Professional Documents

Culture Documents

Class Work For Chapter 10

Class Work For Chapter 10

Uploaded by

Madiha Abu Saied Tazul Islam 1721217Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class Work For Chapter 10

Class Work For Chapter 10

Uploaded by

Madiha Abu Saied Tazul Islam 1721217Copyright:

Available Formats

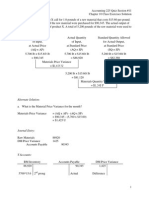

Exercise 10-1

Flandar Industries Berhad of Malaysia manufactures sporting equipment.

One of the company’s products, a football helmet for the North American

market, requires a special plastic. During the quarter ending June 30, the

company manufactured 35,000 helmets, using 22,500 kilograms of plastic.

The plastic cost the company $171,000.

According to the standard cost card, each helmet should require 0.6

kilograms of plastic, at a cost of $8 per kilogram.

Required: 1. According to the standards, what cost for plastic should

have been incurred to make 35,000 helmets? How much greater or less is

this than the cost that was incurred?

2 . Break down the difference computed in (1) above into a materials

price variance and a materials quantity variance.

Solution

1. Number of helmets............................................ 35,000

Standard kilograms of plastic per helmet............. × 0.6

Total standard kilograms allowed....................... 21,000

Standard cost per kilogram................................ × $8

Total standard cost............................................ $168,000

Actual cost incurred (given)............................... $171,000

Total standard cost (above)............................... 168,000

Total material variance—unfavorable.................. $ 3,000

2 The variances can be computed using the formulas:

Materials price variance = AQ (AP – SP)

22,500 kilograms ($7.60 per kilogram* – $8.00 per kilogram)

= $9,000 F

* $171,000 ÷ 22,500 kilograms = $7.60 per kilogram

Materials quantity variance = SP (AQ – SQ)

$8 per kilogram (22,500 kilograms – 21,000 kilograms)

= $12,000 U

. *35,000 helmets × 0.6 kilograms per helmet = 21,000 kilograms

EXERCISE 10–2

Direct Labor Variances [LO10–2] SkyChefs, Inc., prepares in-flight meals

for a number of major airlines. One of the company’s products is grilled

salmon in dill sauce with baby new potatoes and spring vegetables. During

the most recent week, the company prepared 4,000 of these meals using

960 direct labor-hours. The company paid these direct labor workers a total

of $9,600 for this work, or $10.00 per hour. A ccording to the standard

cost card for this meal, it should require 0.25 direct labor-hours at a cost of

$9.75 per hour.

Required: 1. According to the standards, what direct labor cost should

have been incurred to prepare 4,000 meals? How much does this differ

from the actual direct labor cost?

2 . Break down the difference computed in (1) above into a labor rate

variance and a labor efficiency variance.

Solution

1. Number of meals prepared.................... 4,000

Standard direct labor-hours per meal..... × 0.25

Total direct labor-hours allowed............. 1,000

Standard direct labor cost per hour........ × $9.75

Total standard direct labor cost............. $9,750

Actual cost incurred.............................. $9,600

Total standard direct labor cost (above). 9,750

Total direct labor variance..................... $ 150 Favorable

2. The variances can be computed using the formulas:

Labor rate variance = AH(AR – SR)

= 960 hours ($10.00 per hour – $9.75 per hour)

= $240 U

Labor efficiency variance = SR(AH – SH)

= $9.75 per hour (960 hours – 1,000 hours)

= $390 F

EXERCISE 10–3 Variable Overhead Variances [LO10–3] L ogistics

Solutions provides order fulfillment services for d ot.com merchants. The

company maintains warehouses that stock items carried by its d ot.com

clients. When a client receives an order from a customer, the order is

forwarded to Logistics Solutions, which pulls the item from storage, packs

it, and ships it to the customer. The company uses a predetermined

variable overhead rate based on direct labor-hours. I n the most recent

month, 120,000 items were shipped to customers using 2,300 direct

laborhours. The company incurred a total of $7,360 in variable overhead

costs. According to the company’s standards, 0.02 direct labor-hours are

required to fulfill an order for one item and the variable overhead rate is

$3.25 per direct labor-hour.

Required: 1. According to the standards, what variable overhead cost

should have been incurred to fill the orders for the 120,000 items? How

much does this differ from the actual variable overhead cost?

2. Break down the difference computed in (1) above into a variable

overhead rate variance and a variable overhead efficiency variance.

Solution

1. Number of items shipped................................. 120,000

Standard direct labor-hours per item................ × 0.02

Total direct labor-hours allowed....................... 2,400

Standard variable overhead cost per hour......... × $3.25

Total standard variable overhead cost.............. $ 7,800

Actual variable overhead cost incurred.............. $7,360

Total standard variable overhead cost (above). . 7,800

Total variable overhead variance...................... $ 440 Favorable

2. The variances can be computed using the formulas:

Variable overhead rate variance:

AH(AR – SR) = 2,300 hours ($3.20 per hour – $3.25 per hour)

= $115 F

Variable overhead efficiency variance:

SR(AH – SH) = $3.25 per hour (2,300 hours – 2,400 hours)

= $325 F

*$7,360 ÷ 2,300 hours = $3.20 per hour

You might also like

- Strategic Human Resources Planning 7th Edition Belcourt Test BankDocument16 pagesStrategic Human Resources Planning 7th Edition Belcourt Test BankMrsStephanieVincentMDaerjk100% (15)

- Activity-Based Costing - Sample Problems With SolutionsDocument5 pagesActivity-Based Costing - Sample Problems With SolutionsMarjorie Nepomuceno100% (1)

- Jenga Inc Solution Year 1 Year 2: © Corporate Finance InstituteDocument2 pagesJenga Inc Solution Year 1 Year 2: © Corporate Finance InstitutePirvuNo ratings yet

- BigbasketDocument1 pageBigbasketKritikaNo ratings yet

- Nama: Nabila Indri Yani No. BP: 2010931037 Tugas 1: Analisis Dan Estimasi BiayaDocument4 pagesNama: Nabila Indri Yani No. BP: 2010931037 Tugas 1: Analisis Dan Estimasi BiayaInnabilaNo ratings yet

- Final Exam - Ba 213Document6 pagesFinal Exam - Ba 213api-408647155100% (1)

- Chart of Accounts FABM1Document8 pagesChart of Accounts FABM1Mylene Santiago100% (3)

- Chapter 19 - Professional Conduct, Independence, and Quality ControlDocument18 pagesChapter 19 - Professional Conduct, Independence, and Quality ControlBlake CrusiusNo ratings yet

- Assignment Marketing - DBFA 2009-37 LatestDocument23 pagesAssignment Marketing - DBFA 2009-37 Latestcjayaneththi100% (3)

- Accounting For Ijarah and Ijarah MuntahiaDocument12 pagesAccounting For Ijarah and Ijarah Muntahiatheintelligentgirl100% (1)

- ASG 3 Soloist PDFDocument4 pagesASG 3 Soloist PDFJohnsen PratamaNo ratings yet

- BACOSTMX Module 8 Self-ReviewerDocument10 pagesBACOSTMX Module 8 Self-ReviewerAlyssa CaddawanNo ratings yet

- Hite Company Has Developed The Following Standard Costs For Its Product For 2009Document6 pagesHite Company Has Developed The Following Standard Costs For Its Product For 2009Ghaill CruzNo ratings yet

- MGT Acc SolutionsDocument34 pagesMGT Acc Solutionsshamsirarefin275285No ratings yet

- Hilton CH 15 Select SolutionsDocument11 pagesHilton CH 15 Select SolutionsPiyushSharmaNo ratings yet

- DocxDocument15 pagesDocxAhsan IqbalNo ratings yet

- Ch10ex10-3 Cost AccountingDocument2 pagesCh10ex10-3 Cost AccountingRichKingNo ratings yet

- Flexible BudgetDocument3 pagesFlexible BudgetGregorian JerahmeelNo ratings yet

- Chapter 8 Homework MADocument13 pagesChapter 8 Homework MAErvin Jello Rosete RagonotNo ratings yet

- Acct 260 Chapter 11Document38 pagesAcct 260 Chapter 11John Guy100% (1)

- Chapter 111Document4 pagesChapter 111ym5c2324No ratings yet

- Chương 2-3 10đ - 2Document4 pagesChương 2-3 10đ - 2Trần Khánh VyNo ratings yet

- Hilton CH 6 Select SolutionsDocument19 pagesHilton CH 6 Select SolutionsRaymondSinegar100% (1)

- Chapter 2 Selected Answers PDFDocument16 pagesChapter 2 Selected Answers PDFsadiaNo ratings yet

- Flexible Budget and VarianceDocument8 pagesFlexible Budget and VarianceLhorene Hope DueñasNo ratings yet

- ADMS 2510 Week 13 SolutionsDocument20 pagesADMS 2510 Week 13 Solutionsadms examzNo ratings yet

- Hilton CH 10 Select SolutionsDocument24 pagesHilton CH 10 Select SolutionsRaza Ze0% (1)

- Exercise 9-10: Solutions (12/01)Document8 pagesExercise 9-10: Solutions (12/01)ppaulyni33No ratings yet

- QS11 - Class Exercises SolutionDocument8 pagesQS11 - Class Exercises Solutionlyk0tex100% (2)

- 商四 A 管理會計 九十五學年度第二學期 QUIZ 2 原屬班級: - - - - - - - - - - - 學號: - - - - - - - - - - - 姓名: - - - - - - - - - - - - - - -Document4 pages商四 A 管理會計 九十五學年度第二學期 QUIZ 2 原屬班級: - - - - - - - - - - - 學號: - - - - - - - - - - - 姓名: - - - - - - - - - - - - - - -Parth ParthNo ratings yet

- ACCT 2302 Summer II, 2007 Exam 3 Chapter 10-13: Answer: C Level: Easy LO: 2Document13 pagesACCT 2302 Summer II, 2007 Exam 3 Chapter 10-13: Answer: C Level: Easy LO: 2Chris Jay LatibanNo ratings yet

- Standard Costing Quiz 2Document2 pagesStandard Costing Quiz 2Shafni DulnuanNo ratings yet

- Garrison 13e Practice Exam - Chapter 11Document6 pagesGarrison 13e Practice Exam - Chapter 11pujarze2No ratings yet

- MAS TEST With AnswerDocument10 pagesMAS TEST With Answerjoneth.duenasNo ratings yet

- Problem10 18 and 10 20Document10 pagesProblem10 18 and 10 20roseNo ratings yet

- Key Chapter 2 & 3Document9 pagesKey Chapter 2 & 3bxp9b56xv4No ratings yet

- Solution P5 - 4656Document5 pagesSolution P5 - 4656HO JING YI MBS221190No ratings yet

- Standard Costing and Variance Analysis Problems Exam SolutionDocument5 pagesStandard Costing and Variance Analysis Problems Exam SolutionsarahbeeNo ratings yet

- Instructions: Please Complete All 3 Multi-Part Problems For This Week's AssignmentDocument4 pagesInstructions: Please Complete All 3 Multi-Part Problems For This Week's AssignmentMike FasanoNo ratings yet

- Standard CostingDocument12 pagesStandard CostingKUNAL GOSAVINo ratings yet

- Test Bank For Engineering Economy 16th Edition by Sullivan Wicks Koelling ISBN 0133439275 9780133439274Document35 pagesTest Bank For Engineering Economy 16th Edition by Sullivan Wicks Koelling ISBN 0133439275 9780133439274AshleyParksegn100% (27)

- Test Bank For Engineering Economy 16Th Edition by Sullivan Wicks Koelling Isbn 0133439275 9780133439274 Full Chapter PDFDocument25 pagesTest Bank For Engineering Economy 16Th Edition by Sullivan Wicks Koelling Isbn 0133439275 9780133439274 Full Chapter PDFmindy.sorrell339100% (18)

- Evaluating Personnel and DivisionsDocument37 pagesEvaluating Personnel and DivisionsGaluh Boga KuswaraNo ratings yet

- CH 3Document12 pagesCH 3Firas HamadNo ratings yet

- Chapter 3 Sol 11-20Document4 pagesChapter 3 Sol 11-20Something ChicNo ratings yet

- Activity Based Costing Sample Problems With Solutions - CompressDocument5 pagesActivity Based Costing Sample Problems With Solutions - CompressRaniya H. H.NaimNo ratings yet

- Activity-Based Costing - Sample Problems With SolutionsDocument5 pagesActivity-Based Costing - Sample Problems With Solutionsfaye pantiNo ratings yet

- Solutions To Relevant Cost ProblemsDocument13 pagesSolutions To Relevant Cost ProblemsAndrian VillanuevaNo ratings yet

- AccDocument15 pagesAccMartin TrịnhNo ratings yet

- ABC MethodDocument6 pagesABC MethodPrincess RapisuraNo ratings yet

- Exercise STD CostingDocument1 pageExercise STD CostingMaria Callista LovinaNo ratings yet

- Problem 18 - 18 18 - 31 and 18 - 32Document5 pagesProblem 18 - 18 18 - 31 and 18 - 32anon_459698449No ratings yet

- Standard Costing and Balanced ScorecardDocument25 pagesStandard Costing and Balanced ScorecardMary Joy BalangcadNo ratings yet

- Sol ch03Document12 pagesSol ch03Ahmed MousaNo ratings yet

- Cost and IntaccDocument6 pagesCost and IntaccSAFLOR, Edlyn Mae A.No ratings yet

- Cost Accounting AssigDocument6 pagesCost Accounting AssigHamse HusseinNo ratings yet

- Review Problem 1: Variance Analysis Using A Flexible Budget: RequiredDocument12 pagesReview Problem 1: Variance Analysis Using A Flexible Budget: RequiredGraieszian Lyra100% (1)

- Nabila Indri Yani 2010931037 Tugas AEBDocument4 pagesNabila Indri Yani 2010931037 Tugas AEBInnabilaNo ratings yet

- Acct 260 CHAPTER 8Document25 pagesAcct 260 CHAPTER 8John Guy0% (1)

- Quiz 3 SolutionDocument5 pagesQuiz 3 SolutionMichel BanvoNo ratings yet

- Sanders CompanyDocument6 pagesSanders CompanyculadiNo ratings yet

- 11 Standard CostingDocument30 pages11 Standard CostingLalan JaiswalNo ratings yet

- Chaper 78Document4 pagesChaper 78Nyan Lynn HtunNo ratings yet

- OM Numerical 2012Document27 pagesOM Numerical 2012Daneyal MirzaNo ratings yet

- 201B Exam 3 PracticeDocument16 pages201B Exam 3 PracticeChanel NguyenNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Department of Biochemistry & Microbiology, North South UniversityDocument16 pagesDepartment of Biochemistry & Microbiology, North South UniversityMadiha Abu Saied Tazul Islam 1721217No ratings yet

- ACT202 Term PaperDocument2 pagesACT202 Term PaperMadiha Abu Saied Tazul Islam 1721217No ratings yet

- Lecture 4 BIO201Document34 pagesLecture 4 BIO201Madiha Abu Saied Tazul Islam 1721217No ratings yet

- Lecture 2 BIO201Document31 pagesLecture 2 BIO201Madiha Abu Saied Tazul Islam 1721217No ratings yet

- Hello, Ami Madiha Ajk Ami Uposthapon Korbo Amar Kathladori Er Assignment Abong Er Moddhe Ami Ki Grohon Korte PerechiDocument3 pagesHello, Ami Madiha Ajk Ami Uposthapon Korbo Amar Kathladori Er Assignment Abong Er Moddhe Ami Ki Grohon Korte PerechiMadiha Abu Saied Tazul Islam 1721217No ratings yet

- Lecture 3 BIO201Document32 pagesLecture 3 BIO201Madiha Abu Saied Tazul Islam 1721217No ratings yet

- SLA Cover Page and Answer ScriptDocument4 pagesSLA Cover Page and Answer ScriptMadiha Abu Saied Tazul Islam 1721217No ratings yet

- FALL 2020 INB 372 (International Business) Student Learning Assessment (SLA) CaseDocument5 pagesFALL 2020 INB 372 (International Business) Student Learning Assessment (SLA) CaseMadiha Abu Saied Tazul Islam 1721217No ratings yet

- Modeling Data in The Organization (Data Analysis)Document38 pagesModeling Data in The Organization (Data Analysis)Madiha Abu Saied Tazul Islam 1721217No ratings yet

- The Database Environment and Development ProcessDocument21 pagesThe Database Environment and Development ProcessMadiha Abu Saied Tazul Islam 1721217No ratings yet

- Project Proposal - BUS 251: Subject: Proposal For Selecting Japan As The Preferred Country For Expansion With EnglishDocument3 pagesProject Proposal - BUS 251: Subject: Proposal For Selecting Japan As The Preferred Country For Expansion With EnglishMadiha Abu Saied Tazul Islam 1721217No ratings yet

- BUS251 Understanding Business Communication: by The Group: Pineapple Pizza Is A SinDocument1 pageBUS251 Understanding Business Communication: by The Group: Pineapple Pizza Is A SinMadiha Abu Saied Tazul Islam 1721217No ratings yet

- Dissertation Financial MathematicsDocument7 pagesDissertation Financial MathematicsCustomWritingPapersSingapore100% (1)

- Lec 2 Final Eng - EcoDocument16 pagesLec 2 Final Eng - EcoSoundhar RajanNo ratings yet

- T09 - Not-for-Profit Organizations PDFDocument9 pagesT09 - Not-for-Profit Organizations PDFriver garciaNo ratings yet

- Log21 - Logistics For The 21st Century ProgramDocument1 pageLog21 - Logistics For The 21st Century ProgramThom RoddyNo ratings yet

- Chapter 12Document38 pagesChapter 12Troy CrooksNo ratings yet

- The Sale of GoodsDocument23 pagesThe Sale of GoodsNabil Islam 26No ratings yet

- ABC Menurut LEN HOLMDocument15 pagesABC Menurut LEN HOLMNur halivaNo ratings yet

- Mariveles Water District Bataan Executive Summary 2021Document4 pagesMariveles Water District Bataan Executive Summary 2021jncbrazilNo ratings yet

- Michael E. MatzDocument3 pagesMichael E. MatzmemseaNo ratings yet

- Zero To One-Book Review (By Divya Anand)Document27 pagesZero To One-Book Review (By Divya Anand)DEEPALI ANANDNo ratings yet

- About Profiles Asia Pacific Inc.Document2 pagesAbout Profiles Asia Pacific Inc.Ninoy C CarranzaNo ratings yet

- Creating Agility The Next Agenda For Strategy Organization Leaders and Individuals PDFDocument63 pagesCreating Agility The Next Agenda For Strategy Organization Leaders and Individuals PDFYurika Fauzia WardhaniNo ratings yet

- Neil Patel Digital India - Business Deck 1.0Document30 pagesNeil Patel Digital India - Business Deck 1.0Vishnu 2018No ratings yet

- Business Analytics and Data Warehouse Evaluation - Information BuildersDocument10 pagesBusiness Analytics and Data Warehouse Evaluation - Information BuildersSeth FordNo ratings yet

- SPE-189139-MS Integrating Modular Refining and Marginal Field Operations Under Proposed Fiscal Terms - Is Value Possible?Document12 pagesSPE-189139-MS Integrating Modular Refining and Marginal Field Operations Under Proposed Fiscal Terms - Is Value Possible?Thuunder ThunderNo ratings yet

- GSTR1 03ajdpk8658g1z5 032023Document7 pagesGSTR1 03ajdpk8658g1z5 032023SANJEEV KUMARNo ratings yet

- Carta NSF-Feb 3, 2011-UPR's Corrective Action Plan Approval Letter - W NotesDocument73 pagesCarta NSF-Feb 3, 2011-UPR's Corrective Action Plan Approval Letter - W NotesmarioNo ratings yet

- Cadbury ProposalDocument9 pagesCadbury ProposalNurul AinNo ratings yet

- Research Papers On Credit Risk Management in BanksDocument6 pagesResearch Papers On Credit Risk Management in Banksgz7gh8h0No ratings yet

- Bom PresentationDocument27 pagesBom PresentationprashantNo ratings yet

- Spring 2020 Activity PacketDocument20 pagesSpring 2020 Activity PacketCarolina EstradaNo ratings yet

- The AgileguidetobusinessanalystsDocument5 pagesThe AgileguidetobusinessanalystsSumit TripathiNo ratings yet

- Assignment - 4Document4 pagesAssignment - 4Simoni Viral ShahNo ratings yet