Professional Documents

Culture Documents

Journal-WPS Office

Journal-WPS Office

Uploaded by

Surendra SharmaCopyright:

Available Formats

You might also like

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii87% (15)

- Business Studies Grade 8 9 Text PDFDocument30 pagesBusiness Studies Grade 8 9 Text PDFFideliss Malilwe75% (40)

- NPS MCQDocument30 pagesNPS MCQAmit Kumar88% (33)

- NPS MCQDocument30 pagesNPS MCQAmit Kumar88% (33)

- Bookkeeping & Accounting For Small Business, 7th Ed PDFDocument190 pagesBookkeeping & Accounting For Small Business, 7th Ed PDFAhrian Bena100% (2)

- Bookkeeping Engagement LetterDocument5 pagesBookkeeping Engagement LetterJake YangNo ratings yet

- Ak - Keu (Problem)Document51 pagesAk - Keu (Problem)RAMA100% (9)

- Latihan Acca v02Document17 pagesLatihan Acca v02Indriyanti KrisdianaNo ratings yet

- Book 5: Preparing Financial StatementsDocument104 pagesBook 5: Preparing Financial Statementsinfo m-alamriNo ratings yet

- FABM 121 Week 11-20 (I Think)Document12 pagesFABM 121 Week 11-20 (I Think)Lymenson Boongaling75% (4)

- Financial Accounting Atc 1Document3 pagesFinancial Accounting Atc 1hshing02No ratings yet

- 3 Column Cash BookDocument4 pages3 Column Cash BookMuketoi AlexNo ratings yet

- Level 1 Book Keeping With Logo PDFDocument14 pagesLevel 1 Book Keeping With Logo PDFShwe HtayNo ratings yet

- Explain Bank Reconciliation Statement. Why Is It PreparedDocument6 pagesExplain Bank Reconciliation Statement. Why Is It Preparedjoker.dutta100% (1)

- Inter - AcctDocument11 pagesInter - AcctAizha NarioNo ratings yet

- QuesDocument4 pagesQuesSreejith NairNo ratings yet

- Share Accounting-WPS OfficeDocument5 pagesShare Accounting-WPS OfficeSurendra SharmaNo ratings yet

- Steps in Accounting CycleDocument34 pagesSteps in Accounting Cycleahmad100% (4)

- Review of Accounting ProcessDocument8 pagesReview of Accounting ProcessVenn Bacus RabadonNo ratings yet

- Accounting Vocabulary (A To C)Document4 pagesAccounting Vocabulary (A To C)MARY GRACE VARGASNo ratings yet

- Source Document: The Accounting Process (The Accounting Cycle)Document4 pagesSource Document: The Accounting Process (The Accounting Cycle)rap_rrc75No ratings yet

- Accounting VocabularyDocument4 pagesAccounting Vocabularyapi-526065196No ratings yet

- Financial AccountingDocument1 pageFinancial AccountingCindy The GoddessNo ratings yet

- Chapter - 1 Basic Concepts (Accounting Process) : TransactionsDocument8 pagesChapter - 1 Basic Concepts (Accounting Process) : Transactionsgagan vermaNo ratings yet

- Special Journals and Subsidiary LedgersDocument51 pagesSpecial Journals and Subsidiary LedgersFrances Monique AlburoNo ratings yet

- Accounting BooksDocument30 pagesAccounting BooksAshley Keith CadizNo ratings yet

- Features of Accounting BookDocument2 pagesFeatures of Accounting BookPhạm DiệuNo ratings yet

- Suraj Singh Lodhi Accountancy Project 2023 24Document7 pagesSuraj Singh Lodhi Accountancy Project 2023 24www.friendlyaniket1992No ratings yet

- Chapter 3Document29 pagesChapter 3Sisira ChandranNo ratings yet

- Review of Accounting Process 1Document2 pagesReview of Accounting Process 1Stacy SmithNo ratings yet

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnNo ratings yet

- Adjusting Entries and Accounting CycleDocument4 pagesAdjusting Entries and Accounting Cyclekimingyuse1010No ratings yet

- Special Journals and Internal ControlDocument16 pagesSpecial Journals and Internal ControlFarah PatelNo ratings yet

- Accounting Manual On Double Entry System of AccountingDocument12 pagesAccounting Manual On Double Entry System of AccountingGaurav TrivediNo ratings yet

- Accounting Calculations - Learning of FundamentalsDocument7 pagesAccounting Calculations - Learning of FundamentalsRobinHood TiwariNo ratings yet

- ACTBAS 1 Lecture 6 Notes Accounting Cycle of A Service Business Part I: Journalizing, Posting and Trial BalanceDocument22 pagesACTBAS 1 Lecture 6 Notes Accounting Cycle of A Service Business Part I: Journalizing, Posting and Trial BalanceAA Del Rosario AlipioNo ratings yet

- Mefa Iv 1Document23 pagesMefa Iv 120-M-140 HrushikeshNo ratings yet

- Bookkeeping Is The Recording of Financial Transactions. Transactions Include SalesDocument247 pagesBookkeeping Is The Recording of Financial Transactions. Transactions Include SalesSantosh PanigrahiNo ratings yet

- Accounts From Incomplete RecordsDocument13 pagesAccounts From Incomplete Recordsriyasmakkar100% (2)

- Chapter Two General and Subsidiary Ledgers Chapter Two General and Subsidiary LedgersDocument25 pagesChapter Two General and Subsidiary Ledgers Chapter Two General and Subsidiary LedgersGirmaNo ratings yet

- 70281.a.priya Ojha - Internal 3RD - Part 2. Types of Cashbook.Document30 pages70281.a.priya Ojha - Internal 3RD - Part 2. Types of Cashbook.Priya OjhaNo ratings yet

- Cash Book: Cash Book - A Subsidiary Book and A Principal BookDocument6 pagesCash Book: Cash Book - A Subsidiary Book and A Principal BooklatestNo ratings yet

- Accounting CycleDocument4 pagesAccounting Cycleddoc.mimiNo ratings yet

- Accounting Books - Journal, Ledger and Trial BalanceDocument35 pagesAccounting Books - Journal, Ledger and Trial BalanceGhie Ragat100% (3)

- Chapter VDocument6 pagesChapter VRanak BiswasNo ratings yet

- Accounting ConceptsDocument25 pagesAccounting ConceptsRaj Kumar100% (1)

- Unit 5Document6 pagesUnit 5deepshrmNo ratings yet

- Accounting CycleDocument2 pagesAccounting CyclepoornapavanNo ratings yet

- Bookkeeping PDFDocument4 pagesBookkeeping PDFYo Yo0% (1)

- Books of Orginal EntryDocument6 pagesBooks of Orginal EntryMuhammad BilalNo ratings yet

- Closing EntriesDocument1 pageClosing EntriesCharles Reginald K. HwangNo ratings yet

- Review of The Accounting ProcessDocument18 pagesReview of The Accounting ProcessRoyceNo ratings yet

- Define JournalDocument6 pagesDefine JournalOrbin SunnyNo ratings yet

- Accounting Process NotesDocument5 pagesAccounting Process NotesYudna YuNo ratings yet

- What Are The Different Types of Subsidiary Books Usually Maintained by A Firm?Document11 pagesWhat Are The Different Types of Subsidiary Books Usually Maintained by A Firm?sweet19girlNo ratings yet

- Week 3: 1. Please Read, For Understanding, All The CONTENT Information in This Module For WEEK 3Document3 pagesWeek 3: 1. Please Read, For Understanding, All The CONTENT Information in This Module For WEEK 3Javan SmithNo ratings yet

- Income and Expenditure NotesDocument2 pagesIncome and Expenditure NotesRashmi Anand JhaNo ratings yet

- Subsidiary BooksDocument6 pagesSubsidiary BooksBamidele AdegboyeNo ratings yet

- Question SheetDocument7 pagesQuestion Sheetscientistmonster0001No ratings yet

- Accounting MechanicsDocument21 pagesAccounting MechanicsPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (1)

- 5 Simple Steps To Write and Prepare Ledger AccountDocument4 pages5 Simple Steps To Write and Prepare Ledger AccountNik ZulaimiNo ratings yet

- The Accounting CycleDocument3 pagesThe Accounting Cycleliesly buticNo ratings yet

- SECRET SAUCE-WITH FORMATS - Aslevel - 2023Document81 pagesSECRET SAUCE-WITH FORMATS - Aslevel - 2023Anayah KhanNo ratings yet

- Journal or Day BookDocument42 pagesJournal or Day BookRaviSankar100% (1)

- Posting Journal Entries To The LedgerDocument14 pagesPosting Journal Entries To The LedgerJeanlyn Vallejos DomingoNo ratings yet

- Steps in Accounting CycleDocument16 pagesSteps in Accounting CycleMuhammad AyazNo ratings yet

- Extensive Theory PackageDocument70 pagesExtensive Theory PackageLeon BurresNo ratings yet

- ACCTG 114 Lecture (04-05-2022)Document4 pagesACCTG 114 Lecture (04-05-2022)Janna Mari FriasNo ratings yet

- Finalizing The Accounting ProcessDocument2 pagesFinalizing The Accounting ProcessMilagro Del ValleNo ratings yet

- FAABM11 Final SummaryDocument18 pagesFAABM11 Final SummaryJeferson LincosananNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- (Telephone Directory) Name & Designation Office E-Mail Hon'Ble Minister of Housing and Urban AffairsDocument35 pages(Telephone Directory) Name & Designation Office E-Mail Hon'Ble Minister of Housing and Urban AffairsSurendra SharmaNo ratings yet

- Land Price 202122 16721Document15 pagesLand Price 202122 16721Surendra SharmaNo ratings yet

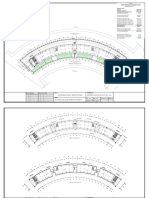

- Ultra Modern Commercial Complex: WWW - Shrivinayaka.inDocument18 pagesUltra Modern Commercial Complex: WWW - Shrivinayaka.inSurendra SharmaNo ratings yet

- Constitution Objective PDFDocument16 pagesConstitution Objective PDFAYYANAR RAJANo ratings yet

- D-119 Welcome LetterDocument1 pageD-119 Welcome LetterSurendra SharmaNo ratings yet

- Central Government Health Scheme (Delhi and NCR)Document1 pageCentral Government Health Scheme (Delhi and NCR)Surendra SharmaNo ratings yet

- 'KGHN Fot Flag Iffkd Øhmk Ladqy: Shaheed Vijay Singh Pathik Sports ComplexDocument26 pages'KGHN Fot Flag Iffkd Øhmk Ladqy: Shaheed Vijay Singh Pathik Sports ComplexSurendra SharmaNo ratings yet

- Multiple Choice QuestionsDocument78 pagesMultiple Choice QuestionsSurendra Sharma75% (8)

- Chapter 13 Cam2Document10 pagesChapter 13 Cam2Surendra SharmaNo ratings yet

- Page No. 9, Size: (17.11) Cms X (26.55) CmsDocument1 pagePage No. 9, Size: (17.11) Cms X (26.55) CmsSurendra SharmaNo ratings yet

- Govt - Accounting Rules 1990Document63 pagesGovt - Accounting Rules 1990kandukurisrimanNo ratings yet

- Space Design Group: Knowledge Park 2, Greater Noida Ground Floor Plan (Plot No 1 & 2)Document7 pagesSpace Design Group: Knowledge Park 2, Greater Noida Ground Floor Plan (Plot No 1 & 2)Surendra SharmaNo ratings yet

- List of 4%, 5%, 6%, 8%, 10% Kisan Abadi Plots Registered Up To 10-11-2020Document97 pagesList of 4%, 5%, 6%, 8%, 10% Kisan Abadi Plots Registered Up To 10-11-2020Surendra Sharma100% (1)

- Chapter 1 - MohitDocument4 pagesChapter 1 - MohitSurendra SharmaNo ratings yet

- Commercial Plots - 4 FAR: (Higher Than Reserve Price) Acceptance of Bid 1% Above Reserve Price Incremental ValueDocument2 pagesCommercial Plots - 4 FAR: (Higher Than Reserve Price) Acceptance of Bid 1% Above Reserve Price Incremental ValueSurendra SharmaNo ratings yet

- List of Empanelled HCOs-Delhi NCR As On 11 June 2020Document94 pagesList of Empanelled HCOs-Delhi NCR As On 11 June 2020Surendra SharmaNo ratings yet

- Sanskriti School: Admission To Pre-School For The Academic Year 2020-2021Document3 pagesSanskriti School: Admission To Pre-School For The Academic Year 2020-2021Surendra SharmaNo ratings yet

- Space Design Group: Knowledge Park 2, Greater Noida Ground Floor Plan (Plot No 3 & 4)Document7 pagesSpace Design Group: Knowledge Park 2, Greater Noida Ground Floor Plan (Plot No 3 & 4)Surendra SharmaNo ratings yet

- Ka Checklist 20112020Document81 pagesKa Checklist 20112020Surendra SharmaNo ratings yet

- NOT FO R S ALE: Made ObjectiveDocument40 pagesNOT FO R S ALE: Made ObjectiveSurendra Sharma100% (1)

- Procedure Catg-Ii VDocument48 pagesProcedure Catg-Ii VSurendra SharmaNo ratings yet

- NHSRCL News-19 Oct 2020Document5 pagesNHSRCL News-19 Oct 2020Surendra SharmaNo ratings yet

- Share Accounting-WPS OfficeDocument5 pagesShare Accounting-WPS OfficeSurendra SharmaNo ratings yet

- F3 Mock Exam 1Document12 pagesF3 Mock Exam 1Smith TiwariNo ratings yet

- 11th Book Keeping and AccountingDocument2 pages11th Book Keeping and AccountingAlefiya BurhaniNo ratings yet

- CBC Bookkeeping NC IIIDocument85 pagesCBC Bookkeeping NC IIIDhet Pas-Men100% (6)

- Fabm1 ch1Document22 pagesFabm1 ch1Crisson FermalinoNo ratings yet

- Agriculture Junior Secondary School (Jss 3) First TermDocument8 pagesAgriculture Junior Secondary School (Jss 3) First TermErnest Belamo100% (1)

- Client Bookkeeping Solution TutorialDocument304 pagesClient Bookkeeping Solution Tutorialburhan_qureshiNo ratings yet

- Bank Reconciliation ActivitiesDocument1 pageBank Reconciliation Activitiesmaligaya evelynNo ratings yet

- Trial BalanceDocument21 pagesTrial BalanceshaannivasNo ratings yet

- 761 Not. Intent Serve Subpoenas For Production 12 28 2021Document101 pages761 Not. Intent Serve Subpoenas For Production 12 28 2021larry-612445No ratings yet

- Internship Report On MCB BankDocument88 pagesInternship Report On MCB BankShahid RandhāwaNo ratings yet

- Ffa12efmq A Low ResDocument34 pagesFfa12efmq A Low ResAdi StănescuNo ratings yet

- Midterm Test AKT 1A Nop 20Document3 pagesMidterm Test AKT 1A Nop 20Henki Setya BudiNo ratings yet

- Jenny MineDocument22 pagesJenny MineSANTOSH KumarNo ratings yet

- Adms 2500 FinalDocument20 pagesAdms 2500 Finalmuyy1No ratings yet

- Group 2 Sec 1 Taco LabDocument159 pagesGroup 2 Sec 1 Taco LabSadAccountant100% (1)

- Cornelia Lightfoot ResumeDocument2 pagesCornelia Lightfoot ResumeDarrell WilcoxNo ratings yet

- Af As Chapter 8Document18 pagesAf As Chapter 8FarrukhsgNo ratings yet

- M.B.A Hospital ManagementDocument42 pagesM.B.A Hospital ManagementArun MuruganNo ratings yet

- Accounting Dashboard: Dashboard WP ERP Accounting. Once You Get There You Will See The FollowingDocument40 pagesAccounting Dashboard: Dashboard WP ERP Accounting. Once You Get There You Will See The FollowingusmanNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesJanna PleteNo ratings yet

Journal-WPS Office

Journal-WPS Office

Uploaded by

Surendra SharmaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Journal-WPS Office

Journal-WPS Office

Uploaded by

Surendra SharmaCopyright:

Available Formats

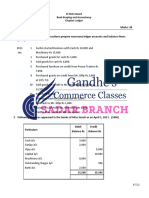

Journal

-also called book of original entry/day book/the basic book of accounting

-journalising:-the process of recording a transaction in a journal

-posting:-the transfer of journal entry to ledger account

-transactions are recorded in chronological order

-the column ledger folio is filled at the time of posting into the ledger and not at the time of journalising

-opening entry:-this is the journal entry through which the closing balances of the previous year are

brought forward in the current years book of account

-businessman close books of account at the end of each year due to accounting period concept.

- in this process nominal accounts are closed by transferring them to trading account or profit and loss

account

-the balances of personal and real accounts are carried forward to the next year. these balances become

the opening balances of the next year. Opening entry is passed to record closing balances of the

previous year

-simple entry:-journal entry in which one account is debited and another account is credited

-compound entry:-journal entry in which one or more accounts are debited and one or more accounts

are credited

- subsidiary books:-

There are lot of transactions and it's very hard to record all entries in journal book. It is convenient to

maintain separate book for each type of specific transactions. It is called subsidiary books.journal entries

not passed for the transactions recorded in such books and are directly posted in the ledger account

-these books of original entry or primary entry are also called special purpose books or special journals

-subdivision of journal:-

1. Cash book-to record receipt and payment of cash and Bank

2. Purchase book-to record credit purchase of goods

3. Sales book:- to record credit sale of goods

4. Purchase return book-to record return of goods purchased on credit

5. Sales return book- to record return of credit sales

6. Journal proper-transactions which not covered in the above subsidiary books example outstanding

expenses,B/R, B/P, bad debts, depreciation, interest on drawing etc

Note: journal proper is the subdivision of journal but it's not a subsidiary book. But all are the book of

original entry

Cash book

-it is also a book of primary entry

- in which cash and Bank transactions are recorded in a chronological order

-it perform the function of both journal and the ledger at the same time

-the balances are entered in the trial balance directly

-it is both = subsidiary book and a principal book

-it is both: a book of journal and ledger

-cash column will either have debit balance or nil balance

-Bank column may have either debit or credit balance (overdraft)

-receipts are recorded in the debit side of the cash book

-while making ledger receipts posted to the credit side

-payments are recorded in the credit side of cash book

-while making ledger payments posted to the debit side

-contra entry:-

The entries which effect both cash and bank. balance of one will decrease and the other will increase.

-Such transactions are recorded on both sides of cash book. once in the cash column And the another

one in bank column

-Contra entries are not posted in the ledger account and mark with the letter C in the ledger folio

column

-Contra entries transactions between cash and Bank are not posted in the ledger

Example- 1. Cash deposited in bank

2. Cash withdrawn from bank for office use

Petty cash book:-

-maintained by petty cashier to record petty expenses

-chief cashier paid some amount to petty cahier at the start of the month. petty cashier make expenses

and remit account at the end of the month

-it is not a subsidiary book because it is not mandatory to maintain

-balance of petty cash book is an assets for the firm

System of petty cash-

1. Simple system

2. Imprest system-opening balance and closing balance should be same

Type of petty cash book:-

1. Simple petty cash book

-it is identical with the cash book

-it is like a statement

2. Analytical petty cash book

-separate column is provided for recording a particular item of expenditure

-petty expenses are classified into appropriate head of expenses

-expenses under different heads can be determined easily

You might also like

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii87% (15)

- Business Studies Grade 8 9 Text PDFDocument30 pagesBusiness Studies Grade 8 9 Text PDFFideliss Malilwe75% (40)

- NPS MCQDocument30 pagesNPS MCQAmit Kumar88% (33)

- NPS MCQDocument30 pagesNPS MCQAmit Kumar88% (33)

- Bookkeeping & Accounting For Small Business, 7th Ed PDFDocument190 pagesBookkeeping & Accounting For Small Business, 7th Ed PDFAhrian Bena100% (2)

- Bookkeeping Engagement LetterDocument5 pagesBookkeeping Engagement LetterJake YangNo ratings yet

- Ak - Keu (Problem)Document51 pagesAk - Keu (Problem)RAMA100% (9)

- Latihan Acca v02Document17 pagesLatihan Acca v02Indriyanti KrisdianaNo ratings yet

- Book 5: Preparing Financial StatementsDocument104 pagesBook 5: Preparing Financial Statementsinfo m-alamriNo ratings yet

- FABM 121 Week 11-20 (I Think)Document12 pagesFABM 121 Week 11-20 (I Think)Lymenson Boongaling75% (4)

- Financial Accounting Atc 1Document3 pagesFinancial Accounting Atc 1hshing02No ratings yet

- 3 Column Cash BookDocument4 pages3 Column Cash BookMuketoi AlexNo ratings yet

- Level 1 Book Keeping With Logo PDFDocument14 pagesLevel 1 Book Keeping With Logo PDFShwe HtayNo ratings yet

- Explain Bank Reconciliation Statement. Why Is It PreparedDocument6 pagesExplain Bank Reconciliation Statement. Why Is It Preparedjoker.dutta100% (1)

- Inter - AcctDocument11 pagesInter - AcctAizha NarioNo ratings yet

- QuesDocument4 pagesQuesSreejith NairNo ratings yet

- Share Accounting-WPS OfficeDocument5 pagesShare Accounting-WPS OfficeSurendra SharmaNo ratings yet

- Steps in Accounting CycleDocument34 pagesSteps in Accounting Cycleahmad100% (4)

- Review of Accounting ProcessDocument8 pagesReview of Accounting ProcessVenn Bacus RabadonNo ratings yet

- Accounting Vocabulary (A To C)Document4 pagesAccounting Vocabulary (A To C)MARY GRACE VARGASNo ratings yet

- Source Document: The Accounting Process (The Accounting Cycle)Document4 pagesSource Document: The Accounting Process (The Accounting Cycle)rap_rrc75No ratings yet

- Accounting VocabularyDocument4 pagesAccounting Vocabularyapi-526065196No ratings yet

- Financial AccountingDocument1 pageFinancial AccountingCindy The GoddessNo ratings yet

- Chapter - 1 Basic Concepts (Accounting Process) : TransactionsDocument8 pagesChapter - 1 Basic Concepts (Accounting Process) : Transactionsgagan vermaNo ratings yet

- Special Journals and Subsidiary LedgersDocument51 pagesSpecial Journals and Subsidiary LedgersFrances Monique AlburoNo ratings yet

- Accounting BooksDocument30 pagesAccounting BooksAshley Keith CadizNo ratings yet

- Features of Accounting BookDocument2 pagesFeatures of Accounting BookPhạm DiệuNo ratings yet

- Suraj Singh Lodhi Accountancy Project 2023 24Document7 pagesSuraj Singh Lodhi Accountancy Project 2023 24www.friendlyaniket1992No ratings yet

- Chapter 3Document29 pagesChapter 3Sisira ChandranNo ratings yet

- Review of Accounting Process 1Document2 pagesReview of Accounting Process 1Stacy SmithNo ratings yet

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnNo ratings yet

- Adjusting Entries and Accounting CycleDocument4 pagesAdjusting Entries and Accounting Cyclekimingyuse1010No ratings yet

- Special Journals and Internal ControlDocument16 pagesSpecial Journals and Internal ControlFarah PatelNo ratings yet

- Accounting Manual On Double Entry System of AccountingDocument12 pagesAccounting Manual On Double Entry System of AccountingGaurav TrivediNo ratings yet

- Accounting Calculations - Learning of FundamentalsDocument7 pagesAccounting Calculations - Learning of FundamentalsRobinHood TiwariNo ratings yet

- ACTBAS 1 Lecture 6 Notes Accounting Cycle of A Service Business Part I: Journalizing, Posting and Trial BalanceDocument22 pagesACTBAS 1 Lecture 6 Notes Accounting Cycle of A Service Business Part I: Journalizing, Posting and Trial BalanceAA Del Rosario AlipioNo ratings yet

- Mefa Iv 1Document23 pagesMefa Iv 120-M-140 HrushikeshNo ratings yet

- Bookkeeping Is The Recording of Financial Transactions. Transactions Include SalesDocument247 pagesBookkeeping Is The Recording of Financial Transactions. Transactions Include SalesSantosh PanigrahiNo ratings yet

- Accounts From Incomplete RecordsDocument13 pagesAccounts From Incomplete Recordsriyasmakkar100% (2)

- Chapter Two General and Subsidiary Ledgers Chapter Two General and Subsidiary LedgersDocument25 pagesChapter Two General and Subsidiary Ledgers Chapter Two General and Subsidiary LedgersGirmaNo ratings yet

- 70281.a.priya Ojha - Internal 3RD - Part 2. Types of Cashbook.Document30 pages70281.a.priya Ojha - Internal 3RD - Part 2. Types of Cashbook.Priya OjhaNo ratings yet

- Cash Book: Cash Book - A Subsidiary Book and A Principal BookDocument6 pagesCash Book: Cash Book - A Subsidiary Book and A Principal BooklatestNo ratings yet

- Accounting CycleDocument4 pagesAccounting Cycleddoc.mimiNo ratings yet

- Accounting Books - Journal, Ledger and Trial BalanceDocument35 pagesAccounting Books - Journal, Ledger and Trial BalanceGhie Ragat100% (3)

- Chapter VDocument6 pagesChapter VRanak BiswasNo ratings yet

- Accounting ConceptsDocument25 pagesAccounting ConceptsRaj Kumar100% (1)

- Unit 5Document6 pagesUnit 5deepshrmNo ratings yet

- Accounting CycleDocument2 pagesAccounting CyclepoornapavanNo ratings yet

- Bookkeeping PDFDocument4 pagesBookkeeping PDFYo Yo0% (1)

- Books of Orginal EntryDocument6 pagesBooks of Orginal EntryMuhammad BilalNo ratings yet

- Closing EntriesDocument1 pageClosing EntriesCharles Reginald K. HwangNo ratings yet

- Review of The Accounting ProcessDocument18 pagesReview of The Accounting ProcessRoyceNo ratings yet

- Define JournalDocument6 pagesDefine JournalOrbin SunnyNo ratings yet

- Accounting Process NotesDocument5 pagesAccounting Process NotesYudna YuNo ratings yet

- What Are The Different Types of Subsidiary Books Usually Maintained by A Firm?Document11 pagesWhat Are The Different Types of Subsidiary Books Usually Maintained by A Firm?sweet19girlNo ratings yet

- Week 3: 1. Please Read, For Understanding, All The CONTENT Information in This Module For WEEK 3Document3 pagesWeek 3: 1. Please Read, For Understanding, All The CONTENT Information in This Module For WEEK 3Javan SmithNo ratings yet

- Income and Expenditure NotesDocument2 pagesIncome and Expenditure NotesRashmi Anand JhaNo ratings yet

- Subsidiary BooksDocument6 pagesSubsidiary BooksBamidele AdegboyeNo ratings yet

- Question SheetDocument7 pagesQuestion Sheetscientistmonster0001No ratings yet

- Accounting MechanicsDocument21 pagesAccounting MechanicsPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (1)

- 5 Simple Steps To Write and Prepare Ledger AccountDocument4 pages5 Simple Steps To Write and Prepare Ledger AccountNik ZulaimiNo ratings yet

- The Accounting CycleDocument3 pagesThe Accounting Cycleliesly buticNo ratings yet

- SECRET SAUCE-WITH FORMATS - Aslevel - 2023Document81 pagesSECRET SAUCE-WITH FORMATS - Aslevel - 2023Anayah KhanNo ratings yet

- Journal or Day BookDocument42 pagesJournal or Day BookRaviSankar100% (1)

- Posting Journal Entries To The LedgerDocument14 pagesPosting Journal Entries To The LedgerJeanlyn Vallejos DomingoNo ratings yet

- Steps in Accounting CycleDocument16 pagesSteps in Accounting CycleMuhammad AyazNo ratings yet

- Extensive Theory PackageDocument70 pagesExtensive Theory PackageLeon BurresNo ratings yet

- ACCTG 114 Lecture (04-05-2022)Document4 pagesACCTG 114 Lecture (04-05-2022)Janna Mari FriasNo ratings yet

- Finalizing The Accounting ProcessDocument2 pagesFinalizing The Accounting ProcessMilagro Del ValleNo ratings yet

- FAABM11 Final SummaryDocument18 pagesFAABM11 Final SummaryJeferson LincosananNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- (Telephone Directory) Name & Designation Office E-Mail Hon'Ble Minister of Housing and Urban AffairsDocument35 pages(Telephone Directory) Name & Designation Office E-Mail Hon'Ble Minister of Housing and Urban AffairsSurendra SharmaNo ratings yet

- Land Price 202122 16721Document15 pagesLand Price 202122 16721Surendra SharmaNo ratings yet

- Ultra Modern Commercial Complex: WWW - Shrivinayaka.inDocument18 pagesUltra Modern Commercial Complex: WWW - Shrivinayaka.inSurendra SharmaNo ratings yet

- Constitution Objective PDFDocument16 pagesConstitution Objective PDFAYYANAR RAJANo ratings yet

- D-119 Welcome LetterDocument1 pageD-119 Welcome LetterSurendra SharmaNo ratings yet

- Central Government Health Scheme (Delhi and NCR)Document1 pageCentral Government Health Scheme (Delhi and NCR)Surendra SharmaNo ratings yet

- 'KGHN Fot Flag Iffkd Øhmk Ladqy: Shaheed Vijay Singh Pathik Sports ComplexDocument26 pages'KGHN Fot Flag Iffkd Øhmk Ladqy: Shaheed Vijay Singh Pathik Sports ComplexSurendra SharmaNo ratings yet

- Multiple Choice QuestionsDocument78 pagesMultiple Choice QuestionsSurendra Sharma75% (8)

- Chapter 13 Cam2Document10 pagesChapter 13 Cam2Surendra SharmaNo ratings yet

- Page No. 9, Size: (17.11) Cms X (26.55) CmsDocument1 pagePage No. 9, Size: (17.11) Cms X (26.55) CmsSurendra SharmaNo ratings yet

- Govt - Accounting Rules 1990Document63 pagesGovt - Accounting Rules 1990kandukurisrimanNo ratings yet

- Space Design Group: Knowledge Park 2, Greater Noida Ground Floor Plan (Plot No 1 & 2)Document7 pagesSpace Design Group: Knowledge Park 2, Greater Noida Ground Floor Plan (Plot No 1 & 2)Surendra SharmaNo ratings yet

- List of 4%, 5%, 6%, 8%, 10% Kisan Abadi Plots Registered Up To 10-11-2020Document97 pagesList of 4%, 5%, 6%, 8%, 10% Kisan Abadi Plots Registered Up To 10-11-2020Surendra Sharma100% (1)

- Chapter 1 - MohitDocument4 pagesChapter 1 - MohitSurendra SharmaNo ratings yet

- Commercial Plots - 4 FAR: (Higher Than Reserve Price) Acceptance of Bid 1% Above Reserve Price Incremental ValueDocument2 pagesCommercial Plots - 4 FAR: (Higher Than Reserve Price) Acceptance of Bid 1% Above Reserve Price Incremental ValueSurendra SharmaNo ratings yet

- List of Empanelled HCOs-Delhi NCR As On 11 June 2020Document94 pagesList of Empanelled HCOs-Delhi NCR As On 11 June 2020Surendra SharmaNo ratings yet

- Sanskriti School: Admission To Pre-School For The Academic Year 2020-2021Document3 pagesSanskriti School: Admission To Pre-School For The Academic Year 2020-2021Surendra SharmaNo ratings yet

- Space Design Group: Knowledge Park 2, Greater Noida Ground Floor Plan (Plot No 3 & 4)Document7 pagesSpace Design Group: Knowledge Park 2, Greater Noida Ground Floor Plan (Plot No 3 & 4)Surendra SharmaNo ratings yet

- Ka Checklist 20112020Document81 pagesKa Checklist 20112020Surendra SharmaNo ratings yet

- NOT FO R S ALE: Made ObjectiveDocument40 pagesNOT FO R S ALE: Made ObjectiveSurendra Sharma100% (1)

- Procedure Catg-Ii VDocument48 pagesProcedure Catg-Ii VSurendra SharmaNo ratings yet

- NHSRCL News-19 Oct 2020Document5 pagesNHSRCL News-19 Oct 2020Surendra SharmaNo ratings yet

- Share Accounting-WPS OfficeDocument5 pagesShare Accounting-WPS OfficeSurendra SharmaNo ratings yet

- F3 Mock Exam 1Document12 pagesF3 Mock Exam 1Smith TiwariNo ratings yet

- 11th Book Keeping and AccountingDocument2 pages11th Book Keeping and AccountingAlefiya BurhaniNo ratings yet

- CBC Bookkeeping NC IIIDocument85 pagesCBC Bookkeeping NC IIIDhet Pas-Men100% (6)

- Fabm1 ch1Document22 pagesFabm1 ch1Crisson FermalinoNo ratings yet

- Agriculture Junior Secondary School (Jss 3) First TermDocument8 pagesAgriculture Junior Secondary School (Jss 3) First TermErnest Belamo100% (1)

- Client Bookkeeping Solution TutorialDocument304 pagesClient Bookkeeping Solution Tutorialburhan_qureshiNo ratings yet

- Bank Reconciliation ActivitiesDocument1 pageBank Reconciliation Activitiesmaligaya evelynNo ratings yet

- Trial BalanceDocument21 pagesTrial BalanceshaannivasNo ratings yet

- 761 Not. Intent Serve Subpoenas For Production 12 28 2021Document101 pages761 Not. Intent Serve Subpoenas For Production 12 28 2021larry-612445No ratings yet

- Internship Report On MCB BankDocument88 pagesInternship Report On MCB BankShahid RandhāwaNo ratings yet

- Ffa12efmq A Low ResDocument34 pagesFfa12efmq A Low ResAdi StănescuNo ratings yet

- Midterm Test AKT 1A Nop 20Document3 pagesMidterm Test AKT 1A Nop 20Henki Setya BudiNo ratings yet

- Jenny MineDocument22 pagesJenny MineSANTOSH KumarNo ratings yet

- Adms 2500 FinalDocument20 pagesAdms 2500 Finalmuyy1No ratings yet

- Group 2 Sec 1 Taco LabDocument159 pagesGroup 2 Sec 1 Taco LabSadAccountant100% (1)

- Cornelia Lightfoot ResumeDocument2 pagesCornelia Lightfoot ResumeDarrell WilcoxNo ratings yet

- Af As Chapter 8Document18 pagesAf As Chapter 8FarrukhsgNo ratings yet

- M.B.A Hospital ManagementDocument42 pagesM.B.A Hospital ManagementArun MuruganNo ratings yet

- Accounting Dashboard: Dashboard WP ERP Accounting. Once You Get There You Will See The FollowingDocument40 pagesAccounting Dashboard: Dashboard WP ERP Accounting. Once You Get There You Will See The FollowingusmanNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesJanna PleteNo ratings yet