a new job. There is always an option to work for other

companies, and—in the end—your monthly income is secure.

On the other hand, when you become a full-time trader, it comes with 100% accountability. No

boss and clients to deal with, no time-in and time-out, no commute, no workloads to finish. What a

carefree life, right? On the contrary, it entails a lot of hardwork and discipline. And since you’re re-

lying on yourself to make all the big decisions, you’ll need self-mastery.

ZFT ETERNUS © 2018 38

As a trader, you are responsible for every mistake you make. And in this game, one grave mistake

can deplete all those gains that took you time to make. There aren’t any paychecks waiting for you

every 15th and 30th of the month. Sometimes, you’ll even incur losses for months and that’s some-

thing you must be prepared for.

If you don’t do your homework, the risks are financially fatal. The same goes if you approach trad-

ing casually. Without the right amount of dedication, you will only produce half-baked plans and

inconsistent results.

Trading is a very fair game—in that, you simply get what you deserve. Your commitment to mastery

ZFT

will determine whether you can or can’t stay in this field. Your outcomes are the reflection of your

hard work. No subjective judgments involved.

ETERNUS

©

2018

When I started in the corporate world, I was always looking for good investments. For many,

the simplest way was to put money in the bank. But we all know that the interest would only be

overpowered by yearly inflation rates.

That’s why I looked for alternatives. I learned about the stock market, specifically about peso-

cost averaging. Most of the references I found claimed that investing in blue chips can yield up

to a 12-percent return, a growth rate that easily trumps anything the bank can offer.

So I opened an account and started. After sometime, I learned about active trading, and I was

enticed by the idea that some people are actually consistently making money through trading. I

was a fresh graduate, new to the corporate world, and earning an average salary. And I quickly

saw that trading could earn me my entire month’s salary (or more) in just one day. So, how else

would I react?

Needless to say, my perspective changed. I left my initial goals of climbing the corporate ladder

and becoming a valuable employee.

I wanted to make extra money on the side, so I thought trading a few thousand pesos wouldn’t

be a bad option. It seemed so easy. But I couldn’t have been more wrong.

ZFT ETERNUS © 2018 39

I was too focused on the money, and I didn’t profit from that mindset. While I had some win-

ning trades, my losing trades ate up my gains and eventually my capital. I was trading without

any kind of system. I have also been a victim of hype. What do you expect?

A lot of things happened before I got here, being trained with technical analysis and being giv-

en a system that can make me a consistently profitable trader. But let me share what I realized

along the way.

ZFT

A common trap for people new to trading is the idea that they will earn big money right off the

bat. Yes, some may have beginner’s luck, but that’s not what determines your staying power as

ETERNUS

a trader. You need a correct mindset that aims for continuous excellence. Just like athletes and

musicians, traders need years and years of practice to flourish.

©

Same with any other skill, you cannot automatically be great at it.

2018

This is why many people quit trading. They want success without the necessary hardships that

come with it. They want a one-time-big-time gain, and not consistency. They want to skip the

process of backtesting, paper trading, and documenting trades. And that type of work ethic

will not get you anywhere in life, and it surely won’t get you anywhere in trading.

Just like what I have said previously, trading is a real profession.

To be a consistently profitable trader, you must embrace the process of learning. Being a slack

-off or putting up a part-time effort hoping for a full-time trader’s gain is not a good idea to

stick with. Half-hearted effort will only get half-hearted results.

ZFT ETERNUS © 2018 40

In school, there are report cards. At work, there are yearly reports.

In trading, there are journals.

ZFT

A trader can process hundreds of trades in the span of a year. Whether a trade wins or loses,

they have a purpose—they serve as our references for future scenarios. This is why both need

ETERNUS

to be documented with equal importance.

Trade documentation is a major contributor to your success as a trader. If you want to go full

time, treat trading as full-time work, giving it full-time effort. For traders, keeping a journal is

©

part of good work ethic.

2018

Journaling is more than listing your entries and exits. It also includes your reflections after

each trade. This can be done on a weekly basis, considering the following questions: Why did

you win? Was it because of execution or luck? Did you execute the winning trade better than

the others? Did the trade fail despite being properly planned? Indicate what went wrong with

your execution and how you could have done it right.

Write down the emotions you encountered, pinpoint the moments you felt fear and hope.

Write a reflection for every trade you make -- This lets you: track your progress as a trader;

distinguish the differences in your trading approaches; and assess your reactions on previous

trades.

ZFT ETERNUS © 2018 41

Stock Market trading is a big game of paradox.

And one way to survive it is to conquer yourself.

ZFT

Let’s say you already have all the tools and a well-built system to trade. You have the deepest

of all whys to keep you motivated and focused. You always make time for studying and prepa-

ETERNUS

ration. Despite all these, you still keep losing trades.

Look within yourself. It is very likely that your emotions are getting the best of you, without

you even realizing it.

©

2018

The secret is to keep calm at all times. When you gain, suppress that feeling of euphoria. When

you lose, you have to get back up and not let it stop you. A breakdown of our neutral state can

hamper our performance.

Fear and hope. These are the common causes of mishaps in trading. Fear prevents you from

hitting that buy button, even if the chart is telling you this is the right time to take a position.

Hope makes you hold on to a stock longer, even if it is obvious that you should exit the trade.

Your biggest enemy and competitor in trading is yourself. Once you master your emotions and

find your neutral zone, you’ve already won half the battle.

Having your “WHY” in trading will only keep you going.

Having a WINNING MINDSET will only help you recover from your setbacks.

But managing your EMOTIONS well is the greatest factor that can drive your success as a trader.

ZFT ETERNUS © 2018 42

I strongly believe in mentoring. Having a mentor helps you fast track your learning curve and

progress. Mentors are more than just teachers. Their dedication, commitment, and passion are

very evident. They not only want you to learn, they want you to be successful, and even urge you

to outwork them.

Trading is one of the most commonly misunderstood professions, and it can get lonely not having

a person to share it with. Have you ever had the feeling of wanting to share your current experi-

ences in trading, but no one was willing to listen? Or maybe some would, but later on say…

ZFT

“I don’t get what you’re doing, it seems complicated.”

ETERNUS

Later on you may find a fellow trader who you can occasionally chat with, one who is embarking

on the same journey as you are. What a relief right?

But what if you were given more than just a friend? What if you were given a person who guides

you, advises you, and teaches you? One that you can turn to when you are down; a confidant you

©

can open up to when you make mistakes; a person that motivates you to do better when you tell

them about your setbacks.

2018

That’s the beauty of having a mentor.

If teachers are meant to explain subjects in school, determine if you pass or fail, then just move on

to the next batch of students, mentors—I believe, are meant to be with you throughout your en-

tire journey. So don’t ever, ever take them for granted. Appreciate them and make them proud.

If Mishil could start college all over again,

she’d take Psychology as her major.

You can read about her trading journey

through her blog—

mokshasanctuary.wordpress.com

She simply wants to live in a house by the beach,

travel the world, and immerse herself in different cultures.

ZFT ETERNUS © 2018 43

Panday Pira

ZFT

Before the course began, the mentors asked us to write down our “deepest whys” in trading. He

said we would use this to consistently visualize our motivations. He added that we would refer

ETERNUS

to it whenever we experienced setbacks and challenges—serving as a reminder to stay the

course.

I admit, when I started this journey, my only goal was to earn extra money, nothing else. I had a

job, which—I believed—could sustain the needs of my family. But like most, I wanted to be in

©

control of my own time.

2018

When I started trading, my account was overblown with losses. I suffered a -35% in my portfo-

lio, which had all my savings. My poor performance in trading began trickling down to my day

job.

With a series of losing trades and very few winning ones, I was afraid that my port would have

a drastic drawdown with just one wrong execution. This was compounded by a series of prob-

lems at work and at home.

I felt that I had hit rock bottom. Depression followed and I took a break from trading. I couldn’t

sleep. I kept asking myself, “Why am I in this mess?”

With the help of my partner, I found myself in the service of others—doing random acts of

kindness and being active in church ministry service. This gave me new, meaningful reasons to

return to trading—not just for myself, but more importantly, for others as well. This remains

one of my strongest whys in trading.

ZFT ETERNUS © 2018 44

As I write this, I just finished the program and I’m looking forward to applying what I’ve learned. I

don’t expect it to be easy. In fact, I expect a whole new set of challenges and setbacks. But I believe

I’m ready to face them, carrying lessons from the past and new motivations in the present. I’m de-

termined to be among the 1 percent of traders, who successfully ‘beat this game.’

I draw inspiration from Sir Alpha, who once incurred a -40% loss, but it didn’t stop him from trying

again. I will persevere as he did.

P.S.

I tried joining the Subasta Program twice and failed. I also applied to Project Seed three times and I

ZFT

was blessed to be given an opportunity to be in the current batch of Eternus.

ETERNUS

I liken my journey to a Multiple Point Bullish Life Divergence, because as life keeps pushing me

down, I become more determined to be the best version of myself. I will experience ups and downs

of it, but in the end I’m confident I’ll push through and reach my goals and dreams. My advice to my

fellow newbie traders out there: don’t ever quit, because like you, God is always at work.

©

2018

I used to overlook the value of developing a trading mindset. I was so focused in studying different

technical indicators and other market variables, that I forgot the “intangibles.”

Even when I’m reading books and blogs or watching video tutorials, I found trading mindset to be

kind of boring as a topic. I do not mean to generalize, but most aspiring traders go through this

stage, believing that they will find the “holy grail” in trading by focusing on charts.

As Kapitan Kidlat says, only 1% of success in trading is seen on the charts, the rest depends on the

intangibles, which we never see on technical indicators or analysis. Unfortunately, most traders tend

to focus on nothing but indicators and analysis. We underestimate the intangibles that may have a

big impact in improving our trading skills.

According to Mark Douglas (author of Trading in the Zone), in order for us to attain the

“consistency” that we have been dreaming of, we need to know how we think before, during, and af-

ter the trade, how we become aware of our emotions and behaviors, and how we perceive opportu-

nities that the market presents to us.

ZFT ETERNUS © 2018 45

We may have experienced revenge trades or whipsaws on stocks, leading to huge losses. But

often times we never take the time to analyze the emotions that got us there. More often than

not, anger and regret drove us, and little by little, they swallowed our neutral state of mind.

The same goes for winning trades as well. They can easily wipe out previous gains (consider

Superman Syndrome).

I’m not saying these happen again and again, but traders need to prepare for all possible sce-

ZFT

narios through better habits and “intangibles.” These are ways we can do so:

ETERNUS

Before the Market Opens

Practice possible scenarios that may happen during market hours. You need to be able

to act without hesitation if the price breaks out or breaks down.

©

During Market Hours

2018

List down all your good behaviors, bad behaviors, and mindset while the trade is hap-

pening. Sirius Lee recommends getting the top common denominators among them

and working on them.

Be self-aware or religiously assess your emotions during the execution of the trade.

After Market Hours

Revisit your journal and assess your behavior, mindset, and emotions. Familiarize

yourself with your own strengths and weaknesses.

Read books and blogs about the psychology of trading, and watch videos about grit,

habit, and emotion (c/o Kap)

Take on a hobby that can help develop your mental focus

We may not see results immediately, but if we put in extra hours and effort in applying these

simple steps, they can speed up our effectiveness as traders. Because always remember, a

good student of Ms. Market always focuses on the things that matter.

ZFT ETERNUS © 2018 46

Technical analysis or Fundamental approach? Pick one. You can’t choose both, because these

are two conflicting ideas that influence your judgment when you’re making trading decisions.

They are contrasts, like heaven and hell or oil and water. Of course, this is just my point of

view, and I am not against any Fundamentalist out there, as it can be equally effective in anal-

ZFT

ysis. In fact, I once tried to use the fundamental approach, but reading and analyzing long fi-

nancial statements became a headache for me. For me, both approaches require rigorous fo-

cus, effort, and dedication.

ETERNUS

The Fundamental Approach became popular in the early periods of studying the market. It

uses different mathematical models to determine the potential market value of a certain

stock. It was not until later that some analysts countered this model, suggesting that it only

works under certain parameters and is hampered by “reality gaps.” These are the gaps of

©

“what should be” and “what is,” which make the analysis even more complicated from the

2018

perspective of traders.

The Technical Approach not only closes the “reality gap,” but also presents infinite opportuni-

ties to profit from the market. This is where we examine the previous price action in relation

to its current trend, enabling us to make predictions. It can also measure behavioral patterns

of participants, as they can become the triggers for higher probabilities of winning trades.

In sum, we use different ways and systems on how to interpret the market—from different

indicators to Trendlines, Ichimoku, Harmonics, and many more. What is important is that we

have a firm mastery over the weapons we choose. This means understanding its strengths

and limitations.

Practice it daily and create your own trading system from its theoretical foundation. Shape it

in a way that complements your own personality. If you’re a pure technician, stick to the

charts, nothing else. Everything else is just a noise.

ZFT ETERNUS © 2018 47

What’s the difference between a casual trader and a professional one? If you answered their

level of technical comprehension or emotional awareness, you may be right. But, I believe

their biggest difference lies in how they see probabilities.

In the words of Sir Boaris, one of our mentors from the course, “walang sureball sa merkado

ZFT

[there is no sure thing in the market].” We can be consistently wrong with the positions we

take and we can be subject to a rollercoaster of emotions during any given trade.

ETERNUS

Even the ZFT System, which is already proven and tested, can’t guarantee a 100% win rate.

Our setups can fail again and again. But, a professional trader is able to minimize losses when

he makes mistakes and maximize wins, when he does right. And this is what thinking in

probabilities is all about.

©

Thinking in probabilities requires two things, which go hand in hand. First, we must accept

2018

that the outcome is random, unpredictable, and uncertain. There is an unsystematic distribu-

tion between wins and losses. Even our “bread and butter” setups will not materialize every

time. We do not control the situation and we must only react on what the market is trying to

say.

Second, if you’re already confident in your own system, exercise it with conviction—live with

the results. The goal is not to be winners all the time (that’s not possible), but to be con-

sistent winners. Strictly adhere to your rules, minding risk management and position sizing.

Acknowledging that there are always risks in every trade is a prerequisite to thinking in

probabilities. We must expect all possible scenarios and prepare for them by plotting differ-

ent trading plans, so Ms. Market will no longer be able to surprise us. If Stock X continues its

upsurge, we go to Plan A; if it goes sideways, Plan B; and, if it made a sell off, then Plan C. One

stock needs different strategies in place.

From there, it’s all about planning without emotion and hesitation, and neutralizing any

sense of expectation.

ZFT ETERNUS © 2018 48

Famous motivational speaker Jim Rohn says that “You’re the average of five people you spend

the most time with.” For me, this applies in life and learning.

So, what if you’re surrounded by people with no goals or ambitions? They would not be able

to push your own limitations, hampering your capacity to grow. Find an environment where

you will be a cub in a lion’s den, where people around you are much skilled and learned than

you.

Find a coach or mentor that will influence you to be the best version of yourself. It doesn’t

ZFT

have to be someone you personally know. Your mentor can be an author, a motivational

speaker, or a podcast host. The important thing is you spend time with them on a daily ba-

ETERNUS

sis—this will bring out your potential.

©

2018

As a child, he dreamt of being a professional

tennis player.

Panday Pira strongly believes that trading

is a way to escape the rat race.

ZFT ETERNUS © 2018 49

Rey Kalipulako

ZFT

Growing up, I had a concrete idea of the life that I wanted. I wanted to retire at a young age,

and I believed hard work and a simple lifestyle were essential to achieving this. But 3 years in-

ETERNUS

to the corporate world, I quickly realized it wasn’t going to be this simple.

Consequently, I left my parents, friends, and country behind to be an OFW in 2011. It was a

risk—be it a calculated one. At the time, I was convinced that a career abroad was the only way

I could retire earlier, allowing me to focus on the things that mattered the most for me, mainly

©

my family.

2018

However, the years abroad took their toll on me. Every time I came home: my parents got old-

er, my friends’ lives changed, and even my pets got older. I became less interested in my work

and more concerned about the things I was missing at home.

I stopped creating personal milestones at the office, which used to be one of the ways I moti-

vated myself. Instead, I felt empty whenever I got ready for work. I had to drag my feet to get

to the office.