Professional Documents

Culture Documents

Development Industries Purchased A Depreciable Asset For 50 000 On January

Development Industries Purchased A Depreciable Asset For 50 000 On January

Uploaded by

hassan taimour0 ratings0% found this document useful (0 votes)

4 views1 pageDevelopment Industries purchased a depreciable asset for $50,000 on January 1, 2012. The asset has a five-year useful life and $10,000 estimated salvage value. The company will use straight-line depreciation for book purposes and double-declining balance for tax purposes. The question asks to prepare depreciation schedules for both methods and calculate the 2012 tax savings from accelerated depreciation.

Original Description:

Accounts

Original Title

Development Industries Purchased a Depreciable Asset for 50 000 on January

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDevelopment Industries purchased a depreciable asset for $50,000 on January 1, 2012. The asset has a five-year useful life and $10,000 estimated salvage value. The company will use straight-line depreciation for book purposes and double-declining balance for tax purposes. The question asks to prepare depreciation schedules for both methods and calculate the 2012 tax savings from accelerated depreciation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageDevelopment Industries Purchased A Depreciable Asset For 50 000 On January

Development Industries Purchased A Depreciable Asset For 50 000 On January

Uploaded by

hassan taimourDevelopment Industries purchased a depreciable asset for $50,000 on January 1, 2012. The asset has a five-year useful life and $10,000 estimated salvage value. The company will use straight-line depreciation for book purposes and double-declining balance for tax purposes. The question asks to prepare depreciation schedules for both methods and calculate the 2012 tax savings from accelerated depreciation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Development Industries purchased a depreciable asset for

50 000 on January #719

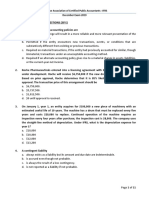

Development Industries purchased a depreciable asset for $50,000 on January 1, 2012. The

asset has a five-year useful life and a $10,000 estimated salvage value. The company will use

the straight-line method of depreciation for book purposes. However, Development will use the

double-declining balance method for tax purposes. Assume a tax rate of 30%.Requireda.

Prepare depreciation schedules using the straight-line and double-declining-balance methods of

depreciation for the useful life of the asset.b. Calculate the 2012 tax savings from the use of the

accelerated depreciation method for tax purposes.c. Under the straight-line method of

depreciation, what is the gain or loss if the equipment is sold (1) at the end of 2014 for $30,000

or (2) at the end of 2015 for $16,000?d. How is the gain or loss on the disposal of the

equipment presented in the financial statements? How does this differ from how depreciation

expense is presented?View Solution:

Development Industries purchased a depreciable asset for 50 000 on January

ANSWER

http://paperinstant.com/downloads/development-industries-purchased-a-depreciable-asset-

for-50-000-on-january/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- HRM732 Final Exam Review Practice Questions SUMMER 2022Document12 pagesHRM732 Final Exam Review Practice Questions SUMMER 2022Rajwinder KaurNo ratings yet

- Quiz - Module 10 PDFDocument11 pagesQuiz - Module 10 PDFAlyanna AlcantaraNo ratings yet

- Zumra Company S Annual Accounting Year Ends On December 31 It PDFDocument1 pageZumra Company S Annual Accounting Year Ends On December 31 It PDFhassan taimourNo ratings yet

- Wright Oil Company S Balance Sheet Includes Three Assets Natural Gas PDFDocument1 pageWright Oil Company S Balance Sheet Includes Three Assets Natural Gas PDFhassan taimourNo ratings yet

- Intermacc Depreciation, Depletion, Revaluation, and Impairment Prelec WaDocument1 pageIntermacc Depreciation, Depletion, Revaluation, and Impairment Prelec WaClarice Awa-aoNo ratings yet

- Local Media2481017670403448793 1Document3 pagesLocal Media2481017670403448793 1Drie LimNo ratings yet

- Nfjpia Nmbe Auditing 2017 AnsDocument9 pagesNfjpia Nmbe Auditing 2017 AnsBriana DizonNo ratings yet

- Borrowing CostsDocument4 pagesBorrowing CostsAila Mae SuarezNo ratings yet

- Quiz - Module 9Document12 pagesQuiz - Module 9Alyanna AlcantaraNo ratings yet

- ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFDocument11 pagesACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFPiyal HossainNo ratings yet

- KC1 Corporate Financial Reporting Q June 2015 - EnglishDocument8 pagesKC1 Corporate Financial Reporting Q June 2015 - EnglishSuranga PriyanandanaNo ratings yet

- Applied Auditing Audit of Intangibles: Problem No. 1Document2 pagesApplied Auditing Audit of Intangibles: Problem No. 1danix929No ratings yet

- Easy Round 1 Point Each Theory - 10 Seconds Problem - 15 SecondsDocument11 pagesEasy Round 1 Point Each Theory - 10 Seconds Problem - 15 Secondsby ScribdNo ratings yet

- Unit II - Audit of Intangibles and Other Assets - Final - t31314Document9 pagesUnit II - Audit of Intangibles and Other Assets - Final - t31314Jake BundokNo ratings yet

- Bcom Y3 Acc3 12 August 2021 s1Document4 pagesBcom Y3 Acc3 12 August 2021 s1Ntokozo Siphiwo Collin DlaminiNo ratings yet

- p1 ADocument8 pagesp1 Aincubus_yeahNo ratings yet

- Sixth Departmental QuizDocument8 pagesSixth Departmental QuizMica R.No ratings yet

- s16 f7 QDocument17 pagess16 f7 QJean LeongNo ratings yet

- 10 PpeDocument53 pages10 PpeSalsa Byla100% (1)

- UCDocument2 pagesUCJohn Alden NatividadNo ratings yet

- CAF 6 MFA Spring 2022Document7 pagesCAF 6 MFA Spring 2022hamizNo ratings yet

- Asignación 3 PNIADocument4 pagesAsignación 3 PNIAElia SantanaNo ratings yet

- Paper5 2Document61 pagesPaper5 2RAj BardHanNo ratings yet

- Module 6 CFAS PAS 23 - BORROWING COSTDocument6 pagesModule 6 CFAS PAS 23 - BORROWING COSTJan JanNo ratings yet

- Advanced Accounting Beams Anthony 11th Edition Test BankDocument38 pagesAdvanced Accounting Beams Anthony 11th Edition Test BankStevenRichardsdesk100% (40)

- Dupont Reported Depreciation Expense of 1 251 Million On ItsDocument1 pageDupont Reported Depreciation Expense of 1 251 Million On ItsMuhammad ShahidNo ratings yet

- Diagnostic Exam 1.1 AKDocument15 pagesDiagnostic Exam 1.1 AKmarygraceomacNo ratings yet

- Naqdown Final Round 2013Document8 pagesNaqdown Final Round 2013MJ YaconNo ratings yet

- Multiple Choice Questions 1 A Method That Excludes Residual Value FromDocument1 pageMultiple Choice Questions 1 A Method That Excludes Residual Value FromHassan JanNo ratings yet

- On January 1 2011 Borstad Company Purchased Equipment ForDocument1 pageOn January 1 2011 Borstad Company Purchased Equipment ForHassan JanNo ratings yet

- Intermidiate FA II Group Assigment QuestionsDocument6 pagesIntermidiate FA II Group Assigment Questionsnewaybeyene5No ratings yet

- Business Studies 12 Set 3 DS2Document20 pagesBusiness Studies 12 Set 3 DS2Vaibhav NegiNo ratings yet

- University of Santo Tomas Amv College of Accountancy Intermediate Acccounting 2 NAMEDocument3 pagesUniversity of Santo Tomas Amv College of Accountancy Intermediate Acccounting 2 NAMEElaine AntonioNo ratings yet

- Universiti Teknologi Mara Common Test 1: Confidential AC/AUG 2016/MAF253Document6 pagesUniversiti Teknologi Mara Common Test 1: Confidential AC/AUG 2016/MAF253Bonna Della TianamNo ratings yet

- Final Exam, s2, 2019-FINALDocument13 pagesFinal Exam, s2, 2019-FINALReenalNo ratings yet

- Term Test-1 FAR-1Document6 pagesTerm Test-1 FAR-1Dua FarmoodNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS December Exam 2019Document11 pagesLebanese Association of Certified Public Accountants - IFRS December Exam 2019jad NasserNo ratings yet

- Responsi Akkeu 2 Borrowing CostDocument20 pagesResponsi Akkeu 2 Borrowing CostAngel Valentine TirayoNo ratings yet

- A Firm Has 100 Million Available For Capital Expenditures ItDocument1 pageA Firm Has 100 Million Available For Capital Expenditures ItMuhammad ShahidNo ratings yet

- FR 1 Assignment 1 IAS 16 08112022 071429am 15102023 114037amDocument2 pagesFR 1 Assignment 1 IAS 16 08112022 071429am 15102023 114037amAnasNo ratings yet

- Mod 5Document15 pagesMod 5leeminleeNo ratings yet

- Irmaya Safitra - FR Session 1 Practice Assignment - Questions (8th July 2023)Document5 pagesIrmaya Safitra - FR Session 1 Practice Assignment - Questions (8th July 2023)irmaya.safitraNo ratings yet

- ©2014 Devry/Becker Educational Development Corp. All Rights ReservedDocument3 pages©2014 Devry/Becker Educational Development Corp. All Rights ReservedSyed Munib AbdullahNo ratings yet

- The Geek Squad - AC 115 Final Review (Accelerated)Document65 pagesThe Geek Squad - AC 115 Final Review (Accelerated)Paul YukNo ratings yet

- DySAS General Review Acctg6 - AnsDocument11 pagesDySAS General Review Acctg6 - Ansyasira0% (1)

- Solved Cost and Fair Value For The Trading Investments of KootenayDocument1 pageSolved Cost and Fair Value For The Trading Investments of KootenayAnbu jaromiaNo ratings yet

- Solved Refer To The Data in Starter 11 1 Show What MissionDocument1 pageSolved Refer To The Data in Starter 11 1 Show What MissionAnbu jaromiaNo ratings yet

- Acctg21 Midterm L1 Exercise: Multiple ChoiceDocument3 pagesAcctg21 Midterm L1 Exercise: Multiple ChoiceGarp BarrocaNo ratings yet

- FAR q1q2Document7 pagesFAR q1q2Leane MarcoletaNo ratings yet

- IKKA Classes F7-Test 3Document3 pagesIKKA Classes F7-Test 3ishika bihaniNo ratings yet

- IFA Chapter 5Document68 pagesIFA Chapter 5kqk07829No ratings yet

- Business Studies XII Pre Board IDocument7 pagesBusiness Studies XII Pre Board Ibhumika aggarwalNo ratings yet

- Group 1 - 7 (110722)Document8 pagesGroup 1 - 7 (110722)JACOB MAZHANGANo ratings yet

- Prequalifying Exam Level 1 Set B AK FSUU AccountingDocument9 pagesPrequalifying Exam Level 1 Set B AK FSUU AccountingRobert CastilloNo ratings yet

- Answers To Intangible AssetsDocument5 pagesAnswers To Intangible AssetsSoorya SubramaniamNo ratings yet

- Question PaperDocument6 pagesQuestion Papervinitsharma95035No ratings yet

- FA2e Chapter02 Solutions StudentsDocument45 pagesFA2e Chapter02 Solutions StudentsKira YamatoNo ratings yet

- Unit 4 Long Term Investment Decisions MakingDocument17 pagesUnit 4 Long Term Investment Decisions MakingGizaw BelayNo ratings yet

- Guided Exercises Current Liabilities PDFDocument4 pagesGuided Exercises Current Liabilities PDFlexfred55No ratings yet

- Multiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019Document8 pagesMultiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019jad NasserNo ratings yet

- Final Preboard-FAR-with AnswersDocument11 pagesFinal Preboard-FAR-with AnswersLuisito CorreaNo ratings yet

- Philippines: Management of Contingent Liabilities Arising from Public-Private Partnership ProjectsFrom EverandPhilippines: Management of Contingent Liabilities Arising from Public-Private Partnership ProjectsNo ratings yet

- You Ca Have Been Working For Plener and Partners Chartered PDFDocument4 pagesYou Ca Have Been Working For Plener and Partners Chartered PDFhassan taimourNo ratings yet

- Zippy A Regional Convenience Store Chain Maintains Milk Inventory by PDFDocument1 pageZippy A Regional Convenience Store Chain Maintains Milk Inventory by PDFhassan taimourNo ratings yet

- Your Best Friend From Home Writes You A Letter About PDFDocument1 pageYour Best Friend From Home Writes You A Letter About PDFhassan taimourNo ratings yet

- You Ca Have Recently Been Assigned As Audit Senior For PDFDocument2 pagesYou Ca Have Recently Been Assigned As Audit Senior For PDFhassan taimourNo ratings yet

- You Manage A 13 5 Million Portfolio Currently All Invested PDFDocument1 pageYou Manage A 13 5 Million Portfolio Currently All Invested PDFhassan taimourNo ratings yet

- Xanadu LTD Has Accounts Receivable Totalling 142 800 and A 3 640 PDFDocument1 pageXanadu LTD Has Accounts Receivable Totalling 142 800 and A 3 640 PDFhassan taimourNo ratings yet

- Your Supervisor Has Asked You To Research The Following Situation PDFDocument1 pageYour Supervisor Has Asked You To Research The Following Situation PDFhassan taimourNo ratings yet

- Yangzi International Inc Uses The Aging of Accounts Receivable Method PDFDocument1 pageYangzi International Inc Uses The Aging of Accounts Receivable Method PDFhassan taimourNo ratings yet

- You Are A Senior Manager at Poeing Aircraft and Have PDFDocument1 pageYou Are A Senior Manager at Poeing Aircraft and Have PDFhassan taimourNo ratings yet

- Windmere Corporation S Statement of Financial Position at December 31 2016 PDFDocument1 pageWindmere Corporation S Statement of Financial Position at December 31 2016 PDFhassan taimourNo ratings yet

- You Own 10 000 Shares 1 of The Outstanding Shares of PDFDocument1 pageYou Own 10 000 Shares 1 of The Outstanding Shares of PDFhassan taimourNo ratings yet

- Your Friend Is Celebrating Her 30th Birthday Today and Wants PDFDocument1 pageYour Friend Is Celebrating Her 30th Birthday Today and Wants PDFhassan taimourNo ratings yet

- Whistler Blackcomb Holdings Inc Has A 75 Interest in Whistler PDFDocument1 pageWhistler Blackcomb Holdings Inc Has A 75 Interest in Whistler PDFhassan taimourNo ratings yet

- Wood Work LTD Sells Home Furnishings Including A Wide Range PDFDocument1 pageWood Work LTD Sells Home Furnishings Including A Wide Range PDFhassan taimourNo ratings yet

- While Pursuing His Undergraduate Studies Bruno Clarke Needed To Earn PDFDocument1 pageWhile Pursuing His Undergraduate Studies Bruno Clarke Needed To Earn PDFhassan taimourNo ratings yet

- Wright Fishing Charters Has Collected The Following Data For The PDFDocument1 pageWright Fishing Charters Has Collected The Following Data For The PDFhassan taimourNo ratings yet

- Whiskey Industries LTD A Nanaimo British Columbia Based Company Has A PDFDocument1 pageWhiskey Industries LTD A Nanaimo British Columbia Based Company Has A PDFhassan taimourNo ratings yet

- Whitley Company Is Considering Two Capital Investments Both Investments Have PDFDocument1 pageWhitley Company Is Considering Two Capital Investments Both Investments Have PDFhassan taimourNo ratings yet