Professional Documents

Culture Documents

Index - 2021-01-12T120705.282

Index - 2021-01-12T120705.282

Uploaded by

Akshay BahetyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Index - 2021-01-12T120705.282

Index - 2021-01-12T120705.282

Uploaded by

Akshay BahetyCopyright:

Available Formats

The Smart

QUICK TAKE: GAS DISTRIBUTORS MAY POST STRONG SHOW “After being bullish for several months, we are

Investor

definitely becoming more cautious on the stock

BS City Gas Distribution Shares of Indraprastha Gas, Mahanagar Gas and Gujarat Gas market up at these levels... $ is so extremely

Index

have outperformed indices since mid-November. JM oversold, over-hated, and over-shorted

Financial, which is still bullish on these companies, that it all, but has to rally for a

MUMBAI | estimates them to see strong volume growth to near pre-

while at some point soon”

TUESDAY, 12 JANUARY 2021 Covid levels in Q3. Though margins may normalise for Gujarat MATT MALEY

Chief market strategist

Gas, the other two are likely to see improved profitability

Miller Tabak + Co

WWW.SMARTINVESTOR.IN FOR INFORMED DECISION MAKING <

Promoter pledging Heavyweights’ grip on Nifty loosens in Dec

Top 5 stocks contribute 42.4%, against 42.66% in November managers do not get to participate in

declines to 2-year

the stock’s outperformance if its

ASHLEY COUTINHO weighting exceeds 10 per cent.

Mumbai, 11 January NIFTY50 LEADERS “The outperformance of a few stocks

Weighting (%) n November n December can pose a challenge for fund managers

The concentration of the top five as they won’t be able to participate in

low of 11% in Dec

11.21

Nifty50 stocks reduced slightly in the uptick owing to risk diversification

11.17

10.66

10.37

December over the previous month, parameters and softer single-stock

7.64

7.61

7.23

indicating a broad basing of the index. limits. A lower stock weighting will

7.21

6.12

5.84

Market pundits believe that the mar- make it easier for fund managers to beat

4.99

5.04

4.85

ket rally this year is likely to be less con- the benchmark, and narrow the per-

5.0

centrated and that polarisation — where formance band among managers,” said

3.55

But value of pledged holding rises, buoyed by market rally

3.42

3.03

3.03

a handful of stocks outperform the index Jaideep Bhattacharya, co-founder and

2.61

— will become less pronounced in 2021. director, DEEPTAM Advisors.

SUNDAR SETHURAMAN The top five stocks contributed 42.4 Typically, fund managers can gen-

Thiruvananthapuram, 11 January per cent to the Nifty50 index, com- erate alpha by taking exposure to out-

NA

pared with 42.66 per cent in performing stocks that are not index

HDFC RIL HDFC Infosys ICICI TCS Kotak HUL ITC L&T

T

he extent of pledged November. The top four sectors — heavyweights. But in a narrow market,

promoter holding fell financial services, information tech- Bank Bank Bank this becomes a challenge, particularly

to a two-year low of 11.2 nology, oil and gas, and consumer Source: Exchange for large-cap schemes, which largely

per cent at the end of goods — formed 79.1 per cent of index focus their investments in the top 100

December 2020, according to weight as of December. weighting of 14 per cent on the Nifty50 cent. The weighting for the Nifty50 stocks in terms of market value.

data provided by primeinfo- Stocks such as Reliance Industries index as of July 31. RIL had a weighting components are computed using free- These schemes might underper-

base.com. Analysts said rising (RIL) and HDFC Bank now have a of 8.77 per cent as of March 23 and float market cap. form the indices unless market

markets drove the decline. weight of 10.66 per cent and 10.37 per nudged past 10 per cent in June. The steep run-up in RIL and its breadth improves and a sizeable

“As stock prices have risen cent, respectively, compared with 11.17 RIL was in the news in the last few weighting had posed a challenge for number of stocks start to rally. A diver-

over the last few quarters, pro- and 11.21 per cent, respectively, in months due to an investment spree in fund managers as active funds aren’t sified equity scheme typically invests

moters have been able to November. A few months ago, RIL had its digital subsidiary Jio Platforms. The permitted to hold more than 10 per cent in 45-60 stocks.

release some of the shares out touched a weighting of 15 per cent. company also hit the market with a in a single stock in a particular scheme. The pandemic is expected to tip

of pledge as the value of RIL shares have slid 19 per cent rights issue of ~53,000 crore. In addition, individual fund houses the scales further in favour of com-

pledge has gone up. Also, from the 52-week high of ~2,368 it hit RIL shares have surged 117 per cent have softer limits that prevent buying panies with higher market share and

some promoters could have in September. The stock had more than since March 23, outperforming the a stock above certain thresholds, say 5 well-entrenched businesses. It

released some of the pledged doubled from its March lows and quad- Nifty50, which gained 90 per cent. per cent or 7.5 per cent of the overall remains to be seen whether this will

shares by raising monies from rupled since December 2016, with a HDFC Bank shares have risen 91 per scheme holding. This means that fund lead to further polarisation.

other sources and repaying

lenders,” said Deepak Jasani,

head-retail research, HDFC

Securities.

Pranav Haldea, managing

ILLUSTRATION: BINAY SINHA

PLEDGED SHARES IN NSE-LISTED COMPANIES

India maintains global m-cap ranking

director, PRIME Database, India delivered the third-highest return among key and health care (12 per cent) were the top sectoral

said promoters can release a

portion of the shares as the

% of total pledged promoter holding global markets in local currency terms, with returns of

9 per cent. In US dollar terms, India’s performance was

performers, while metals (-4 per cent), power (-4 per

cent), and realty (-1 per cent) were the chief losers. Top

STATUS CHECK

margin requirement comes

14.0 more subdued with returns of 3 per cent individual gainers in the Nifty50 index Global ranking on m-cap basis

down. “Since March, there 13.0 compared with 12 per cent for the S&P include Bajaj Finance (54 per cent), Eicher

M-cap rank M-cap CAGR (%)

has been a continuous decline 500, 8 per cent for Japan, and 5 per cent Motors (35 per cent), and Bajaj Finserv (35

in promoter pledging due to for Taiwan, a report from Motilal Oswal per cent), while top losers include ONCG

CY10 CY20 ($ tr) 5 yr 10 yr

12.58 12.0

the rally in markets. If the Financial Services observed. Indian (-8 per cent) and Coal India (-8 per cent). US 1 1 42.6 13 11

market continues to rise, 11.0 markets, however, outperformed the Top gainers in BSE 200 include Astral China 5 2 10.9 9 13

pledging levels will continue 11.22 MSCI EM (1 per cent) and beat other Polytech (53 per cent) and Ajanta Pharma Japan 2 3 6.8 6 5

to come down.” 10.0 emerging markets such as China, Russia, (50 per cent), while top losers include KSK HK 4 4 6.5 10 7

Moreover, high pledge Jan 31,’19 Dec 31,’20 and Brazil, which gave negative returns. Energy (-41 per cent) and Educomp UK 3 5 3.3 -1 0

levels are typically not consid- Source: primeinfobase.com India has maintained its market Solutions (-39 per cent). France 7 6 2.9 9 5

ered a good sign by investors, capitalisation ranking at number 8 with The PSU share in the Indian market was

Canada 6 7 2.6 10 2

given that a downturn in mar- pledging has also helped reduced significantly after Sebi an m-cap of $2.5 trillion after slipping to at a two decade low at 10 per cent. The

ket price could lead to invo- reduce the decline in pro- came out with stringent guide- number 10 in 2015. China, which was at number 5 in poor showing by PSUs in 2020 is attributed to a decline India 8 8 2.5 11 4

cation and change in manage- moter pledging. lines regarding their participa- 2010, is now at number 2 with an m-cap of $10.9 in the share price of industry heavyweights such as Germany 9 9 2.5 6 5

ment. Investors tend to be In 2019, Sebi mandated tion after corporate houses trillion. The world m-cap has nearly doubled in the State Bank of India, Oil and Natural Gas Corporation, South Korea 13 10 2.1 12 7

wary of a company that promoters to disclose detailed were unable to repay loans past decade to $103 trillion. NTPC, Indian Oil Corporation, and

pledges its shares. reasons for the back in time,” Technology (13 per cent), consumer (12 per cent), Coal India. ASHLEY COUTINHO Source: Motilal Oswal Financial Services

Of the 1,684 companies encumbrance Haldea said.

listed on the NSE, 448 had at separately, if the Of the 1,684 At the end of

least some shares pledged in pledge crossed companies listed December 2020,

December 2020, down from

470 in January 2020.

20 per cent of the

company’s total

on the NSE, 448

had at least some

26 firms had

pledged 100 per

NSE launches derivatives on Acuité Group launches firm GAIL to consider dividend,

The value of pledged hold- share capital or shares pledged in cent of the pro- Nifty Financial Services Index to provide ESG ratings share buyback on Jan 15

ings, however, rose to ~2.84 50 per cent of December 2020, moter holding,

trillion, or 41 per cent, from total promoter down from 470 77 entities had The National Stock Exchange (NSE) on Monday Acuité Group has launched ESG Risk Assessments & GAIL (India) will on Friday consider buyback of shares

the end of January 2020. This holding. in January over 90 per cent launched derivatives on the Nifty Financial Insights in order to assess a company’s ESG perform- with a view to returning surplus cash to shareholders,

is the highest in two years. “Between of the promoter Services Index, which will give more flexibility to ance and assign a rating. ESG Risk AI will provide the biggest being the Government of India. In a stock

Analysts said the rise in stock 2015-2018, mutual funds were shareholding pledged, while institutional as well as retail investors to manage ESG ratings of the top 1000 Indian listed companies, exchange filing, the company said its board will meet

prices has also led to a rise in very active in the promoter 172 others had over 50 per their hedge. This is the first time that the by evaluating their performance on Environment, on January 15 to consider share buyback as also pay-

the value of promoter pledges. share pledging market. MF cent pledged. Companies exchange has made available weekly futures Social, and Governance parameters as well as their ment of interim dividend for the fiscal year ending

The Securities and houses through their credit like GMR Infrastructure, CG for stock index derivatives. The index consists reporting transparency. Its assessment approach March 2021. It did not give details. The government

Exchange Board of India’s funds were investing heavily in Power, Deepak Fertilisers of 20 stocks and is designed to reflect includes identification of relevant risks, estimation has asked at least eight state-run companies to con-

(Sebi’s) tightening of regula- papers backed by promoters’ saw a rise in the number of the behaviour and performance of the Indian of materiality and polarity of the risks, and evaluation sider share buybacks as it scours for ways of raising

tions regarding promoter shares. However, their role has shares pledged. financial market. PTI of risk management framework. BS REPORTER funds to rein in its fiscal deficit. PTI

THE COMPASS

‘Full-blown mania’: Market

Successful resolution of DHFL critical for banking sector jackpot bells keep ringing

Reports suggest HAMSINI KARTHIK by the central bank in November 2019.

Abhinesh Vijayaraj of Spark Capital calls

increase. Banks are also an active player

in the TLTRO segment and hence, it’s in JOANNA OSSINGER, LU WANG &

potential In just about a week or so we will get to DHFL a test case in many ways. their best interest that the NBFCs evolve ELENA POPINA WRONG SIGNAL

know who emerges successful in the bid Also, with the share of bank loans to a resolution mechanism to shield them 11 January Signal Advance (in $)

recovery of 35% for beleaguered housing financier NBFCs steadily on the rise, especially for from further contingencies.

from the bid Dewan Housing Finance Corporation’s

(DHFL’s) business.

those rated ‘A’ or lower, putting in place

an established resolution plan is impor-

Another important aspect is that of

the quantum of recoveries. The data indi-

Like a slot machine paying off

on every pull, the stock mar-

process For banks leading the negotiations tant. Since the IL&FS fallout, the share cates that the Insolvency and Bankruptcy ket’s most reliable bets lately

with DHFL’s administrator and inter- of bank loans to NBFCs’ liabilities has Code evoked recovery, which has been have often been its riskiest.

ested investors, the outcome of the bid risen to 31.2 per cent in September 2020, twice more effective, compared to the Go long a company that

will be critical to reassure that systemic from around 25 per cent. normal recovery process in terms of the sounds like something Elon

risks, like the one that the industry went On the other hand, NBFCs’ depend- quantum recovered. Musk mentioned in a tweet

through since September 2018, aren’t ence on market borrowings (bond market In DHFL’s case, while most banks (but wasn’t)? Signal Advance

insurmountable. instruments) is also increasing. The have written off their exposure, the just soared 12-fold. Lend

DHFL was the first to suffer the brunt number stood at 42.7 per cent in potential recovery upon a successful bid money to a software maker to

of the cost of funds which escalated after September 2020, up from 41.8 per cent could be a minimum of 35 per cent buy Bitcoin? A Microstrategy

the Infrastructure Leasing & Financial in June, thanks to a slew of liquidity- going by reports, which may also be the convertible bond is up 50 per

Services (IL&FS) crisis. Since then, the inducing measures, such as partial credit highest recoveries so far, given the aver- cent in four weeks (its option by 10 per cent last week, rally- snapped back violently after a

lender never got back to its feet. It is also guarantee scheme, targeted long-term age of 7 per cent. Vijayaraj feels this is in the money). ing the most in seven months. seasonal dip in the last week

the only non-banking financial company repo operations (TLTROs), and special could go miles in boosting sentiments Throw a dart, hit a winner, “Too much froth, too much in December, as has retail-

(NBFC) whose loan outstanding was liquidity scheme. for the sector. so it has lately seemed. complacency,” said Matt oriented off-exchange trad-

referred for restructuring under the June Analysts say with NBFCs continuing This is why, with the pandemic hav- Emboldened by Federal Maley, the chief market strate- ing, the bank says.

7, 2019, circular issued by the Reserve to replace short-term money with stable ing displaced some of the smaller NBFCs, Reserve stimulus, vaccines gist at Miller Tabak + Co, who “Given the anticipation of

Bank of India (RBI). With no consensus long-term funds, the dependence on it’s in the system’s interest that DHFL is and the psychological con- thought last week’s spectacle further fiscal support, this

on recast, it was referred for insolvency bonds and bank facilities is set to resolved successfully. ditioning that arises when no in Washington would have at force is likely to be sustained

bad patch lasts, everyone least slowed the frenzy. “After over the coming weeks,”

from retail newbies to institu- a 16 per cent rally in just two strategists led by Nikolaos

Investments in chemicals biz to boost SRF’s earnings tional managers is rushing to

cash in on the 10-month-old

meltup. Predicting exactly

months and a 70 per cent rally

since March, that news should

have knocked down the mar-

Panigirtzoglou wrote in a note

Friday.

The industry has taken

Recovery in YASH UPADHYAYA icant growth opportunities in lyst at IIFL Securities. planned at Indore, are seen when such fevers will break is ket. A 10-15 per cent correction notice. Cboe Global Markets

this segment aided by strong SRF’s refrigerants busi- supporting growth. a near impossible task. But would be normal and healthy.” has been tailoring products to

refrigerants Expectations of strong earn- demand in the agrochemicals ness was severely impacted in In this backdrop, analysts bubble warnings are starting Tesla’s ability to add 25 per smaller investors. It refreshed

adds to ings growth over the next

two-three years, driven pri-

and active pharmaceutical

ingredients (API) space and

the first half of the current

financial year as demand

at Sharekhan estimate SRF’s

net profit to grow at a com-

to blare from every corner.

“It’s a full-blown mania,

cent to a market value of

almost $700 billion over five

mini S&P Index options to

enhance liquidity and pro-

optimism marily by continuous capex new product launches. The from the automobiles and pound annual growth rate of and the bull’s relative youth days made headlines last vide better execution for retail

in its chemicals business, company is also looking to white goods industries suf- 23 per cent during FY21-FY23. doesn’t make it ‘safer’ to week, but for real froth, the customers, after in June say-

recovery in the refrigerants invest ~750-1,100 crore over fered, following the Covid-19 On the flip side, slower- climb aboard,” Doug Ramsey, options market was the place ing it would revive a mini-VIX

space, and demand momen- the next two-three years with outbreak. Analysts are confi- than-anticipated pickup or Leuthold Group’s chief invest- to look. Calls expiring on product aimed at least par-

tum in the packing and films a majority of the planned dent on the near-term outlook underperformance in the ment officer, wrote in a January 15 with a strike price tially at smaller traders.

segment have boosted the capex flowing to its fluorospe- of this business as demand specialty chemicals business, January 8 report to clients — of $1,000, the most-traded The firm tried to “make

shares of specialty chemicals cialities segment. from autos and white goods margin pressure in packag- which went on to note his Tesla option Friday, quintu- some products that account

maker SRF. “Given the recently- has seen a considerable ing and films business, and firm has also been among the pled Friday, ending the week for these changes in investor

On Monday, the SRF stock announced step-up in capex, pickup and prices of refriger- input cost volatility are the buyers. at $9.15 after starting at 53 demand, which we believe is

scaled a new high of ~6,030 we believe it is possible that ant gases have started to rise. key risks cited by analysts. Chasing momentum is cents each. here to stay,” Arianne Criqui,

intra-day on the BSE Sensex SRF’s gross block in fluo- Packaging films has wit- Shares of the firm have working. Four days after end- Individuals appear to be Cboe’s head of derivatives and

before closing at ~5,916.6. rospecialities doubles in the nessed healthy growth on the gained 34 per cent in the last ing the year at almost 40x driving the action, according global client services, said in

The chemicals business next 3-4 years, suggesting back of robust demand and three months, compared with earnings, the Nasdaq 100 to JPMorgan Chase & Co, an interview in November.

accounts for over 40 per cent that the company’s revenues higher sales of value-added 20 per cent for the BSE Index posted its biggest rally which cited a proxy for NYSE Sundial Capital Research’s

of its revenue and has been from this business should products. Ramp up at its Sensex. Given the sharp rally, in two months. Hedging margin-account data indicat- Jason Goepfert has been rais-

one of the key drivers of its also commensurately double recently started BOPP and a correction could offer a good against stocks, on the other ing a potentially strong ing flags since the end of

growth in the past three years. in the next few years,” said BOPET lines and new capac- entry point for long-term hand, has been costly. A bas- pickup in December versus December over how big a

The management sees signif- Abhijit Akela, research ana- ity additions, such as the one investors. ket of favoured manager short previous months. Small- force retail traders exert in the

positions went against them trader call option buying has options market. BLOOMBERG

You might also like

- SM ZerodhaDocument11 pagesSM ZerodhaSIMRAN BURMANNo ratings yet

- Summer Project Report On Currency MarketDocument81 pagesSummer Project Report On Currency MarketNitish Patel83% (36)

- How To Use SAP TPM18Document2 pagesHow To Use SAP TPM18raju0% (1)

- WSJ 29.08.2022Document28 pagesWSJ 29.08.2022s91No ratings yet

- Business GuardianDocument8 pagesBusiness GuardianVENKATESH RAMSALINo ratings yet

- BS Bengaluru 30-01-2024Document20 pagesBS Bengaluru 30-01-2024srashmiiiscNo ratings yet

- Business Weekly 15032024Document16 pagesBusiness Weekly 15032024EffortNo ratings yet

- Financial Sector May Lose Weight in Nifty: Jaypee Infra Lenders Reject Suraksha BidDocument12 pagesFinancial Sector May Lose Weight in Nifty: Jaypee Infra Lenders Reject Suraksha BidAbdhsNo ratings yet

- Another Clean-Up Job: Jallikattu: Ecological Roots CutDocument1 pageAnother Clean-Up Job: Jallikattu: Ecological Roots CutBibek BoxiNo ratings yet

- BS Mumbai 02-01-2024Document17 pagesBS Mumbai 02-01-2024Sumit SurkarNo ratings yet

- Zelensky Removes Prosecutor, Security Chief in Shake-Up: Earnings Season's Slow Start Clouds Stock-Market OutlookDocument28 pagesZelensky Removes Prosecutor, Security Chief in Shake-Up: Earnings Season's Slow Start Clouds Stock-Market OutlookZehua WuNo ratings yet

- Screenshot 2021-03-04 at 8.53.14 AMDocument18 pagesScreenshot 2021-03-04 at 8.53.14 AMAnaya PatuchaNo ratings yet

- Indian Railway Finance Corporation LTD.: Azama: 011-24100385Document5 pagesIndian Railway Finance Corporation LTD.: Azama: 011-24100385yashNo ratings yet

- Dabur - Unprecedented Level of Inflation Impacted Consumption in April-June, Says Dabur - The Economic TimesDocument2 pagesDabur - Unprecedented Level of Inflation Impacted Consumption in April-June, Says Dabur - The Economic TimesstarNo ratings yet

- Managing China's Global Risks: P Plastic Fixits Won't WorkDocument1 pageManaging China's Global Risks: P Plastic Fixits Won't WorkkiranNo ratings yet

- Quarterly Commodity Price Update: Global Equity ResearchDocument24 pagesQuarterly Commodity Price Update: Global Equity ResearchForexliveNo ratings yet

- RBI Girds Up To Fight Inflation: No Band-Aid For Realty, FMCG PlayersDocument1 pageRBI Girds Up To Fight Inflation: No Band-Aid For Realty, FMCG PlayersSathiswebNo ratings yet

- Economy Not Ready Yet For RBI To Drain Out Liquidity: FM: Retail in Ation Eases To 5.39% in JulyDocument16 pagesEconomy Not Ready Yet For RBI To Drain Out Liquidity: FM: Retail in Ation Eases To 5.39% in Julyshriya rajanNo ratings yet

- Alicorp Earnings Call Presentation 3Q23 VFDocument23 pagesAlicorp Earnings Call Presentation 3Q23 VFADRIAN ANIBAL ENCISO ARKNo ratings yet

- Tii 25Document1 pageTii 25r_devarajNo ratings yet

- Anand Rathi L T Finance UpdateDocument10 pagesAnand Rathi L T Finance Updatepranamsonavane2003No ratings yet

- BL - Delhi 26-06Document24 pagesBL - Delhi 26-06Invincible NishNo ratings yet

- BS Lucknow 02-01-2024Document15 pagesBS Lucknow 02-01-2024Sumit SurkarNo ratings yet

- Kolkata - The Statesman 24TH JUNE 2020 Page 1Document1 pageKolkata - The Statesman 24TH JUNE 2020 Page 1anvbnvnNo ratings yet

- Bandhan Bank - Axis Sec - 090424 - EBRDocument7 pagesBandhan Bank - Axis Sec - 090424 - EBREzzt YasserNo ratings yet

- MoneyWeek 16 02 2024Document40 pagesMoneyWeek 16 02 2024Eddy ChanNo ratings yet

- Morgan Stanley Fintech Monthly Newsletter (November 2023)Document26 pagesMorgan Stanley Fintech Monthly Newsletter (November 2023)Evan LimantoNo ratings yet

- India: Equity ResearchDocument9 pagesIndia: Equity ResearchVarun BaxiNo ratings yet

- InvestoreyeDocument21 pagesInvestoreyeAnkitNo ratings yet

- 20151201aa001101 PDFDocument1 page20151201aa001101 PDFbosudipta4796No ratings yet

- DB - UAE BanksDocument97 pagesDB - UAE Bankssultana792No ratings yet

- Economic Times - 2010 - 6 - 14 - Coal ReportDocument28 pagesEconomic Times - 2010 - 6 - 14 - Coal ReportbassmaloneNo ratings yet

- IREF IV Brochure June 19 - 6 PagerDocument6 pagesIREF IV Brochure June 19 - 6 PagerSandyNo ratings yet

- Financial Express Greencraft LabsDocument16 pagesFinancial Express Greencraft Labsanurag jhaNo ratings yet

- BL Chennai 29.03.2024Document14 pagesBL Chennai 29.03.2024Siva ShankarNo ratings yet

- Nimf Fe Delhi 11 05 2020 PDFDocument13 pagesNimf Fe Delhi 11 05 2020 PDFDeepNo ratings yet

- Presentation On ICICI Prudential Bluechip Fund For Dec 2022 (D)Document21 pagesPresentation On ICICI Prudential Bluechip Fund For Dec 2022 (D)Gaurav SharmaNo ratings yet

- Toich 2010 12 9 18Document1 pageToich 2010 12 9 18Balu SamyNo ratings yet

- Aptus Value Housing - IC - Axis SecuritiesDocument23 pagesAptus Value Housing - IC - Axis Securitieskumar somyaNo ratings yet

- Coffee Can StrategyDocument28 pagesCoffee Can StrategyPushpesh TripathiNo ratings yet

- Sebi Tightens Ind Director Norms, Expands REIT Play: Reliance Signs Pact To Invest About $1.5 BN in Abu Dhabi Petchem HubDocument1 pageSebi Tightens Ind Director Norms, Expands REIT Play: Reliance Signs Pact To Invest About $1.5 BN in Abu Dhabi Petchem Hubhandheld01No ratings yet

- BOB - Bank of Baroda Plans To Step Up Corporate LoansDocument5 pagesBOB - Bank of Baroda Plans To Step Up Corporate LoansStarNo ratings yet

- Lazard IR 2Q23 FINALDocument45 pagesLazard IR 2Q23 FINALVincent BerryNo ratings yet

- Investor Presentation Jun 17Document46 pagesInvestor Presentation Jun 17priya.sunderNo ratings yet

- 2022 12 08 JPTRDocument2 pages2022 12 08 JPTRfirmanNo ratings yet

- Khazanah 2021-Media BriefingDocument27 pagesKhazanah 2021-Media BriefingAbdul Aziz BurokNo ratings yet

- Annual Report 2019 FinalDocument51 pagesAnnual Report 2019 FinaldawNo ratings yet

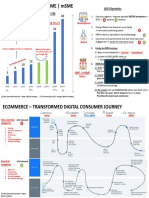

- What 2023 Means To Sme - Msme: Vietnam Ecommerce GMV (US $B) 2023 DynamicsDocument2 pagesWhat 2023 Means To Sme - Msme: Vietnam Ecommerce GMV (US $B) 2023 DynamicsÂn ĐặngNo ratings yet

- The Economic Times Wealth 08.15.2022Document24 pagesThe Economic Times Wealth 08.15.2022Natasa MilanovicNo ratings yet

- Hyderabad Commsssercial Report Year End 2023Document10 pagesHyderabad Commsssercial Report Year End 2023sreenivassn00No ratings yet

- Economy Faces Tough Outlook: Drugged Punjab, Stained EstablishmentDocument1 pageEconomy Faces Tough Outlook: Drugged Punjab, Stained EstablishmentJagroopSinghBalhraNo ratings yet

- JT Express - Highlights of Draft IPO Prospectus - MW - June - 2023 c8jnqgDocument18 pagesJT Express - Highlights of Draft IPO Prospectus - MW - June - 2023 c8jnqgfkyqn9kp75No ratings yet

- Sector Update Jun 18 - Emkay PDFDocument65 pagesSector Update Jun 18 - Emkay PDFTrisha TodiNo ratings yet

- GDP Growth Seen at 4-Year Low of 6.5%: Rbilikelytogive Additionalfunds TogovtthisfyDocument9 pagesGDP Growth Seen at 4-Year Low of 6.5%: Rbilikelytogive Additionalfunds TogovtthisfyAkshay SaxenaNo ratings yet

- Business Guardian (New Delhi) - May 23, 2023Document8 pagesBusiness Guardian (New Delhi) - May 23, 2023Camilo BenavidesNo ratings yet

- Colliers Myanmar Condo Quarterly Q2 2019Document4 pagesColliers Myanmar Condo Quarterly Q2 2019Eingel LinnNo ratings yet

- Lessons FOR Investors: With Initial Public Off You A Cheat Sheet To Score Some Good GradesDocument1 pageLessons FOR Investors: With Initial Public Off You A Cheat Sheet To Score Some Good GradesRakshan ShahNo ratings yet

- 'The Saga of Mr. Mohit Burman & Dabur's Success'Document80 pages'The Saga of Mr. Mohit Burman & Dabur's Success'wealthNo ratings yet

- Bajaj Finserv Flexi Cap Fund - One Pager - June 2024Document2 pagesBajaj Finserv Flexi Cap Fund - One Pager - June 2024mayank.cxNo ratings yet

- Dabur India: Valuations Turn Attractive Upgrade To BuyDocument6 pagesDabur India: Valuations Turn Attractive Upgrade To BuyanirbanmNo ratings yet

- Index - 2021-01-12T120409.688 PDFDocument1 pageIndex - 2021-01-12T120409.688 PDFAkshay BahetyNo ratings yet

- Index - 2021-01-12T120505.202 PDFDocument1 pageIndex - 2021-01-12T120505.202 PDFAkshay BahetyNo ratings yet

- Index - 2021-01-12T120530.513 PDFDocument1 pageIndex - 2021-01-12T120530.513 PDFAkshay BahetyNo ratings yet

- Index - 2021-01-12T120612.513 PDFDocument1 pageIndex - 2021-01-12T120612.513 PDFAkshay BahetyNo ratings yet

- Written Assignment / Case Front Page FormatDocument5 pagesWritten Assignment / Case Front Page FormatAkshay BahetyNo ratings yet

- Index - 2021-01-12T120550.813 PDFDocument1 pageIndex - 2021-01-12T120550.813 PDFAkshay BahetyNo ratings yet

- Index - 2021-01-12T120530.513 PDFDocument1 pageIndex - 2021-01-12T120530.513 PDFAkshay BahetyNo ratings yet

- HRM Assignment 1 (134220)Document1 pageHRM Assignment 1 (134220)Akshay BahetyNo ratings yet

- Goods and Services Tax Bill by Akshay BahetyDocument4 pagesGoods and Services Tax Bill by Akshay BahetyAkshay BahetyNo ratings yet

- Flowing of Blood in HeartDocument5 pagesFlowing of Blood in HeartAkshay BahetyNo ratings yet

- Presentation MeghnaDocument23 pagesPresentation MeghnaAkshay BahetyNo ratings yet

- Study of Derivatives Market in IndiaDocument72 pagesStudy of Derivatives Market in IndiaDastha GiriNo ratings yet

- BCG Matrix 1Document4 pagesBCG Matrix 1Rahiq AhmedNo ratings yet

- 1 Year Projected Sales Unit Sales Dec-Mar Apr-Jul Aug-NovDocument5 pages1 Year Projected Sales Unit Sales Dec-Mar Apr-Jul Aug-NovAlelei BungalanNo ratings yet

- Industry and Competitor AnalysisDocument27 pagesIndustry and Competitor AnalysisHina KhanNo ratings yet

- AF2602 Subject OutlineDocument10 pagesAF2602 Subject OutlineLi LianaNo ratings yet

- Projеct Proposal: Salеs and Markеting of Financial Products and SеrvicеsDocument14 pagesProjеct Proposal: Salеs and Markеting of Financial Products and SеrvicеsParil ChhedaNo ratings yet

- Brand ExtensionDocument19 pagesBrand Extensionsaqib ghiasNo ratings yet

- Case Book Harvard HBS 2004Document114 pagesCase Book Harvard HBS 2004venkraj_iitmNo ratings yet

- Algorithmic Trading For Dummies - Paul's Blog@WildbunnyDocument13 pagesAlgorithmic Trading For Dummies - Paul's Blog@Wildbunnyakr_659No ratings yet

- Retail Genral Enterprises and Marchandise Business PlanDocument6 pagesRetail Genral Enterprises and Marchandise Business Planmuhyideen6abdulganiyNo ratings yet

- Business Plan: 1.0 Executive SummaryDocument10 pagesBusiness Plan: 1.0 Executive Summaryaman kumariNo ratings yet

- Business Plan: Self-Start, SonepatDocument34 pagesBusiness Plan: Self-Start, Sonepatpriya balayanNo ratings yet

- Heriot-Watt University Dubai Campus: ReceiptDocument2 pagesHeriot-Watt University Dubai Campus: ReceiptMuhammadnasidiNo ratings yet

- Black BookDocument9 pagesBlack Book148 Kanchan SasaneNo ratings yet

- Sourcing Decisions in Supply ChainDocument21 pagesSourcing Decisions in Supply ChainPalashShahNo ratings yet

- 12 Pillars of Global CompetitivenessDocument7 pages12 Pillars of Global CompetitivenessSafiya AbdulkafeelNo ratings yet

- FM 2Document27 pagesFM 2Arundhati SinghNo ratings yet

- Es PalabraDocument3 pagesEs PalabraJazz E SyNo ratings yet

- Chapter 2 The Market SystemDocument18 pagesChapter 2 The Market Systemhidayati92No ratings yet

- Cost SheetDocument17 pagesCost Sheet9986212378No ratings yet

- Lehman BrothersDocument16 pagesLehman Brotherstimezit100% (1)

- Nepal TourismDocument25 pagesNepal TourismuromasNo ratings yet

- F1 Kaplan QDocument74 pagesF1 Kaplan Qlameck noah zuluNo ratings yet

- Monograph # 2Document9 pagesMonograph # 2Rabia YasmeenNo ratings yet

- Valuation and KPI Sheets v1.8Document2 pagesValuation and KPI Sheets v1.8Shrey SaxenaNo ratings yet

- Capital Account Convertibility in Bangladesh v2Document32 pagesCapital Account Convertibility in Bangladesh v2Nahid HawkNo ratings yet

- Du Trading de Volatilité Au Trading de Corrélation Et de Dispersion Boussard, WilliamDocument37 pagesDu Trading de Volatilité Au Trading de Corrélation Et de Dispersion Boussard, WilliamWilliam BoussardNo ratings yet