Professional Documents

Culture Documents

Taxation Management (FIN623) : Assignment # 02

Taxation Management (FIN623) : Assignment # 02

Uploaded by

Rajesh Kumar0 ratings0% found this document useful (0 votes)

33 views2 pagesOriginal Title

Fall 2010_FIN623_2.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

33 views2 pagesTaxation Management (FIN623) : Assignment # 02

Taxation Management (FIN623) : Assignment # 02

Uploaded by

Rajesh KumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

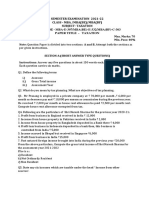

Taxation Management (FIN623)

Assignment # 02

Marks: 20

Please read the following Instructions carefully before attempting the

Assignment:

• Last date for submission of Assignment is January 13, 2011.

• You are required to use the tax rates of year 2010-2011. You can use the

Income Tax Ordinance 2010-2011 uploaded on the LMS.

• You can consult the concerned topics from handouts and recommended

book for the assignment.

• Read the question carefully and provide complete solution. You are required

to provide complete calculation/working as it carries reasonable marks.

• Make sure that you upload the Assignment before due date. No assignment

will be accepted through E-mail after the due date.

• You are required to submit your solution in Microsoft Word 2003

format or in Open Office Writer format.

• The Assignment once uploaded over LMS will not be replaced so, care

should be taken while uploading files over LMS.

• According to ZERO TOLERANCE POLICY, cheating or copying of

assignment is strictly prohibited; NO CREDIT WILL BE GIVEN TO

COPIED ASSIGNMENT.

Please note that you will NOT be awarded any marks if:

• Your solution is submitted after due date.

• The file you uploaded is corrupt or does not open.

• Your assignment is found cheated or copied.

Question:

From the following particulars given by Mr. X, an officer in the Ministry of Trade, calculate

the taxable income and tax payable by him in respect of the year ended on June 30, 2010.

1. Basic salary Rs. 120,000

2. He has been provided with the rent-free furnished accommodation with annual value

of Rs. 60,000

3. He has been given a car by his employer and Rs. 1,000 per month to meet the running

costs, etc. he can take that car home as well.

4. He is provided one free Karachi-London and back air ticket every year. During the

year he received Rs. 17,000 in this respect.

5. Leave encashment paid to him Rs. 10,000.

6. He has let out his house at Rs. 3,000 per month. The tenant has left without paying

rent for two months, which could not be recovered despite the best efforts.

7. He claims the following payments including Rs. 400 as Zakat deposited in Zakat

fund.

Property tax Rs. 6,000 Fire Insurance Rs. 1,000

Corporation tax Rs. 5,000 Income tax deducted Rs. 3,000

Books purchased Rs. 5,000 Life Insurance Premium Rs. 6,000

8. The following amounts were received:

Dividend from NIT units (Zakat Rs. 1,000) 8,000

Dividend from XY (Pvt.) Ltd. (Zakat Rs. 600) 3,000

9. The life policy has Rs. 50,000 sum insured and the employee contributes one month’s

basic salary to the Recognized Provident Fund.

You might also like

- PCIL Study Material English PDFDocument123 pagesPCIL Study Material English PDFIsaac Wong100% (1)

- Grier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 1-150Document150 pagesGrier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 1-150HILDA IDANo ratings yet

- Namrata Infy LetterDocument10 pagesNamrata Infy LetterRohit Mandal0% (1)

- Travel Insurance Final Project Yash NaikDocument57 pagesTravel Insurance Final Project Yash NaikVedant Mahajan80% (5)

- Business Taxation MBA III 566324802Document5 pagesBusiness Taxation MBA III 566324802mohanraokp2279No ratings yet

- Income From SalaryDocument26 pagesIncome From SalaryAkash VisputeNo ratings yet

- Tax NumericalsDocument11 pagesTax NumericalsRohit PanpatilNo ratings yet

- PGBP New SlidesDocument40 pagesPGBP New SlidesSachin Jain100% (2)

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- Tut Q Extra TrustDocument3 pagesTut Q Extra Trustchunlun87No ratings yet

- CA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Document36 pagesCA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Velayudham ThiyagarajanNo ratings yet

- Salary - Practice QuestionsDocument8 pagesSalary - Practice Questionssyedameerhamza762No ratings yet

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarNo ratings yet

- Bachelor's Degree Programme (BDP) : Assignment 2015-16Document4 pagesBachelor's Degree Programme (BDP) : Assignment 2015-16Paras JainNo ratings yet

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainNo ratings yet

- Mba E307 - Mbe E332 - MBF C303Document4 pagesMba E307 - Mbe E332 - MBF C303Shashank TripathiNo ratings yet

- QuestionsDocument16 pagesQuestionsAayush SunejaNo ratings yet

- TAX Papers - Paper 1Document2 pagesTAX Papers - Paper 1syedshahNo ratings yet

- FA - Excercises & Answers PDFDocument17 pagesFA - Excercises & Answers PDFRasanjaliGunasekera100% (1)

- Acc 723 Tutorial One QuestionsDocument4 pagesAcc 723 Tutorial One QuestionsJohn TomNo ratings yet

- Part A - Written or Oral QuestionsDocument5 pagesPart A - Written or Oral Questionswilson garzonNo ratings yet

- pcc-2011 TaxDocument19 pagespcc-2011 TaxHeena NigamNo ratings yet

- Santosh and Dipak PFP PresentationDocument8 pagesSantosh and Dipak PFP PresentationKaira EventsNo ratings yet

- FE QuestionsDocument2 pagesFE Questionsviedereen12No ratings yet

- Income From Salary Chapter QuestionsDocument5 pagesIncome From Salary Chapter Questionsanon_595315274100% (1)

- Tax A1 QCF Feb 2014 UteDocument8 pagesTax A1 QCF Feb 2014 UteAi Em DoNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Single SystemDocument7 pagesSingle SystemRobert HensonNo ratings yet

- Tax Laws in Tanzania: Taxation Questions & AnswersDocument11 pagesTax Laws in Tanzania: Taxation Questions & AnswersKessy Juma90% (119)

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionnikunjrnanavatiNo ratings yet

- Tax Assignment For FinalDocument4 pagesTax Assignment For FinalEnaiya IslamNo ratings yet

- Income Tax Law: Business Law Fom, MmuDocument21 pagesIncome Tax Law: Business Law Fom, MmuFaizun SekinNo ratings yet

- SBI Home Loan FinalDocument13 pagesSBI Home Loan FinalRonduck50% (2)

- SBI Home Loan FinalDocument13 pagesSBI Home Loan Finalnikita_8100% (2)

- TAX3247N 3226N May 2024 Assignment Question PaperDocument10 pagesTAX3247N 3226N May 2024 Assignment Question PaperfortuinpdNo ratings yet

- FdggseeDocument2 pagesFdggseefghhnnnjmlNo ratings yet

- Assignment 1Document2 pagesAssignment 1pradeepNo ratings yet

- MB0041Document3 pagesMB0041Smu DocNo ratings yet

- The New Direct Tax Code (DTC)Document18 pagesThe New Direct Tax Code (DTC)aggarwalajay2No ratings yet

- Sagar & AnandDocument9 pagesSagar & AnandAnand ChavanNo ratings yet

- Ftxmys 2011 Dec QDocument12 pagesFtxmys 2011 Dec Qaqmal16No ratings yet

- Basics of Financial MathsDocument25 pagesBasics of Financial MathsKrishan GogiaNo ratings yet

- Gratuiuty ActDocument10 pagesGratuiuty ActPrachi B.No ratings yet

- Tax Planning & Financial Reporting 2nd Mid TermDocument6 pagesTax Planning & Financial Reporting 2nd Mid TermKrishan Kant PartiharNo ratings yet

- Imp Theory Ques of Itp All UnitsDocument25 pagesImp Theory Ques of Itp All UnitsEpic FailsNo ratings yet

- AE211 Final ExamDocument10 pagesAE211 Final ExamMariette Alex AgbanlogNo ratings yet

- Group AssignmentDocument2 pagesGroup Assignmentymolla922No ratings yet

- Income Tax 21bco246Document2 pagesIncome Tax 21bco246nikhilesh1364No ratings yet

- Personal Income TaxDocument31 pagesPersonal Income TaxRenese LeeNo ratings yet

- I Year B.Com., LL.B. (Hons)Document15 pagesI Year B.Com., LL.B. (Hons)Vishal AnandNo ratings yet

- Canada UFEDocument26 pagesCanada UFESam MkandwireNo ratings yet

- income From Salary-Problems, Theory and Solutions: by Prof - Augustin AmaladasDocument76 pagesincome From Salary-Problems, Theory and Solutions: by Prof - Augustin AmaladasAnkit Dhyani100% (6)

- Tax Assignment 1 March 2012Document11 pagesTax Assignment 1 March 2012Bé HòaNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper2Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper2mansoorbariNo ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- Accounting StandardDocument33 pagesAccounting StandardPooja BaghelNo ratings yet

- Income Tax ProjectDocument6 pagesIncome Tax Projectdipmoip2210No ratings yet

- Law PPR FinalDocument4 pagesLaw PPR FinalMariumm ParusNo ratings yet

- IT Calculator FY2009-10Document7 pagesIT Calculator FY2009-10RanjaniNo ratings yet

- Accounting Chapter 10Document11 pagesAccounting Chapter 10Andrew ChouNo ratings yet

- Accounting Level Ii AnswerDocument6 pagesAccounting Level Ii AnswerMujib AbdlhadiNo ratings yet

- Theory Type Questions - For Reference OnlyDocument13 pagesTheory Type Questions - For Reference OnlyHaseeb Ahmed ShaikhNo ratings yet

- Extention PARCODocument1 pageExtention PARCORajesh KumarNo ratings yet

- Lesson No. 28Document5 pagesLesson No. 28Rajesh KumarNo ratings yet

- Semester Spring 2012 Corporate Finance (Fin 622) : Assignment No. 02Document3 pagesSemester Spring 2012 Corporate Finance (Fin 622) : Assignment No. 02Rajesh KumarNo ratings yet

- Letter of Warning BX Article 7 - Discipline and Dismissal Scope: AseDocument3 pagesLetter of Warning BX Article 7 - Discipline and Dismissal Scope: AseRajesh KumarNo ratings yet

- Direct Taxes Withholding Taxes Tax Rate Card - Tax Year 2013 & 2014Document1 pageDirect Taxes Withholding Taxes Tax Rate Card - Tax Year 2013 & 2014Rajesh KumarNo ratings yet

- Variables and Types of VariablesDocument4 pagesVariables and Types of VariablesRajesh KumarNo ratings yet

- Lesson No. 03Document7 pagesLesson No. 03Rajesh KumarNo ratings yet

- Lesson # 21 Indirect Investing Contd Exchange-Traded Funds (Etfs)Document3 pagesLesson # 21 Indirect Investing Contd Exchange-Traded Funds (Etfs)Rajesh KumarNo ratings yet

- Lesson # 22 Common Stock: Analysis and Strategy The Passive StrategyDocument3 pagesLesson # 22 Common Stock: Analysis and Strategy The Passive StrategyRajesh KumarNo ratings yet

- Tools For Data Collection: Schedule, The List of Questions Remains in The Hands of The Interviewer Who Asks QuestionsDocument4 pagesTools For Data Collection: Schedule, The List of Questions Remains in The Hands of The Interviewer Who Asks QuestionsRajesh KumarNo ratings yet

- Semester "Fall 2010": "Research Methods (STA 630) "Document2 pagesSemester "Fall 2010": "Research Methods (STA 630) "Rajesh KumarNo ratings yet

- Semester "Fall 2010": "Investment Analysis & Portfolio Management" (Fin 630)Document2 pagesSemester "Fall 2010": "Investment Analysis & Portfolio Management" (Fin 630)Rajesh KumarNo ratings yet

- Labor Gsis ReportDocument35 pagesLabor Gsis ReportIbarra ConradNo ratings yet

- Sample Marital Settlement Agreement ProvisionsDocument16 pagesSample Marital Settlement Agreement ProvisionsKitty LaringoNo ratings yet

- Income Taxation DimaampaoDocument175 pagesIncome Taxation DimaampaoMondrich Gabriente100% (1)

- BAR EXAM Mercantile Law 2012Document34 pagesBAR EXAM Mercantile Law 2012Aling KinaiNo ratings yet

- Comprehensive Topics With AnsDocument14 pagesComprehensive Topics With AnsGrace Corpo100% (3)

- What Is Assignment and Nomination in Life InsuranceDocument4 pagesWhat Is Assignment and Nomination in Life InsuranceDivanshu DhingraNo ratings yet

- THE INSULAR LIFE ASSURANCE COMPANY, LTD. vs. CARPONIA T. EBRADO and PASCUALA VDA. DE EBRADODocument2 pagesTHE INSULAR LIFE ASSURANCE COMPANY, LTD. vs. CARPONIA T. EBRADO and PASCUALA VDA. DE EBRADOReynaldo DizonNo ratings yet

- Private Placement Life Insurance PlanningDocument33 pagesPrivate Placement Life Insurance PlanningAdam Pocsi100% (1)

- Pup College of Law Insurance: 2011 Bar ReviewerDocument45 pagesPup College of Law Insurance: 2011 Bar ReviewerHoney Crisril M. CalimotNo ratings yet

- Claim Reserving Estimation by Using The Chain Ladder Method: Conference PaperDocument13 pagesClaim Reserving Estimation by Using The Chain Ladder Method: Conference PaperAzhal23No ratings yet

- Birla Sun Life Insurance Product Portfolio PROJECT ReportDocument70 pagesBirla Sun Life Insurance Product Portfolio PROJECT Reportkajal nayakNo ratings yet

- The Secret AssetDocument175 pagesThe Secret AssetPhương HoàngNo ratings yet

- The Relevance of Mathematics in Insurance Industry PDFDocument65 pagesThe Relevance of Mathematics in Insurance Industry PDFMeriNo ratings yet

- Pce CeilliDocument261 pagesPce Ceillivf5jmszwg2No ratings yet

- LIFEB305Document209 pagesLIFEB305PriyalPatel0% (1)

- Section 80D Deduction For Mediclaim Insurance PremiumDocument46 pagesSection 80D Deduction For Mediclaim Insurance PremiumsameerNo ratings yet

- Case Study of LicDocument21 pagesCase Study of LicfrazfarooquiNo ratings yet

- MLC Exam SoaDocument55 pagesMLC Exam SoaAki TsukiyomiNo ratings yet

- Life InsuranceDocument3 pagesLife Insurancesangita_banikyaNo ratings yet

- Prudential Insurance AnalysisDocument10 pagesPrudential Insurance AnalysisAbdan M AdaniNo ratings yet

- Insunews: Weekly E-NewsletterDocument47 pagesInsunews: Weekly E-NewsletterHimanshu PantNo ratings yet

- Compañia General de Tabacos de Filipinas v. Collector of Internal Revenue, 275 U.S. 87 (1927)Document10 pagesCompañia General de Tabacos de Filipinas v. Collector of Internal Revenue, 275 U.S. 87 (1927)Scribd Government DocsNo ratings yet

- Life Insurance Offerings Globe Life - Liberty National Colonial AflacDocument3 pagesLife Insurance Offerings Globe Life - Liberty National Colonial AflacTina HughesNo ratings yet

- Finance TOPICDocument29 pagesFinance TOPICAdil HafeezNo ratings yet

- Department v. South Sea Surety Insurance Co., Inc. and The Charter Insurance CorporationDocument60 pagesDepartment v. South Sea Surety Insurance Co., Inc. and The Charter Insurance CorporationClarisse30No ratings yet