Professional Documents

Culture Documents

After The Accounts Are Closed On July 3 2008 Prior

After The Accounts Are Closed On July 3 2008 Prior

Uploaded by

M Bilal SaleemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

After The Accounts Are Closed On July 3 2008 Prior

After The Accounts Are Closed On July 3 2008 Prior

Uploaded by

M Bilal SaleemCopyright:

Available Formats

After the accounts are closed on July 3 2008 prior

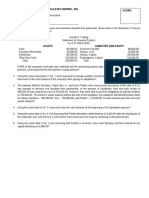

After the accounts are closed on July 3, 2008, prior to liquidating the partnership, the capital

accounts of Ann Daniels, Harold Burton, and Carla Ramariz are $27,000, $4,500, and $32,000,

respectively. Cash and noncash assets total $9,500 and $84,000, respectively.Amounts owed

to creditors total $30,000. The partners share income and losses in the ratio of 2:1:1. Between

July 3 and July 29, the noncash assets are sold for $54,000, the partner with the capital

deficiency pays his deficiency to the partnership, and the liabilities are paid.Instructions1.

Prepare a statement of partnership liquidation, indicating (a) The sale of assets and division of

loss, (b) The payment of liabilities, (c) The receipt of the deficiency (from the appropriate

partner), and (d) The distribution of cash.2. If the partner with the capital deficiency declares

bankruptcy and is unable to pay the deficiency, explain how the deficiency would be divided

between the partners.View Solution:

After the accounts are closed on July 3 2008 prior

SOLUTION-- http://expertanswer.online/downloads/after-the-accounts-are-closed-on-

july-3-2008-prior/

See Answer here expertanswer.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Piecemeal Distribution TheoryDocument5 pagesPiecemeal Distribution TheoryNitesh Kotian75% (8)

- Solved Write in Algebraic Form A Calculation of U K Pounds PerDocument1 pageSolved Write in Algebraic Form A Calculation of U K Pounds PerM Bilal SaleemNo ratings yet

- After The Accounts Are Closed On July 3 2012 PriorDocument1 pageAfter The Accounts Are Closed On July 3 2012 PriorM Bilal SaleemNo ratings yet

- After The Accounts Are Closed On July 3 2012 Prior PDFDocument1 pageAfter The Accounts Are Closed On July 3 2012 Prior PDFM Bilal SaleemNo ratings yet

- After The Accounts Are Closed On September 10 2008 PriorDocument1 pageAfter The Accounts Are Closed On September 10 2008 PriorM Bilal SaleemNo ratings yet

- After The Accounts Are Closed On September 10 2012 Prior PDFDocument1 pageAfter The Accounts Are Closed On September 10 2012 Prior PDFM Bilal SaleemNo ratings yet

- After The Accounts Are Closed On September 10 2012 PriorDocument1 pageAfter The Accounts Are Closed On September 10 2012 PriorM Bilal SaleemNo ratings yet

- On June 3 2012 The Firm of Lyon Malone andDocument1 pageOn June 3 2012 The Firm of Lyon Malone andM Bilal SaleemNo ratings yet

- After The Accounts Are Closed On February 3 2014 PriorDocument1 pageAfter The Accounts Are Closed On February 3 2014 PriorMiroslav GegoskiNo ratings yet

- After The Accounts Are Closed On February 3 2016 PriorDocument1 pageAfter The Accounts Are Closed On February 3 2016 PriorMuhammad ShahidNo ratings yet

- 3 Partnership LiquidationDocument11 pages3 Partnership LiquidationLach Mae . FloresNo ratings yet

- Post Test. A12Document5 pagesPost Test. A12GICHA FEARL GIPALANo ratings yet

- Lecture On Lump Sum LiquidationDocument10 pagesLecture On Lump Sum LiquidationKim Nicole ReyesNo ratings yet

- AFAR 1 Partnership Accounting (Installment Liquidation)Document3 pagesAFAR 1 Partnership Accounting (Installment Liquidation)Jeepee JohnNo ratings yet

- Chapter 2 Partnership LiquidationDocument35 pagesChapter 2 Partnership LiquidationmustafeNo ratings yet

- Review Materials Parliq EditDocument9 pagesReview Materials Parliq EditRosevie ZantuaNo ratings yet

- Partnership LiquidationDocument4 pagesPartnership LiquidationShanley Vanna EscalonaNo ratings yet

- The Red White Blue Partnership Was Begun With InvestmentsDocument1 pageThe Red White Blue Partnership Was Begun With InvestmentsM Bilal SaleemNo ratings yet

- Quiz 15Document10 pagesQuiz 15Jyasmine Aura V. AgustinNo ratings yet

- Partnership LIquidation.2 2 1 ActitivtydocxDocument2 pagesPartnership LIquidation.2 2 1 Actitivtydocxtraveldesk.sphNo ratings yet

- HHHHDocument7 pagesHHHHleejongsukNo ratings yet

- On October 1 2012 The Firm of Sams Price andDocument1 pageOn October 1 2012 The Firm of Sams Price andM Bilal SaleemNo ratings yet

- Fa Unit V Final PDFDocument8 pagesFa Unit V Final PDFAakaash100% (1)

- After The Accounts Are Closed On April 10 2014 PriorDocument1 pageAfter The Accounts Are Closed On April 10 2014 PriorMiroslav GegoskiNo ratings yet

- ADVANCED ACCOUNTING Chapter 6Document90 pagesADVANCED ACCOUNTING Chapter 6Stork EscobidoNo ratings yet

- Unit 5 - Advanced Financial AccountingDocument5 pagesUnit 5 - Advanced Financial AccountingsekargnansNo ratings yet

- Multiple Choice QuestionsDocument11 pagesMultiple Choice QuestionsTULIO, Jeremy I.No ratings yet

- Partnership Corp. Chapter4Document21 pagesPartnership Corp. Chapter4deniseanne clementeNo ratings yet

- Handouts PartnershipDocument9 pagesHandouts PartnershipCPANo ratings yet

- IM-PARTNERSHIP LUMP SUM LIQUIDATION With ExercisesDocument16 pagesIM-PARTNERSHIP LUMP SUM LIQUIDATION With ExercisesAisea Juliana VillanuevaNo ratings yet

- Accounting 2 Partnership Liquidation by Dissolution Part IDocument2 pagesAccounting 2 Partnership Liquidation by Dissolution Part IEmerish SarmientoNo ratings yet

- Study Session 11 - ReceivablesDocument8 pagesStudy Session 11 - ReceivablesRuwani RathnayakeNo ratings yet

- Quiz 1 Lump Sum Liquidation Answer Key PeresDocument7 pagesQuiz 1 Lump Sum Liquidation Answer Key PeresChelit LadylieGirl FernandezNo ratings yet

- 3.2 - Lecture Notes - Partnership LiquidationDocument20 pages3.2 - Lecture Notes - Partnership LiquidationKatrina Regina BatacNo ratings yet

- Advacc 1 Quiz 1 With AnswersDocument9 pagesAdvacc 1 Quiz 1 With AnswersGround ZeroNo ratings yet

- Partnership Testbank Part 2Document19 pagesPartnership Testbank Part 2Klay LuisNo ratings yet

- Chap 10 PartnershipDocument24 pagesChap 10 PartnershipIvhy Cruz Estrella100% (2)

- AKLII RMKBab17Document23 pagesAKLII RMKBab17Dizzy nindyaNo ratings yet

- Acctg 2 QuizDocument4 pagesAcctg 2 QuizAshNor RandyNo ratings yet

- Quiz 2 SolutionsDocument5 pagesQuiz 2 SolutionsAngel Alejo AcobaNo ratings yet

- QUIZ 2 Partnership Liquidation Installment PerezDocument6 pagesQUIZ 2 Partnership Liquidation Installment PerezChelit LadylieGirl FernandezNo ratings yet

- Chapter 16 Dissolution and Liquidation of PartnershipDocument23 pagesChapter 16 Dissolution and Liquidation of PartnershipKristine LuntaoNo ratings yet

- Acctba2 Lecture - Lump Sum LiquidationDocument10 pagesAcctba2 Lecture - Lump Sum Liquidationmia_catapangNo ratings yet

- Test Bank Advanced Accounting 3e by Jeter 16 ChapterDocument24 pagesTest Bank Advanced Accounting 3e by Jeter 16 ChapterJaceNo ratings yet

- Piecemeal RealizationDocument6 pagesPiecemeal RealizationSethwilsonNo ratings yet

- After The Accounts Are Closed On April 10 2016 PriorDocument1 pageAfter The Accounts Are Closed On April 10 2016 PriorMuhammad ShahidNo ratings yet

- Accounting For PartnershipsDocument10 pagesAccounting For PartnershipsRicaRhayaMangahasNo ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- Chapter 15 Advanced SolutionsDocument33 pagesChapter 15 Advanced SolutionsPremium Meditation MusicNo ratings yet

- AFAR-01D Partnership LiquidationDocument8 pagesAFAR-01D Partnership LiquidationLouie RobitshekNo ratings yet

- March April and May Have Been in Partnership For A: Unlock Answers Here Solutiondone - OnlineDocument1 pageMarch April and May Have Been in Partnership For A: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Chapter 16 Test Bank Dissolution and Liquidation of A PartnershipDocument23 pagesChapter 16 Test Bank Dissolution and Liquidation of A Partnershipjosh lunarNo ratings yet

- PartnershipDocument5 pagesPartnershipjohnNo ratings yet

- Financial Accounting and Reporting ExamDocument6 pagesFinancial Accounting and Reporting ExamVye DumaleNo ratings yet

- Dapper Hat Makers Company Sells Merchandise On Credit During TheDocument1 pageDapper Hat Makers Company Sells Merchandise On Credit During Thetrilocksp SinghNo ratings yet

- For DemoDocument25 pagesFor Demoericamaecarpila0520No ratings yet

- Pretest LiquidationsDocument1 pagePretest LiquidationsMondays AndNo ratings yet

- Chapter 4 Partnership Liquidation 2021 v2.0Document56 pagesChapter 4 Partnership Liquidation 2021 v2.0Aj ZNo ratings yet

- Module 4-Lump Sum Liquidation-Faculty VersionDocument22 pagesModule 4-Lump Sum Liquidation-Faculty VersionJan Ian Greg M. GangawanNo ratings yet

- Solved You Should Never Buy Precooked Frozen Foods Because The PriceDocument1 pageSolved You Should Never Buy Precooked Frozen Foods Because The PriceM Bilal SaleemNo ratings yet

- Solved You Want To Price Posters at The Poster Showcase ProfitablyDocument1 pageSolved You Want To Price Posters at The Poster Showcase ProfitablyM Bilal SaleemNo ratings yet

- Solved Your Company Is Bidding For A Service Contract in ADocument1 pageSolved Your Company Is Bidding For A Service Contract in AM Bilal SaleemNo ratings yet

- Solved You Have Been Hired by The Government of Kenya WhichDocument1 pageSolved You Have Been Hired by The Government of Kenya WhichM Bilal SaleemNo ratings yet

- Solved Your Local Fast Food Chain With Two Dozen Stores UsesDocument1 pageSolved Your Local Fast Food Chain With Two Dozen Stores UsesM Bilal SaleemNo ratings yet

- Solved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesDocument1 pageSolved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesM Bilal SaleemNo ratings yet

- Solved You Won A Free Ticket To See A Bruce SpringsteenDocument1 pageSolved You Won A Free Ticket To See A Bruce SpringsteenM Bilal SaleemNo ratings yet

- Solved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25Document1 pageSolved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25M Bilal SaleemNo ratings yet

- Solved Zack and Andon Compete in The Peanut Market Zack IsDocument1 pageSolved Zack and Andon Compete in The Peanut Market Zack IsM Bilal SaleemNo ratings yet

- Solved Your Company Sponsors A 401 K Plan Into Which You DepositDocument1 pageSolved Your Company Sponsors A 401 K Plan Into Which You DepositM Bilal SaleemNo ratings yet

- Solved With A Purchase Price of 350 000 A Small Warehouse ProvidesDocument1 pageSolved With A Purchase Price of 350 000 A Small Warehouse ProvidesM Bilal SaleemNo ratings yet

- Solved You Are An Advisor To The Egyptian Government Which HasDocument1 pageSolved You Are An Advisor To The Egyptian Government Which HasM Bilal SaleemNo ratings yet

- Solved You Have 832 66 in A Savings Account That Offers ADocument1 pageSolved You Have 832 66 in A Savings Account That Offers AM Bilal SaleemNo ratings yet

- Solved Why Should The Early Adopters of An Information Technology SystemDocument1 pageSolved Why Should The Early Adopters of An Information Technology SystemM Bilal SaleemNo ratings yet

- Solved You Are Driving On A Trip and Have Two ChoicesDocument1 pageSolved You Are Driving On A Trip and Have Two ChoicesM Bilal SaleemNo ratings yet

- Solved You Plan To Purchase A House For 115 000 UsingDocument1 pageSolved You Plan To Purchase A House For 115 000 UsingM Bilal SaleemNo ratings yet

- Solved You Are The Manager of A Monopoly A Typical Consumer SDocument1 pageSolved You Are The Manager of A Monopoly A Typical Consumer SM Bilal SaleemNo ratings yet

- Solved You Have Decided That You Are Going To Consume 600Document1 pageSolved You Have Decided That You Are Going To Consume 600M Bilal SaleemNo ratings yet

- Solved Your Brother Calls You On The Phone Telling You ThatDocument1 pageSolved Your Brother Calls You On The Phone Telling You ThatM Bilal SaleemNo ratings yet

- Solved You Are Considering An Investment in 30 Year Bonds Issued byDocument1 pageSolved You Are Considering An Investment in 30 Year Bonds Issued byM Bilal SaleemNo ratings yet

- Solved Wilson Walks Into His Class 10 Minutes Late Because HeDocument1 pageSolved Wilson Walks Into His Class 10 Minutes Late Because HeM Bilal SaleemNo ratings yet

- Solved You Are A Usda Pork Analyst Charged With Keeping Up To DateDocument1 pageSolved You Are A Usda Pork Analyst Charged With Keeping Up To DateM Bilal SaleemNo ratings yet

- Solved You Are Given The Production Function y Ak1 3n2 3 WhereDocument1 pageSolved You Are Given The Production Function y Ak1 3n2 3 WhereM Bilal SaleemNo ratings yet

- Solved You Are Selling Two Goods 1 and 2 To ADocument1 pageSolved You Are Selling Two Goods 1 and 2 To AM Bilal SaleemNo ratings yet

- Solved You and Your Roommate Have A Stack of Dirty DishesDocument1 pageSolved You and Your Roommate Have A Stack of Dirty DishesM Bilal SaleemNo ratings yet

- Solved You Are Considering Buying A New House and Have FoundDocument1 pageSolved You Are Considering Buying A New House and Have FoundM Bilal SaleemNo ratings yet

- Solved You Can Either Take A Bus or Drive Your CarDocument1 pageSolved You Can Either Take A Bus or Drive Your CarM Bilal SaleemNo ratings yet

- Solved With The Growth of The Internet There Are A LargeDocument1 pageSolved With The Growth of The Internet There Are A LargeM Bilal SaleemNo ratings yet

- Solved With Reference To Figure 14 4 Explain A Why There Will BeDocument1 pageSolved With Reference To Figure 14 4 Explain A Why There Will BeM Bilal SaleemNo ratings yet