Professional Documents

Culture Documents

Statement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015

Statement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015

Uploaded by

Alyssa Alejandro0 ratings0% found this document useful (0 votes)

55 views2 pagesTea International Technology Inc. reported $8,400 in net income for 2015. Their statement of cash flows will show $2,000 increase in cash from $3,500 to $5,500 using both direct and indirect methods. Under the direct method, their operating activities will show $12,100 in operating income adjusted for non-cash items like depreciation of $3,400 and a gain on sale of equipment of $600. Their investing activities will show $15,200 used to purchase equipment and $2,100 from the sale of equipment. Their financing activities will show $8,000 from issuing bonds.

Original Description:

Original Title

Statement-of-Cash-Flows-Problem

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTea International Technology Inc. reported $8,400 in net income for 2015. Their statement of cash flows will show $2,000 increase in cash from $3,500 to $5,500 using both direct and indirect methods. Under the direct method, their operating activities will show $12,100 in operating income adjusted for non-cash items like depreciation of $3,400 and a gain on sale of equipment of $600. Their investing activities will show $15,200 used to purchase equipment and $2,100 from the sale of equipment. Their financing activities will show $8,000 from issuing bonds.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

55 views2 pagesStatement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015

Statement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015

Uploaded by

Alyssa AlejandroTea International Technology Inc. reported $8,400 in net income for 2015. Their statement of cash flows will show $2,000 increase in cash from $3,500 to $5,500 using both direct and indirect methods. Under the direct method, their operating activities will show $12,100 in operating income adjusted for non-cash items like depreciation of $3,400 and a gain on sale of equipment of $600. Their investing activities will show $15,200 used to purchase equipment and $2,100 from the sale of equipment. Their financing activities will show $8,000 from issuing bonds.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

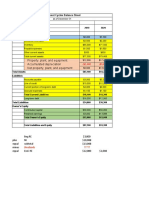

Statement of Cash Flows

The condensed financial information of the Tea International Technology Inc. for 2015 is shown below

for the preparation of the Statement of Cash Flows.

Requirement: Prepare the Statement of Cash Flows under both Direct and Indirect Methods

Tea International Technology Inc.

Condensed Financial Information

Statement of Financial Position Information

Balances

Accounts Jan 1, 2015 Dec 31, 2015

Cash $ 3,500 $ 5,500 + 2k

Accounts receivable 4,400 3,600

Inventory 5,000 6,600

Land 8,200 12,200

Buildings and equipment 35,700 48,700

Accumulated depreciation (6,000) (8,700)

Total Assets $ 50,800 $ 67,900

Accounts payable $ 5,100 $ 3,200

Salaries payable 1,400 1,800

Bonds payable, 10% 7,000 15,000

Ordinary shares, $10 par 8,000 9,000

Additional paid-in capital 16,000 19,000

Retained earnings 13,300 19,900

Total Liabilities and Equity $ 50,800 $ 67,900

Income Statement for 2015

Sales revenue $ 80,000

Cost of goods sold 48,600

Gross profit $ 31,400

Operating expenses

Depreciation expense $ 3,400

Other expenses 15,900 19,300

Operating income $12,100

Other revenues and expenses:

Gain on sale of equipment $ 600

Interest expense 700 100

Income before income taxes $12,000

Income tax expense 3,600

Net income $ 8,400

Retained Earnings Information for 2015

Beginning retained earnings $ 13,300

Add: Net income 8,400

TOTAL $ 21,700

Less: Dividends (1,800)

Ending retained earnings $ 19,900

Supplementary Information for 2015

a. Equipment was purchased for cash at a cost of $ 15,200.

b. Ten-year bonds payable with a face value of $ 8,000 were issued for $ 8,000 at the end of the

year.

c. Land was acquired through the issuance for 100 ordinary shares of $10 par shares when the stock

was selling at a market price of $40 per share.

d. Equipment with a cost of $ 2,200 and a book value of $ 1,500 was sold for $ 2,100 cash.

Additional information: ????

a. Purchase of equipment worth $15,200 – investing – negative

b. Payment of Bond payable $8,000 – financing – negative

c. Land acquisition of worth $4000 – investing – positive

d. Sale of equipment 2100 – 1500 = 600 – investing – positive

You might also like

- Crown Pallet PC 4500 Parts Catalog Maintenance Service Manual en FRDocument22 pagesCrown Pallet PC 4500 Parts Catalog Maintenance Service Manual en FRjohnathanfoster080802obr96% (27)

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- 167 A 2Document3 pages167 A 2hira malik0% (1)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Module 4 - Population Growth Economic Development - Causes - Consequences and Controversies - PPTDocument56 pagesModule 4 - Population Growth Economic Development - Causes - Consequences and Controversies - PPTAlyssa Alejandro100% (4)

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocument4 pagesProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- FIN1000 Module06 Forecasting AssignmentDocument4 pagesFIN1000 Module06 Forecasting AssignmentfaithNo ratings yet

- Module 2 - Classic Theories of Economic Growth and Development PPT - PDF - 2Document44 pagesModule 2 - Classic Theories of Economic Growth and Development PPT - PDF - 2Alyssa Alejandro0% (1)

- Original PetitionDocument14 pagesOriginal PetitionCraigNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Comparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Document2 pagesComparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Rose BaynaNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- Financial Accounting HomeworkDocument9 pagesFinancial Accounting HomeworkDương Nguyễn BìnhNo ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Financial PlanDocument4 pagesFinancial PlanrowanNo ratings yet

- Financial Accounts Assingnment 3Document5 pagesFinancial Accounts Assingnment 3Zakarya KhanNo ratings yet

- Blue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlDocument4 pagesBlue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlKimberley WrightNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Cash Flow ProblemsDocument2 pagesCash Flow ProblemsMeiMisakiNo ratings yet

- Tutorial 1Document13 pagesTutorial 1vinaykrishnas97No ratings yet

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Intercorporate - Class Exercises - ANSWERSDocument5 pagesIntercorporate - Class Exercises - ANSWERSKhushbooNo ratings yet

- IAS 7 Full Conso Statement of Cash Flows-Akorfa GroupDocument2 pagesIAS 7 Full Conso Statement of Cash Flows-Akorfa GroupeoafriyieNo ratings yet

- Audit of Financial Statements Part 2Document2 pagesAudit of Financial Statements Part 2Brit NeyNo ratings yet

- 1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Document7 pages1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Adzinta Syamsa100% (1)

- 01 - Exercises Session 1 - EmptyDocument4 pages01 - Exercises Session 1 - EmptyAgustín RosalesNo ratings yet

- Carley NDocument11 pagesCarley NaliNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Jawaban Latihan Soal AklDocument11 pagesJawaban Latihan Soal AklFauzi AbdillahNo ratings yet

- Consolidated Net Income P 370,000 P 460,000: Illustrative ProblemsDocument11 pagesConsolidated Net Income P 370,000 P 460,000: Illustrative ProblemsKeir GaspanNo ratings yet

- Pelenio - Abm 12-ADocument2 pagesPelenio - Abm 12-AAAAAANo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Soal AkuntansiDocument4 pagesSoal AkuntansinairobiNo ratings yet

- ACCT 3061 Asignación Cap 4 y 5Document4 pagesACCT 3061 Asignación Cap 4 y 5gpm-81No ratings yet

- Kimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadDocument4 pagesKimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadKimberly VeguillaNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- Copies Express Inc - by Cherryl ValmoresDocument7 pagesCopies Express Inc - by Cherryl ValmoresCHERRYL VALMORESNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Exercise 8Document6 pagesExercise 8syraNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Additional Cash Flow ProblemsDocument3 pagesAdditional Cash Flow ProblemsChelle HullezaNo ratings yet

- Chapter 1 - Some Solved ProblemsDocument12 pagesChapter 1 - Some Solved ProblemsBracu 2023No ratings yet

- S 5.8-5.13 Limited CompaniesDocument11 pagesS 5.8-5.13 Limited CompaniesIlovejjcNo ratings yet

- ExerciseDocument12 pagesExercisesde.ofcl20No ratings yet

- Bac 3 Review QNSDocument16 pagesBac 3 Review QNSsaidkhatib368No ratings yet

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocument5 pagesStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- BUS 285 F23 Practice Questions in WordDocument6 pagesBUS 285 F23 Practice Questions in WordLê AnhNo ratings yet

- Explained: AccountingDocument3 pagesExplained: AccountingAJNo ratings yet

- Statement of Financial Position As at 31st March 2015Document52 pagesStatement of Financial Position As at 31st March 2015Shameel IrshadNo ratings yet

- Practice+Quiz+ +quiz+#1 Solutions+to+PsDocument6 pagesPractice+Quiz+ +quiz+#1 Solutions+to+PsmareagodinezNo ratings yet

- Ap - Ap 2.1Document19 pagesAp - Ap 2.1viethoangduongkhanhNo ratings yet

- Assets 2018 2019 Forecast: Balance SheetDocument12 pagesAssets 2018 2019 Forecast: Balance SheetJosephAmparoNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- Accounting Exercises On Cash FlowsDocument2 pagesAccounting Exercises On Cash FlowsMicaella GoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Module 6 - Agriculture - BDocument38 pagesModule 6 - Agriculture - BAlyssa AlejandroNo ratings yet

- Module 5 - Urbanization - ADocument38 pagesModule 5 - Urbanization - AAlyssa AlejandroNo ratings yet

- Module 3 - Poverty, Inequality & Development - PPTDocument41 pagesModule 3 - Poverty, Inequality & Development - PPTAlyssa Alejandro100% (1)

- Itab RetakeDocument2 pagesItab RetakeAlyssa AlejandroNo ratings yet

- Angeles University Foundation College of Business and AccountancyDocument9 pagesAngeles University Foundation College of Business and AccountancyAlyssa AlejandroNo ratings yet

- Metrobank: The Following Are The Metrobank ConglomerateDocument3 pagesMetrobank: The Following Are The Metrobank ConglomerateAlyssa AlejandroNo ratings yet

- Liquidity Ratios (Do Not Include Working Capital) : - Longer BetterDocument3 pagesLiquidity Ratios (Do Not Include Working Capital) : - Longer BetterAlyssa AlejandroNo ratings yet

- Realtime Drafting & Managements Services: Debit To: Isujuta SDN BHD TawauDocument4 pagesRealtime Drafting & Managements Services: Debit To: Isujuta SDN BHD TawauJingjing Ramirez LimpahanNo ratings yet

- Obli EditedDocument147 pagesObli EditedMary Ann MasangcayNo ratings yet

- Chapter 10 - Ethical Decision MakingDocument38 pagesChapter 10 - Ethical Decision MakingGraceNo ratings yet

- Arii 2018Document207 pagesArii 2018Bisa AcademyNo ratings yet

- Birla Organization StructureDocument19 pagesBirla Organization StructureSouravsapPPNo ratings yet

- The Bible (101 Most Powerful Series) (PDFDrive)Document257 pagesThe Bible (101 Most Powerful Series) (PDFDrive)amojo ayokunle100% (2)

- Auditing in CIS Prelim ExamDocument2 pagesAuditing in CIS Prelim ExamOlivas ArjayNo ratings yet

- Cost II - CH - 2-Decision MakingDocument9 pagesCost II - CH - 2-Decision MakingYitera SisayNo ratings yet

- Future of Voice: Telecoms Strategy Masterclass - Santa Clara & LondonDocument4 pagesFuture of Voice: Telecoms Strategy Masterclass - Santa Clara & LondonDean BubleyNo ratings yet

- Protection in Respect of Conviction For Offences: A Constitutional BlendDocument19 pagesProtection in Respect of Conviction For Offences: A Constitutional BlendRohit AhujaNo ratings yet

- 7.1.1 Record Keeping: It Is Necessary To Have Good Records For Effective Control and For Tax PurposesDocument9 pages7.1.1 Record Keeping: It Is Necessary To Have Good Records For Effective Control and For Tax PurposesTarekegnNo ratings yet

- Almarai CompanyDocument6 pagesAlmarai CompanyMishal SubhhaniNo ratings yet

- Cornelius HILL Trudie Hastings Hill, H/W, Appellants v. Reederei F. Laeisz G.M.B.H., Rostock Schiffarhtsgesellschaft MS Priwall MBH & CO. KGDocument29 pagesCornelius HILL Trudie Hastings Hill, H/W, Appellants v. Reederei F. Laeisz G.M.B.H., Rostock Schiffarhtsgesellschaft MS Priwall MBH & CO. KGScribd Government DocsNo ratings yet

- RA 9208 - Anti-Trafficking in Persons Act of 2003Document13 pagesRA 9208 - Anti-Trafficking in Persons Act of 2003Rocky MarcianoNo ratings yet

- Lucrare Domnul Profesor Liviu Alexandru SOFONEA Anglia 2013 ICONOGRAFIA +NOTEDocument21 pagesLucrare Domnul Profesor Liviu Alexandru SOFONEA Anglia 2013 ICONOGRAFIA +NOTEVictoria CotorobaiNo ratings yet

- Unit 1 Introduction To International Business: StructureDocument13 pagesUnit 1 Introduction To International Business: Structureprskrs2No ratings yet

- Anacalypsis v2 Godfrey HigginsDocument671 pagesAnacalypsis v2 Godfrey HigginsSkibear777No ratings yet

- Wagner For TranscriptDocument13 pagesWagner For TranscriptSean PowersNo ratings yet

- Accounting For Business DecisionsDocument7 pagesAccounting For Business DecisionsFaizan AhmedNo ratings yet

- Dallas Business Journal 20150102 - SiDocument28 pagesDallas Business Journal 20150102 - Sisarah123No ratings yet

- Oracle Order Backlog Management DsDocument4 pagesOracle Order Backlog Management DsSaurabh SharmaNo ratings yet

- Result PHY-I-SEM 2712011Document73 pagesResult PHY-I-SEM 2712011Akshay K. AgarwalNo ratings yet

- Ramos-Yeo vs. Chua DigestDocument4 pagesRamos-Yeo vs. Chua DigestEmir MendozaNo ratings yet

- AE3 Policing PowersDocument5 pagesAE3 Policing PowersSian BrownNo ratings yet

- Oracle Database 11 Product Family: An Oracle White Paper June 2012Document19 pagesOracle Database 11 Product Family: An Oracle White Paper June 2012Aliasger BharmalNo ratings yet

- Sonza vs. ABS CBNDocument26 pagesSonza vs. ABS CBNDani McstNo ratings yet

- Twisted Travel Tales - The Sorrow of WarDocument1 pageTwisted Travel Tales - The Sorrow of WarandredewNo ratings yet

- Property and Land LawDocument13 pagesProperty and Land LawKathyrine BalacaocNo ratings yet