Professional Documents

Culture Documents

Bank Performance Analysis

Bank Performance Analysis

Uploaded by

Surbhî GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Performance Analysis

Bank Performance Analysis

Uploaded by

Surbhî GuptaCopyright:

Available Formats

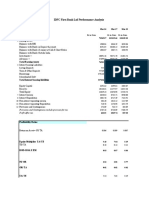

Bank Performance Analysis - HDFC bank

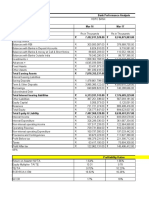

PROFITABILITY ANALYSIS

Mar-16 Mar-17

Rs in Crore Rs in Crore

1 Total Assets 7,408,899.40 8,639,616.90

2 Earning Assets

Balances with RBI 300,583,087.00 378,968,755.00

Balances with Banks in Deposit Accounts 6,824,510.00 9,716,581.00

Balances with Banks & money at Call & Short Notice 88,605,293.00 110,552,196.00

Balances with Banks Outside India 78,040,290.00 98,757,385.00

Investments + 1,958,362.90 2,144,633.50

Advances + 4,645,939.60 5,545,682.00

Total Earning Assets 480,657,482.50 605,685,232.50

3 Interest bearing Liabilities 464,593.96 554,568.20

Saving Deposits 1,478,861.80 1,935,786.30

Term & Other Deposits 3,101,133.40 3,344,871.70

Borrowings 849,689.90 740,288.70

Subordinated Debt 144,279.00 131,820.00

Total Interest bearing liabilities 6,038,558.06 6,707,334.90

Equity Capital 5,056.40 5,125.10

Reserves 721,721.40 889,498.50

Total Equity 726,777.80 894,623.60

5 Interest Income 600,394.20 690,493.20

6 Interest Expenditure 326,299.30 361,667.40

10 Non-interest operating income 112,116,541.00 128,776,329.00

11 Non-interest operating Expenditure 178,318,808.00 207,510,707.00

12 Provisions and Contingencies 90,673,223.00 120,689,285.00

Provisions and Contingencies include provision for tax

Profit After tax 122,962.10 145,496.40

otherexpeses 65,730,016.00 78,762,012.00

other income 10,751.72 12,296.49

Intrest income 60,221.45 69,305.96

Intrest expense 32,629.93 36,166.74

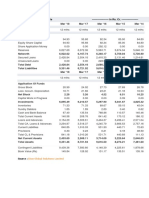

Profitability Ratios

Return on Assets= NI/ TA 1.66% 1.68%

Equity Multiplier TA/ TE 10.19 9.66

TE/ TA 0.10 0.10

ROE=ROA X EM 16.92% 16.26%

NI/ OR 0.20 0.21

OR/ TA 0.08 0.08

TA/ TE 10.19 9.66

(II - IE)/ TA 0.04 0.04

(OI-OE)/ TA

Provisions/TA 12.24 13.97

ROA 1.92% 1.88%

(II- IE)/E A 0.06% 0.05%

EA/ TA 64.88 70.11

(II - IE)/ TA 0.37% 0.38%

NIM 4.30% 4.30%

II/ EA 0.01% 0.01%

IE/ Intt Bearing Liab

Intt Bearing Liabilities/ EA

Spread

Efficiency ratio= Non intt exp/ (Net Interest Income+Non intt income)

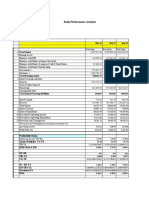

Risk Ratios

Liquidity Risk= Short term securities/ Deposits

Interest Rate Risk = Interest Sensitive Assets/ Interest Sensitive Liabili hota hai kuch

Credit Risk = Provisioning / Assets 0.0004 0.0004

Capital Risk = Capital / Assets 0.001 0.001

Leverage ratio= Total equity/Total assets 9.81% 10.35%

Total capital ratio= (Total equity + Long-term debt + Reserve for loan

losses)/Total assets

Provision for loan loss ratio= PLL/ TL (provision for loan losses/total

loans and leases)

Loan Ratio = Net loans/ Total assets 0.06 0.06

Loss Ratio = Net charge-offs on loans (gross charge-offs minus

recoveries)/ Total loans and leases

Reserve Ratio = Reserve for loan losses (reserve for loan losses last year

minus gross charge-offs plus PLL and recoveries)/Total loans and leases

Nonperforming ratio= Nonperforming assets (nonaccrual loans and

restructured loans)/Total loans and leases 0.28% 0.33%

Operating efficiency (cost control)= Wages and salaries/Total expenses

9.72% 9.67%

Volatile liability dependency ratio= (Total volatile liabilities -

Temporary investments)/Net loans and leases kh

Other Financial Ratios

Tax rate = Total taxes paid/Net income before taxes 34.03% 34.28%

Gap ratio = (Interest rate-sensitive assets – Interest rate-sensitive

liabilities)/ Total assets

ank

Analysis and comments

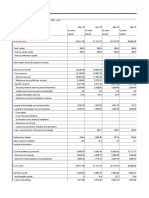

Mar-18 Mar-19 Mar-20

Rs in Crore Rs in Crore Rs in Crore

10,639,880.60 12,445,407.00 15,305,112.70

1,046,704,730.00 467,636,184.00 722,051,210.00

2,091,212.00 4,242,945.00 12,476,849.00

182,446,097.00 345,840,208.00 144,135,970.00

127,888,848.00 247,215,133.00 140,658,814.00

2,422,002.50 2,931,307.00 3,918,266.60

6,583,331.00 8,194,012.20 9,937,028.80

1,368,136,220.50 1,076,059,789.20 1,033,178,138.40

658,333.09 819,401.22 993,702.88

2,238,102.10 2,487,003.80 3,103,771.40

4,456,778.50 5,319,427.80 6,628,772.80

1,231,049.70 1,170,851.30 1,446,285.40

211,070.00 182,320.00 182,320.00

8,795,333.39 9,979,004.12 12,354,852.48

5,190.20 5,446.60 5,483.30

1,057,759.90 1,486,616.90 1,704,377.00

1,062,950.10 1,492,063.50 1,709,860.30

800,807.60 985,637.80 1,146,655.60

401,464.90 507,288.30 586,264.00

160,566,041.00 189,470,579.00 248,789,748.00

239,272,220.00 276,947,604.00 330,360,555.00

164,749,045.00 20,254.73 24,598.52

174,867.30 210,781.70 262,573.20

101,762,636.00 121,940,914.00 146,823,698.00

15,220.31 17,625.87 23,260.82

80,241.35 98,972.05 114,812.65

40,146.49 50,728.83 58,626.40

1.64% 1.69% 1.72%

10.01 8.34 8.95

0.10 0.12 0.11

16.45% 14.13% 15.36%

0.22 0.21 0.23

0.08 0.08 0.07

10.01 8.34 8.95

0.04 0.04 0.04

15.48 0.00 0.00

1.93% 1.90% 2.01%

0.03% 0.04% 0.05%

128.59 86.46 67.51

0.38% 0.39% 0.37%

4.30% 4.30% 4.30%

0.01% 0.01% 0.01%

0.0006 0.0006 0.0008

0.000 0.000 0.000

9.99% 11.99% 11.17%

0.06 0.07 0.06

1.30% 1.36% 1.26%

8.73% 10.28% 10.79%

34.50% 34.54% 28.27%

You might also like

- Coca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Document6 pagesCoca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Sayan BiswasNo ratings yet

- P and L PDFDocument2 pagesP and L PDFjigar jainNo ratings yet

- Equities and Liabilities Shareholder'S Funds Mar-20 Mar-19 Total Share Capital 3,277.66 2,760.03Document11 pagesEquities and Liabilities Shareholder'S Funds Mar-20 Mar-19 Total Share Capital 3,277.66 2,760.03Surbhî GuptaNo ratings yet

- Sources of Funds: Balance Sheet - in Rs. Cr.Document10 pagesSources of Funds: Balance Sheet - in Rs. Cr.mayankjain_90No ratings yet

- Rashi AggarwalDocument17 pagesRashi AggarwalSurbhî GuptaNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- Foreign Institutional Investors (FII) : Shareholders (As of 31 December 2015) Promoter Group (HDFC)Document10 pagesForeign Institutional Investors (FII) : Shareholders (As of 31 December 2015) Promoter Group (HDFC)Vinod KananiNo ratings yet

- Assignment pgfc1913Document9 pagesAssignment pgfc1913Surbhî GuptaNo ratings yet

- Reshma Chauhan - PGFC1927 (BOCA)Document9 pagesReshma Chauhan - PGFC1927 (BOCA)Surbhî GuptaNo ratings yet

- Financial+Statements+ +Maruti+Suzuki+&+Tata+MotorsDocument5 pagesFinancial+Statements+ +Maruti+Suzuki+&+Tata+MotorsApoorv Gupta100% (1)

- FSA - Additional HandoutDocument6 pagesFSA - Additional HandoutApoorva SharmaNo ratings yet

- Boca Vinay pgfc1948 Icici BankDocument12 pagesBoca Vinay pgfc1948 Icici BankSurbhî GuptaNo ratings yet

- Hindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument4 pagesHindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldNo ratings yet

- Introduction of DLF LimitedDocument15 pagesIntroduction of DLF LimitedArun Kumar SinghNo ratings yet

- Provisions and Contingencies Include Provision For TaxDocument6 pagesProvisions and Contingencies Include Provision For TaxSurbhî GuptaNo ratings yet

- Ratio Analysis For Maruti Suzuki BY, Abhigna M.P Section C Group 7 PROV/MBA-7-21/079Document10 pagesRatio Analysis For Maruti Suzuki BY, Abhigna M.P Section C Group 7 PROV/MBA-7-21/079AbhignaNo ratings yet

- Bank of India Performance Analysis: Total AssetsDocument6 pagesBank of India Performance Analysis: Total AssetsSurbhî GuptaNo ratings yet

- Presented by Harichandana Y (2001MBA018) Sanskriti Bharti (2001MBA022) Pragati Upadhya (2001MBA110)Document23 pagesPresented by Harichandana Y (2001MBA018) Sanskriti Bharti (2001MBA022) Pragati Upadhya (2001MBA110)Harichandana YNo ratings yet

- Company Info - Print Financials2Document2 pagesCompany Info - Print Financials2rojaNo ratings yet

- 11 - Eshaan Chhagotra - Maruti Suzuki Ltd.Document8 pages11 - Eshaan Chhagotra - Maruti Suzuki Ltd.rajat_singlaNo ratings yet

- Bluestar PNLDocument6 pagesBluestar PNLg23033No ratings yet

- Balance Sheet of ZEE NETWORK (Rs in Crores)Document12 pagesBalance Sheet of ZEE NETWORK (Rs in Crores)abid ali khanNo ratings yet

- 14 - Karan Singh - BHELDocument12 pages14 - Karan Singh - BHELrajat_singlaNo ratings yet

- Bank Performance Analysis-INDUSIND BANK: Particulars Mar-16Document26 pagesBank Performance Analysis-INDUSIND BANK: Particulars Mar-16Surbhî GuptaNo ratings yet

- Graphite India LTD.: Balance Sheet Summary: Mar 2012 - Mar 2021: Non-Annualised: Rs. MillionDocument4 pagesGraphite India LTD.: Balance Sheet Summary: Mar 2012 - Mar 2021: Non-Annualised: Rs. MillionForam SukhadiaNo ratings yet

- Balance Sheet of Indiabulls - in Rs. Cr.Document3 pagesBalance Sheet of Indiabulls - in Rs. Cr.MubeenNo ratings yet

- Akash Cost AssignmentDocument10 pagesAkash Cost AssignmentAkash HedaooNo ratings yet

- ABB India: PrintDocument2 pagesABB India: PrintAbhay Kumar SinghNo ratings yet

- Consolidated Balance Sheet: Wipro TCS InfosysDocument4 pagesConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarNo ratings yet

- FA Balance SheetDocument15 pagesFA Balance SheetPrakash BhanushaliNo ratings yet

- Sapm Stock AnalysisDocument23 pagesSapm Stock AnalysisAthira K. ANo ratings yet

- HDFC Bank Annual ReportDocument1 pageHDFC Bank Annual ReportlovenotafeelingNo ratings yet

- Financials of Canara BankDocument14 pagesFinancials of Canara BankSattwik rathNo ratings yet

- Profit Loss AccountDocument8 pagesProfit Loss AccountAbhishek JenaNo ratings yet

- A Summer Project Report OnDocument17 pagesA Summer Project Report OnHarsh MidhaNo ratings yet

- Comprehensive IT Industry Analysis - ProjectDocument52 pagesComprehensive IT Industry Analysis - ProjectdhruvNo ratings yet

- IncomeDocument1 pageIncomeSwetal SwetalNo ratings yet

- Titan Balance-SheetDocument2 pagesTitan Balance-SheetDt.vijaya ShethNo ratings yet

- HDFC Bank LTD.: Profit and Loss A/CDocument4 pagesHDFC Bank LTD.: Profit and Loss A/CsureshkarnaNo ratings yet

- Vodafone Idea Limited: PrintDocument2 pagesVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Balance Sheet of Cipla 1Document6 pagesBalance Sheet of Cipla 1anjalipawaskarNo ratings yet

- ITM MaricoDocument8 pagesITM MaricoAdarsh ChaudharyNo ratings yet

- Balance Sheet of DR Reddys Laboratories: - in Rs. Cr.Document14 pagesBalance Sheet of DR Reddys Laboratories: - in Rs. Cr.Anand MalashettiNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Profit & Loss Account of Interglobe Aviation (In CR.)Document7 pagesProfit & Loss Account of Interglobe Aviation (In CR.)Sreyashi GhoshNo ratings yet

- DCF ModelingDocument12 pagesDCF ModelingTabish JamalNo ratings yet

- Kotak Mahindra Bank Ltd. Performance Analysis For The Period 2016-2020Document15 pagesKotak Mahindra Bank Ltd. Performance Analysis For The Period 2016-2020Surbhî GuptaNo ratings yet

- Print: Previous YearsDocument2 pagesPrint: Previous YearsShyamlee KanojiaNo ratings yet

- Consolidated Balance Sheet (Rs. in MN)Document24 pagesConsolidated Balance Sheet (Rs. in MN)prernagadiaNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Birla RatioDocument22 pagesBirla RatioveeraranjithNo ratings yet

- 18 - Nacchhater - Tata MotorsDocument17 pages18 - Nacchhater - Tata Motorsrajat_singlaNo ratings yet

- Particulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018Document6 pagesParticulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018MOHIT MARHATTANo ratings yet

- Cash Flow of ICICI Bank - in Rs. Cr.Document12 pagesCash Flow of ICICI Bank - in Rs. Cr.Neethu GesanNo ratings yet

- Queen SouthDocument16 pagesQueen SouthMohammad Sayad ArmanNo ratings yet

- Advanced Financial ManagementDocument5 pagesAdvanced Financial ManagementAkshay KapoorNo ratings yet

- Shinepukur Ceramics Limited: Balance Sheet StatementDocument9 pagesShinepukur Ceramics Limited: Balance Sheet StatementTahmid Shovon100% (1)

- Cipla P& LDocument2 pagesCipla P& LNEHA LALNo ratings yet

- Assignment On Ratio AnalysisDocument6 pagesAssignment On Ratio AnalysisSurbhî GuptaNo ratings yet

- Kotak Mahindra Bank Performance AnalysisDocument18 pagesKotak Mahindra Bank Performance AnalysisSurbhî GuptaNo ratings yet

- Marketing Channels For ServicesDocument24 pagesMarketing Channels For ServicesSurbhî GuptaNo ratings yet

- Electronic Marketing ChannelsDocument25 pagesElectronic Marketing ChannelsSurbhî GuptaNo ratings yet

- Samarth Mehrotra - BOCADocument23 pagesSamarth Mehrotra - BOCASurbhî GuptaNo ratings yet

- Boca Vinay pgfc1948 Icici BankDocument12 pagesBoca Vinay pgfc1948 Icici BankSurbhî GuptaNo ratings yet

- B.O.C.A Assignment - Vishal Singh - pgsf1951 - Performance AnalysisDocument14 pagesB.O.C.A Assignment - Vishal Singh - pgsf1951 - Performance AnalysisSurbhî GuptaNo ratings yet

- Shreeya Verma (PGSF1952)Document15 pagesShreeya Verma (PGSF1952)Surbhî GuptaNo ratings yet

- Bank Performance Analysis-INDUSIND BANK: Particulars Mar-16Document26 pagesBank Performance Analysis-INDUSIND BANK: Particulars Mar-16Surbhî GuptaNo ratings yet

- Shreya Jain - PGFC1935 - Performance AnalysisDocument13 pagesShreya Jain - PGFC1935 - Performance AnalysisSurbhî GuptaNo ratings yet

- YES Bank Performance AnalysisDocument11 pagesYES Bank Performance AnalysisSurbhî GuptaNo ratings yet

- Bank of India Performance Analysis: Total AssetsDocument6 pagesBank of India Performance Analysis: Total AssetsSurbhî GuptaNo ratings yet

- Performance Analysis - CbiDocument19 pagesPerformance Analysis - CbiSurbhî GuptaNo ratings yet

- Shashank Malik - PGFB1944 - BOCA GR2 - Study Group 4 - Central Bank of IndiaDocument13 pagesShashank Malik - PGFB1944 - BOCA GR2 - Study Group 4 - Central Bank of IndiaSurbhî GuptaNo ratings yet

- Axis Bank Ltd. Performance AnalysisDocument13 pagesAxis Bank Ltd. Performance AnalysisSurbhî GuptaNo ratings yet

- Bank Performance Analysis - Sahil Badaya PGFB1942Document10 pagesBank Performance Analysis - Sahil Badaya PGFB1942Surbhî GuptaNo ratings yet

- Nitesh Khandelwal (PGFC1921) - BOCA (Central Bank of India)Document12 pagesNitesh Khandelwal (PGFC1921) - BOCA (Central Bank of India)Surbhî GuptaNo ratings yet

- Satyam PGSF1937 BOCA BOI BADocument15 pagesSatyam PGSF1937 BOCA BOI BASurbhî GuptaNo ratings yet

- Bank Performance AnalysisDocument10 pagesBank Performance AnalysisSurbhî GuptaNo ratings yet

- Kotak Mahindra Bank Ltd. Performance Analysis For The Period 2016-2020Document15 pagesKotak Mahindra Bank Ltd. Performance Analysis For The Period 2016-2020Surbhî GuptaNo ratings yet

- Reshma Chauhan - PGFC1927 (BOCA)Document9 pagesReshma Chauhan - PGFC1927 (BOCA)Surbhî GuptaNo ratings yet

- Bank Performance Analysis With Risk RatiosDocument8 pagesBank Performance Analysis With Risk RatiosSurbhî GuptaNo ratings yet

- Rashi AggarwalDocument17 pagesRashi AggarwalSurbhî GuptaNo ratings yet

- Priya Bansal pgfc1924Document8 pagesPriya Bansal pgfc1924Surbhî GuptaNo ratings yet

- Equities and Liabilities Shareholder'S Funds Mar-20 Mar-19 Total Share Capital 3,277.66 2,760.03Document11 pagesEquities and Liabilities Shareholder'S Funds Mar-20 Mar-19 Total Share Capital 3,277.66 2,760.03Surbhî GuptaNo ratings yet

- Axis Bank Ltd. Performance AnalysisDocument11 pagesAxis Bank Ltd. Performance AnalysisSurbhî GuptaNo ratings yet

- IDFC First Bank LTD Performance Analysis: Total AssetsDocument9 pagesIDFC First Bank LTD Performance Analysis: Total AssetsSurbhî GuptaNo ratings yet

- Performance Analysis of ICICI BankDocument7 pagesPerformance Analysis of ICICI BankSurbhî GuptaNo ratings yet

- Provisions and Contingencies Include Provision For TaxDocument6 pagesProvisions and Contingencies Include Provision For TaxSurbhî GuptaNo ratings yet

- Assignment pgfc1913Document9 pagesAssignment pgfc1913Surbhî GuptaNo ratings yet

- IDFC First Bank LTD Performance Analysis: Total AssetsDocument6 pagesIDFC First Bank LTD Performance Analysis: Total AssetsSurbhî GuptaNo ratings yet

- The Business& Finance News: Originators:Areeba Imtiaz, Naima Navaid, Afsheen Khan, Saira Iqbal, MehwishalmasDocument2 pagesThe Business& Finance News: Originators:Areeba Imtiaz, Naima Navaid, Afsheen Khan, Saira Iqbal, MehwishalmasAreeba Imtiaz HUssainNo ratings yet

- PDF International Financial Management Eun Resnick 5Th Edition Test Bank Online Ebook Full ChapterDocument86 pagesPDF International Financial Management Eun Resnick 5Th Edition Test Bank Online Ebook Full Chapterrickey.schuch349100% (9)

- Notes FS Unit 2Document41 pagesNotes FS Unit 2Vishal GoyalNo ratings yet

- Thesis Actuarial ScienceDocument5 pagesThesis Actuarial Sciencekristinoliversaintpaul100% (2)

- The Role of Culture: Chapter ObjectivesDocument16 pagesThe Role of Culture: Chapter ObjectivesYomi BrainNo ratings yet

- Kimberly Amadeo: Money SupplyDocument3 pagesKimberly Amadeo: Money SupplytawandaNo ratings yet

- Strategic Management Final ReportDocument59 pagesStrategic Management Final Reportkk55220% (1)

- Oblicon CasesDocument12 pagesOblicon CasesAlyssa CornejoNo ratings yet

- Deduction U/s 80C, 80CCC, 80CCD, 80CCE, 80D, 80DD, 80DDB, 80E, 80G EtcDocument10 pagesDeduction U/s 80C, 80CCC, 80CCD, 80CCE, 80D, 80DD, 80DDB, 80E, 80G EtcHimanshu SharmaNo ratings yet

- Intermediate Accounting Test BanksDocument45 pagesIntermediate Accounting Test BanksBaekhyun ByunNo ratings yet

- RISK MANAGEMENT IN BANK pROJECTDocument62 pagesRISK MANAGEMENT IN BANK pROJECTMoni Budhiraja100% (2)

- Acquisition of Interests in Renova and Belo Monte Enable Generation GrowthDocument101 pagesAcquisition of Interests in Renova and Belo Monte Enable Generation GrowthLightRINo ratings yet

- Dhaval File 123Document72 pagesDhaval File 123Rahul NishadNo ratings yet

- Resolving Economic DeadlockDocument27 pagesResolving Economic DeadlockPlutopiaNo ratings yet

- Class Work & Home Work Question of Final Account of Banking Conpany 22-23Document23 pagesClass Work & Home Work Question of Final Account of Banking Conpany 22-23DARK KING GamersNo ratings yet

- Financial Markets and Institutions Solved MCQs (Set-7)Document6 pagesFinancial Markets and Institutions Solved MCQs (Set-7)Tonie NascentNo ratings yet

- Grade 10 Provincial Case Study QP 2023Document5 pagesGrade 10 Provincial Case Study QP 2023kwazy dlaminiNo ratings yet

- Developing A Service Delivery Model To Bridge The Gap Between Services Expected and Provided by ICICI Home Loans.Document43 pagesDeveloping A Service Delivery Model To Bridge The Gap Between Services Expected and Provided by ICICI Home Loans.johnashmitNo ratings yet

- Assignment 2 For ABM 311 Principles of Farm ManagementDocument8 pagesAssignment 2 For ABM 311 Principles of Farm Managementsailas mulambiaNo ratings yet

- Problem 4: Redemption by Lumpsum Using Sinking FundDocument5 pagesProblem 4: Redemption by Lumpsum Using Sinking FundGopal DasNo ratings yet

- Bond ValuationDocument12 pagesBond ValuationvarunjajooNo ratings yet

- Poa ExcelDocument4 pagesPoa Excelahm_sarahNo ratings yet

- FAR-I Borrowing Cost IAS-23 Sir MMDocument7 pagesFAR-I Borrowing Cost IAS-23 Sir MMarhamNo ratings yet

- Eun Resnick 8e Chapter 11Document18 pagesEun Resnick 8e Chapter 11Wai Man NgNo ratings yet

- Partnership Operations Part 2Document14 pagesPartnership Operations Part 2Nerish PlazaNo ratings yet

- Pooled Funds 2019 EditionDocument97 pagesPooled Funds 2019 EditionPatrick CuraNo ratings yet

- CAP II Group II June 2022Document97 pagesCAP II Group II June 2022aneupane465No ratings yet

- Plaint For Recovery of MoneyDocument4 pagesPlaint For Recovery of MoneyGautam JhaNo ratings yet

- Buy Now Pay Later BNPLOn Your Credit CardDocument26 pagesBuy Now Pay Later BNPLOn Your Credit CardShivaniNo ratings yet

- The Balance Sheet, and What It Tells Us: Learning ObjectivesDocument26 pagesThe Balance Sheet, and What It Tells Us: Learning Objectiveshesham zakiNo ratings yet