Professional Documents

Culture Documents

Solutiondone 316

Solutiondone 316

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutiondone 316

Solutiondone 316

Uploaded by

trilocksp SinghCopyright:

Available Formats

Champion Contractors completed the following

transactions and events involving the

Champion Contractors completed the following transactions and events involving the

Champion Contractors completed the following transactions and events involving the

purchase and operation of equipment in its business.

2016

Jan. 1 Paid $287,600 cash plus $11,500 in sales tax and $1,500 in transportation (FOB

shipping point) for a new loader. The loader is estimated to have a four-year life and a $20,600

salvage value. Loader costs are recorded in the Equipment account.

3 Paid $4,800 to enclose the cab and install air-conditioning in the loader to enable operations

under harsher conditions. This increased the estimated salvage value of the loader by another

$1,400.

Dec. 31 Recorded annual straight-line depreciation on the loader.

2017

Jan. 1 Paid $5,400 to overhaul the loader's engine, which increased the loader's estimated

useful life by two years.

Feb. 17 Paid $820 to repair the loader after the operator backed it into a tree.

Dec. 31 Recorded annual straight-line depreciation on the loader.

Required

Prepare journal entries to record these transactions and events.

Champion Contractors completed the following transactions and events involving the

SOLUTION-- http://solutiondone.online/downloads/champion-contractors-completed-the-

following-transactions-and-events-involving-the/

Unlock answers here solutiondone.online

You might also like

- Soal Aset TetapDocument3 pagesSoal Aset TetapNamla Elfa Syariati67% (3)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- ACCT550 Homework Week 6Document6 pagesACCT550 Homework Week 6Natasha DeclanNo ratings yet

- Test (BBA)Document5 pagesTest (BBA)Ab Wahab100% (4)

- Act 20-Ap 04 PpeDocument7 pagesAct 20-Ap 04 PpeJomar VillenaNo ratings yet

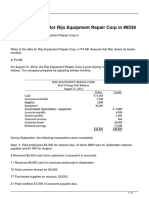

- Refer To The Data For Rijo Equipment Repair Corp inDocument2 pagesRefer To The Data For Rijo Equipment Repair Corp inMiroslav Gegoski0% (1)

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- Solutiondone 314Document1 pageSolutiondone 314trilocksp SinghNo ratings yet

- Depreciation QuestionsDocument3 pagesDepreciation QuestionsAhmed Hayat WagganNo ratings yet

- Yoshi Company Completed The Following Transactions and Events Involving ItsDocument1 pageYoshi Company Completed The Following Transactions and Events Involving Itstrilocksp SinghNo ratings yet

- Solutiondone 313Document1 pageSolutiondone 313trilocksp SinghNo ratings yet

- Chapter 8 Extra QuestionsDocument9 pagesChapter 8 Extra Questionsandrew.yerokhin1No ratings yet

- Work Sheet AcctDocument5 pagesWork Sheet Acctaterefemelaku29No ratings yet

- C 5 A: P U B A: Hapter Cquisitions Urchase and Se of Usiness SsetsDocument17 pagesC 5 A: P U B A: Hapter Cquisitions Urchase and Se of Usiness SsetsKenKdwNo ratings yet

- FINANCE EXAM 3 The Hasting Company Began Operations On January 1, 2003Document7 pagesFINANCE EXAM 3 The Hasting Company Began Operations On January 1, 2003Mike Russell50% (2)

- Solutiondone 2-341Document1 pageSolutiondone 2-341trilocksp SinghNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Chapter 8 - Handout (Student Version) - TaggedDocument5 pagesChapter 8 - Handout (Student Version) - TaggedSteven JiangNo ratings yet

- ACCT3001 Ch.10 WP SolutionsDocument14 pagesACCT3001 Ch.10 WP SolutionsJoshua Solite0% (1)

- Activity #1Document5 pagesActivity #1Lyka Nicole DoradoNo ratings yet

- مادة الامتحان النهائيDocument13 pagesمادة الامتحان النهائيsana.otaibi2002No ratings yet

- 2021 COAF 4201 GroupsDocument16 pages2021 COAF 4201 GroupsTawanda Tatenda HerbertNo ratings yet

- Finance - Exam 3Document15 pagesFinance - Exam 3Neeta Joshi50% (6)

- Financial Accounting Practice ProblemsDocument15 pagesFinancial Accounting Practice ProblemsFaryal Mughal100% (1)

- Tutorial 6 QsDocument6 pagesTutorial 6 QsDylan Rabin PereiraNo ratings yet

- Ajd 2023 PR Materi Sesi 1 Akuntansi Dan Persamaan AkuntansiDocument2 pagesAjd 2023 PR Materi Sesi 1 Akuntansi Dan Persamaan AkuntansiX IPS 3/01 Ade Isna MaulidaNo ratings yet

- Solutiondone 2-337Document1 pageSolutiondone 2-337trilocksp SinghNo ratings yet

- 2.2. PPE IAS16 - Practice - EnglishDocument12 pages2.2. PPE IAS16 - Practice - EnglishBích TrâmNo ratings yet

- The Following Account Balances Were Included in Bromley Company S BalanceDocument1 pageThe Following Account Balances Were Included in Bromley Company S BalanceTaimur TechnologistNo ratings yet

- Exercise2 PPEDocument2 pagesExercise2 PPEAlaine Milka GosycoNo ratings yet

- Quiz - Ppe Cost 2Document1 pageQuiz - Ppe Cost 2Ana Mae HernandezNo ratings yet

- Recitation #9Document5 pagesRecitation #9wtfNo ratings yet

- Pset 4Document3 pagesPset 4Ahmed AltohamyNo ratings yet

- AIS16Exercises SCDocument6 pagesAIS16Exercises SCSarah GherdaouiNo ratings yet

- The Following Transactions Adjusting Entries and Closing Entries Were CompletedDocument1 pageThe Following Transactions Adjusting Entries and Closing Entries Were Completedtrilocksp SinghNo ratings yet

- ACC 308 - Week2 - 2-2 Homework - Chapter 10Document8 pagesACC 308 - Week2 - 2-2 Homework - Chapter 10Lilian LNo ratings yet

- Non Current Assets 2019ADocument4 pagesNon Current Assets 2019AKezy Mae GabatNo ratings yet

- Latihan MatrikulasiDocument4 pagesLatihan MatrikulasiD Ayu Hamama PitraNo ratings yet

- Solutiondone 2-340Document1 pageSolutiondone 2-340trilocksp SinghNo ratings yet

- Fin2bsat Quiz1 InvProperty Fund PpeDocument5 pagesFin2bsat Quiz1 InvProperty Fund PpeMarvin San JuanNo ratings yet

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- Additional Problems For Ppe - Acct202: Problem #1Document1 pageAdditional Problems For Ppe - Acct202: Problem #1Excelsia Grace A. ParreñoNo ratings yet

- Practice Exercise Ch10Document2 pagesPractice Exercise Ch10Nguyễn Dương Thanh PhươngNo ratings yet

- HSHDocument3 pagesHSHMonny MOMNo ratings yet

- ACC 205 Complete Class HomeworkDocument40 pagesACC 205 Complete Class HomeworkSwadesh BangladeshNo ratings yet

- Terrific Lawn Three PartsDocument2 pagesTerrific Lawn Three PartsAjit kumarNo ratings yet

- Solved On August 31 2018 Rijo Equipment Repair Corp S Opening TrialDocument1 pageSolved On August 31 2018 Rijo Equipment Repair Corp S Opening TrialDoreenNo ratings yet

- Unit 7. Audit of Property, Plant and Equipment - Handout - Final - t21516Document8 pagesUnit 7. Audit of Property, Plant and Equipment - Handout - Final - t21516mimi96No ratings yet

- PPE QuizDocument6 pagesPPE QuizKristelle Mae Bautista100% (1)

- Auditing Problems-Ppep1Document4 pagesAuditing Problems-Ppep1Par CorNo ratings yet

- 333333Document3 pages333333Levi OrtizNo ratings yet

- DepreciationDocument6 pagesDepreciationKylie Luigi Leynes Bagon100% (2)

- Acc Pro Sol EXERDocument17 pagesAcc Pro Sol EXERAli Al AjamiNo ratings yet

- 003 ExDocument14 pages003 ExanandhuNo ratings yet

- Chapter 3 QuestionDocument2 pagesChapter 3 Questionjugnu0% (1)

- Audit of PPEDocument6 pagesAudit of PPEJuvy DimaanoNo ratings yet

- A Company Must Record Its Expenses Incurred To Generate TheDocument9 pagesA Company Must Record Its Expenses Incurred To Generate TheNguyen Hoai Linh (K15 HL)No ratings yet

- FARQ1Q2 MendozaDocument6 pagesFARQ1Q2 MendozaLeane MarcoletaNo ratings yet

- Day 13 Chap 8 Rev. FI5 Ex PRDocument13 pagesDay 13 Chap 8 Rev. FI5 Ex PRSubash ShresthaNo ratings yet

- Quiz 1Document4 pagesQuiz 1Ming Le YapNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet