Professional Documents

Culture Documents

Module 2.3 - Loan Receivable

Module 2.3 - Loan Receivable

Uploaded by

Eilana CandelariaCopyright:

Available Formats

You might also like

- Financial AccountingandAnalysisJan18 FJ5qQXjrmwDocument384 pagesFinancial AccountingandAnalysisJan18 FJ5qQXjrmwShubham Raghav100% (2)

- Business Vantage Listening Sample Paper 2 - Full TestDocument8 pagesBusiness Vantage Listening Sample Paper 2 - Full TestDaniel KottnauerNo ratings yet

- Cost Compiled Past Papers UpdatedDocument364 pagesCost Compiled Past Papers UpdatedAbubakar PalhNo ratings yet

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document4 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Jayr BV100% (1)

- Mama Mo Lily I AbilitiesDocument39 pagesMama Mo Lily I AbilitiesjdNo ratings yet

- Commerce Stage 5 Scope and Sequence 2020Document3 pagesCommerce Stage 5 Scope and Sequence 2020api-505729019No ratings yet

- AP0004.02 Loan Receivable and ECL ModelDocument4 pagesAP0004.02 Loan Receivable and ECL ModelKatrina Peralta FabianNo ratings yet

- Lecture Slides LiabilitiesDocument104 pagesLecture Slides LiabilitiesHuiru ChuaNo ratings yet

- Chapter 6-8 - Notes, Loans, and Receivable FinanceDocument7 pagesChapter 6-8 - Notes, Loans, and Receivable FinanceAvia Chelsy DeangNo ratings yet

- Hand-Out No. 5: Loan Receivable Financial Accounting and Reporting HAND-OUT NO. 5: Loan ReceivableDocument4 pagesHand-Out No. 5: Loan Receivable Financial Accounting and Reporting HAND-OUT NO. 5: Loan ReceivableJorufel PapasinNo ratings yet

- Loans ReceivableDocument14 pagesLoans ReceivableshaneNo ratings yet

- Chapter 5 Loans ReceivableDocument12 pagesChapter 5 Loans ReceivableiamjasmineivoriNo ratings yet

- Other Topic To Notes Payable, Loans and Bonds PayableDocument47 pagesOther Topic To Notes Payable, Loans and Bonds PayableLea Victoria PronuevoNo ratings yet

- ch13 Kieso IFRS4 PPTDocument101 pagesch13 Kieso IFRS4 PPTĐức Huy100% (2)

- Loan ReceivableDocument3 pagesLoan ReceivableJenelyn AliordeNo ratings yet

- Loans ReceivableDocument22 pagesLoans ReceivableJendall SisonNo ratings yet

- LiabilitiesDocument14 pagesLiabilitiesKaye Choraine NadumaNo ratings yet

- Liabilities Technical Knowledge: Lesson 1Document12 pagesLiabilities Technical Knowledge: Lesson 1Cirelle Faye SilvaNo ratings yet

- Hand Out 1 Practice SetDocument6 pagesHand Out 1 Practice SetLayka ResorezNo ratings yet

- Module 8 - Loan ReceivableDocument10 pagesModule 8 - Loan Receivablejustine cabanaNo ratings yet

- Midterm Quizzes Compilation - Docx-1Document91 pagesMidterm Quizzes Compilation - Docx-1Yess poooNo ratings yet

- Chapter 13Document89 pagesChapter 13Sneha KumariNo ratings yet

- Loans ReceivableDocument4 pagesLoans ReceivableDianna Dayawon0% (1)

- Lesson 1 - Intro To LiabilitiesDocument21 pagesLesson 1 - Intro To LiabilitiesGrace Joy MarcelinoNo ratings yet

- f9273788-bb82-4fc5-8cdc-162d918f41e6Document6 pagesf9273788-bb82-4fc5-8cdc-162d918f41e6Xuan TraNo ratings yet

- Impairment of Loans: Comparison of "Incurred Loss Approach" and "Expected Credit Loss Impairment Approach"Document33 pagesImpairment of Loans: Comparison of "Incurred Loss Approach" and "Expected Credit Loss Impairment Approach"Christine Joy Rapi MarsoNo ratings yet

- Assignment C7Document4 pagesAssignment C7matt100% (1)

- @2015 Ifa II CH 1 - CL - Con and Prov.Document62 pages@2015 Ifa II CH 1 - CL - Con and Prov.genenegetachew64No ratings yet

- Liabilities and ProvisonsDocument3 pagesLiabilities and ProvisonsAmberlynn PaduaNo ratings yet

- Chapter 8 PayablesDocument46 pagesChapter 8 PayablesLEE WEI LONGNo ratings yet

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document4 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Jehan CodanteNo ratings yet

- Integrated Accounting: Financial Accounting & Reporting (P1) Integrated Accounting - Far (P1) Module 4: LiabilitiesDocument10 pagesIntegrated Accounting: Financial Accounting & Reporting (P1) Integrated Accounting - Far (P1) Module 4: LiabilitiesKamyll VidadNo ratings yet

- AE 121 Prelim Quiz 1 THEORIES (10 Items X 2 Points 20 POINTS)Document10 pagesAE 121 Prelim Quiz 1 THEORIES (10 Items X 2 Points 20 POINTS)Eryn GabrielleNo ratings yet

- FAR Financial Liabilities BERNARTE ReviewerDocument5 pagesFAR Financial Liabilities BERNARTE ReviewerMarjorie AugustoNo ratings yet

- 7Document19 pages7Maria G. BernardinoNo ratings yet

- Bonds Payable - StudentDocument3 pagesBonds Payable - StudentLOVENo ratings yet

- GenMath11 Q2 Mod9 Basic-Concepts-of-Loans Version2Document10 pagesGenMath11 Q2 Mod9 Basic-Concepts-of-Loans Version2Angelica ZipaganNo ratings yet

- IA - Receivables Addtl ConceptsDocument3 pagesIA - Receivables Addtl ConceptsDiana AcostaNo ratings yet

- Term SheetDocument3 pagesTerm Sheetdicky bhaktiNo ratings yet

- Module 2 AssignmentDocument3 pagesModule 2 Assignmentricamae saladagaNo ratings yet

- ESG General Loan Terms-2024.4Document1 pageESG General Loan Terms-2024.4alazahero37No ratings yet

- Impairment of Loans and Receivable FinancingDocument17 pagesImpairment of Loans and Receivable FinancingGelyn CruzNo ratings yet

- Auditing Problems Test Banks - LIABILITIES Part 1Document5 pagesAuditing Problems Test Banks - LIABILITIES Part 1Alliah Mae Arbasto0% (1)

- 3 - Accounting For Loans and ImpairmentDocument1 page3 - Accounting For Loans and ImpairmentReese AyessaNo ratings yet

- Financial Assets ReviewDocument3 pagesFinancial Assets ReviewJobelle Candace Flores AbreraNo ratings yet

- ACC 211 Quiz-LIABILITIESDocument1 pageACC 211 Quiz-LIABILITIESAeyjay ManangaranNo ratings yet

- Activity in LOAN RECEIVABLEDocument2 pagesActivity in LOAN RECEIVABLEChristopher Mau BambalanNo ratings yet

- AK Kieso Chapter 13-14Document106 pagesAK Kieso Chapter 13-14Desinta Putri100% (1)

- Mid-Term-Exam 2021 2022Document3 pagesMid-Term-Exam 2021 2022dangNo ratings yet

- PDF Chapter 9 Audit of Liabilities Roque CompressDocument77 pagesPDF Chapter 9 Audit of Liabilities Roque CompressLovely Dela Cruz GanoanNo ratings yet

- Guided Exercises 1 Current LiabilitiesDocument2 pagesGuided Exercises 1 Current Liabilitiescharizza.ashleyNo ratings yet

- Chap10 - Student (Revised)Document15 pagesChap10 - Student (Revised)Fung Yat Kit KeithNo ratings yet

- Audit of Long-Term LiabilitiesDocument3 pagesAudit of Long-Term LiabilitiesJhaybie San BuenaventuraNo ratings yet

- Name: Dharshini S College: Sri Krishna College of Technology Topic: BankingDocument25 pagesName: Dharshini S College: Sri Krishna College of Technology Topic: BankingDharshini SelvarajNo ratings yet

- Chapter 3-Uses of Funds - Part 3Document5 pagesChapter 3-Uses of Funds - Part 3Pháp NguyễnNo ratings yet

- Inermidiate 2 Chapter 1Document11 pagesInermidiate 2 Chapter 1endris yimerNo ratings yet

- Audit 2Document6 pagesAudit 2Frances Mikayla EnriquezNo ratings yet

- Baluation - Bonds PayableDocument8 pagesBaluation - Bonds PayableDanica Mae AnunciadoNo ratings yet

- LEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Document1 pageLEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Miles SantosNo ratings yet

- Advance Accounting 3Document5 pagesAdvance Accounting 3James Paul SinciocoNo ratings yet

- Delinquency Resolution and LearningsDocument18 pagesDelinquency Resolution and LearningsWhats going on indiaNo ratings yet

- From Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsFrom EverandFrom Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsNo ratings yet

- Credit Score Secrets: Unlocking the Path to Financial HealthFrom EverandCredit Score Secrets: Unlocking the Path to Financial HealthRating: 1 out of 5 stars1/5 (1)

- Module 1.3-2 Date Bank ReconDocument2 pagesModule 1.3-2 Date Bank ReconEilana CandelariaNo ratings yet

- Module 2.2 - Notes ReceivableDocument1 pageModule 2.2 - Notes ReceivableEilana CandelariaNo ratings yet

- Module 2 - Receivables & ARDocument2 pagesModule 2 - Receivables & AREilana CandelariaNo ratings yet

- Module 2.4 - FinancingDocument2 pagesModule 2.4 - FinancingEilana CandelariaNo ratings yet

- Sap® Solution Manager Adapter For Sap Quality Center by HPDocument2 pagesSap® Solution Manager Adapter For Sap Quality Center by HPnikhil.gangwar2892No ratings yet

- IKEA Case StudyDocument7 pagesIKEA Case StudyIzwan YusofNo ratings yet

- Harshad MehtaDocument6 pagesHarshad MehtaBenika RajputNo ratings yet

- Vis Moot - CISGDocument1 pageVis Moot - CISGJose Angelo DavidNo ratings yet

- R-O Matrix TemplateDocument37 pagesR-O Matrix TemplateAdenisSetyawanNo ratings yet

- 2014 2015 Annual Registration Renewal Form RRF 1Document2 pages2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetNo ratings yet

- Request-Hyatt India Fact SheetDocument3 pagesRequest-Hyatt India Fact Sheetajay_kumar_5No ratings yet

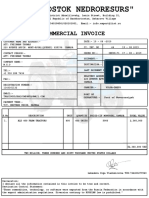

- Ald 400 Farm Tractor Commercial Invoice PDFDocument2 pagesAld 400 Farm Tractor Commercial Invoice PDFAlexanderNo ratings yet

- Benefits of Gantt ChartDocument4 pagesBenefits of Gantt ChartRavi KaniyawalaNo ratings yet

- Textbook State Capitalism How The Return of Statism Is Transforming The World 1St Edition Joshua Kurlantzick Ebook All Chapter PDFDocument53 pagesTextbook State Capitalism How The Return of Statism Is Transforming The World 1St Edition Joshua Kurlantzick Ebook All Chapter PDFeric.waters674100% (3)

- AmbitionBox Sample Placement GuideDocument15 pagesAmbitionBox Sample Placement GuideMayur MundadaNo ratings yet

- VUCA Concept and Leadership: October 2020Document23 pagesVUCA Concept and Leadership: October 2020NadyasesdilaNo ratings yet

- Strategic OperationsDocument24 pagesStrategic Operationsshitturahman100% (1)

- Stores Management NotesDocument39 pagesStores Management NotesAbankwa Boateng Mensah100% (3)

- Unit 2 Business Structures and ProcessDocument130 pagesUnit 2 Business Structures and ProcessNirali SoniNo ratings yet

- ICMAP New Reshuffled Courses Schedule 2012Document3 pagesICMAP New Reshuffled Courses Schedule 2012KhAliq KHanNo ratings yet

- Principles of Accounting Assignment Date of Submission 24 January 2022Document3 pagesPrinciples of Accounting Assignment Date of Submission 24 January 2022Beast aNo ratings yet

- Code-Of-ethics For Business - SBDocument38 pagesCode-Of-ethics For Business - SBDump GandaraNo ratings yet

- Answers Part 4Document26 pagesAnswers Part 4Great Empress GalaponNo ratings yet

- ProductivityDocument6 pagesProductivityMallikarjun ReddyNo ratings yet

- Jennifer Barnes: Background Report OnDocument53 pagesJennifer Barnes: Background Report OnDed MarozNo ratings yet

- FINAL ContemporaryDocument36 pagesFINAL Contemporaryelie lucidoNo ratings yet

- Oracle Database 11g: Administration Workshop IDocument2 pagesOracle Database 11g: Administration Workshop IFilipe Santos100% (1)

- Advertising and Personal SellingDocument6 pagesAdvertising and Personal SellingAbhishek Jain0% (1)

- UGC NET Managemant SyllabusDocument4 pagesUGC NET Managemant Syllabuskumar HarshNo ratings yet

- Nism Series II B Registrar To An Issue Mutual Funds Workbook in PDFDocument188 pagesNism Series II B Registrar To An Issue Mutual Funds Workbook in PDFManiesh MahajanNo ratings yet

Module 2.3 - Loan Receivable

Module 2.3 - Loan Receivable

Uploaded by

Eilana CandelariaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 2.3 - Loan Receivable

Module 2.3 - Loan Receivable

Uploaded by

Eilana CandelariaCopyright:

Available Formats

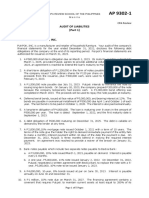

PSBA -MANILA PROBLEM 2

ACCOUNTING 3 V. R. ESPIRITU BPI loaned P10M to Good Venture Company on January 1, 2010. The terms

TOPIC: LOANS RECEIVABLE of the loan require principal payment of P2M each year for 5 years plus

interest at 10%. The 2010 and 2011 principal and interest payments were

TERMINOLOGIES: made. However, during 2012, Good Venture experienced financial

difficulties and was unable to make the principal and interest payment at

Loan receivable is a financial asset arising from a loan granted by a bank or the end of 2012. It was assessed that the remaining principal payments will

other financial institution to a borrower or client. be collected. The company cannot make good interest payment. The loan

receivable has carrying amount of P6.6M including accrued interest of

Initial measurement - Fair value plus transaction cost P600,000 on December 31, 2012. Cash flows on the loan on December 31,

Fair value is the transaction price or the amount of the loan granted 2012 as follows:

Subsequent measurement - at amortized cost Date of cash flows Projected Amount

Origination fees - fees charged by the bank against the borrower for the December 31, 2013 1M

creation of the loan. They are included in the measurement of the loan December 31, 2014 2M

receivable December 31, 2015 3M

A. Origination fees received from borrower

B. Direct origination ocst - not chargeable against borrower Present value at 10% follows:

One period 0.9091

Two period 0.8264

PROBLEM 1 Three period 0.7513

MetroBank granted a P10M loan to a borrower on January 1, 2012 with a

12% interest payable annually starting December 31, 2012. The loan Required: Present value of cash flows

matures on January 1, 2015. Other data are: Impairment loss

Origination fee received 663,600 Carrying amount on December 31, 2012

Direct Origination cost incurred 200,000

Required: 1. Carrying amount of the loan

2. Journal entries in 2012

Impairment of Loan - PAS 39 provides that an entity shall assess at every end

of reporting period whether there is objective evidence that a financial

asset or a group of financial assets is impaired.

Present value xxx

Less: Carrying value xxx

Impairment loss xxx

You might also like

- Financial AccountingandAnalysisJan18 FJ5qQXjrmwDocument384 pagesFinancial AccountingandAnalysisJan18 FJ5qQXjrmwShubham Raghav100% (2)

- Business Vantage Listening Sample Paper 2 - Full TestDocument8 pagesBusiness Vantage Listening Sample Paper 2 - Full TestDaniel KottnauerNo ratings yet

- Cost Compiled Past Papers UpdatedDocument364 pagesCost Compiled Past Papers UpdatedAbubakar PalhNo ratings yet

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document4 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Jayr BV100% (1)

- Mama Mo Lily I AbilitiesDocument39 pagesMama Mo Lily I AbilitiesjdNo ratings yet

- Commerce Stage 5 Scope and Sequence 2020Document3 pagesCommerce Stage 5 Scope and Sequence 2020api-505729019No ratings yet

- AP0004.02 Loan Receivable and ECL ModelDocument4 pagesAP0004.02 Loan Receivable and ECL ModelKatrina Peralta FabianNo ratings yet

- Lecture Slides LiabilitiesDocument104 pagesLecture Slides LiabilitiesHuiru ChuaNo ratings yet

- Chapter 6-8 - Notes, Loans, and Receivable FinanceDocument7 pagesChapter 6-8 - Notes, Loans, and Receivable FinanceAvia Chelsy DeangNo ratings yet

- Hand-Out No. 5: Loan Receivable Financial Accounting and Reporting HAND-OUT NO. 5: Loan ReceivableDocument4 pagesHand-Out No. 5: Loan Receivable Financial Accounting and Reporting HAND-OUT NO. 5: Loan ReceivableJorufel PapasinNo ratings yet

- Loans ReceivableDocument14 pagesLoans ReceivableshaneNo ratings yet

- Chapter 5 Loans ReceivableDocument12 pagesChapter 5 Loans ReceivableiamjasmineivoriNo ratings yet

- Other Topic To Notes Payable, Loans and Bonds PayableDocument47 pagesOther Topic To Notes Payable, Loans and Bonds PayableLea Victoria PronuevoNo ratings yet

- ch13 Kieso IFRS4 PPTDocument101 pagesch13 Kieso IFRS4 PPTĐức Huy100% (2)

- Loan ReceivableDocument3 pagesLoan ReceivableJenelyn AliordeNo ratings yet

- Loans ReceivableDocument22 pagesLoans ReceivableJendall SisonNo ratings yet

- LiabilitiesDocument14 pagesLiabilitiesKaye Choraine NadumaNo ratings yet

- Liabilities Technical Knowledge: Lesson 1Document12 pagesLiabilities Technical Knowledge: Lesson 1Cirelle Faye SilvaNo ratings yet

- Hand Out 1 Practice SetDocument6 pagesHand Out 1 Practice SetLayka ResorezNo ratings yet

- Module 8 - Loan ReceivableDocument10 pagesModule 8 - Loan Receivablejustine cabanaNo ratings yet

- Midterm Quizzes Compilation - Docx-1Document91 pagesMidterm Quizzes Compilation - Docx-1Yess poooNo ratings yet

- Chapter 13Document89 pagesChapter 13Sneha KumariNo ratings yet

- Loans ReceivableDocument4 pagesLoans ReceivableDianna Dayawon0% (1)

- Lesson 1 - Intro To LiabilitiesDocument21 pagesLesson 1 - Intro To LiabilitiesGrace Joy MarcelinoNo ratings yet

- f9273788-bb82-4fc5-8cdc-162d918f41e6Document6 pagesf9273788-bb82-4fc5-8cdc-162d918f41e6Xuan TraNo ratings yet

- Impairment of Loans: Comparison of "Incurred Loss Approach" and "Expected Credit Loss Impairment Approach"Document33 pagesImpairment of Loans: Comparison of "Incurred Loss Approach" and "Expected Credit Loss Impairment Approach"Christine Joy Rapi MarsoNo ratings yet

- Assignment C7Document4 pagesAssignment C7matt100% (1)

- @2015 Ifa II CH 1 - CL - Con and Prov.Document62 pages@2015 Ifa II CH 1 - CL - Con and Prov.genenegetachew64No ratings yet

- Liabilities and ProvisonsDocument3 pagesLiabilities and ProvisonsAmberlynn PaduaNo ratings yet

- Chapter 8 PayablesDocument46 pagesChapter 8 PayablesLEE WEI LONGNo ratings yet

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document4 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Jehan CodanteNo ratings yet

- Integrated Accounting: Financial Accounting & Reporting (P1) Integrated Accounting - Far (P1) Module 4: LiabilitiesDocument10 pagesIntegrated Accounting: Financial Accounting & Reporting (P1) Integrated Accounting - Far (P1) Module 4: LiabilitiesKamyll VidadNo ratings yet

- AE 121 Prelim Quiz 1 THEORIES (10 Items X 2 Points 20 POINTS)Document10 pagesAE 121 Prelim Quiz 1 THEORIES (10 Items X 2 Points 20 POINTS)Eryn GabrielleNo ratings yet

- FAR Financial Liabilities BERNARTE ReviewerDocument5 pagesFAR Financial Liabilities BERNARTE ReviewerMarjorie AugustoNo ratings yet

- 7Document19 pages7Maria G. BernardinoNo ratings yet

- Bonds Payable - StudentDocument3 pagesBonds Payable - StudentLOVENo ratings yet

- GenMath11 Q2 Mod9 Basic-Concepts-of-Loans Version2Document10 pagesGenMath11 Q2 Mod9 Basic-Concepts-of-Loans Version2Angelica ZipaganNo ratings yet

- IA - Receivables Addtl ConceptsDocument3 pagesIA - Receivables Addtl ConceptsDiana AcostaNo ratings yet

- Term SheetDocument3 pagesTerm Sheetdicky bhaktiNo ratings yet

- Module 2 AssignmentDocument3 pagesModule 2 Assignmentricamae saladagaNo ratings yet

- ESG General Loan Terms-2024.4Document1 pageESG General Loan Terms-2024.4alazahero37No ratings yet

- Impairment of Loans and Receivable FinancingDocument17 pagesImpairment of Loans and Receivable FinancingGelyn CruzNo ratings yet

- Auditing Problems Test Banks - LIABILITIES Part 1Document5 pagesAuditing Problems Test Banks - LIABILITIES Part 1Alliah Mae Arbasto0% (1)

- 3 - Accounting For Loans and ImpairmentDocument1 page3 - Accounting For Loans and ImpairmentReese AyessaNo ratings yet

- Financial Assets ReviewDocument3 pagesFinancial Assets ReviewJobelle Candace Flores AbreraNo ratings yet

- ACC 211 Quiz-LIABILITIESDocument1 pageACC 211 Quiz-LIABILITIESAeyjay ManangaranNo ratings yet

- Activity in LOAN RECEIVABLEDocument2 pagesActivity in LOAN RECEIVABLEChristopher Mau BambalanNo ratings yet

- AK Kieso Chapter 13-14Document106 pagesAK Kieso Chapter 13-14Desinta Putri100% (1)

- Mid-Term-Exam 2021 2022Document3 pagesMid-Term-Exam 2021 2022dangNo ratings yet

- PDF Chapter 9 Audit of Liabilities Roque CompressDocument77 pagesPDF Chapter 9 Audit of Liabilities Roque CompressLovely Dela Cruz GanoanNo ratings yet

- Guided Exercises 1 Current LiabilitiesDocument2 pagesGuided Exercises 1 Current Liabilitiescharizza.ashleyNo ratings yet

- Chap10 - Student (Revised)Document15 pagesChap10 - Student (Revised)Fung Yat Kit KeithNo ratings yet

- Audit of Long-Term LiabilitiesDocument3 pagesAudit of Long-Term LiabilitiesJhaybie San BuenaventuraNo ratings yet

- Name: Dharshini S College: Sri Krishna College of Technology Topic: BankingDocument25 pagesName: Dharshini S College: Sri Krishna College of Technology Topic: BankingDharshini SelvarajNo ratings yet

- Chapter 3-Uses of Funds - Part 3Document5 pagesChapter 3-Uses of Funds - Part 3Pháp NguyễnNo ratings yet

- Inermidiate 2 Chapter 1Document11 pagesInermidiate 2 Chapter 1endris yimerNo ratings yet

- Audit 2Document6 pagesAudit 2Frances Mikayla EnriquezNo ratings yet

- Baluation - Bonds PayableDocument8 pagesBaluation - Bonds PayableDanica Mae AnunciadoNo ratings yet

- LEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Document1 pageLEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Miles SantosNo ratings yet

- Advance Accounting 3Document5 pagesAdvance Accounting 3James Paul SinciocoNo ratings yet

- Delinquency Resolution and LearningsDocument18 pagesDelinquency Resolution and LearningsWhats going on indiaNo ratings yet

- From Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsFrom EverandFrom Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsNo ratings yet

- Credit Score Secrets: Unlocking the Path to Financial HealthFrom EverandCredit Score Secrets: Unlocking the Path to Financial HealthRating: 1 out of 5 stars1/5 (1)

- Module 1.3-2 Date Bank ReconDocument2 pagesModule 1.3-2 Date Bank ReconEilana CandelariaNo ratings yet

- Module 2.2 - Notes ReceivableDocument1 pageModule 2.2 - Notes ReceivableEilana CandelariaNo ratings yet

- Module 2 - Receivables & ARDocument2 pagesModule 2 - Receivables & AREilana CandelariaNo ratings yet

- Module 2.4 - FinancingDocument2 pagesModule 2.4 - FinancingEilana CandelariaNo ratings yet

- Sap® Solution Manager Adapter For Sap Quality Center by HPDocument2 pagesSap® Solution Manager Adapter For Sap Quality Center by HPnikhil.gangwar2892No ratings yet

- IKEA Case StudyDocument7 pagesIKEA Case StudyIzwan YusofNo ratings yet

- Harshad MehtaDocument6 pagesHarshad MehtaBenika RajputNo ratings yet

- Vis Moot - CISGDocument1 pageVis Moot - CISGJose Angelo DavidNo ratings yet

- R-O Matrix TemplateDocument37 pagesR-O Matrix TemplateAdenisSetyawanNo ratings yet

- 2014 2015 Annual Registration Renewal Form RRF 1Document2 pages2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetNo ratings yet

- Request-Hyatt India Fact SheetDocument3 pagesRequest-Hyatt India Fact Sheetajay_kumar_5No ratings yet

- Ald 400 Farm Tractor Commercial Invoice PDFDocument2 pagesAld 400 Farm Tractor Commercial Invoice PDFAlexanderNo ratings yet

- Benefits of Gantt ChartDocument4 pagesBenefits of Gantt ChartRavi KaniyawalaNo ratings yet

- Textbook State Capitalism How The Return of Statism Is Transforming The World 1St Edition Joshua Kurlantzick Ebook All Chapter PDFDocument53 pagesTextbook State Capitalism How The Return of Statism Is Transforming The World 1St Edition Joshua Kurlantzick Ebook All Chapter PDFeric.waters674100% (3)

- AmbitionBox Sample Placement GuideDocument15 pagesAmbitionBox Sample Placement GuideMayur MundadaNo ratings yet

- VUCA Concept and Leadership: October 2020Document23 pagesVUCA Concept and Leadership: October 2020NadyasesdilaNo ratings yet

- Strategic OperationsDocument24 pagesStrategic Operationsshitturahman100% (1)

- Stores Management NotesDocument39 pagesStores Management NotesAbankwa Boateng Mensah100% (3)

- Unit 2 Business Structures and ProcessDocument130 pagesUnit 2 Business Structures and ProcessNirali SoniNo ratings yet

- ICMAP New Reshuffled Courses Schedule 2012Document3 pagesICMAP New Reshuffled Courses Schedule 2012KhAliq KHanNo ratings yet

- Principles of Accounting Assignment Date of Submission 24 January 2022Document3 pagesPrinciples of Accounting Assignment Date of Submission 24 January 2022Beast aNo ratings yet

- Code-Of-ethics For Business - SBDocument38 pagesCode-Of-ethics For Business - SBDump GandaraNo ratings yet

- Answers Part 4Document26 pagesAnswers Part 4Great Empress GalaponNo ratings yet

- ProductivityDocument6 pagesProductivityMallikarjun ReddyNo ratings yet

- Jennifer Barnes: Background Report OnDocument53 pagesJennifer Barnes: Background Report OnDed MarozNo ratings yet

- FINAL ContemporaryDocument36 pagesFINAL Contemporaryelie lucidoNo ratings yet

- Oracle Database 11g: Administration Workshop IDocument2 pagesOracle Database 11g: Administration Workshop IFilipe Santos100% (1)

- Advertising and Personal SellingDocument6 pagesAdvertising and Personal SellingAbhishek Jain0% (1)

- UGC NET Managemant SyllabusDocument4 pagesUGC NET Managemant Syllabuskumar HarshNo ratings yet

- Nism Series II B Registrar To An Issue Mutual Funds Workbook in PDFDocument188 pagesNism Series II B Registrar To An Issue Mutual Funds Workbook in PDFManiesh MahajanNo ratings yet