Professional Documents

Culture Documents

Unit 4 - Topic 4

Unit 4 - Topic 4

Uploaded by

yzaCopyright:

Available Formats

You might also like

- GB550M2 AssessmentDocument3 pagesGB550M2 AssessmentAndrew Carter100% (6)

- Advanced Accounting Chapter 1Document11 pagesAdvanced Accounting Chapter 1Nellie Panedy80% (15)

- Ch2 TB Moodle 20201030Document6 pagesCh2 TB Moodle 20201030Wang JukNo ratings yet

- Tugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- Task 4 - Consolidation: Patricia HarringtonDocument9 pagesTask 4 - Consolidation: Patricia HarringtonDewi Agus SukowatiNo ratings yet

- Chapter 1 Solutions To Suggested Homework ProblemsDocument5 pagesChapter 1 Solutions To Suggested Homework ProblemsZeren BegumNo ratings yet

- Reporting Intercorporate InterestDocument21 pagesReporting Intercorporate Interestwahyu dirosoNo ratings yet

- TugasCh15 - Heru Kurnia Azra - 1910536018Document9 pagesTugasCh15 - Heru Kurnia Azra - 1910536018Heru Kurnia AzraNo ratings yet

- Advanced Accounting Chapter 1 PDF FreeDocument11 pagesAdvanced Accounting Chapter 1 PDF FreeSitiNo ratings yet

- Ch04 Consolidation TechniquesDocument54 pagesCh04 Consolidation TechniquesRizqita Putri Ramadhani0% (1)

- Strategic Asset AllocationDocument6 pagesStrategic Asset AllocationNehal BadawyNo ratings yet

- Online Ass Advance Acc NEWDocument6 pagesOnline Ass Advance Acc NEWRara Rarara30No ratings yet

- TeDocument8 pagesTeRaja JulianNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 7 - SolutionsDocument3 pagesACF 103 - Fundamentals of Finance Tutorial 7 - SolutionsRiri FahraniNo ratings yet

- Tugas TM 8 Abdul Azis Faisal 041611333243Document4 pagesTugas TM 8 Abdul Azis Faisal 041611333243Abdul AzisNo ratings yet

- Solution E2-3 1: Preliminary ComputationsDocument3 pagesSolution E2-3 1: Preliminary ComputationsRifda AmaliaNo ratings yet

- HbjhjhjhujuhjDocument3 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- Solutions To Problems AFAR2 Chap4Document7 pagesSolutions To Problems AFAR2 Chap4Sassy GirlNo ratings yet

- Laporan Keuangan KonsolidasiDocument49 pagesLaporan Keuangan KonsolidasiMuhammad Tamul FikriNo ratings yet

- P2 1Document2 pagesP2 1Febi100% (1)

- Subsequent To DOADocument5 pagesSubsequent To DOANacelle SayaNo ratings yet

- Section 9-4 QADocument3 pagesSection 9-4 QAZeinab MohamadNo ratings yet

- Chapter 16 - Consol. Fs Part 1Document17 pagesChapter 16 - Consol. Fs Part 1PutmehudgJasdNo ratings yet

- Module 3 - Handout 1 80% Acquisition: Price FMV: ExampleDocument3 pagesModule 3 - Handout 1 80% Acquisition: Price FMV: ExampleChinee CastilloNo ratings yet

- Module 3 Handout 1 Business ComDocument3 pagesModule 3 Handout 1 Business ComChinee CastilloNo ratings yet

- GEN4Document7 pagesGEN4Mylene HeragaNo ratings yet

- Chapter 15 - Bus. Combination Part 3Document8 pagesChapter 15 - Bus. Combination Part 3PutmehudgJasdNo ratings yet

- Dinar Annisa - 142180194 - Tugas 2Document4 pagesDinar Annisa - 142180194 - Tugas 2Salsa BilaNo ratings yet

- Materi 13Document32 pagesMateri 13Elsa RosalindaNo ratings yet

- Solutions Ch08Document19 pagesSolutions Ch08KyleNo ratings yet

- Accounting QuestionsDocument18 pagesAccounting QuestionsashmitaNo ratings yet

- Final ExamDocument5 pagesFinal ExamSultan LimitNo ratings yet

- Module 3 - Subsequent To AcquisitionDocument8 pagesModule 3 - Subsequent To AcquisitionRENZ ALFRED ASTRERONo ratings yet

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Document6 pagesYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaNo ratings yet

- Tugas 2 AklDocument3 pagesTugas 2 Akledit andraeNo ratings yet

- DocumentDocument3 pagesDocumentcryNo ratings yet

- Pfrs 3 and 10 EXAM - FINALDocument12 pagesPfrs 3 and 10 EXAM - FINALElizabeth DumawalNo ratings yet

- BÀI TẬP ÁP DỤNGDocument6 pagesBÀI TẬP ÁP DỤNGNguyễn ThươngNo ratings yet

- 124 Final Practice v2 SolutionDocument5 pages124 Final Practice v2 SolutiondrakowamNo ratings yet

- Consolidation Techniques and Procedures (Revised) - Part1Document39 pagesConsolidation Techniques and Procedures (Revised) - Part1Raihan YonaldiiNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Chapter 10 Tax 2014 PDFDocument6 pagesChapter 10 Tax 2014 PDFtherock25No ratings yet

- Akuntansi Keuangan Lanjutan 1Document4 pagesAkuntansi Keuangan Lanjutan 1Salsa BilaNo ratings yet

- Advanced ACCT PROJECT II FINAL DRAFTDocument3 pagesAdvanced ACCT PROJECT II FINAL DRAFTnoureen sohailNo ratings yet

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDocument8 pagesSorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonTine Griego0% (1)

- Final Exam Essay QuestionsDocument4 pagesFinal Exam Essay Questionsapi-408647155No ratings yet

- Homework Ch. 7 and 13Document24 pagesHomework Ch. 7 and 13L100% (1)

- Solution Manual Advanced Accounting Beams 11e Chp1 PDFDocument14 pagesSolution Manual Advanced Accounting Beams 11e Chp1 PDFArifta Nur Rahmat100% (21)

- Model Exam Work Out FADocument5 pagesModel Exam Work Out FAnewaybeyene5No ratings yet

- Pembahasan Tugas AKLDocument8 pagesPembahasan Tugas AKLyashmutjabbar25No ratings yet

- Consolidated FS Date of AcquisitionDocument30 pagesConsolidated FS Date of AcquisitionSanhica Chantahl PacquiaoNo ratings yet

- Problem 1 Forex TranslationDocument12 pagesProblem 1 Forex TranslationDevine Zarriz IINo ratings yet

- Accounting PresentationDocument12 pagesAccounting Presentationgelly studiesNo ratings yet

- ACC 401 Homework CH 4Document4 pagesACC 401 Homework CH 4leelee03020% (1)

- FABULAR Intercompany DividendsDocument6 pagesFABULAR Intercompany DividendsRico, Jalaica B.No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Cos AccDocument6 pagesCos Accyza0% (3)

- Allowable Deductions From Gross Income - ReviewerDocument4 pagesAllowable Deductions From Gross Income - RevieweryzaNo ratings yet

- Auditing Multiple ChoicesDocument8 pagesAuditing Multiple ChoicesyzaNo ratings yet

- Compensation Income and Fringe Benefit Tax. ReviewerDocument4 pagesCompensation Income and Fringe Benefit Tax. RevieweryzaNo ratings yet

- Capital Gains ReviewerDocument1 pageCapital Gains RevieweryzaNo ratings yet

- Final Tax ReviewerDocument35 pagesFinal Tax Revieweryza100% (1)

- The Consumer Behaviour Theory: Slope Px/PyDocument3 pagesThe Consumer Behaviour Theory: Slope Px/PyyzaNo ratings yet

- Market StructuresDocument24 pagesMarket StructuresyzaNo ratings yet

- Practical Accounting 1 ValixDocument277 pagesPractical Accounting 1 ValixyzaNo ratings yet

- Fundamental Arms and Feet PositionsDocument10 pagesFundamental Arms and Feet PositionsyzaNo ratings yet

- Unit5-Impairment of Assets - SolutionsDocument1 pageUnit5-Impairment of Assets - SolutionsyzaNo ratings yet

- Week1 AnswersDocument7 pagesWeek1 AnswersyzaNo ratings yet

- Fundamentals of Accountancy: Financial StatementsDocument2 pagesFundamentals of Accountancy: Financial StatementsyzaNo ratings yet

- Activity 2 PDFDocument5 pagesActivity 2 PDFyzaNo ratings yet

- Activity 3 PDFDocument4 pagesActivity 3 PDFyzaNo ratings yet

- Adjusting Entries For Merchandising (4 Step) : Merchandising Concern Manufacturing ConcernDocument1 pageAdjusting Entries For Merchandising (4 Step) : Merchandising Concern Manufacturing ConcernyzaNo ratings yet

Unit 4 - Topic 4

Unit 4 - Topic 4

Uploaded by

yzaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 4 - Topic 4

Unit 4 - Topic 4

Uploaded by

yzaCopyright:

Available Formats

UNIT 4 - TOPIC 4 Investment in associate

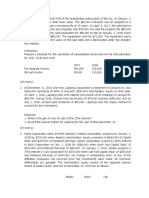

ACTIVITY 2 - PROB 4 NO. 5

(b) Sage paid $400,000 for its 40% investment in Adams when Adams net assets had a carrying amount

of $900,000. Therefore, the book value Sage purchased is $360,000 (40% $900,000), resulting in an

excess of cost over book value of $40,000 ($400,000 $360,000). This excess must be attributed to

specific assets of Adams; any amount not attributed to specific assets is attributed to goodwill. In this

case, the excess is attributed to plant assets (40% $90,000 = $36,000) and inventory (40% $10,000 =

$4,000). The portion attributed to plant assets is amortized over eighteen years, while the portion

attributed to inventory is expensed immediately (since all inventory was sold during year 1). Therefore,

Sages investment income is $42,000, as computed below. Share of income (40% $120,000) $48,000

Excess amortization [($36,000/18) + $4,000] (6,000) $42,000

You might also like

- GB550M2 AssessmentDocument3 pagesGB550M2 AssessmentAndrew Carter100% (6)

- Advanced Accounting Chapter 1Document11 pagesAdvanced Accounting Chapter 1Nellie Panedy80% (15)

- Ch2 TB Moodle 20201030Document6 pagesCh2 TB Moodle 20201030Wang JukNo ratings yet

- Tugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- Task 4 - Consolidation: Patricia HarringtonDocument9 pagesTask 4 - Consolidation: Patricia HarringtonDewi Agus SukowatiNo ratings yet

- Chapter 1 Solutions To Suggested Homework ProblemsDocument5 pagesChapter 1 Solutions To Suggested Homework ProblemsZeren BegumNo ratings yet

- Reporting Intercorporate InterestDocument21 pagesReporting Intercorporate Interestwahyu dirosoNo ratings yet

- TugasCh15 - Heru Kurnia Azra - 1910536018Document9 pagesTugasCh15 - Heru Kurnia Azra - 1910536018Heru Kurnia AzraNo ratings yet

- Advanced Accounting Chapter 1 PDF FreeDocument11 pagesAdvanced Accounting Chapter 1 PDF FreeSitiNo ratings yet

- Ch04 Consolidation TechniquesDocument54 pagesCh04 Consolidation TechniquesRizqita Putri Ramadhani0% (1)

- Strategic Asset AllocationDocument6 pagesStrategic Asset AllocationNehal BadawyNo ratings yet

- Online Ass Advance Acc NEWDocument6 pagesOnline Ass Advance Acc NEWRara Rarara30No ratings yet

- TeDocument8 pagesTeRaja JulianNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 7 - SolutionsDocument3 pagesACF 103 - Fundamentals of Finance Tutorial 7 - SolutionsRiri FahraniNo ratings yet

- Tugas TM 8 Abdul Azis Faisal 041611333243Document4 pagesTugas TM 8 Abdul Azis Faisal 041611333243Abdul AzisNo ratings yet

- Solution E2-3 1: Preliminary ComputationsDocument3 pagesSolution E2-3 1: Preliminary ComputationsRifda AmaliaNo ratings yet

- HbjhjhjhujuhjDocument3 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- Solutions To Problems AFAR2 Chap4Document7 pagesSolutions To Problems AFAR2 Chap4Sassy GirlNo ratings yet

- Laporan Keuangan KonsolidasiDocument49 pagesLaporan Keuangan KonsolidasiMuhammad Tamul FikriNo ratings yet

- P2 1Document2 pagesP2 1Febi100% (1)

- Subsequent To DOADocument5 pagesSubsequent To DOANacelle SayaNo ratings yet

- Section 9-4 QADocument3 pagesSection 9-4 QAZeinab MohamadNo ratings yet

- Chapter 16 - Consol. Fs Part 1Document17 pagesChapter 16 - Consol. Fs Part 1PutmehudgJasdNo ratings yet

- Module 3 - Handout 1 80% Acquisition: Price FMV: ExampleDocument3 pagesModule 3 - Handout 1 80% Acquisition: Price FMV: ExampleChinee CastilloNo ratings yet

- Module 3 Handout 1 Business ComDocument3 pagesModule 3 Handout 1 Business ComChinee CastilloNo ratings yet

- GEN4Document7 pagesGEN4Mylene HeragaNo ratings yet

- Chapter 15 - Bus. Combination Part 3Document8 pagesChapter 15 - Bus. Combination Part 3PutmehudgJasdNo ratings yet

- Dinar Annisa - 142180194 - Tugas 2Document4 pagesDinar Annisa - 142180194 - Tugas 2Salsa BilaNo ratings yet

- Materi 13Document32 pagesMateri 13Elsa RosalindaNo ratings yet

- Solutions Ch08Document19 pagesSolutions Ch08KyleNo ratings yet

- Accounting QuestionsDocument18 pagesAccounting QuestionsashmitaNo ratings yet

- Final ExamDocument5 pagesFinal ExamSultan LimitNo ratings yet

- Module 3 - Subsequent To AcquisitionDocument8 pagesModule 3 - Subsequent To AcquisitionRENZ ALFRED ASTRERONo ratings yet

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Document6 pagesYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaNo ratings yet

- Tugas 2 AklDocument3 pagesTugas 2 Akledit andraeNo ratings yet

- DocumentDocument3 pagesDocumentcryNo ratings yet

- Pfrs 3 and 10 EXAM - FINALDocument12 pagesPfrs 3 and 10 EXAM - FINALElizabeth DumawalNo ratings yet

- BÀI TẬP ÁP DỤNGDocument6 pagesBÀI TẬP ÁP DỤNGNguyễn ThươngNo ratings yet

- 124 Final Practice v2 SolutionDocument5 pages124 Final Practice v2 SolutiondrakowamNo ratings yet

- Consolidation Techniques and Procedures (Revised) - Part1Document39 pagesConsolidation Techniques and Procedures (Revised) - Part1Raihan YonaldiiNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Chapter 10 Tax 2014 PDFDocument6 pagesChapter 10 Tax 2014 PDFtherock25No ratings yet

- Akuntansi Keuangan Lanjutan 1Document4 pagesAkuntansi Keuangan Lanjutan 1Salsa BilaNo ratings yet

- Advanced ACCT PROJECT II FINAL DRAFTDocument3 pagesAdvanced ACCT PROJECT II FINAL DRAFTnoureen sohailNo ratings yet

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDocument8 pagesSorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonTine Griego0% (1)

- Final Exam Essay QuestionsDocument4 pagesFinal Exam Essay Questionsapi-408647155No ratings yet

- Homework Ch. 7 and 13Document24 pagesHomework Ch. 7 and 13L100% (1)

- Solution Manual Advanced Accounting Beams 11e Chp1 PDFDocument14 pagesSolution Manual Advanced Accounting Beams 11e Chp1 PDFArifta Nur Rahmat100% (21)

- Model Exam Work Out FADocument5 pagesModel Exam Work Out FAnewaybeyene5No ratings yet

- Pembahasan Tugas AKLDocument8 pagesPembahasan Tugas AKLyashmutjabbar25No ratings yet

- Consolidated FS Date of AcquisitionDocument30 pagesConsolidated FS Date of AcquisitionSanhica Chantahl PacquiaoNo ratings yet

- Problem 1 Forex TranslationDocument12 pagesProblem 1 Forex TranslationDevine Zarriz IINo ratings yet

- Accounting PresentationDocument12 pagesAccounting Presentationgelly studiesNo ratings yet

- ACC 401 Homework CH 4Document4 pagesACC 401 Homework CH 4leelee03020% (1)

- FABULAR Intercompany DividendsDocument6 pagesFABULAR Intercompany DividendsRico, Jalaica B.No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Cos AccDocument6 pagesCos Accyza0% (3)

- Allowable Deductions From Gross Income - ReviewerDocument4 pagesAllowable Deductions From Gross Income - RevieweryzaNo ratings yet

- Auditing Multiple ChoicesDocument8 pagesAuditing Multiple ChoicesyzaNo ratings yet

- Compensation Income and Fringe Benefit Tax. ReviewerDocument4 pagesCompensation Income and Fringe Benefit Tax. RevieweryzaNo ratings yet

- Capital Gains ReviewerDocument1 pageCapital Gains RevieweryzaNo ratings yet

- Final Tax ReviewerDocument35 pagesFinal Tax Revieweryza100% (1)

- The Consumer Behaviour Theory: Slope Px/PyDocument3 pagesThe Consumer Behaviour Theory: Slope Px/PyyzaNo ratings yet

- Market StructuresDocument24 pagesMarket StructuresyzaNo ratings yet

- Practical Accounting 1 ValixDocument277 pagesPractical Accounting 1 ValixyzaNo ratings yet

- Fundamental Arms and Feet PositionsDocument10 pagesFundamental Arms and Feet PositionsyzaNo ratings yet

- Unit5-Impairment of Assets - SolutionsDocument1 pageUnit5-Impairment of Assets - SolutionsyzaNo ratings yet

- Week1 AnswersDocument7 pagesWeek1 AnswersyzaNo ratings yet

- Fundamentals of Accountancy: Financial StatementsDocument2 pagesFundamentals of Accountancy: Financial StatementsyzaNo ratings yet

- Activity 2 PDFDocument5 pagesActivity 2 PDFyzaNo ratings yet

- Activity 3 PDFDocument4 pagesActivity 3 PDFyzaNo ratings yet

- Adjusting Entries For Merchandising (4 Step) : Merchandising Concern Manufacturing ConcernDocument1 pageAdjusting Entries For Merchandising (4 Step) : Merchandising Concern Manufacturing ConcernyzaNo ratings yet