Professional Documents

Culture Documents

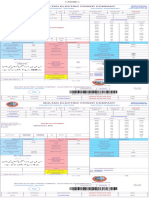

Askin Capital

Askin Capital

Uploaded by

PoorvaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Askin Capital

Askin Capital

Uploaded by

PoorvaCopyright:

Available Formats

Product Involved in the disaster- Askin Capital Management owned three hedge funds that

sustained significant losses in 1994, Granite Partners, Granite Corporation, and Quartz Hedge Fund.

How does the product basically work?- hedge fund is nothing more than an investment

company that invests its clients' money in alternative investments to either beat the market

or provide a hedge against unforeseen market changes.

Cause of failure- Askin Capital Management is a case of wrong investment priorities by investing

in mortgage-backed securities and speculating on interest rates. David Askin was a mortgage trader

who had floated investment funds, investing in high-quality mortgage securities. On the promise of

liquidity high and leverage low, "risk neutral" investment strategies, investors handed over some USD

630 million to Askin's hedge funds - Granite Partners, Granite Corporation, and Quartz Hedge Fund.

Askin invested in PO strips of CMOs.

However, in 1994, interest rates, especially short-term rates, rose dramatically. As is the feature of PO

strips, when interest rates rise, prepayments come down and the value of PO strips falls.

Four Askin funds with $600 million in assets filed for bankruptcy when the rising rates drove down

the market values of POs. Investors lost virtually everything, and the collapse stopped the MBS

market in its tracks, generating a string of lawsuits, some of which are still pending. Askin was barred

by the SEC from the securities industry for two years, and agreed to pay a $50,000 fine without

admitting or denying guilt.

Principal only strips (PO strips) are a fixed-income security where the holder receives the non-interest

portion of the monthly payments on the underlying loan pool. Principal only strips are created when

loans are pooled into securities and then split into two types.

Although principal only strips can be created out of any debt-backed security, the term is most

strongly associated with mortgage-backed securities (MBS). The mortgage-backed securities that are

split into PO and IO strips are referred to as a stripped MBS. Investors in PO strips benefit from

faster repayment speeds while also being protected from contraction risk. This means that, unlike a

usual bond or traditional MBS, the PO investor will benefit from decreases in the interest rate as the

loans are likely to get repaid faster.

State the type of risk- systematic, non systematic risk

Askin Capital Management Fixed-income arbitrage (mortgage-backed) 1994 660 Failed hedge,

market losses, margin calls

You might also like

- Open Letter To Senator Levin Aug 2014Document4 pagesOpen Letter To Senator Levin Aug 2014tabbforumNo ratings yet

- JPM CDO Research 12-Feb-2008Document20 pagesJPM CDO Research 12-Feb-2008Gunes KulaligilNo ratings yet

- The "Exorbitant Privilege" - A Theoretical ExpositionDocument25 pagesThe "Exorbitant Privilege" - A Theoretical ExpositionANIBAL LOPEZNo ratings yet

- Operations Management: Trends & Issues: Author: B. Mahadevan Operations Management: Theory and Practice, 3eDocument22 pagesOperations Management: Trends & Issues: Author: B. Mahadevan Operations Management: Theory and Practice, 3ePoorva100% (1)

- STP MarketingDocument3 pagesSTP MarketingPoorvaNo ratings yet

- Lecture21 Cdo & CdsDocument25 pagesLecture21 Cdo & Cdsfunkchunk33No ratings yet

- Orange CountryDocument4 pagesOrange CountrylilisliliNo ratings yet

- VelocityShares Etn Final Pricing Supplement VixlongDocument196 pagesVelocityShares Etn Final Pricing Supplement VixlongtgokoneNo ratings yet

- Daily Strategy Note Daily Strategy Note: Pravit ChintawongvanichDocument3 pagesDaily Strategy Note Daily Strategy Note: Pravit Chintawongvanichchris mbaNo ratings yet

- Art em Is Capital Currency NoteDocument35 pagesArt em Is Capital Currency NoteBen SchwartzNo ratings yet

- Fabozzi Gupta MarDocument16 pagesFabozzi Gupta MarFernanda RodriguesNo ratings yet

- CMBS Special Topic: Outlook For The CMBS Market in 2011Document26 pagesCMBS Special Topic: Outlook For The CMBS Market in 2011Yihai YuNo ratings yet

- Artemis - Meeting+of+the+Waters - March2016Document5 pagesArtemis - Meeting+of+the+Waters - March2016jacekNo ratings yet

- ACM - The Great Vega ShortDocument10 pagesACM - The Great Vega ShortThorHollisNo ratings yet

- The Crisis & What To Do About It: George SorosDocument7 pagesThe Crisis & What To Do About It: George SorosCarlos PLNo ratings yet

- Dual Range AccrualsDocument1 pageDual Range AccrualszdfgbsfdzcgbvdfcNo ratings yet

- CdosDocument53 pagesCdosapi-3742111No ratings yet

- CMBS Strategy WeeklyDocument14 pagesCMBS Strategy Weeklykkohle03No ratings yet

- Bosphorus CLO II Designated Activity CompanyDocument18 pagesBosphorus CLO II Designated Activity Companyeimg20041333No ratings yet

- Day1 Session3 ColeDocument36 pagesDay1 Session3 ColeLameuneNo ratings yet

- Portfolio ConstructionDocument15 pagesPortfolio ConstructionParul GuptaNo ratings yet

- What Are The Major Founders of LTCM and Their Backgrounds?Document4 pagesWhat Are The Major Founders of LTCM and Their Backgrounds?msirisekaraNo ratings yet

- Moore CapitalDocument1 pageMoore CapitalZerohedgeNo ratings yet

- Devonshire Research Group - Tesla Motors - TSLA - Public Release - Part IIDocument37 pagesDevonshire Research Group - Tesla Motors - TSLA - Public Release - Part IIZerohedge100% (1)

- Nomura Global Phoenix Autocallable FactsheetDocument4 pagesNomura Global Phoenix Autocallable FactsheetbearsqNo ratings yet

- Unicredit, On Cruise Control - A Guide To The European Auto Abs MarketDocument34 pagesUnicredit, On Cruise Control - A Guide To The European Auto Abs MarketFlooredNo ratings yet

- CS - GMN - 22 - Collateral Supply and Overnight RatesDocument49 pagesCS - GMN - 22 - Collateral Supply and Overnight Rateswmthomson50% (2)

- Dresdner Struct Products Vicious CircleDocument8 pagesDresdner Struct Products Vicious CircleBoris MangalNo ratings yet

- Deutsche Bank - The Arbitrage CDO Market (2000-03)Document28 pagesDeutsche Bank - The Arbitrage CDO Market (2000-03)MystinNo ratings yet

- RealPoint CMBS Methodology DisclosureDocument19 pagesRealPoint CMBS Methodology DisclosureCarneadesNo ratings yet

- Rates, Rotation, and Re Ation: Taking Stock of 1Q 2021: US Quarterly ChartbookDocument51 pagesRates, Rotation, and Re Ation: Taking Stock of 1Q 2021: US Quarterly ChartbookShivam GuptaNo ratings yet

- JPM - Life Insurance Overview - Jimmy Bhullar - Aug 2011Document16 pagesJPM - Life Insurance Overview - Jimmy Bhullar - Aug 2011ishfaque10No ratings yet

- GS ESS - newfWAssessingFairValueEmergMktsDocument26 pagesGS ESS - newfWAssessingFairValueEmergMktsKasey OwensNo ratings yet

- Principal Protected Investments: Structured Investments Solution SeriesDocument8 pagesPrincipal Protected Investments: Structured Investments Solution SeriessonystdNo ratings yet

- Zoltan Pozsar Bretton III - Apr 12 2022Document8 pagesZoltan Pozsar Bretton III - Apr 12 2022ryantongyanNo ratings yet

- Artemis+Letter+to+Investors What+is+Water July2018 2 PDFDocument11 pagesArtemis+Letter+to+Investors What+is+Water July2018 2 PDFmdorneanuNo ratings yet

- 507068Document43 pages507068ab3rdNo ratings yet

- Barth, M.E., Landsman, W.R. & Wahlen, J.M. (1995). Fair value accounting: Effects on banks’ earnings volatility, regulatory capital and value of contractual cash flows. Journal of Banking and Finance, 19, 577-605.Document29 pagesBarth, M.E., Landsman, W.R. & Wahlen, J.M. (1995). Fair value accounting: Effects on banks’ earnings volatility, regulatory capital and value of contractual cash flows. Journal of Banking and Finance, 19, 577-605.Marchelyn PongsapanNo ratings yet

- JPM Midyear Emerging Mar 2018-06-08 2686356Document79 pagesJPM Midyear Emerging Mar 2018-06-08 2686356rumi mahmoodNo ratings yet

- Model For Base CorrelationsDocument12 pagesModel For Base CorrelationseunicezzNo ratings yet

- HSBC - 7-10-2015Document54 pagesHSBC - 7-10-2015mmosny83No ratings yet

- LemonsAndCDOsWhyDidSoManyLenders PreviewDocument68 pagesLemonsAndCDOsWhyDidSoManyLenders PreviewkunalwarwickNo ratings yet

- April Remit BarCApDocument21 pagesApril Remit BarCApZerohedgeNo ratings yet

- 2008 DB Fixed Income Outlook (12!14!07)Document107 pages2008 DB Fixed Income Outlook (12!14!07)STNo ratings yet

- FE-Seminar 10 15 2012Document38 pagesFE-Seminar 10 15 2012yerytNo ratings yet

- Deutsche Bank - US ETF Market Weekly Review: $35bn Removed From ETP AUM After Market Sell-OffDocument38 pagesDeutsche Bank - US ETF Market Weekly Review: $35bn Removed From ETP AUM After Market Sell-OffRussell FryNo ratings yet

- CampelloSaffi15 PDFDocument39 pagesCampelloSaffi15 PDFdreamjongenNo ratings yet

- The Dynamics of Leveraged and Inverse Exchange-Traded FundsDocument24 pagesThe Dynamics of Leveraged and Inverse Exchange-Traded FundsshorttermblogNo ratings yet

- CB Primer GsDocument141 pagesCB Primer GsKarya BangunanNo ratings yet

- Standard Cds Economics F 102282706Document6 pagesStandard Cds Economics F 102282706Matt WallNo ratings yet

- IIF Capital Flows Report 10 15Document38 pagesIIF Capital Flows Report 10 15ed_nycNo ratings yet

- UBS Synthetic CDOsDocument6 pagesUBS Synthetic CDOsarahmedNo ratings yet

- Gundlach 6-14-16 Total Return Webcast Slides - Final - UnlockedDocument73 pagesGundlach 6-14-16 Total Return Webcast Slides - Final - UnlockedZerohedge100% (1)

- Interest Rates & HY Returns - JPM StudyDocument12 pagesInterest Rates & HY Returns - JPM Studyvilnius00No ratings yet

- ING Trups DiagramDocument5 pagesING Trups DiagramhungrymonsterNo ratings yet

- Money and Inflation: MacroeconomicsDocument71 pagesMoney and Inflation: MacroeconomicsDilla Andyana SariNo ratings yet

- Answers To 10 Common Questions On EMU BreakupDocument11 pagesAnswers To 10 Common Questions On EMU BreakupzeleneyeNo ratings yet

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesFrom EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in Viet NamFrom EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNo ratings yet

- European Fixed Income Markets: Money, Bond, and Interest Rate DerivativesFrom EverandEuropean Fixed Income Markets: Money, Bond, and Interest Rate DerivativesJonathan A. BattenNo ratings yet

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketFrom EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketNo ratings yet

- Mar-19 Mar-18 Mar-17: Fixed Assets 1718.63 1317.69 1006.11Document17 pagesMar-19 Mar-18 Mar-17: Fixed Assets 1718.63 1317.69 1006.11PoorvaNo ratings yet

- Current Asset Ratio Quick Assets Ratio: LiquidityDocument5 pagesCurrent Asset Ratio Quick Assets Ratio: LiquidityPoorvaNo ratings yet

- Chapter 02 Exercise ProblemsDocument7 pagesChapter 02 Exercise ProblemsPoorvaNo ratings yet

- Chapter 06 Exercise ProblemsDocument22 pagesChapter 06 Exercise ProblemsPoorvaNo ratings yet

- F9Chap4 TutorSlidesDocument31 pagesF9Chap4 TutorSlidesSeema Parboo-AliNo ratings yet

- Omni Fintech Digital Payments and Banking A Digital RevolutionDocument11 pagesOmni Fintech Digital Payments and Banking A Digital Revolutionvicgreer100% (1)

- Developing A Business PlanDocument25 pagesDeveloping A Business PlanDum DumNo ratings yet

- CHAPTER 19 - AnswerDocument12 pagesCHAPTER 19 - Answernash100% (5)

- AMLA 2A MergedDocument525 pagesAMLA 2A MergeddasdsadsadasdasdNo ratings yet

- Ch26 Pension Fund OperationsDocument33 pagesCh26 Pension Fund OperationsTHIVIYATHINI PERUMALNo ratings yet

- Ex. WorksheetDocument3 pagesEx. WorksheetAllysa Kim RubisNo ratings yet

- Osservazioni Sui Rinvenimenti Monetari Dagli Scavi Archeologici Dell'antica Caulonia / Giorgia GarganoDocument32 pagesOsservazioni Sui Rinvenimenti Monetari Dagli Scavi Archeologici Dell'antica Caulonia / Giorgia GarganoDigital Library Numis (DLN)No ratings yet

- Spao X BT21 Backpack - 6 PDFDocument5 pagesSpao X BT21 Backpack - 6 PDFEdgardo BeaNo ratings yet

- Financial KYE Performance Analysis of SBI and HDFC Bank (Year 2016-17 To 2019-20)Document6 pagesFinancial KYE Performance Analysis of SBI and HDFC Bank (Year 2016-17 To 2019-20)International Journal of Innovative Science and Research Technology100% (1)

- Multan Electric Power Company: Detection BillDocument1 pageMultan Electric Power Company: Detection BillMubashar NazirNo ratings yet

- Summer Training Report at HDFC Bank (Repaired)Document45 pagesSummer Training Report at HDFC Bank (Repaired)Pavan kumarNo ratings yet

- Subject Wise 3.0 2024Document50 pagesSubject Wise 3.0 2024KritikaNo ratings yet

- Module 9 Earnings and Market Approach ValuationDocument46 pagesModule 9 Earnings and Market Approach ValuationJohn Paul TomasNo ratings yet

- Raj Singh Fazilka 24.06.2023Document7 pagesRaj Singh Fazilka 24.06.2023rohit. remooNo ratings yet

- Case British Columbia HydroDocument6 pagesCase British Columbia Hydropauline faye bayaniNo ratings yet

- 3 0 Schedule of Fees 22 Sep 2015Document2 pages3 0 Schedule of Fees 22 Sep 2015Wahyudin AdeNo ratings yet

- (Doc) Bouye Et Al 2000 Copulas For Finance. A Reading Guide and Some Applications - City Univ. London & Credit LyonnaisDocument69 pages(Doc) Bouye Et Al 2000 Copulas For Finance. A Reading Guide and Some Applications - City Univ. London & Credit LyonnaispavleinNo ratings yet

- Bill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)Document11 pagesBill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)Vaishnavi ManoharanNo ratings yet

- The Templars As Papal BankersDocument6 pagesThe Templars As Papal BankersDan ClausenNo ratings yet

- Analysis of Financial Statements Mix RatioDocument30 pagesAnalysis of Financial Statements Mix RatioBianca Angela Camayra QuiaNo ratings yet

- CGTMSE Presentation FinalDocument30 pagesCGTMSE Presentation FinalVishal Chaudhari100% (1)

- Banko Sentral NG PilipinasDocument8 pagesBanko Sentral NG PilipinasJoshua OrobiaNo ratings yet

- BRS Ca Foundation RevisionDocument19 pagesBRS Ca Foundation RevisionSiddharth ThakurNo ratings yet

- Chapter 4. Review of AccountingDocument49 pagesChapter 4. Review of AccountingMichenNo ratings yet

- Statement of Account: L018 SBI Magnum Tax Gain Scheme - Regular Plan - Dividend NAV As On 04/01/2016: 43.4754Document2 pagesStatement of Account: L018 SBI Magnum Tax Gain Scheme - Regular Plan - Dividend NAV As On 04/01/2016: 43.4754maakabhawan26No ratings yet

- Basic Excel Functions - ProblemsDocument31 pagesBasic Excel Functions - ProblemsSushma Jeswani TalrejaNo ratings yet

- Data Interpretation Practice Exercise: Ref: DEX1002103Document3 pagesData Interpretation Practice Exercise: Ref: DEX1002103raviNo ratings yet

- 02 Conceptual FrameworkDocument13 pages02 Conceptual FrameworkShey INFTNo ratings yet

- SAS PC 16 - Accounts of Divisional OfficersDocument30 pagesSAS PC 16 - Accounts of Divisional OfficersMukesh100% (1)