Professional Documents

Culture Documents

Suppose The Inflation Rate Is Expected To Be 7 Next PDF

Suppose The Inflation Rate Is Expected To Be 7 Next PDF

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suppose The Inflation Rate Is Expected To Be 7 Next PDF

Suppose The Inflation Rate Is Expected To Be 7 Next PDF

Uploaded by

Anbu jaromiaCopyright:

Available Formats

Suppose the inflation rate is expected to be 7 next

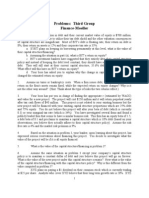

Suppose the inflation rate is expected to be 7% next year, 5% the following year, and 3%

thereafter. Assume that the real risk-free rate, r*, will remain at 2% and that maturity risk

premiums on Treasury securities rise from zero on very short-term bonds (those that mature in

a few days) to 0.2% for 1-year securities. Furthermore, maturity risk premiums increase 0.2%

for each year to maturity, up to a limit of 1.0% on 5-year or longer-term T-bonds.a. Calculate the

interest rate on 1-, 2-, 3-, 4-, 5-, 10-, and 20-year Treasury securities and plot the yield curve.b.

Suppose a AAA-rated company (which is the highest bond rating a firm can have) had bonds

with the same maturities as the Treasury bonds. Estimate and plot what you believe a AAA-

rated company’s yield curve would look like on the same graph with the Treasury bond yield

curve. c. On the same graph, plot the approximate yield curve of a much riskier lower-rated

company with a much higher risk of defaulting on its bonds.View Solution:

Suppose the inflation rate is expected to be 7 next

SOLUTION-- http://accountinginn.online/downloads/suppose-the-inflation-rate-is-expected-to-

be-7-next/

For Solutions Visit accountinginn.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- Tugas Problem 6Document20 pagesTugas Problem 6Vinni Stefanie100% (1)

- Multiple ChoiceDocument3 pagesMultiple ChoicePeng GuinNo ratings yet

- Estimating Hurdle Rate For FirmsDocument95 pagesEstimating Hurdle Rate For FirmsFarzad TouhidNo ratings yet

- Ch5Probset Bonds+Interest 13ed. - MasterDocument8 pagesCh5Probset Bonds+Interest 13ed. - Masterpratiksha1091No ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Chapter 7 ProblemsDocument6 pagesChapter 7 ProblemsOkabe RinNo ratings yet

- A Suppose You Are Considering Two Possible Investment Opportunities ADocument1 pageA Suppose You Are Considering Two Possible Investment Opportunities AMuhammad ShahidNo ratings yet

- Lecture 5 BH CH 6 Interest RatesDocument28 pagesLecture 5 BH CH 6 Interest RatesAydin GaniyevNo ratings yet

- ANALYZEDocument3 pagesANALYZEPeng GuinNo ratings yet

- FM Testbank Ch07Document11 pagesFM Testbank Ch07David LarryNo ratings yet

- EFM2e, CH 06, Interest RatesDocument21 pagesEFM2e, CH 06, Interest RatesAerhia KimNo ratings yet

- Equity Valuation 5 Examples and Some Answers From in ClassDocument57 pagesEquity Valuation 5 Examples and Some Answers From in Classlongbisctn55No ratings yet

- Handout 2Document3 pagesHandout 2Anu AmruthNo ratings yet

- Week 3-HWDocument19 pagesWeek 3-HWarwa_mukadam03No ratings yet

- Lezione 4Document16 pagesLezione 4PaoloPasoZuccaroNo ratings yet

- Assignment 4Document4 pagesAssignment 4lilyNo ratings yet

- Problem Set - Chapter 2Document12 pagesProblem Set - Chapter 2Vũ Thu LanNo ratings yet

- Econ 122 Lecture 8 Debt Securities 4Document27 pagesEcon 122 Lecture 8 Debt Securities 4cihtanbioNo ratings yet

- Hurdle Rates Iii: Estimating Equity Risk Premiums Part IDocument12 pagesHurdle Rates Iii: Estimating Equity Risk Premiums Part IAnshik BansalNo ratings yet

- Finman Answer TypeDocument8 pagesFinman Answer TypequeeneNo ratings yet

- Tugas Kelompok Manajemen KeuanganDocument9 pagesTugas Kelompok Manajemen Keuangan2j9yp89bkgNo ratings yet

- Lecture # 33Document8 pagesLecture # 33bwcs1122No ratings yet

- Clase VI - Discount Rates (Equity Risk Premium)Document25 pagesClase VI - Discount Rates (Equity Risk Premium)Miguel Vega OtinianoNo ratings yet

- Bond MarketDocument4 pagesBond Marketeunice.mazigeNo ratings yet

- Chapter 5 NotesDocument6 pagesChapter 5 NotesTawasul Hussain Shah RizviNo ratings yet

- Damodaran Chapter 4 WACCDocument5 pagesDamodaran Chapter 4 WACCJesus LuisNo ratings yet

- Suppose Most Investors Expect The Inflation Rate To Be 5 PDFDocument1 pageSuppose Most Investors Expect The Inflation Rate To Be 5 PDFAnbu jaromiaNo ratings yet

- Chapter 20 Interest Rate Risk: 1. ObjectivesDocument14 pagesChapter 20 Interest Rate Risk: 1. Objectivessamuel_dwumfourNo ratings yet

- Session3 PDFDocument12 pagesSession3 PDFOscar Adrián Trejo RomeroNo ratings yet

- Chapter 7 (13E) Bonds and Their Valuation: Answers To End-of-Chapter QuestionsDocument38 pagesChapter 7 (13E) Bonds and Their Valuation: Answers To End-of-Chapter QuestionsSaraNowakNo ratings yet

- FinanceDocument2 pagesFinanceAishaNo ratings yet

- FM - Lecture3 Handouts 2020NCTDocument3 pagesFM - Lecture3 Handouts 2020NCTnhu1582004No ratings yet

- Chapter 4 - MinicaseDocument4 pagesChapter 4 - MinicaseMuhammad Aditya TMNo ratings yet

- Tutorial 4 QuestionsDocument4 pagesTutorial 4 QuestionsNguyễn Thùy Linh 1TC-20ACNNo ratings yet

- Risk and Rates of ReturnDocument38 pagesRisk and Rates of ReturnTheo SimonNo ratings yet

- Tutorial Questions Weesadk 5. - Risk UncertainDocument3 pagesTutorial Questions Weesadk 5. - Risk UncertainMinh VănNo ratings yet

- Minicase - Term Structure Interest RateDocument2 pagesMinicase - Term Structure Interest RateTho ThoNo ratings yet

- Chapter 1Document11 pagesChapter 1Ambrose Tumuhimbise MuhumuzaNo ratings yet

- You Plan To Buy A Piece of Machinery That Costs 1 2 MillionDocument3 pagesYou Plan To Buy A Piece of Machinery That Costs 1 2 MillionDoreenNo ratings yet

- Problems: Third Group Finance-MoellerDocument4 pagesProblems: Third Group Finance-MoellerEvan BenedictNo ratings yet

- IUFM - Lecture 3 - Homework Handouts 1Document3 pagesIUFM - Lecture 3 - Homework Handouts 1Thuận Nguyễn Thị KimNo ratings yet

- BT Chap 6Document4 pagesBT Chap 6Hang NguyenNo ratings yet

- Answers To ch05 Chapter 5 NotesDocument3 pagesAnswers To ch05 Chapter 5 NotesMamun RashidNo ratings yet

- Module 2 - Determinants of Interest Rates - QuestionsDocument4 pagesModule 2 - Determinants of Interest Rates - Questionsdenvermanapo2000No ratings yet

- Assign - Structure of Interest RatesDocument2 pagesAssign - Structure of Interest RatesƎdibern Lester Primo Destura0% (1)

- BANK3011 Workshop Week 3 SolutionsDocument5 pagesBANK3011 Workshop Week 3 SolutionsZahraaNo ratings yet

- Chapter 6Document23 pagesChapter 6red8blue8No ratings yet

- Ch. 6 - Interest RatesDocument20 pagesCh. 6 - Interest RatescjonNo ratings yet

- Chapter 2 Time Value of Money ANSWERS TO END-OF-CHAPTER QUESTIONSDocument9 pagesChapter 2 Time Value of Money ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual67% (3)

- FM Worksheet IDocument3 pagesFM Worksheet IMISRA MUHUDINNo ratings yet

- Mcqs Help FahadDocument7 pagesMcqs Help FahadAREEBA ABDUL MAJEEDNo ratings yet

- Chapter 2 - Numerical QuestionsDocument2 pagesChapter 2 - Numerical Questionskapil DevkotaNo ratings yet

- Chapter 3 Structure of Interest Rates Risks and Rates of ReturnDocument56 pagesChapter 3 Structure of Interest Rates Risks and Rates of Returnhopemanaloramos28No ratings yet

- You Expect Interest Rates To Rise On Five Year Bonds byDocument1 pageYou Expect Interest Rates To Rise On Five Year Bonds byHassan JanNo ratings yet

- Portofolio ManagementDocument6 pagesPortofolio ManagementAziza FrancienneNo ratings yet

- Yield CurveDocument7 pagesYield CurveJishan Enterprises Ltd.No ratings yet

- LBSIM, New Delhi: - Group 7 Gaurav Gupta Vivek Sharan Amrita Pattnaik Anand Wardhan Srikant SharmaDocument35 pagesLBSIM, New Delhi: - Group 7 Gaurav Gupta Vivek Sharan Amrita Pattnaik Anand Wardhan Srikant SharmazvaibhavNo ratings yet

- AC513-Quiz Bowl QuestionsDocument13 pagesAC513-Quiz Bowl QuestionsJeoNo ratings yet

- Lecture 3 ScriptDocument3 pagesLecture 3 ScriptAshish MalhotraNo ratings yet

- Test-2: New Scheme Final Course - Group I Paper 2: Strategic Financial ManagementDocument6 pagesTest-2: New Scheme Final Course - Group I Paper 2: Strategic Financial Managementshiva kumarNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet