Professional Documents

Culture Documents

Homestead Financial Corporation Owns Numerous Investments in The Shares of

Homestead Financial Corporation Owns Numerous Investments in The Shares of

Uploaded by

Muhammad ShahidOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homestead Financial Corporation Owns Numerous Investments in The Shares of

Homestead Financial Corporation Owns Numerous Investments in The Shares of

Uploaded by

Muhammad ShahidCopyright:

Available Formats

Homestead Financial Corporation owns numerous

investments in the shares of #6688

Homestead Financial Corporation owns numerous investments in the shares of

Homestead Financial Corporation owns numerous investments in the shares of other

companies. Homestead Financial completed the following long-term investment transactions:

2017

May 1 Purchased 8,000 shares, which make up 25% of the common shares of Mars Company

at total cost of $450,000

Sept. 15 Received a cash dividend of $1.40 per share on the Mars investment

Oct. 12 Purchased 1,000 common shares of Mercury Corporation as a non-strategic

investment, paying $22.50 per share

Dec. 14 Received a cash dividend of $0.75 per share on the Mercury investment

31 Received annual report from Mars Company. Net income for the year was $350,000.

At year-end the current fair value of the Mercury shares is $19,200. The fair value of the Mars

shares is $740,000. The company reports changes in fair value through net income.

Requirements

1. For which investment is current fair value used in the accounting? Why is fair value used for

one investment and not the other?

2. Show what Homestead Financial will report on its year-end balance sheet and income

statement for these investments. (It is helpful to use a T-account for the Long-Term Investment

in Mars Shares account.) Ignore income tax?

Homestead Financial Corporation owns numerous investments in the shares of

ANSWER

http://paperinstant.com/downloads/homestead-financial-corporation-owns-numerous-

investments-in-the-shares-of/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Investments Bodie Kane Marcus 9th Edition Solutions ManualDocument6 pagesInvestments Bodie Kane Marcus 9th Edition Solutions ManualDouglas Thompson100% (30)

- Physical Therapy Initial EvaluationDocument3 pagesPhysical Therapy Initial EvaluationkhushmitNo ratings yet

- Satyanarayana PoojaDocument33 pagesSatyanarayana Poojasrinivas3us100% (1)

- De 08 TS Diesel Engine - Specification System Operation Testing and Adjusting - DOOSANDocument108 pagesDe 08 TS Diesel Engine - Specification System Operation Testing and Adjusting - DOOSANCarlos67% (6)

- ACCO 420 Case 1 - FINALDocument5 pagesACCO 420 Case 1 - FINALJane YangNo ratings yet

- Chapter 1 Answer Key 10ce Foundations of Financial ManagementDocument4 pagesChapter 1 Answer Key 10ce Foundations of Financial ManagementPanda875No ratings yet

- Consolidations-Subsequent To The Date of Acquisition: Multiple Choice QuestionsDocument199 pagesConsolidations-Subsequent To The Date of Acquisition: Multiple Choice QuestionsMarwa HassanNo ratings yet

- BS en 13478 Fire Prevention and ProtectionDocument30 pagesBS en 13478 Fire Prevention and Protectiontoalok4723No ratings yet

- Flowers - A Golden Nature GuideDocument164 pagesFlowers - A Golden Nature GuideKenneth93% (15)

- Instrument Installation RequirementsDocument98 pagesInstrument Installation Requirementszelda1022100% (4)

- Sabre Corporation Which Reports Under Ifrs Has The Following InvestmentsDocument1 pageSabre Corporation Which Reports Under Ifrs Has The Following InvestmentsBube KachevskaNo ratings yet

- Big Seven Insurance LTD Owns Numerous Investments in The SharesDocument2 pagesBig Seven Insurance LTD Owns Numerous Investments in The SharesMiroslav GegoskiNo ratings yet

- Chapter 1: The Investment Environment: Assets Liabilities & Shareholders' EquityDocument5 pagesChapter 1: The Investment Environment: Assets Liabilities & Shareholders' EquityAnonymous sZLcBAgNo ratings yet

- Solved Kress Products Corporate Charter Authorized The Firm To Sell 800 000Document1 pageSolved Kress Products Corporate Charter Authorized The Firm To Sell 800 000Anbu jaromiaNo ratings yet

- Chapter 1: The Investment Environment: Problem SetsDocument6 pagesChapter 1: The Investment Environment: Problem SetsMehrab Jami Aumit 1812818630No ratings yet

- Bodie10ce SM Ch01Document5 pagesBodie10ce SM Ch01beadand1No ratings yet

- Lesson 1 (Mutual Funds)Document14 pagesLesson 1 (Mutual Funds)JINKY MARIELLA VERGARANo ratings yet

- Accounting PrinciplesDocument25 pagesAccounting PrinciplesEshetieNo ratings yet

- Chapter 1: The Investment Environment: Problem SetsDocument5 pagesChapter 1: The Investment Environment: Problem SetsEddy WirahadiNo ratings yet

- Dokumen - Tips Bodie Kane Marcus 8th Editionsolution CH 1 4Document35 pagesDokumen - Tips Bodie Kane Marcus 8th Editionsolution CH 1 4Shahab AftabNo ratings yet

- Accounting Principles: Second Canadian EditionDocument25 pagesAccounting Principles: Second Canadian EditionEshetieNo ratings yet

- Corporate Finance: Fifth Edition, Global EditionDocument96 pagesCorporate Finance: Fifth Edition, Global Editionkaylakshmi8314No ratings yet

- HUMANITIESDocument12 pagesHUMANITIESBipradip DeyNo ratings yet

- Dwnload Full Venture Capital Private Equity and The Financing of Entrepreneurship 1st Edition Lerner Solutions Manual PDFDocument13 pagesDwnload Full Venture Capital Private Equity and The Financing of Entrepreneurship 1st Edition Lerner Solutions Manual PDFdemivoltnotpatedf6u2ra92% (12)

- Abbreviations Related To International TradeDocument15 pagesAbbreviations Related To International TradeSawsan HatemNo ratings yet

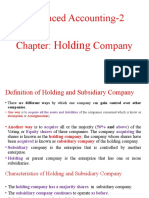

- Advanced Accounting-2 Company: HoldingDocument20 pagesAdvanced Accounting-2 Company: HoldingTB AhmedNo ratings yet

- NISM - Mutual Fund Distribution Certification ExaminationDocument169 pagesNISM - Mutual Fund Distribution Certification ExaminationPMNo ratings yet

- Foundations of Financial Management Canadian 11th Edition Block Solutions ManualDocument6 pagesFoundations of Financial Management Canadian 11th Edition Block Solutions ManualEricYoderptkaoNo ratings yet

- Solution Manual For Investments 11th Edition by Bodie: Problem SetsDocument6 pagesSolution Manual For Investments 11th Edition by Bodie: Problem Setssunanda mNo ratings yet

- Annual Report 2018 4 PDFDocument44 pagesAnnual Report 2018 4 PDFAnnie LamNo ratings yet

- 10 The Basics of Private Equity FundsDocument13 pages10 The Basics of Private Equity FundsAlvaro MorenoNo ratings yet

- Penfold Penfold Technology LTD Pitch Uk Investment Summary Equity 2Document8 pagesPenfold Penfold Technology LTD Pitch Uk Investment Summary Equity 2waqar.asgharNo ratings yet

- Mutual Fund AnalysisDocument67 pagesMutual Fund Analysisakki reddyNo ratings yet

- Balance Sheet OverviewDocument8 pagesBalance Sheet OverviewRavi Chaurasia100% (1)

- Financial Institutions Hold Large Quantities of Bond Investments Suppose SunDocument1 pageFinancial Institutions Hold Large Quantities of Bond Investments Suppose SunMuhammad ShahidNo ratings yet

- CofpDocument5 pagesCofpAdil HassanNo ratings yet

- Applied Auditing Audit of InvestmentsDocument2 pagesApplied Auditing Audit of InvestmentsCar Mae LaNo ratings yet

- EXAMPLEofadealpresentation East Palm Self StorageDocument12 pagesEXAMPLEofadealpresentation East Palm Self StorageAlex VazquezNo ratings yet

- The IB Business of EquitiesDocument79 pagesThe IB Business of EquitiesNgọc Phan Thị BíchNo ratings yet

- INVESTMENTS With AnswersDocument3 pagesINVESTMENTS With AnswersShaira BugayongNo ratings yet

- Reliance Diversified Power Sector FundDocument31 pagesReliance Diversified Power Sector Fundsrscribd10No ratings yet

- InvesmentDocument5 pagesInvesmentMaricar San AntonioNo ratings yet

- Fundamentals of Advanced Accounting 5Th Edition Hoyle Test Bank Full Chapter PDFDocument52 pagesFundamentals of Advanced Accounting 5Th Edition Hoyle Test Bank Full Chapter PDFDaisyHillyowek100% (15)

- (Submitted Towards The Partial Fulfillment of Master of Business Administration Awarded by Devi Ahilya Vishvavidhyalaya, IndoreDocument43 pages(Submitted Towards The Partial Fulfillment of Master of Business Administration Awarded by Devi Ahilya Vishvavidhyalaya, IndoreAbhishek ShahNo ratings yet

- Dwnload Full Foundations of Financial Management Canadian 11th Edition Block Solutions Manual PDFDocument36 pagesDwnload Full Foundations of Financial Management Canadian 11th Edition Block Solutions Manual PDFhenrykr7men100% (16)

- IDFC Mutual FundDocument93 pagesIDFC Mutual FundrukasnaNo ratings yet

- Summary - Mutual Funds Lyst7702Document14 pagesSummary - Mutual Funds Lyst7702hk2292No ratings yet

- Corporate Finance: Suresh HerurDocument49 pagesCorporate Finance: Suresh Herurlove_abhi_n_22No ratings yet

- CF LectureDocument36 pagesCF LecturehannahfavrefergusonNo ratings yet

- Intro Stock Market PDFDocument65 pagesIntro Stock Market PDFthilaksafaryNo ratings yet

- FM 313Document5 pagesFM 313Charmaine PerochoNo ratings yet

- CA Final FR CA Vivek Panwar GE Free Crash CourseDocument8 pagesCA Final FR CA Vivek Panwar GE Free Crash CourseGokul dnNo ratings yet

- MFIN7005 Corporate Finance and Asset Valuation: Lecture 1 Introduction Prof. Wenlan QianDocument53 pagesMFIN7005 Corporate Finance and Asset Valuation: Lecture 1 Introduction Prof. Wenlan QianSIQING LINo ratings yet

- IntaccDocument19 pagesIntaccMelita CarriedoNo ratings yet

- 31 The Upscaling Business of Private EquityDocument12 pages31 The Upscaling Business of Private EquityCritiNo ratings yet

- Chapter 01 Overview of Financial ManagementDocument42 pagesChapter 01 Overview of Financial Management叶文伟No ratings yet

- Investments and Fair Value Accounting: Principles of Financial Accounting With Conceptual Emphasis On IFRSDocument137 pagesInvestments and Fair Value Accounting: Principles of Financial Accounting With Conceptual Emphasis On IFRSallfi basirohNo ratings yet

- Instuitional InvestorsDocument4 pagesInstuitional Investors1c796e65b8a4c8No ratings yet

- Mutual Funds LakshmiDocument12 pagesMutual Funds LakshmilakshminayakotiNo ratings yet

- Assets Liabilities and EquityDocument16 pagesAssets Liabilities and EquityYahlianah LeeNo ratings yet

- Test Bank For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy DoupnikDocument8 pagesTest Bank For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy Doupnikacetize.maleyl.hprj100% (52)

- Repuestas Cap 1 Investments 2010 Bodie, Kane, MarcusDocument6 pagesRepuestas Cap 1 Investments 2010 Bodie, Kane, MarcusElkin CalderonNo ratings yet

- Define Corporate Finance and Its ImportanceDocument80 pagesDefine Corporate Finance and Its ImportanceShanthiNo ratings yet

- Public Sector Organisations - Government Owned Private Sector Organisations - Private Parties OwnedDocument4 pagesPublic Sector Organisations - Government Owned Private Sector Organisations - Private Parties OwnedAdit BhatiaNo ratings yet

- Mutual Funds for Beginners: The Basic Guide You Need to Get Started with Mutual FundsFrom EverandMutual Funds for Beginners: The Basic Guide You Need to Get Started with Mutual FundsNo ratings yet

- You Have Been Asked To Evaluate Two Companies As PossibleDocument2 pagesYou Have Been Asked To Evaluate Two Companies As PossibleMuhammad ShahidNo ratings yet

- You Are The Controller of Small Toys Inc Marta JohnsDocument1 pageYou Are The Controller of Small Toys Inc Marta JohnsMuhammad ShahidNo ratings yet

- Your Supervisor Has Asked You To Research A Potential TaxDocument1 pageYour Supervisor Has Asked You To Research A Potential TaxMuhammad ShahidNo ratings yet

- You Are Given The Following Price of The Stock 18 PriceDocument1 pageYou Are Given The Following Price of The Stock 18 PriceMuhammad ShahidNo ratings yet

- You Are A Portfolio Manager and Senior Executive Vice PresidentDocument1 pageYou Are A Portfolio Manager and Senior Executive Vice PresidentMuhammad ShahidNo ratings yet

- You Have Been Named As Investment Adviser To A FoundationDocument1 pageYou Have Been Named As Investment Adviser To A FoundationMuhammad ShahidNo ratings yet

- Zeus Industries Manufactures Two Types of Electrical Power Units CustomDocument1 pageZeus Industries Manufactures Two Types of Electrical Power Units CustomMuhammad ShahidNo ratings yet

- You Can Find A Spreadsheet Containing The Historic Returns PresentedDocument1 pageYou Can Find A Spreadsheet Containing The Historic Returns PresentedMuhammad ShahidNo ratings yet

- You Are Being Interviewed For A Job As A PortfolioDocument1 pageYou Are Being Interviewed For A Job As A PortfolioMuhammad ShahidNo ratings yet

- You Are P J Walter Cfa A Managing Partner ofDocument1 pageYou Are P J Walter Cfa A Managing Partner ofMuhammad ShahidNo ratings yet

- You Decide Which Method Is Better The Direct Write Off Method orDocument1 pageYou Decide Which Method Is Better The Direct Write Off Method orMuhammad ShahidNo ratings yet

- You Are Maintaining A Subsidiary Ledger Account For Firefighter Training ExpendituresDocument1 pageYou Are Maintaining A Subsidiary Ledger Account For Firefighter Training ExpendituresMuhammad ShahidNo ratings yet

- You Are Considering Making A Contribution To The Conservation FundDocument1 pageYou Are Considering Making A Contribution To The Conservation FundMuhammad ShahidNo ratings yet

- Wireless Communications Inc Is Preparing Its Cash Budget For 2014Document1 pageWireless Communications Inc Is Preparing Its Cash Budget For 2014Muhammad ShahidNo ratings yet

- World Mosaic Furniture Gallery Inc Provided The Following Data FromDocument2 pagesWorld Mosaic Furniture Gallery Inc Provided The Following Data FromMuhammad ShahidNo ratings yet

- You Are Reviewing The Financial Statements of Rising Yeast CoDocument1 pageYou Are Reviewing The Financial Statements of Rising Yeast CoMuhammad ShahidNo ratings yet

- West Texas Exploration Co Was Established On October 15 2016Document2 pagesWest Texas Exploration Co Was Established On October 15 2016Muhammad ShahidNo ratings yet

- Wimberley Glass Inc Has Shops in The Shopping Malls ofDocument1 pageWimberley Glass Inc Has Shops in The Shopping Malls ofMuhammad ShahidNo ratings yet

- You Are Given The Following Information Expected Return On Stock ADocument1 pageYou Are Given The Following Information Expected Return On Stock AMuhammad ShahidNo ratings yet

- When Sandra Costello S Father Died Suddenly Sandra Had Just CompletedDocument1 pageWhen Sandra Costello S Father Died Suddenly Sandra Had Just CompletedMuhammad ShahidNo ratings yet

- Waypine Enterprises Reported A Pretax Operating Loss of 84 000 inDocument1 pageWaypine Enterprises Reported A Pretax Operating Loss of 84 000 inMuhammad ShahidNo ratings yet

- Winnipeg Enterprises Inc Reported The Following Summarized Balance Sheet atDocument2 pagesWinnipeg Enterprises Inc Reported The Following Summarized Balance Sheet atMuhammad ShahidNo ratings yet

- Waylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Document1 pageWaylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Muhammad ShahidNo ratings yet

- Wilma Company Must Decide Whether To Make or Buy SomeDocument1 pageWilma Company Must Decide Whether To Make or Buy SomeMuhammad ShahidNo ratings yet

- Walter Liu Has Owned and Operated LW Media Inc SinceDocument2 pagesWalter Liu Has Owned and Operated LW Media Inc SinceMuhammad ShahidNo ratings yet

- Washington City Created An Information Technology Department in 2013 To PDFDocument1 pageWashington City Created An Information Technology Department in 2013 To PDFMuhammad ShahidNo ratings yet

- Webmasters Com Has Developed A Powerful New Server That Would BeDocument1 pageWebmasters Com Has Developed A Powerful New Server That Would BeMuhammad ShahidNo ratings yet

- Western Agriculture Industries LTD Is Authorized by The Province ofDocument1 pageWestern Agriculture Industries LTD Is Authorized by The Province ofMuhammad ShahidNo ratings yet

- Web Marketing Services Inc Completed These Transactions During The FirstDocument2 pagesWeb Marketing Services Inc Completed These Transactions During The FirstMuhammad ShahidNo ratings yet

- Using The Data Below Compute Net Income Accounts PayableDocument1 pageUsing The Data Below Compute Net Income Accounts PayableMuhammad ShahidNo ratings yet

- 046: Unsafe Acts vs. Unsafe Conditions: Background Discussion Leader Duties For This SessionDocument2 pages046: Unsafe Acts vs. Unsafe Conditions: Background Discussion Leader Duties For This SessionVarahi VigneshNo ratings yet

- 107 327 2 PBDocument17 pages107 327 2 PBduniayanNo ratings yet

- Aerobic CompostingDocument4 pagesAerobic CompostingChris MohankumarNo ratings yet

- The Indian Medical Council (Professional Conduct, Etiquette and Ethics) Regulations, 2002Document7 pagesThe Indian Medical Council (Professional Conduct, Etiquette and Ethics) Regulations, 2002Arkopal GuptaNo ratings yet

- Schneider Electric - ATV71 Quick Selection GuideDocument4 pagesSchneider Electric - ATV71 Quick Selection GuideJohn100% (1)

- Apxvdgll26exd 43-C-I20 PreDocument4 pagesApxvdgll26exd 43-C-I20 Precmsd01No ratings yet

- Glickman (1) - Ethical and Scientific Implications of The Globalization of Clinical Research NEJMDocument8 pagesGlickman (1) - Ethical and Scientific Implications of The Globalization of Clinical Research NEJMMaria BernalNo ratings yet

- 15 Chinese Diesel Heater Problems + Troubleshooting & Error CodesDocument15 pages15 Chinese Diesel Heater Problems + Troubleshooting & Error CodesJean NobleNo ratings yet

- CĐ 16.1. WORD FORMS (Cont)Document8 pagesCĐ 16.1. WORD FORMS (Cont)Imaginative AsiaNo ratings yet

- GEMU090 Iceomatic Service ManualDocument25 pagesGEMU090 Iceomatic Service Manualdan themanNo ratings yet

- Onychophagia (Nail-Biting) Signs of Psychological Disorders or Simple HabitDocument7 pagesOnychophagia (Nail-Biting) Signs of Psychological Disorders or Simple HabitIJAR JOURNALNo ratings yet

- Ilovepdf Merged PDFDocument8 pagesIlovepdf Merged PDFHeta PanchalNo ratings yet

- Practical ElectricityDocument18 pagesPractical ElectricityJamaica RamosNo ratings yet

- BHSEC Chemistry Practical 2009Document4 pagesBHSEC Chemistry Practical 2009sawanchhetriNo ratings yet

- Lecture 8 XPSDocument62 pagesLecture 8 XPSarulmuruguNo ratings yet

- Food Grade Anti-Corrosion Grease: Special FeaturesDocument2 pagesFood Grade Anti-Corrosion Grease: Special Featureschem KhanNo ratings yet

- MUCLecture 2023 10319526Document13 pagesMUCLecture 2023 10319526Mustafa AlhumayreNo ratings yet

- Acid Value and Amine Value of Fatty Quaternary Ammonium ChloridesDocument3 pagesAcid Value and Amine Value of Fatty Quaternary Ammonium ChloridesShaker Qaidi100% (1)

- Water Management in Meghalaya - Final ProjectDocument10 pagesWater Management in Meghalaya - Final ProjectAyush DharnidharkaNo ratings yet

- UntitledDocument873 pagesUntitledjoker hotNo ratings yet

- Taenia SagitaDocument3 pagesTaenia SagitaNur LiyanaNo ratings yet

- Ficha Tecnica Medit I600Document12 pagesFicha Tecnica Medit I600sebastian ramosNo ratings yet

- Solutions ACC415Document46 pagesSolutions ACC415gloriyaNo ratings yet

- Soal SMSTR Genap Bahasa InggrisDocument7 pagesSoal SMSTR Genap Bahasa InggrisEric WilkersonNo ratings yet