Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

18 viewsRupees Salary Income:: Expenditure Claimed Against Property Income

Rupees Salary Income:: Expenditure Claimed Against Property Income

Uploaded by

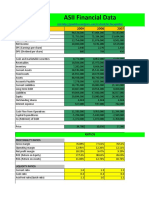

Ali HassanMr. Noor earned Rs. 2,624,000 in 2019 from his salary, provident fund, literary work, property rentals and other sources. He incurred Rs. 15,000 in property taxes and Rs. 9,600 in repairs. His taxable income is Rs. 2,599,400. Based on the tax rates, his income tax liability is Rs. 419,940.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- UConn Athletics Financial StatementDocument83 pagesUConn Athletics Financial StatementHartford CourantNo ratings yet

- 9.2 Assignment - Allowable DeductionsDocument5 pages9.2 Assignment - Allowable Deductionssam imperialNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Document45 pagesSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaNo ratings yet

- Question CAP III AND CA MEMBERHSIP New OneDocument17 pagesQuestion CAP III AND CA MEMBERHSIP New OneSuraj ThapaNo ratings yet

- BCom Business Taxation Income Tax and Sales Tax Numerical 2018Document5 pagesBCom Business Taxation Income Tax and Sales Tax Numerical 2018AHSAN LASHARINo ratings yet

- CTFP Unit 2 PGBP ProblemsDocument6 pagesCTFP Unit 2 PGBP ProblemsKshitishNo ratings yet

- Quiz On Tax On CompensationDocument3 pagesQuiz On Tax On CompensationMaster GTNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Day 8 TaxationDocument2 pagesDay 8 TaxationKhan Shadab -27No ratings yet

- Practical Questions With HintsDocument4 pagesPractical Questions With HintsMff DeadsparkNo ratings yet

- Income From BusinessDocument8 pagesIncome From BusinessSuyash PrakashNo ratings yet

- Income Tax - Individuals With SolutionsDocument5 pagesIncome Tax - Individuals With SolutionsRandom VidsNo ratings yet

- Taxation On Partnership FirmDocument11 pagesTaxation On Partnership FirmnarendraNo ratings yet

- Presentation of TaxationDocument10 pagesPresentation of TaxationMaaz SiddiquiNo ratings yet

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseDocument9 pagesBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- PGBPDocument3 pagesPGBPJimmy ShergillNo ratings yet

- SFS U.G. B.com. Income TaxDocument3 pagesSFS U.G. B.com. Income TaxAbinash VeeraragavanNo ratings yet

- Assignment-2 - Mid Term Paxi Ko AssignmentDocument5 pagesAssignment-2 - Mid Term Paxi Ko Assignmenty.yubaraj001No ratings yet

- Tutorial 10-2021-PIT2 ProblemsDocument8 pagesTutorial 10-2021-PIT2 ProblemsHien Bach Thi Tra QTKD-3KT-18No ratings yet

- PartnershipDocument13 pagesPartnershipAdrian RamsundarNo ratings yet

- Presented by Archana Gupta 0221031 Bharat Gaikwad 0221023Document12 pagesPresented by Archana Gupta 0221031 Bharat Gaikwad 0221023Bharat GaikwadNo ratings yet

- Required: Compute The Taxable Rental Income and Tax Liability AssumeDocument2 pagesRequired: Compute The Taxable Rental Income and Tax Liability AssumeTilahun GirmaNo ratings yet

- Salary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Document5 pagesSalary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Samia AkterNo ratings yet

- Taxation Attempt All Questions (10 10 100)Document6 pagesTaxation Attempt All Questions (10 10 100)Mff DeadsparkNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- Corporation Income Tax ProblemsDocument3 pagesCorporation Income Tax ProblemsRandy Manzano50% (2)

- Chapter 2 Capsule SessionDocument40 pagesChapter 2 Capsule SessionKshitishNo ratings yet

- Question On Income From Business and Profession 2Document9 pagesQuestion On Income From Business and Profession 2Ayush BholeNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDocument5 pagesTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNo ratings yet

- Examples Salary 2019Document18 pagesExamples Salary 2019Asma ZeeshanNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Drill On Gross Income Suggested AnswersDocument5 pagesDrill On Gross Income Suggested AnswersAngel HiaviaNo ratings yet

- Tax On PartnershipDocument3 pagesTax On PartnershipPrankyJellyNo ratings yet

- IT AssignmentDocument7 pagesIT AssignmentNipun AroraNo ratings yet

- Taxation of PartnershipDocument4 pagesTaxation of PartnershipkirigofortunateNo ratings yet

- ABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationDocument10 pagesABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationHuilunNgoNo ratings yet

- Income Taxation - Regular Income Tax 2Document5 pagesIncome Taxation - Regular Income Tax 2Drew BanlutaNo ratings yet

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocument4 pagesCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNo ratings yet

- TX 201Document4 pagesTX 201Pau SantosNo ratings yet

- Tax DeductionsDocument4 pagesTax DeductionsAnonymous LC5kFdtcNo ratings yet

- Assessment of CompaniesDocument5 pagesAssessment of Companiesmohanraokp22790% (1)

- Account Titles Debit Credit Cash 131,000 Utilities Expenses 39,000 Accounts Receivable 70,000 Advertising Expense 10,000Document13 pagesAccount Titles Debit Credit Cash 131,000 Utilities Expenses 39,000 Accounts Receivable 70,000 Advertising Expense 10,000angelo eleazarNo ratings yet

- AnswerDocument53 pagesAnswerM ShNo ratings yet

- IPCC Gr.I Paper 4 TaxationDocument10 pagesIPCC Gr.I Paper 4 TaxationAyushi RajputNo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentAM NerdyNo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- 37524E240 Reg. NoDocument7 pages37524E240 Reg. Noshejal naikNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Review MaterialsDocument3 pagesReview MaterialsAngie S. Rosales100% (1)

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- AC405 Dec 2019Document8 pagesAC405 Dec 2019hilton magagadaNo ratings yet

- Rutendo KamukonoDocument3 pagesRutendo KamukonoHazel ChatsNo ratings yet

- Total IncomeDocument4 pagesTotal IncomeSiddharth VaswaniNo ratings yet

- PartnershipDocument10 pagesPartnershipdora76pataNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Basic C StructureDocument8 pagesThe Basic C StructureXian ShengNo ratings yet

- How Business and Government Interact: Government Cooperates With Business For Mutually Beneficial GoalsDocument11 pagesHow Business and Government Interact: Government Cooperates With Business For Mutually Beneficial GoalsGururaj AvNo ratings yet

- Nimzo-Indian Defence - WikipediaDocument9 pagesNimzo-Indian Defence - WikipediaMadhu KaushikaNo ratings yet

- 1) SSP 005 - Odyssey Plan - SASDocument6 pages1) SSP 005 - Odyssey Plan - SASmike espinaNo ratings yet

- Roots Run DeepDocument1 pageRoots Run DeepDMV2DMZNo ratings yet

- Group 2 MM Project ReportDocument31 pagesGroup 2 MM Project ReportAnkush AgarwalNo ratings yet

- South Dakota University ProjectsDocument61 pagesSouth Dakota University ProjectsShellyNo ratings yet

- SL Biology Syllabus NotesDocument52 pagesSL Biology Syllabus NotesRyel MuchunkuNo ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Yulianita AdrimaNo ratings yet

- Food and Nutrition ProgrammesDocument56 pagesFood and Nutrition ProgrammesDipesh UpadhyayNo ratings yet

- CV of Hasibul HasanDocument2 pagesCV of Hasibul HasanHasibul Hasan JewelNo ratings yet

- James Cameron - Original Screenplay For AvatarDocument152 pagesJames Cameron - Original Screenplay For AvatarAngelSuicide67% (3)

- Henry Schein Orthodontics Catalog - General SuppliesDocument8 pagesHenry Schein Orthodontics Catalog - General SuppliesOrtho OrganizersNo ratings yet

- GratitudeDocument13 pagesGratitudeAditi Singh BhatiNo ratings yet

- Session 2 Sensors - TransducerDocument106 pagesSession 2 Sensors - TransducerJenny JadhavNo ratings yet

- Answer SheetDocument4 pagesAnswer Sheetmae santosNo ratings yet

- Budget NotesDocument17 pagesBudget NotesHeer SirwaniNo ratings yet

- 1st Rhyming GameDocument6 pages1st Rhyming GameCikgu Pejo50% (2)

- Nokia Lumia 1520 UG en GBDocument127 pagesNokia Lumia 1520 UG en GBhola vpnNo ratings yet

- Module 3Document37 pagesModule 3Melanie De Felipe SilveroNo ratings yet

- Compilation of Cases in Human Rights LawDocument12 pagesCompilation of Cases in Human Rights LawGracia SullanoNo ratings yet

- Final Proposal PDFDocument27 pagesFinal Proposal PDFRose Anne LlaveNo ratings yet

- Scoala: Avizat Director, Profesor: Clasa: Manual:: Gimnaziala Nr.2, MilcovatuDocument4 pagesScoala: Avizat Director, Profesor: Clasa: Manual:: Gimnaziala Nr.2, MilcovatuGianina EneNo ratings yet

- Classified 2015 03 29 000000Document9 pagesClassified 2015 03 29 000000sasikalaNo ratings yet

- Bidding Document For Construction of Indoor Stadium at Zuangtui, Aizawl Volume-IiDocument104 pagesBidding Document For Construction of Indoor Stadium at Zuangtui, Aizawl Volume-Iisonmezender9100% (1)

- SRP As of TFA Minimart Estancia SupermartDocument18 pagesSRP As of TFA Minimart Estancia SupermartJulius Espiga ElmedorialNo ratings yet

- Inner Beauty Doesn't Really ExistDocument1 pageInner Beauty Doesn't Really ExistMistermickeyNo ratings yet

- Quarter 2-Module 4: MathematicsDocument15 pagesQuarter 2-Module 4: MathematicsAdrian James S Angeles33% (3)

- 01.04 - Director-Lmb vs. CA (324 Scra 757)Document10 pages01.04 - Director-Lmb vs. CA (324 Scra 757)JMarc100% (1)

Rupees Salary Income:: Expenditure Claimed Against Property Income

Rupees Salary Income:: Expenditure Claimed Against Property Income

Uploaded by

Ali Hassan0 ratings0% found this document useful (0 votes)

18 views1 pageMr. Noor earned Rs. 2,624,000 in 2019 from his salary, provident fund, literary work, property rentals and other sources. He incurred Rs. 15,000 in property taxes and Rs. 9,600 in repairs. His taxable income is Rs. 2,599,400. Based on the tax rates, his income tax liability is Rs. 419,940.

Original Description:

Cash Budgeting

Original Title

Case Finance

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMr. Noor earned Rs. 2,624,000 in 2019 from his salary, provident fund, literary work, property rentals and other sources. He incurred Rs. 15,000 in property taxes and Rs. 9,600 in repairs. His taxable income is Rs. 2,599,400. Based on the tax rates, his income tax liability is Rs. 419,940.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views1 pageRupees Salary Income:: Expenditure Claimed Against Property Income

Rupees Salary Income:: Expenditure Claimed Against Property Income

Uploaded by

Ali HassanMr. Noor earned Rs. 2,624,000 in 2019 from his salary, provident fund, literary work, property rentals and other sources. He incurred Rs. 15,000 in property taxes and Rs. 9,600 in repairs. His taxable income is Rs. 2,599,400. Based on the tax rates, his income tax liability is Rs. 419,940.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Mr. Noor has been working as a Senior Manager in Karachi Terminal Limited.

Assume that he has

provided following information about his income pertaining to the year ended June 30, 2019:

Rupees

Salary Income:

Basic salary 840,000

Bonus 100,000

Dearness allowance 84,000

House rent allowance 420,000

Medical allowance (actual expenses Rs.30,000) 80,000

Contribution by Mr. Noor towards recognized provident fund

(including equal contribution by the company) 168,000

Interest credited during the year (provident fund) 300,000

Other Income

Remuneration for literary work (Mr. Noor is a non-professional writer) 120,000

Profit on profit and loss sharing bank account 9,000

Capital loss on sale of shares of public listed company 35,000

Rent from house let out 192,000

Expenditure claimed against property income:

Property tax 15,000

Repair & maintenance 5% of rent

Other Information:

Zakat paid 10,000

Required: Being a tax consultant, you are required to calculate Mr. Noor’s taxable income and his

income tax liability for the tax year 2019.

TAXABLE INCOME RATE OF TAX

0 to Rs.400,000 0%

Rs.400,000 to Rs.750,000 5% of the amount exceeding Rs.400,000

Rs.750,000 to Rs.1,500,000 Rs.17,500 plus 10% of the amount exceeding Rs.750,000

Rs.1,500,000 to Rs.2,000,000 Rs.95,000 plus 15% of the amount exceeding Rs.1,500,000

Rs.2,000,000 to Rs.2,500,000 Rs.175,000 plus 17.5% of the amount exceeding Rs.2,000,000

Income exceeds Rs.2,500,000 Rs.420,000 plus 20% of the amount exceeding Rs.2,500,000

You might also like

- UConn Athletics Financial StatementDocument83 pagesUConn Athletics Financial StatementHartford CourantNo ratings yet

- 9.2 Assignment - Allowable DeductionsDocument5 pages9.2 Assignment - Allowable Deductionssam imperialNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Document45 pagesSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaNo ratings yet

- Question CAP III AND CA MEMBERHSIP New OneDocument17 pagesQuestion CAP III AND CA MEMBERHSIP New OneSuraj ThapaNo ratings yet

- BCom Business Taxation Income Tax and Sales Tax Numerical 2018Document5 pagesBCom Business Taxation Income Tax and Sales Tax Numerical 2018AHSAN LASHARINo ratings yet

- CTFP Unit 2 PGBP ProblemsDocument6 pagesCTFP Unit 2 PGBP ProblemsKshitishNo ratings yet

- Quiz On Tax On CompensationDocument3 pagesQuiz On Tax On CompensationMaster GTNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Day 8 TaxationDocument2 pagesDay 8 TaxationKhan Shadab -27No ratings yet

- Practical Questions With HintsDocument4 pagesPractical Questions With HintsMff DeadsparkNo ratings yet

- Income From BusinessDocument8 pagesIncome From BusinessSuyash PrakashNo ratings yet

- Income Tax - Individuals With SolutionsDocument5 pagesIncome Tax - Individuals With SolutionsRandom VidsNo ratings yet

- Taxation On Partnership FirmDocument11 pagesTaxation On Partnership FirmnarendraNo ratings yet

- Presentation of TaxationDocument10 pagesPresentation of TaxationMaaz SiddiquiNo ratings yet

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseDocument9 pagesBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- PGBPDocument3 pagesPGBPJimmy ShergillNo ratings yet

- SFS U.G. B.com. Income TaxDocument3 pagesSFS U.G. B.com. Income TaxAbinash VeeraragavanNo ratings yet

- Assignment-2 - Mid Term Paxi Ko AssignmentDocument5 pagesAssignment-2 - Mid Term Paxi Ko Assignmenty.yubaraj001No ratings yet

- Tutorial 10-2021-PIT2 ProblemsDocument8 pagesTutorial 10-2021-PIT2 ProblemsHien Bach Thi Tra QTKD-3KT-18No ratings yet

- PartnershipDocument13 pagesPartnershipAdrian RamsundarNo ratings yet

- Presented by Archana Gupta 0221031 Bharat Gaikwad 0221023Document12 pagesPresented by Archana Gupta 0221031 Bharat Gaikwad 0221023Bharat GaikwadNo ratings yet

- Required: Compute The Taxable Rental Income and Tax Liability AssumeDocument2 pagesRequired: Compute The Taxable Rental Income and Tax Liability AssumeTilahun GirmaNo ratings yet

- Salary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Document5 pagesSalary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Samia AkterNo ratings yet

- Taxation Attempt All Questions (10 10 100)Document6 pagesTaxation Attempt All Questions (10 10 100)Mff DeadsparkNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- Corporation Income Tax ProblemsDocument3 pagesCorporation Income Tax ProblemsRandy Manzano50% (2)

- Chapter 2 Capsule SessionDocument40 pagesChapter 2 Capsule SessionKshitishNo ratings yet

- Question On Income From Business and Profession 2Document9 pagesQuestion On Income From Business and Profession 2Ayush BholeNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDocument5 pagesTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNo ratings yet

- Examples Salary 2019Document18 pagesExamples Salary 2019Asma ZeeshanNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Drill On Gross Income Suggested AnswersDocument5 pagesDrill On Gross Income Suggested AnswersAngel HiaviaNo ratings yet

- Tax On PartnershipDocument3 pagesTax On PartnershipPrankyJellyNo ratings yet

- IT AssignmentDocument7 pagesIT AssignmentNipun AroraNo ratings yet

- Taxation of PartnershipDocument4 pagesTaxation of PartnershipkirigofortunateNo ratings yet

- ABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationDocument10 pagesABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationHuilunNgoNo ratings yet

- Income Taxation - Regular Income Tax 2Document5 pagesIncome Taxation - Regular Income Tax 2Drew BanlutaNo ratings yet

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocument4 pagesCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNo ratings yet

- TX 201Document4 pagesTX 201Pau SantosNo ratings yet

- Tax DeductionsDocument4 pagesTax DeductionsAnonymous LC5kFdtcNo ratings yet

- Assessment of CompaniesDocument5 pagesAssessment of Companiesmohanraokp22790% (1)

- Account Titles Debit Credit Cash 131,000 Utilities Expenses 39,000 Accounts Receivable 70,000 Advertising Expense 10,000Document13 pagesAccount Titles Debit Credit Cash 131,000 Utilities Expenses 39,000 Accounts Receivable 70,000 Advertising Expense 10,000angelo eleazarNo ratings yet

- AnswerDocument53 pagesAnswerM ShNo ratings yet

- IPCC Gr.I Paper 4 TaxationDocument10 pagesIPCC Gr.I Paper 4 TaxationAyushi RajputNo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentAM NerdyNo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- 37524E240 Reg. NoDocument7 pages37524E240 Reg. Noshejal naikNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Review MaterialsDocument3 pagesReview MaterialsAngie S. Rosales100% (1)

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- AC405 Dec 2019Document8 pagesAC405 Dec 2019hilton magagadaNo ratings yet

- Rutendo KamukonoDocument3 pagesRutendo KamukonoHazel ChatsNo ratings yet

- Total IncomeDocument4 pagesTotal IncomeSiddharth VaswaniNo ratings yet

- PartnershipDocument10 pagesPartnershipdora76pataNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Basic C StructureDocument8 pagesThe Basic C StructureXian ShengNo ratings yet

- How Business and Government Interact: Government Cooperates With Business For Mutually Beneficial GoalsDocument11 pagesHow Business and Government Interact: Government Cooperates With Business For Mutually Beneficial GoalsGururaj AvNo ratings yet

- Nimzo-Indian Defence - WikipediaDocument9 pagesNimzo-Indian Defence - WikipediaMadhu KaushikaNo ratings yet

- 1) SSP 005 - Odyssey Plan - SASDocument6 pages1) SSP 005 - Odyssey Plan - SASmike espinaNo ratings yet

- Roots Run DeepDocument1 pageRoots Run DeepDMV2DMZNo ratings yet

- Group 2 MM Project ReportDocument31 pagesGroup 2 MM Project ReportAnkush AgarwalNo ratings yet

- South Dakota University ProjectsDocument61 pagesSouth Dakota University ProjectsShellyNo ratings yet

- SL Biology Syllabus NotesDocument52 pagesSL Biology Syllabus NotesRyel MuchunkuNo ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Yulianita AdrimaNo ratings yet

- Food and Nutrition ProgrammesDocument56 pagesFood and Nutrition ProgrammesDipesh UpadhyayNo ratings yet

- CV of Hasibul HasanDocument2 pagesCV of Hasibul HasanHasibul Hasan JewelNo ratings yet

- James Cameron - Original Screenplay For AvatarDocument152 pagesJames Cameron - Original Screenplay For AvatarAngelSuicide67% (3)

- Henry Schein Orthodontics Catalog - General SuppliesDocument8 pagesHenry Schein Orthodontics Catalog - General SuppliesOrtho OrganizersNo ratings yet

- GratitudeDocument13 pagesGratitudeAditi Singh BhatiNo ratings yet

- Session 2 Sensors - TransducerDocument106 pagesSession 2 Sensors - TransducerJenny JadhavNo ratings yet

- Answer SheetDocument4 pagesAnswer Sheetmae santosNo ratings yet

- Budget NotesDocument17 pagesBudget NotesHeer SirwaniNo ratings yet

- 1st Rhyming GameDocument6 pages1st Rhyming GameCikgu Pejo50% (2)

- Nokia Lumia 1520 UG en GBDocument127 pagesNokia Lumia 1520 UG en GBhola vpnNo ratings yet

- Module 3Document37 pagesModule 3Melanie De Felipe SilveroNo ratings yet

- Compilation of Cases in Human Rights LawDocument12 pagesCompilation of Cases in Human Rights LawGracia SullanoNo ratings yet

- Final Proposal PDFDocument27 pagesFinal Proposal PDFRose Anne LlaveNo ratings yet

- Scoala: Avizat Director, Profesor: Clasa: Manual:: Gimnaziala Nr.2, MilcovatuDocument4 pagesScoala: Avizat Director, Profesor: Clasa: Manual:: Gimnaziala Nr.2, MilcovatuGianina EneNo ratings yet

- Classified 2015 03 29 000000Document9 pagesClassified 2015 03 29 000000sasikalaNo ratings yet

- Bidding Document For Construction of Indoor Stadium at Zuangtui, Aizawl Volume-IiDocument104 pagesBidding Document For Construction of Indoor Stadium at Zuangtui, Aizawl Volume-Iisonmezender9100% (1)

- SRP As of TFA Minimart Estancia SupermartDocument18 pagesSRP As of TFA Minimart Estancia SupermartJulius Espiga ElmedorialNo ratings yet

- Inner Beauty Doesn't Really ExistDocument1 pageInner Beauty Doesn't Really ExistMistermickeyNo ratings yet

- Quarter 2-Module 4: MathematicsDocument15 pagesQuarter 2-Module 4: MathematicsAdrian James S Angeles33% (3)

- 01.04 - Director-Lmb vs. CA (324 Scra 757)Document10 pages01.04 - Director-Lmb vs. CA (324 Scra 757)JMarc100% (1)