Professional Documents

Culture Documents

The Following Data Were Taken From The Records of Skate

The Following Data Were Taken From The Records of Skate

Uploaded by

M Bilal SaleemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Following Data Were Taken From The Records of Skate

The Following Data Were Taken From The Records of Skate

Uploaded by

M Bilal SaleemCopyright:

Available Formats

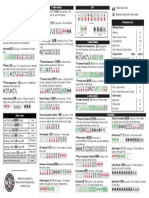

The following data were taken from the records of Skate

The following data were taken from the records of Skate N’ Ski Corporation for the year

endedOctober 31, 2006:Income statement data:Administrative expenses .........................$

100,000Cost of merchandise sold ..........................732,000Gain on condemnation of land

..........................60,000Income tax:Applicable to continuing operations

......................206,000Applicable to loss from discontinued operations

...................28,800Applicable to gain on condemnation of land ...................24,000Interest

expense ................................8,000Interest revenue ................................5,000Loss from

discontinued operations ......................76,800Loss from fixed asset impairment

......................200,000Restructuring charge . ...........................90,000Sales

..................................2,020,000Selling expenses ...............................400,000Retained earnings

and balance sheet data:Accounts payable ............................$ 89,500Accounts receivable

............................309,050Accumulated depreciation ........................3,050,000Accumulated

other comprehensive loss .....................24,000Allowance for doubtful accounts

.........................21,500Cash ...................................145,500Common stock, $15 par (400,000

shares authorized; 152,000 shares issued) ......2,280,000Deferred income taxes payable

(current portion, $4,700) ...............25,700Dividends:Cash dividends for common stock

.......................40,000Cash dividends for preferred stock .......................100,000Stock dividends

for common stock ......................60,000Dividends payable ..............................30,000Employee

termination benefit obligation (current) ................60,000Equipment

...............................9,541,050Income tax payable ............................55,900Interest receivable

.............................2,500Merchandise inventory (October 31, 2006), at lower of cost (FIFO) or

market .....425,000Notes receivable ..............................77,500Paid-in capital from sale of

Treasury stock ...................16,000Paid-in capital in excess of par—common stock

.................894,750Paid-in capital in excess of par—preferred stock .................240,000Patents

.................................$ 55,000Preferred 6 2/3% stock, $100 par (30,000 shares authorized;

15,000 shares issued) ..1,500,000Prepaid expenses ..............................15,900Retained

earnings, November 1, 2005 ......................2,446,150Temporary investment in marketable

equity securities ...............145,000Treasury stock (2,000 shares of common stock at cost of $35

per share) ..........70,000Unrealized loss (net of tax) on temporary equity securities

.............24,000Instructions1. Prepare a multiple-step income statement for the year ended

October 31, 2006, concluding with earnings per share. In computing earnings per share,

assume that the average number of common shares outstanding was 150,000 and preferred

dividends were $100,000. Assume that the gain on condemnation of land is an extraordinary

item. 2. Prepare a retained earnings statement for the year ended October 31, 2006.3. Prepare

a balance sheet in report form as of October 31, 2006.View Solution:

The following data were taken from the records of Skate

SOLUTION-- http://expertanswer.online/downloads/the-following-data-were-taken-from-the-

records-of-skate/

See Answer here expertanswer.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- Ethiopian OSH Directive-2008Document155 pagesEthiopian OSH Directive-2008Abel100% (22)

- Module III. Business Combination - Subsequent To Date of AcquisitionDocument5 pagesModule III. Business Combination - Subsequent To Date of AcquisitionAldrin Zolina0% (4)

- Mitochondria in Health and Disease: Ray GriffithsDocument338 pagesMitochondria in Health and Disease: Ray GriffithsMbaye Diaw DIOUM100% (1)

- Deluxe Chicken CaseDocument5 pagesDeluxe Chicken CaseevansNo ratings yet

- Solved Write in Algebraic Form A Calculation of U K Pounds PerDocument1 pageSolved Write in Algebraic Form A Calculation of U K Pounds PerM Bilal SaleemNo ratings yet

- A Summary of Myer Policies ProceduresDocument17 pagesA Summary of Myer Policies Proceduresvhlactaotao0% (1)

- 7 Essene MirrorsDocument3 pages7 Essene Mirrorsupcphln100% (4)

- The Following Data Were Taken From The Records of Surf SDocument1 pageThe Following Data Were Taken From The Records of Surf SM Bilal SaleemNo ratings yet

- Cash FlowsDocument6 pagesCash FlowsZaheer AhmadNo ratings yet

- Accounting For Merchandising Businesses: Problems Prob. 5-1ADocument22 pagesAccounting For Merchandising Businesses: Problems Prob. 5-1ARheino WahyuNo ratings yet

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- The Following Data Presented in Alphabetical Order Are Taken From 68954 PDFDocument1 pageThe Following Data Presented in Alphabetical Order Are Taken From 68954 PDFAnbu jaromiaNo ratings yet

- The Following Data Presented in Alphabetical Order Are Taken From 118334Document1 pageThe Following Data Presented in Alphabetical Order Are Taken From 118334M Bilal SaleemNo ratings yet

- ABC Manufacturing Entity Sole Trader Has Provided You With TheDocument1 pageABC Manufacturing Entity Sole Trader Has Provided You With TheMiroslav GegoskiNo ratings yet

- Balance Sheet and Statement of Cash FlowsDocument8 pagesBalance Sheet and Statement of Cash FlowsAntonios FahedNo ratings yet

- ITFA Solution June 2018 ExamDocument7 pagesITFA Solution June 2018 ExamF A Saffat RahmanNo ratings yet

- 111Document7 pages111haerudinsaniNo ratings yet

- 03 Course Notes On Statement of Cash Flows-2 PDFDocument4 pages03 Course Notes On Statement of Cash Flows-2 PDFMaxin TanNo ratings yet

- Chapter 5Document4 pagesChapter 5Ngô Hoàng Bích KhaNo ratings yet

- Presented Here Is The Total Column of The Governmental FundsDocument1 pagePresented Here Is The Total Column of The Governmental Fundstrilocksp SinghNo ratings yet

- ACCT336 Chapter23 SolutionsDocument7 pagesACCT336 Chapter23 SolutionskareemrawwadNo ratings yet

- Chapter 18Document21 pagesChapter 18Sunny SunnyNo ratings yet

- Acct 3101 Chapter 05Document13 pagesAcct 3101 Chapter 05Arief RachmanNo ratings yet

- Practice Exercise - Pas 7Document4 pagesPractice Exercise - Pas 7Martha Nicole MaristelaNo ratings yet

- EXERCISE 5-5 (30-35 Minutes) Uhura Company Balance Sheet ...Document4 pagesEXERCISE 5-5 (30-35 Minutes) Uhura Company Balance Sheet ...Thùy Dương ĐồngNo ratings yet

- Jawaban Laporan Arus Kas Dan Laba Rugi KomprehensifDocument4 pagesJawaban Laporan Arus Kas Dan Laba Rugi KomprehensifAksit RistiyaningsihNo ratings yet

- Test # 3 Review Material - BACC 152 16th EditionDocument17 pagesTest # 3 Review Material - BACC 152 16th EditionskswNo ratings yet

- Final Exam AnswerDocument5 pagesFinal Exam AnswerPham Ngoc AnhNo ratings yet

- Solutions - CH 5Document4 pagesSolutions - CH 5Khánh AnNo ratings yet

- BE5Document5 pagesBE5salsaNo ratings yet

- Exhibit 7.1: Financial Statement AnalysisDocument2 pagesExhibit 7.1: Financial Statement AnalysisYean SoramyNo ratings yet

- AKM 1 Bab 3Document5 pagesAKM 1 Bab 3alesha nindyaNo ratings yet

- More Cash Flow ExercisesDocument4 pagesMore Cash Flow ExercisesLorenzodeLunaNo ratings yet

- Prepare A Set of Financial StatementsDocument5 pagesPrepare A Set of Financial Statementskenshi ihsnekNo ratings yet

- CHapter 4A SolutionDocument17 pagesCHapter 4A SolutionSen Ho Ng100% (1)

- Akm3 Week-10Document5 pagesAkm3 Week-10pizzaanutriaNo ratings yet

- Chapter 9 - Supplementary ProblemsDocument6 pagesChapter 9 - Supplementary ProblemsMichaela Francess Abrasado AbalosNo ratings yet

- Buscom - Module 3Document10 pagesBuscom - Module 3naddieNo ratings yet

- P 13-9A - SolutionDocument1 pageP 13-9A - SolutionMichelle GraciaNo ratings yet

- Prob 3-30 - Advanced Accounting HoyleDocument2 pagesProb 3-30 - Advanced Accounting Hoylessmith0128No ratings yet

- AIK CH 7 Part 2Document11 pagesAIK CH 7 Part 2rizky unsNo ratings yet

- Selected Transactions Completed by Equinox Products Inc During The FiscalDocument2 pagesSelected Transactions Completed by Equinox Products Inc During The FiscalAmit PandeyNo ratings yet

- DocxDocument17 pagesDocxVy Pham Nguyen KhanhNo ratings yet

- CH 4 In-Class Exercise SOLUTIONSDocument7 pagesCH 4 In-Class Exercise SOLUTIONSAbdullah alhamaadNo ratings yet

- The Following Information For The Year Ending December 31 2015Document1 pageThe Following Information For The Year Ending December 31 2015Muhammad ShahidNo ratings yet

- Exam Review Problem 13-H1Document2 pagesExam Review Problem 13-H1Kim HangNo ratings yet

- (15-16) Solution For Chapter 9Document9 pages(15-16) Solution For Chapter 9poisonlresourcesNo ratings yet

- Problems: Trial Balances For The Companies For The Year Ended December 31, 20x4 Are As FollowsDocument10 pagesProblems: Trial Balances For The Companies For The Year Ended December 31, 20x4 Are As FollowsBetty SantiagoNo ratings yet

- Jawaban S 3-2Document4 pagesJawaban S 3-2Lamtiur LidiaqNo ratings yet

- 2010-09-10 013205 WinterschidDocument6 pages2010-09-10 013205 WinterschidJa Mi LahNo ratings yet

- Description Income Statement Adjustments Statement of Cash FlowsDocument2 pagesDescription Income Statement Adjustments Statement of Cash FlowsFhem Leighn SimetraNo ratings yet

- Bryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Document4 pagesBryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Goji iiiNo ratings yet

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- Module 2 Homework Answer KeyDocument5 pagesModule 2 Homework Answer KeyMrinmay kunduNo ratings yet

- Cosi 2015 Financial StatementsDocument4 pagesCosi 2015 Financial StatementsSumangal VinjamuriNo ratings yet

- Perpetual System ADocument11 pagesPerpetual System APeter WagdyNo ratings yet

- Prepare in Good Form The 20X9 GAAP Based Statement of RevenuesDocument1 pagePrepare in Good Form The 20X9 GAAP Based Statement of Revenuestrilocksp SinghNo ratings yet

- Solutions To Exercises - Chapter 17Document6 pagesSolutions To Exercises - Chapter 17Ng. Minh ThảoNo ratings yet

- Fix Asset&Intangible AssetDocument7 pagesFix Asset&Intangible AssetAdinda0% (1)

- FIX ASSET&INTANGIBLE ASSET Kel. 10 AKM 1Document7 pagesFIX ASSET&INTANGIBLE ASSET Kel. 10 AKM 1AdindaNo ratings yet

- Buscom 7Document9 pagesBuscom 7dmangiginNo ratings yet

- Fix Asset Intangible AssetDocument7 pagesFix Asset Intangible AssetMichelleNo ratings yet

- Questions On Chapter FourDocument2 pagesQuestions On Chapter Fourbrook butaNo ratings yet

- Some Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandFrom EverandSome Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandNo ratings yet

- Solved Your Local Fast Food Chain With Two Dozen Stores UsesDocument1 pageSolved Your Local Fast Food Chain With Two Dozen Stores UsesM Bilal SaleemNo ratings yet

- Solved You Should Never Buy Precooked Frozen Foods Because The PriceDocument1 pageSolved You Should Never Buy Precooked Frozen Foods Because The PriceM Bilal SaleemNo ratings yet

- Solved You Want To Price Posters at The Poster Showcase ProfitablyDocument1 pageSolved You Want To Price Posters at The Poster Showcase ProfitablyM Bilal SaleemNo ratings yet

- Solved You Have Been Hired by The Government of Kenya WhichDocument1 pageSolved You Have Been Hired by The Government of Kenya WhichM Bilal SaleemNo ratings yet

- Solved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesDocument1 pageSolved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesM Bilal SaleemNo ratings yet

- Solved Zack and Andon Compete in The Peanut Market Zack IsDocument1 pageSolved Zack and Andon Compete in The Peanut Market Zack IsM Bilal SaleemNo ratings yet

- Solved You Are The Manager of A Monopoly A Typical Consumer SDocument1 pageSolved You Are The Manager of A Monopoly A Typical Consumer SM Bilal SaleemNo ratings yet

- Solved You Won A Free Ticket To See A Bruce SpringsteenDocument1 pageSolved You Won A Free Ticket To See A Bruce SpringsteenM Bilal SaleemNo ratings yet

- Solved Your Company Is Bidding For A Service Contract in ADocument1 pageSolved Your Company Is Bidding For A Service Contract in AM Bilal SaleemNo ratings yet

- Solved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25Document1 pageSolved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25M Bilal SaleemNo ratings yet

- Solved You Are Driving On A Trip and Have Two ChoicesDocument1 pageSolved You Are Driving On A Trip and Have Two ChoicesM Bilal SaleemNo ratings yet

- Solved Your Company Sponsors A 401 K Plan Into Which You DepositDocument1 pageSolved Your Company Sponsors A 401 K Plan Into Which You DepositM Bilal SaleemNo ratings yet

- Solved Why Should The Early Adopters of An Information Technology SystemDocument1 pageSolved Why Should The Early Adopters of An Information Technology SystemM Bilal SaleemNo ratings yet

- Solved With A Purchase Price of 350 000 A Small Warehouse ProvidesDocument1 pageSolved With A Purchase Price of 350 000 A Small Warehouse ProvidesM Bilal SaleemNo ratings yet

- Solved You Are Given The Production Function y Ak1 3n2 3 WhereDocument1 pageSolved You Are Given The Production Function y Ak1 3n2 3 WhereM Bilal SaleemNo ratings yet

- Solved You Are An Advisor To The Egyptian Government Which HasDocument1 pageSolved You Are An Advisor To The Egyptian Government Which HasM Bilal SaleemNo ratings yet

- Solved You Have Decided That You Are Going To Consume 600Document1 pageSolved You Have Decided That You Are Going To Consume 600M Bilal SaleemNo ratings yet

- Solved You Are A Usda Pork Analyst Charged With Keeping Up To DateDocument1 pageSolved You Are A Usda Pork Analyst Charged With Keeping Up To DateM Bilal SaleemNo ratings yet

- Solved You and Your Roommate Have A Stack of Dirty DishesDocument1 pageSolved You and Your Roommate Have A Stack of Dirty DishesM Bilal SaleemNo ratings yet

- Solved Your Brother Calls You On The Phone Telling You ThatDocument1 pageSolved Your Brother Calls You On The Phone Telling You ThatM Bilal SaleemNo ratings yet

- Solved You Plan To Purchase A House For 115 000 UsingDocument1 pageSolved You Plan To Purchase A House For 115 000 UsingM Bilal SaleemNo ratings yet

- Solved You Are Considering An Investment in 30 Year Bonds Issued byDocument1 pageSolved You Are Considering An Investment in 30 Year Bonds Issued byM Bilal SaleemNo ratings yet

- Solved Wilson Walks Into His Class 10 Minutes Late Because HeDocument1 pageSolved Wilson Walks Into His Class 10 Minutes Late Because HeM Bilal SaleemNo ratings yet

- Solved You Are Selling Two Goods 1 and 2 To ADocument1 pageSolved You Are Selling Two Goods 1 and 2 To AM Bilal SaleemNo ratings yet

- Solved You Have 832 66 in A Savings Account That Offers ADocument1 pageSolved You Have 832 66 in A Savings Account That Offers AM Bilal SaleemNo ratings yet

- Solved With The Growth of The Internet There Are A LargeDocument1 pageSolved With The Growth of The Internet There Are A LargeM Bilal SaleemNo ratings yet

- Solved You Are Considering Buying A New House and Have FoundDocument1 pageSolved You Are Considering Buying A New House and Have FoundM Bilal SaleemNo ratings yet

- Solved You Can Either Take A Bus or Drive Your CarDocument1 pageSolved You Can Either Take A Bus or Drive Your CarM Bilal SaleemNo ratings yet

- Solved With Reference To Figure 14 4 Explain A Why There Will BeDocument1 pageSolved With Reference To Figure 14 4 Explain A Why There Will BeM Bilal SaleemNo ratings yet

- A Color Atlas of Poultry Diseases by J L VegadDocument144 pagesA Color Atlas of Poultry Diseases by J L VegadId DyNo ratings yet

- Norme SangeDocument2 pagesNorme SangePS NINo ratings yet

- Sam Sandan EssayDocument3 pagesSam Sandan Essayjose simplicio NetoNo ratings yet

- PDV01 - CO1.1. Knowing-Oneself-and-Development-and-Self-awarenessDocument9 pagesPDV01 - CO1.1. Knowing-Oneself-and-Development-and-Self-awarenessChlarisse Gabrielle TanNo ratings yet

- (Ebook - pdf.NsO) (Martial - Arts) Seven - Habits.of - Highly.successful - Martial.artists (WWW - Northshare.tk)Document6 pages(Ebook - pdf.NsO) (Martial - Arts) Seven - Habits.of - Highly.successful - Martial.artists (WWW - Northshare.tk)riffkiNo ratings yet

- Economic Factors in Materials SelectionDocument19 pagesEconomic Factors in Materials SelectionAnonymous S9qBDVkyNo ratings yet

- HOME Managing A Business Taxes Taxation of Partnership FirmsDocument3 pagesHOME Managing A Business Taxes Taxation of Partnership FirmsKushagradhi DebnathNo ratings yet

- Primary Frca Help Plain UpdatedDocument5 pagesPrimary Frca Help Plain UpdatedDavid PappinNo ratings yet

- Chromatics Full Size Shade Chart-1Document2 pagesChromatics Full Size Shade Chart-1CB100% (1)

- Previous HSE Questions From The Chapter "ELECTROCHEMISTRY": E E - 2.303RT Log (M) NF (M)Document2 pagesPrevious HSE Questions From The Chapter "ELECTROCHEMISTRY": E E - 2.303RT Log (M) NF (M)Chemistry MESNo ratings yet

- STS PrelimsDocument9 pagesSTS PrelimsKatrina PeñaNo ratings yet

- Self Help GroupsDocument18 pagesSelf Help Groupsykbharti101No ratings yet

- SP-1074 Pom PDFDocument24 pagesSP-1074 Pom PDFHari Prakash GrandheyNo ratings yet

- 2012 Building Code OverviewDocument155 pages2012 Building Code OverviewAhmed MianNo ratings yet

- AttendancepolicyDocument6 pagesAttendancepolicyapi-262412035No ratings yet

- Ppt-Sugarcane Bagasse AshDocument27 pagesPpt-Sugarcane Bagasse AshHegdeVenugopalNo ratings yet

- Ultra High Temperature 100HTL Adhesive Transfer Tapes: Technical Data November, 2006Document4 pagesUltra High Temperature 100HTL Adhesive Transfer Tapes: Technical Data November, 2006Iris SoonNo ratings yet

- Halal Shops and Restaurants in JapanDocument13 pagesHalal Shops and Restaurants in JapanHaissamNo ratings yet

- Surface Preparation of Galvanized Steel SurfacesDocument2 pagesSurface Preparation of Galvanized Steel SurfacesFernando AlvarengaNo ratings yet

- Leijssen Mia. (Manuscript MOOC) .: The Existential Approach: An IntroductionDocument6 pagesLeijssen Mia. (Manuscript MOOC) .: The Existential Approach: An IntroductionSofiaLimaNo ratings yet

- api/resources/file/CH604MM/ATA 100/CH604/AMM/49/AMM49 10 00 04.fullDocument40 pagesapi/resources/file/CH604MM/ATA 100/CH604/AMM/49/AMM49 10 00 04.fullRahul VaishnavNo ratings yet

- Causes of Migraine PDFDocument7 pagesCauses of Migraine PDFJohn Christopher LucesNo ratings yet

- Category C Dog Cat Import Flowchart Apr2018Document4 pagesCategory C Dog Cat Import Flowchart Apr2018J FNo ratings yet

- Removable Guardrail SystemsDocument3 pagesRemovable Guardrail SystemsSaiful AnnasNo ratings yet

- Dry Well PSDocument7 pagesDry Well PSprajmenNo ratings yet

- Closed Hand Only Reduced Value When Hand Open: 2-Han Hands KEY 1-Han HandsDocument1 pageClosed Hand Only Reduced Value When Hand Open: 2-Han Hands KEY 1-Han Hands8o1kfW9No ratings yet