Professional Documents

Culture Documents

On August 31 2013 The Balance in The Checkbook and

On August 31 2013 The Balance in The Checkbook and

Uploaded by

Muhammad ShahidOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

On August 31 2013 The Balance in The Checkbook and

On August 31 2013 The Balance in The Checkbook and

Uploaded by

Muhammad ShahidCopyright:

Available Formats

On August 31 2013 the balance in the checkbook and

#6121

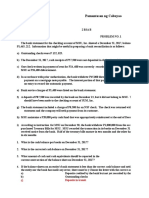

On August 31, 2013, the balance in the checkbook and the Cash account of the Sunoma Inn

was $12,281. The balance shown on the bank statement on the same date was

$13,197.Notesa. The firm's records indicate that a $1,450 deposit dated August 30 and a $701

deposit dated August 31 do not appear on the bank statement.b. A service charge of $8 and a

debit memorandum of $320 covering an NSF check have not yet been entered in the firm's

records. (The check was issued by Art Corts, a credit customer.)c. The following checks were

issued but have not yet been paid by the bank:Check 712, $110 Check 713, $125 Check 716,

$238 Check 736, $577 Check 739, $78 Check 741, $120d. A credit memorandum shows that

the bank collected a $2,084 note receivable and interest of $63 for the firm. These amounts

have not yet been entered in the firm's records.INSTRUCTIONS1. Prepare a bank reconciliation

statement for the firm as of August 31.2. Record general journal entries for items on the bank

reconciliation statement that must be journalized. Date the entries August

31,2013.Analyze:What effect did the journal entries recorded as a result of the bank

reconciliation have on the fundamental accounting equation?View Solution:

On August 31 2013 the balance in the checkbook and

ANSWER

http://paperinstant.com/downloads/on-august-31-2013-the-balance-in-the-checkbook-and/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- The Following Is The Unadjusted Trial Balance For Rocky MountainDocument2 pagesThe Following Is The Unadjusted Trial Balance For Rocky MountainMiroslav GegoskiNo ratings yet

- Lone Pine CafeDocument4 pagesLone Pine CafeRahul TiwariNo ratings yet

- Sergio Lucas Worked Long Hours During The Summer and Saved PDFDocument1 pageSergio Lucas Worked Long Hours During The Summer and Saved PDFTaimour HassanNo ratings yet

- Assignment No. 1 Audit of CashDocument5 pagesAssignment No. 1 Audit of CashMa Tiffany Gura RobleNo ratings yet

- Ch. 7 NumericalsDocument20 pagesCh. 7 NumericalsSevera Zahoor100% (1)

- On August 31 2016 The Balance in The Checkbook And: Unlock Answers Here Solutiondone - OnlineDocument1 pageOn August 31 2016 The Balance in The Checkbook And: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Open Doors With Brother Andrew, Inc.: Financial Statements With Independent Auditors' Report December 31, 2019 and 2018Document19 pagesOpen Doors With Brother Andrew, Inc.: Financial Statements With Independent Auditors' Report December 31, 2019 and 2018Um NarradorNo ratings yet

- CH 07 Alt ProbDocument8 pagesCH 07 Alt ProbAli Basti100% (1)

- The Cash Records and Bank Statement For The Month ofDocument1 pageThe Cash Records and Bank Statement For The Month ofMiroslav GegoskiNo ratings yet

- On October 31 2012 The Bank Statement For The CheckingDocument1 pageOn October 31 2012 The Bank Statement For The CheckingMiroslav GegoskiNo ratings yet

- The Cash Account For Stone Systems at July 31 2016Document1 pageThe Cash Account For Stone Systems at July 31 2016Muhammad ShahidNo ratings yet

- The Information That Follows Is Available From The General LedgerDocument1 pageThe Information That Follows Is Available From The General LedgerTaimour HassanNo ratings yet

- The Records of Clairemont Company Indicate An August 31 2013Document1 pageThe Records of Clairemont Company Indicate An August 31 2013Amit PandeyNo ratings yet

- The Cash Transactions and Cash Balances of Dodge Inc ForDocument1 pageThe Cash Transactions and Cash Balances of Dodge Inc Foramit raajNo ratings yet

- 12 SSDDDDocument3 pages12 SSDDDAlvira FajriNo ratings yet

- The Cash Account of Switzer LTD Reported A Balance ofDocument1 pageThe Cash Account of Switzer LTD Reported A Balance ofMuhammad ShahidNo ratings yet

- TugasDocument4 pagesTugasrianiaffi02No ratings yet

- Self-Test 1Document8 pagesSelf-Test 1Dymphna Ann CalumpianoNo ratings yet

- The Records of Parker Company Indicate A July 31 2016Document1 pageThe Records of Parker Company Indicate A July 31 2016Muhammad ShahidNo ratings yet

- Assignment 1 Deadline: August 31, 2018Document4 pagesAssignment 1 Deadline: August 31, 2018anon_806011137No ratings yet

- Auditing JPIADocument18 pagesAuditing JPIAAken Lieram Ats AnaNo ratings yet

- NW NSC Accounting P2 Eng QP Sept 2023Document15 pagesNW NSC Accounting P2 Eng QP Sept 2023lehlohonolomaile283No ratings yet

- Infinity Emporium Company Received The Monthly Statement For Its Bank PDFDocument1 pageInfinity Emporium Company Received The Monthly Statement For Its Bank PDFhassan taimourNo ratings yet

- 2010 01 16 - 041240 - P3 2aDocument12 pages2010 01 16 - 041240 - P3 2ahandiniNo ratings yet

- Lupus Colorado 2014 Financial Statement PDFDocument14 pagesLupus Colorado 2014 Financial Statement PDFAnonymous eZV1gVrNo ratings yet

- Audit of CashDocument6 pagesAudit of CashMark Lord Morales Bumagat100% (2)

- Essay Test BSDocument2 pagesEssay Test BSTùng NgôNo ratings yet

- The Following Accounts With The BalancesDocument1 pageThe Following Accounts With The BalancesM Bilal SaleemNo ratings yet

- The Following Accounts With The BalancesDocument1 pageThe Following Accounts With The BalancesM Bilal SaleemNo ratings yet

- Seminar 3S212 - 13 PDFDocument4 pagesSeminar 3S212 - 13 PDFShweta SridharNo ratings yet

- Intermediate Accounting 1Document14 pagesIntermediate Accounting 1cpacpacpa100% (1)

- ACC17-FAR Take Home Activities 1 and 2: Test IDocument19 pagesACC17-FAR Take Home Activities 1 and 2: Test IJustine Cruz67% (3)

- Audit of CashDocument4 pagesAudit of CashBromanineNo ratings yet

- Audit of Cash 11Document2 pagesAudit of Cash 11Raz MahariNo ratings yet

- Cash and Cash Equivalent HandoutsDocument6 pagesCash and Cash Equivalent HandoutsMichael BongalontaNo ratings yet

- The September 30 2014 Records of First Data Communications IncludeDocument1 pageThe September 30 2014 Records of First Data Communications IncludeMuhammad ShahidNo ratings yet

- Solutiondone 2-414Document1 pageSolutiondone 2-414trilocksp SinghNo ratings yet

- ArticleDocument1 pageArticleDarlene Kate Honra CantelaNo ratings yet

- The December Bank Statement and Cash T Account For StewartDocument1 pageThe December Bank Statement and Cash T Account For StewartTaimur TechnologistNo ratings yet

- CH 07Document5 pagesCH 07Ngọc NgốNo ratings yet

- On August 31 The Balance Sheet of La Brava VeterinaryDocument1 pageOn August 31 The Balance Sheet of La Brava Veterinarytrilocksp SinghNo ratings yet

- The Cash Transactions and Cash Balances of Banner Inc ForDocument1 pageThe Cash Transactions and Cash Balances of Banner Inc Foramit raajNo ratings yet

- Chapter 6 ICADocument5 pagesChapter 6 ICAAndrew MarchukNo ratings yet

- During The Bank Reconciliation Process at Fontes Company On MayDocument1 pageDuring The Bank Reconciliation Process at Fontes Company On MayMuhammad ShahidNo ratings yet

- Neosho River Resort Opened For Business On June 1 With PDFDocument1 pageNeosho River Resort Opened For Business On June 1 With PDFAnbu jaromiaNo ratings yet

- ACF - Audited-Financials-2021Document23 pagesACF - Audited-Financials-2021ejazahmad5No ratings yet

- Johnson Corporation S Bank Statement For October Reports An Ending BalanceDocument1 pageJohnson Corporation S Bank Statement For October Reports An Ending BalanceLet's Talk With HassanNo ratings yet

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Fatimatuz Zahro - Exercise CHP 8 Dan 9Document6 pagesFatimatuz Zahro - Exercise CHP 8 Dan 9Fatimatuz ZahroNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument11 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 Dockets100% (1)

- 3int - 2007 - Jun - QUS CAT T3Document10 pages3int - 2007 - Jun - QUS CAT T3asad19100% (1)

- Refer To The Data For Rocky Mountain Resort Inc inDocument2 pagesRefer To The Data For Rocky Mountain Resort Inc inMiroslav GegoskiNo ratings yet

- Cantu Office Supply Company Received A Bank Statement Showing ADocument1 pageCantu Office Supply Company Received A Bank Statement Showing AMuhammad ShahidNo ratings yet

- Bank Reconciliations C1 - Activities CDocument8 pagesBank Reconciliations C1 - Activities CSuy YanghearNo ratings yet

- Accaf3junwk3qa PDFDocument13 pagesAccaf3junwk3qa PDFTiny StarsNo ratings yet

- Business School: ACCT1501 Accounting and Financial Management 1A Session 1 2016Document60 pagesBusiness School: ACCT1501 Accounting and Financial Management 1A Session 1 2016Sarthak GargNo ratings yet

- Quiz # 11 Bank Reconciliation, Proof of Cash & AR - FinalDocument2 pagesQuiz # 11 Bank Reconciliation, Proof of Cash & AR - FinalDarren Jacob EspinaNo ratings yet

- ch08 PDFDocument4 pagesch08 PDFRabie HarounNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- You Are The Controller of Small Toys Inc Marta JohnsDocument1 pageYou Are The Controller of Small Toys Inc Marta JohnsMuhammad ShahidNo ratings yet

- You Have Been Asked To Evaluate Two Companies As PossibleDocument2 pagesYou Have Been Asked To Evaluate Two Companies As PossibleMuhammad ShahidNo ratings yet

- Zeus Industries Manufactures Two Types of Electrical Power Units CustomDocument1 pageZeus Industries Manufactures Two Types of Electrical Power Units CustomMuhammad ShahidNo ratings yet

- Your Supervisor Has Asked You To Research A Potential TaxDocument1 pageYour Supervisor Has Asked You To Research A Potential TaxMuhammad ShahidNo ratings yet

- You Are Being Interviewed For A Job As A PortfolioDocument1 pageYou Are Being Interviewed For A Job As A PortfolioMuhammad ShahidNo ratings yet

- You Can Find A Spreadsheet Containing The Historic Returns PresentedDocument1 pageYou Can Find A Spreadsheet Containing The Historic Returns PresentedMuhammad ShahidNo ratings yet

- You Decide Which Method Is Better The Direct Write Off Method orDocument1 pageYou Decide Which Method Is Better The Direct Write Off Method orMuhammad ShahidNo ratings yet

- You Have Been Named As Investment Adviser To A FoundationDocument1 pageYou Have Been Named As Investment Adviser To A FoundationMuhammad ShahidNo ratings yet

- You Are Considering Making A Contribution To The Conservation FundDocument1 pageYou Are Considering Making A Contribution To The Conservation FundMuhammad ShahidNo ratings yet

- Wireless Communications Inc Is Preparing Its Cash Budget For 2014Document1 pageWireless Communications Inc Is Preparing Its Cash Budget For 2014Muhammad ShahidNo ratings yet

- You Are P J Walter Cfa A Managing Partner ofDocument1 pageYou Are P J Walter Cfa A Managing Partner ofMuhammad ShahidNo ratings yet

- You Are Reviewing The Financial Statements of Rising Yeast CoDocument1 pageYou Are Reviewing The Financial Statements of Rising Yeast CoMuhammad ShahidNo ratings yet

- You Are A Portfolio Manager and Senior Executive Vice PresidentDocument1 pageYou Are A Portfolio Manager and Senior Executive Vice PresidentMuhammad ShahidNo ratings yet

- Washington City Created An Information Technology Department in 2013 To PDFDocument1 pageWashington City Created An Information Technology Department in 2013 To PDFMuhammad ShahidNo ratings yet

- World Mosaic Furniture Gallery Inc Provided The Following Data FromDocument2 pagesWorld Mosaic Furniture Gallery Inc Provided The Following Data FromMuhammad ShahidNo ratings yet

- You Are Maintaining A Subsidiary Ledger Account For Firefighter Training ExpendituresDocument1 pageYou Are Maintaining A Subsidiary Ledger Account For Firefighter Training ExpendituresMuhammad ShahidNo ratings yet

- You Are Given The Following Price of The Stock 18 PriceDocument1 pageYou Are Given The Following Price of The Stock 18 PriceMuhammad ShahidNo ratings yet

- When Sandra Costello S Father Died Suddenly Sandra Had Just CompletedDocument1 pageWhen Sandra Costello S Father Died Suddenly Sandra Had Just CompletedMuhammad ShahidNo ratings yet

- You Are Given The Following Information Expected Return On Stock ADocument1 pageYou Are Given The Following Information Expected Return On Stock AMuhammad ShahidNo ratings yet

- Wimberley Glass Inc Has Shops in The Shopping Malls ofDocument1 pageWimberley Glass Inc Has Shops in The Shopping Malls ofMuhammad ShahidNo ratings yet

- Walter Liu Has Owned and Operated LW Media Inc SinceDocument2 pagesWalter Liu Has Owned and Operated LW Media Inc SinceMuhammad ShahidNo ratings yet

- Waylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Document1 pageWaylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Muhammad ShahidNo ratings yet

- Wilma Company Must Decide Whether To Make or Buy SomeDocument1 pageWilma Company Must Decide Whether To Make or Buy SomeMuhammad ShahidNo ratings yet

- West Texas Exploration Co Was Established On October 15 2016Document2 pagesWest Texas Exploration Co Was Established On October 15 2016Muhammad ShahidNo ratings yet

- Winnipeg Enterprises Inc Reported The Following Summarized Balance Sheet atDocument2 pagesWinnipeg Enterprises Inc Reported The Following Summarized Balance Sheet atMuhammad ShahidNo ratings yet

- Webmasters Com Has Developed A Powerful New Server That Would BeDocument1 pageWebmasters Com Has Developed A Powerful New Server That Would BeMuhammad ShahidNo ratings yet

- Western Agriculture Industries LTD Is Authorized by The Province ofDocument1 pageWestern Agriculture Industries LTD Is Authorized by The Province ofMuhammad ShahidNo ratings yet

- Waypine Enterprises Reported A Pretax Operating Loss of 84 000 inDocument1 pageWaypine Enterprises Reported A Pretax Operating Loss of 84 000 inMuhammad ShahidNo ratings yet

- Web Marketing Services Inc Completed These Transactions During The FirstDocument2 pagesWeb Marketing Services Inc Completed These Transactions During The FirstMuhammad ShahidNo ratings yet

- Using The Data Below Compute Net Income Accounts PayableDocument1 pageUsing The Data Below Compute Net Income Accounts PayableMuhammad ShahidNo ratings yet