Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

174 viewsBrazil List

Brazil List

Uploaded by

Luiz Bonacin NettoThis list provides bond information for various Brazilian issuers, including sovereign bonds from Brazil and state-owned banks like BNDES, as well as private banks like Bradesco and BTG Pactual. Key details provided for each bond include the issuer, coupon rate, maturity date, current yield, ratings, and trading volume. The list is for illustrative purposes only and does not constitute an investment recommendation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Delta Capital Bonds Feb2024 - 240208 - 092614Document6 pagesDelta Capital Bonds Feb2024 - 240208 - 092614Marvin RamirezNo ratings yet

- Dimensional 2035 Target Date Retirement Income FundDocument394 pagesDimensional 2035 Target Date Retirement Income FundEdgar salvador Arreola valenciaNo ratings yet

- Corporate US HYDocument5 pagesCorporate US HYtarja19761No ratings yet

- RUN Corp y Soberanos de Brazil USD 24.10.17Document6 pagesRUN Corp y Soberanos de Brazil USD 24.10.17quiquemoNo ratings yet

- IsinDocument3 pagesIsinLCR FINANCE PLCNo ratings yet

- (138224) (CD) BCI - HoldingsDocument4 pages(138224) (CD) BCI - HoldingsguitraderNo ratings yet

- Island Homes Sold - 2023Document4 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document4 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document4 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document4 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Jetta SportlineDocument2 pagesJetta SportlineEdgar BarronNo ratings yet

- Kristal Bond WatchList - 29th MayDocument6 pagesKristal Bond WatchList - 29th MayPranab PattanaikNo ratings yet

- Island Homes Sold - 2023Document1 pageIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document4 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document3 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2020Document12 pagesIsland Homes Sold - 2020Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document2 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Land Sold - 2023Document1 pageIsland Land Sold - 2023Louis CutajarNo ratings yet

- Island Land Sold - 2023Document1 pageIsland Land Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2021Document5 pagesIsland Homes Sold - 2021cutty54No ratings yet

- Island Homes Sold - 2021Document9 pagesIsland Homes Sold - 2021Louis CutajarNo ratings yet

- Island Homes Sold - 2020Document5 pagesIsland Homes Sold - 2020Louis CutajarNo ratings yet

- Island Land Sold - 2023Document1 pageIsland Land Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document7 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document7 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2020Document9 pagesIsland Homes Sold - 2020Louis Cutajar100% (2)

- Island Homes Sold - 2020Document3 pagesIsland Homes Sold - 2020Louis CutajarNo ratings yet

- Asit Bera Beniajola, Pashchim Ghoshpur Beniajola, Hooghly, West Bengal - 712613Document1 pageAsit Bera Beniajola, Pashchim Ghoshpur Beniajola, Hooghly, West Bengal - 712613hdeygstNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2021Document9 pagesIsland Homes Sold - 2021Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document6 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document7 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Land Sold - 2023Document1 pageIsland Land Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Sukuk Indicative QuotesDocument5 pagesSukuk Indicative QuotesAhmedNo ratings yet

- Island Homes Sold - 2024Document1 pageIsland Homes Sold - 2024Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document1 pageIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Land Sold - 2023Document1 pageIsland Land Sold - 2023Louis CutajarNo ratings yet

- UntitledDocument2 pagesUntitledSrinivasSeenuNo ratings yet

- Pay Stub Portal 2Document1 pagePay Stub Portal 2cynthiaruder74No ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2024Document2 pagesIsland Homes Sold - 2024Louis CutajarNo ratings yet

- HDFC Bike LoanDocument3 pagesHDFC Bike LoanRavi ChristoNo ratings yet

- Crypto PNL Sheet - MayDocument2 pagesCrypto PNL Sheet - MayMirza Muhammad BaigNo ratings yet

- EconomyDocument7 pagesEconomypresencabNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Shortage - Mar - 20.3.2024Document43 pagesShortage - Mar - 20.3.2024hoangthihongnhung0201No ratings yet

- Island Homes Sold - 2020Document3 pagesIsland Homes Sold - 2020cutty54No ratings yet

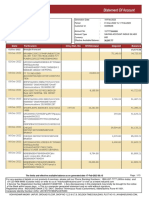

- Statement From January 23 Upto Nov 2023Document5 pagesStatement From January 23 Upto Nov 2023DawitNo ratings yet

- Bond Focus - Mandiri Sekuritas - 20231129Document7 pagesBond Focus - Mandiri Sekuritas - 20231129heroki wdyaNo ratings yet

- Opp 15.11.2023 Na A Parts Overhaul RWF Ii 134 Mna KTDocument3 pagesOpp 15.11.2023 Na A Parts Overhaul RWF Ii 134 Mna KTRahmadsyah PutraNo ratings yet

- Island Homes Sold - 2020Document52 pagesIsland Homes Sold - 2020cutty54No ratings yet

- Island Homes Sold - 2020Document6 pagesIsland Homes Sold - 2020cutty54No ratings yet

- PIMCO Funds Emerging Markets Bond Fund Portfolio HoldingsDocument15 pagesPIMCO Funds Emerging Markets Bond Fund Portfolio HoldingsVijay KumarNo ratings yet

- Island Homes Sold - 2020Document2 pagesIsland Homes Sold - 2020cutty54No ratings yet

- Island Homes Sold - 2020Document2 pagesIsland Homes Sold - 2020cutty54No ratings yet

- Course Outline Technology EntrepreneurshipDocument3 pagesCourse Outline Technology EntrepreneurshipBisma khanNo ratings yet

- DocxDocument5 pagesDocxNevan NovaNo ratings yet

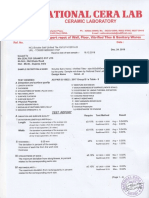

- 12 - National Cera Lab Test Report - 600x1200 MM - 24.12.2019Document3 pages12 - National Cera Lab Test Report - 600x1200 MM - 24.12.2019Shaikh MohammedHanifSultanNo ratings yet

- The Trading NuggetsDocument31 pagesThe Trading NuggetsZiaur RahmanNo ratings yet

- Analysis of Indian GDP.Document8 pagesAnalysis of Indian GDP.Navdeep TiwariNo ratings yet

- Roche - John Locke and The Bank of England (2021)Document175 pagesRoche - John Locke and The Bank of England (2021)RublesNo ratings yet

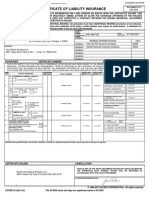

- CertificateOfInsurance - GeminiDocument1 pageCertificateOfInsurance - Geminiganesh gaddeNo ratings yet

- 5052-H112 Aluminum: Related SpecificationsDocument1 page5052-H112 Aluminum: Related SpecificationsDamon CiouNo ratings yet

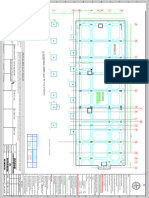

- Raft Slab LayoutDocument1 pageRaft Slab LayoutDINESH M.NNo ratings yet

- Upsrlm LetterDocument4 pagesUpsrlm LetterSURYAKANT PATHAKNo ratings yet

- DITO Tower Civil Work - Acceptance Checklist 20200521-TCW - 1625704814Document1 pageDITO Tower Civil Work - Acceptance Checklist 20200521-TCW - 1625704814bashirNo ratings yet

- Magbook Indian Economy-ArihantDocument241 pagesMagbook Indian Economy-Arihantmanish100% (3)

- Gyan Ganga: Institute of Technology &sciencesDocument6 pagesGyan Ganga: Institute of Technology &sciencesMandhir NarangNo ratings yet

- Approved Drawing of Boundary WallDocument1 pageApproved Drawing of Boundary WallAnup Singh RajputNo ratings yet

- The Impact of Earnings Management On The Value Relevance of EarningsDocument25 pagesThe Impact of Earnings Management On The Value Relevance of Earningsanubha srivastavaNo ratings yet

- Management Programme: MFP-1: Equity MarketsDocument2 pagesManagement Programme: MFP-1: Equity MarketsDivey GuptaNo ratings yet

- Volferda VL-PB02 Luxury Prefabricated Small House Hotel High-End Hotel Tempered Glass Room InsulatioDocument1 pageVolferda VL-PB02 Luxury Prefabricated Small House Hotel High-End Hotel Tempered Glass Room InsulatioDigy MaleachiqNo ratings yet

- Syllabus Logistics ManagementDocument4 pagesSyllabus Logistics ManagementRegine NanitNo ratings yet

- Ib Economics Unit 1 MicroDocument12 pagesIb Economics Unit 1 Microapi-196719233No ratings yet

- ICICI Health Policy 2022Document6 pagesICICI Health Policy 2022HuddarNo ratings yet

- Kolotan 5A - DeEDDocument14 pagesKolotan 5A - DeEDAl Mahmud HasanNo ratings yet

- Report 4Document32 pagesReport 4BILENGE MALILONo ratings yet

- Adhoc00000007241758 2000712387Document6 pagesAdhoc00000007241758 2000712387Suman KumarNo ratings yet

- Setting Product StrategyDocument30 pagesSetting Product StrategyAfik 178No ratings yet

- TDI Válvula Relevadora Mca. TDIDocument14 pagesTDI Válvula Relevadora Mca. TDIJorge CalcaneoNo ratings yet

- Gift Deed and Transfer Set Required at MumbaiDocument28 pagesGift Deed and Transfer Set Required at MumbaiSandeep DubeyNo ratings yet

- SolutionDocument8 pagesSolutionArslanNo ratings yet

- Jasa & Part Dozer Wira Doni Trakindo Medan Quot - V2 - D6R2 - XL - TTT00306 - Repair - Maintenance - Brake - PT. - Aruan - Cipta - EnergiDocument4 pagesJasa & Part Dozer Wira Doni Trakindo Medan Quot - V2 - D6R2 - XL - TTT00306 - Repair - Maintenance - Brake - PT. - Aruan - Cipta - EnergiGogot YuliyantoNo ratings yet

- ABC MemoDocument4 pagesABC MemoPriyanshi PatelNo ratings yet

- M and B 3 Hybrid 3rd Edition Dean Croushore Solutions Manual Full Chapter PDFDocument34 pagesM and B 3 Hybrid 3rd Edition Dean Croushore Solutions Manual Full Chapter PDFjamesstokesmfyqdrocjp100% (15)

Brazil List

Brazil List

Uploaded by

Luiz Bonacin Netto0 ratings0% found this document useful (0 votes)

174 views2 pagesThis list provides bond information for various Brazilian issuers, including sovereign bonds from Brazil and state-owned banks like BNDES, as well as private banks like Bradesco and BTG Pactual. Key details provided for each bond include the issuer, coupon rate, maturity date, current yield, ratings, and trading volume. The list is for illustrative purposes only and does not constitute an investment recommendation.

Original Description:

BONDS PRICE LIST

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis list provides bond information for various Brazilian issuers, including sovereign bonds from Brazil and state-owned banks like BNDES, as well as private banks like Bradesco and BTG Pactual. Key details provided for each bond include the issuer, coupon rate, maturity date, current yield, ratings, and trading volume. The list is for illustrative purposes only and does not constitute an investment recommendation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

174 views2 pagesBrazil List

Brazil List

Uploaded by

Luiz Bonacin NettoThis list provides bond information for various Brazilian issuers, including sovereign bonds from Brazil and state-owned banks like BNDES, as well as private banks like Bradesco and BTG Pactual. Key details provided for each bond include the issuer, coupon rate, maturity date, current yield, ratings, and trading volume. The list is for illustrative purposes only and does not constitute an investment recommendation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

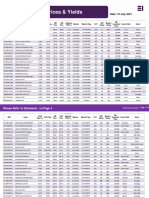

BRAZIL BOND LIST UNIVERSE

This list does not constitute a recommendation to buy / sell by Santander, is for illustrative purposes only and provided at your request

Bid Next Call Z-

Mininum CCY Cupon Bonds Maturity Bid Ask Ask YTM Ask YTC Mod Dur Rating Vol MM ISIN Collateral

YTM Date Spread

BRAZIL SOVEREIGN

100,000 USD 4.875 BRAZIL 4 7/8 01/22/21 22.01.2021 100.03 100.26 3.85% -4.44% -462 0.03 BB- 2,713 US105756BS83 Sr Unsecured

200,000 USD 2.625 BRAZIL 2 5/8 01/05/23 05.01.2023 103.38 103.84 0.90% 0.67% 46 1.94 BB- 2,150 US105756BU30 Sr Unsecured

1,000 USD 8.875 BRAZIL 8 7/8 04/15/24 15.04.2024 124.30 125.46 1.24% 0.92% 61 2.88 BB- 1,029 US105756AR10 Sr Unsecured

200,000 USD 4.250 BRAZIL 4 1/4 01/07/25 07.01.2025 109.13 109.63 1.86% 1.74% 135 3.69 BB- 4,300 US105756BV13 Sr Unsecured

1,000 USD 8.750 BRAZIL 8 3/4 02/04/25 04.02.2025 125.55 126.42 2.15% 1.95% 156 3.44 BB- 688 US105756BF62 Sr Unsecured

200,000 USD 6.000 BRAZIL 6 04/07/26 07.04.2026 119.08 119.63 2.13% 2.03% 148 4.53 BB- 2,176 US105756BX78 Sr Unsecured

1,000 USD 10.125 BRAZIL 10 1/8 05/15/27 15.05.2027 142.38 143.31 2.79% 2.66% 201 4.99 BB- 765 US105756AE07 Sr Unsecured

200,000 USD 4.625 BRAZIL 4 5/8 01/13/28 13.01.2028 110.69 111.30 2.93% 2.83% 13.10.2027 2.78% 205 5.73 BB- 3,000 US105756BZ27 Sr Unsecured

200,000 USD 4.500 BRAZIL 4 1/2 05/30/29 30.05.2029 109.87 110.40 3.15% 3.08% 217 6.83 BB- 2,000 US105756CA66 Sr Unsecured

200,000 USD 4.625 BRAZIL 4 5/8 01/13/28 13.01.2028 110.69 111.30 2.93% 2.83% 13.10.2027 2.78% 205 5.73 BB- 3,000 US105756BZ27 Sr Unsecured

200,000 USD 3.875 BRAZIL 3 7/8 06/12/30 12.06.2030 103.53 104.02 3.43% 3.37% 238 7.86 BB- 3,500 US105756CC23 Sr Unsecured

1,000 USD 7.125 BRAZIL 7 1/8 01/20/37 20.01.2037 131.70 132.68 4.36% 4.28% 302 10.19 BB- 1,634 US105756BK57 Sr Unsecured

200,000 USD 5.000 BRAZIL 5 01/27/45 27.01.2045 106.55 107.05 4.55% 4.52% 308 13.97 BB- 3,300 US105756BW95 Sr Unsecured

100,000 USD 5.625 BRAZIL 5 5/8 01/07/41 07.01.2041 113.92 114.79 4.56% 4.50% 312 12.51 BB- 2,221 US105756BR01 Sr Unsecured

200,000 USD 5.625 BRAZIL 5 5/8 02/21/47 21.02.2047 114.75 115.60 4.64% 4.59% 315 14.23 BB- 2,789 US105756BY51 Sr Unsecured

200,000 USD 4.750 BRAZIL 4 3/4 01/14/50 14.01.2050 101.96 102.69 4.63% 4.58% 14.07.2049 4.58% 311 15.36 BB- 3,250 US105756CB40 Sr Unsecured

BNDES

200,000 USD 5.750 BNDES 5 3/4 09/26/23 26.09.2023 111.79 112.47 1.30% 1.06% 80 2.51 BB- 1,094 USP14486AJ63 Sr Unsecured

200,000 USD 4.750 BNDES 4 3/4 05/09/24 09.05.2024 108.89 109.58 1.97% 1.77% 145 3.08 BB- 497 USP14486AM92 Sr Unsecured

BANBRA

100,000 USD 5.375 BANBRA 5 3/8 01/15/21 15.01.2021 99.89 100.27 18.00% -26.26% -2,486 0.01 N/A 660 USP3772WAB83 Subordinated

200,000 USD 5.875 BANBRA 5 7/8 01/26/22 26.01.2022 104.43 104.89 1.56% 1.12% 93 0.99 N/A 1,490 USG07402DN01 Subordinated

200,000 USD 3.875 BANBRA 3 7/8 10/10/22 10.10.2022 103.92 104.41 1.59% 1.31% 111 1.68 BB- 1,810 US05958AAJ79 Sr Unsecured

200,000 USD 4.875 BANBRA 4 7/8 04/19/23 19.04.2023 106.51 107.06 1.93% 1.69% 146 2.14 BB- 750 USP3772WAJ10 Sr Unsecured

200,000 USD 5.875 BANBRA 5 7/8 01/19/23 19.01.2023 107.24 107.95 2.19% 1.85% 163 1.87 B- 741 USP3772WAE23 Subordinated

200,000 USD 4.750 BANBRA 4 3/4 03/20/24 20.03.2024 107.56 108.13 2.28% 2.10% 179 2.94 BB- 750 USP1R027AA25 Sr Unsecured

200,000 USD 4.625 BANBRA 4 5/8 01/15/25 15.01.2025 108.52 109.17 2.38% 2.22% 183 3.60 BB- 1,000 USP3772WAH53 Sr Unsecured

200,000 USD 6.250 BANBRA 6 1/4 PERP Perpetual 102.14 102.87 5.49% 5.45% 15.04.2024 5.28% 497 2.89 CCC+ 1,950 USG07402DP58 Jr Subordinated

200,000 USD 9.000 BANBRA 9 PERP Perpetual 111.05 111.96 7.00% 6.94% 18.06.2024 5.15% 483 2.96 CCC+ 2,150 USP3772WAF97 Jr Subordinated

200,000 USD 9.250 BANBRA 9 1/4 PERP Perpetual 109.53 110.42 7.80% 7.73% 15.04.2023 4.35% 412 2.02 CCC+ 1,286 USP3772WAC66 Jr Subordinated

BRADESCO

100,000 USD 5.900 BRADES 5.9 01/16/21 16.01.2021 99.92 100.29 12.83% -19.14% -1,850 0.01 Ba3 1,600 USG0732RAF58 Subordinated

200,000 USD 5.750 BRADES 5 3/4 03/01/22 01.03.2022 104.64 105.23 1.61% 1.10% 91 1.09 Ba3 1,100 USG0732RAG32 Subordinated

200,000 USD 2.850 BRADES 2.85 01/27/23 27.01.2023 102.16 102.68 1.77% 1.51% 130 1.96 BB- 800 US05947LAY48 Sr Unsecured

200,000 USD 3.200 BRADES 3.2 01/27/25 27.01.2025 104.24 104.84 2.10% 1.95% 155 3.74 BB- 800 US05947LAZ13 Sr Unsecured

BTG

200,000 USD 5.750 BTGPBZ 5 3/4 09/28/22 28.09.2022 105.69 106.35 2.33% 1.96% 175 1.62 Ba3 450 USP07790AD31 Subordinated

200,000 USD 5.500 BTGPBZ 5 1/2 01/31/23 31.01.2023 106.55 107.47 2.21% 2.21% 155 1.91 Ba2 500 US05971BAD10 Sr Unsecured

200,000 USD 4.500 BTGPBZ 4 1/2 01/10/25 10.01.2025 106.36 107.12 2.81% 2.61% 10.12.2024 2.58% 219 3.59 BB- 500 US05971BAE92 Sr Unsecured

200,000 USD 7.750 BTGPBZ 7 3/4 02/15/29 15.02.2029 108.48 109.34 5.22% 5.18% 15.02.2024 4.52% 423 2.68 B1 600 USP07790AE14 Subordinated

ITAU

100,000 USD 5.750 ITAU 5 3/4 01/22/21 22.01.2021 99.88 100.33 9.67% -5.91% -606 0.03 Ba3 1,250 US46556MAB81 Subordinated

200,000 USD 6.200 ITAU 6.2 12/21/21 21.12.2021 104.21 104.72 1.68% 1.15% 96 0.92 Ba3 1,050 US46556MAE21 Subordinated

200,000 USD 5.650 ITAU 5.65 03/19/22 19.03.2022 104.30 104.93 1.97% 1.44% 124 1.14 Ba3 1,250 US46556MAF95 Subordinated

200,000 USD 5.500 ITAU 5 1/2 08/06/22 06.08.2022 105.33 105.93 2.03% 1.65% 145 1.48 Ba3 1,375 US46556MAH51 Subordinated

200,000 USD 5.125 ITAU 5 1/8 05/13/23 13.05.2023 106.64 107.31 2.19% 1.91% 167 2.20 Ba3 1,870 US46556MAJ18 Subordinated

200,000 USD 2.900 ITAU 2.9 01/24/23 24.01.2023 102.23 102.84 1.78% 1.48% 126 1.95 BB- 1,000 US46556KAA43 Sr Unsecured

200,000 USD 3.250 ITAU 3 1/4 01/24/25 24.01.2025 104.39 105.01 2.11% 1.95% 155 3.73 BB- 500 US46556KAB26 Sr Unsecured

200,000 USD 4.500 ITAU 4 1/2 11/21/29 21.11.2029 102.88 103.61 3.48% 3.38% 311 3.51 B1 750 US46556MAM47 Subordinated

200,000 USD 6.125 ITAU 6 1/8 PERP Perpetual 101.75 102.68 4.50% 4.46% 12.12.2022 4.65% 444 1.79 B2 1,250 USP5R6DPAA84 Jr Subordinated

200,000 USD 6.500 ITAU 6 1/2 PERP Perpetual 103.28 104.07 4.38% 4.34% 19.03.2023 4.52% 429 1.99 B2 750 USP5R6DPAB67 Jr Subordinated

200,000 USD 4.625 ITAU 4 5/8 PERP Perpetual 97.80 98.56 3.91% 3.88% 27.02.2025 5.01% 461 3.64 BB- 700 USP59699AB77 Jr Subordinated

BANCO SAFRA

200,000 USD 6.750 BANSAF 6 3/4 01/27/21 27.01.2021 100.18 100.50 2.40% -5.04% -521 0.04 Ba3 500 USP1507FAA32 Subordinated

200,000 USD 4.125 BANSAF 4 1/8 02/08/23 08.02.2023 103.57 104.35 2.35% 1.97% 175 1.96 BB- 500 US05964TAQ22 Sr Unsecured

BANCO VOTORANTIM

200,000 USD 4.000 BANVOR 4 09/24/22 24.09.2022 103.51 104.09 1.89% 1.55% 135 1.63 BB- 400 XS2055651082 Sr Unsecured

200,000 USD 4.500 BANVOR 4 1/2 09/24/24 24.09.2024 105.84 106.59 2.83% 2.62% 226 3.37 BB- 450 XS2055749720 Sr Unsecured

200,000 USD 4.375 BANVOR 4 3/8 07/29/25 29.07.2025 106.33 106.96 2.88% 2.74% 227 4.06 BB- 600 XS2210789934 Sr Unsecured

200,000 USD 8.250 BANVOR 8 1/4 PERP Perpetual 106.12 107.32 6.37% 6.29% 07.12.2022 4.20% 399 1.75 CCC 300 USP1516SFH42 Jr Subordinated

OTHER BANKS

150,000 USD 3.500 CAIXBR 3 1/2 11/07/22 07.11.2022 103.27 103.87 1.67% 1.34% 113 1.76 Ba2 500 US12803X2B68 Sr Unsecured

200,000 USD 7.375 BRSRBZ 7 3/8 02/02/22 02.02.2022 104.93 105.20 2.61% 2.36% 217 0.99 B1 523 USP12445AA33 Subordinated

150,000 USD 4.250 DAYCOV 4 1/4 12/13/24 13.12.2024 103.81 104.64 3.21% 2.99% 260 3.59 Ba2 450 XS2092941330 Sr Unsecured

BRASKEM

200,000 USD 5.375 BRASKM 5 3/8 05/02/22 02.05.2022 104.31 105.11 2.01% 1.41% 121 1.26 BB+ 289 USG1315RAG68 Sr Unsecured

200,000 USD 3.500 BRASKM 3 1/2 01/10/23 10.01.2023 102.21 102.99 2.36% 1.96% 169 1.85 BB+ 207 USN15516AA01 Sr Unsecured

200,000 USD 6.450 BRASKM 6.45 02/03/24 03.02.2024 109.68 110.40 3.11% 2.87% 258 2.73 BB+ 750 US10553YAF25 Sr Unsecured

200,000 USD 4.500 BRASKM 4 1/2 01/10/28 10.01.2028 104.64 105.50 3.74% 3.60% 285 5.81 BB+ 1,250 USN15516AB83 Sr Unsecured

200,000 USD 4.500 BRASKM 4 1/2 01/31/30 31.01.2030 102.64 103.50 4.15% 4.03% 308 7.27 BB+ 1,500 USN15516AD40 Sr Unsecured

200,000 USD 7.125 BRASKM 7 1/8 07/22/41 22.07.2041 115.56 116.57 5.82% 5.74% 439 10.99 BB+ 750 USU1065PAA94 Sr Unsecured

200,000 USD 5.875 BRASKM 5 7/8 01/31/50 31.01.2050 103.26 104.59 5.65% 5.55% 412 13.83 BB+ 750 USN15516AE23 Sr Unsecured

200,000 USD 8.500 BRASKM 8 1/2 01/23/81 23.01.2081 111.19 112.16 7.75% 7.68% 24.10.2025 5.57% 509 3.83 B+ 600 USN15516AF97 Subordinated

100,000 USD 7.375 BRASKM 7 3/8 PERP 102.55 103.09 7.19% 7.15% 15.01.2021 -351.52% 0.01 BB+ 500 USG1315RAC54 Sr Unsecured

PETROBRAS

2,000 USD 4.375 PETBRA 4 3/8 05/20/23 20.05.2023 106.46 107.07 1.57% 1.32% 108 2.24 BB- 932 US71647NAF69 Sr Unsecured

2,000 USD 6.250 PETBRA 6 1/4 03/17/24 17.03.2024 113.50 114.19 1.86% 1.65% 135 2.88 BB- 795 US71647NAM11 Sr Unsecured

2,000 USD 5.299 PETBRA 5.299 01/27/25 27.01.2025 112.68 113.47 2.02% 1.83% 143 3.61 BB- 1,099 US71647NAV10 Sr Unsecured

2,000 USD 8.750 PETBRA 8 3/4 05/23/26 23.05.2026 129.29 130.09 2.83% 2.69% 214 4.43 BB- 1,072 US71647NAQ25 Sr Unsecured

2,000 USD 7.375 PETBRA 7 3/8 01/17/27 17.01.2027 123.09 123.86 3.13% 3.01% 238 4.87 BB- 1,833 US71647NAS80 Sr Unsecured

2,000 USD 5.999 PETBRA 5.999 01/27/28 27.01.2028 115.90 116.72 3.44% 3.32% 256 5.72 BB- 2,028 US71647NAY58 Sr Unsecured

2,000 USD 5.750 PETBRA 5 3/4 02/01/29 01.02.2029 115.13 116.02 3.57% 3.45% 260 6.43 BB- 1,000 US71647NAZ24 Sr Unsecured

2,000 USD 5.093 PETBRA 5.093 01/15/30 15.01.2030 110.23 111.02 3.75% 3.65% 270 7.14 BB- 3,924 US71647NBE85 Sr Unsecured

2,000 USD 5.600 PETBRA 5.6 01/03/31 03.01.2031 113.00 113.65 4.01% 3.93% 291 7.62 BB- 2,385 US71647NBH17 Sr Unsecured

2,000 USD 6.875 PETBRA 6 7/8 01/20/40 20.01.2040 123.45 124.60 4.96% 4.88% 354 11.19 BB- 1,029 US71645WAQ42 Sr Unsecured

2,000 USD 6.750 PETBRA 6 3/4 01/27/41 27.01.2041 122.10 123.23 4.99% 4.91% 356 11.58 BB- 1,059 US71645WAS08 Sr Unsecured

2,000 USD 7.250 PETBRA 7 1/4 03/17/44 17.03.2044 126.53 127.55 5.26% 5.19% 381 12.30 BB- 1,648 US71647NAK54 Sr Unsecured

2,000 USD 6.900 PETBRA 6.9 03/19/49 19.03.2049 124.13 125.31 5.25% 5.18% 376 13.70 BB- 2,048 US71647NBD03 Sr Unsecured

2,000 USD 6.750 PETBRA 6 3/4 06/03/50 03.06.2050 121.10 122.14 5.33% 5.26% 382 14.00 BB- 1,726 US71647NBG34 Sr Unsecured

2,000 USD 6.850 PETBRA 6.85 06/05/15 05.06.2115 120.96 122.17 5.66% 5.60% 421 17.58 BB- 2,199 US71647NAN93 Sr Unsecured

CSN

200,000 USD 7.625 CSNABZ 7 5/8 02/13/23 13.02.2023 103.56 104.25 5.79% 5.44% 13.02.2021 2.34% 212 0.09 B2 925 USL21779AC45 Sr Unsecured

200,000 USD 7.625 CSNABZ 7 5/8 04/17/26 17.04.2026 107.15 108.32 6.02% 5.77% 17.04.2022 3.79% 359 1.19 B2 600 USL21779AD28 Sr Unsecured

200,000 USD 6.750 CSNABZ 6 3/4 01/28/28 28.01.2028 108.04 108.97 5.36% 5.21% 28.01.2024 4.60% 432 2.68 B2 1,300 USG2583XAB76 Sr Unsecured

100,000 USD 7.000 CSNABZ 7 PERP 98.22 99.30 7.13% 7.05% 23.03.2021 7.05% 562 13.89 B- 1,000 USG2585XAA75 Sr Unsecured

GERDAU

100,000 USD 5.750 GGBRBZ 5 3/4 01/30/21 30.01.2021 100.15 100.55 2.64% -5.01% -518 0.05 BBB- 366 USG3925DAA84 Sr Unsecured

200,000 USD 4.750 GGBRBZ 4 3/4 04/15/23 15.04.2023 107.41 108.27 1.40% 1.03% 80 2.14 BBB- 518 USG3925DAB67 Sr Unsecured

Bid Next Call Z-

Mininum CCY Cupon Bonds Maturity Bid Ask Ask YTM Ask YTC Mod Dur Rating Vol MM ISIN Collateral

YTM Date Spread

150,000 USD 5.893 GGBRBZ 5.893 04/29/24 29.04.2024 112.71 113.52 1.90% 1.66% 106 2.80 BBB- 355 USG24422AA83 Sr Unsecured

200,000 USD 4.875 GGBRBZ 4 7/8 10/24/27 24.10.2027 115.39 116.30 2.40% 2.27% 154 5.82 BBB- 650 USG3925DAD24 Sr Unsecured

200,000 USD 4.250 GGBRBZ 4 1/4 01/21/30 21.01.2030 111.59 112.54 2.79% 2.68% 169 7.11 BBB- 500 USU4034GAA14 Sr Unsecured

200,000 USD 7.250 GGBRBZ 7 1/4 04/16/44 16.04.2044 143.94 144.05 4.26% 4.25% 283 12.89 BBB- 500 USG2440JAG07 Sr Unsecured

VALE

2,000 USD 6.250 VALEBZ 6 1/4 08/10/26 10.08.2026 123.97 124.68 1.72% 1.61% 102 4.75 BBB- 1,706 US91911TAP84 Sr Unsecured

2,000 USD 8.250 VALEBZ 8 1/4 01/17/34 17.01.2034 153.07 154.54 3.22% 3.12% 196 8.85 BBB- 681 US91911TAE38 Sr Unsecured

2,000 USD 6.875 VALEBZ 6 7/8 11/21/36 21.11.2036 146.00 147.15 3.16% 3.09% 181 10.78 BBB- 1,619 US91911TAH68 Sr Unsecured

2,000 USD 6.875 VALEBZ 6 7/8 11/10/39 10.11.2039 148.52 149.82 3.37% 3.30% 195 12.06 BBB- 1,331 US91911TAK97 Sr Unsecured

2,000 USD 5.625 VALEBZ 5 5/8 09/11/42 11.09.2042 134.09 135.22 3.39% 3.33% 191 13.67 BBB- 520 US91912EAA38 Sr Unsecured

VOTORANTIM

200,000 USD 4.750 VOTORA 4 3/4 06/17/24 17.06.2024 107.90 108.85 2.34% 2.06% 173 3.18 BBB- 144 USP3059UAA80 Sr Unsecured

200,000 USD 5.750 VOTORA 5 3/4 01/28/27 28.01.2027 116.97 118.02 2.69% 2.52% 179 4.91 BBB- 500 USC86068AA80 Sr Unsecured

200,000 USD 5.375 NEXA 5 3/8 05/04/27 04.05.2027 110.80 111.64 3.46% 3.32% 260 5.17 BB+ 700 USP98118AA38 Sr Unsecured

200,000 USD 7.250 VOTORA 7 1/4 04/05/41 05.04.2041 136.08 137.32 4.51% 4.44% 308 11.86 BBB- 610 USP98088AA83 Sr Unsecured

EMBRAER

2,000 USD 5.150 EMBRBZ 5.15 06/15/22 15.06.2022 102.91 103.71 3.05% 2.49% 229 1.37 BB+ 332 US29082AAA51 Sr Unsecured

2,000 USD 5.696 EMBRBZ 5.696 09/16/23 16.09.2023 106.53 107.30 3.13% 2.84% 258 2.45 BB+ 458 USG30376AB69 Sr Unsecured

2,000 USD 5.050 EMBRBZ 5.05 06/15/25 15.06.2025 105.81 106.65 3.62% 3.42% 297 3.95 BB+ 1,000 US29082HAA05 Sr Unsecured

2,000 USD 5.400 EMBRBZ 5.4 02/01/27 01.02.2027 106.17 107.17 4.23% 4.05% 341 5.06 BB+ 750 US29082HAB87 Sr Unsecured

200,000 USD 6.950 EMBRBZ 6.95 01/17/28 17.01.2028 113.09 114.04 4.74% 4.59% 385 5.53 BB+ 750 USN29505AA70 Sr Unsecured

BRF

100,000 EUR 2.750 BRFSBZ 2 3/4 06/03/22 03.06.2022 101.81 102.92 1.42% 0.63% 115 1.35 BB- 206 XS1242327168 Sr Unsecured

200,000 USD 3.950 BRFSBZ 3.95 05/22/23 22.05.2023 103.82 104.77 2.28% 1.88% 164 2.25 BB- 234 USP1905CAD22 Sr Unsecured

200,000 USD 4.750 BRFSBZ 4 3/4 05/22/24 22.05.2024 107.27 108.19 2.48% 2.21% 188 3.10 BB- 295 USP1905CAE05 Sr Unsecured

200,000 USD 4.350 BRFSBZ 4.35 09/29/26 29.09.2026 105.59 106.45 3.27% 3.11% 250 5.01 BB- 499 USA08163AA41 Sr Unsecured

200,000 USD 4.875 BRFSBZ 4 7/8 01/24/30 24.01.2030 108.49 109.31 3.76% 3.66% 270 7.05 Ba2 750 USP1905CJX94 Sr Unsecured

200,000 USD 5.750 BRFSBZ 5 3/4 09/21/50 21.09.2050 110.09 111.01 5.09% 5.03% 358 14.59 Ba2 800 USP1905CAJ91 Sr Unsecured

MARFRIG

200,000 USD 7.000 MRFGBZ 7 03/15/24 15.03.2024 102.51 103.00 6.12% 5.95% 08.02.2021 -0.14% -36 0.18 BB- 750 USG5825AAA00 Sr Unsecured

200,000 USD 6.875 MRFGBZ 6 7/8 01/19/25 19.01.2025 103.45 104.00 5.90% 5.75% 08.02.2021 -0.86% -110 0.07 BB- 1,000 USG5825AAB82 Sr Unsecured

200,000 USD 7.000 MRFGBZ 7 05/14/26 14.05.2026 108.65 109.42 5.13% 4.97% 14.05.2022 2.39% 219 1.28 BB- 1,000 USU63768AA01 Sr Unsecured

200,000 USD 6.625 MRFGBZ 6 5/8 08/06/29 06.08.2029 114.98 115.88 4.50% 4.38% 06.08.2024 2.81% 246 3.14 BB- 500 USU63768AB83 Sr Unsecured

JBS

2,000 USD 5.750 JBSSBZ 5 3/4 06/15/25 15.06.2025 103.00 103.56 4.98% 4.94% 08.02.2021 -3.58% 102 0.07 BB+ 900 USU0901CAJ90 Sr Unsecured

200,000 USD 5.750 JBSSBZ 5 3/4 01/15/28 15.01.2028 107.00 107.75 4.57% 4.45% 15.07.2022 2.37% 217 1.41 BB+ 750 USA29875AC44 Sr Unsecured

2,000 USD 5.500 JBSSBZ 5 1/2 01/15/30 15.01.2030 114.00 115.37 3.66% 3.50% 15.01.2025 2.14% 175 3.56 BB+ 1,250 USL56608AE95 Sr Unsecured

MINERVA

200,000 USD 6.500 BEEFBZ 6 1/2 09/20/26 20.09.2026 105.05 105.57 5.45% 5.35% 20.09.2021 2.97% 278 0.66 BB 1,289 USL6401PAF01 Sr Unsecured

200,000 USD 5.875 BEEFBZ 5 7/8 01/19/28 19.01.2028 107.76 108.58 4.57% 4.44% 19.01.2023 2.89% 268 1.86 BB 476 USL6401PAH66 Sr Unsecured

COSAN

200,000 USD 5.000 CSANBZ 5 03/14/23 14.03.2023 100.81 101.20 4.60% 4.41% 08.02.2021 -1.90% -212 0.17 BB- 121 USL20041AA41 Sr Unsecured

200,000 USD 5.950 CZZ 5.95 09/20/24 20.09.2024 #N/A N/A #N/A N/A ####### #VALUE! 28.01.2021 #VALUE!

#N/A Field Not Applicable

#N/A N/A BB- 204 USG25343AA52 Sr Unsecured

200,000 USD 7.000 CSANBZ 7 01/20/27 20.01.2027 107.45 108.36 5.53% 5.36% 20.01.2022 2.09% 190 0.97 BB- 650 USL20041AD89 Sr Unsecured

200,000 USD 5.500 CZZ 5 1/2 09/20/29 20.09.2029 109.84 110.57 4.14% 4.04% 20.09.2024 3.15% 279 3.31 BB- 750 USG25343AB36 Sr Unsecured

100,000 USD 8.250 CSANBZ 8 1/4 PERP 102.51 103.10 8.05% 8.00% 05.05.2021 -1.58% -179 0.31 BB- 500 XS0556373347 Sr Unsecured

200,000 USD 7.375 RAILBZ 7 3/8 02/09/24 09.02.2024 103.95 104.37 5.95% 5.80% 09.02.2021 -1.59% -181 0.08 BB- 750 USL79090AA13 Sr Unsecured

200,000 USD 5.875 RAILBZ 5 7/8 01/18/25 18.01.2025 105.73 106.40 4.31% 4.13% 18.01.2022 2.34% 215 0.97 BB- 500 USL79090AB95 Sr Unsecured

200,000 USD 5.300 RAIZBZ 5.3 01/20/27 20.01.2027 114.64 115.49 2.65% 2.51% 187 5.12 BBB- 725 USL7909CAA55 Sr Unsecured

SUZANO

200,000 USD 5.750 SUZANO 5 3/4 07/14/26 14.07.2026 117.17 118.03 2.34% 2.25% 167 4.70 BBB- 517 USA9890AAA81 Sr Unsecured

200,000 USD 6.000 SUZANO 6 01/15/29 15.01.2029 120.11 120.86 3.14% 3.04% 215 6.22 BBB- 1,748 US86964WAF95 Sr Unsecured

200,000 USD 5.000 SUZANO 5 01/15/30 15.01.2030 112.97 113.73 3.32% 3.23% 227 7.05 BBB- 1,000 US86964WAH51 Sr Unsecured

1,000 USD 3.750 SUZANO 3 3/4 01/15/31 15.01.2031 106.04 106.57 3.05% 2.99% 195 8.10 BBB- 1,250 US86964WAJ18 Sr Unsecured

200,000 USD 7.000 SUZANO 7 03/16/47 16.03.2047 133.61 134.65 4.75% 4.69% 325 13.49 BBB- 1,250 USA8372TAC20 Sr Unsecured

KLABIN

200,000 USD 5.250 KLAB 5 1/4 07/16/24 16.07.2024 111.06 111.92 1.98% 1.74% 140 3.17 BB+ 271 USL5828LAA72 Sr Unsecured

200,000 USD 4.875 KLAB 4 7/8 09/19/27 19.09.2027 111.25 112.24 3.00% 2.85% 213 5.69 BB+ 500 USL5828LAB55 Sr Unsecured

200,000 USD 5.750 KLAB 5 3/4 04/03/29 03.04.2029 116.08 116.90 3.49% 3.38% 247 6.44 BB+ 750 USA35155AA77 Sr Unsecured

200,000 USD 3.200 KLAB 3.2 01/12/31 12.01.2031 99.95 100.20 3.21% 3.18% 215 8.32 BB+ 500 USA35155AE99 Sr Unsecured

200,000 USD 7.000 KLAB 7 04/03/49 03.04.2049 126.36 127.45 5.21% 5.14% 371 13.64 BB+ 700 USA35155AB50 Sr Unsecured

FIBRIA

2,000 USD 5.250 FIBRBZ 5 1/4 05/12/24 12.05.2024 110.02 110.81 2.12% 1.89% 157 3.06 BBB- 353 US31572UAE64 Sr Unsecured

2,000 USD 4.000 FIBRBZ 4 01/14/25 14.01.2025 107.06 107.92 2.15% 1.94% 14.11.2024 1.85% 148 3.51 BBB- 340 US31572UAG13 Sr Unsecured

2,000 USD 5.500 FIBRBZ 5 1/2 01/17/27 17.01.2027 114.17 114.97 2.91% 2.78% 214 5.08 BBB- 700 US31572UAF30 Sr Unsecured

GOL

10,000 USD 7.000 GOLLBZ 7 01/31/25 31.01.2025 88.66 89.82 10.51% 10.12% 31.01.2022 10.12% 973 3.28 CCC+ 650 USL4441RAA43 Sr Unsecured

100,000 USD 8.750 GOLLBZ 8 3/4 PERP #N/A Field Not Applicable

83.72 86.12 10.40% 10.24% 05.04.2021 10.24% 897 9.50 Caa1 154 USG3980PAA33 Sr Unsecured

GLOBO

200,000 USD 4.843 GLOPAR 4.843 06/08/25 08.06.2025 106.10 107.03 3.34% 3.12% 08.03.2025 3.03% 262 3.75 BB+ 325 USP47773AN93 Sr Unsecured

200,000 USD 5.125 GLOPAR 5 1/8 03/31/27 31.03.2027 106.95 108.08 3.86% 3.66% 31.12.2026 3.61% 297 5.09 BB+ 200 USP47777AA86 Sr Unsecured

200,000 USD 4.875 GLOPAR 4 7/8 01/22/30 22.01.2030 106.85 107.65 3.96% 3.86% 292 7.18 BB+ 500 USP47777AB69 Sr Unsecured

OTHERS

200,000 USD 4.950 RDEDOR 4.95 01/17/28 17.01.2028 107.30 108.17 3.76% 3.62% 17.10.2027 3.58% 285 5.64 BB 500 USL7915RAA43 Sr Unsecured

200,000 USD 4.500 RDEDOR 4 1/2 01/22/30 22.01.2030 104.34 105.08 3.92% 3.83% 22.10.2029 3.81% 288 7.11 BB 1,200 USL7915TAA09 Sr Unsecured

200,000 USD 5.875 AZULBZ 5 7/8 10/26/24 26.10.2024 92.92 94.30 8.08% 7.63% 26.10.2021 7.63% 726 3.27 CCC+ 400 USU0551UAA17 Sr Unsecured

200,000 USD 9.250 CMIGBZ 9 1/4 12/05/24 05.12.2024 115.95 116.77 4.72% 4.51% 05.12.2023 3.15% 287 2.57 B 1,500 USP2205LAC92 Sr Unsecured

200,000 USD 3.625 ELEBRA 3 5/8 02/04/25 04.02.2025 103.67 104.41 2.67% 2.48% 207 3.72 BB- 500 USP22835AA30 Sr Unsecured

200,000 USD 4.625 ELEBRA 4 5/8 02/04/30 04.02.2030 106.80 107.55 3.73% 3.64% 269 7.30 BB- 750 USP22835AB13 Sr Unsecured

200,000 USD 5.950 HIDRVS 5.95 01/24/25 24.01.2025 105.03 105.86 4.57% 4.35% 24.01.2022 3.01% 281 0.98 Ba3 600 USL48008AA19 Sr Unsecured

90,000 USD 3.750 CIELBZ 3 3/4 11/16/22 16.11.2022 102.47 103.08 2.37% 2.04% 183 1.77 405 USU1714UAA35 Sr Unsecured

200,000 USD 5.950 HIDRVS 5.95 01/24/25 24.01.2025 105.03 105.86 4.57% 4.35% 24.01.2022 3.01% 281 0.98 Ba3 600 USL48008AA19 Sr Unsecured

200,000 USD 7.750 JSLGBZ 7 3/4 07/26/24 26.07.2024 105.46 106.19 6.01% 5.79% 26.07.2021 3.37% 317 0.51 BB- 625 USL5800PAB87 Sr Unsecured

200,000 USD 7.250 LIGTBZ 7 1/4 05/03/23 03.05.2023 104.54 105.37 5.13% 4.76% 03.05.2021 1.49% 127 0.31 Ba3 390 USP62763AA81 Sr Unsecured

200,000 USD 5.375 NATURA 5 3/8 02/01/23 01.02.2023 102.63 103.24 4.03% 3.72% 08.02.2021 -2.18% -241 0.07 BB 750 USP7088CTF33 Sr Unsecured

200,000 USD 4.750 LAMEBZ 4 3/4 10/20/30 20.10.2030 107.25 108.09 3.85% 3.75% 274 7.62 BB 500 USL5788AAA99 Sr Unsecured

200,000 USD 5.250 UGPABZ 5 1/4 10/06/26 06.10.2026 111.57 112.51 3.04% 2.87% 226 4.94 BB+ 550 USL9412AAA53 Sr Unsecured

200,000 USD 5.250 UGPABZ 5 1/4 06/06/29 06.06.2029 111.61 112.49 3.63% 3.52% 263 6.85 BB+ 850 USL9412AAB37 Sr Unsecured

200,000 USD 5.875 USIM 5 7/8 07/18/26 18.07.2026 108.49 109.40 4.14% 3.96% 18.07.2023 3.10% 285 2.29 Ba3 750 USL95806AA06 Sr Unsecured

200,000 USD 6.875 LTMCI 6 7/8 04/11/24 11.04.2024 51.18 53.04 31.00% 30.70% 11.04.2021 29.59% 2.39 NR 700 USG53770AB22 Sr Unsecured

200,000 USD 7.000 LTMCI 7 03/01/26 01.03.2026 52.35 53.18 22.97% 22.98% 01.03.2023 22.54% 3.48 NR 800 USG53770AC05 Sr Unsecured

Prices are indicative only. Source: Bloomberg. Only bonds with minimum outstanding US$ 150MM

08.01.2021

You might also like

- Delta Capital Bonds Feb2024 - 240208 - 092614Document6 pagesDelta Capital Bonds Feb2024 - 240208 - 092614Marvin RamirezNo ratings yet

- Dimensional 2035 Target Date Retirement Income FundDocument394 pagesDimensional 2035 Target Date Retirement Income FundEdgar salvador Arreola valenciaNo ratings yet

- Corporate US HYDocument5 pagesCorporate US HYtarja19761No ratings yet

- RUN Corp y Soberanos de Brazil USD 24.10.17Document6 pagesRUN Corp y Soberanos de Brazil USD 24.10.17quiquemoNo ratings yet

- IsinDocument3 pagesIsinLCR FINANCE PLCNo ratings yet

- (138224) (CD) BCI - HoldingsDocument4 pages(138224) (CD) BCI - HoldingsguitraderNo ratings yet

- Island Homes Sold - 2023Document4 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document4 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document4 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document4 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Jetta SportlineDocument2 pagesJetta SportlineEdgar BarronNo ratings yet

- Kristal Bond WatchList - 29th MayDocument6 pagesKristal Bond WatchList - 29th MayPranab PattanaikNo ratings yet

- Island Homes Sold - 2023Document1 pageIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document4 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document3 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2020Document12 pagesIsland Homes Sold - 2020Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document2 pagesIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Land Sold - 2023Document1 pageIsland Land Sold - 2023Louis CutajarNo ratings yet

- Island Land Sold - 2023Document1 pageIsland Land Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2021Document5 pagesIsland Homes Sold - 2021cutty54No ratings yet

- Island Homes Sold - 2021Document9 pagesIsland Homes Sold - 2021Louis CutajarNo ratings yet

- Island Homes Sold - 2020Document5 pagesIsland Homes Sold - 2020Louis CutajarNo ratings yet

- Island Land Sold - 2023Document1 pageIsland Land Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document7 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document7 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2020Document9 pagesIsland Homes Sold - 2020Louis Cutajar100% (2)

- Island Homes Sold - 2020Document3 pagesIsland Homes Sold - 2020Louis CutajarNo ratings yet

- Asit Bera Beniajola, Pashchim Ghoshpur Beniajola, Hooghly, West Bengal - 712613Document1 pageAsit Bera Beniajola, Pashchim Ghoshpur Beniajola, Hooghly, West Bengal - 712613hdeygstNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2021Document9 pagesIsland Homes Sold - 2021Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document6 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document7 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Land Sold - 2023Document1 pageIsland Land Sold - 2023Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Sukuk Indicative QuotesDocument5 pagesSukuk Indicative QuotesAhmedNo ratings yet

- Island Homes Sold - 2024Document1 pageIsland Homes Sold - 2024Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2023Document1 pageIsland Homes Sold - 2023Louis CutajarNo ratings yet

- Island Land Sold - 2023Document1 pageIsland Land Sold - 2023Louis CutajarNo ratings yet

- UntitledDocument2 pagesUntitledSrinivasSeenuNo ratings yet

- Pay Stub Portal 2Document1 pagePay Stub Portal 2cynthiaruder74No ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2024Document2 pagesIsland Homes Sold - 2024Louis CutajarNo ratings yet

- HDFC Bike LoanDocument3 pagesHDFC Bike LoanRavi ChristoNo ratings yet

- Crypto PNL Sheet - MayDocument2 pagesCrypto PNL Sheet - MayMirza Muhammad BaigNo ratings yet

- EconomyDocument7 pagesEconomypresencabNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Shortage - Mar - 20.3.2024Document43 pagesShortage - Mar - 20.3.2024hoangthihongnhung0201No ratings yet

- Island Homes Sold - 2020Document3 pagesIsland Homes Sold - 2020cutty54No ratings yet

- Statement From January 23 Upto Nov 2023Document5 pagesStatement From January 23 Upto Nov 2023DawitNo ratings yet

- Bond Focus - Mandiri Sekuritas - 20231129Document7 pagesBond Focus - Mandiri Sekuritas - 20231129heroki wdyaNo ratings yet

- Opp 15.11.2023 Na A Parts Overhaul RWF Ii 134 Mna KTDocument3 pagesOpp 15.11.2023 Na A Parts Overhaul RWF Ii 134 Mna KTRahmadsyah PutraNo ratings yet

- Island Homes Sold - 2020Document52 pagesIsland Homes Sold - 2020cutty54No ratings yet

- Island Homes Sold - 2020Document6 pagesIsland Homes Sold - 2020cutty54No ratings yet

- PIMCO Funds Emerging Markets Bond Fund Portfolio HoldingsDocument15 pagesPIMCO Funds Emerging Markets Bond Fund Portfolio HoldingsVijay KumarNo ratings yet

- Island Homes Sold - 2020Document2 pagesIsland Homes Sold - 2020cutty54No ratings yet

- Island Homes Sold - 2020Document2 pagesIsland Homes Sold - 2020cutty54No ratings yet

- Course Outline Technology EntrepreneurshipDocument3 pagesCourse Outline Technology EntrepreneurshipBisma khanNo ratings yet

- DocxDocument5 pagesDocxNevan NovaNo ratings yet

- 12 - National Cera Lab Test Report - 600x1200 MM - 24.12.2019Document3 pages12 - National Cera Lab Test Report - 600x1200 MM - 24.12.2019Shaikh MohammedHanifSultanNo ratings yet

- The Trading NuggetsDocument31 pagesThe Trading NuggetsZiaur RahmanNo ratings yet

- Analysis of Indian GDP.Document8 pagesAnalysis of Indian GDP.Navdeep TiwariNo ratings yet

- Roche - John Locke and The Bank of England (2021)Document175 pagesRoche - John Locke and The Bank of England (2021)RublesNo ratings yet

- CertificateOfInsurance - GeminiDocument1 pageCertificateOfInsurance - Geminiganesh gaddeNo ratings yet

- 5052-H112 Aluminum: Related SpecificationsDocument1 page5052-H112 Aluminum: Related SpecificationsDamon CiouNo ratings yet

- Raft Slab LayoutDocument1 pageRaft Slab LayoutDINESH M.NNo ratings yet

- Upsrlm LetterDocument4 pagesUpsrlm LetterSURYAKANT PATHAKNo ratings yet

- DITO Tower Civil Work - Acceptance Checklist 20200521-TCW - 1625704814Document1 pageDITO Tower Civil Work - Acceptance Checklist 20200521-TCW - 1625704814bashirNo ratings yet

- Magbook Indian Economy-ArihantDocument241 pagesMagbook Indian Economy-Arihantmanish100% (3)

- Gyan Ganga: Institute of Technology &sciencesDocument6 pagesGyan Ganga: Institute of Technology &sciencesMandhir NarangNo ratings yet

- Approved Drawing of Boundary WallDocument1 pageApproved Drawing of Boundary WallAnup Singh RajputNo ratings yet

- The Impact of Earnings Management On The Value Relevance of EarningsDocument25 pagesThe Impact of Earnings Management On The Value Relevance of Earningsanubha srivastavaNo ratings yet

- Management Programme: MFP-1: Equity MarketsDocument2 pagesManagement Programme: MFP-1: Equity MarketsDivey GuptaNo ratings yet

- Volferda VL-PB02 Luxury Prefabricated Small House Hotel High-End Hotel Tempered Glass Room InsulatioDocument1 pageVolferda VL-PB02 Luxury Prefabricated Small House Hotel High-End Hotel Tempered Glass Room InsulatioDigy MaleachiqNo ratings yet

- Syllabus Logistics ManagementDocument4 pagesSyllabus Logistics ManagementRegine NanitNo ratings yet

- Ib Economics Unit 1 MicroDocument12 pagesIb Economics Unit 1 Microapi-196719233No ratings yet

- ICICI Health Policy 2022Document6 pagesICICI Health Policy 2022HuddarNo ratings yet

- Kolotan 5A - DeEDDocument14 pagesKolotan 5A - DeEDAl Mahmud HasanNo ratings yet

- Report 4Document32 pagesReport 4BILENGE MALILONo ratings yet

- Adhoc00000007241758 2000712387Document6 pagesAdhoc00000007241758 2000712387Suman KumarNo ratings yet

- Setting Product StrategyDocument30 pagesSetting Product StrategyAfik 178No ratings yet

- TDI Válvula Relevadora Mca. TDIDocument14 pagesTDI Válvula Relevadora Mca. TDIJorge CalcaneoNo ratings yet

- Gift Deed and Transfer Set Required at MumbaiDocument28 pagesGift Deed and Transfer Set Required at MumbaiSandeep DubeyNo ratings yet

- SolutionDocument8 pagesSolutionArslanNo ratings yet

- Jasa & Part Dozer Wira Doni Trakindo Medan Quot - V2 - D6R2 - XL - TTT00306 - Repair - Maintenance - Brake - PT. - Aruan - Cipta - EnergiDocument4 pagesJasa & Part Dozer Wira Doni Trakindo Medan Quot - V2 - D6R2 - XL - TTT00306 - Repair - Maintenance - Brake - PT. - Aruan - Cipta - EnergiGogot YuliyantoNo ratings yet

- ABC MemoDocument4 pagesABC MemoPriyanshi PatelNo ratings yet

- M and B 3 Hybrid 3rd Edition Dean Croushore Solutions Manual Full Chapter PDFDocument34 pagesM and B 3 Hybrid 3rd Edition Dean Croushore Solutions Manual Full Chapter PDFjamesstokesmfyqdrocjp100% (15)