Professional Documents

Culture Documents

Year Interest Received Interest Income Discount Amortization Amortized Cost 2008 2009 2010 2011 2012

Year Interest Received Interest Income Discount Amortization Amortized Cost 2008 2009 2010 2011 2012

Uploaded by

Gray JavierOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Year Interest Received Interest Income Discount Amortization Amortized Cost 2008 2009 2010 2011 2012

Year Interest Received Interest Income Discount Amortization Amortized Cost 2008 2009 2010 2011 2012

Uploaded by

Gray JavierCopyright:

Available Formats

BSA 8

1. How much discount amortization should be recognized in 2012?

a. P27,275

b. P 0

c. P120,000

d. P75,000

ANSWER: A (SEE AMORTIZATION TABLE)

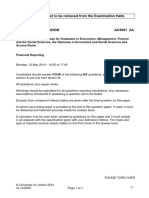

SCHEDULE OF DISCOUNT AMORTIZATION

Year Interest Interest Discount Amortized

Received Income Amortization Cost

1,386,275

2008 120,000 138,628 18,628 1,404,903

2009 120,000 140,490 20,490 1,425,393

2010 120,000 142,539 22,539 1,447,932

2011 120,000 144,793 24,793 1,472,725

2012 120,000 147,272 27,275 1,500,00

Data for no. 37- 40

Kiwi Company invested in a debt instrument on July 1, 2008. At this date, the cost and

fair value of the instrument is P1,000,000. The company’s practice is to buy securities to

be available for sale when circumstances warrant, not to profit from short-term

differences in price and not to necessarily hold them to maturity. Hence, the debt

instrument acquired is classified as available-for-sale and measured at fair value, and

changes in fair value are classified as component of other comprehensive income.

The table sets out the changes in the fair value of the debt instrument, and the nature of

change in each year:

Year Fair Value Change Nature of Change

2009 (P100,000) No objective evidence of

impairment

2010 (P200,000) Objective evidence of

impairment

2011 P15,000 Objective evidence of

reversal of impairment

2. The impairment loss to be recognized in 2009 is

a. P100,000

b. P900,000

c. P200,000

d. P 0

ANSWER: D

The decrease in fair value of the debt instrument classified as available-for-sale should

be recognized as unrealized loss and classified as component of other comprehensive

income.

3. The impairment loss to be recognized in 2010 is

a. P100,000

b. P200,000

c. P300,000

d. P 0

ANSWER: C

Decrease in fair value in 2010 P200,000

Unrealized loss recognized in 2009 100,000

Impairment loss P300,000

4. The amount of reversal of impairment loss to be recognized in profit and loss in

2011 is

a. P100,000

b. P200,000

c. P 15,000

d. P 0

ANSWER: C

PAS 39 permits recognition of reversal of impairment loss for available-for-sale debt

security.

5. At the end of 2011, the available-for-sale debt security should be stated at

a. P715,000

b. P700,000

c. P800,000

d. P1,000,000

ANSWER: A

At the end of 2011, available-for-sale debt security should be stated at its fair value of

P715,000 (P1,000,000 – P100,000 – P200,000 + P15,000).

You might also like

- Resa p1 First PB 1015Document21 pagesResa p1 First PB 1015Din Rose GonzalesNo ratings yet

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Chapters-1-10-Exam-Problem (2) Answer JessaDocument6 pagesChapters-1-10-Exam-Problem (2) Answer JessaLynssej BarbonNo ratings yet

- This Study Resource Was: Midterm-Final Exam Aec 215 - Business TaxationDocument8 pagesThis Study Resource Was: Midterm-Final Exam Aec 215 - Business TaxationGray JavierNo ratings yet

- Integrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDocument18 pagesIntegrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDarren Joy CoronaNo ratings yet

- NFJPIA Mockboard 2011 P2Document6 pagesNFJPIA Mockboard 2011 P2ELAIZA BASHNo ratings yet

- 1007 (RA, SR and TP)Document6 pages1007 (RA, SR and TP)Neil Ryan CatagaNo ratings yet

- ReviewerDocument9 pagesReviewerMarielle JoyceNo ratings yet

- Simulated Qualifying Exam ReviewerDocument10 pagesSimulated Qualifying Exam ReviewerJanina Frances Ruidera100% (1)

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Prefinals Exam in Income TaxationDocument3 pagesPrefinals Exam in Income TaxationYen YenNo ratings yet

- Pre-Test 3Document3 pagesPre-Test 3BLACKPINKLisaRoseJisooJennieNo ratings yet

- Mindanao State University College of Business Administration and Accountancy Marawi CityDocument7 pagesMindanao State University College of Business Administration and Accountancy Marawi CityHasmin Saripada AmpatuaNo ratings yet

- Examination About Investment 3Document2 pagesExamination About Investment 3BLACKPINKLisaRoseJisooJennieNo ratings yet

- FAR2Document8 pagesFAR2Kenneth DiabordoNo ratings yet

- Financial Accounting Q&aDocument4 pagesFinancial Accounting Q&aGlen JavellanaNo ratings yet

- Responsibility AccountingDocument6 pagesResponsibility Accountingrodell pabloNo ratings yet

- AC15 Quiz 2Document6 pagesAC15 Quiz 2Kristine Esplana Toralde100% (1)

- Gpva PDF FreeDocument3 pagesGpva PDF FreeMariah LuisaNo ratings yet

- Examination About Investment 4Document3 pagesExamination About Investment 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- Mas Cup 21 - QuestionsDocument4 pagesMas Cup 21 - QuestionsPhilip CastroNo ratings yet

- 13-B Income Distribution Made by Taxable Estates or Trusts IllustrationDocument27 pages13-B Income Distribution Made by Taxable Estates or Trusts IllustrationSheilamae Sernadilla GregorioNo ratings yet

- Solution Chapter 10 Rev Final CompressDocument21 pagesSolution Chapter 10 Rev Final CompressCleofe Mae Piñero AseñasNo ratings yet

- Pre-Test 4Document3 pagesPre-Test 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- SM07 4thExamReview 054702Document4 pagesSM07 4thExamReview 054702Hilarie JeanNo ratings yet

- Ia2 QuestionsDocument6 pagesIa2 QuestionsSharjaaahNo ratings yet

- Bsa 7Document2 pagesBsa 7Gray JavierNo ratings yet

- DocxDocument16 pagesDocxJustin NoladaNo ratings yet

- Anindita SenguptaDocument8 pagesAnindita Senguptandim betaNo ratings yet

- IA3 - REVIEWER - Internediate 3Document38 pagesIA3 - REVIEWER - Internediate 3Mujahad QuirinoNo ratings yet

- AUDITING Material 2Document9 pagesAUDITING Material 2Blessy Zedlav LacbainNo ratings yet

- Corporate Liquidation Practical Accounting IIDocument4 pagesCorporate Liquidation Practical Accounting IIJalieha Mahmod100% (2)

- DocxDocument20 pagesDocxGuinevereNo ratings yet

- Auditing Problems QaDocument12 pagesAuditing Problems QaSheena CalderonNo ratings yet

- Test Bank Chapter 3 Cost Volume Profit ADocument4 pagesTest Bank Chapter 3 Cost Volume Profit AKarlo D. ReclaNo ratings yet

- Investment in Associates ProblemsDocument4 pagesInvestment in Associates ProblemsLDB Ashley Jeremiah Magsino - ABMNo ratings yet

- #Test Bank - Finc - L Acctg. 2 - 3 (V)Document34 pages#Test Bank - Finc - L Acctg. 2 - 3 (V)Nhaj100% (1)

- Unit Iv Assessment ProblemsDocument9 pagesUnit Iv Assessment ProblemsChin FiguraNo ratings yet

- Examination About Investment 12Document4 pagesExamination About Investment 12BLACKPINKLisaRoseJisooJennieNo ratings yet

- Mendoza - UNIT 1 - Statement of Comprehensive IncomeDocument9 pagesMendoza - UNIT 1 - Statement of Comprehensive IncomeAim RubiaNo ratings yet

- Batch 19 1st Preboard (P1)Document12 pagesBatch 19 1st Preboard (P1)Mike Oliver Nual100% (1)

- Cup - Basic ParcorDocument8 pagesCup - Basic ParcorJerauld BucolNo ratings yet

- Solution Chapter 8Document19 pagesSolution Chapter 8Bianca AcoymoNo ratings yet

- Sevilla - Unit 1 - IA3Document14 pagesSevilla - Unit 1 - IA3Hensel SevillaNo ratings yet

- Chapter 2 - Statement of Comprehensive Income - UnlockedDocument2 pagesChapter 2 - Statement of Comprehensive Income - UnlockedJerome_JadeNo ratings yet

- Chap14 The Calculation & Interpretation of Accounting RatiosDocument6 pagesChap14 The Calculation & Interpretation of Accounting RatiosSaiful AliNo ratings yet

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- Installment SalesDocument12 pagesInstallment SalesJocel Ann GuerraNo ratings yet

- TAX Final Preboard SolutionDocument25 pagesTAX Final Preboard SolutionLaika Mae D. CariñoNo ratings yet

- Examination About Investment 17Document4 pagesExamination About Investment 17BLACKPINKLisaRoseJisooJennieNo ratings yet

- 2014 CommentaryDocument46 pages2014 Commentaryduong duongNo ratings yet

- Examination About Investment 9Document3 pagesExamination About Investment 9BLACKPINKLisaRoseJisooJennieNo ratings yet

- Find Study Resources: Answered Step-By-StepDocument12 pagesFind Study Resources: Answered Step-By-StepBisag AsaNo ratings yet

- Mercader Cherry May LDocument8 pagesMercader Cherry May LKindred WolfeNo ratings yet

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- Assignemnt Analysis of FS 03.22.2021Document3 pagesAssignemnt Analysis of FS 03.22.2021Eva Ruth MedilloNo ratings yet

- Fin ExamDocument6 pagesFin ExamKissesNo ratings yet

- FAR Material-2Document8 pagesFAR Material-2Blessy Zedlav LacbainNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- Name: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsDocument7 pagesName: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsEsse ValdezNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Metrobank Case Involving Maria Victoria LopezDocument9 pagesMetrobank Case Involving Maria Victoria LopezGray JavierNo ratings yet

- Aplikasi International IssuesDocument16 pagesAplikasi International IssuesGray JavierNo ratings yet

- DocxDocument2 pagesDocxGray JavierNo ratings yet

- Notes in Fi2Document4 pagesNotes in Fi2Gray JavierNo ratings yet

- Notes in Fi3Document5 pagesNotes in Fi3Gray JavierNo ratings yet

- Notes in Acstr11Document2 pagesNotes in Acstr11Gray JavierNo ratings yet

- The Cash Flows From Granting CreditDocument4 pagesThe Cash Flows From Granting CreditGray JavierNo ratings yet

- Limited Partnership, Concept A Partnership Which Has One or More General Partners and One or More Limited Partners. TheDocument2 pagesLimited Partnership, Concept A Partnership Which Has One or More General Partners and One or More Limited Partners. TheGray JavierNo ratings yet

- Notes in Fi4Document1 pageNotes in Fi4Gray JavierNo ratings yet

- Notes in Acstr13Document2 pagesNotes in Acstr13Gray JavierNo ratings yet

- Notes in Acstr14Document3 pagesNotes in Acstr14Gray JavierNo ratings yet

- Notes in Acstr11Document2 pagesNotes in Acstr11Gray JavierNo ratings yet

- Notes in Acstra7Document2 pagesNotes in Acstra7Gray JavierNo ratings yet

- Notes in Acstr14Document3 pagesNotes in Acstr14Gray JavierNo ratings yet

- Notes in Acstra6Document2 pagesNotes in Acstra6Gray JavierNo ratings yet

- Notes in Acstra8Document3 pagesNotes in Acstra8Gray JavierNo ratings yet

- Waiver or Compromise of Limited Partner's Liability in No. 3 and 4Document2 pagesWaiver or Compromise of Limited Partner's Liability in No. 3 and 4Gray JavierNo ratings yet

- Liability For False Statement (Art. 1847) : Restrictions of A General PartnerDocument2 pagesLiability For False Statement (Art. 1847) : Restrictions of A General PartnerGray JavierNo ratings yet

- Notes in Law 70Document1 pageNotes in Law 70Gray JavierNo ratings yet

- Test Bank Law 2 DiazDocument11 pagesTest Bank Law 2 DiazGray JavierNo ratings yet

- Notes in Law 68Document2 pagesNotes in Law 68Gray JavierNo ratings yet

- M2E1 - A2C Notes in BustaxDocument8 pagesM2E1 - A2C Notes in BustaxGray JavierNo ratings yet

- The Professional CPA Review SchoolDocument23 pagesThe Professional CPA Review SchoolGray JavierNo ratings yet

- Iato RequirementsDocument1 pageIato RequirementsGray JavierNo ratings yet

- Quiz # 1 Engineering EconomicsDocument2 pagesQuiz # 1 Engineering Economicsmuhammad bilalNo ratings yet

- Cel 1 Prac 1 Answer KeyDocument12 pagesCel 1 Prac 1 Answer KeyLauren ObrienNo ratings yet

- Chapter 2 Financail Analysis&planningDocument13 pagesChapter 2 Financail Analysis&planninganteneh hailieNo ratings yet

- RM of Non Banking Company Mahindra FinanceDocument34 pagesRM of Non Banking Company Mahindra Finance5077 Aniket malikNo ratings yet

- Course OutlineDocument13 pagesCourse Outlinemuiz ahmadNo ratings yet

- Min ZoDocument3 pagesMin ZoaniclazarNo ratings yet

- Full Download Ebook Ebook PDF Macroeconomics Australia in The Global Environment 1st Australia PDFDocument42 pagesFull Download Ebook Ebook PDF Macroeconomics Australia in The Global Environment 1st Australia PDFshiela.martinez137100% (50)

- 01 Handout FINAC2 Lease Accounting Debt Restructuring PDFDocument4 pages01 Handout FINAC2 Lease Accounting Debt Restructuring PDFNil Allen Dizon FajardoNo ratings yet

- 633833334841206250Document57 pages633833334841206250Ritesh Kumar Dubey100% (1)

- The Chavakkad Firka CoDocument13 pagesThe Chavakkad Firka CorajinalokbaiNo ratings yet

- Charter Byelaws 2017Document32 pagesCharter Byelaws 2017starsss80No ratings yet

- AS Business Paper October 2019Document4 pagesAS Business Paper October 2019Ved “Veko” KodothNo ratings yet

- Assignment # 1 Spring-2021: Teacher's MessageDocument3 pagesAssignment # 1 Spring-2021: Teacher's MessageSayed AssadullahNo ratings yet

- Financial Reporting: Cost of Investment PropertyDocument11 pagesFinancial Reporting: Cost of Investment PropertyRITZ BROWNNo ratings yet

- Transforming Digital Cash Management: Finacle Virtual Accounts ManagementDocument20 pagesTransforming Digital Cash Management: Finacle Virtual Accounts ManagementsnclgsraoNo ratings yet

- Obligations To The FirmDocument2 pagesObligations To The FirmAngel Pearl DeneroNo ratings yet

- Lehman Brothers Case StudyDocument7 pagesLehman Brothers Case Studyali goharNo ratings yet

- History of BankDocument18 pagesHistory of BankMahwish NawazNo ratings yet

- Chaos Theory FinanceDocument8 pagesChaos Theory FinanceElmeDinoNo ratings yet

- Time Value of Money TVMDocument48 pagesTime Value of Money TVMNikita KumariNo ratings yet

- Financial Accounting in An Economic Context 8Th Edition Pratt Solutions Manual Full Chapter PDFDocument48 pagesFinancial Accounting in An Economic Context 8Th Edition Pratt Solutions Manual Full Chapter PDFthomasowens1asz100% (11)

- Bisnis Internasional - Week 9 - The Global Capital MarketDocument21 pagesBisnis Internasional - Week 9 - The Global Capital MarketannabethNo ratings yet

- TCS Smart Hiring Numerical AbilityDocument6 pagesTCS Smart Hiring Numerical Abilitymoferix892No ratings yet

- Accruals and Prepayments ExamplesDocument3 pagesAccruals and Prepayments ExamplesRameen FatimaNo ratings yet

- BOAT Strategyblueprint - v2Document88 pagesBOAT Strategyblueprint - v2Fejiro GbagiNo ratings yet

- Project Report: Akrash Mehrotra Dr. Sankalp SrivastavaDocument120 pagesProject Report: Akrash Mehrotra Dr. Sankalp Srivastavasharath kumarNo ratings yet

- Factors Affecting Stock MarketDocument80 pagesFactors Affecting Stock MarketAjay SanthNo ratings yet

- Income Under The Head SalaryDocument8 pagesIncome Under The Head Salarykhullar6870No ratings yet

- AssignmentDocument12 pagesAssignmentMeera JoshyNo ratings yet

- IGNOU Foreign Exchange MarketDocument17 pagesIGNOU Foreign Exchange Marketayush KumarNo ratings yet