Professional Documents

Culture Documents

Profit: NMB Bank PLC Audited Financial Statements

Profit: NMB Bank PLC Audited Financial Statements

Uploaded by

MFIIFM2022Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profit: NMB Bank PLC Audited Financial Statements

Profit: NMB Bank PLC Audited Financial Statements

Uploaded by

MFIIFM2022Copyright:

Available Formats

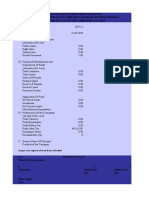

NMB BANK PLC AUDITED FINANCIAL STATEMENTS

Issued pursuant to regulations 7 and 8 of the Banking and Financial Institutions (Disclosures) Regulations, 2014

AUDITED STATEMENT OF FINANCIAL POSITION AUDITED STATEMENT OF CASH FLOW

FOR THE YEAR ENDED 31 DECEMBER, 2019

TZS 4.9 Trillion AS AT 31ST DECEMBER, 2019

GROUP GROUP

(Amounts in million shillings)

BANK BANK

GROUP

Current Year

GROUP

Previous Year

(Amounts in million shillings)

BANK

Current Year

BANK

Previous Year

Customer Current Year Previous Year Current Year Previous Year

31.12.19 31.12.18 31.12.19 31.12.18

Deposits

I: Cash flow from Operating activities:

31.12.19 31.12.18 31.12.19 31.12.18

Net income (loss) 215,861 144,362 211,088 141,641

A. ASSETS

Adjustment for:

1 Cash 498,231 402,709 498,231 402,709

- Impairment/amortization 73,367 55,904 73,609 53,933

2 Balances with Bank of Tanzania 842,909 667,713 842,909 667,713 - Net change in loans and advances (348,605) (484,410) (343,894) (479,487)

3 Investments in Government securities 761,554 740,185 761,554 740,185 - Gain/loss on sale of assets (131) (143) (131) (143)

3.6 Trillion

4 Balances with other banks and financial institutions 264,326 174,391 264,326 174,391 - Net change in deposits 614,007 64,677 607,347 76,973

5 Cheques and items for clearing 4,152 1,613 4,152 1,613 - Net change in short term negotiable securities (2,717) (2,630) (2,717) (2,630)

TZS 6 Inter branch float items - - - - - Net change in other liabilities 36,843 49,403 54,422 38,344

- Net change in other assets (21,716) (28,572) (36,876) (30,040)

Loan &

7 Bills negotiated - - - -

- Tax paid (60,418) (68,480) (56,357) (68,480)

8 Customers' liabitities for acceptances - - - -

Advances

- Others 10,063 (12,301) 10,063 (12,301)

9 Interbank loans receivables - - - -

Net cash provided (used) by operating activities 516,554 (282,190) 516,554 (282,190)

10 Investments in other securities - - - -

Loans, advances and overdrafts II: Cash flow from Investing activities:

11 3,590,006 3,241,401 3,595,688 3,251,794

(net of allowances for probable losses) Dividends received - - - -

Purchase of fixed assets (12,649) (25,530) (12,649) (25,530)

6.4 Trillion

12 Other assets 214,160 179,581 383,191 212,052

Proceeds from sale of fixed assets 292 365 292 365

13 Equity investments 2,920 2,920 2,920 2,920

Purchase of non-dealing securities (659,892) (608,848) (659,892) (608,848)

TZS 14 Underwriting accounts - - - -

Proceeds from sale of non-dealing securities 641,480 791,522 641,480 791,522

15 Property, Plant and equipment 239,169 265,700 203,044 227,607

Others-(Equity investment and Securities) (10,967) (11,930) (10,967) (11,930)

Total 16 TOTAL ASSETS 6,417,427 5,676,213 6,556,015 5,680,984 Net cash provided (used) by investing activities (41,736) 145,579 (41,736) 145,579

Assets

III: Cash Flow from Financing activities:

B. LIABILITIES Repayment of long-term debt - - - -

17 Deposits from other banks and financial institutions 33,446 20,770 33,446 20,770 Proceeds from issuance of long term debt - 68,190 - 68,190

18 Customer deposits 4,882,123 4,274,732 4,887,850 4,287,119 Proceeds from issuance of share capital - - - -

19 Cash letters of credit 19,833 22,535 19,833 22,535 Payment of cash dividends (33,000) (32,000) (33,000) (32,000)

Net change in other borrowings (71,102) (66,120) (71,102) (66,120)

20 Special Deposits 14,595 17,953 14,595 17,953

Others (Specify) (60) 6,861 (60) 6,861

21 Payment orders/transfers payable - - - -

Net cash provided(used) by financing activities (104,162) (23,069) (104,162) (23,069)

22 Bankers’ cheques and drafts issued - - - -

23 Accrued taxes and expenses payable 33,355 35,019 33,355 35,019 IV: Cash and Cash equivalents:

24 Acceptances outstanding - - - - Net increase/(decrease) in cash and cash equivalents 370,656 (159,680) 370,656 (159,680)

Cash and cash equivalents at the beginning of the Quarter/Year 842,714 1,002,394 842,714 1,002,394

25 Inter branch float items - - - -

26 Unearned income and other deferred charges - - - - Cash and cash equivalents at the end of the Quarter/Year 1,213,370 842,714 1,213,370 842,714

Non 27 Other liabilities 117,530 75,649 247,104 62,174

28 Borrowings 347,443 372,360 347,443 372,360

CONDENSED BANK’S STATEMENT OF CHANGES IN EQUITY

Interest 29 TOTAL LIABILITIES 5,448,325 4,819,018 5,583,626 4,817,930

AS AT 31TH DECEMBER 2019 (Amounts in million shillings)

Income 30 NET ASSETS /(LIABILITIES) 969,102 857,195 972,389 863,054

4%

General

Share Share Retained Regulatory Others (Fair Valuation/

Provision Total

Capital Premium Earnings Reserve Non Controlling Interest)

Reserve

C. SHAREHOLDERS’ FUNDS

31 Paid up share capital 20,000 20,000 20,000 20,000 Current Year 2019

YoY 32 Capital reserves - - - -

Balance as at the beginning

of the year

20,000 - 808,448 - 33,725 881 863,054

33 Retained earnings 799,733 698,167 809,173 710,785 Profit for the year - - 142,167 - - - 142,167

34 Profit (Loss) account 144,739 100,961 142,167 97,663 Other Comprehensive Income - - - - - - -

35 Other capital accounts 1,049 34,606 1,049 34,606 Transactions with owners - - - - - - -

36 Minority interest 3,581 3,461 - - Dividends Paid - - (33,000) - - - (33,000)

37 TOTAL SHAREHOLDERS’ FUNDS 969,102 857,195 972,389 863,054 Regulatory Reserve - - - - - - -

General Provision Reserve - - 33,725 - (33,725) - -

Others - - - - - 168 168

Foreign

38 Contingent liabilities 652,654 542,366 652,654 542,366

Balance as at the end of the

39 Non performing loans & advances 178,533 199,874 178,533 199,874 current period 20,000 - 951,340 - - 1,049 972,389

Exchange 40

41

Allowances for probable losses

Other non performing assets

173,110

196

131,599

1,568

173,110

196

131,599

1,568

Previous Year 2018

Income

Balance as at the beginning

of the year 20,000 - 749,661 - 26,849 699 797,209

17%

D SELECTED FINANCIAL CONDITION INDICATORS Profit for the year - - 97,663 - - - 97,663

Other Comprehensive Income - - - - - - -

(i) Shareholders Funds to total assets 15.1% 15.1% 14.8% 15.2%

Transactions with owners - - - - - - -

(ii) Non performing loans to total gross loans 4.8% 5.9% 4.8% 5.9%

YoY

Dividends Paid - - (32,000) - - - (32,000)

(iii) Gross loans and advances to total deposits 76.5% 78.2% 76.6% 78.2% Regulatory Reserve - - - - - - -

(iv) Loans and advances to total assets 55.9% 57.1% 54.8% 57.2% General Provision Reserve - - (6,876) - 6,876 - -

(v) Earnings assets to total Assets 72.0% 73.3% 70.5% 73.4% Others - - - - - 182 182

(vi) Deposits growth 13.9% 1.0% 13.7% 1.3% Balance as at the end of the

20,000 - 808,448 - 33,725 881 863,054

Previous period

(vii) Assets growth 13.1% 3.2% 15.4% 3.2%

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

AUDITED STATEMENT OF PROFIT AND LOSS OR OTHER AS AT 31TH DECEMBER 2019 (Amounts in million shillings)

COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER, 2019 Share Share Retained Regulatory

General

Others (Fair Valuation/

Provision Total

(Amounts in million shillings) Capital Premium Earnings Reserve Non Controlling Interest)

Reserve

GROUP GROUP BANK BANK Current Year 2019

Balance as at the beginning

Current Year Previous Year Current Year Previous Year 20,000 - 799,128 - 33,725 4,342 857,195

of the year

31.12.19 31.12.18 31.12.19 31.12.18 Profit for the year - - 144,619 - - 120 144,739

1 Interest income 653,195 600,555 653,974 601,638

Profit

Other Comprehensive Income - - - - - - -

2 Interest expense (130,820) (109,615) (136,333) (109,615) Transactions with owners - - - - - - -

Dividends Paid - - (33,000) - - - (33,000)

3 Net interest income (1minus2) 522,375 490,940 517,641 492,023

Regulatory Reserve - - 33,725 - (33,725) - -

4 Bad debts written off - - - - General Provision Reserve - - - - - - -

5 Impairment Losses on Loans and (100,410) (137,305) (100,410) (137,305) Others - - - - - 168 168

After Tax 6

Advances

Non interest income: 204,409 195,823 204,409 195,876

Balance as at the end of the

current period

Previous Year 2018

20,000 - 944,472 - - 4,630 969,102

6.1 Foreign currency dealings and 25,554 21,894 25,554 21,947

Balance as at the beginning

translation gain/(loss) of the year 20,000 - 737,494 - 26,849 3,709 788,052

6.2 Fee and commisions 169,153 166,282 169,153 166,282 Profit for the year - - 100,510 - - 451 100,961

TZS 6.3 Dividend income - 32 - 32 Other Comprehensive Income - - - - - - -

145

Transactions with owners - - - - - - -

6.4 Other operating income 9,702 7,615 9,702 7,615

Dividends Paid - - (32,000) - - - (32,000)

7 Non interest expense: (410,513) (405,096) (410,552) (408,953) Regulatory Reserve - - (6,876) - 6,876 - -

7.1 Salaries and benefits (182,579) (166,149) (182,579) (166,149) General Provision Reserve - - - - - - -

Others - - - - - 182 182

7.2 Fees and commissions (10,793) (18,340) (10,793) (18,340)

Balance as at the end of the

Previous period 20,000 - 799,128 - 33,725 4,342 857,195

7.3 Other operating expenses (217,141) (220,607) (217,180) (224,464)

8 Operating income/(loss) 215,861 144,362 211,088 141,641

Billion

9 Income tax expense (71,122) (43,401) (68,921) (43,978)

SELECTED EXPLANATORY NOTES FOR THE YEAR ENDED 31TH DECEMBER 2019

10 Net income(loss)after income tax 144,739 100,961 142,167 97,663

In preparation of the financial statements, consistent accounting policies have been used as those applicable to the

11 Other comprehensive income, net of 168 182 168 182

previous year audited financial statements.

tax Fair value gain/ (loss) on FVOCI –

net of tax Name and Title Signature Date

Total comprehensive income for 144,907 101,143 142,335 97,845 Ruth Zaipuna March 30, 2020

the year Ag. Managing Director

Benedicto Baragomwa March 30, 2020

12 Number of employees 3,450 3,450 3,450 3,450

Ag. Chief Financial Officer

13 Basic earnings per share 289 201 284 195 Juma Kimori March 30, 2020

27

Chief Internal Auditor

14 Diluted earnings per share 289 201 284 195

15 Number of branches 224 223 224 223 We, the undersigned directors, attest to the faithful representation of the above statements. We declare that the statements

have been examined by us and, to the best of our knowledge and belief, have prepared in conformance with International

Financial Reporting Standards and the requirements of the Banking and Financial Institutions Act, 2006 The Financial

YoY SELECTED PERFORMANCE INDICATORS Statements were audited by PricewaterhouseCoopers, Certified Public Accountants(T), and they present a true and fair view.

The Financial Statements were approved by the Board of Directors and signed on their behalf by:

Impairment (i) Return on average total assets 2.3% 1.8% 2.2% 1.7%

Name Signature Date

(ii) Return on average shareholders funds 14.9% 11.8% 14.6% 11.3%

Margaret Ikongo March 30, 2020

(iii) Non interest expense to gross income 56.5% 59.0% 56.9% 59.4% Director

(iv) Net interest income to average earning 11.3% 11.8% 11.2% 11.8% Leonard Mususa March 30, 2020

*YoY - Year on Year

assets Director

www.nmbbank.co.tz

You might also like

- Financial Management of A Marketing Firm (Second Edition) by David C. BakerDocument309 pagesFinancial Management of A Marketing Firm (Second Edition) by David C. BakerGabriel De LunaNo ratings yet

- Case 08 29 Cravat Sales CompanyDocument5 pagesCase 08 29 Cravat Sales CompanyDianaSafaryan0% (1)

- Far460 - Set 1 - Feb 2021 - Suggested SolutionsDocument8 pagesFar460 - Set 1 - Feb 2021 - Suggested SolutionsRuzaikha razaliNo ratings yet

- Pt. Transpasific Finance: Periode January 2023Document35 pagesPt. Transpasific Finance: Periode January 2023Ayu LestariNo ratings yet

- Exim Bank 2020 Financial StatementDocument1 pageExim Bank 2020 Financial StatementLucas MgangaNo ratings yet

- Advanced Accounting Chapter 5 AnswerDocument12 pagesAdvanced Accounting Chapter 5 Answeryacapinburgos40% (5)

- JMPGuitars 18 Watt Tremolo TMB Reverb LayoutDocument1 pageJMPGuitars 18 Watt Tremolo TMB Reverb LayoutRenan Franzon GoettenNo ratings yet

- Infographic of Vinamilk Channel MapDocument1 pageInfographic of Vinamilk Channel MapGiang ĐặngNo ratings yet

- 216 Hidraulico PDFDocument4 pages216 Hidraulico PDFGarcia Jihoo ReneNo ratings yet

- ZK 99 UAVa 9 FRVM WAdj DSZQJG 6 G7 Ps HP 6 X9 W 6 VK F2 PDocument1 pageZK 99 UAVa 9 FRVM WAdj DSZQJG 6 G7 Ps HP 6 X9 W 6 VK F2 Pmarikadavid572No ratings yet

- Weekly Mutual Fund Update 9th June 2019Document5 pagesWeekly Mutual Fund Update 9th June 2019Aslam HossainNo ratings yet

- Liste in Tret in EreDocument5 pagesListe in Tret in EreFlorin PodNo ratings yet

- Expose Capaian Program p2ptm Dan Keswa TW 3Document10 pagesExpose Capaian Program p2ptm Dan Keswa TW 3anirianisunartoNo ratings yet

- Crowd Cylinder and Manifold View: 7495 Electric Rope Shovel Hydraulic System Hydracrowd Advanced ControlDocument2 pagesCrowd Cylinder and Manifold View: 7495 Electric Rope Shovel Hydraulic System Hydracrowd Advanced ControlAndesito ReañoNo ratings yet

- October AccomplishmentDocument17 pagesOctober AccomplishmentReyma GalingganaNo ratings yet

- Issued Pursuant To Regulations 7 and 8 of The Banking and Financial Institutions (Disclosures) Regulations, 2014Document1 pageIssued Pursuant To Regulations 7 and 8 of The Banking and Financial Institutions (Disclosures) Regulations, 2014Salumu Mwalimu MkwayuNo ratings yet

- 12-Month Business Budget: Budget Analysis (Profit & Loss Category) Budget Analysis (Balance Sheet Category)Document2 pages12-Month Business Budget: Budget Analysis (Profit & Loss Category) Budget Analysis (Balance Sheet Category)Mohamed SururrNo ratings yet

- Business World May 15 2018Document20 pagesBusiness World May 15 2018junior juniorNo ratings yet

- Rodillo CS56B Sistema HidráulicoDocument2 pagesRodillo CS56B Sistema Hidráulicodayronhamsik18No ratings yet

- 5 Gaikindo Production Data Jandec2019 DikonversiDocument3 pages5 Gaikindo Production Data Jandec2019 DikonversidinaNo ratings yet

- Cat Loader980G Hyd Steering CircuitDocument2 pagesCat Loader980G Hyd Steering CircuitveereshNo ratings yet

- KENR9408KENR9408 - SIS Mini JXMDocument4 pagesKENR9408KENR9408 - SIS Mini JXMLiliana Rebeca Santos santosNo ratings yet

- Kenha Pow Cylu KimanaDocument1 pageKenha Pow Cylu KimanaMwiti EmmanuelNo ratings yet

- Plano 2 Hidra.374fDocument2 pagesPlano 2 Hidra.374fIlder NavizNo ratings yet

- Kenr7523kenr7523-03 SisDocument2 pagesKenr7523kenr7523-03 SisnunosoniaNo ratings yet

- Laporan Poned JUNI NoviaDocument3 pagesLaporan Poned JUNI Noviaastri syadiahNo ratings yet

- Exe Summary Ss-12Document1 pageExe Summary Ss-12RagavanNo ratings yet

- C Persperctive Proposed Modern ResortDocument9 pagesC Persperctive Proposed Modern Resortgawgaming11No ratings yet

- Drum and Blade Attachment Under Platform: CS56B, CP56B, CS68B, and CP68B Hydraulic System Vibratory Soil CompactorsDocument2 pagesDrum and Blade Attachment Under Platform: CS56B, CP56B, CS68B, and CP68B Hydraulic System Vibratory Soil CompactorsAndresCorreaNo ratings yet

- Plano Sistema Vibracion CS78BDocument2 pagesPlano Sistema Vibracion CS78BricsnikNo ratings yet

- Crisil Sme Connect Aug12 PDFDocument60 pagesCrisil Sme Connect Aug12 PDFSK Business groupNo ratings yet

- S - Curve: MonthDocument1 pageS - Curve: MonthKhadijaNo ratings yet

- Temporary FenceDocument5 pagesTemporary FenceAngelineNo ratings yet

- Econs 2Document1 pageEcons 2khai.phamtien2002No ratings yet

- Country Profile: BahrainDocument10 pagesCountry Profile: BahrainOMERNo ratings yet

- AllWards StatisticsDocument1 pageAllWards StatisticsCHMLNo ratings yet

- NVH SD WS 117Document1 pageNVH SD WS 117Qusai ShamlakhNo ratings yet

- Percentage of Completion: Planned Vs Actual AccomplishmentDocument2 pagesPercentage of Completion: Planned Vs Actual AccomplishmentGenetNo ratings yet

- Camión 789C Schematic AirDocument8 pagesCamión 789C Schematic AirJorge VizcainoNo ratings yet

- State Highway FEDERAL AID PROJECT NO. STBG-9999-07 (384) : Plan and Profile of ProposedDocument66 pagesState Highway FEDERAL AID PROJECT NO. STBG-9999-07 (384) : Plan and Profile of Proposedcharles blairNo ratings yet

- PASAR REJOSARI (Recovery) - Sheet - B-A-009 - Denah Pola LT DasarDocument1 pagePASAR REJOSARI (Recovery) - Sheet - B-A-009 - Denah Pola LT DasarCindar TengikNo ratings yet

- Reporte Ventas Diarias Total PerúDocument11 pagesReporte Ventas Diarias Total PerúFranco Camacho CanchariNo ratings yet

- O Racle P Ro Jects - R Elease11i.9 Logical Data Model: ProjectDocument1 pageO Racle P Ro Jects - R Elease11i.9 Logical Data Model: ProjectMalik AzizNo ratings yet

- Job No. 25800: Quebrada Blanca Fase 2Document1 pageJob No. 25800: Quebrada Blanca Fase 2Ricardo Alberto Zapata Balcazar100% (1)

- Monthly Dashboard: Finance No.: 54350Document91 pagesMonthly Dashboard: Finance No.: 54350venkateshNo ratings yet

- DPWH Tranformer PadDocument1 pageDPWH Tranformer PadAl-fin KaytingNo ratings yet

- Lubricacion de Ejes PosterioresDocument2 pagesLubricacion de Ejes PosterioresDavid TurpoNo ratings yet

- Print - P&P NH-44 (Sheripally) Opt-3Document3 pagesPrint - P&P NH-44 (Sheripally) Opt-3Rakibul JamanNo ratings yet

- Cat Dcs Sis ControllerDocument2 pagesCat Dcs Sis ControllerMatiussChesteerNo ratings yet

- Monthly Budget - GrayDocument1 pageMonthly Budget - GrayAgnes Novia JNo ratings yet

- Plano Hidraulico 314 C 1Document2 pagesPlano Hidraulico 314 C 1galvis1020100% (2)

- Universitas Trisakti: Denah Basement 1 & Basement 2Document19 pagesUniversitas Trisakti: Denah Basement 1 & Basement 2aliNo ratings yet

- 2023 - Kiriman - Februari 2023Document26 pages2023 - Kiriman - Februari 2023trisna nur robbyNo ratings yet

- Ground Floor and Site Dev.Document1 pageGround Floor and Site Dev.Marie BacasNo ratings yet

- Hydraulic System 784C Tractor 785C Off-Highway Truck: Fluid Power SymbolsDocument2 pagesHydraulic System 784C Tractor 785C Off-Highway Truck: Fluid Power SymbolsGustavo Enrique fontalvoNo ratings yet

- Print - P&P NH-44 (Sheripally) Opt-3ADocument5 pagesPrint - P&P NH-44 (Sheripally) Opt-3ARakibul JamanNo ratings yet

- COA-RO9 APP CSE 2023 FormDocument30 pagesCOA-RO9 APP CSE 2023 FormKlienberg Ferenal CancinoNo ratings yet

- Kenr6503-04 - Sis D11T HidraulicoDocument2 pagesKenr6503-04 - Sis D11T HidraulicoMilton AbudNo ratings yet

- Opt Nissan 3Document4 pagesOpt Nissan 3YduR ZurCNo ratings yet

- Capitalbanking PDFDocument1 pageCapitalbanking PDFBALAJI NAWLENo ratings yet

- Revised STPDocument2 pagesRevised STPRomel DecenillaNo ratings yet

- Tire Pressure Warning System 570Document1 pageTire Pressure Warning System 570Ngoc AnNo ratings yet

- Main Entry Gate - 1: A) Fsi Area StatementDocument1 pageMain Entry Gate - 1: A) Fsi Area StatementR K YADAVNo ratings yet

- FDNACCT Unit 3 - Financial Statements - Rules of DR & CR - Study GuideDocument2 pagesFDNACCT Unit 3 - Financial Statements - Rules of DR & CR - Study GuideAshley SheyNo ratings yet

- Cost Acct Answer KeyDocument95 pagesCost Acct Answer KeyCarlaNo ratings yet

- Schedule III Financial StatementsDocument21 pagesSchedule III Financial StatementsKunal DixitNo ratings yet

- Finanlcial Statements AnalysisDocument25 pagesFinanlcial Statements AnalysisAhsaan NadeemNo ratings yet

- ICAEW-Accounting-QB-2023-chapter 12Document3 pagesICAEW-Accounting-QB-2023-chapter 12daolengan03No ratings yet

- LQ 2 AnswersDocument21 pagesLQ 2 Answersby ScribdNo ratings yet

- Corporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Document9 pagesCorporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Eunice NanaNo ratings yet

- Mini Test QDocument2 pagesMini Test Qpako oneetsengNo ratings yet

- Partnership Mock ExamDocument15 pagesPartnership Mock ExamPerbielyn BasinilloNo ratings yet

- P1 Part4.2Document8 pagesP1 Part4.2Minie KimNo ratings yet

- DuPont Profitability ModelDocument1 pageDuPont Profitability ModelcwkkarachchiNo ratings yet

- Description PT Casio (Induk) PT Kenko (Anak)Document4 pagesDescription PT Casio (Induk) PT Kenko (Anak)OLIVIA CHRISTINANo ratings yet

- Accrued ExpenseDocument3 pagesAccrued ExpenseNiño Rey LopezNo ratings yet

- Catherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Document4 pagesCatherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Jamycka Antolin100% (1)

- Cherry Vantica - 201950336 - Uts - Ak318d - Apliaud - LBR JawabDocument13 pagesCherry Vantica - 201950336 - Uts - Ak318d - Apliaud - LBR JawabCherry VanticaNo ratings yet

- Cash Distribution ProgramDocument5 pagesCash Distribution ProgramJuvy Dimaano100% (1)

- Isuzu Pro Forma InvoiceDocument1 pageIsuzu Pro Forma InvoiceFayas RasheedNo ratings yet

- Unit IV Merchandising ConcernDocument27 pagesUnit IV Merchandising ConcernCamelia CanamanNo ratings yet

- Format of Financial Statements Under The Revised Schedule VIDocument97 pagesFormat of Financial Statements Under The Revised Schedule VIDebadarshi RoyNo ratings yet

- Chapter 36Document20 pagesChapter 36Flores Renato Jr. S.No ratings yet

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- Activity 5 - TolentinoDocument2 pagesActivity 5 - TolentinoDJazel TolentinoNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Financial Statement Analysis Lecture 5 - Cash FlowDocument17 pagesFinancial Statement Analysis Lecture 5 - Cash FlowKenan AbishovNo ratings yet

- Financial Report Analysis v.5Document56 pagesFinancial Report Analysis v.5Joi Pia Sison SantosNo ratings yet

- Financial Statement Analysis AssignmentDocument12 pagesFinancial Statement Analysis Assignmentsalman ameerNo ratings yet