Professional Documents

Culture Documents

05 Current Taxation 05 Current Taxation

05 Current Taxation 05 Current Taxation

Uploaded by

ShehrozSTOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

05 Current Taxation 05 Current Taxation

05 Current Taxation 05 Current Taxation

Uploaded by

ShehrozSTCopyright:

Available Formats

lOMoARcPSD|3314559

05 Current taxation

Financial Accounting 2A (University of Namibia)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.1

a) Income tax is the tax levied by tax authorities on taxable profits.

b) Taxable profit is calculated in accordance with tax legislation and profit before tax is calculated in

accordance with International Financial Reporting Standards.

c) We use the rate that is enacted at reporting date unless the proposed new rate has been

substantively enacted at reporting date, in which case we use the proposed new rate (i.e. the

substantively enacted tax rate).

d) The difference between profit before tax and taxable profit can be split into two kinds of

differences:

Temporary differences

Permanent differences.

Differences that are temporary are those that will resolve over time. For instance, the cost of an

asset will be expensed by an accountant over a certain period of time where this same cost may be

deducted by the tax authorities, but over a shorter or longer period of time. Income may be

recognised as income in a different year to which the income is included in taxable profits.

Differences that are permanent are those that will not resolve over time. For instance, income will

appear in profit before tax that will never be included as income in taxable profit (e.g. dividend

income) and expenses will appear in profit before tax that will never be allowed as deductions in

taxable profit (e.g. fines).

e) Non-taxable items: Exempt portions of capital profits and dividend income.

f) Non-deductible items: Fines and certain donations.

g) The profit on sale is C80 000, split between a capital profit of C20 000 and a non-capital profit of

C60 000.

The capital gain is C20 000 and at an inclusion rate of 80%, the taxable capital gain is C16 000.

Workings

W1 Profit on sale: capital and non-capital portions C

Proceeds on sale Given 240 000

Less carrying amount Given (160 000)

Profit on sale Balancing 80 000

Capital profit Proceeds: 240 000 – Cost price: 220 000) 20 000

Non-capital profit Cost price: 220 000 – CA: 160 000; or 60 000

Balancing: Total profit: 80 000 – Capital profit: 20 000

W2: Capital gain and taxable capital gain

C

Proceeds on sale Given 240 000

Less base cost Given (220 000)

Capital gain Balancing 20 000

Inclusion rate Given @ 80%

Taxable capital gain Capital gain: 10 000 x Inclusion rate: 80% 16 000

© Service & Kolitz, 2018 Chapter 5: Page 1

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.1 continued . . .

h) The profit on sale is C120 000 and the taxable recoupment is C70 000.

Workings

W1: Calculation of profit or loss on sale (IFRSs) C

Proceeds on sale 220 000

Less carrying amount Cost: 300 000 – Acc depreciation:200 000 (100 000)

Profit on sale 120 000

W2: Calculation of recoupment or scrapping allowance on sale C

Proceeds on sale 220 000

Less tax base Cost: 300 000 – Acc wear & tear:150 000 (150 000)

Recoupment on sale 70 000

i) The profit on sale is C 20 000 and the scrapping allowance is C30 000.

Workings

W1: Calculation of profit or loss on sale (IFRSs) C

Proceeds on sale 120 000

Less carrying amount Cost: 300 000 – Acc depreciation:200 000 (100 000)

Profit on sale 20 000

W2: Calculation of recoupment or scrapping allowance on sale C

Proceeds on sale 120 000

Less tax base Cost: 300 000 – Acc wear & tear:150 000 (150 000)

Scrapping allowance (30 000)

j) Income received in advance and certain expenses prepaid would cause temporary differences

between profit before tax and taxable profits. The adjustments required in order to convert profit

before tax into taxable profits are as follows:

C

Profit before tax xxx

Add income received in advance: closing balance xxx

Less income received in advance: opening balance (xxx)

Less expenses prepaid: closing balance (xxx)

Add expenses prepaid: opening balance xxx

Taxable profit xxx

k) The journal entry to account for the current income tax estimate for the year is:

Debit Credit

Income tax expense (SOCI: P/L) xxx

Current tax payable: income tax (SOFP: current liability) xxx

Current income tax estimate for the current year

© Service & Kolitz, 2018 Chapter 5: Page 2

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.2

a) False: VAT may only be claimed back if the claimant is a ‘vendor for VAT purposes’. (It

should also be noted that VAT paid on certain items is not allowed to be reclaimed per the

VAT Act).

b) False: VAT will not be charged if the seller is a ‘non-vendor’ and will not be charged if

the goods are considered to be zero-rated or exempt supplies.

c) False: employees’ tax is incurred by the employee. The company only has the obligation

to deduct such tax and pay it over to the tax authorities.

d) False: since employees’ tax is not incurred by the company, it cannot be shown as the tax

expense incurred by the company.

e) False: since the portion of the salaries and wages that are paid over to the Tax authorities

is not a tax expense incurred by the company (but rather an expense incurred by the

employee) it is not shown as part of the tax expense of the company. If it is not shown as

tax expense of the company, it must therefore be included in the salaries and wages

expense incurred by the company.

f) False: VAT paid is either a tax that is able to be reclaimed from the tax authorities,

(therefore shown as a VAT asset), or not able to be reclaimed (shown as part of the cost of

the item purchased). VAT received must always be paid over to the tax authorities, so

should be shown as a VAT liability. The VAT asset and VAT liability accounts may be

netted off and shown as a net VAT asset or liability in the statement of financial position.

g) False: inventories and cost of sales will be shown net of VAT when the VAT is able to be

reclaimed whereas it will be shown inclusive of VAT in the event that VAT is not able to

be reclaimed.

h) False: Dividends tax is a tax on the shareholder. The entity merely has the responsibility

of withholding the dividends tax (in order to pay to the tax authorities) before physically

paying the dividend to the shareholders. Thus, it is not a tax on the entity, so it will not

form part of the entity’s tax expense.

i) False: Dividends tax will form part of the dividend declared and be presented in the

statement of changes in equity.

j) False: If the company is a listed company, dividends tax is only payable when the

dividends are paid. If the company is an unlisted company, dividends tax is only payable

on the earlier of when the dividends are paid or when they are due and payable. In

conclusion, the date that the dividend is declared does not influence when the dividends

tax becomes payable.

© Service & Kolitz, 2018 Chapter 5: Page 3

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.3

a) Journals

Debit Credit

Jan 2.

Inventories (A) 300 000

Accounts payable: Pencil (L) 300 000

Purchase of inventories for C300 000 (no VAT included as from non-vendor)

Jan 5.

Inventories (A) 43 421

Current tax receivable: VAT (A) 6 079

Bank (A) 49 500

Purchase of inventories for C49 500 (including VAT: C49 500x 14/114)

Jan 7.

Accounts receivable: High (A) 1 200

Revenue: sales (I) 1 053

Current tax payable: VAT (L) 147

Sale of goods (including VAT of C1 200 x 14/114)

Cost of sales (E) 450

Inventories (A) 450

Cost of the goods sold: given

Jan 8.

Bank (A) 18 000

Revenue: sales (I) 15 789

Current tax payable: VAT (L) 2 211

Sale of goods (including VAT of C18 000 x 14/114)

Cost of sales (E) 10 500

Inventories (A) 10 500

Cost of the goods sold: given

Jan 12.

Electricity and water (E) 553

Current tax receivable: VAT (A) 77

Bank (A) 630

Payment of electricity and water (including VAT of C630 x 14/114)

Jan 14.

Telephone (E) 250

Current tax receivable: VAT 35

Bank (A) 285

Payment of telephone (including VAT of C285 x 14/114)

Jan 15.

Vehicles: cost (A) 7 500

Current tax receivable: VAT (A) 1 050

Bank (A) 8 550

Purchase of single cab truck from a VAT vendor (including VAT of C8 550 x 14/114):

since the vehicle does not meet the definition of a ‘motor car’, the VAT paid is able to

be claimed back

© Service & Kolitz, 2018 Chapter 5: Page 4

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.3 continued . . .

Debit Credit

Jan 17.

Vehicles: cost (A) 180 000

Loan finance: trader (L) 180 000

Purchase of single cab truck: the vehicle does meet the definition of a ‘motor car’ and

thus the VAT paid is not able to be claimed back

Jan 25.

Salaries (E) 15 000

Current tax payable: employees tax (L) 3 000

Bank (A) 12 000

Paid net salaries of C12 000 and owe C2 000 to the tax authorities

Jan 26.

Current tax payable: employees tax (L) 7 500

Bank (A) 7 500

Paid employees’ tax to the tax authorities

Jan 27.

Bank (A) 7 500

Current tax receivable: VAT (L) 7 500

Receipt of VAT refund from the tax authorities

Jan 29.

Bank (A) 18 000

Dividend income (I) 18 000

Dividend income earned

Jan 31.

Dividends declared (OE) 27 000

Current tax payable: dividends tax (L) 4 050

Shareholders for dividends (L) 22 950

Dividends declared, of which 15% is withheld and payable to the tax authorities

(27 000 x 15%) and the balance of 85% is payable to the shareholders

(27 000 x 85%)

© Service & Kolitz, 2018 Chapter 5: Page 5

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.4

All companies are provisional taxpayers. This means that no later than six months into the

company's financial year, the company must estimate its tax for the year and pay half this amount

to the tax authorities. It then has to pay the rest of the estimated tax due by the last day of its

financial year-end, in a second provisional payment. Both the first and second provisional

payments are based on estimated taxable profits.

It is, however, only possible to calculate the final estimate of the tax expense once all accounting

entries for the year have been processed and the company's final profit (or loss) for the year and

taxable profit for the year has been calculated. In practice, the finalisation of accounts takes time

and final figures are normally only available sometime after year-end. Only then can the final

tax expense be estimated and compared to the provisional payments made during the year. These

payments may have been more or less than the calculated amount. A journal entry will need to be

processed to adjust the tax expense to reflect the final tax estimate for the year, resulting in the

statement of financial position reflecting either a current tax receivable (debtor: asset) or payable

(creditor: liability) at year-end.

Usually, the tax authority's assessment of taxable profit and the resultant tax charge will coincide

with that calculated by the company. In this case, if the company still owes any tax (e.g. it has

underpaid), they will have a current tax payable in their statement of financial position and will

merely make a third, "top-up" payment to settle the tax payable. If the company overpaid and

has a current tax receivable, they will set this amount off the next provisional payment or receive

a refund from the tax authority.

It can happen, however, that the tax authority does not agree with the amount calculated by the

company. The amount provided for taxation in the statement of comprehensive income will then

not agree with the tax authority’s assessment and the company will be in the position of having

"overprovided" or "underprovided" for taxation in the previous year.

The facts given suggest that the provisional payments during the current tax year exceeded the

final tax calculated for the current tax year. In other words, there was an overpayment of tax. It

is this overpayment of tax that resulted in the recognition of the current tax receivable (asset) that

was presented in the statement of financial position in the current year.

The facts given also suggest that, during the current year, the tax authority assessed the taxation

due in the prior year as being greater than the final tax calculated and provided (i.e. recognised)

by the company in that prior year. In other words, the tax recognised in the prior year was

underprovided, which also means: under-estimated (i.e. the amount of the tax expense and tax

payable recognised in that prior year was too small). An under-provision of the tax estimate in

that prior year must be ‘corrected’ by processing an adjustment that increases the tax in the

current year. IAS 12 par 80(b) requires us to separately disclose any adjustment recognised in

the current period for current tax of prior periods (i.e. an under or over provision) in the taxation

expense note. Thus, this adjustment in the current year is presented separately as an adjustment

for the under-provision of prior year tax. The reason that we process the under-provision

adjustment relating to prior year tax in the current year is because the prior year financial

statements are finalised when we receive the assessment and thus it is too later to make a change

to the estimated final tax provided in the prior year.

Not only must the under-provision of prior year tax be recognised in the current year, it will also

have to be paid in the current year (i.e. the year in which the tax assessment is received).

Suggested discussion outline

timing of provisional payments;

the creation of a current tax debtor/creditor at year-end;

the difference between "over/under-paying" and "over/under-providing";

disclosure of the under provision in the financial statements.

© Service & Kolitz, 2018 Chapter 5: Page 6

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.5

a) Discussion

Definition of a liability

A present obligation of the entity

As a result of a past event

The settlement of which is expected to result in an outflow of future economic benefits.

Definition of an expense

Decrease in economic benefits

During the accounting period

In the form of decrease in assets or increase in liabilities resulting in a decrease in equity

Other than through a distribution to equity participants.

Recognition criteria

A reliable estimate must be possible.

The outflow of future economic benefits must be probable.

Discussion: liability

Since the taxable profits were earned by the entity, the tax thereon is a legal obligation of the

entity.

The event is the earning/ receiving of the taxable profits: since the profits on which the tax is

calculated were earned/ received before 31 December 20X3, there is a past event.

The settlement of the obligation will result in an outflow of cash when as the amount owing to the

tax authorities are paid.

Discussion: recognition criteria

A reliable estimate is possible since the Income Tax Act is available to the public to use in the

estimate thereof / the auditors, who are professionals in this area, have already calculated the

estimated tax.

The outflow is probable since it has either already been pre-paid via the provisional payment

system / or will have to be paid since it is a legislative requirement.

Discussion: expense

The decrease in economic benefits is the tax outflow expected in relation to the profits made (i.e.

a decrease in profits).

The profits arose in 20X3 and therefore the tax arose in 20X3 and thus it is a decrease in

economic benefits during the accounting period 20X3.

Since there has been an increase in liabilities, equity will decrease.

The tax payable on the profits is not a distribution to equity participants.

Conclusion

Since both the definitions and the recognition criteria have been met, the current tax liability and

related tax expense of C80 000 should be processed.

© Service & Kolitz, 2018 Chapter 5: Page 7

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.5 continued …

b) Journals

Debit Credit

Income tax expense (SOCI: P/L) 80 000

Current tax payable: income tax (SOFP: L) 80 000

Current income tax estimate for 20X3

Income tax expense (SOCI: P/L) 7 000

Current tax payable: income tax (SOFP: L) 7 000

Under-provision of current income tax estimate in 20X2

© Service & Kolitz, 2018 Chapter 5: Page 8

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.6

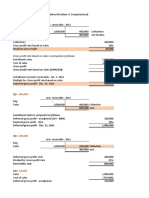

a) Ledger accounts

CURRENT TAX PAYABLE/ RECEIVABLE: INCOME TAX

20X1 C 20X1 C

30 June Bank 26 000 31 Dec Income tax expense 56 000

31 Dec Bank 28 000

31 Dec Balance W1: (1) 2 000

56 000 56 000

20X2 20X2

16 May Bank (underpayment) 2 000 1 Jan Balance 2 000

30 June Bank 29 000 31 Dec Income tax expense 58 000

31 Dec Bank 30 000 31 Dec Balance W1: (2) 1 000

61 000 61 000

20X3 20X3

1 Jan Balance 1 000 19 May Income tax expense (under- 1 500

provision)

19 June Bank (underpayment) 500

30 June Bank 31 000 31 Dec Income tax expense 65 000

31 Dec Bank 31 500

31 Dec Balance W1: (3) 2 500

66 500 66 500

20X4 20X4

18 April Income tax expense 200 1 Jan Balance 2 500

(over-provision)

18 May Bank (underpayment) 2 300

30 June Bank 33 000 31 Dec Income tax expense 67 400

31 Dec Bank 34 000

31 Dec Balance W1: (4) 400

69 900 69 900

20X5

1 Jan Balance 400

Workings

W1: Balance on current tax payable/ (receivable) account

Balance at 31/12/X1 (1) 31/12/X2 (2) 31/12/X3 (3) 31/12/X4 (4)

Provided 56 000 58 000 65 000 67 400

Paid 54 000 59 000 62 500 67 000

2 000 (1 000) 2 500 400

© Service & Kolitz, 2018 Chapter 5: Page 9

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.6 continued . . .

a) Continued . . .

INCOME TAX EXPENSE (P/L)

20X1 C 20X1 C

31 Dec Current tax payable: income 56 000 31 Dec Profit or loss 56 000

tax

20X2 20X2

31 Dec Current tax payable: income 58 000 31 Dec Profit or loss 58 000

tax

20X3 20X3

19 May Current tax payable: income 1 500 31 Dec Profit or loss 66 500

tax (under-provision)

31 Dec Current tax payable: income 65 000

tax

66 500 66 500

20X4 20X4

31 Dec Current tax payable: income 67 400 18 April Current tax payable: income 200

tax tax (over-provision)

31 Dec Profit or loss 67 200

67 400 67 400

Workings

20X1 20X2 20X3 20X4

Assessment as per tax authorities 56 000 59 500 64 800

Provided 56 000 58 000 65 000

Under/(over) provision - 1 500 (200)

Assessment as per tax authorities 56 000 59 500 64 800

Total payments 54 000 59 000 62 500

Amount owing 2 000 500 2 300

Provided 56 000 58 000 65 000 67 400

Total payments 54 000 59 000 62 500 67 000

Statement of financial position liability (asset) 2 000 (1 000) 2 500 400

© Service & Kolitz, 2018 Chapter 5: Page 10

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.6 continued . . .

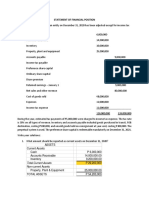

b) Disclosure

MISTY RIDGE LIMITED

STATEMENT OF FINANCIAL POSITION (extracts)

AS AT 31 DECEMBER 20X4

Note 20X4 20X3 20X2 20X1

C C C C

Current liabilities

Current tax payable: income tax 400 2 500 0 2 000

Current assets

Current tax receivable: income tax 0 0 1 000 0

MISTY RIDGE LIMITED

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 20X4

20X4 20X3 20X2 20X1

Note C C C C

Income tax expense 14 67 200 66 500 58 000 56 000

MISTY RIDGE LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 20X4

20X4 20X3 20X2 20X1

C C C C

14 Income tax expense

Current tax

- Current year provision 67 400 65 000 58 000 56 000

- Prior year under / (over) provision * (200) 1 500 0 0

Tax expense per statement of comprehensive income 67 200 66 500 58 000 56 000

* As the tax expense has been increased by the under provision in 20X3 (in respect of 20X2) and decreased by the

over provision in 20X4 (in respect of 20X3), a tax rate reconciliation should be disclosed for both years. The

standard tax rates and the profit before tax were not provided in the question and therefore the rate reconciliation is

not able to be completed for the purposes of this question. A tax rate reconciliation is mandatory as per IAS 12 par

81(c).

© Service & Kolitz, 2018 Chapter 5: Page 11

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.7

a) Journals

Debit Credit

31 December 20X5

Income tax expense (SOCI: P/L) 450 000 x 0,30) 135 000

Current tax payable: income tax (SOFP: current liability) 135 000

Current income tax provided for the year

Dividend declared (SOCIE: distribution of Equity) 150 000

Shareholders for dividends (SOFP: current liability) 150 000

Dividend declared

Shareholders for dividends (SOFP: current liability) 150 000 x 15% 22 500

Current tax payable: dividends tax (SOFP: current liability) 22 500

Dividends tax on dividends due as a result of declaration is withheld

b) Statement of comprehensive income

CATS AND CUDDLES LIMITED

EXTRACT FROM THE STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 20X5

20X5

C

Profit before taxation 450 000

Income tax expense (450 000 x 0,30) (135 000)

Profit for the year 315 000

Other comprehensive income for the year -

Total comprehensive income for the year 315 000

© Service & Kolitz, 2018 Chapter 5: Page 12

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.7 continued …

b) Statement of changes in equity

CATS AND CUDDLES LIMITED

EXTRACT FROM THE STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 20X5

Share capital Retained Total

C earnings

C C

Balance at 31 December 20X4 3 000 2 325 000 2 328 000

Total comprehensive income 315 000 315 000

Dividends declared The full dividend (150 000) (150 000)

even though some

is withheld and

paid to the tax

authorities

Balance at 31 December 20X5 3 000 2 490 000 2 493 000

d) Statement of financial position

CATS AND CUDDLES LIMITED

EXTRACT FROM THE STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 20X5

20X5

C

EQUITY AND LIABILITIES

Current liabilities

Shareholders for dividend (150 000-22 500) 127 500

Current tax payable: income tax 135 000

Current tax payable: dividends tax 22 500

© Service & Kolitz, 2018 Chapter 5: Page 13

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.8

a) Journals

Debit Credit

31 May 20X6

Income tax expense (SOCI: P/L) 26 500 - 25 000 1 500

Current tax payable/ receivable: income tax (SOFP: L/A) 1 500

Under provision for the prior year.

Income tax expense (SOCI: P/L) W1 37 450

Current tax payable/ receivable: income tax (SOFP: L/A) 37 450

Current income tax provided for the year

Dividends declared (OE) 10 000

Shareholders for dividends ( SOFP L) 10 000

Dividends declared during the year

Shareholders for dividends (SOFP L) 10 000 x 15% 1 500

Current tax payable/receivable: dividends tax (SOFP: L/A) 1 500

Dividends tax on dividends due as a result of declaration is withheld

b) Statement of comprehensive income

PLUM LIMITED

EXTRACT FROM THE STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 MAY 20X6

Note C

Gross profit (Balancing: 115 000 + 2 000 + 40 000 – 8 000) 149 000

Investment income 8 000

Operating expenses (40 000)

Finance costs (2 000)

Profit before taxation 115 000

Income tax expense (37 450 + 1 500) 12 (38 950)

Profit for the year 76 050

Other comprehensive income for the year 0

Total comprehensive income for the year 76 050

© Service & Kolitz, 2018 Chapter 5: Page 14

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.8 continued . . .

c) Statement of financial position

PLUM LIMITED

EXTRACT FROM THE STATEMENT OF FINANCIAL POSITION

AT 31 MAY 20X6

ASSETS C

Current assets

Current tax receivable: income tax (43 000 – CT expense: 37 450 – Under-provision of CT 4 050

expense in PY: 1 500)

EQUITY AND LIABILITIES

Current liabilities

Shareholders for dividends 7 500

Current tax payable: dividends tax (2 250 + 1 500) 3 750

d) Notes to the financial statements: Income tax expense note

PLUM LIMITED

EXTRACT FROM THE NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MAY 20X6

12. Income tax expense C

Current tax

- Current year W1 37 450

- Prior year under-provision Assessed: 26 500 – Expensed: 25 000 1 500

Tax expense per statement of comprehensive income 38 950

Tax rate reconciliation: %

Applicable tax rate (ATR) 35

Tax effects of:

Profit before tax 35.00 40 250

Exempt dividend (8 000 x 35%/115 000) (2.43) (2 800)

Under-provision (1 500 / 115 000) 1.30 1 500

Tax expense per statement of comprehensive (38 950 / 115 000) 33.87 38 950

income / effective rate

© Service & Kolitz, 2018 Chapter 5: Page 15

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.8 continued . . .

Workings:

W1: Current income tax expense

C

Profit before taxation 115 000

Exempt dividend income (8 000)

107 000

Temporary differences -

Taxable profit 107 000

Current income tax (C107 000 x 35%) 37 450 Dr TE; Cr CTP

W2: Current income tax payable

CURRENT TAX RECEIVABLE/PAYABLE: INCOME TAX

20X6 C 20X6 C

31 May Balance 43 000 31 May Income tax expense (Under- 1 500

(Given: opening balance of nil provision: of PY current tax:

plus provisional payments made tax assessment: 26 500 – tax

during year ended 31 May 20X6) provided: 25 000)

31 May Income tax expense 37 450

(CY current tax: W1)

Balance c/d 4 050

43 000 43 000

31 May Balance b/d 4 050

© Service & Kolitz, 2018 Chapter 5: Page 16

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.9

a) Tax-related journals

Debit Credit

31 December 20X2

Income tax expense (SOCI: P/L) W1 87 000

Current tax payable: income tax 87 000

(SOFP: L)

Current income tax provided for the year.

31 December 20X3

Current tax payable: income tax (SOFP: L) 87 000 - 85 900 1 100

Income tax expense (SOCI: P/L) 1 100

Over-provision for the prior year.

Income tax expense (SOCI: P/L) W1 84 750

Current tax payable: income tax 84 750

(SOFP: L)

Current income tax provided for the year.

Dividends declared (OE) Given 30 000

Current tax payable: dividends tax (SOFPL) 30 000 x 15% 4 500

Shareholders for dividends (SOFP: L) 30 000 – 4 500 25 500

Dividends declared and dividends tax withheld.

© Service & Kolitz, 2018 Chapter 5: Page 17

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.9 continued...

b) Income tax expense note

BIG BLUE LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 20X3

20X3 20X2

5 Income tax expense C C

Current taxation

- Current year provision W1 84 750 87 000

- Prior year under/ (over) provision 20X2: first year of operations (1 100) -

20X3: 87 000 – 85 900

Tax expense per statement of comprehensive income Given 83 650 87 000

Tax rate reconciliation:

Applicable tax rate (ATR) 30% 30%

Tax effects of:

Profit before tax 20X2: 290 000 x 30%; 90 000 87 000

20X3: 300 000 x 30%

Exempt capital profit 20X3: (26 000 - 13 000) (3 900) -

x 30%

Exempt dividend income 20X3: 5 000 x 30% (1 500) -

Non-deductible fine 20X3: 500 x 30% 150 -

Prior year over-provision of current tax Per above (1 100) -

Tax expense per statement of comprehensive income Given 83 650 87 000

Effective tax rate (ETR) 20X3: 83 650 / 300 000 27,88% 30%

20X2: 87 000 / 290 000

c) Statement of financial position

BIG BLUE LIMITED

STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 20X3

20X3 20X2

Current liabilities C C

Current tax payable: income tax W2 or: 8 650 5 000

20X3: 5 000 + 84 750 (CT) -1 100(o/p)

- 80 000 (pmts)

Current tax payable: dividends tax 30 000 x 15% 4 500 0

Shareholders for dividends 30 000 – 4 500 25 500 0

© Service & Kolitz, 2018 Chapter 5: Page 18

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.9 continued …

Workings

W1: Current income tax

20X3 20X2

Profit before tax 300 000 290 000

Less capital profit Given (26 000) 0

Add taxable capital gain 26 000 x 50% (inclusion rate) 13 000 0

Less dividend received (exempt) (5 000) 0

Add fine (non-deductible) 500 0

Taxable profit 282 500 290 000

Current income tax 20X3: 282 500 x 30% 84 750 87 000

20X2: 290 000 x 30%

Dr TE Cr CTP Dr TE Cr CTP

W2: Current income tax payable

CURRENT TAX PAYABLE/ RECEIVABLE: INCOME TAX

20X3 C 20X3 C

31 Dec Income tax expense 1 100 1 Jan Balance b/d 5 000

(overprovision)

(C87 000 – C85 900)

Bank 80 000 31 Dec Income tax expense (W1) 84 750

Balance c/d 8 650

89 750 89 750

31 Dec Balance b/d 8 650

© Service & Kolitz, 2018 Chapter 5: Page 19

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.10

a) Calculation: taxable profits and current income tax

Profit before tax Given 400 000

Less exempt income:

Less dividend income Not taxable (40 000)

Less capital profits W1 (50 000)

Add taxable capital gain W1 25 000

Add non-deductible expenses:

Add back donations Not deductible 100 000

Add back fines Not deductible 10 000

Taxable profit 445 000

Current income tax C445 000 x 30% 133 500

Workings:

W1: Capital profit and Taxable capital gain on sale of building

Proceeds on sale:

Carrying amount on date of sale (Cost 500 000 – Accumulated depreciation 300 000) 200 000

Profit on sale (given) 350 000

Proceeds 550 000

Capital profit:

Proceeds (calculated above) 550 000

Less original cost/ base cost (the question stated that these were the same) 500 000

Capital profit/ Capital gain 50 000

Taxable capital gain:

Capital gain (calculated above) 50 000

Inclusion rate 50%

Taxable portion of the capital gain 25 000

b) Journals

Debit Credit

31 December 20X2

Income tax expense (E) see (a) 133 500

Current tax payable: income tax (L) 133 500

Income tax for the current year

Dividend declared (OE) Given 70 000

Current tax payable: dividends tax (L) 70 000 x 10% 7 000

Shareholders for dividends (L) 70 000 x 10% 63 000

Dividends declared and dividends tax withheld

© Service & Kolitz, 2018 Chapter 5: Page 20

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.10 continued ...

c) Disclosure

YACK LIMITED

EXTRACTS FROM STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 20X2

Note 20X2

C

Profit before tax 400 000

Income tax expense 4 (133 500)

Profit for the year 266 500

Other comprehensive income for the year -

Total comprehensive income for the year 266 500

YACK LIMITED

EXTRACTS FROM NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 20X2

4. Income tax expense

20X2

C

Current 133 500

Deferred (no temporary differences) -

Tax expense per statement of comprehensive income 133 500

Tax rate reconciliation:

Applicable tax rate 30%

Tax effects of:

Profits before tax (400 000 x 30%) 120 000

Exempt dividend income (C40 000 x 30%) (12 000)

Exempt capital profit [(capital profit: 50K – taxable capital gain: 25 000) x 30%] (7 500)

Non-deductible fines (C10 000 x 30%) 3 000

Non-deductible donations (C100 000 x 30%) 30 000

Tax expense per statement of comprehensive income 133 500

Effective tax rate (133 500 / 400 000) 33.4%

The effective tax rate is higher than the applicable tax rate due mainly to:

Non-deductible donations.

© Service & Kolitz, 2018 Chapter 5: Page 21

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.10 continued …

Note:

Dividends tax does not form part of tax expense as it is a tax on the shareholders receiving the dividend, not

a tax on the company paying the dividends. The company paying the dividend merely withholds the

dividend tax (thus dividend tax is treated in much the same way as employees’ tax).

The fact that there are no temporary differences means that there is no deferred tax. Temporary differences

and deferred tax are explained in chapter 6.

d) Calculations

Accounting Tax

records records

Selling price 550 000 550 000

Carrying amount/ tax base 200 000 220 000

(Cost 500 000 – Accumulated Depreciation: 300 000)

(Cost 500 000 – Accumulated Wear & Tear: 280 000)

Profit 350 000 330 000

Capital profit / Capital gain 50 000 40 000

Accounting: Proceeds: 550 000(part a) – Cost price: 500 000

Tax records: Proceeds: 550 000(part a) – Base cost: 510 000

300 000 280 000

Non-capital profit / recoupment

Accounting: Proceeds ltd to cost: 500 000 – CA: (cost 500 000 – accumulated

depreciation 300 000)

Tax records: Proceeds ltd to cost: 500 000 – TB: (cost 500 000 – accumulated

wear & tear 280 000)

Note:

Under the tax records, the total profit is C330 000. However, the capital gain (C40 000) and the recoupment

(C280 000) add up to only C320 000. This is because the base cost (C510 000) is C10 000 more than the cost (C500

000). Thus C10 000 of the profit is immediately exempted from tax.

© Service & Kolitz, 2018 Chapter 5: Page 22

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.11

Journals Debit Credit

20X1

Current tax payable: income tax (SOFP: L) 60 000

Bank (SOFP: A) 60 000

Provisional tax payments (this is the total of the 2 provisional payments -

these would normally each be journalised separately)

Income tax expense (SOCI: P/L) 95 250

Current tax payable: income tax (SOFP: L) 95 250

Current income tax estimated for 20X1 (see working 1)

20X2

Current tax payable: income tax (SOFP: L) 70 000

Bank (SOFP: current asset) 70 000

Provisional tax payments (this is the total of the 2 provisional payments -

these would normally each be journalised separately)

Income tax expense (SOCI: P/L) 111 000

Current tax payable: income tax (SOFP: L) 111 000

Current income tax estimated for 20X2 (see working 1)

Current tax payable: income tax (SOFP: L) 1 250

Income tax expense (SOCI: P/L) 1 250

Current income tax over-estimated in 20X1 (see working 2)

20X3

Current tax payable: income tax (SOFP: L) 100 000

Bank (SOFP: current asset) 100 000

Provisional tax payments (this is the total of the 2 provisional payments -

these would normally each be journalised separately)

Income tax expense (SOCI: P/L) 150 750

Current tax payable: income tax (SOFP: L) 150 750

Current income tax estimated for 20X3 (see working 1)

Income tax expense (SOCI: P/L) 3 500

Current tax payable: income tax (SOFP: L) 3 500

Current income tax under-estimated in 20X2 (see working 2)

© Service & Kolitz, 2018 Chapter 5: Page 23

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.11 continued . . .

Workings

W1: Calculation of current income tax 20X1 20X2 20X3

C C C

Profit before tax 300 000 400 000 450 000

Non-temporary differences:

Add donations (non-deductible) 40 000 0 0

Less capital profit on sale of vehicle Given (20 000) 0 0

Add taxable capital gain on sale of vehicle 15 000 x 50% 7 500 0 0

Less capital profit on sale of machine SP: 70 -15 -15+ 40 -

CP: 70 (10 000)

Add taxable capital gain on sale of SP: 70 – 15 -15 + 40 -

machine BC: 75 x 50% 2 500

327 500 400 000 442 500

Temporary differences

Total profit: 50 000 - (30 000)

Less non-cap profit on sale of vehicle cap profit: 20 000

Add recoupment on sale of vehicle (1) 30 000

SP, limited to CP: (30 000)

Less non-capital profit on sale of machine 80 limited to70 less

CA: 70 - 15 - 15

Add recoupment on sale of machine SP, limited to CP: 50 000

80 to 70 less

TB: 70 - 25 - 25

Add income received in advance: c/bal 20 000 10 000 40 000

Less income received in advance: o/bal 0 (20 000) (10 000)

Less expenses prepaid: c/bal (30 000) (40 000) (20 000)

Add expenses prepaid: o/bal 0 30 000 40 000

Add depreciation 0 15 000 15 000

Less wear and tear 0 (25 000) (25 000)

Taxable profit 317 500 370 000 502 500

Current income tax at 30% 95 250 111 000 150 750

SP: Selling price

CP: Cost price

CA: Carrying amount

TB: Tax base

BC: Base cost

(1) Yr1: the calculation cannot be performed using the usual equation (SP limited to CP - TB) since there is insufficient

information to do so. However it is 30 000 and this is determined on the basis that the question states that there are no other

TD's, thus it must equal the non-capital profit.

© Service & Kolitz, 2018 Chapter 5: Page 24

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.11 continued . . .

W2: Calculation of over/ under provision of current income 20X1 20X2 20X3

tax

C C C

Current income tax estimated (W1) 95 250 111 000 150 750

not yet

Current income tax assessed (Given) 94 000 114 500 assessed

(Over-provision) / Under-provision (1 250) 3 500 unknown

Assessment received in 20X2, thus journalised in: 20X2

Assessment received in 20X3, thus journalised in: 20X3

© Service & Kolitz, 2018 Chapter 5: Page 25

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.12

a) Current income tax calculation

30%

Profit before tax 963 000

Add non deductible items: donation 54 000

Add taxable capital gain: equipment ( W2.4) 108 000

Less capital profit: equipment (given) (216 000)

Temporary differences:

Add depreciation – vehicle and equipment (given) 342 000

Add impairment – equipment (given) 36 000

Less wear and tear (given) (306 000)

Less income received in advance- O/B (given) (16 020)

Add income received in advance: C/B (given) 9 900

Less expense prepaid C/B (given) (30 600)

Add expense prepaid O/B (given) 32 400

Less scrapping allowance vehicle (W1.2) (306 000)

Less non capital profit: vehicle (W1.1 / Given) (54 000)

Less non capital profit: equipment (W2.2) (36 000)

Add recoupment: equipment (W2.3) 18 000

Taxable profit 598 680 179 604 Dr TE Cr CTP

Workings

W1 Vehicle

W1.1 Vehicle: carrying amount

Proceeds Given 414 000

Profit on sale of vehicle All non-capital profit because SP less than CP: given (54 000)

Carrying amount 360 000

W1.2 Vehicle: scrapping allowance

Proceeds limited to cost Proceeds: 414 000 and Cost: 1 440 000 so not limited 414 000

Less tax base Cost: 1 440 000 – Deductions allowed: 720 000 (720 000)

Scrapping allowance (306 000)

W2 Equipment

W2.1 Equipment: proceeds on sale

Capital profit Given 216 000

Cost Given 180 000

Proceeds 396 000

W2.2 Equipment: profit on sale – non-capital portion

Proceeds limited to cost Proceeds: 396 000 limited to Cost: 180 000 180 000

Less carrying amount Given (144 000)

Non-capital profit 36 000

W2.3 Equipment: recoupment

Proceeds limited to cost Proceeds: 396 000 limited to Cost: 180 000 180 000

Less tax base Given (162 000)

Recoupment 18 000

© Service & Kolitz, 2018 Chapter 5: Page 26

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

lOMoARcPSD|3314559

Solutions to GAAP : Graded Questions Taxation: various types and current income tax

Solution 5.12 continued . . .

a) Continued ...

W2 Equipment: continued …

W2.4 Equipment: taxable and exempt capital gain

Proceeds W2.1 396 000

Less cost Given (180 000)

Capital gain 216 000

Taxable capital gain Capital gain: 216 000 x 50% 108 000

Exempt capital gain Capital gain: 216 000– Taxable capital gain: 108 000 108 000

b) Journal entries

Debit Credit

28 February 20X6

Current tax payable: income tax (L) 20 430

Bank 20 430

Payment of outstanding balance

31 March 20X6

Current tax payable: income tax (L) (1 080 000 x 30%) / 2 162 000

Bank 162 000

Payment of first provisional payment

31 December 20X6

Current tax payable: income tax (L) (729 000 x 30%) – 162 000 56 700

Bank 56 700

Payment of second provisional payment

Income tax expense (P/L) Part a 179 604

Current tax payable: income tax (L) 179 604

Current year tax expense

Income tax expense Part a: 421 200 – 406 200 15 000

Current tax payable: income tax (L) 15 000

Prior year current tax expense underprovided

© Service & Kolitz, 2018 Chapter 5: Page 27

Downloaded by shehroz sami (m.shehrozsami@gmail.com)

You might also like

- Test Bank 2 - Ia 3Document31 pagesTest Bank 2 - Ia 3Xiena100% (6)

- Financial Analysis With Microsoft Excel 6th Edition Mayes Solutions ManualDocument49 pagesFinancial Analysis With Microsoft Excel 6th Edition Mayes Solutions ManualChelseaPowelljscna100% (13)

- Understanding Financial Statements 11th Edition Fraser Solutions ManualDocument26 pagesUnderstanding Financial Statements 11th Edition Fraser Solutions ManualDerekGarrettdfexi100% (33)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Acc 109 p2 Quiz Statement of Comprehensive IncomeDocument10 pagesAcc 109 p2 Quiz Statement of Comprehensive IncomeRhea Lalas100% (4)

- LBO Modeling Test Example - Street of WallsDocument18 pagesLBO Modeling Test Example - Street of WallsVineetNo ratings yet

- Statement of Comprehensive Income: Problem 1: True or FalseDocument17 pagesStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- CFIN 4 4th Edition Besley Solutions Manual PDFDocument9 pagesCFIN 4 4th Edition Besley Solutions Manual PDFbill334No ratings yet

- Chapter 10 - Teacher's Manual - Afar Part 1Document20 pagesChapter 10 - Teacher's Manual - Afar Part 1Angelic67% (3)

- Accounting Funeral Service CompendDocument25 pagesAccounting Funeral Service Compendasafoabe4065No ratings yet

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- Installment SalesDocument12 pagesInstallment SalesRusselle Therese DaitolNo ratings yet

- Comprehensive Income & NcahsDocument6 pagesComprehensive Income & NcahsNuarin JJ67% (3)

- Advanced Accounting Solutions Chapter 7 ProblemsDocument2 pagesAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNo ratings yet

- Module 7 InstallmentDocument12 pagesModule 7 InstallmentNiki DimaanoNo ratings yet

- Chapter 9Document23 pagesChapter 9TouseefsabNo ratings yet

- Installment Sales MethodDocument11 pagesInstallment Sales MethodJanella Umieh De UngriaNo ratings yet

- Ias 07Document72 pagesIas 07Hannan Fatima EllahiNo ratings yet

- Financial Decision Making: Module Code: UMADFJ-15-MDocument9 pagesFinancial Decision Making: Module Code: UMADFJ-15-MFaraz BakhshNo ratings yet

- Chapter 2 Statement of Comprehensive IncomeDocument4 pagesChapter 2 Statement of Comprehensive IncomebwimeeeNo ratings yet

- Semi-Finals Solutions MartinezDocument10 pagesSemi-Finals Solutions MartinezGeraldine Martinez DonaireNo ratings yet

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- Statement of Changes in Comprehensive IncomeDocument33 pagesStatement of Changes in Comprehensive Incomeellyzamae quiraoNo ratings yet

- Financial Accounting: Tools For Business Decision Making: Ninth EditionDocument70 pagesFinancial Accounting: Tools For Business Decision Making: Ninth EditionJesussNo ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- Acc. ReceivDocument4 pagesAcc. ReceivMikaella LamadoraNo ratings yet

- Chapter 10Document6 pagesChapter 10Love FreddyNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- Sol. Man. - Chapter 2 - Statement of Comprehensive IncomeDocument15 pagesSol. Man. - Chapter 2 - Statement of Comprehensive IncomeKATHRYN CLAUDETTE RESENTE100% (1)

- Solutions:: I. In-Transit ItemDocument6 pagesSolutions:: I. In-Transit ItemMary EdsylleNo ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial Reportingbelle crisNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Taxation AccountingDocument10 pagesTaxation Accountingjanahh.omNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- Assignment 2Document6 pagesAssignment 2TAWHID ARMANNo ratings yet

- Income Taxation 2023 DiscussionsDocument16 pagesIncome Taxation 2023 DiscussionsKenjay SarcoNo ratings yet

- Ventura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Document7 pagesVentura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Mary VenturaNo ratings yet

- Section C Answer Student'sDocument7 pagesSection C Answer Student'sAmir ArifNo ratings yet

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNo ratings yet

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Document24 pages(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaNo ratings yet

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- 5 6336743075766863237 PDFDocument75 pages5 6336743075766863237 PDFshagufta afrin100% (1)

- Acc 109 p2 Quiz Statement of Comprehensive IncomeDocument11 pagesAcc 109 p2 Quiz Statement of Comprehensive IncomeRonel CastillonNo ratings yet

- Module 3 Exercises 1. Pro Forma Income Statements: Scenario AnalysisDocument7 pagesModule 3 Exercises 1. Pro Forma Income Statements: Scenario AnalysisJARED DARREN ONGNo ratings yet

- Assignment - Cash FlowsDocument9 pagesAssignment - Cash FlowsArshad ChaudharyNo ratings yet

- Problem 1: SolutionDocument4 pagesProblem 1: Solutionpapa1No ratings yet

- Cash Flow Statement Ias 7Document5 pagesCash Flow Statement Ias 7JOSEPH LUBEMBANo ratings yet

- 1stLecture-Partnership LiquidationDocument25 pages1stLecture-Partnership LiquidationRechelle Dalusung100% (1)

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Ia Assignment 2Document2 pagesIa Assignment 2Shekinah SesbrenoNo ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Sol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1a - 2020 EditionDocument20 pagesSol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- BAFACR16 01 Problem IllustrationsDocument2 pagesBAFACR16 01 Problem Illustrationsmisssunshine112No ratings yet

- Installment Sales NotesDocument19 pagesInstallment Sales NotesTrixie HicaldeNo ratings yet

- ExampleDocument8 pagesExampleAli Akand AsifNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Variance IQ FileDocument34 pagesVariance IQ FileShehrozSTNo ratings yet

- Solutions Consolidation-FormattedDocument22 pagesSolutions Consolidation-FormattedShehrozSTNo ratings yet

- Solutions of Revision Session by AMK Sept 2020 AttemptDocument13 pagesSolutions of Revision Session by AMK Sept 2020 AttemptShehrozSTNo ratings yet

- Solution Ifrs 16 QuizDocument6 pagesSolution Ifrs 16 QuizShehrozSTNo ratings yet

- Solutions IAS 1 For SEPT ATTEMPT FinalDocument25 pagesSolutions IAS 1 For SEPT ATTEMPT FinalShehrozSTNo ratings yet

- Standard Costing Practice Questions FinalDocument5 pagesStandard Costing Practice Questions FinalShehrozSTNo ratings yet

- Standard Costing Homework Questions FinalDocument2 pagesStandard Costing Homework Questions FinalShehrozSTNo ratings yet

- Cost and Management Accounting Quiz - 1Document3 pagesCost and Management Accounting Quiz - 1ShehrozSTNo ratings yet

- Shortcut For TOCsDocument2 pagesShortcut For TOCsShehrozSTNo ratings yet

- GIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyDocument36 pagesGIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyShehrozSTNo ratings yet

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- Grand Mock CMA CAF 8 With Solution Sir Saud Tariq ST AcademyDocument15 pagesGrand Mock CMA CAF 8 With Solution Sir Saud Tariq ST AcademyShehrozST100% (2)

- Chapter 1 - Inventory Valuation: Caf-08 Cma Complete TheoryDocument8 pagesChapter 1 - Inventory Valuation: Caf-08 Cma Complete TheoryShehrozSTNo ratings yet

- 1 AppleBiz Problem 1Document3 pages1 AppleBiz Problem 1Valerie AsimacopoulosNo ratings yet

- Overview & Financial Analysis On City BankDocument28 pagesOverview & Financial Analysis On City BankMickey Mathew D'CostaNo ratings yet

- Accounting - An Information Process Accounting - An Information ProcessDocument58 pagesAccounting - An Information Process Accounting - An Information ProcessBernadette Cunanan RamosNo ratings yet

- AC1025 2011-Principles of Accounting Main EQP and Commentaries AC1025 2011-Principles of Accounting Main EQP and CommentariesDocument68 pagesAC1025 2011-Principles of Accounting Main EQP and Commentaries AC1025 2011-Principles of Accounting Main EQP and Commentaries전민건No ratings yet

- Financial Performance of Private Sector and Public Sector Banks in India An Empirical AnalysisDocument11 pagesFinancial Performance of Private Sector and Public Sector Banks in India An Empirical AnalysisEmranul Islam ShovonNo ratings yet

- Acst252 - Week 3 - Ross - 7e - PPT - ch03 - V3Document41 pagesAcst252 - Week 3 - Ross - 7e - PPT - ch03 - V3nathanNo ratings yet

- XL 2048Document5 pagesXL 2048ChiTat LoNo ratings yet

- Warehousing Fundamentals, Inventory ManagementDocument18 pagesWarehousing Fundamentals, Inventory ManagementNayan NagmotiNo ratings yet

- VEDL - Investor Presentation - 28-Oct-22 - TickertapeDocument84 pagesVEDL - Investor Presentation - 28-Oct-22 - TickertapeSarthakNo ratings yet

- CB Insights - Venture Trends Q2 2021Document375 pagesCB Insights - Venture Trends Q2 2021DIVYANSHU SHEKHARNo ratings yet

- Corporate Finance Cheat SheetsDocument7 pagesCorporate Finance Cheat SheetsDianeDianeNo ratings yet

- BK - Board Question Paper - March 2023 - 640c2df6aaec0Document6 pagesBK - Board Question Paper - March 2023 - 640c2df6aaec0Priyansh ShahNo ratings yet

- ACTBAS1 SyllabusDocument5 pagesACTBAS1 SyllabustjpalancaNo ratings yet

- QUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsDocument13 pagesQUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsSiddharth VoraNo ratings yet

- Strategic Management Case Study TemplateDocument86 pagesStrategic Management Case Study TemplateNeil NaduaNo ratings yet

- New Company Law AssignmentDocument11 pagesNew Company Law AssignmentAshish pariharNo ratings yet

- FINMAN Notes - April 14, 2021Document10 pagesFINMAN Notes - April 14, 2021Nicole Andrea TuazonNo ratings yet

- Chapter 9 Investments Ia Part 1aDocument9 pagesChapter 9 Investments Ia Part 1arobinady dollagaNo ratings yet

- Financial Accounting BasicsDocument259 pagesFinancial Accounting BasicsPrachi GargNo ratings yet

- Answer KeyDocument52 pagesAnswer KeyDevonNo ratings yet

- Fundamental Accounting I Chapter 1$2 NewwDocument25 pagesFundamental Accounting I Chapter 1$2 NewwDere GurandaNo ratings yet

- Analysis of IPO As An Exit Strategy For Private Equity Firms in The Present ScenarioDocument10 pagesAnalysis of IPO As An Exit Strategy For Private Equity Firms in The Present ScenarioPushpak Reddy GattupalliNo ratings yet

- Financial Plan For BusinessDocument4 pagesFinancial Plan For Businesschandralekhakodavali100% (1)

- Chapter 2 - Capital Structure PlanningDocument11 pagesChapter 2 - Capital Structure PlanningParth GargNo ratings yet

- Cafés Monte Blanco: Building A Profit PlanDocument11 pagesCafés Monte Blanco: Building A Profit Planvipul tutejaNo ratings yet

- Introduction To Financial Accounting: 8th EditionDocument59 pagesIntroduction To Financial Accounting: 8th EditionDevendra Pratap SinghNo ratings yet