Professional Documents

Culture Documents

Error Correction Entries The First Audit of The Books of PDF

Error Correction Entries The First Audit of The Books of PDF

Uploaded by

Anbu jaromiaCopyright:

Available Formats

You might also like

- David Bornstein - How To Change The World - Social Entrepreneurs and The Power of New Ideas-Oxford University Press (2007) (001-100)Document100 pagesDavid Bornstein - How To Change The World - Social Entrepreneurs and The Power of New Ideas-Oxford University Press (2007) (001-100)Ari Indarto78% (9)

- Wells Fargo Everyday Checking: Important Account InformationDocument4 pagesWells Fargo Everyday Checking: Important Account InformationPatricia100% (2)

- Gulf Oil TakeoverDocument9 pagesGulf Oil Takeoverkumar.kunal0% (2)

- Acct101 Financial Accounting: Instructions To CandidatesDocument26 pagesAcct101 Financial Accounting: Instructions To CandidatesYing Sheng ÖNo ratings yet

- W7 CMA SampleEssayQuestionsDocument11 pagesW7 CMA SampleEssayQuestionsLouieNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Error Analysis and Correcting Entry You Have Been Engaged To PDFDocument1 pageError Analysis and Correcting Entry You Have Been Engaged To PDFAnbu jaromiaNo ratings yet

- Trafflet Enterprises Incorporated On May 3 2011 The Company EngagedDocument1 pageTrafflet Enterprises Incorporated On May 3 2011 The Company EngagedAmit PandeyNo ratings yet

- AS Advanced Audit Assurance May June 2012Document4 pagesAS Advanced Audit Assurance May June 2012Laskar REAZNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesShang BugayongNo ratings yet

- On May 5 2012 You Were Hired by Gavin Inc PDFDocument1 pageOn May 5 2012 You Were Hired by Gavin Inc PDFFreelance WorkerNo ratings yet

- ch1 8 5eDocument9 pagesch1 8 5eJean Pierre HitimanaNo ratings yet

- Soal Asistensi Special EditionDocument6 pagesSoal Asistensi Special EditionEden ZaristaNo ratings yet

- Sample Exam Acc 3100Document10 pagesSample Exam Acc 3100abdul235No ratings yet

- FABM1 LP SET 2.aDocument10 pagesFABM1 LP SET 2.aJC RoblesNo ratings yet

- 1st Mid Term Exam Spring 2013Document4 pages1st Mid Term Exam Spring 2013SarahZeidatNo ratings yet

- A Company Must Record Its Expenses Incurred To Generate TheDocument9 pagesA Company Must Record Its Expenses Incurred To Generate TheNguyen Hoai Linh (K15 HL)No ratings yet

- Home Office, Branch, & Agency AccountingDocument13 pagesHome Office, Branch, & Agency AccountingGround ZeroNo ratings yet

- Audit & Assurance - Ja-2023 - QuestionDocument5 pagesAudit & Assurance - Ja-2023 - QuestionMd Jakaria Md JakariaNo ratings yet

- Individual AssignmentDocument2 pagesIndividual AssignmentmuhaNo ratings yet

- Past Exam PaperDocument6 pagesPast Exam Paperprecious mountainsNo ratings yet

- Advance Stage May June 2012 - AllDocument27 pagesAdvance Stage May June 2012 - AllSHEIKH MOHAMMAD KAUSARUL ALAMNo ratings yet

- 0 - Revision Batch Compilation Sept 18 Only As Questions-1 PDFDocument14 pages0 - Revision Batch Compilation Sept 18 Only As Questions-1 PDFKunal DhepleNo ratings yet

- You Are The Auditor of Vegatron Services Inc A Privately PDFDocument1 pageYou Are The Auditor of Vegatron Services Inc A Privately PDFHassan JanNo ratings yet

- ACCA F8 Revision Mock December 2011 QUESTIONSDocument6 pagesACCA F8 Revision Mock December 2011 QUESTIONSPomri EllisNo ratings yet

- Discontinued Operations Acctg. Test BankDocument12 pagesDiscontinued Operations Acctg. Test BankDalrymple CasballedoNo ratings yet

- Accounting Principles I - Online: Chapters 3 & 4 - Exam - Part IIDocument7 pagesAccounting Principles I - Online: Chapters 3 & 4 - Exam - Part IILouie CraneNo ratings yet

- Comprehensive Accounting Change and Error Analysis Problem Botti PDFDocument1 pageComprehensive Accounting Change and Error Analysis Problem Botti PDFAnbu jaromiaNo ratings yet

- Katie Company Had Three Intangible Assets at The End ofDocument1 pageKatie Company Had Three Intangible Assets at The End ofM Bilal SaleemNo ratings yet

- A Building That Was Purchased December 31Document2 pagesA Building That Was Purchased December 31muhaNo ratings yet

- P7int 2009 Dec Q PDFDocument8 pagesP7int 2009 Dec Q PDFhiruspoonNo ratings yet

- CH 09 In-Class Problems - Fall 2013Document4 pagesCH 09 In-Class Problems - Fall 2013StephNo ratings yet

- You Are Auditing The December 31 2011 Financial Statements PDFDocument1 pageYou Are Auditing The December 31 2011 Financial Statements PDFAnbu jaromiaNo ratings yet

- The Equitee Corporation Was Incorporated On January 2 2015 With PDFDocument1 pageThe Equitee Corporation Was Incorporated On January 2 2015 With PDFLet's Talk With HassanNo ratings yet

- Chapter 01 Review QuestionsDocument3 pagesChapter 01 Review QuestionsjosemanuelNo ratings yet

- Chapter 1 - Session 1Document3 pagesChapter 1 - Session 1Subhankar PatraNo ratings yet

- Quizzer - IaDocument2 pagesQuizzer - IajeffreeNo ratings yet

- Name SectionDocument9 pagesName SectionbenuocdayNo ratings yet

- Advanced Auditing: T I C A PDocument4 pagesAdvanced Auditing: T I C A PDanish KhanNo ratings yet

- BUS 211 - Ch. 3 - Week 6Document37 pagesBUS 211 - Ch. 3 - Week 6memeaaNo ratings yet

- Reviewer ErrorDocument13 pagesReviewer ErrorPatriciaSamaritaNo ratings yet

- Tutorial 1 AFAR MMUDocument2 pagesTutorial 1 AFAR MMUyuyin.gohyyNo ratings yet

- Auditing Problems: Problem 1Document4 pagesAuditing Problems: Problem 1Krizelle Jo MarquezNo ratings yet

- Uj 32635+SOURCE1+SOURCE1.1Document22 pagesUj 32635+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- 13 Accounting Cycle of A Service Business 2Document28 pages13 Accounting Cycle of A Service Business 2Ashley Judd Mallonga Beran60% (5)

- 01 Accounting StatementsDocument4 pages01 Accounting StatementsTijana DoberšekNo ratings yet

- Final Exam Paper (C) 2020.11 OpenDocument3 pagesFinal Exam Paper (C) 2020.11 OpenKshitiz NeupaneNo ratings yet

- Chapter 3 Quick StudyDocument10 pagesChapter 3 Quick StudyPhạm Hồng Trang Alice -No ratings yet

- At The End of The Current Year Jodi Corporation S ControllerDocument1 pageAt The End of The Current Year Jodi Corporation S ControllerTaimur TechnologistNo ratings yet

- Injection Plastics Company Has Been Operating For Three Years ADocument1 pageInjection Plastics Company Has Been Operating For Three Years AM Bilal SaleemNo ratings yet

- CA AccountingDocument115 pagesCA Accountingamitblair007100% (8)

- CHAPTER 10 - PROPERTY, PLANT AND EQUIPMENT (v2)Document20 pagesCHAPTER 10 - PROPERTY, PLANT AND EQUIPMENT (v2)VerrelyNo ratings yet

- Chapter 8 Long Lived Assets - SolutionsDocument102 pagesChapter 8 Long Lived Assets - SolutionsKate SandersNo ratings yet

- Effects of Business TransactionsDocument4 pagesEffects of Business TransactionsP leeNo ratings yet

- Final Exam BSC 2nd 2020Document3 pagesFinal Exam BSC 2nd 2020NadeemNo ratings yet

- Accounting For ErrorsDocument16 pagesAccounting For ErrorsDarynn F. LinggonNo ratings yet

- Aud and atDocument21 pagesAud and atVtgNo ratings yet

- PS 2 Spring 2021Document5 pagesPS 2 Spring 2021sybiltan123No ratings yet

- Microsoft Word - In-Class Exercise Chapter 7 - RevisedDocument12 pagesMicrosoft Word - In-Class Exercise Chapter 7 - RevisedAndaman BunjongkarnNo ratings yet

- Tutorial 13 & 14 (Exercise)Document2 pagesTutorial 13 & 14 (Exercise)Vidya IntaniNo ratings yet

- KTQT Eng 1Document9 pagesKTQT Eng 1Huỳnh Như PhạmNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- Account Statement For Account:1305001500145782: Branch DetailsDocument6 pagesAccount Statement For Account:1305001500145782: Branch DetailsShubham RoyNo ratings yet

- Mary Jo Woodall Arrest Warrant AffidavitDocument15 pagesMary Jo Woodall Arrest Warrant AffidavitMark LisheronNo ratings yet

- Unit-2 Sums SheetDocument8 pagesUnit-2 Sums SheetAstha ParmanandkaNo ratings yet

- DPB20033 Workbook Chapter 1 Intro MacroDocument17 pagesDPB20033 Workbook Chapter 1 Intro MacroRozilaNo ratings yet

- Why Cambodia Guide, Introduction To Asia's Emerging Real Estate EconomyDocument42 pagesWhy Cambodia Guide, Introduction To Asia's Emerging Real Estate EconomyAnani SongNo ratings yet

- Startup KoreaDocument3 pagesStartup KoreaPeter AnnorNo ratings yet

- COA CIRCULAR NO. 2023 008 August 17 2023Document14 pagesCOA CIRCULAR NO. 2023 008 August 17 2023Leah FlorentinoNo ratings yet

- Old MembersDocument50 pagesOld MemberssNo ratings yet

- Pag Ibig Foreclosed Properties Pubbid 2017 06 30 NCR No Discount PDFDocument23 pagesPag Ibig Foreclosed Properties Pubbid 2017 06 30 NCR No Discount PDFmarcoNo ratings yet

- Ostvareni Saobraćaj: Korisnik: Danijela Kanalaš Račun: Novembar 2023Document15 pagesOstvareni Saobraćaj: Korisnik: Danijela Kanalaš Račun: Novembar 2023tp4z4wkwgxNo ratings yet

- Aracanut Plates 10 LakhsDocument19 pagesAracanut Plates 10 LakhsManju MysoreNo ratings yet

- Vijayawada Municipal Corporation: OriginalDocument4 pagesVijayawada Municipal Corporation: Originallakshmiteja105_18319No ratings yet

- Applied Economics - Lesson 2Document48 pagesApplied Economics - Lesson 2Ma Nicole Ann ManteleNo ratings yet

- Economic Turbulence in GreeceDocument9 pagesEconomic Turbulence in GreeceSatish BindumadhavanNo ratings yet

- TT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarDocument5 pagesTT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarNGỌC ĐIỆP TRẦNNo ratings yet

- Gordie Howe International BridgeDocument10 pagesGordie Howe International BridgeMehmetNo ratings yet

- Business Plan (Sample 2)Document50 pagesBusiness Plan (Sample 2)sajetha sezliyanNo ratings yet

- Recent Updated Citibank Account Statement-20220417 To 20221014 - UnlockedDocument22 pagesRecent Updated Citibank Account Statement-20220417 To 20221014 - UnlockedMayank YadavNo ratings yet

- Assessing Challenges and Opportunities of Telebirr Services (6)Document23 pagesAssessing Challenges and Opportunities of Telebirr Services (6)yonas zelekeNo ratings yet

- UTR Registration BY POSTDocument5 pagesUTR Registration BY POSTMadalina Maria MNo ratings yet

- Business Incubation in South AfricaDocument21 pagesBusiness Incubation in South AfricasabetaliNo ratings yet

- SMIF Annual Report 2010-2011Document40 pagesSMIF Annual Report 2010-2011CelticAcesNo ratings yet

- Company Trade DataDocument3 pagesCompany Trade DataVivek DomadiaNo ratings yet

- Economics Assignment1Document67 pagesEconomics Assignment1tamam hajiNo ratings yet

- SEBI (Prohibition of Insider Trading) Regulations, 2015 - Taxguru - inDocument13 pagesSEBI (Prohibition of Insider Trading) Regulations, 2015 - Taxguru - inshubhendra mishraNo ratings yet

- Pawan Project-1Document56 pagesPawan Project-1pawan vermaNo ratings yet

- Top Business Books of All TimeDocument5 pagesTop Business Books of All Timechandel08No ratings yet

Error Correction Entries The First Audit of The Books of PDF

Error Correction Entries The First Audit of The Books of PDF

Uploaded by

Anbu jaromiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Error Correction Entries The First Audit of The Books of PDF

Error Correction Entries The First Audit of The Books of PDF

Uploaded by

Anbu jaromiaCopyright:

Available Formats

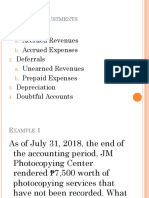

Error Correction Entries the first audit of the books of

Error Correction Entries the first audit of the books of Fennimore Company was made for the

year ended December 31, 2010. In examining the books, the auditor found that certain items

had been overlooked or incorrectly handled in the last 3 years. These items are:1. At the

beginning of 2008, the company purchased a machine for $510,000 (salvage value of $51,000)

that had a useful life of 5 years. The bookkeeper used straight-line depreciation, but failed to

deduct the salvage value in computing the depreciation base for the 3 years.2. At the end of

2009, the company failed to accrue sales salaries of $45,000.3. A tax lawsuit that involved the

year 2008 was settled late in 2010. It was determined that the company owed an additional

$85,000 in taxes related to 2008. The company did not record a liability in 2008 or 2009

because the possibility of loss was considered remote, and debited the $85,000 to a loss

account in 2010 and credited Cash for the same amount.4. Fennimore Company purchased a

copyright from another company early in 2008 for $50,000. Fennimore had not amortized the

copyright because its value had not diminished. The copyright has a useful life at purchase of

20 years.5. In 2010, the company wrote off $87,000 of inventory considered to be obsolete; this

loss was charged directly to Retained Earnings and credited to Inventory.Prepare the journal

entries necessary in 2010 to correct the books, assuming that the books have not been closed.

Disregard effects of corrections on income tax.View Solution:

Error Correction Entries the first audit of the books of

SOLUTION-- http://accountinginn.online/downloads/error-correction-entries-the-first-audit-of-the-

books-of/

For Solutions Visit accountinginn.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- David Bornstein - How To Change The World - Social Entrepreneurs and The Power of New Ideas-Oxford University Press (2007) (001-100)Document100 pagesDavid Bornstein - How To Change The World - Social Entrepreneurs and The Power of New Ideas-Oxford University Press (2007) (001-100)Ari Indarto78% (9)

- Wells Fargo Everyday Checking: Important Account InformationDocument4 pagesWells Fargo Everyday Checking: Important Account InformationPatricia100% (2)

- Gulf Oil TakeoverDocument9 pagesGulf Oil Takeoverkumar.kunal0% (2)

- Acct101 Financial Accounting: Instructions To CandidatesDocument26 pagesAcct101 Financial Accounting: Instructions To CandidatesYing Sheng ÖNo ratings yet

- W7 CMA SampleEssayQuestionsDocument11 pagesW7 CMA SampleEssayQuestionsLouieNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Error Analysis and Correcting Entry You Have Been Engaged To PDFDocument1 pageError Analysis and Correcting Entry You Have Been Engaged To PDFAnbu jaromiaNo ratings yet

- Trafflet Enterprises Incorporated On May 3 2011 The Company EngagedDocument1 pageTrafflet Enterprises Incorporated On May 3 2011 The Company EngagedAmit PandeyNo ratings yet

- AS Advanced Audit Assurance May June 2012Document4 pagesAS Advanced Audit Assurance May June 2012Laskar REAZNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesShang BugayongNo ratings yet

- On May 5 2012 You Were Hired by Gavin Inc PDFDocument1 pageOn May 5 2012 You Were Hired by Gavin Inc PDFFreelance WorkerNo ratings yet

- ch1 8 5eDocument9 pagesch1 8 5eJean Pierre HitimanaNo ratings yet

- Soal Asistensi Special EditionDocument6 pagesSoal Asistensi Special EditionEden ZaristaNo ratings yet

- Sample Exam Acc 3100Document10 pagesSample Exam Acc 3100abdul235No ratings yet

- FABM1 LP SET 2.aDocument10 pagesFABM1 LP SET 2.aJC RoblesNo ratings yet

- 1st Mid Term Exam Spring 2013Document4 pages1st Mid Term Exam Spring 2013SarahZeidatNo ratings yet

- A Company Must Record Its Expenses Incurred To Generate TheDocument9 pagesA Company Must Record Its Expenses Incurred To Generate TheNguyen Hoai Linh (K15 HL)No ratings yet

- Home Office, Branch, & Agency AccountingDocument13 pagesHome Office, Branch, & Agency AccountingGround ZeroNo ratings yet

- Audit & Assurance - Ja-2023 - QuestionDocument5 pagesAudit & Assurance - Ja-2023 - QuestionMd Jakaria Md JakariaNo ratings yet

- Individual AssignmentDocument2 pagesIndividual AssignmentmuhaNo ratings yet

- Past Exam PaperDocument6 pagesPast Exam Paperprecious mountainsNo ratings yet

- Advance Stage May June 2012 - AllDocument27 pagesAdvance Stage May June 2012 - AllSHEIKH MOHAMMAD KAUSARUL ALAMNo ratings yet

- 0 - Revision Batch Compilation Sept 18 Only As Questions-1 PDFDocument14 pages0 - Revision Batch Compilation Sept 18 Only As Questions-1 PDFKunal DhepleNo ratings yet

- You Are The Auditor of Vegatron Services Inc A Privately PDFDocument1 pageYou Are The Auditor of Vegatron Services Inc A Privately PDFHassan JanNo ratings yet

- ACCA F8 Revision Mock December 2011 QUESTIONSDocument6 pagesACCA F8 Revision Mock December 2011 QUESTIONSPomri EllisNo ratings yet

- Discontinued Operations Acctg. Test BankDocument12 pagesDiscontinued Operations Acctg. Test BankDalrymple CasballedoNo ratings yet

- Accounting Principles I - Online: Chapters 3 & 4 - Exam - Part IIDocument7 pagesAccounting Principles I - Online: Chapters 3 & 4 - Exam - Part IILouie CraneNo ratings yet

- Comprehensive Accounting Change and Error Analysis Problem Botti PDFDocument1 pageComprehensive Accounting Change and Error Analysis Problem Botti PDFAnbu jaromiaNo ratings yet

- Katie Company Had Three Intangible Assets at The End ofDocument1 pageKatie Company Had Three Intangible Assets at The End ofM Bilal SaleemNo ratings yet

- A Building That Was Purchased December 31Document2 pagesA Building That Was Purchased December 31muhaNo ratings yet

- P7int 2009 Dec Q PDFDocument8 pagesP7int 2009 Dec Q PDFhiruspoonNo ratings yet

- CH 09 In-Class Problems - Fall 2013Document4 pagesCH 09 In-Class Problems - Fall 2013StephNo ratings yet

- You Are Auditing The December 31 2011 Financial Statements PDFDocument1 pageYou Are Auditing The December 31 2011 Financial Statements PDFAnbu jaromiaNo ratings yet

- The Equitee Corporation Was Incorporated On January 2 2015 With PDFDocument1 pageThe Equitee Corporation Was Incorporated On January 2 2015 With PDFLet's Talk With HassanNo ratings yet

- Chapter 01 Review QuestionsDocument3 pagesChapter 01 Review QuestionsjosemanuelNo ratings yet

- Chapter 1 - Session 1Document3 pagesChapter 1 - Session 1Subhankar PatraNo ratings yet

- Quizzer - IaDocument2 pagesQuizzer - IajeffreeNo ratings yet

- Name SectionDocument9 pagesName SectionbenuocdayNo ratings yet

- Advanced Auditing: T I C A PDocument4 pagesAdvanced Auditing: T I C A PDanish KhanNo ratings yet

- BUS 211 - Ch. 3 - Week 6Document37 pagesBUS 211 - Ch. 3 - Week 6memeaaNo ratings yet

- Reviewer ErrorDocument13 pagesReviewer ErrorPatriciaSamaritaNo ratings yet

- Tutorial 1 AFAR MMUDocument2 pagesTutorial 1 AFAR MMUyuyin.gohyyNo ratings yet

- Auditing Problems: Problem 1Document4 pagesAuditing Problems: Problem 1Krizelle Jo MarquezNo ratings yet

- Uj 32635+SOURCE1+SOURCE1.1Document22 pagesUj 32635+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- 13 Accounting Cycle of A Service Business 2Document28 pages13 Accounting Cycle of A Service Business 2Ashley Judd Mallonga Beran60% (5)

- 01 Accounting StatementsDocument4 pages01 Accounting StatementsTijana DoberšekNo ratings yet

- Final Exam Paper (C) 2020.11 OpenDocument3 pagesFinal Exam Paper (C) 2020.11 OpenKshitiz NeupaneNo ratings yet

- Chapter 3 Quick StudyDocument10 pagesChapter 3 Quick StudyPhạm Hồng Trang Alice -No ratings yet

- At The End of The Current Year Jodi Corporation S ControllerDocument1 pageAt The End of The Current Year Jodi Corporation S ControllerTaimur TechnologistNo ratings yet

- Injection Plastics Company Has Been Operating For Three Years ADocument1 pageInjection Plastics Company Has Been Operating For Three Years AM Bilal SaleemNo ratings yet

- CA AccountingDocument115 pagesCA Accountingamitblair007100% (8)

- CHAPTER 10 - PROPERTY, PLANT AND EQUIPMENT (v2)Document20 pagesCHAPTER 10 - PROPERTY, PLANT AND EQUIPMENT (v2)VerrelyNo ratings yet

- Chapter 8 Long Lived Assets - SolutionsDocument102 pagesChapter 8 Long Lived Assets - SolutionsKate SandersNo ratings yet

- Effects of Business TransactionsDocument4 pagesEffects of Business TransactionsP leeNo ratings yet

- Final Exam BSC 2nd 2020Document3 pagesFinal Exam BSC 2nd 2020NadeemNo ratings yet

- Accounting For ErrorsDocument16 pagesAccounting For ErrorsDarynn F. LinggonNo ratings yet

- Aud and atDocument21 pagesAud and atVtgNo ratings yet

- PS 2 Spring 2021Document5 pagesPS 2 Spring 2021sybiltan123No ratings yet

- Microsoft Word - In-Class Exercise Chapter 7 - RevisedDocument12 pagesMicrosoft Word - In-Class Exercise Chapter 7 - RevisedAndaman BunjongkarnNo ratings yet

- Tutorial 13 & 14 (Exercise)Document2 pagesTutorial 13 & 14 (Exercise)Vidya IntaniNo ratings yet

- KTQT Eng 1Document9 pagesKTQT Eng 1Huỳnh Như PhạmNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- Account Statement For Account:1305001500145782: Branch DetailsDocument6 pagesAccount Statement For Account:1305001500145782: Branch DetailsShubham RoyNo ratings yet

- Mary Jo Woodall Arrest Warrant AffidavitDocument15 pagesMary Jo Woodall Arrest Warrant AffidavitMark LisheronNo ratings yet

- Unit-2 Sums SheetDocument8 pagesUnit-2 Sums SheetAstha ParmanandkaNo ratings yet

- DPB20033 Workbook Chapter 1 Intro MacroDocument17 pagesDPB20033 Workbook Chapter 1 Intro MacroRozilaNo ratings yet

- Why Cambodia Guide, Introduction To Asia's Emerging Real Estate EconomyDocument42 pagesWhy Cambodia Guide, Introduction To Asia's Emerging Real Estate EconomyAnani SongNo ratings yet

- Startup KoreaDocument3 pagesStartup KoreaPeter AnnorNo ratings yet

- COA CIRCULAR NO. 2023 008 August 17 2023Document14 pagesCOA CIRCULAR NO. 2023 008 August 17 2023Leah FlorentinoNo ratings yet

- Old MembersDocument50 pagesOld MemberssNo ratings yet

- Pag Ibig Foreclosed Properties Pubbid 2017 06 30 NCR No Discount PDFDocument23 pagesPag Ibig Foreclosed Properties Pubbid 2017 06 30 NCR No Discount PDFmarcoNo ratings yet

- Ostvareni Saobraćaj: Korisnik: Danijela Kanalaš Račun: Novembar 2023Document15 pagesOstvareni Saobraćaj: Korisnik: Danijela Kanalaš Račun: Novembar 2023tp4z4wkwgxNo ratings yet

- Aracanut Plates 10 LakhsDocument19 pagesAracanut Plates 10 LakhsManju MysoreNo ratings yet

- Vijayawada Municipal Corporation: OriginalDocument4 pagesVijayawada Municipal Corporation: Originallakshmiteja105_18319No ratings yet

- Applied Economics - Lesson 2Document48 pagesApplied Economics - Lesson 2Ma Nicole Ann ManteleNo ratings yet

- Economic Turbulence in GreeceDocument9 pagesEconomic Turbulence in GreeceSatish BindumadhavanNo ratings yet

- TT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarDocument5 pagesTT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarNGỌC ĐIỆP TRẦNNo ratings yet

- Gordie Howe International BridgeDocument10 pagesGordie Howe International BridgeMehmetNo ratings yet

- Business Plan (Sample 2)Document50 pagesBusiness Plan (Sample 2)sajetha sezliyanNo ratings yet

- Recent Updated Citibank Account Statement-20220417 To 20221014 - UnlockedDocument22 pagesRecent Updated Citibank Account Statement-20220417 To 20221014 - UnlockedMayank YadavNo ratings yet

- Assessing Challenges and Opportunities of Telebirr Services (6)Document23 pagesAssessing Challenges and Opportunities of Telebirr Services (6)yonas zelekeNo ratings yet

- UTR Registration BY POSTDocument5 pagesUTR Registration BY POSTMadalina Maria MNo ratings yet

- Business Incubation in South AfricaDocument21 pagesBusiness Incubation in South AfricasabetaliNo ratings yet

- SMIF Annual Report 2010-2011Document40 pagesSMIF Annual Report 2010-2011CelticAcesNo ratings yet

- Company Trade DataDocument3 pagesCompany Trade DataVivek DomadiaNo ratings yet

- Economics Assignment1Document67 pagesEconomics Assignment1tamam hajiNo ratings yet

- SEBI (Prohibition of Insider Trading) Regulations, 2015 - Taxguru - inDocument13 pagesSEBI (Prohibition of Insider Trading) Regulations, 2015 - Taxguru - inshubhendra mishraNo ratings yet

- Pawan Project-1Document56 pagesPawan Project-1pawan vermaNo ratings yet

- Top Business Books of All TimeDocument5 pagesTop Business Books of All Timechandel08No ratings yet