Professional Documents

Culture Documents

The Following Transactions and Events Affected A Special Revenue Fund

The Following Transactions and Events Affected A Special Revenue Fund

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Following Transactions and Events Affected A Special Revenue Fund

The Following Transactions and Events Affected A Special Revenue Fund

Uploaded by

trilocksp SinghCopyright:

Available Formats

The following transactions and events affected a Special

Revenue Fund

The following transactions and events affected a Special Revenue Fund of Stem Independent

School District during 20X4.1. The chief accountant discovered that (a) the $20,000 proceeds of

a sale of used educational equipment in 20X3 had been recorded as 20X4 revenues when

received in early 20X4, and (b) $150,000 of property taxes receivable were not available at the

end of 20X3 but were reported as revenues in 20X3.2. Because of a change in the timing of the

payments of the state minimum education program assistance grants to school districts, the

related revenue recognition policy was changed. Substantial amounts of the state payments for

the prior fiscal year were reported as deferred revenue at year end under the old policy, but

most will now be considered available revenue. The comparative Deferred State Assistance

account balances at the end of the current year and prior year under the old and new policies

were determined to be:.:.3. The auditor discovered the following errors:a. Special instruction

fees of $8,000 paid for the hearing-impaired education program, properly chargeable to the

20X4 Education—Hearing-Impaired account in the General Fund, were charged to that account

in this Special Revenue Fund.b. $130,000 of federal grant revenues were earned by incurring

qualifying expenditures during 20X3, but no grant cash had been received and no revenues

were recorded in 20X3. Furthermore, the federal grantor agency has not been billed for this

payment.c. A transfer from the General Fund during 20X4, $85,000, was credited to the

Revenues—Other account in this Special Revenue Fund.d. Interest revenue earned and

received during 20X4, $15,000, was improperly recorded as Revenues—Other, whereas a

separate Revenues—Interest account is maintained.e. A 20X4 payment in lieu of taxes by the

federal government was erroneously credited to the Education—General and Administrative

expenditures account, $50,000.4. The following adjusting entries were determined to be

necessary at the end of 20X4:a. State special education grants received during 20X4 and

recorded as 20X4 revenues, $800,000, were only 75% earned by incurring qualifying

expenditures during 20X4.b. The Stem Independent School District was notified that the state

had collected $300,000 of sales taxes for its benefit and would remit them early in

20X5.RequiredPrepare the journal entries to record these error corrections, changes in

accounting principles, and adjustments in the General Ledger accounts only of the Special

Revenue Fund of Stem Independent School District.View Solution: The following transactions

and events affected a Special Revenue Fund

SOLUTION-- http://solutiondone.online/downloads/the-following-transactions-and-events-

affected-a-special-revenue-fund/

Unlock answers here solutiondone.online

You might also like

- Capgemini-Payslip For The Month MAYDocument1 pageCapgemini-Payslip For The Month MAYnagendraNo ratings yet

- ACG 4501 Exam 2 PracticeDocument10 pagesACG 4501 Exam 2 Practicerprasad05100% (2)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- TAX-501 (Excise Taxes)Document6 pagesTAX-501 (Excise Taxes)Ryan AllanicNo ratings yet

- Test Bank For Introduction To Government and Non-For-Profit Accounting 7E - IvesDocument22 pagesTest Bank For Introduction To Government and Non-For-Profit Accounting 7E - IvesIven ChienNo ratings yet

- ACG 4501 Exam 3 Practice-2Document10 pagesACG 4501 Exam 3 Practice-2rprasad05No ratings yet

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- RR 9-89Document6 pagesRR 9-89papepipupoNo ratings yet

- Unlock Answers Here Solutiondone - OnlineDocument1 pageUnlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- A Analyze The Effects of The Following Transactions On The: Unlock Answers Here Solutiondone - OnlineDocument1 pageA Analyze The Effects of The Following Transactions On The: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Test MidtermDocument4 pagesTest MidtermcirujeffNo ratings yet

- Solutiondone 2-230Document1 pageSolutiondone 2-230trilocksp SinghNo ratings yet

- Using The Information From Problem 19 4 Prepare The Three FinancialDocument1 pageUsing The Information From Problem 19 4 Prepare The Three Financialtrilocksp SinghNo ratings yet

- Except: © 2009 Pearson Education, Inc. Publishing As Prentice HallDocument10 pagesExcept: © 2009 Pearson Education, Inc. Publishing As Prentice Hallb-80815bNo ratings yet

- The City of Cherokee Hill Adopted Its Fiscal Year 20X8: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe City of Cherokee Hill Adopted Its Fiscal Year 20X8: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- ACCT 450 - AICPA Questions FlashcardsDocument24 pagesACCT 450 - AICPA Questions FlashcardsdissidentmeNo ratings yet

- 2021 2nd AC - Acctg Gov Quiz 04Document4 pages2021 2nd AC - Acctg Gov Quiz 04Merliza JusayanNo ratings yet

- Following Is The September 30 20X8 Trial Balance For ABC: Unlock Answers Here Solutiondone - OnlineDocument1 pageFollowing Is The September 30 20X8 Trial Balance For ABC: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Yellow Final Ans Thanks// Palagay San Nakita For Ex: NASA FILE OR LINK - Final Answer - No Answer Yet/not SureDocument7 pagesYellow Final Ans Thanks// Palagay San Nakita For Ex: NASA FILE OR LINK - Final Answer - No Answer Yet/not SureA. MagnoNo ratings yet

- Solutiondone 2-283Document1 pageSolutiondone 2-283trilocksp SinghNo ratings yet

- Practice NPO Acctg12 PDFDocument6 pagesPractice NPO Acctg12 PDFCresca Cuello CastroNo ratings yet

- ACC-553 Federal Taxation Midterm Exam (Keller)Document16 pagesACC-553 Federal Taxation Midterm Exam (Keller)FreeBookNo ratings yet

- Solutiondone 2-228Document1 pageSolutiondone 2-228trilocksp SinghNo ratings yet

- ACC-553 Federal Taxation Midterm Exam (Keller)Document9 pagesACC-553 Federal Taxation Midterm Exam (Keller)robertmoreno0% (1)

- Fiduciary Funds and Permanent Funds: True/False (Chapter 10)Document25 pagesFiduciary Funds and Permanent Funds: True/False (Chapter 10)Holban AndreiNo ratings yet

- General Fundtrial Balance JANUARY 1, 2018 Debits CreditsDocument2 pagesGeneral Fundtrial Balance JANUARY 1, 2018 Debits CreditsTehone TeketelewNo ratings yet

- ch18 Beams10e TBDocument14 pagesch18 Beams10e TBFaraid AlchalabiNo ratings yet

- Multiple Choice Questions 1 The General Fund Pays Rent For: Unlock Answers Here Solutiondone - OnlineDocument1 pageMultiple Choice Questions 1 The General Fund Pays Rent For: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- TaxDocument5 pagesTaxAl Francis Delmar PariñasNo ratings yet

- Acc 496 Chapter 6Document2 pagesAcc 496 Chapter 6Abdul HassonNo ratings yet

- The Trial Balance of Farley College A Government University AsDocument1 pageThe Trial Balance of Farley College A Government University Astrilocksp SinghNo ratings yet

- NPO AssignmentDocument4 pagesNPO AssignmentZyrah Mae SaezNo ratings yet

- EeeDocument9 pagesEeeNico evansNo ratings yet

- Solutiondone 2-190Document1 pageSolutiondone 2-190trilocksp SinghNo ratings yet

- E12.2 Fund and Government-Wide ReportingDocument5 pagesE12.2 Fund and Government-Wide ReportingHa NoiNo ratings yet

- Intax Quiz 11Document1 pageIntax Quiz 11BLACKPINKLisaRoseJisooJennieNo ratings yet

- Sevilla - Unit 3 - IA3Document22 pagesSevilla - Unit 3 - IA3Hensel SevillaNo ratings yet

- BLT 2011 First Pre-Board FebruaryDocument11 pagesBLT 2011 First Pre-Board FebruaryLester AguinaldoNo ratings yet

- Factors Contributing To FY 2010 Shortfall: Description Amount Approximate Date When IdentifiedDocument4 pagesFactors Contributing To FY 2010 Shortfall: Description Amount Approximate Date When IdentifiedShane CurcuruNo ratings yet

- Quiz - Accounting For VHWO (Ver. 7)Document9 pagesQuiz - Accounting For VHWO (Ver. 7)Von Andrei MedinaNo ratings yet

- Finals ReviewerDocument9 pagesFinals ReviewerAira Jaimee GonzalesNo ratings yet

- Acc431 Quiz2 Answers V1Document7 pagesAcc431 Quiz2 Answers V1novaNo ratings yet

- Solutiondone 2-49Document1 pageSolutiondone 2-49trilocksp SinghNo ratings yet

- WK 3 Textbook AssignmentDocument4 pagesWK 3 Textbook AssignmentTressa audellNo ratings yet

- Solutiondone 2-282Document1 pageSolutiondone 2-282trilocksp SinghNo ratings yet

- Assignment Module 3Document2 pagesAssignment Module 3Drew BanlutaNo ratings yet

- 2011 AICPA FAR Release QuestionsDocument51 pages2011 AICPA FAR Release Questionsjklein2588100% (1)

- Chapter 18 States and Local Govermental UnitsDocument14 pagesChapter 18 States and Local Govermental UnitsHyewon100% (1)

- Financial Statements Types Presentation Limitations UsersDocument20 pagesFinancial Statements Types Presentation Limitations UsersGemma PalinaNo ratings yet

- CAS QuizDocument6 pagesCAS QuizLeng ChhunNo ratings yet

- Chapter 11 Problems - 2Document7 pagesChapter 11 Problems - 2salehin1969No ratings yet

- Concepts in Federal Taxation 2017 24th Edition Murphy Test Bank 1Document40 pagesConcepts in Federal Taxation 2017 24th Edition Murphy Test Bank 1hiedi100% (47)

- Concepts in Federal Taxation 2017 24Th Edition Murphy Test Bank Full Chapter PDFDocument36 pagesConcepts in Federal Taxation 2017 24Th Edition Murphy Test Bank Full Chapter PDFantonio.letourneau987100% (15)

- Chap10 5Document1 pageChap10 5Bubble GumNo ratings yet

- Quiz Accounting For VHWODocument7 pagesQuiz Accounting For VHWOCarol PagalNo ratings yet

- Solutiondone 2-251Document1 pageSolutiondone 2-251trilocksp SinghNo ratings yet

- AEC 34 - ACB Assignment: Module 3: Problem 3-1.TRUE OR FALSEDocument2 pagesAEC 34 - ACB Assignment: Module 3: Problem 3-1.TRUE OR FALSEDrew BanlutaNo ratings yet

- Sample FinalDocument18 pagesSample FinalDavid MendietaNo ratings yet

- Chapter IX Accounting For Fiduciary FundsDocument12 pagesChapter IX Accounting For Fiduciary Fundsnatnaelsleshi3No ratings yet

- Taxation of Business Entities 4Th Edition Spilker Test Bank Full Chapter PDFDocument67 pagesTaxation of Business Entities 4Th Edition Spilker Test Bank Full Chapter PDFKelseyWeberbdwk100% (12)

- Tax OriginalPre-Board ExaminationDocument7 pagesTax OriginalPre-Board ExaminationmaricielaNo ratings yet

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018From EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- A Study On Income Tax Law & Accounting 2019Document26 pagesA Study On Income Tax Law & Accounting 2019Novelyn Hiso-anNo ratings yet

- Actividad 7 1040 FormDocument2 pagesActividad 7 1040 FormKevin ÁlvarezNo ratings yet

- Administrative Provisions - Estate Tax (Presentation Slides)Document9 pagesAdministrative Provisions - Estate Tax (Presentation Slides)KezNo ratings yet

- Show All Work For Credit: Introduction To Income Taxation Brown Homework Set #5 (Chapter 7)Document2 pagesShow All Work For Credit: Introduction To Income Taxation Brown Homework Set #5 (Chapter 7)para uqeenNo ratings yet

- Cprs Payslip1.jspDocument1 pageCprs Payslip1.jspSarthakNo ratings yet

- Capital Budgeting CaseDocument2 pagesCapital Budgeting CaseEkta AgarwalNo ratings yet

- Zimbabwe Revenue AuthorityDocument27 pagesZimbabwe Revenue AuthorityFranco DurantNo ratings yet

- Tax 03 05 Income Taxation of Partnership Estate and Trust - EncryptedDocument6 pagesTax 03 05 Income Taxation of Partnership Estate and Trust - EncryptedPj ManezNo ratings yet

- Wide Band Communication PVT LTD - Psid# 37347217 (2015)Document1 pageWide Band Communication PVT LTD - Psid# 37347217 (2015)Asif JavidNo ratings yet

- Taxation: DFA 2104YDocument16 pagesTaxation: DFA 2104YFhawez KodoruthNo ratings yet

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- A Project Report On Direct TaxDocument44 pagesA Project Report On Direct Taxrani26oct100% (2)

- w-4 IN PDFDocument2 pagesw-4 IN PDFAnonymous rPkHXogyNo ratings yet

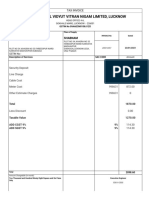

- Madhyanchal Vidyut Vitran Nigam Limited, Lucknow: Shabnam ShabnamDocument2 pagesMadhyanchal Vidyut Vitran Nigam Limited, Lucknow: Shabnam ShabnamYadav Manish KumarNo ratings yet

- A Government of West Bengal EnterpriseDocument1 pageA Government of West Bengal EnterprisetanmoyNo ratings yet

- Alberta Economic Multipliers 2011Document66 pagesAlberta Economic Multipliers 2011Ffedsw NicksNo ratings yet

- Ghana Fiscal Guide 2015 2016Document10 pagesGhana Fiscal Guide 2015 2016batuchemNo ratings yet

- Bustax Chapter 1Document9 pagesBustax Chapter 1Pineda, Paula MarieNo ratings yet

- Invoice: Page 1 of 3Document3 pagesInvoice: Page 1 of 3AbhinavNo ratings yet

- 12 Set of Handwritten NotesDocument6 pages12 Set of Handwritten NotesHritik HarlalkaNo ratings yet

- Aldi Senate SubmissionDocument4 pagesAldi Senate SubmissionMathewDunckleyNo ratings yet

- PaymentDocument1 pagePaymentMenegraalNo ratings yet

- PROBLEM NO. 3 - Various Current LiabilitiesDocument2 pagesPROBLEM NO. 3 - Various Current LiabilitiesMark Michael LegaspiNo ratings yet

- Declaration For Housing LoanDocument2 pagesDeclaration For Housing LoanjasNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood AhmadNo ratings yet

- Cis305 2Document4 pagesCis305 2vqx9phyftvNo ratings yet

- Item Name HSN Code GST Rate QTY Taxable Rate Taxable ValueDocument5 pagesItem Name HSN Code GST Rate QTY Taxable Rate Taxable ValueAnup gurungNo ratings yet