Professional Documents

Culture Documents

Gotham City Issued 500 000 of 8 Regular Serial Bonds At: Unlock Answers Here Solutiondone - Online

Gotham City Issued 500 000 of 8 Regular Serial Bonds At: Unlock Answers Here Solutiondone - Online

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gotham City Issued 500 000 of 8 Regular Serial Bonds At: Unlock Answers Here Solutiondone - Online

Gotham City Issued 500 000 of 8 Regular Serial Bonds At: Unlock Answers Here Solutiondone - Online

Uploaded by

trilocksp SinghCopyright:

Available Formats

Gotham City issued 500 000 of 8 regular serial bonds at

Gotham City issued $500,000 of 8% regular serial bonds at par (no accrued interest) on

January 2, 20X0, to finance a capital improvement project. Interest is payable semiannually on

January 2 and July 2, and $50,000 of the principal matures each January 2 beginning in 20X1

and ending in 20Y0. Resources for servicing the debt will be made available through a special

tax levy for this purpose and transfers as needed from a Special Revenue Fund. The required

transfers typically will be made on January 1 and July 1, respectively. The DSF is not under

formal budget control; the city’s fiscal year begins October 1.Prepare general journal entries to

record the following transactions and events in the General Ledger of the DSF.1. June 28,

20X0—The first installment of the special tax was received, $52,000.2. June 29, 20X0—A Special

Revenue Fund transfer of $38,000 was received.3. July 2, 20X0—The semiannual interest

payment on the bonds was made.4. July 3, 20X0—The remaining cash ($70,000) was

invested.5. December 30, 20X0—The investments matured, and $73,000 cash was received.6.

January 2, 20X1—The semiannual interest payment and the bond payment were made.7.

January 2, 20Y0—At the beginning of 20Y0, the DSF had accumulated $30,000 in investments

(from transfers) and $25,000 in cash (from taxes). The investments were liquidated at face

value, and the final interest and principal payment on the bonds was made.8. January 3,

20Y0—The DSF purpose having been served, the council ordered the residual assets

transferred to a Special Revenue Fund and the DSF terminated.View Solution: Gotham City

issued 500 000 of 8 regular serial bonds at

SOLUTION-- http://solutiondone.online/downloads/gotham-city-issued-500-000-of-8-regular-

serial-bonds-at/

Unlock answers here solutiondone.online

You might also like

- Audprob Answer 1Document1 pageAudprob Answer 1venice cambryNo ratings yet

- The City Council of The City of Eastover Adopted The: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe City Council of The City of Eastover Adopted The: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

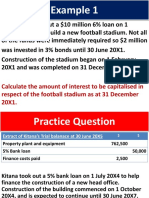

- Questions Bayo IAS12,20 AND 23Document6 pagesQuestions Bayo IAS12,20 AND 23Edrisa ColleyNo ratings yet

- NFP AssDocument9 pagesNFP AssAbdii Dhufeera100% (2)

- Cash BudgetDocument3 pagesCash BudgetJann Kerky0% (1)

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- Analyze Each of The Following Transactions and Events 1 IndicateDocument1 pageAnalyze Each of The Following Transactions and Events 1 Indicatetrilocksp SinghNo ratings yet

- You Have Been Engaged by The Town of Rego To: Unlock Answers Here Solutiondone - OnlineDocument1 pageYou Have Been Engaged by The Town of Rego To: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Smith CountyAssignment IDocument1 pageSmith CountyAssignment ILemuel VelasquezNo ratings yet

- UB - Course - Outline - NotforProfit1Aug2023 Assignment # 2Document1 pageUB - Course - Outline - NotforProfit1Aug2023 Assignment # 2cartajenamarlenisNo ratings yet

- Practice QuestionsDocument2 pagesPractice QuestionsnoumantamilNo ratings yet

- 1 Analyze The Effects of Each of The Following Transactions: Unlock Answers Here Solutiondone - OnlineDocument1 page1 Analyze The Effects of Each of The Following Transactions: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Chapter 10 Review Updated 11th EdDocument15 pagesChapter 10 Review Updated 11th EdalmazwmbashiraNo ratings yet

- Shareholder's EquityDocument10 pagesShareholder's EquityNicole Gole CruzNo ratings yet

- Test Bank - Problems and Essays 2008Document148 pagesTest Bank - Problems and Essays 2008okkie50% (6)

- Class Work - CH 8Document8 pagesClass Work - CH 8Manar FakhrNo ratings yet

- The July 1 20X5 Trial Balance For The Bond Redemption: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe July 1 20X5 Trial Balance For The Bond Redemption: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- A Town Plans To Borrow About 10 Million and Is: Unlock Answers Here Solutiondone - OnlineDocument1 pageA Town Plans To Borrow About 10 Million and Is: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Prepare The General Journal Entries To Record The Following TransactionsDocument1 pagePrepare The General Journal Entries To Record The Following Transactionstrilocksp SinghNo ratings yet

- QuestionDocument1 pageQuestionAshik Uz Zaman0% (2)

- The City of Merlot Operates A Central Garage Through An: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe City of Merlot Operates A Central Garage Through An: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Illustration: Debt Service Accounting For Regular Serial Bonds (2011 Transaction)Document3 pagesIllustration: Debt Service Accounting For Regular Serial Bonds (2011 Transaction)Jichang HikNo ratings yet

- Ias 23 Borrrowing Costs QuestionsDocument3 pagesIas 23 Borrrowing Costs QuestionsKiri chrisNo ratings yet

- Case Study - Project AC322 - City of Sprinfields Solutions - Government Fund AccountingDocument6 pagesCase Study - Project AC322 - City of Sprinfields Solutions - Government Fund Accountingalka murarkaNo ratings yet

- FA & FFA Mock Exam Questions Set 5Document18 pagesFA & FFA Mock Exam Questions Set 5miss ainaNo ratings yet

- Test MidtermDocument4 pagesTest MidtermcirujeffNo ratings yet

- FR 2018 Sepdec Sample QDocument5 pagesFR 2018 Sepdec Sample QfatehsalehNo ratings yet

- Kuis AK 2Document4 pagesKuis AK 2Jhon F SinagaNo ratings yet

- Case No. 1: BM2008/BM2015 - Auditing and Assurance: Concepts and Application 1 & 2Document8 pagesCase No. 1: BM2008/BM2015 - Auditing and Assurance: Concepts and Application 1 & 2Ken MateyowNo ratings yet

- ProblemDocument2 pagesProblemAshik Uz ZamanNo ratings yet

- Charter City Issued 100 Million of 6 Percent 20 Year GeneralDocument1 pageCharter City Issued 100 Million of 6 Percent 20 Year Generaltrilocksp SinghNo ratings yet

- Group Assignment Accounting Cycle - ADDocument4 pagesGroup Assignment Accounting Cycle - ADShewatatek MelakuNo ratings yet

- Topic 4 Class Discussion QuestionsDocument2 pagesTopic 4 Class Discussion Questionssyedimranmasood100No ratings yet

- Soal Asis Ak2 Pertemuan 1Document2 pagesSoal Asis Ak2 Pertemuan 1Aisya Fadhilla ShamaraNo ratings yet

- Acc423 in 2015 Better City Received 5000000 of BondDocument8 pagesAcc423 in 2015 Better City Received 5000000 of BondDoreenNo ratings yet

- Longboat Key Fiscal Year 2021 Recommended BudgetDocument130 pagesLongboat Key Fiscal Year 2021 Recommended BudgetMark BerginNo ratings yet

- FR QB 1Document14 pagesFR QB 1Tanya AgarwalNo ratings yet

- Slowhand Services Was Formed On May 1 2010 The Following PDFDocument1 pageSlowhand Services Was Formed On May 1 2010 The Following PDFAnbu jaromiaNo ratings yet

- Chapter 14Document4 pagesChapter 14ks1043210No ratings yet

- ACCT 2062 Homework #2Document22 pagesACCT 2062 Homework #2downinpuertorico100% (1)

- Prelim Take-Home ExamDocument8 pagesPrelim Take-Home ExamMelanie SamsonaNo ratings yet

- Shareholder's Equity: ReviewDocument12 pagesShareholder's Equity: ReviewG7 HexagonNo ratings yet

- Taxation Chapter 10 Interest On Sec.Document8 pagesTaxation Chapter 10 Interest On Sec.JewelNo ratings yet

- Unit 3 - Essay QuestionsDocument4 pagesUnit 3 - Essay QuestionsJaijuNo ratings yet

- Final Review ProblemsDocument17 pagesFinal Review ProblemsEvan KlineNo ratings yet

- Classroom Exercises On Sinking FundDocument3 pagesClassroom Exercises On Sinking Fundjay1ar1guyenaNo ratings yet

- Quiz Chapter 11 Advance AccountingDocument5 pagesQuiz Chapter 11 Advance Accounting20174112008 HERI AHMAD FAUZINo ratings yet

- Wildwood Township Entered Into The Following Transactions During 20X6 1Document1 pageWildwood Township Entered Into The Following Transactions During 20X6 1trilocksp SinghNo ratings yet

- Intermediate: AccountingDocument74 pagesIntermediate: AccountingTiến NguyễnNo ratings yet

- The City of Hinton S General Fund Had The Following Post ClosingDocument2 pagesThe City of Hinton S General Fund Had The Following Post ClosingMuhammad ShahidNo ratings yet

- Chapter 16 Tutorial QuestionsDocument3 pagesChapter 16 Tutorial QuestionsAniket KumarNo ratings yet

- Soal LatihanDocument15 pagesSoal LatihanRafi FarrasNo ratings yet

- Quiz - Chapter 32 - She Part 1 PrintingDocument3 pagesQuiz - Chapter 32 - She Part 1 PrintingAllen Kate50% (2)

- General Fundtrial Balance JANUARY 1, 2018 Debits CreditsDocument2 pagesGeneral Fundtrial Balance JANUARY 1, 2018 Debits CreditsTehone TeketelewNo ratings yet

- DT Group QNDocument2 pagesDT Group QNJohn WickNo ratings yet

- Financing Philippine Local Governments: Presented By: Amora Rossel M. PascuaDocument15 pagesFinancing Philippine Local Governments: Presented By: Amora Rossel M. PascuaAmora Rossel PascuaNo ratings yet

- Problem 3Document11 pagesProblem 3Charmaine Kaye OndoyNo ratings yet

- baitap-sinhvien-IAS 21Document12 pagesbaitap-sinhvien-IAS 21tonight752No ratings yet

- Accountancy & Auditing-I Subjective - 1Document4 pagesAccountancy & Auditing-I Subjective - 1zaman virkNo ratings yet

- Midterm RevisionDocument2 pagesMidterm RevisionKean Christopher GandalalNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet