Professional Documents

Culture Documents

5 Intangible Assets

5 Intangible Assets

Uploaded by

NeighvestOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 Intangible Assets

5 Intangible Assets

Uploaded by

NeighvestCopyright:

Available Formats

Chapter 05

Intangible Assets

Inclusions and Exclusions From Intangible Asset

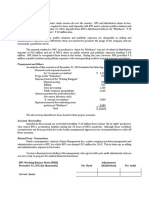

1) The following costs are generally incurred by Bound Eye Corporation:

Goodwill purchased in a business combination 500,000

Cost of developing website for the promotion and advertisement of the entity’s products 150,000

Cost incurred in the corporation’s formation and organization 230,000

Operating losses incurred in the start-up of the business 130,000

Initial franchise fee paid 175,000

Continuing franchise fee 50,000

Internally generated goodwill 800,000

Cost of purchasing a patent form an investor 137,000

Cost of leasehold improvement 70,000

Legal costs incurred in successfully defending a patent 55,500

Internally generated customer list 40,000

Cost of purchasing a trademark 250,000

Computer software for a computer controlled machine – cannot be operate without that specific software 325,500

How much from the above items can be recognized as intangible assets including goodwill?

A. 1,132,000

B. 1,387,500

C. 1,172,000

D. 1,062,000

Inclusions and Exclusions From Research & Development

2) Zazu provided you the following information pertaining to its Research and Development activities for the year 2022:

Searching for applications of new research findings 57,000

Trouble-shooting in connection with breakdowns during commercial production 87,000

Adaptation of an existing capability to a particular requirement of customer’s need as part of continuing

commercial activity 39,000

Engineering follow-through in an early phase of commercial production 45,000

Laboratory research aimed to discovery of new knowledge 204,000

Design of tools, jigs, and molds involving new technology 72,000

Quality control during commercial production, including routine testing of products 174,000

Testing in search for product or process alternative 300,000

Design and construction of preproduction prototype and model 384,000

Routine and on-going efforts to refine, enrich, or otherwise, improve upon the qualities of an existing 750,000

product

What is the total amount to be classified and expensed as research and development for 2022?

A. 1,095,000

B. 1,017,000

C. 456,000

D. 561,000

Inclusions and Exclusions From Research & Development – Treatment to PPE Used in R & D

3) All of the following expenditures were included in the R & D expense account:

Salaries and wages for laboratory research 1,000,000

Design of preproduction prototype 200,000

Construction of production prototype 150,000

Quality control during commercial production 100,000

Materials and supplies consumed for laboratory research 400,000

Purchase of equipment used solely for the project – useful life 5 years 600,000

Patent filing and legal fees for completed project 50,000

Payments to other for research 300,000

What amount should be reported as research and development expense for the current year?

A. 2,650,000

B. 2,170,000

C. 2,050,000

D. 2,350,000

FAR by: John Bo S. Cayetano, CPA, MBA Page 1 of 5

Inclusions and Exclusions from Research & Development – Expenditure after Technical Feasibility

4) Floyd incurred the following costs during the current year:

February 1 P100,000 in legal and processing fees to file a patent

March 5 P250,000 in laboratory and material fees to identify new technology

April 15 Prototype development and testing, P340,000

May 1 Floyd achieved technical feasibility

July 1 Final development of the product and testing P550,000

What amount should be recognized as research and development expense?

A. 590,000

B. 250,000

C. 340,000

D. 1,140,000

Initial Measurement – Externally Generated, Without Direct Attributable Cost

5) Piptin Corporation acquires a patent from Siktin Company in exchange for 2,500 shares of Piptin Corporation’s P5

par value ordinary shares and P75,000 cash.

When the patent was initially issued to Siktin Company., Piptin Corporation’s shares were selling at P7.50 per share.

When Piptin acquired the patent, its shares were selling for P9 a share. Pipin Corporation should record the patent at

what amount?

A. 87,500

B. 93,750

C. 97,500

D. 75,000

Initial Measurement – Externally Generated, Issuance of Notes

6) On January 1, 2022, Black Mamba Company signed an agreement to operate as a franchise of Doug company for an

initial franchise fee of P30,000,000. Of this amount, P10,000,000 was paid when the agreement was signed and the

balance is payable in equal annual payment of P5,000,000 beginning December 31, 2022.

The agreement provides that the down payment is not refundable and no future services are required of the franchisor.

Black Mamba’s credit rating indicates that it can borrow money at 12% for loan of this type.

Present value of 1 at 12% for four periods 0.636

Present value of ordinary annuity at 12% for four periods 3.037

Present value of annuity due at 12% for four periods 3.402

How much is the cost of franchise?

A. 30,000,000

B. 25,185,000

C. 21,541,500

D. 15,185,000

Initial Measurement – Externally Generated, With Direct Attributable Cost

7) An entity purchases a trademark and incurs the following costs in connection with the trademark:

One-time trademark purchase price P100,000

Nonrefundable taxes 5,000

Training sales personnel on the use of the new trademark 7,000

Research expenditures associated with the purchase of the new trademark 24,000

Legal costs incurred to register the trademark 10,500

Salaries of the administrative personnel 12,000

Assuming that the trademark meets all of the applicable initial asset recognition criteria, the entity should recognized

an asset in the amount of

A. 100,000

B. 115,500

C. 146,500

D. 158,500

FAR by: John Bo S. Cayetano, CPA, MBA Page 2 of 5

Initial Measurement – Internally Generated

8) Tamis Company developed a new machine which it had patented. The following costs were incurred in developing

and patenting the machine:

Purchased a special equipment to be used solely for development of new machine 1,800,000

Research salaries and fringe benefits for engineers and scientist 200,000

Cost of testing prototype 250,000

Legal cost of filing patent 300,000

Fees paid to government patent office 500,000

Drawings required by patent office to be filed with patent application 400,000

Legal fees incurred in a successful defense of patent 200,000

What amount should be capitalized as cost of patent?

A. 1,200,000

B. 1,400,000

C. 1,450,000

D. 3,450,000

Subsequent Measurement – Amortization

9) Alaminos Company acquired three patents in January 2016. The patents have different lives as indicated in the

following schedule:

Remaining Remaining

Patent Cost useful life legal life

A P2,000,000 10 8

B 3,000,000 5 10

C 6,000,000 Indefinite 15

The company’s policy is to amortize intangible assets by the straight-line method to the nearest half year. The

company reports on a calendar-year basis. The amount of amortization that should be recognized for 2016 is

A. 1,330,000

B. 1,250,000

C. 2,050,000

D. 950,000

Subsequent Measurement – Amortization, With Change in Estimate

10) On January 1, 2017, Josabelle Company purchased a patent for P7,140,000. The patents is being amortized over the

remaining legal life of 15 years. During January 2020, the entity determined that the economic benefits of patent

would not last longer than seven years from the date of acquisition.

What is the carrying amount of the patent on December 31, 2020?

A. 4,284,000

B. 4,896,000

C. 3,264,000

D. 5,236,000

Subsequent Measurement – Amortization of Software

11) In 2021, Rover spent P6,000,000 in its new software package. Of this amount, 60% was spent before technological

feasibility was established for the product, which is to be marketed to third parties. The package was completed at

December 31, 2021. Rover expects a useful life of 8 years with total revenues of P20,000,000.

During 2022, Rover realizes revenues of P4,000,000. Net realizable value of the software on December 31, 2022 is

85% of cost.

What amount of software expense should be included in the December 31, 2022 income statement?

A. 840,000

B. 360,000

C. 480,000

D. 600,000

FAR by: John Bo S. Cayetano, CPA, MBA Page 3 of 5

Subsequent Measurement – Impairment, Impairment of Definite Life Asset and New Amortization

On January 1, 2020, Blessed Company purchased a Patent for P280,000. The asset has a legal life of 10 years but due

to rapidly changing technology, Blessed estimates a useful life of only 7 years. On January 1, 2022, Blessed is uncertain

that the process can actually be made economically feasible, and decides to write down the patent.

The future cash inflows expected from the patent will be P40,000 per year for the remaining life of the patent. The present

value of these cash flows, discounted at 12% market interest rate, is P144,200. The fair value less cost to sell is P130,000.

12) How much is the impairment loss for the year 2022?

A. 135,800

B. 79,800

C. 70,000

D. 55,800

13) How much is the amortization expense for the year 2022?

A. 28,840

B. 26,000

C. 18,025

D. 16,250

Subsequent Measurement – Impairment, Impairment of Indefinite Life Asset

14) On January 1, 2020, Rowena Company acquired a trademark for P3,000,000. The trademark has eight years

remaining in the legal life. It is anticipated that the trademark will be renewed in the future indefinitely without problem.

On December 31, 2020, the trademark is assessed for impairment. Because of a decline in economy, the trademark

is expected to generate cash flows of just P120,000 annually. The useful life of the trademark will extends beyond the

foreseeable horizon.

The appropriate discount rate is 6%. What amount should be recognized as impairment loss on trademark for 2020?

A. 1,000,000

B. 2,000,000

C. 3,000,000

D. 0

Total Related Expenses of Patent – Amortization, Cost of Defense, Impairment due to Unsuccessful Defense

Numbers 15, 16, 17 and 18

Behemoth Company incurred P100,000 of research and development costs to develop a product for which a patent was

granted on January 1, 2020. Legal fees and other costs associated with registration of the patent totaled P300,000. The

patent is being amortized over its legal life. On July 1, 2022, Behemoth Company won and paid legal fees of P80,000 for

the successful defense of the patent against an infringement lawsuit by Doug Company.

15) How much is the amortization expense for the year 2020?

A. 5,000

B. 20,000

C. 15,000

D. 30,000

16) How much is the carrying amount of the patent on December 31, 2022?

A. 255,000

B. 262,500

C. 248,800

D. 335,000

17) How much is the total expenses for the year 2022?

A. 15,000

B. 80,000

C. 95,000

D. 87,500

18) How much is the total expenses for the year 2022 assuming Behemoth Company did not win the lawsuit?

A. 80,000

B. 87,500

C. 262,500

D. 350,000

FAR by: John Bo S. Cayetano, CPA, MBA Page 4 of 5

Total Related Expenses of Franchise – Amortization, Interest, CFF & Impairment

19) On January 1, 2022, Blight Stones obtained a franchise from Doug Corporation to sell for 20 years Doug’s product.

The initial franchise fee as agreed upon shall be P6,000,000, and shall be payable in cash, P1,000,000, when the

contract is signed and the balance in four equal installments thereafter, as evidenced by a non-interest bearing note.

The agreement provides that the franchisor shall provide the necessary initial services required under a franchise

contract. The agreement also provides that 5% of the revenue from the franchise must be paid to the franchisor.

Revenue from the franchise for 2022 was P5,000,000. PV of ordinary annuity at 12% for four periods 3.03735.

How much is the total expenses for the year 2022?

A. 458,875

B. 945,433

C. 239,831

D. 489,831

Goodwill – Direct Method

Numbers 20, 21, 22, 23 and 24

Life Company is planning to sell the business to new interests. The cumulative net earnings for the past five years

amounted to P16,500,000 including expropriation loss of P1,500,000. The normal rate of return is 20%. The fair value of

net assets of entity at current year-end was P10,000,000. Determine the goodwill thru the following indirect method:

20) Excess earnings are purchased for 5 years?

A. 8,000,000

B. 4,000,000

C. 5,000,000

D. 4,500,000

21) Excess earnings are capitalized at 25%?

A. 7,200,000

B. 6,400,000

C. 8,000,000

D. 3,600,000

22) Annual average earnings are purchased for 3 years?

A. 10,800,000

B. 18,000,000

C. 4,800,000

D. 5,400,000

23) Annual average earnings are capitalized at 25%?

A. 1,600,000

B. 3,600,000

C. 4,400,000

D. 2,000,000

24) Excess earnings are discounted at 12% for 5 years? (the PV of an ordinary annuity of 1 for 5 years at 12% is 3.60)

A. 12,960,000

B. 10,800,000

C. 5,760,000

D. 7,200,000

Goodwill – Indirect Method

25) Jennylyn purchased another entity for P8,000,000 cash. The assets and liabilities of the acquire are as follows:

Carrying Amount Fair Value

Cash 1,000,000 1,000,000

Inventory 400,000 500,000

In-process R and D 6,000,000 5,000,000

Assembled Workforce 1,100,000 1,200,000

Liabilities 2,500,000 3,000,000

What is the goodwill arising from acquisition?

A. 4,500,000

B. 3,300,000

C. 3,100,000

D. 2,200,000

--- ¥ --- ¥ --- ¥ --- ¥ --- ¥ --- ¥ --- [End of Chapter 42] --- ¥ --- ¥ --- ¥ --- ¥ --- ¥ --- ¥ ---

FAR by: John Bo S. Cayetano, CPA, MBA Page 5 of 5

You might also like

- Spiceland SM ch11 PDFDocument79 pagesSpiceland SM ch11 PDFmas aziz100% (3)

- AP Quiz 1 B44 1Document25 pagesAP Quiz 1 B44 1Young Metro100% (1)

- ACCCOB2 Reflection Paper 3 PDFDocument3 pagesACCCOB2 Reflection Paper 3 PDFMIGUEL DIEGO PANGILINANNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Nepomuceno, Henry James B. - Ast Quiz 5Document2 pagesNepomuceno, Henry James B. - Ast Quiz 5Mitch Tokong MinglanaNo ratings yet

- AUDProb TEST BANKDocument28 pagesAUDProb TEST BANKFrancine HollerNo ratings yet

- Muh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9Document3 pagesMuh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9RismayantiNo ratings yet

- Financial Accounting Study ManualDocument311 pagesFinancial Accounting Study ManualLuke Shaw100% (3)

- Test Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Document17 pagesTest Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Kimberly Etulle Celona100% (1)

- Revenue CycleDocument3 pagesRevenue CycleAireyNo ratings yet

- DocxDocument10 pagesDocxAiziel OrenseNo ratings yet

- Investment in AssociateDocument2 pagesInvestment in AssociateChiChi0% (1)

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- The University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16Document5 pagesThe University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16ana rosemarie enaoNo ratings yet

- PSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Investment PropertyDocument2 pagesPSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Investment PropertyKendrew SujideNo ratings yet

- Additional Problems DepnRevaluation and ImpairmentDocument2 pagesAdditional Problems DepnRevaluation and Impairmentfinn heartNo ratings yet

- Assignment 3Document4 pagesAssignment 3Anna Mae NebresNo ratings yet

- Solve Me PDFDocument1 pageSolve Me PDFWinona Anne EscarezNo ratings yet

- Problem 1Document8 pagesProblem 1Celine Marie AntonioNo ratings yet

- FAR Summary Lecture (14 May 2021)Document10 pagesFAR Summary Lecture (14 May 2021)rav danoNo ratings yet

- Share Based PaymentDocument5 pagesShare Based PaymentGlen JavellanaNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacNo ratings yet

- Quiz 1Document9 pagesQuiz 1Czarhiena SantiagoNo ratings yet

- Equity YyyDocument33 pagesEquity YyyJude SantosNo ratings yet

- Module 3 InvestmentDocument12 pagesModule 3 InvestmentKim JisooNo ratings yet

- ProblemsDocument9 pagesProblemsMark Angelo AlvarezNo ratings yet

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- p1 IaDocument1 pagep1 IaLeika Gay Soriano OlarteNo ratings yet

- Current LiabilitiesDocument9 pagesCurrent LiabilitiesErine ContranoNo ratings yet

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDocument12 pagesGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Midterm ExamDocument9 pagesMidterm ExamElla TuratoNo ratings yet

- PDF ReceivablesDocument6 pagesPDF ReceivablesJanine SarzaNo ratings yet

- Lyceum First Preboard 2020Document3 pagesLyceum First Preboard 2020Jordan Tobiagon100% (1)

- Audit of Investment, Do It Yourself - DiyDocument4 pagesAudit of Investment, Do It Yourself - Diymark100% (1)

- ROGEN AssignmentDocument9 pagesROGEN AssignmentRogen Paul GeromoNo ratings yet

- Aud Application 2 - Handout 6 Revaluation (UST)Document5 pagesAud Application 2 - Handout 6 Revaluation (UST)RNo ratings yet

- National Mock Board Examination 2017 Financial Accounting and ReportingDocument9 pagesNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- ReviewerDocument5 pagesReviewermaricielaNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- Audit Fot Liability Problem #3Document2 pagesAudit Fot Liability Problem #3Ma Teresa B. CerezoNo ratings yet

- Chapter 11 - RR: ConsignmentDocument17 pagesChapter 11 - RR: ConsignmentJane DizonNo ratings yet

- Rmbe FarDocument15 pagesRmbe FarMiss Fermia0% (1)

- AdfjsdfjksdfDocument12 pagesAdfjsdfjksdfJohn Carlo PeruNo ratings yet

- Pre-Test 3Document3 pagesPre-Test 3BLACKPINKLisaRoseJisooJennieNo ratings yet

- Installments SalesDocument21 pagesInstallments Salesbekbek12No ratings yet

- Practical Accounting 2.2Document14 pagesPractical Accounting 2.2Jao FloresNo ratings yet

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- Practice ExercisesDocument2 pagesPractice ExercisesNikki Labial0% (1)

- Prelimx No AnswersDocument7 pagesPrelimx No Answerscarl fuerzasNo ratings yet

- FAR.2929 Bonds Payable PDFDocument3 pagesFAR.2929 Bonds Payable PDFNah HamzaNo ratings yet

- This Study Resource Was: C. P6,050,000 D. P53,900Document2 pagesThis Study Resource Was: C. P6,050,000 D. P53,900Nah HamzaNo ratings yet

- Iac 11 Current Liabilities PDFDocument9 pagesIac 11 Current Liabilities PDFClarisse Pelayo0% (1)

- MA CUP PracticeDocument9 pagesMA CUP PracticeFlor Danielle Querubin100% (1)

- Intangible Assets SoftwareDocument3 pagesIntangible Assets SoftwareZerjo CantalejoNo ratings yet

- Partnership FormationDocument13 pagesPartnership FormationGround ZeroNo ratings yet

- Cup 3 Questions Answer KeyDocument34 pagesCup 3 Questions Answer KeyDenmarc John AragosNo ratings yet

- Far 17 Investment PropertyDocument12 pagesFar 17 Investment PropertyTeresaNo ratings yet

- CH 11Document69 pagesCH 11Abriel BumatayNo ratings yet

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- Depletion PDFDocument3 pagesDepletion PDFAlexly Gift UntalanNo ratings yet

- Intangible Assets ProblemsDocument4 pagesIntangible Assets ProblemsDianne TorresNo ratings yet

- ACCO 30053 - Audit of Intangible Assets & Investment Property - MARPDocument3 pagesACCO 30053 - Audit of Intangible Assets & Investment Property - MARPBanna SplitNo ratings yet

- Intermediate Accounting I Intangible AssetsDocument7 pagesIntermediate Accounting I Intangible AssetsKyla Flaviano GallegoNo ratings yet

- Instruction: Answer The Following Questions Problem 1Document11 pagesInstruction: Answer The Following Questions Problem 1nicole bancoroNo ratings yet

- Ifrs 6 PDFDocument8 pagesIfrs 6 PDFSanket AggarwalNo ratings yet

- Research and Development CostDocument17 pagesResearch and Development CostKaye Choraine NadumaNo ratings yet

- Recent Rulings in Income Tax ActDocument91 pagesRecent Rulings in Income Tax ActKarthik Chandrashekar100% (1)

- Practical Accounting 1Document32 pagesPractical Accounting 1EdenA.Mata100% (9)

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangNo ratings yet

- Module 3 - Borrowing CostsDocument3 pagesModule 3 - Borrowing CostsLui100% (1)

- Other Important TermsDocument4 pagesOther Important TermsSaugat KarNo ratings yet

- Updates in Financial Reporting StandardsDocument9 pagesUpdates in Financial Reporting Standardsloyd smith100% (1)

- J17 DipIFR - AnswersDocument8 pagesJ17 DipIFR - Answers刘宝英No ratings yet

- Accounting Policies - Study Group 4IDocument24 pagesAccounting Policies - Study Group 4ISatish Ranjan PradhanNo ratings yet

- Unit II - Audit of Intangibles and Other Assets - Final - t31314Document9 pagesUnit II - Audit of Intangibles and Other Assets - Final - t31314Jake BundokNo ratings yet

- IntangiblesDocument3 pagesIntangiblesJP DCNo ratings yet

- Solution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian EditionDocument38 pagesSolution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian Editionwarpingmustacqgmael100% (19)

- BNVBVBDocument8 pagesBNVBVBsaif ullahNo ratings yet

- BhupiDocument251 pagesBhupiRaju PrasadNo ratings yet

- Chapter 4 SDocument17 pagesChapter 4 SLê Đăng Cát NhậtNo ratings yet

- MFR203 FAR-4 AssignmentDocument5 pagesMFR203 FAR-4 Assignmentgillian soonNo ratings yet

- tbch12Document35 pagestbch12Daisy Jane V. CamalingNo ratings yet

- 2017 JuneDocument16 pages2017 JuneHsaung HaymarnNo ratings yet

- Faa IDocument18 pagesFaa INishtha RathNo ratings yet

- ADC 401 Financial ReportingDocument4 pagesADC 401 Financial ReportingM Ahmad M Ahmad100% (2)

- Sunbeam TransactionsDocument3 pagesSunbeam TransactionsmegafieldNo ratings yet

- CAF 8 Spring 2022Document6 pagesCAF 8 Spring 2022hamizNo ratings yet

- Objective Questions FinalDocument48 pagesObjective Questions FinalAvijitneetika Mehta100% (1)

- Intangibles HandoutsDocument11 pagesIntangibles HandoutsAries BautistaNo ratings yet