Professional Documents

Culture Documents

Cotton Marketing News

Cotton Marketing News

Uploaded by

Morgan Ingram0 ratings0% found this document useful (0 votes)

17 views1 page- US cotton production was reduced by 1 million bales from the previous estimate, now standing at 14.95 million bales, over 3 million less than initial projections. Exports for 2020 were also raised 250,000 bales.

- World cotton production decreased from prior estimates due to reductions in the US and Pakistan, while Turkey and Australia saw increases. World cotton use was raised 100,000 bales.

- Strong export sales and shipments numbers, coupled with an overall tighter supply/demand outlook, contributed to cotton prices rising to over 2-year highs. However, economic and trade uncertainties could potentially derail price gains.

Original Description:

DS Cotton Comments

Original Title

Cm n 01152021

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- US cotton production was reduced by 1 million bales from the previous estimate, now standing at 14.95 million bales, over 3 million less than initial projections. Exports for 2020 were also raised 250,000 bales.

- World cotton production decreased from prior estimates due to reductions in the US and Pakistan, while Turkey and Australia saw increases. World cotton use was raised 100,000 bales.

- Strong export sales and shipments numbers, coupled with an overall tighter supply/demand outlook, contributed to cotton prices rising to over 2-year highs. However, economic and trade uncertainties could potentially derail price gains.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

17 views1 pageCotton Marketing News

Cotton Marketing News

Uploaded by

Morgan Ingram- US cotton production was reduced by 1 million bales from the previous estimate, now standing at 14.95 million bales, over 3 million less than initial projections. Exports for 2020 were also raised 250,000 bales.

- World cotton production decreased from prior estimates due to reductions in the US and Pakistan, while Turkey and Australia saw increases. World cotton use was raised 100,000 bales.

- Strong export sales and shipments numbers, coupled with an overall tighter supply/demand outlook, contributed to cotton prices rising to over 2-year highs. However, economic and trade uncertainties could potentially derail price gains.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

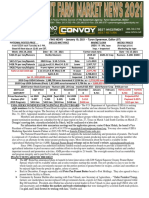

REPRESENTING COTTON GROWERS THROUGHOUT ALABAMA, FLORIDA, GEORGIA, NORTH CAROLINA, SOUTH CAROLINA, AND VIRGINIA

COTTON MARKETING NEWS

Volume 19, No. 2 January 15, 2021

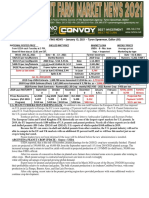

This results in a large draw down in US ending stocks to 4.6

Sponsored by million bales compared to 5.7 last month and 7.25 for last year.

World production down due to US reduction and also a 200,000

bale decrease for Pakistan. No change for China. Turkey and

Australia each increased 100,000 bales from Dec estimate.

Cotton Enjoying One Heck of a Ride-

World Use increased 100,000 bales from the December

But Caution Ahead

estimate. China Use was increased ½ million bales, Turkey

200,000 bales. Use for Vietnam was down 100,000 and

Old crop March futures pushed above 81 cents this week. New

Indonesia down 200,000 bales.

crop December has topped 77 cents. Old crop was down a little

today to close out the week but cotton enjoyed another good

The run-up in price is due mostly to improved optimism in

week due to several positive reports released.

demand. Yes, the smaller US crop has also been a factor. Should

news turn negative, the market has support at 77-78 and lower at

March gained 0.93 cents for the week (down 0.45 today), 2.58

74. The market should continue strong as long as the signals

cents so far for the month, and 9.59 cents since December 3rd.

confirm what has fueled the run-up—a recovery in demand/Use.

Price is now the highest in over 2 years—since September 2018.

Should prices continue to trend up, there will be “resistance” at

This week’s export report (for the previous week ending January

83 cents. There should now be “support” at 77 and again at 74.

7th) was strong and also helped support the market. Net sales for

the week were 372,800 bales and shipments were 293,400 bales.

Sales were more than double the prior week with 44% to China.

Large buyers also included Pakistan, Turkey, Vietnam, and

Bangladesh. Shipments included 56% to China.

As prices have improved, hopefully growers have taken advantage

of the opportunities at multiple levels to achieve a good overall

average price. Looking back, maybe you now regret pricing at 72

or 74 or 78—but no one knows where price is headed and one

marketing approach is to sell as the market improves hoping to do

better (scale up) each time.

Optimism continues to reign but there are economic, political, and

USDA’s supply/demand estimates were released on Tuesday this

trade uncertainties and cautions ahead that could sidetrack prices

week. The market was/is looking for signs of improved

for both remaining old crop and new crop. New crop contract is

demand/Use and an overall tightening supply/demand picture.

at 77 basis December or a Put locks in a floor of mostly 70 to 71

This week’s numbers were encouraging.

basis December depending on the Strike Price. As we move

The 2020 US crop was trimmed another 1 million bales from the

forward, be alert and carefully evaluate alternatives.

December estimate and now stands at 14.95 million bales. This

is over 3 million bales less than the first estimate back in March.

Cotton Economist-Retired

US exports for the 2020 crop year was raised 250,000 bales from

Professor Emeritus of Cotton Economics

the December projection.

To have a large cut in the crop (less available supply) and also to

have an increase in exports at the same time is especially

positive for the overall supply/demand picture.

You might also like

- Innsbruck (Steel Bars Case)Document22 pagesInnsbruck (Steel Bars Case)Weng Santos100% (1)

- Plumbing Mathematics Reference SheetDocument18 pagesPlumbing Mathematics Reference SheetMai Robles100% (1)

- August 2021 Peanut Market ReportDocument5 pagesAugust 2021 Peanut Market ReportAhmedFatehyAbdelsalam100% (1)

- The Sauer ReportDocument29 pagesThe Sauer ReportSampada DeoNo ratings yet

- Project Report For Fly Ash Brick Making MachinesDocument7 pagesProject Report For Fly Ash Brick Making Machinesg26agarwalNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- 2 CMN12142020Document1 page2 CMN12142020Morgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Weekly 10 Oct 22Document4 pagesCotton Weekly 10 Oct 22Vamsi Krishna KonaNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- 2021 01 Monthly Economic LetterDocument14 pages2021 01 Monthly Economic LetterPadmanaban PasuvalingamNo ratings yet

- Cotton Weekly 1 Nov 22Document3 pagesCotton Weekly 1 Nov 22Vamsi Krishna KonaNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Wheat Follow Up Sept 23Document9 pagesWheat Follow Up Sept 23Leonardo IntriagoNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- USGC Market Perspectives ReportDocument14 pagesUSGC Market Perspectives Reportajdcavalcante78No ratings yet

- All Nuts Market Report - May 2023 - FNL3Document10 pagesAll Nuts Market Report - May 2023 - FNL3bonnetNo ratings yet

- Don Shurley: This Analysis and Commentary Is Not Affiliated With The University of GeorgiaDocument1 pageDon Shurley: This Analysis and Commentary Is Not Affiliated With The University of GeorgiaMorgan IngramNo ratings yet

- Market Perspectives: July 16, 2020Document16 pagesMarket Perspectives: July 16, 2020Katya Vasquez QuezadaNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Weekly 8 Nov 22Document3 pagesCotton Weekly 8 Nov 22Vamsi Krishna KonaNo ratings yet

- Usda Mar 30 On GrainsDocument3 pagesUsda Mar 30 On Grainsdennis1606No ratings yet

- Cotton Weekly 13 Sep 22Document5 pagesCotton Weekly 13 Sep 22Vamsi Krishna KonaNo ratings yet

- Don Shurley: This Analysis and Commentary Is Not Affiliated With The University of GeorgiaDocument1 pageDon Shurley: This Analysis and Commentary Is Not Affiliated With The University of GeorgiaMorgan IngramNo ratings yet

- 09 135 20Document1 page09 135 20Morgan IngramNo ratings yet

- Cable Industry: OilseedsDocument2 pagesCable Industry: OilseedsYogesh SalujaNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNo ratings yet

- South America To Dominate SoybeansDocument2 pagesSouth America To Dominate SoybeansSamyakNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- CMN08242020Document1 pageCMN08242020Morgan IngramNo ratings yet

- PEANUT MARKETING NEWS - October 29, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - October 29, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - May 13, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 13, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNo ratings yet

- Commodities: Wheat Scare Unwarranted As Stocks Remain HugeDocument5 pagesCommodities: Wheat Scare Unwarranted As Stocks Remain HugelgfinanceNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Weekly CME 13 7 2020 1594543835Document7 pagesWeekly CME 13 7 2020 1594543835swapnidNo ratings yet

- Weekly Cotton Market Review: Vol. 103 No. 26 February 4, 2022Document9 pagesWeekly Cotton Market Review: Vol. 103 No. 26 February 4, 2022Abbas BananiNo ratings yet

- Situation and Outlook - December 2023 - ReportDocument11 pagesSituation and Outlook - December 2023 - ReportBabak BnNo ratings yet

- US Grain Exports and Trade 20201217Document15 pagesUS Grain Exports and Trade 20201217Naing WinNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Mcopelan@scda SC GovDocument1 pageMcopelan@scda SC GovBrittany EtheridgeNo ratings yet

- 2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingDocument1 page2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton PDFDocument29 pagesCotton PDFSUPER INDUSTRIAL ONLINENo ratings yet

- Arcadia Agri 01032021Document7 pagesArcadia Agri 01032021fredtag4393No ratings yet

- Arcadia Agri 15032021Document7 pagesArcadia Agri 15032021fredtag4393No ratings yet

- Oilseeds Update January 2021Document40 pagesOilseeds Update January 2021Andry HoesniNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets. November 2017From EverandFood Outlook: Biannual Report on Global Food Markets. November 2017No ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Morgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Peanut Marketing News - January 22, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - January 22, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument2 pagesCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Morgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Broiler Hatchery 01-06-21Document2 pagesBroiler Hatchery 01-06-21Morgan IngramNo ratings yet

- PEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Cit 0121Document4 pagesCit 0121Morgan IngramNo ratings yet

- 1,000 Acres Pounds/Acre TonsDocument1 page1,000 Acres Pounds/Acre TonsMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Demand and Suply ResumeDocument15 pagesDemand and Suply ResumeAnifa Mirza LiadianiNo ratings yet

- BOQDocument32 pagesBOQsowmyaNo ratings yet

- Performance of Contract of SaleDocument63 pagesPerformance of Contract of SaleYatharth KohliNo ratings yet

- Small Account Futures - Class SlidesDocument154 pagesSmall Account Futures - Class Slideshotdog10No ratings yet

- First Equation Second EquationDocument10 pagesFirst Equation Second EquationNeoNo ratings yet

- ME2Document2 pagesME2Anonymous oYT7mQt3100% (1)

- (ICB) Latest BusinessDocument6 pages(ICB) Latest BusinessMike TrNo ratings yet

- Chapter 2Document25 pagesChapter 2Rheanna NogalesNo ratings yet

- The Rediscovered Benjamin Graham-Lectures On Security AnalysisDocument66 pagesThe Rediscovered Benjamin Graham-Lectures On Security AnalysiskenatiguiNo ratings yet

- EOQ and In#ation Uncertainty: Ira HorowitzDocument8 pagesEOQ and In#ation Uncertainty: Ira HorowitzLivia MarsaNo ratings yet

- Glossary of Key Terms: International EconomicsDocument21 pagesGlossary of Key Terms: International EconomicsAjay KaundalNo ratings yet

- Brammer Efficient MRO Procurement ManagementDocument6 pagesBrammer Efficient MRO Procurement ManagementFendi Mohamad Zaini100% (1)

- Intake 16 - F101SKL - Min Thein Htein - Myanmar and Oil ProblemDocument14 pagesIntake 16 - F101SKL - Min Thein Htein - Myanmar and Oil ProblemWei Pong LaNo ratings yet

- CH 3Document8 pagesCH 3z_k_j_vNo ratings yet

- DR Ashraf Elsafty E SC 61D Youstina Fouad #FinalDocument14 pagesDR Ashraf Elsafty E SC 61D Youstina Fouad #FinalYoustinaNo ratings yet

- Concept of Anti-Profiteering Measures Under GST RegimeDocument3 pagesConcept of Anti-Profiteering Measures Under GST RegimemuskanNo ratings yet

- Property Sales Analysis in Vanderburgh County J Indiana - A Comprehensive Study of Real Estate Trends in 2013Document8 pagesProperty Sales Analysis in Vanderburgh County J Indiana - A Comprehensive Study of Real Estate Trends in 2013Varalakshmy ChaudhariNo ratings yet

- Kinkead StudentDocument3 pagesKinkead StudentEnder Danaci33% (3)

- Fastmarkets Steel Prices & News Daily 2023-11-30Document16 pagesFastmarkets Steel Prices & News Daily 2023-11-30sarfraz.entpNo ratings yet

- Inven HW6Document2 pagesInven HW6Phan Gia NghiNo ratings yet

- Prepares Feasible and Practical BudgetDocument26 pagesPrepares Feasible and Practical BudgetAbegail HiliraNo ratings yet

- SAP Standard Vs Moving Average PriceDocument2 pagesSAP Standard Vs Moving Average PriceKathiresan NagarajanNo ratings yet

- G.R. NoDocument9 pagesG.R. NoDaniel Danjur DagumanNo ratings yet

- Managerial EconomicsDocument15 pagesManagerial EconomicsSurya PanwarNo ratings yet

- Chapter 19Document31 pagesChapter 19Kad SaadNo ratings yet

- Chapter Ten: Pricing: Understanding and Capturing Customer ValueDocument35 pagesChapter Ten: Pricing: Understanding and Capturing Customer ValueFatima AsprerNo ratings yet

- Ruaha Law Review (RLR) : Vol. 5-6, No. 1 (2017-2018)Document43 pagesRuaha Law Review (RLR) : Vol. 5-6, No. 1 (2017-2018)Jonas S. MsigalaNo ratings yet