Professional Documents

Culture Documents

Hunter Douglas N.V.: Unaudited Interim Condensed Consolidated Financial Statements

Hunter Douglas N.V.: Unaudited Interim Condensed Consolidated Financial Statements

Uploaded by

Daniel KwanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hunter Douglas N.V.: Unaudited Interim Condensed Consolidated Financial Statements

Hunter Douglas N.V.: Unaudited Interim Condensed Consolidated Financial Statements

Uploaded by

Daniel KwanCopyright:

Available Formats

Hunter Douglas N.V.

Unaudited interim condensed consolidated financial statements

30 June 2018

Hunter Douglas Half Year Report 2018 1

Contents

Chairman’s letter 3

Statement of income 4

Cash flow statement 6

Balance sheet 7

Statement of changes in equity 9

Notes to financial statements 10

Hunter Douglas Half Year Report 2018 2

Chairman’s letter

To our shareholders

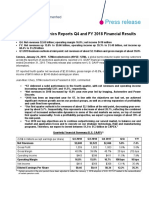

Sales: USD 1,792.6 million, 18.5% higher, compared with USD 1,512.8 million in the first half of 2017.

Earnings before interest, tax, depreciation and amortization - EBITDA:

USD 211.7 million, 20.4% higher than USD 175.8 million in the first half of 2017.

Income from Operations:

USD 161.0 million, 26.4% higher than USD 127.4 million in the first half of 2017.

Results in local currencies were higher in North America and Europe and lower in all other areas.

Profit before Tax: USD 156.6 million, 22.5% higher than USD 127.8 million in the first half of 2017.

Total Net Profit: USD 122.7 million (per share EUR 2.93), 23.3% higher than USD 99.5 million in the first

half of 2017 (per share EUR 2.63).

Acquisitions: Included:

Debel: 80% of a leading Danish supplier of window coverings to the mass merchant channel (January).

Capital expenditures were USD 67 million, compared with USD 60 million in the first half of 2017, while

depreciation was USD 40 million compared with USD 40 million in the first half of 2017. For the full year capital

expenditures are expected to be approximately USD 140 million and depreciation USD 85 million.

Operating cash flow: USD 68 million compared with USD 19 million in the first half of 2017.

Shareholder’s equity was USD 1,380 million, compared with USD 1,485 million at the end of 2017, reflecting the

first half year results offset by negative exchange translation and the payment of the dividend of EUR 1.85, totalling

USD 76 million.

RONAE (Return before interest/net assets employed) excluding Metals Trading and Investment Portfolio

was 12.9% compared with 16.5% in the first half of 2017.

Outlook

We expect continued growth in Europe, the US and Asia, and improving economic conditions in Latin America.

Hunter Douglas is in a strong position in terms of its brands, products, distribution and finances.

Sensitivity to External Factors

The Company’s results are sensitive to external factors of which the following are most influential:

• Overall economic activity and particularly consumer confidence which affects demand for consumer durables.

Our decentralized entrepreneurial organization manages these market risks as effectively as possible;

• Prices for raw materials, in particular: aluminium, steel, fabric, synthetics and other oil based products. Changes

in material prices for our window covering and architectural products are normally passed on in our product

prices. Base commodity price risks in our Metal Trading business are substantially hedged;

• The Investment Portfolio risks are limited by the wide diversification of the funds;

• Exchange rates: rates of non US dollar currencies can affect the Company’s results. Hunter Douglas’ policy is to

selectively hedge transactional exposures and generally not to hedge balance sheet exposures.

The company has a low risk appetite to the above mentioned factors.

Financial reporting

To the best of our knowledge and in accordance with the applicable accounting principles for interim financial

reporting, the interim consolidated financial statements give a true and fair view of the assets, liabilities, financial

position and profit and loss of the Group.

The Chairman’s letter gives a true and fair view of the important events of the past six-months’ period and their

impact on the half year financial statements, as well as the principal risks and uncertainties for the six-months’

period to come.

Hunter Douglas Half Year Report 2018 3

Interim consolidated statement of income for the first half year ended 30 June

USD

Amounts in millions 2018 2017

(unaudited) (unaudited)

Net sales 1,792.6 1,512.8

Cost of sales -1,084.5 -916.9

Gross profit 708.1 595.9

Gross profit metals trading 9.8 7.9

Total gross profit 717.9 603.8

Selling and marketing expense -359.3 -296.9

General and administrative expense -197.6 -179.5

Income from operations (EBIT) 161.0 127.4

Finance costs -9.9 -7.5

Finance income 5.5 7.9

Income before taxes 156.6 127.8

Taxes on income -34.1 -23.8

Net profit for the year 122.5 104.0

Net profit attributable to minority interest -0.2 4.5

Net profit attributable to equity shareholders 122.7 99.5

Earnings per share attributable to

equity shareholders

- basic for profit for the year 3.53 2.86

- fully diluted for profit for the year 3.53 2.86

Interim consolidated statement of comprehensive income for the first half year ended 30 June

USD

Amounts in millions 2018 2017

(unaudited) (unaudited)

Net profit for the year 122.5 104.0

Other comprehensive income

Currency translation differences *) -52.5 -6.5

Net movement in cash flow hedges *) 2.1

Total comprehensive income for the year, net of tax 70.0 99.6

Attributable to equity shareholders 71.0 98.1

Attributable to minority interest -1.0 1.5

*) These items will be recycled thru statement of income at a future point in time.

Hunter Douglas Half Year Report 2018 4

Interim consolidated statement of income for the second quarter ended 30 June

USD

Amounts in millions 2018 2017

(unaudited) (unaudited)

Net sales 974.2 809.1

Cost of sales -583.6 -481.5

Gross profit 390.6 327.6

Gross profit metals trading 5.7 4.1

Total gross profit 396.3 331.7

Selling and marketing expense -182.7 -149.9

General and administrative expense -96.7 -94.8

Income from operations (EBIT) 116.9 87.0

Finance costs -5.0 -4.0

Finance income 4.1 3.0

Income before taxes 116.0 86.0

Taxes on income -27.7 -16.7

Net profit for the year 88.3 69.3

Net profit attributable to minority interest -1.3 4.5

Net profit attributable to equity shareholders 89.6 64.8

Earnings per share attributable to

equity shareholders

- basic for profit for the year 2.58 1.86

- fully diluted for profit for the year 2.58 1.86

Interim consolidated statement of comprehensive income for the second quarter ended 30 June

USD

Amounts in millions 2018 2017

(unaudited) (unaudited)

Net profit for the year 88.3 69.3

Other comprehensive income

Currency translation differences *) -62.1 -11.8

Net movement in cash flow hedges *) 1.0

Total comprehensive income for the year, net of tax 26.2 58.5

Attributable to equity shareholders 28.3 52.5

Attributable to minority interest -2.1 6.0

*) These items will be recycled thru statement of income at a future point in time.

Hunter Douglas Half Year Report 2018 5

Interim consolidated cash flow statement for the first half year ended 30 June

USD

Amounts in millions 2018 2017

(unaudited) (unaudited)

Net profit attributable to equity shareholders 122.7 99.5

Adjustments for:

Depreciation property, plant & equipment 39.8 39.7

Amortization patents & trademarks 10.9 8.7

Increase (decrease) provisions 7.0 -2.1

Other non-cash items -21.9 -1.6

Unrealized result investment portfolio -0.4 -5.7

Operating cash flow before working capital changes 158.1 138.5

Changes in working capital:

-increase trade and other receivables and prepayments -21.8 -105.1

-increase inventories -15.6 -23.9

-(decrease) increase trade and other payables -53.1 9.9

Operating cash flow 67.6 19.4

Dividend paid -75.8 -68.1

Net cash from operations -8.2 -48.7

Cash flow from investing activities

Investments subsidiaries, net of cash acquired -30.0

Investment property, plant and equipment -66.7 -60.2

Divestment property, plant and equipment 5.4 2.2

Increase intangible fixed assets -7.9

Decrease investment portfolio 22.0 90.5

Increase other financial non-current assets -7.3 -12.6

Net cash from investing activities -84.5 19.9

Cash flow from financing activities

Increase interest-bearing loans and borrowings 85.9 24.0

Net cash from financing activities 85.9 24.0

Net decrease in cash and cash equivalents -6.8 -4.8

Change in cash and cash equivalents

Balance at 1 January 32.0 41.4

Net decrease in cash and cash equivalents -6.8 -4.8

Exchange difference cash and cash equivalents -0.9 1.4

Balance at 30 June 24.3 38.0

Hunter Douglas Half Year Report 2018 6

Interim consolidated balance sheet as per

Assets

USD

Amounts in millions 30-jun-18 31-dec-17

(unaudited)

Non-current assets

Intangible fixed assets 1,083.8 1,062.0

Property, plant and equipment 539.9 521.5

Deferred income tax assets 161.1 164.2

Other financial non-current assets 78.6 73.4

Total non-current assets 1,863.4 1,821.1

Current assets

Inventories 732.1 727.0

Trade and other receivables 605.6 547.1

Prepaid income tax 35.1 59.3

Prepayments 112.1 102.8

Metal derivatives 27.6 43.1

Currency derivatives 1.0 8.3

Investment portfolio 13.0 33.5

Cash and short-term deposits 24.3 32.1

Total current assets 1,550.8 1,553.2

TOTAL ASSETS 3,414.2 3,374.3

Hunter Douglas Half Year Report 2018 7

Interim consolidated balance sheet as per

Shareholders’ equity and liabilities

USD

Amounts in millions 30-jun-18 31-dec-17

(unaudited)

Equity attributable to equity shareholders

Issued capital 9.9 10.2

Share premium 82.6 84.9

Treasury shares -28.5 -28.5

Cash flow hedge reserve 0.5 0.5

Foreign currency translation -296.9 -245.2

Retained earnings 1,612.2 1,562.7

Total equity attributable to equity shareholders of the parent 1,379.8 1,384.6

Non-controlling interest 10.0 23.5

Total equity 1,389.8 1,408.1

Non-current liabilities

Interest-bearing loans and borrowings 730.5 801.1

Preferred shares 9.7 9.9

Provisions 271.9 234.6

Deferred income tax liabilities 9.3 9.4

Total non-current liabilities 1,021.4 1,055.0

Current liabilities

Trade and other payables 712.0 711.6

Income tax payable 33.3 26.6

Restructuring provisions 1.2 5.1

Metal derivatives 3.7

Currency derivatives 8.3

Interest-bearing loans and borrowings 256.5 155.9

Total current liabilities 1,003.0 911.2

TOTAL LIABILITIES 2,024.4 1,966.2

TOTAL SHAREHOLDERS' EQUITY AND LIABILITIES 3,414.2 3,374.3

Hunter Douglas Half Year Report 2018 8

Interim consolidated statement of changes in equity for the first half year 2018

Amounts in millions Attributable to equity shareholders of the parent

Cashflow Foreign Non-

Issued Share Treasury hedge currency Retained controlling Total

capital premium shares reserve translation earnings Total interest Equity

At 1 January 2018 10.2 84.9 -28.5 0.5 -245.2 1,562.7 1,384.6 23.5 1,408.1

Net profit 122.7 122.7 -0.2 122.5

Other comprehensive income (expense) -0.3 -2.3 -51.7 2.6 -51.7 -0.8 -52.5

Total comprehensive income (expense) -0.3 -2.3 0.0 0.0 -51.7 125.3 71.0 -1.0 70.0

Movement to provisions 0.0 -12.5 -12.5

Equity dividends -75.8 -75.8 -75.8

At 30 June 2018 (unaudited) 9.9 82.6 -28.5 0.5 -296.9 1,612.2 1,379.8 10.0 1,389.8

Interim consolidated statement of changes in equity for the first half year 2017

Cashflow Foreign Non-

Issued Share Treasury hedge currency Retained controlling Total

capital premium shares reserve translation earnings Total interest Equity

At 1 January 2017 9.0 74.6 -28.5 -2.9 -251.2 1,442.9 1,243.9 21.6 1,265.5

Net profit 99.5 99.5 4.5 104.0

Other comprehensive income (expense) 0.7 6.0 2.1 -3.5 -6.7 -1.4 -3.0 -4.4

Total comprehensive income (expense) 0.7 6.0 0.0 2.1 -3.5 92.8 98.1 1.5 99.6

Equity dividends -68.1 -68.1 -68.1

At 30 June 2017 (unaudited) 9.7 80.6 -28.5 -0.8 -254.7 1,467.6 1,273.9 23.1 1,297.0

Hunter Douglas Half Year Report 2018 9

Notes to the interim condensed consolidated financial statements

USD (millions, unless indicated otherwise)

1. Corporate information

The interim condensed consolidated financial statements of Hunter Douglas N.V. for the half year ended 30 June

2018 were authorized for issue in accordance with a resolution of the Directors on 31 July 2018.

Hunter Douglas N.V. has its statutory seat in Curaçao. Common shares are publicly traded at Amsterdam (HDG)

and Frankfurt (HUD); the preferred shares are traded at Amsterdam (HUNDP).

The principal activities of the Group are described in note 3.

2. Basis of preparation and significant accounting policies

Basis of preparation

The consolidated financial statements of Hunter Douglas N.V. and all its subsidiaries have been prepared in

accordance with IAS 34 Interim Financial Reporting.

The interim condensed consolidated financial statements do not include all the information and disclosures

required in the annual financial statements, and should be read in conjunction with the Group’s annual financial

statements as at 31 December 2017. The same accounting policies are followed in the interim condensed

consolidated financial statements as compared with the Group’s annual financial statements as at 31 December

2017.

IFRS accounting standards effective as from 2018

In July 2014 the IASB issued IFRS 9 - Financial Instruments. The improvements introduced by the new standard

includes a logical approach for classification and measurement of financial instruments driven by cash flow

characteristics and the business model in which an asset is held, a single “expected loss” impairment model for

financial assets and a substantially reformed approach for hedge accounting. The standard is effective,

retrospectively with limited exceptions, for annual periods beginning on or after January 1, 2018 with earlier

application permitted. The Group expects that there will be no material impact on the Group’s consolidated financial

statements upon initial adoption of the standard.

In May 2014, the IASB issued IFRS 15 - Revenue from Contracts with Customers. The standard requires a

company to recognize revenue upon transfer of control of goods or services to a customer at an amount that

reflects the consideration it expects to receive. The impact on metals trading is still under investigation by the

group.

The standard and amendments are effective for annual periods beginning on or after January 1, 2018, with earlier

adoption permitted. The Group is currently quantifying the impact of adoption and determining the implementation

approach. However based on currently available information, the Group does not expect a material impact on its

Consolidated Financial Statements from the adoption of this standard and related amendments.

IFRS 16 is effective from January 1, 2019 with early adoption allowed only if IFRS 15 - Revenue from Contracts

with Customers is also applied. The Group is currently evaluating the method of implementation and impact of

adoption on its Consolidated Financial Statements. Refer to note 23 for expected balance sheet impact of

recording the former operational leases as financial lease as required by IFRS 16. Based on currently available

information, the Group does expect a material impact on its Consolidated Financial Statements from the adoption

of this standard and related amendments, however the Group is currently evaluating the impact so no exact

quantification can currently be made.

Hunter Douglas Half Year Report 2018 10

3. Segment information

The Company has determined its reportable segments based on its internal reporting practices and on how the

Company’s management evaluates the performance of operations and allocates resources. The segments are

organized and managed separately according to the nature of the products and services provided, with each

segment representing a strategic business unit that offers different products and serves different markets. The

window covering products segment relates to sales and manufacturing of window coverings for commercial and

residential use. The architectural products segment relates to sales and manufacturing of architectural products

mainly for commercial use. The metal trading segment represents trading in metals mainly in contracts on bulk

aluminium. The investment segment relates to the Group’s investment portfolio which is invested in marketable

securities in a variety of asset classes, including hedged equities, arbitrage, financial trading and fixed income. No

operating segments have been aggregated to form the above reportable business segments. Management

monitors the operating results of its business segments separately for the purpose of making decisions about

resource allocation and performance assessment. Segment performance is evaluated based on net profit and is

measured consistently with net profit in the consolidated financial statements. Transfer prices between business

segments are set on an arm’s length basis in a manner similar to transactions with third parties. The Group’s

geographical segments are determined by the location of the Group’s assets and operations.

Business segments

The following table presents revenue and income information and certain asset and liability information regarding

the Group’s business segments:

First half year 2018 Window Architectural Metals Investment

Coverings Products Trading Portfolio Total

Revenue

Sales to external customers 1,538.6 254.0 1,792.6

Total revenue 1,538.6 254.0 1,792.6

Results

Segment profit before tax 138.2 13.1 4.9 0.4 156.6

First half year 2017 Window Architectural Metals Investment

Coverings Products Trading Portfolio Total

Revenue

Sales to external customers 1,282.5 230.3 1,512.8

Total revenue 1,282.5 230.3 1,512.8

Results

Segment profit before tax 108.9 10.1 3.1 5.7 127.8

Assets and liabilities

Segment assets 2,719.8 457.9 199.4 13.0 3,390.1

Investment in an associate 24.1 24.1

Total assets at 30 June 2018 2,743.9 457.9 199.4 13.0 3,414.2

Segment liabilities 1,649.8 283.3 91.3 2,024.4

Total liabilities at 30 June 2018 1,649.8 283.3 91.3 0.0 2,024.4

Assets and liabilities

Segment assets 2,116.3 413.0 172.0 121.5 2,822.8

Investment in an associate 18.6 0.5 19.1

Total assets at 30 June 2017 2,134.9 413.0 172.5 121.5 2,841.9

Segment liabilities 1,215.2 270.4 59.3 1,544.9

Total liabilities at 30 June 2017 1,215.2 270.4 59.3 0.0 1,544.9

Hunter Douglas Half Year Report 2018 11

4. Business combination

In the first half year of 2018 Hunter Douglas acquired the following business:

80% of Debel, a leading Danish supplier of window coverings to the mass merchant channel since January.

In the first half year of 2017 Hunter Douglas did not acquire new businesses.

5. Impairment testing of indefinitely lived goodwill, patents and licenses

An impairment analysis has been performed per the end of 2017. There are no impairment indicators that would

require an updated calculation.

6. Cash and short-term deposits

Cash at bank and in hand earns interest at floating rates based on market conditions. Short-term deposits are

made for varying periods of between one day and 3 months depending on the immediate cash requirements of the

Group, and earn interest at the respective short-term deposit rates. The fair value of cash and cash equivalents at

30 June 2018 is 24.3 (30 June 2017: 38.0).

At 30 June 2018 the Group had available 391 of undrawn committed borrowing facilities in respect of which all

conditions precedent had been met. For the purposes of the consolidated cash flow statement, cash and cash

equivalents comprise the following at 30 June:

Amounts in millions 2018 2017

Cash at bank and in hand 24.1 37.3

Short-term deposits 0.2 0.7

24.3 38.0

Funds in certain countries in which the Group operates are subject to varying exchange regulations. No material

restrictions exist for transfers of a current nature, such as dividends from subsidiaries. A few countries have more

severe restrictions on remittances of a capital nature, which are immaterial to the Group.

7. Dividends paid

Amounts in millions 2018 2017

Declared and paid during the year:

Equity dividends on ordinary shares:

Final dividend for 2017: EUR 1.85 (2016: EUR 1.75) 75.8 68.1

75.8 68.1

8. Capital commitments and other commitments

Capital commitments

At 30 June 2018, the Group has commitments for capital expenditures of 46 (31 December 2017: 34).

9. Events after balance sheet date

- Acquisitions

Akant, 70% of a leading Polish supplier of custom window coverings (July).

Vertilux, a leading commercial window covering fabricator in Australia (July).

- Divestments

North American ceilings business: It has been agreed to sell the North American ceilings business to

CertainTeed, a division of Saint Gobian (July).

Rotterdam, 31 July 2018

Board of Directors

Hunter Douglas Half Year Report 2018 12

You might also like

- Engineering Economy 9Th Edition Leland T Blank Full ChapterDocument67 pagesEngineering Economy 9Th Edition Leland T Blank Full Chaptereleanor.gamble412100% (10)

- Enterprise Architecture - GBS-ESM-Shared Services Platform Engagement Architecture - TokyoDocument1 pageEnterprise Architecture - GBS-ESM-Shared Services Platform Engagement Architecture - TokyoEugen OpreaNo ratings yet

- KHD Konzern H1 2018 EnglischDocument42 pagesKHD Konzern H1 2018 EnglischVarun VermaNo ratings yet

- July 31, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal First Quarter ENDED JUNE 30, 2018Document17 pagesJuly 31, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal First Quarter ENDED JUNE 30, 2018Black Star11No ratings yet

- Interim Financial Report First Quarter 2020Document14 pagesInterim Financial Report First Quarter 2020Luis Vargas SalasNo ratings yet

- Statutory Accounts For The Full Year Ended 30 June 2020Document118 pagesStatutory Accounts For The Full Year Ended 30 June 2020TimBarrowsNo ratings yet

- Olam International Limited: Management Discussion and AnalysisDocument22 pagesOlam International Limited: Management Discussion and Analysisashokdb2kNo ratings yet

- Maruti Suzuki Q4FY19 and FY19 Investor Presentation PDFDocument18 pagesMaruti Suzuki Q4FY19 and FY19 Investor Presentation PDFKaur HardeepNo ratings yet

- Otc Atnnf 2019Document152 pagesOtc Atnnf 2019AlexNo ratings yet

- TROW Q3 2020 Earnings ReleaseDocument15 pagesTROW Q3 2020 Earnings ReleaseWilliam HarrisNo ratings yet

- Financial Analysis of P & GDocument25 pagesFinancial Analysis of P & Ghitesh_mahajan_3No ratings yet

- Hgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedDocument6 pagesHgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedChirag LaxmanNo ratings yet

- Semi Annual Report 2018Document21 pagesSemi Annual Report 2018Avinash Singh ChauhanNo ratings yet

- Semi Annual Report 2017Document20 pagesSemi Annual Report 2017A ÁNo ratings yet

- Nestle Holdings Inc Financial Statements 2020Document72 pagesNestle Holdings Inc Financial Statements 2020Michael ScottNo ratings yet

- Stmicro - Q4-Fy2018 PR - FinalDocument12 pagesStmicro - Q4-Fy2018 PR - Finalakshay kumarNo ratings yet

- Compilation Notes Financial Statement AnalysisDocument8 pagesCompilation Notes Financial Statement AnalysisAB12P1 Sanchez Krisly AngelNo ratings yet

- Ratio AnalysisDocument8 pagesRatio AnalysisVivek SinghNo ratings yet

- Olam International Limited: Management Discussion and AnalysisDocument24 pagesOlam International Limited: Management Discussion and Analysisashokdb2kNo ratings yet

- Infosys Q1 2000Document21 pagesInfosys Q1 2000GouthamNo ratings yet

- Lesson 4.2Document4 pagesLesson 4.2crisjay ramosNo ratings yet

- Consolidated Financial Results For The Nine Months Ended December 31, 2019Document27 pagesConsolidated Financial Results For The Nine Months Ended December 31, 2019Tanmoy IimcNo ratings yet

- JJ Income Statement - Common SizeDocument5 pagesJJ Income Statement - Common SizeJastine CahimtongNo ratings yet

- Comptes Consolidés 2019 ANGLAISDocument91 pagesComptes Consolidés 2019 ANGLAISJosé Manuel EstebanNo ratings yet

- V-Guard-Industries - Q4 FY21-Results-PresentationDocument17 pagesV-Guard-Industries - Q4 FY21-Results-PresentationanooppattazhyNo ratings yet

- Nikon 2021 Fiscal Year Financial ReportDocument48 pagesNikon 2021 Fiscal Year Financial ReportNikonRumorsNo ratings yet

- Factbook 2018 0Document92 pagesFactbook 2018 0Yves-donald MakoumbouNo ratings yet

- FY24 Q1 Combined NIKE Press Release Schedules FINALDocument7 pagesFY24 Q1 Combined NIKE Press Release Schedules FINALTADIWANo ratings yet

- 2018-Annual-Report Selected PagesDocument11 pages2018-Annual-Report Selected PagesLuis David BriceñoNo ratings yet

- Earnings Release - 01.30.2023 FINALDocument20 pagesEarnings Release - 01.30.2023 FINALDuangjitr WongNo ratings yet

- Corporate AccountingDocument10 pagesCorporate AccountingFahad JanjuaNo ratings yet

- 4Q 2018 Match Group Earnings ReleaseDocument11 pages4Q 2018 Match Group Earnings ReleaseDIanaNo ratings yet

- SGS 2022 Full Year Results Report ENDocument20 pagesSGS 2022 Full Year Results Report ENGervais AhoureNo ratings yet

- Investor Presentation Q2FY24Document18 pagesInvestor Presentation Q2FY24vishwasmaheshwari10No ratings yet

- Berkley 2009 AnnualReportDocument122 pagesBerkley 2009 AnnualReportbpd3kNo ratings yet

- 2023.05.16 Sea First Quarter 2023 ResultsDocument17 pages2023.05.16 Sea First Quarter 2023 ResultsPrincess DueñasNo ratings yet

- Vertical and Horizontal AnalysisDocument4 pagesVertical and Horizontal AnalysisEmadeldin AbdelghaniNo ratings yet

- 2017 7 Q1-2018 Investor PresentationDocument73 pages2017 7 Q1-2018 Investor PresentationMEGNo ratings yet

- Tutorial 5 Financial Statement Analysis: Accounting and Financial ManagementDocument7 pagesTutorial 5 Financial Statement Analysis: Accounting and Financial ManagementSteven CHONGNo ratings yet

- Estados Financieros 2018 2019 SubaruDocument26 pagesEstados Financieros 2018 2019 SubaruManuel Eduardo Herrera AguilaNo ratings yet

- April 27, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal Fourth Quarter and The Fiscal Year Ended March 31, 2018Document22 pagesApril 27, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal Fourth Quarter and The Fiscal Year Ended March 31, 2018Le NovoNo ratings yet

- 2021AnnualReport FINAL 39 43Document5 pages2021AnnualReport FINAL 39 43Wilson BastidasNo ratings yet

- NIKE Inc Q117 Press Release PDFDocument8 pagesNIKE Inc Q117 Press Release PDFPitroda BhavinNo ratings yet

- FY Mar 2017Document30 pagesFY Mar 2017shankesh singhNo ratings yet

- 107 25 Walmart 10 K ExcerptsDocument6 pages107 25 Walmart 10 K Excerptsi wayan suputraNo ratings yet

- HinoDocument14 pagesHinoOmerSyedNo ratings yet

- Sub: Investor UpdateDocument29 pagesSub: Investor UpdateSHANKAR JADHAVNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Robot Book of KukaDocument28 pagesRobot Book of KukaSumit MahajanNo ratings yet

- Carrefour 2022 Half-Year Financial ReportDocument71 pagesCarrefour 2022 Half-Year Financial Reportgarcia.heberNo ratings yet

- Strengthening Our Core: Reliance Steel & Aluminum Co. 2017 Annual ReportDocument32 pagesStrengthening Our Core: Reliance Steel & Aluminum Co. 2017 Annual ReportShreeyaNo ratings yet

- Consolidated Financial Statements 2020 - 0Document97 pagesConsolidated Financial Statements 2020 - 0Nicolas NunezNo ratings yet

- Otc Atnnf 2020Document138 pagesOtc Atnnf 2020AlexNo ratings yet

- Presentation of M.S &SDocument22 pagesPresentation of M.S &SArun SanalNo ratings yet

- Sodexo Group Presentation FY2018 - ENDocument61 pagesSodexo Group Presentation FY2018 - ENDarksaberNo ratings yet

- Exhibit 99.1 3Q 2022 Press Release - FINALDocument23 pagesExhibit 99.1 3Q 2022 Press Release - FINALadilfarooqaNo ratings yet

- Lesson 4.3Document4 pagesLesson 4.3crisjay ramosNo ratings yet

- Nyse Cas 2011Document118 pagesNyse Cas 2011gaja babaNo ratings yet

- Annual StatementDocument48 pagesAnnual StatementBandita ParidaNo ratings yet

- Gail 2019Document7 pagesGail 2019Faizaan KhanNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- 2022-Annual-Report-Advance Auto PartsDocument76 pages2022-Annual-Report-Advance Auto PartsDaniel KwanNo ratings yet

- 2021 AMERCO Investor WebcastDocument1 page2021 AMERCO Investor WebcastDaniel KwanNo ratings yet

- 21 q2 8k American TowerDocument16 pages21 q2 8k American TowerDaniel KwanNo ratings yet

- 23 q3 Presentation Deck American TowerDocument23 pages23 q3 Presentation Deck American TowerDaniel KwanNo ratings yet

- 10k 22 Acuity BrandsDocument105 pages10k 22 Acuity BrandsDaniel KwanNo ratings yet

- Presentation Jan16Document39 pagesPresentation Jan16Daniel KwanNo ratings yet

- Adidas CEO To Depart Due To Weak China ResultDocument2 pagesAdidas CEO To Depart Due To Weak China ResultDaniel KwanNo ratings yet

- Ag Barr Interim Report 2022 FinalDocument30 pagesAg Barr Interim Report 2022 FinalDaniel KwanNo ratings yet

- 3m Earplug LawsuitsDocument11 pages3m Earplug LawsuitsDaniel KwanNo ratings yet

- 10k Dec 15Document135 pages10k Dec 15Daniel KwanNo ratings yet

- 10k Dec 20Document165 pages10k Dec 20Daniel KwanNo ratings yet

- 10k Dec 11Document137 pages10k Dec 11Daniel KwanNo ratings yet

- 10k Dec19Document186 pages10k Dec19Daniel KwanNo ratings yet

- 2017 AfDocument249 pages2017 AfDaniel KwanNo ratings yet

- American Eagle Outfitters, Inc.: United States Securities and Exchange CommissionDocument28 pagesAmerican Eagle Outfitters, Inc.: United States Securities and Exchange CommissionDaniel KwanNo ratings yet

- 10k Dec17Document176 pages10k Dec17Daniel KwanNo ratings yet

- United States Securities and Exchange Commission FORM 10-QDocument96 pagesUnited States Securities and Exchange Commission FORM 10-QDaniel KwanNo ratings yet

- 10q June 21Document89 pages10q June 21Daniel KwanNo ratings yet

- AllisonTransmissionInc 10K 20180215Document102 pagesAllisonTransmissionInc 10K 20180215Daniel KwanNo ratings yet

- American Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDocument25 pagesAmerican Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDaniel KwanNo ratings yet

- American Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDocument28 pagesAmerican Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDaniel KwanNo ratings yet

- American Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDocument26 pagesAmerican Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDaniel KwanNo ratings yet

- American Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDocument26 pagesAmerican Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDaniel KwanNo ratings yet

- 2018 ArDocument228 pages2018 ArDaniel KwanNo ratings yet

- AG BARR 30482 Annual Report 2019 WebDocument162 pagesAG BARR 30482 Annual Report 2019 WebDaniel KwanNo ratings yet

- AG BARR 33825 Annual Report 2020 WebDocument168 pagesAG BARR 33825 Annual Report 2020 WebDaniel KwanNo ratings yet

- Annual Report and Accounts 2012Document132 pagesAnnual Report and Accounts 2012Daniel KwanNo ratings yet

- A Colorado Corporation Address: 30588 San Antonio ST Hayward, CA 94544 Phone: (510) 441-9300 SIC Code: 2030Document31 pagesA Colorado Corporation Address: 30588 San Antonio ST Hayward, CA 94544 Phone: (510) 441-9300 SIC Code: 2030Daniel KwanNo ratings yet

- 2015 ArDocument243 pages2015 ArDaniel KwanNo ratings yet

- F7 - C2 & C3A PPE & Borrowing Cost AnsDocument53 pagesF7 - C2 & C3A PPE & Borrowing Cost AnsK59 Vo Doan Hoang AnhNo ratings yet

- Volume IDocument64 pagesVolume IVansh PandyaNo ratings yet

- Polo S. Pantaleon vs. American Express International, Inc. G.R. No. 174269Document5 pagesPolo S. Pantaleon vs. American Express International, Inc. G.R. No. 174269robdeqNo ratings yet

- BlackbookDocument46 pagesBlackbookunknowgamer9820680832No ratings yet

- Description of Drop DownDocument4 pagesDescription of Drop DownDNYANESHWAR PATILNo ratings yet

- Webb County Accounts Payable: Check RegisterDocument309 pagesWebb County Accounts Payable: Check Registerpatmos666No ratings yet

- "Water Ro": Mini Project-1 Report ONDocument67 pages"Water Ro": Mini Project-1 Report ONRahul ChaudharyNo ratings yet

- 01 Task Performance 1 - SBADocument6 pages01 Task Performance 1 - SBAPrincess AletreNo ratings yet

- Account Statement For Account Number 4063008700000556: Branch DetailsDocument9 pagesAccount Statement For Account Number 4063008700000556: Branch Detailsmanju maheshNo ratings yet

- Mil Std2035revb 31aug2009Document44 pagesMil Std2035revb 31aug2009김우열No ratings yet

- Unity InteriorDocument5 pagesUnity InteriorfaaltuidNo ratings yet

- Basic Concept & Residential Status of ItDocument15 pagesBasic Concept & Residential Status of ItKANNAN MNo ratings yet

- 56 Brand Management at HCL (Vishal)Document77 pages56 Brand Management at HCL (Vishal)sheemankhanNo ratings yet

- BEp 19Document1 pageBEp 19demo srinilNo ratings yet

- 2002 January - Steve Thomas - Economics of New Nuclear Power Plants and Electricity Liberalisation Lessons For Finland From British ExperienceDocument10 pages2002 January - Steve Thomas - Economics of New Nuclear Power Plants and Electricity Liberalisation Lessons For Finland From British ExperienceSusanne Namer-WaldenstromNo ratings yet

- 20 007 Tax Accounting Unravelling Mystery Income Taxes Second Revised Edition Final PrintDocument32 pages20 007 Tax Accounting Unravelling Mystery Income Taxes Second Revised Edition Final Printmolladagim19No ratings yet

- Lacoste?Document4 pagesLacoste?LofiNo ratings yet

- MGT790 Course Assessment Details MIORDocument3 pagesMGT790 Course Assessment Details MIORnanaNo ratings yet

- MIS201-Group AssignmentDocument7 pagesMIS201-Group Assignmentabanoub khalaf 22No ratings yet

- Adjective Plus Preposition WorksheetDocument4 pagesAdjective Plus Preposition WorksheetRUTH MARIBEL MAMANI MAMANINo ratings yet

- Thesis Statement For Life InsuranceDocument8 pagesThesis Statement For Life Insurancednnsgccc100% (2)

- Warranties For Electrical Engineers: Article Xix Contract Prices and WarrantiesDocument22 pagesWarranties For Electrical Engineers: Article Xix Contract Prices and WarrantiesJannie LeilaNo ratings yet

- SWMS Power FloatDocument10 pagesSWMS Power FloatSam LimNo ratings yet

- Solved Abc Company Has Instituted Good Internal Controls and Has Never PDFDocument1 pageSolved Abc Company Has Instituted Good Internal Controls and Has Never PDFAnbu jaromiaNo ratings yet

- 3 Ism Resume RevisedDocument1 page3 Ism Resume Revisedapi-483333981No ratings yet

- ESG and Investment EfficiencyDocument18 pagesESG and Investment EfficiencyPriyanka AggarwalNo ratings yet

- GYGY - UnLockable-DraftDocument36 pagesGYGY - UnLockable-DraftRishabh Naresh JainNo ratings yet

- Week 6 Lecture NotesDocument62 pagesWeek 6 Lecture NotesXuTongNo ratings yet