Professional Documents

Culture Documents

18.4 Labour Act 2074 Checklist

18.4 Labour Act 2074 Checklist

Uploaded by

Cool DudeCopyright:

Available Formats

You might also like

- IFRS 15 For AirlinesDocument40 pagesIFRS 15 For AirlinesDimakatsoNo ratings yet

- Diploma in Financial Management: Project Db2, Incorporating Subject Areas - Financial Strategy - Risk ManagementDocument7 pagesDiploma in Financial Management: Project Db2, Incorporating Subject Areas - Financial Strategy - Risk ManagementMatthew Lewis0% (1)

- Management Tri Nova CaseDocument4 pagesManagement Tri Nova CaseAie Kah Dupal100% (2)

- Aircraft Leasing in India Ready To Take OffDocument30 pagesAircraft Leasing in India Ready To Take OffGuruNo ratings yet

- Airline Simulation Instructions 2019Document22 pagesAirline Simulation Instructions 2019EK SystemsNo ratings yet

- Airline Simulation SWOTDocument1 pageAirline Simulation SWOTJohn PickleNo ratings yet

- Case Study ValujetDocument5 pagesCase Study Valujetapi-550129088No ratings yet

- Case 23: Southwest Airlines: Capital Budgeting: One Project - Accept/Reject DecisionDocument2 pagesCase 23: Southwest Airlines: Capital Budgeting: One Project - Accept/Reject DecisionKazi HasanNo ratings yet

- People Express Case StudyDocument9 pagesPeople Express Case StudyMontano L. Agudilla JrNo ratings yet

- 2.leverage - Meaning and Its Types (With Formula) PDFDocument10 pages2.leverage - Meaning and Its Types (With Formula) PDFMADHAN KUMAR PARAMESWARANNo ratings yet

- Strama Continental AirlinesDocument4 pagesStrama Continental AirlinesNadine SantiagoNo ratings yet

- IndiaAirline Tejas Mar17Document21 pagesIndiaAirline Tejas Mar17Manoj JosephNo ratings yet

- Airline Business Plan Air LeoDocument64 pagesAirline Business Plan Air LeokgmakNo ratings yet

- CII & KPMG The Emerging Role of PPP in Indian Healthcare Sector PolicyPaper PDFDocument37 pagesCII & KPMG The Emerging Role of PPP in Indian Healthcare Sector PolicyPaper PDFAnanya DasguptaNo ratings yet

- 2022 Global Fleet Aftermarket Key Trend Outlook Asia Pacific Region FINALDocument22 pages2022 Global Fleet Aftermarket Key Trend Outlook Asia Pacific Region FINALFlapNo ratings yet

- Airline Business Plan ExampleDocument50 pagesAirline Business Plan ExampleJoseph QuillNo ratings yet

- Final Internship Guidelines 2012Document5 pagesFinal Internship Guidelines 2012Haris JavedNo ratings yet

- RFP FormatDocument4 pagesRFP FormatSayed A. IqbalNo ratings yet

- Civil Aviation PolicyDocument20 pagesCivil Aviation Policyxmen3489No ratings yet

- Recasting FS ExampleDocument23 pagesRecasting FS ExampleDzaky MaulidanNo ratings yet

- PIA CargoDocument30 pagesPIA CargoRizwanAliYounasNo ratings yet

- Marketing Plan of Kingfisher Airlines: Submitted To:-Submitted By: - Prof. Prakhersharma Ankit Agrawal Devendra ThakurDocument31 pagesMarketing Plan of Kingfisher Airlines: Submitted To:-Submitted By: - Prof. Prakhersharma Ankit Agrawal Devendra ThakurAnkit AgrawalNo ratings yet

- Airline IndustryDocument176 pagesAirline Industrykutty3031100% (2)

- Spice JetDocument4 pagesSpice JetPratik JagtapNo ratings yet

- Aviation Lease & Difference Between Wet & DryDocument15 pagesAviation Lease & Difference Between Wet & DryVaibhav MishraNo ratings yet

- RestructuringDocument25 pagesRestructuringeaswaraniNo ratings yet

- Final PPT 4 April JetBlueDocument43 pagesFinal PPT 4 April JetBlueNii Ben100% (1)

- Five Forces, SWOT and Internal Analysis of Southwest Airlines and The Airline IndustryDocument9 pagesFive Forces, SWOT and Internal Analysis of Southwest Airlines and The Airline IndustryTravelers EyesNo ratings yet

- The Global Airline Industry - The MarketDocument131 pagesThe Global Airline Industry - The MarketMaroua khadimNo ratings yet

- Mokulele Airlines (Proposal)Document25 pagesMokulele Airlines (Proposal)Valley VoiceNo ratings yet

- Jet Airways - Strategy MGMTDocument93 pagesJet Airways - Strategy MGMTShubha Brota Raha100% (2)

- Airlines IndustryDocument17 pagesAirlines IndustryRITIKANo ratings yet

- Pakistan International Airlines - SWOTDocument14 pagesPakistan International Airlines - SWOTHissuNo ratings yet

- Jet Blue Airways - Strategic Management Case Study - Presentation TranscriptDocument4 pagesJet Blue Airways - Strategic Management Case Study - Presentation TranscriptAngel WingsNo ratings yet

- Business Plan Proposal For Launch of Airline Business-KSDocument37 pagesBusiness Plan Proposal For Launch of Airline Business-KSshahzaibNo ratings yet

- Notes Airline & Airport Marketing ManagementDocument21 pagesNotes Airline & Airport Marketing ManagementAnirudh K NNo ratings yet

- ACCA Registration: Submission PeriodDocument16 pagesACCA Registration: Submission PeriodzubyrNo ratings yet

- Project Report On Jet Airways CitrixDocument9 pagesProject Report On Jet Airways CitrixvithanibharatNo ratings yet

- Ethiopian Airlines Market SurveyDocument11 pagesEthiopian Airlines Market SurveyAwad AbdellaNo ratings yet

- Rayyan Air PDFDocument60 pagesRayyan Air PDFSaad Bin Shahid0% (1)

- Brand Audit-Buddha AirDocument31 pagesBrand Audit-Buddha AirNischal KcNo ratings yet

- Aviation Industry AnalysisDocument28 pagesAviation Industry AnalysisKaranNo ratings yet

- Organizational StructureDocument32 pagesOrganizational Structurewww_vibhugorintla100% (1)

- FINAL TERM PROJECT OF Airline ManagementDocument3 pagesFINAL TERM PROJECT OF Airline ManagementSoni VirgoNo ratings yet

- Kingfisher AirlinesDocument10 pagesKingfisher Airlinesswetha padmanaabanNo ratings yet

- Airline Business PlanDocument70 pagesAirline Business PlanKevin MaulanaNo ratings yet

- Emirates Telecommunications Corporation "Etisalat": By: Maha Kanz (CFA)Document11 pagesEmirates Telecommunications Corporation "Etisalat": By: Maha Kanz (CFA)memo ibNo ratings yet

- Accounting Textbook Solutions - 40Document19 pagesAccounting Textbook Solutions - 40acc-expertNo ratings yet

- Ecological NetworkDocument11 pagesEcological NetworkDaisy100% (1)

- JetBlue Study ProjectDocument36 pagesJetBlue Study ProjectIrna Azzadina100% (1)

- Analisis RatioDocument5 pagesAnalisis RatioKata AssalamualaikumNo ratings yet

- MIS Financials Format XlsMISDocument78 pagesMIS Financials Format XlsMISarajamani78100% (1)

- Business Plan of Budget Airline CompanyDocument44 pagesBusiness Plan of Budget Airline CompanyCharlie PhillipsNo ratings yet

- Concept of Operations ManagementDocument5 pagesConcept of Operations ManagementSoe LeiNo ratings yet

- WestJet Charles ProjectDocument27 pagesWestJet Charles Projectinderdhindsa100% (2)

- Hrob117 Jet AirwaysDocument17 pagesHrob117 Jet AirwaysDhruv Singh GosainNo ratings yet

- Indigo Airlines ReportDocument20 pagesIndigo Airlines ReportMriganga Barman100% (1)

- CRM British Airways EditedDocument14 pagesCRM British Airways EditedIshaan BaxiNo ratings yet

- Business Plan For Touch of Class Custom Air Service and TLC AirlinesDocument59 pagesBusiness Plan For Touch of Class Custom Air Service and TLC AirlinesYahia Mustafa AlfazaziNo ratings yet

- Dmgs Dip 27092 FinalDocument11 pagesDmgs Dip 27092 FinalEsa BhattacharyaNo ratings yet

- The Successful Strategies from Customer Managment ExcellenceFrom EverandThe Successful Strategies from Customer Managment ExcellenceNo ratings yet

- 18.3 Bonus Act, 2030 ChecklistDocument3 pages18.3 Bonus Act, 2030 ChecklistCool DudeNo ratings yet

- High Level Control ChecklistDocument8 pagesHigh Level Control ChecklistCool DudeNo ratings yet

- Laws and Regulations: Procedure Ref / CommentsDocument3 pagesLaws and Regulations: Procedure Ref / CommentsCool DudeNo ratings yet

- Section Control Sheet: Summary of Significant Risk and Related Controls Assess Impact H/M/LDocument7 pagesSection Control Sheet: Summary of Significant Risk and Related Controls Assess Impact H/M/LCool DudeNo ratings yet

- Fraud Risk Assessment Procedures PKFDocument3 pagesFraud Risk Assessment Procedures PKFCool DudeNo ratings yet

- 18.3 Bonus Act, 2030 ChecklistDocument3 pages18.3 Bonus Act, 2030 ChecklistCool DudeNo ratings yet

- Control Overview Document VFSDocument7 pagesControl Overview Document VFSCool DudeNo ratings yet

- Mapping of Trial Balance in Financial StatementsDocument3 pagesMapping of Trial Balance in Financial StatementsCool DudeNo ratings yet

- 6.1 The Entity and Its EnvironmentDocument6 pages6.1 The Entity and Its EnvironmentCool DudeNo ratings yet

- 14.1 Fraud and Management Override of ControlsDocument3 pages14.1 Fraud and Management Override of ControlsCool DudeNo ratings yet

- 6.2 APN Planning - Memo - Statutory Audit FY 71-72Document13 pages6.2 APN Planning - Memo - Statutory Audit FY 71-72Cool DudeNo ratings yet

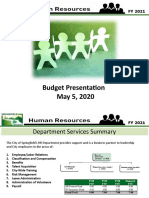

- HR Budget PresentationDocument11 pagesHR Budget PresentationShivam TrivediNo ratings yet

- Procurement Management Plan TemplateDocument9 pagesProcurement Management Plan TemplateAdnan AkhtarNo ratings yet

- Taj Compensation Project FinalDocument16 pagesTaj Compensation Project Finalravina10008100% (1)

- 9 05 607 EngineeringDocument68 pages9 05 607 EngineeringMarianne Hernandez MendietaNo ratings yet

- Crack The Case Level 1 Slides PDFDocument78 pagesCrack The Case Level 1 Slides PDFShyamSunderSriramNo ratings yet

- Group 1 Software Engineering AssignmentDocument5 pagesGroup 1 Software Engineering AssignmentML GisNo ratings yet

- PRDP Coa Audit Report 2015 PDFDocument34 pagesPRDP Coa Audit Report 2015 PDFBillVeelNo ratings yet

- Implementation of Business Marketing StrategyDocument43 pagesImplementation of Business Marketing StrategyMubashir Ali BeighNo ratings yet

- Multiple Choice QuestionsDocument20 pagesMultiple Choice QuestionsPhoebe LanoNo ratings yet

- PeopleSoft ExpensesDocument27 pagesPeopleSoft ExpensesNIHUNo ratings yet

- Propuesta en Idioma Ingles de Un Producto o ServicioDocument9 pagesPropuesta en Idioma Ingles de Un Producto o ServicioOliver Eudan Bolaños SilvaNo ratings yet

- CH 10 AuditingDocument31 pagesCH 10 AuditingPutri Ayu Dwi LestariNo ratings yet

- Regulatory Framework For IBIs-ZahidDocument43 pagesRegulatory Framework For IBIs-Zahidski_leo82No ratings yet

- Trabajo Zarate FinishDocument17 pagesTrabajo Zarate FinishDavidFloresNo ratings yet

- GMP Documentation ModuleDocument49 pagesGMP Documentation ModulePrima SuhastriaNo ratings yet

- United Spirits: Performance HighlightsDocument11 pagesUnited Spirits: Performance HighlightsAngel BrokingNo ratings yet

- Human Resource ManagementDocument54 pagesHuman Resource Managementbhullar_pritpalNo ratings yet

- Theodore Levitt's Marketing Myopia: Colin GrantDocument2 pagesTheodore Levitt's Marketing Myopia: Colin GrantSauravSNo ratings yet

- AIOD - HSBC 12M CNH Twinwin Sharkfin Note Series 1 - 230922 - 152458Document27 pagesAIOD - HSBC 12M CNH Twinwin Sharkfin Note Series 1 - 230922 - 152458jesswjaNo ratings yet

- Doordash: Course Code: The Entrepreneurial MindDocument4 pagesDoordash: Course Code: The Entrepreneurial MindMichael SusmiranNo ratings yet

- National Contexts, Incubator Families and Trends in Incubation - Views From Four CountriesDocument23 pagesNational Contexts, Incubator Families and Trends in Incubation - Views From Four CountriesscribdoibNo ratings yet

- Aef 2013 Audit Acc ReqDocument9 pagesAef 2013 Audit Acc Reqvikas_ojha54706No ratings yet

- Acceptance FormDocument5 pagesAcceptance Formtpwarren23No ratings yet

- Infographic Bank MuamalatDocument2 pagesInfographic Bank Muamalatnur nadrahNo ratings yet

- Dispute FormDocument1 pageDispute Formevy_osh1025No ratings yet

- Ramada Marketing Report (Full)Document9 pagesRamada Marketing Report (Full)Haider SaleemNo ratings yet

- Impact Accounting, LLCDocument6 pagesImpact Accounting, LLCbarber bobNo ratings yet

- Solved Paper of Accounts Assistant in Kerala State Handloom Development Corporation LimitedDocument9 pagesSolved Paper of Accounts Assistant in Kerala State Handloom Development Corporation LimitedAbir SharmaNo ratings yet

18.4 Labour Act 2074 Checklist

18.4 Labour Act 2074 Checklist

Uploaded by

Cool DudeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

18.4 Labour Act 2074 Checklist

18.4 Labour Act 2074 Checklist

Uploaded by

Cool DudeCopyright:

Available Formats

Client: VF Services (Mauritius) Pte.

Limited Prepared By: Namuna Joshi

Year end: 31 December 2017 Date: 22 February 2018

CHECKLIST FOR COMPLIANCE WITH LABOUR ACT 2074

(Labour Act, 2074 issued on 2074.5.19)

Complied with or

W. P.

Particulars Not Remarks

Ref.

Yes No NA

1. Applicability

Headcount Threshold: No headcount

threshold required.

Exempted Entity:

Civil Service, VFS does not belong

Nepal Army, Nepal Police, Armed Police to any of the

Force, exempted entity.

Entities incorporated under other

prevailing laws or in situated in Special

Economic Zones to the extent separate

provisions are provided.

Working Journalists, unless specifically

provided in the Contract.

2. Working Hour (section 28)

Ensure that Regular working hour

of VFS is 8 hours. No

Maximum working hour 8 hours per day employee is put to

Refer

and 48 hours per week. work more than 4

Maximum overtime 4 hours per day and

hours overtime in a

WP

13.12

24 hours per week. (Section 30) day and 20 hours in

Overtime pay of 1.5 times of the regular total in a week.

remuneration.

Reviewed by: Surendra Pathak

Client: VF Services (Mauritius) Pte. Limited Prepared By: Namuna Joshi

Year end: 31 December 2017 Date: 22 February 2018

Complied with or

Particulars Not Remarks W. P. Ref.

Yes No NA

3. Provident Fund (Section 52)

Ensure that:

a) Eligibility: From the first day of

appointment

b) Rate: Provident fund equivalent to

10% of salary is deducted from each

Provident fund

month's salary of staff.

equivalent to 10% of

salary has been

c) Deposit in: Social Security Fund

deducted from

employee’s salary and Refer WP

d) An equivalent amount has been

contributed by the employee and

equal amount has been 13.2 and

contributed by VFS. WP 6.2

deposited in the separate provident

Amount of PF for a

fund account.

month is deposited

within 25 days of the

e) Amount deposited in the Provident

succeeding month.

Fund Account has not been utilized

by an employee prior to his

separation from services.

f) Loan can be availed by an employee

as per the provident fund rules but

deductions have to be made from the

monthly salary of the employee.

4. Gratuity (section 53)

Gratuity has been

Ensure that

computed accordingly.

Eligibility: since the first day of Since social security

employment fund has not been Refer WP

Rate of Gratuity: 8.33% of remuneration established yet, the 7.3

amount provisioned for

every month

gratuity has not been

Deposit in: Social Security Fund deposited anywhere.

5. Medical Insurance (Section 54)

Ensure that:

a) Insurance of at least one lakh rupees Refer WP

per year for every worker 5.15

b) Premium is equally paid by the

employer and worker

6. Accident Insurance (Section 55)

Ensure that

a) Insurance of at least seven lakhs

Refer WP

rupees for every worker. 5.14

b) Premium is paid by the employer

fully

Reviewed by: Surendra Pathak

Client: VF Services (Mauritius) Pte. Limited Prepared By: Namuna Joshi

Year end: 31 December 2017 Date: 22 February 2018

7. Leave

7.1 Home (Annual) Leave (Sec 43) Each employee is

entitled to 18 days

a) Ensure that each employee is calculated on working

entitled to Annual leave of 1 day for days annually.

every 20 days worked. Maximum up to 60 days

privilege leave can be

b) Ensure that accumulated Home carry forward and

leave has not exceeded 90 days. encashed in the

employee’s tenure of

service.

7.2 Sick leave (Sec 44)

a) Ensure that sick leave is granted to

staff for 12 days per annum with The employees are

entitlement of full salary if continuous entitled for 15 days half

service for 1 year is completed. For

paid sick leave.

those who have not completed one

year of service, sick leave is Sick leave is not subject

to carry forward and is Refer WP

provided on a proportional basis. 13.6

encashed at the end of

b) Ensure that accumulated Home the year.

leave has not exceeded 45 days.

7.3 Mourning Leave (Sec 48)

a) Ensure that Mourning leave is 13 days funeral leave is

given.

granted to staff for 13 days.

7.4 Maternity Leave (Sec 45)

a) Ensure that Maternity leave is VFS has not revised its

granted to staff for 14 weeks (Fully HR policy.

paid 60 days).

7.5 Paternity Leave (Sec 45)

b) Ensure that Paternity leave is VFS has not revised its

granted to staff for 15 days fully paid. HR policy.

8. Final settlement time limit

(section 148)

Employer shall pay final settlement

amount to employee within 15 days of

date of separation.

Reviewed by: Surendra Pathak

You might also like

- IFRS 15 For AirlinesDocument40 pagesIFRS 15 For AirlinesDimakatsoNo ratings yet

- Diploma in Financial Management: Project Db2, Incorporating Subject Areas - Financial Strategy - Risk ManagementDocument7 pagesDiploma in Financial Management: Project Db2, Incorporating Subject Areas - Financial Strategy - Risk ManagementMatthew Lewis0% (1)

- Management Tri Nova CaseDocument4 pagesManagement Tri Nova CaseAie Kah Dupal100% (2)

- Aircraft Leasing in India Ready To Take OffDocument30 pagesAircraft Leasing in India Ready To Take OffGuruNo ratings yet

- Airline Simulation Instructions 2019Document22 pagesAirline Simulation Instructions 2019EK SystemsNo ratings yet

- Airline Simulation SWOTDocument1 pageAirline Simulation SWOTJohn PickleNo ratings yet

- Case Study ValujetDocument5 pagesCase Study Valujetapi-550129088No ratings yet

- Case 23: Southwest Airlines: Capital Budgeting: One Project - Accept/Reject DecisionDocument2 pagesCase 23: Southwest Airlines: Capital Budgeting: One Project - Accept/Reject DecisionKazi HasanNo ratings yet

- People Express Case StudyDocument9 pagesPeople Express Case StudyMontano L. Agudilla JrNo ratings yet

- 2.leverage - Meaning and Its Types (With Formula) PDFDocument10 pages2.leverage - Meaning and Its Types (With Formula) PDFMADHAN KUMAR PARAMESWARANNo ratings yet

- Strama Continental AirlinesDocument4 pagesStrama Continental AirlinesNadine SantiagoNo ratings yet

- IndiaAirline Tejas Mar17Document21 pagesIndiaAirline Tejas Mar17Manoj JosephNo ratings yet

- Airline Business Plan Air LeoDocument64 pagesAirline Business Plan Air LeokgmakNo ratings yet

- CII & KPMG The Emerging Role of PPP in Indian Healthcare Sector PolicyPaper PDFDocument37 pagesCII & KPMG The Emerging Role of PPP in Indian Healthcare Sector PolicyPaper PDFAnanya DasguptaNo ratings yet

- 2022 Global Fleet Aftermarket Key Trend Outlook Asia Pacific Region FINALDocument22 pages2022 Global Fleet Aftermarket Key Trend Outlook Asia Pacific Region FINALFlapNo ratings yet

- Airline Business Plan ExampleDocument50 pagesAirline Business Plan ExampleJoseph QuillNo ratings yet

- Final Internship Guidelines 2012Document5 pagesFinal Internship Guidelines 2012Haris JavedNo ratings yet

- RFP FormatDocument4 pagesRFP FormatSayed A. IqbalNo ratings yet

- Civil Aviation PolicyDocument20 pagesCivil Aviation Policyxmen3489No ratings yet

- Recasting FS ExampleDocument23 pagesRecasting FS ExampleDzaky MaulidanNo ratings yet

- PIA CargoDocument30 pagesPIA CargoRizwanAliYounasNo ratings yet

- Marketing Plan of Kingfisher Airlines: Submitted To:-Submitted By: - Prof. Prakhersharma Ankit Agrawal Devendra ThakurDocument31 pagesMarketing Plan of Kingfisher Airlines: Submitted To:-Submitted By: - Prof. Prakhersharma Ankit Agrawal Devendra ThakurAnkit AgrawalNo ratings yet

- Airline IndustryDocument176 pagesAirline Industrykutty3031100% (2)

- Spice JetDocument4 pagesSpice JetPratik JagtapNo ratings yet

- Aviation Lease & Difference Between Wet & DryDocument15 pagesAviation Lease & Difference Between Wet & DryVaibhav MishraNo ratings yet

- RestructuringDocument25 pagesRestructuringeaswaraniNo ratings yet

- Final PPT 4 April JetBlueDocument43 pagesFinal PPT 4 April JetBlueNii Ben100% (1)

- Five Forces, SWOT and Internal Analysis of Southwest Airlines and The Airline IndustryDocument9 pagesFive Forces, SWOT and Internal Analysis of Southwest Airlines and The Airline IndustryTravelers EyesNo ratings yet

- The Global Airline Industry - The MarketDocument131 pagesThe Global Airline Industry - The MarketMaroua khadimNo ratings yet

- Mokulele Airlines (Proposal)Document25 pagesMokulele Airlines (Proposal)Valley VoiceNo ratings yet

- Jet Airways - Strategy MGMTDocument93 pagesJet Airways - Strategy MGMTShubha Brota Raha100% (2)

- Airlines IndustryDocument17 pagesAirlines IndustryRITIKANo ratings yet

- Pakistan International Airlines - SWOTDocument14 pagesPakistan International Airlines - SWOTHissuNo ratings yet

- Jet Blue Airways - Strategic Management Case Study - Presentation TranscriptDocument4 pagesJet Blue Airways - Strategic Management Case Study - Presentation TranscriptAngel WingsNo ratings yet

- Business Plan Proposal For Launch of Airline Business-KSDocument37 pagesBusiness Plan Proposal For Launch of Airline Business-KSshahzaibNo ratings yet

- Notes Airline & Airport Marketing ManagementDocument21 pagesNotes Airline & Airport Marketing ManagementAnirudh K NNo ratings yet

- ACCA Registration: Submission PeriodDocument16 pagesACCA Registration: Submission PeriodzubyrNo ratings yet

- Project Report On Jet Airways CitrixDocument9 pagesProject Report On Jet Airways CitrixvithanibharatNo ratings yet

- Ethiopian Airlines Market SurveyDocument11 pagesEthiopian Airlines Market SurveyAwad AbdellaNo ratings yet

- Rayyan Air PDFDocument60 pagesRayyan Air PDFSaad Bin Shahid0% (1)

- Brand Audit-Buddha AirDocument31 pagesBrand Audit-Buddha AirNischal KcNo ratings yet

- Aviation Industry AnalysisDocument28 pagesAviation Industry AnalysisKaranNo ratings yet

- Organizational StructureDocument32 pagesOrganizational Structurewww_vibhugorintla100% (1)

- FINAL TERM PROJECT OF Airline ManagementDocument3 pagesFINAL TERM PROJECT OF Airline ManagementSoni VirgoNo ratings yet

- Kingfisher AirlinesDocument10 pagesKingfisher Airlinesswetha padmanaabanNo ratings yet

- Airline Business PlanDocument70 pagesAirline Business PlanKevin MaulanaNo ratings yet

- Emirates Telecommunications Corporation "Etisalat": By: Maha Kanz (CFA)Document11 pagesEmirates Telecommunications Corporation "Etisalat": By: Maha Kanz (CFA)memo ibNo ratings yet

- Accounting Textbook Solutions - 40Document19 pagesAccounting Textbook Solutions - 40acc-expertNo ratings yet

- Ecological NetworkDocument11 pagesEcological NetworkDaisy100% (1)

- JetBlue Study ProjectDocument36 pagesJetBlue Study ProjectIrna Azzadina100% (1)

- Analisis RatioDocument5 pagesAnalisis RatioKata AssalamualaikumNo ratings yet

- MIS Financials Format XlsMISDocument78 pagesMIS Financials Format XlsMISarajamani78100% (1)

- Business Plan of Budget Airline CompanyDocument44 pagesBusiness Plan of Budget Airline CompanyCharlie PhillipsNo ratings yet

- Concept of Operations ManagementDocument5 pagesConcept of Operations ManagementSoe LeiNo ratings yet

- WestJet Charles ProjectDocument27 pagesWestJet Charles Projectinderdhindsa100% (2)

- Hrob117 Jet AirwaysDocument17 pagesHrob117 Jet AirwaysDhruv Singh GosainNo ratings yet

- Indigo Airlines ReportDocument20 pagesIndigo Airlines ReportMriganga Barman100% (1)

- CRM British Airways EditedDocument14 pagesCRM British Airways EditedIshaan BaxiNo ratings yet

- Business Plan For Touch of Class Custom Air Service and TLC AirlinesDocument59 pagesBusiness Plan For Touch of Class Custom Air Service and TLC AirlinesYahia Mustafa AlfazaziNo ratings yet

- Dmgs Dip 27092 FinalDocument11 pagesDmgs Dip 27092 FinalEsa BhattacharyaNo ratings yet

- The Successful Strategies from Customer Managment ExcellenceFrom EverandThe Successful Strategies from Customer Managment ExcellenceNo ratings yet

- 18.3 Bonus Act, 2030 ChecklistDocument3 pages18.3 Bonus Act, 2030 ChecklistCool DudeNo ratings yet

- High Level Control ChecklistDocument8 pagesHigh Level Control ChecklistCool DudeNo ratings yet

- Laws and Regulations: Procedure Ref / CommentsDocument3 pagesLaws and Regulations: Procedure Ref / CommentsCool DudeNo ratings yet

- Section Control Sheet: Summary of Significant Risk and Related Controls Assess Impact H/M/LDocument7 pagesSection Control Sheet: Summary of Significant Risk and Related Controls Assess Impact H/M/LCool DudeNo ratings yet

- Fraud Risk Assessment Procedures PKFDocument3 pagesFraud Risk Assessment Procedures PKFCool DudeNo ratings yet

- 18.3 Bonus Act, 2030 ChecklistDocument3 pages18.3 Bonus Act, 2030 ChecklistCool DudeNo ratings yet

- Control Overview Document VFSDocument7 pagesControl Overview Document VFSCool DudeNo ratings yet

- Mapping of Trial Balance in Financial StatementsDocument3 pagesMapping of Trial Balance in Financial StatementsCool DudeNo ratings yet

- 6.1 The Entity and Its EnvironmentDocument6 pages6.1 The Entity and Its EnvironmentCool DudeNo ratings yet

- 14.1 Fraud and Management Override of ControlsDocument3 pages14.1 Fraud and Management Override of ControlsCool DudeNo ratings yet

- 6.2 APN Planning - Memo - Statutory Audit FY 71-72Document13 pages6.2 APN Planning - Memo - Statutory Audit FY 71-72Cool DudeNo ratings yet

- HR Budget PresentationDocument11 pagesHR Budget PresentationShivam TrivediNo ratings yet

- Procurement Management Plan TemplateDocument9 pagesProcurement Management Plan TemplateAdnan AkhtarNo ratings yet

- Taj Compensation Project FinalDocument16 pagesTaj Compensation Project Finalravina10008100% (1)

- 9 05 607 EngineeringDocument68 pages9 05 607 EngineeringMarianne Hernandez MendietaNo ratings yet

- Crack The Case Level 1 Slides PDFDocument78 pagesCrack The Case Level 1 Slides PDFShyamSunderSriramNo ratings yet

- Group 1 Software Engineering AssignmentDocument5 pagesGroup 1 Software Engineering AssignmentML GisNo ratings yet

- PRDP Coa Audit Report 2015 PDFDocument34 pagesPRDP Coa Audit Report 2015 PDFBillVeelNo ratings yet

- Implementation of Business Marketing StrategyDocument43 pagesImplementation of Business Marketing StrategyMubashir Ali BeighNo ratings yet

- Multiple Choice QuestionsDocument20 pagesMultiple Choice QuestionsPhoebe LanoNo ratings yet

- PeopleSoft ExpensesDocument27 pagesPeopleSoft ExpensesNIHUNo ratings yet

- Propuesta en Idioma Ingles de Un Producto o ServicioDocument9 pagesPropuesta en Idioma Ingles de Un Producto o ServicioOliver Eudan Bolaños SilvaNo ratings yet

- CH 10 AuditingDocument31 pagesCH 10 AuditingPutri Ayu Dwi LestariNo ratings yet

- Regulatory Framework For IBIs-ZahidDocument43 pagesRegulatory Framework For IBIs-Zahidski_leo82No ratings yet

- Trabajo Zarate FinishDocument17 pagesTrabajo Zarate FinishDavidFloresNo ratings yet

- GMP Documentation ModuleDocument49 pagesGMP Documentation ModulePrima SuhastriaNo ratings yet

- United Spirits: Performance HighlightsDocument11 pagesUnited Spirits: Performance HighlightsAngel BrokingNo ratings yet

- Human Resource ManagementDocument54 pagesHuman Resource Managementbhullar_pritpalNo ratings yet

- Theodore Levitt's Marketing Myopia: Colin GrantDocument2 pagesTheodore Levitt's Marketing Myopia: Colin GrantSauravSNo ratings yet

- AIOD - HSBC 12M CNH Twinwin Sharkfin Note Series 1 - 230922 - 152458Document27 pagesAIOD - HSBC 12M CNH Twinwin Sharkfin Note Series 1 - 230922 - 152458jesswjaNo ratings yet

- Doordash: Course Code: The Entrepreneurial MindDocument4 pagesDoordash: Course Code: The Entrepreneurial MindMichael SusmiranNo ratings yet

- National Contexts, Incubator Families and Trends in Incubation - Views From Four CountriesDocument23 pagesNational Contexts, Incubator Families and Trends in Incubation - Views From Four CountriesscribdoibNo ratings yet

- Aef 2013 Audit Acc ReqDocument9 pagesAef 2013 Audit Acc Reqvikas_ojha54706No ratings yet

- Acceptance FormDocument5 pagesAcceptance Formtpwarren23No ratings yet

- Infographic Bank MuamalatDocument2 pagesInfographic Bank Muamalatnur nadrahNo ratings yet

- Dispute FormDocument1 pageDispute Formevy_osh1025No ratings yet

- Ramada Marketing Report (Full)Document9 pagesRamada Marketing Report (Full)Haider SaleemNo ratings yet

- Impact Accounting, LLCDocument6 pagesImpact Accounting, LLCbarber bobNo ratings yet

- Solved Paper of Accounts Assistant in Kerala State Handloom Development Corporation LimitedDocument9 pagesSolved Paper of Accounts Assistant in Kerala State Handloom Development Corporation LimitedAbir SharmaNo ratings yet