Professional Documents

Culture Documents

1 A Private Not For Profit Health Care Organization Has The Following

1 A Private Not For Profit Health Care Organization Has The Following

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 A Private Not For Profit Health Care Organization Has The Following

1 A Private Not For Profit Health Care Organization Has The Following

Uploaded by

trilocksp SinghCopyright:

Available Formats

1 A private not for profit health care organization has the

following

1. A private not-for-profit health care organization has the following account balances:Revenue

from newsstand . . . . . . . . . . . . . . . . . . . . . . . . . $ 50,000Amounts charged to patients . . . . . . . .

. . . . . . . . . . . . . . 800,000Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30,000Salary expense—nurses . . . . . . . . . . . . . . . . . . . . . . . . . . . 100,000Bad debts . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000Undesignated gifts . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. 80,000Contractual adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . 110,000What is reported as

the hospital’s net patient service revenue?a. $880,000.b. $800,000.c. $690,000.d. $680,000.2.

A large not-for-profit organization’s statement of activities should report the net change for net

assets that are3. Which of the following statements is true?I. Private not-for-profit universities

must report depreciation expense.II. Public universities must report depreciation expense.a.

Neither I nor II is true.b. Both I and II are true.c. Only I is true.d. Only II is true.4. A private not-

for-profit organization receives three donations:One gift of $70,000 is unrestricted.One gift of

$90,000 is restricted to pay the salary of the organization’s workers.One gift of $120,000 is

restricted forever with the income to be used to provide food for needy families.Which of the

following statements is not true?a. Temporarily restricted net assets have increased by

$90,000.b. Permanently restricted net assets have increased by $210,000.c. When the donated

money is spent for salaries, unrestricted net assets increase and decrease by the same

amount.d. When the donated money is spent for salaries, temporarily restricted net assets

decrease.5. A donor gives Charity 1 $50,000 in cash that it must convey to Charity 2. However,

the donor can revoke the gift at any time prior to its conveyance to Charity 2. Which of the

following statements is true?a. Charity 1 should report a contribution revenue.b. The donor

continues to report an asset even after it is given to Charity 1.c. As soon as the gift is made to

Charity 1, Charity 2 should recognize a contribution revenue.d. As soon as the gift is made to

Charity 1, Charity 2 should recognize an asset.6. A private not-for-profit university charges its

students tuition of $1 million. However, financial aid grants total $220,000. In addition, the

school receives a $100,000 grant restricted for faculty salaries. Of this amount, it spent $30,000

appropriately this year. On the statement of activities, the school reports three categories: (1)

revenues and support, (2) net assets reclassified, and (3) expenses. Which of the following is

not true?a. Unrestricted net assets should show an increase of $30,000 for net assets

reclassified.b. In the unrestricted net assets, the revenues and support should total $1 million.c.

Unrestricted net assets should recognize expenses of $30,000.d. Unrestricted net assets shows

the $220,000 as a direct reduction to the tuition revenue balance.7. A private not-for-profit

organization has the following activities performed by volunteers who work at no charge. In

which case should it report no amount of contribution?a. A carpenter builds a porch on the back

of one building so that patients can sit outside.b. An accountant does the organization’s

financial reporting.c. A local librarian comes each day to read to the patients.d. A computer

expert repairs the organization’s computer.8. To send a mailing, a private not-for-profit charity

spends $100,000. The mailing solicits donations and provides educational and other information

about the charity. Which of the following is true?a. No part of the $100,000 can be reported as a

program service expense.b. Some part of the $100,000 must be reported as a program service

expense.c. No authoritative guidance exists, so the organization can allocate the cost as it

believes best.d. Under certain specified circumstances, the organization should allocate a

Unlock answers here solutiondone.online

You might also like

- CH 13Document16 pagesCH 13April Lynn Horn33% (3)

- Aldi in Australia Case Study AnalysisDocument22 pagesAldi in Australia Case Study AnalysisBIbee NIpanNo ratings yet

- Apologetics, Kreeft Chapter 9: The Resurrection of Jesus ChristDocument56 pagesApologetics, Kreeft Chapter 9: The Resurrection of Jesus Christrichard100% (2)

- NPO-Multiple Choice Questions PART VIDocument3 pagesNPO-Multiple Choice Questions PART VILorraineMartinNo ratings yet

- Chapter 21 Accounting For Non Profit OrganizationsDocument21 pagesChapter 21 Accounting For Non Profit OrganizationsHyewon100% (1)

- Quiz - Other NPEs (Ver. 3)Document5 pagesQuiz - Other NPEs (Ver. 3)Von Andrei MedinaNo ratings yet

- AFAR8721 - Nonprofit Organizations PDFDocument3 pagesAFAR8721 - Nonprofit Organizations PDFSid Tuazon100% (1)

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- 1 A Local Citizen Gives A Not For Profit Organization A CashDocument1 page1 A Local Citizen Gives A Not For Profit Organization A Cashtrilocksp SinghNo ratings yet

- Part LL PRELIM EXAMDocument3 pagesPart LL PRELIM EXAMJovyl InguitoNo ratings yet

- NPO AssignmentDocument4 pagesNPO AssignmentZyrah Mae SaezNo ratings yet

- Finals ReviewerDocument9 pagesFinals ReviewerAira Jaimee GonzalesNo ratings yet

- Q4 Adv 3Document3 pagesQ4 Adv 3-No ratings yet

- Identify The Best Answer For Each of The Following 1: Unlock Answers Here Solutiondone - OnlineDocument1 pageIdentify The Best Answer For Each of The Following 1: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Practice NPO Acctg12 PDFDocument6 pagesPractice NPO Acctg12 PDFCresca Cuello CastroNo ratings yet

- 2021 2nd AC - Acctg Gov Quiz 04Document4 pages2021 2nd AC - Acctg Gov Quiz 04Merliza JusayanNo ratings yet

- Advance Financial Accounting and Reporting: Not For Profit OrganizationDocument8 pagesAdvance Financial Accounting and Reporting: Not For Profit OrganizationMark Gelo WinchesterNo ratings yet

- 02 Exercises - Accounting For NPOs v2Document3 pages02 Exercises - Accounting For NPOs v2Peter Andre GuintoNo ratings yet

- Quiz NPO Multiple ChoiceDocument4 pagesQuiz NPO Multiple ChoiceLJ Aggabao0% (1)

- Nonprofit Accounting LJDocument26 pagesNonprofit Accounting LJFreddhy AndresNo ratings yet

- Aka Balance SheetDocument5 pagesAka Balance Sheetmaj thuanNo ratings yet

- Acc162 Final Exam Write The Letter Pertaining To Best AnswerDocument3 pagesAcc162 Final Exam Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- C13 CHP 15-16-2 HW PRB Exempt Organ Multistate 2013Document3 pagesC13 CHP 15-16-2 HW PRB Exempt Organ Multistate 2013NitinNo ratings yet

- Npo GovDocument8 pagesNpo GovThalia BontigaoNo ratings yet

- Yellow Final Ans Thanks// Palagay San Nakita For Ex: NASA FILE OR LINK - Final Answer - No Answer Yet/not SureDocument7 pagesYellow Final Ans Thanks// Palagay San Nakita For Ex: NASA FILE OR LINK - Final Answer - No Answer Yet/not SureA. MagnoNo ratings yet

- 1 The Jones Family Lost Its Home in A Fire: Unlock Answers Here Solutiondone - OnlineDocument1 page1 The Jones Family Lost Its Home in A Fire: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Name: Student ID: DOB: . (X Month) Tittle: No. Name - Student ID - (Ex: 02. Dang Quynh Anh - 11204255 - )Document2 pagesName: Student ID: DOB: . (X Month) Tittle: No. Name - Student ID - (Ex: 02. Dang Quynh Anh - 11204255 - )Hà NguyễnNo ratings yet

- Chapter 2Document17 pagesChapter 2jinny6061100% (1)

- Results Reporter: Multiple Choice QuizDocument3 pagesResults Reporter: Multiple Choice Quizselmon30No ratings yet

- Bgquiz 2-Cvp: Required: Compute The Break Even Point in Pesos and in Patient DaysDocument2 pagesBgquiz 2-Cvp: Required: Compute The Break Even Point in Pesos and in Patient DaysJanina Marie GarciaNo ratings yet

- Solutiondone 2-465Document1 pageSolutiondone 2-465trilocksp SinghNo ratings yet

- Midterm PDFDocument7 pagesMidterm PDFsubash1111@gmail.comNo ratings yet

- ACCT 450 - AICPA Questions FlashcardsDocument24 pagesACCT 450 - AICPA Questions FlashcardsdissidentmeNo ratings yet

- OutputDocument37 pagesOutputTrisha RafalloNo ratings yet

- Far IDocument9 pagesFar IPamela Bugarso0% (1)

- Mock 2Document14 pagesMock 2Arslan AlviNo ratings yet

- Fiduciary Funds and Permanent Funds: True/False (Chapter 10)Document25 pagesFiduciary Funds and Permanent Funds: True/False (Chapter 10)Holban AndreiNo ratings yet

- F3 Final Mock 2Document8 pagesF3 Final Mock 2Nicat IsmayıloffNo ratings yet

- BU127 Quiz Q&aDocument14 pagesBU127 Quiz Q&aFarah Luay AlberNo ratings yet

- Madhrasathul Ahmadhiyya First Term Test 2002 Grade: 10 Principles of Accounting Paper One Page 1 of 5Document5 pagesMadhrasathul Ahmadhiyya First Term Test 2002 Grade: 10 Principles of Accounting Paper One Page 1 of 5afoo1234No ratings yet

- ACCT 1111 and 2111 Midterm - BBDocument12 pagesACCT 1111 and 2111 Midterm - BBHiu Ching LauNo ratings yet

- NPO ProblemsDocument3 pagesNPO ProblemsAdam Smith50% (2)

- Dev TaxDocument7 pagesDev TaxLucky LuckyNo ratings yet

- Module Exam Financial Accounting Winter Term 20xy/xz Mock ExamDocument9 pagesModule Exam Financial Accounting Winter Term 20xy/xz Mock ExamShahid NaseemNo ratings yet

- AFAR8722 - Nonprofit Organizations PDFDocument2 pagesAFAR8722 - Nonprofit Organizations PDFSid Tuazon100% (1)

- Distinguishing Characteristics of Governmental and NotDocument9 pagesDistinguishing Characteristics of Governmental and NotFantayNo ratings yet

- Ives7e Tif Ch13Document20 pagesIves7e Tif Ch13Rodlyn LajonNo ratings yet

- FA - 6th Mock TestDocument13 pagesFA - 6th Mock TestChaiz MineNo ratings yet

- Pcpar NpoDocument3 pagesPcpar Npodoora keysNo ratings yet

- Soal Test Intermediate 2 MAC 2020Document6 pagesSoal Test Intermediate 2 MAC 2020DikaGustianaNo ratings yet

- Acct 4220 Additional Review Questions For Final ExamDocument5 pagesAcct 4220 Additional Review Questions For Final ExamrakutenmeeshoNo ratings yet

- NFProfit Health Care ProvidersDocument6 pagesNFProfit Health Care ProvidersRie CabigonNo ratings yet

- 1 Accounting-Week-2assignmentsDocument4 pages1 Accounting-Week-2assignmentsTim Thiru0% (1)

- Final Mock Test PA T1 2024Document9 pagesFinal Mock Test PA T1 2024ngminhthu0905No ratings yet

- Preweek ReviewDocument31 pagesPreweek ReviewLeah Hope CedroNo ratings yet

- Question #1: (AICPA.110589FAR)Document5 pagesQuestion #1: (AICPA.110589FAR)iceman2167No ratings yet

- Accounting For NPOsDocument3 pagesAccounting For NPOsRaven BermalNo ratings yet

- P2 07Document3 pagesP2 07rietzhel22No ratings yet

- Finance Fundamentals for Nonprofits: Building Capacity and SustainabilityFrom EverandFinance Fundamentals for Nonprofits: Building Capacity and SustainabilityNo ratings yet

- The Law of Tax-Exempt Healthcare Organizations 2016 SupplementFrom EverandThe Law of Tax-Exempt Healthcare Organizations 2016 SupplementNo ratings yet

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2From EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2No ratings yet

- Corporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringFrom EverandCorporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- Prachi Ashtang YogaDocument18 pagesPrachi Ashtang YogaArushi BhargawaNo ratings yet

- Chapter 2 Capacity To Buy or SellDocument3 pagesChapter 2 Capacity To Buy or Sellariane marsadaNo ratings yet

- Tailieuchung Boi Duong Hoc Sinh Gioi Luong Giac NXB Dai Hoc Quoc Gia 2014-2-8519Document116 pagesTailieuchung Boi Duong Hoc Sinh Gioi Luong Giac NXB Dai Hoc Quoc Gia 2014-2-8519Vincent TuấnNo ratings yet

- CoLMEAL Design Manual SalangaDocument33 pagesCoLMEAL Design Manual SalangaCoco LokoNo ratings yet

- Final Exam Form 1Document12 pagesFinal Exam Form 1ILANGGO KANANNo ratings yet

- Organisation of Prosecuting AgenciesDocument24 pagesOrganisation of Prosecuting AgenciesPAULOMI DASNo ratings yet

- Job Satisfaction PHD Thesis PDFDocument8 pagesJob Satisfaction PHD Thesis PDFBuySchoolPapersOnlineLowell100% (2)

- Excavation Backfill For UtilitiesDocument13 pagesExcavation Backfill For UtilitiesGHL AdaroNo ratings yet

- Define Sales ProcessDocument15 pagesDefine Sales Processwww.GrowthPanel.com100% (5)

- RWD 3 SpeedDocument6 pagesRWD 3 SpeedAbraham VegaNo ratings yet

- The Brain TED TALK Reading Comprehension Questions and VocabularyDocument4 pagesThe Brain TED TALK Reading Comprehension Questions and VocabularyJuanjo Climent FerrerNo ratings yet

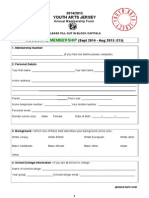

- Youth Arts Jersey - MembershipDocument2 pagesYouth Arts Jersey - MembershipSteve HaighNo ratings yet

- Lesson 7Document20 pagesLesson 7rj libayNo ratings yet

- Erectile Dysfunction: QuestionsDocument24 pagesErectile Dysfunction: QuestionsSayed NourNo ratings yet

- Flipkart Case StudyDocument9 pagesFlipkart Case StudyHarshini ReddyNo ratings yet

- Peckiana Peckiana Peckiana Peckiana PeckianaDocument29 pagesPeckiana Peckiana Peckiana Peckiana PeckianaWais Al-QorniNo ratings yet

- Fast Easy DK HatDocument4 pagesFast Easy DK HatAdina LamasanuNo ratings yet

- The Legacy of Early Humans To Contemporary Population 1Document35 pagesThe Legacy of Early Humans To Contemporary Population 1Norberto Ramirez Furto Jr.78% (9)

- Canning The Catch: University of Alaska FairbanksDocument4 pagesCanning The Catch: University of Alaska FairbanksChaix JohnsonNo ratings yet

- Notes Calendar Free Time Displays No InformationDocument17 pagesNotes Calendar Free Time Displays No InformationfregolikventinNo ratings yet

- ContingentWorker OffboardingTicketDocument7 pagesContingentWorker OffboardingTicketSonia Cuenca AcaroNo ratings yet

- MK Cap Budgeting CH 9 - 10 Ross PDFDocument17 pagesMK Cap Budgeting CH 9 - 10 Ross PDFSajidah PutriNo ratings yet

- Sepak TakrawDocument39 pagesSepak TakrawRandy Gasalao100% (2)

- May 6, 2016 Strathmore TimesDocument28 pagesMay 6, 2016 Strathmore TimesStrathmore TimesNo ratings yet

- Tingkat Kepatuhan Minum Obat Pada Penderita Penyakit Hipertensi Di Puskesmas Kedaung Wetan Kota Tangerang Bulan Juni - Juli Tahun 2021Document6 pagesTingkat Kepatuhan Minum Obat Pada Penderita Penyakit Hipertensi Di Puskesmas Kedaung Wetan Kota Tangerang Bulan Juni - Juli Tahun 2021Ninin KepoNo ratings yet

- VikingsDocument21 pagesVikingsSusan MilliganNo ratings yet

- Fusion Financials Implementation GuideDocument174 pagesFusion Financials Implementation Guidemaddiboina100% (1)

- Sikamelt 700Document2 pagesSikamelt 700Ionut StoicaNo ratings yet