Professional Documents

Culture Documents

In Each of The Following Independent Situations Decide Whether The

In Each of The Following Independent Situations Decide Whether The

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In Each of The Following Independent Situations Decide Whether The

In Each of The Following Independent Situations Decide Whether The

Uploaded by

trilocksp SinghCopyright:

Available Formats

In each of the following independent situations decide

whether the

In each of the following independent situations, decide whether the business organization

should treat the person being paid as an employee and should withhold social security,

Medicare, and employee income taxes from the payment made.1. Tiny Jacobs owns and

operates a cigar shop as a sole proprietor. Jacobs withdraws $2,000 a week from the cigar

shop.2. Sam Brandon is a court reporter. He has an office at the Metro Court Reporting Center

but pays no rent. The manager of the center receives requests from attorneys for court reporters

to take depositions at legal hearings. The manager then chooses a court reporter who best

meets the needs of the client and contacts the court reporter chosen. The court reporter has the

right to refuse to take on the job, and the court reporter controls his or her working hours and

days.Clients make payments to the center, which deducts a 25 percent fee for providing

facilities and rendering services to support the court reporter. The balance is paid to the court

reporter.During the current month, the center collected fees of $40,000 for Brandon, deducted

$10,000 for the center's fee, and remitted the remainder to Brandon.3. Ken, a registered nurse,

has retired from full-time work. However, because of his experience and special skills, on each

Monday, Wednesday, and Thursday afternoon he assists Dr. Grace Sue, a dermatologist. Ken

is paid an hourly fee by Dr. Sue. During the current week, his hourly fees totaled $700.4. After

working several years as an editor for a trade magazine, Lisa quit her job to stay at home with

her two small children. Later, the magazine asked her to work in her home performing editorial

work as needed. Lisa is paid an hourly fee for the work she performs. In some cases, she goes

to the company's offices to pick up or return a manuscript. In other cases the firm sends a

manuscript to her, or she returns one by e-mail. During the current month, Lisa's hourly

earnings totaled $1,500.5. Investor Corporation carries on very little business activity. It merely

holds land and certain assets. The board of directors has concluded that it needs no

employees. It has decided instead to pay David John, one of the shareholders, a consulting fee

of $12,000 per year to serve as president, secretary, and treasurer and to manage all the affairs

of the company. John spends an average of one hour per week on the corporation's business

affairs. However, his fee is fixed regardless of how few or how many hours he works.Analyze:

What characteristics do the persons you identified as "employees" have in common?View

Solution: In each of the following independent situations decide whether the

SOLUTION-- http://solutiondone.online/downloads/in-each-of-the-following-independent-

situations-decide-whether-the/

Unlock answers here solutiondone.online

You might also like

- Foreign Exchange Hedging Strategies at General MotorsDocument7 pagesForeign Exchange Hedging Strategies at General MotorsYun Clare Yang0% (1)

- Business Ethics ExerciseDocument4 pagesBusiness Ethics Exercisedeltsen0% (3)

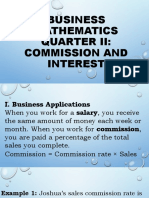

- Business Math 2nd Quarter Module #2Document34 pagesBusiness Math 2nd Quarter Module #2John Lloyd Regala100% (5)

- Homework (AC 423) CHP 5&6 - Loh Yi ChengDocument12 pagesHomework (AC 423) CHP 5&6 - Loh Yi ChengDavid LohNo ratings yet

- ME-Tut 4Document2 pagesME-Tut 4Shekhar SinghNo ratings yet

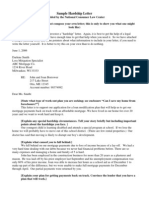

- Foreclose Hardship LetterDocument3 pagesForeclose Hardship LetterHarly SollanoNo ratings yet

- Branch Details:: Account Statement For The Account: 7997000100055573Document6 pagesBranch Details:: Account Statement For The Account: 7997000100055573Parth YadavNo ratings yet

- Marcopolo:: The Making of A Global LatinaDocument3 pagesMarcopolo:: The Making of A Global LatinaShachin Shibi100% (2)

- Julia Dumars Is A Licensed CPA During The First Month: Unlock Answers Here Solutiondone - OnlineDocument1 pageJulia Dumars Is A Licensed CPA During The First Month: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Private Family FoundationsDocument5 pagesPrivate Family Foundationsapi-246909910100% (4)

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- FedEx Project ReportDocument11 pagesFedEx Project ReportRameez Riaz100% (1)

- Internal Controls and Fraud - Case Study - Tools 2012Document1 pageInternal Controls and Fraud - Case Study - Tools 2012Yus CeballosNo ratings yet

- Topic 2 Practice QuestionDocument4 pagesTopic 2 Practice Questionaarzu dangiNo ratings yet

- Assignment 1Document8 pagesAssignment 1SaidurRahamanNo ratings yet

- Assignment Accounting Chapter 1Document7 pagesAssignment Accounting Chapter 1Aarya Aust100% (1)

- Ujian Akhir - Program Profesi Akuntansi Take Home Studi Kasus: Perumahan Bagi para Pemuda (Youths)Document2 pagesUjian Akhir - Program Profesi Akuntansi Take Home Studi Kasus: Perumahan Bagi para Pemuda (Youths)Widyani Indah DewantiNo ratings yet

- Tutorial Solution Chap 5Document4 pagesTutorial Solution Chap 5Nurul AriffahNo ratings yet

- Download: Acc 307 Final Exam Part 1Document2 pagesDownload: Acc 307 Final Exam Part 1AlexNo ratings yet

- Exercises Chapter 23Document13 pagesExercises Chapter 23Le TrungNo ratings yet

- 04 NP Chap 04 General Deduction Formula Additional Questions 2022Document5 pages04 NP Chap 04 General Deduction Formula Additional Questions 2022xgnz1630No ratings yet

- Dr. Jones Case StudyDocument2 pagesDr. Jones Case StudyHaironezza AbdullahNo ratings yet

- Business Mathematics Week 2Document37 pagesBusiness Mathematics Week 2Jewel Joy PudaNo ratings yet

- Reasonable CompensationDocument44 pagesReasonable Compensationqbo.bestarionNo ratings yet

- Assignment 2Document1 pageAssignment 2NFL MarketingNo ratings yet

- Letter of Explanation 39Document3 pagesLetter of Explanation 39Nahiduzzaman NahidNo ratings yet

- Fast Bucks Case StudyDocument4 pagesFast Bucks Case StudyLaddi BoparaiNo ratings yet

- Accounting For SubsidiaryDocument2 pagesAccounting For SubsidiaryNafis Hasan0% (1)

- Assignment Qs 1 - Journalization and PostingDocument2 pagesAssignment Qs 1 - Journalization and PostingShehzad Qureshi100% (1)

- Actg 470-HW #1Document3 pagesActg 470-HW #1Brittany Neilson0% (1)

- FA Skill Review SheetDocument6 pagesFA Skill Review Sheetludy louisNo ratings yet

- Kaitlin Loughran - The Power of Compound Interest AssignmentDocument3 pagesKaitlin Loughran - The Power of Compound Interest Assignmentapi-524390398No ratings yet

- Accounting-Assignment 1Document4 pagesAccounting-Assignment 1Maryam AlmazroueiNo ratings yet

- Financial Plan: 1. PayrollDocument3 pagesFinancial Plan: 1. Payrollle nghiNo ratings yet

- Kilimanjaro Inc Began Operations On January 6 2007 With TheDocument2 pagesKilimanjaro Inc Began Operations On January 6 2007 With TheM Bilal SaleemNo ratings yet

- Project IntroductionsDocument5 pagesProject IntroductionsAbhay SharmaNo ratings yet

- Comm Corona Virus Smallbiz Loan FinalDocument4 pagesComm Corona Virus Smallbiz Loan Finaljn323iNo ratings yet

- In The Financial IndustryDocument2 pagesIn The Financial IndustrySoninder KaurNo ratings yet

- ENTREPRENEURSHIPDocument1 pageENTREPRENEURSHIPMomoh PessimaNo ratings yet

- Tutorial 1 Question and SolutionDocument4 pagesTutorial 1 Question and SolutionShumail AkhundNo ratings yet

- Kofi Royale Case StudyDocument2 pagesKofi Royale Case StudyChintu WatwaniNo ratings yet

- Quiz Present Value at Compounded Interest and AnnuityDocument1 pageQuiz Present Value at Compounded Interest and AnnuityTessa AriateNo ratings yet

- Comm Corona Virus Smallbiz Loan Final Revised PDFDocument4 pagesComm Corona Virus Smallbiz Loan Final Revised PDFAlex LinNo ratings yet

- Chapter 1 - Some Basic QuestionsDocument6 pagesChapter 1 - Some Basic QuestionsBracu 2023No ratings yet

- Comparative Analysis of SBI & HDFC Bank Regarding Personal LoanDocument6 pagesComparative Analysis of SBI & HDFC Bank Regarding Personal LoanAkhil MohantyNo ratings yet

- This Service Is Free To All Our Custom Ers:) .: Self Employed Personsresident Indiansnrimerchant NavyDocument3 pagesThis Service Is Free To All Our Custom Ers:) .: Self Employed Personsresident Indiansnrimerchant Navyrahul_goel2No ratings yet

- Bio Engineering Inc Began Operations On January 2 2012 WithDocument2 pagesBio Engineering Inc Began Operations On January 2 2012 WithM Bilal SaleemNo ratings yet

- Finance HWMDocument5 pagesFinance HWMmobinil1No ratings yet

- ACU CaseDocument7 pagesACU CasePortgas D WeanNo ratings yet

- CH 02Document6 pagesCH 02Celine LescanoNo ratings yet

- ACC501 Tutorial Week 4Document3 pagesACC501 Tutorial Week 4Roy GastroNo ratings yet

- Week 1 Business Math 1Document12 pagesWeek 1 Business Math 1Marissa Corral MatabiaNo ratings yet

- Nguyen Hai Yen - 11195894 - Hww4Document2 pagesNguyen Hai Yen - 11195894 - Hww4Hải Yến NguyễnNo ratings yet

- How Are Notes Payable Different From Accounts Payable?Document3 pagesHow Are Notes Payable Different From Accounts Payable?Ellaine Pearl AlmillaNo ratings yet

- How Are Notes Payable Different From Accounts Payable?Document3 pagesHow Are Notes Payable Different From Accounts Payable?Ellaine Pearl AlmillaNo ratings yet

- Crystal Blue Condominiums Resident Handbook Page 1 of 6Document6 pagesCrystal Blue Condominiums Resident Handbook Page 1 of 6maidieulinh156No ratings yet

- Ben Carter - Foreclosure Continuing Legal EducationDocument48 pagesBen Carter - Foreclosure Continuing Legal EducationGlenn AugensteinNo ratings yet

- How Does A Holding Company WorkDocument6 pagesHow Does A Holding Company WorkDenardConwiBesa100% (2)

- Closer Script LiDocument4 pagesCloser Script LiShiva Narayana Reddy100% (1)

- Mock Exam-BTF3601Document3 pagesMock Exam-BTF3601Overflag0% (1)

- Slandour & Co. in Relation To This Matter. The Purpose of This Letter Is To Outline My Advices inDocument3 pagesSlandour & Co. in Relation To This Matter. The Purpose of This Letter Is To Outline My Advices inDavid HumphreysNo ratings yet

- Part A - Written or Oral QuestionsDocument5 pagesPart A - Written or Oral Questionswilson garzonNo ratings yet

- Ca$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondFrom EverandCa$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Enquiries: 1. Enquiry From A Retailer To A Foreign ManufacturerDocument21 pagesEnquiries: 1. Enquiry From A Retailer To A Foreign ManufacturerVy KhánhNo ratings yet

- Project Muse 72118-2487766Document28 pagesProject Muse 72118-2487766ivan jaramilloNo ratings yet

- Profitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089Document19 pagesProfitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089PradeepNo ratings yet

- B-Law311 - Midterm Examination Bold: 3 Wrong Answers (Excluding Essay)Document7 pagesB-Law311 - Midterm Examination Bold: 3 Wrong Answers (Excluding Essay)Joana TrinidadNo ratings yet

- TeaDocument51 pagesTeaSunil MathewsNo ratings yet

- Form II (Central) LL Renewal ApplicationDocument1 pageForm II (Central) LL Renewal Applicationsaravanan ssNo ratings yet

- Fiches CFA Level I - Ethics Mais Pas SeulementDocument19 pagesFiches CFA Level I - Ethics Mais Pas SeulementIkimasukaNo ratings yet

- Accountancy@UJ - Newsletter - 2012Document21 pagesAccountancy@UJ - Newsletter - 2012UJAccountancyNo ratings yet

- Quiz Week 2 No AnswerDocument10 pagesQuiz Week 2 No AnswerKatherine EderosasNo ratings yet

- Unit 5 Topic 1 Intro of Financial AnalysisDocument4 pagesUnit 5 Topic 1 Intro of Financial AnalysisYash goyalNo ratings yet

- Disparity in Earning Based On Gender - Edited.editedDocument23 pagesDisparity in Earning Based On Gender - Edited.editedJohnNo ratings yet

- Unit 2 - Economic EnvironmentDocument50 pagesUnit 2 - Economic EnvironmentVaibhav AggarwalNo ratings yet

- MR Muhammad Rafeek Offer Letter DomDocument2 pagesMR Muhammad Rafeek Offer Letter Domhzaib768No ratings yet

- Michael Jacque Automotive RV General Manager ResumeDocument2 pagesMichael Jacque Automotive RV General Manager ResumemichaeljacqueNo ratings yet

- FMS Delhi Placement Brochure PDFDocument36 pagesFMS Delhi Placement Brochure PDFpramesh prameshNo ratings yet

- Income From Salary Chapter QuestionsDocument5 pagesIncome From Salary Chapter Questionsanon_595315274100% (1)

- Employee Motivation and Performance Do The Work enDocument13 pagesEmployee Motivation and Performance Do The Work enMOUSSA KEITANo ratings yet

- Answers:: Assignment # 1Document2 pagesAnswers:: Assignment # 1pamela dequillamorteNo ratings yet

- AccHor 7e CH 14Document22 pagesAccHor 7e CH 14Muh BilalNo ratings yet

- Financial Institutions and InvestmentDocument3 pagesFinancial Institutions and Investmenttarekegn gezahegnNo ratings yet

- K04420030120154040K0442 - MetKuan-Inventory ModelsDocument53 pagesK04420030120154040K0442 - MetKuan-Inventory ModelsAdrian TanuwijayaNo ratings yet

- Discussion Forum Unit 5Document2 pagesDiscussion Forum Unit 5Firew AberaNo ratings yet

- Internship Report PELDocument60 pagesInternship Report PELsara-bashir-8426No ratings yet

- Moldova CEMDocument122 pagesMoldova CEMOlga SicoraNo ratings yet

- Myriad Needs - QPG Solution!: 3M India LimitedDocument62 pagesMyriad Needs - QPG Solution!: 3M India LimitedSavitha ChinnaduraiNo ratings yet

- Seminar TopicsDocument2 pagesSeminar Topicspammy313No ratings yet