Professional Documents

Culture Documents

Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15

Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15

Uploaded by

Raman ChawlaCopyright:

Available Formats

You might also like

- The Warren Buffett Spreadsheet Final-Version - PreviewDocument335 pagesThe Warren Buffett Spreadsheet Final-Version - PreviewHari ganesh RNo ratings yet

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Fixed IncomeDocument112 pagesFixed IncomeNGOC NHINo ratings yet

- Busi 331 Project 1 Marking Guide: HandbookDocument28 pagesBusi 331 Project 1 Marking Guide: HandbookDilrajSinghNo ratings yet

- Giant AssignmentDocument7 pagesGiant AssignmentSenthil KumarNo ratings yet

- Joliffe MetalsDocument2 pagesJoliffe MetalsShayan AminNo ratings yet

- Overview If Railway AccountsDocument40 pagesOverview If Railway AccountsKannan ChakrapaniNo ratings yet

- Discuss Whether Rising Real GDP Per Person Was Sufficient To Ensure That Every Citizen of The UK Was Better Off in 2013 Than 1971Document2 pagesDiscuss Whether Rising Real GDP Per Person Was Sufficient To Ensure That Every Citizen of The UK Was Better Off in 2013 Than 1971Shreya KochharNo ratings yet

- 23 Risk Management and Hedging Strategies PDFDocument24 pages23 Risk Management and Hedging Strategies PDFemmadavisons100% (1)

- HW3Document14 pagesHW3Cheram Delapeña BoholNo ratings yet

- Module 3 Chapter 15 DCF ModelDocument2 pagesModule 3 Chapter 15 DCF ModelMaulik JainNo ratings yet

- Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15Document9 pagesFree Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15MBA grievanceNo ratings yet

- Free Cash Flow Estimate (In INR CRS)Document2 pagesFree Cash Flow Estimate (In INR CRS)Kapil KhannaNo ratings yet

- Module 3 Chapter 15 DCF ModelDocument5 pagesModule 3 Chapter 15 DCF ModelAvinash GanesanNo ratings yet

- Free Cash Flow Estimate (In INR CRS)Document2 pagesFree Cash Flow Estimate (In INR CRS)SaiVamsiNo ratings yet

- UntitledDocument8 pagesUntitledPravin AmirthNo ratings yet

- DCF TATA PowerDocument2 pagesDCF TATA PowerAman MankotiaNo ratings yet

- CiplaDocument9 pagesCiplaShivam GoelNo ratings yet

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNo ratings yet

- The Warren Buffett Spreadsheet - PreviewDocument350 pagesThe Warren Buffett Spreadsheet - PreviewbysqqqdxNo ratings yet

- TATA CONSULTANCY SERVICES ValautionDocument3 pagesTATA CONSULTANCY SERVICES ValautionRohit Kumar 4170No ratings yet

- Chapter09 SMDocument17 pagesChapter09 SMkert1234No ratings yet

- Evaluating The Firm'S Dividend PolicyDocument11 pagesEvaluating The Firm'S Dividend PolicyYash Aggarwal BD20073No ratings yet

- Quantamental Research - ITC LTDDocument1 pageQuantamental Research - ITC LTDsadaf hashmiNo ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- Valuation of Tata SteelDocument3 pagesValuation of Tata SteelNishtha Mehra100% (1)

- Kotak Mahindra Bank Limited Consolidated Financials FY18Document60 pagesKotak Mahindra Bank Limited Consolidated Financials FY18Kunal ObhraiNo ratings yet

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocument5 pagesIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNo ratings yet

- Date of Analysis 8/29/2020: Dicount Rate 10y Fed Note %Document61 pagesDate of Analysis 8/29/2020: Dicount Rate 10y Fed Note %bysqqqdxNo ratings yet

- Criterion Weight Word In-House Press Financial Third PartyDocument9 pagesCriterion Weight Word In-House Press Financial Third PartyArdia salsabilaNo ratings yet

- Shareholder Value Creation-2Document5 pagesShareholder Value Creation-2tanadof294No ratings yet

- Gail (India)Document93 pagesGail (India)Ashley KamalasanNo ratings yet

- Income Value para Real EstateDocument13 pagesIncome Value para Real EstateJuan G ScharffenorthNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsSudhanshu Kumar SinghNo ratings yet

- FCFE CalculationDocument23 pagesFCFE CalculationIqbal YusufNo ratings yet

- PayTM FinancialsDocument43 pagesPayTM FinancialststNo ratings yet

- ADVANCED CORPORATE FINANCE 3rd TermDocument11 pagesADVANCED CORPORATE FINANCE 3rd TermdixitBhavak DixitNo ratings yet

- Description Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 AED (Million)Document3 pagesDescription Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 AED (Million)AamirNo ratings yet

- Student May Add To The List of AssumptionsDocument10 pagesStudent May Add To The List of AssumptionsAbhilash NNo ratings yet

- Cms Info Systems Limited: All You Need To Know AboutDocument8 pagesCms Info Systems Limited: All You Need To Know AboutPanktiNo ratings yet

- Onsite Day Care ValuationDocument2 pagesOnsite Day Care Valuationjindalmanoj06No ratings yet

- MCB LTD Conso Annual Report - 1 - tcm55-52880-86Document1 pageMCB LTD Conso Annual Report - 1 - tcm55-52880-86Dani ShaNo ratings yet

- Real Estate Portfolio Valuation Model v3.4Document11 pagesReal Estate Portfolio Valuation Model v3.4daniellehynes69No ratings yet

- TV18 BroadcastDocument30 pagesTV18 Broadcastrishabh jainNo ratings yet

- Ankush Gupta Financial Management and Valuation MBA DBF DEC 2020 Excel FileDocument8 pagesAnkush Gupta Financial Management and Valuation MBA DBF DEC 2020 Excel FileAnkush GuptaNo ratings yet

- Qatar National Bank April 2011Document6 pagesQatar National Bank April 2011Michael KiddNo ratings yet

- Assignment #2 Investment & Portfolio Management Group 3 (GEN) (G1)Document3 pagesAssignment #2 Investment & Portfolio Management Group 3 (GEN) (G1)ramyNo ratings yet

- Commercial Real Estate Valuation ModelDocument6 pagesCommercial Real Estate Valuation Modelkaran yadavNo ratings yet

- Prataap Snacks Limited: DCF Analysis Valuation Date: 07 March, 2019Document41 pagesPrataap Snacks Limited: DCF Analysis Valuation Date: 07 March, 2019CharanjitNo ratings yet

- Maruti Suzuki Q4FY18 and FY18 - Investor PresentationDocument18 pagesMaruti Suzuki Q4FY18 and FY18 - Investor PresentationdarkyNo ratings yet

- K10 SFMDocument6 pagesK10 SFMSrijan AgarwalNo ratings yet

- Brand CoDocument7 pagesBrand CoCamila VillamilNo ratings yet

- Cash Flow Statement Data 2018 2019 2020Document10 pagesCash Flow Statement Data 2018 2019 2020ficiveNo ratings yet

- DCF ModelDocument6 pagesDCF ModelKatherine ChouNo ratings yet

- FMO M5 Soln.sDocument16 pagesFMO M5 Soln.sVishwas ParakkaNo ratings yet

- Spread SheetDocument2 pagesSpread SheetDwi PermanaNo ratings yet

- Cash Flow Statement Data 2015 2016 2017Document9 pagesCash Flow Statement Data 2015 2016 2017milzamamelNo ratings yet

- DownloadDocument22 pagesDownloadAshwani KesharwaniNo ratings yet

- VALUING SYNERGIES IN M&A-Data Revised Jan 2020Document7 pagesVALUING SYNERGIES IN M&A-Data Revised Jan 2020Aninda Dutta100% (1)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- The Art of Commitment Pacing: Engineering Allocations to Private CapitalFrom EverandThe Art of Commitment Pacing: Engineering Allocations to Private CapitalNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Microsoft Tsi Opera PhiladelphiaDocument3 pagesMicrosoft Tsi Opera PhiladelphiaRaman ChawlaNo ratings yet

- Strike Call OI Put OI Cumulative Call Cumulative Put Total ValueDocument4 pagesStrike Call OI Put OI Cumulative Call Cumulative Put Total ValueRaman ChawlaNo ratings yet

- Mock 6 QDocument48 pagesMock 6 QRaman ChawlaNo ratings yet

- Mock 4 QDocument46 pagesMock 4 QRaman ChawlaNo ratings yet

- Mock 5 QDocument47 pagesMock 5 QRaman ChawlaNo ratings yet

- Space2.0 Final 24feb PDFDocument406 pagesSpace2.0 Final 24feb PDFRaman ChawlaNo ratings yet

- Mock 19 QDocument47 pagesMock 19 QRaman ChawlaNo ratings yet

- Knappily Slide On Indian EconomyDocument28 pagesKnappily Slide On Indian EconomyRaman ChawlaNo ratings yet

- Mock 2 QDocument53 pagesMock 2 QRaman ChawlaNo ratings yet

- Branches of Social SciencesDocument16 pagesBranches of Social SciencesRaman Chawla100% (1)

- ScienceDocument12 pagesScienceRaman ChawlaNo ratings yet

- AV 315 Control System: Raman Chawla SC12B042Document37 pagesAV 315 Control System: Raman Chawla SC12B042Raman ChawlaNo ratings yet

- Fluid Mechanics EquationsDocument8 pagesFluid Mechanics EquationsRaman ChawlaNo ratings yet

- TWP Phase Heat TransferDocument6 pagesTWP Phase Heat TransferRaman ChawlaNo ratings yet

- Advanced Microeconomics I SyllabusFall2016Sep1SRDocument25 pagesAdvanced Microeconomics I SyllabusFall2016Sep1SRgeekorbit67% (3)

- UntitledDocument197 pagesUntitledapi-161028199No ratings yet

- Rostow Modernization Theory Final 1Document11 pagesRostow Modernization Theory Final 1Jade Harris ColorjeNo ratings yet

- MFIN6214 Lecture1 2020T3Document29 pagesMFIN6214 Lecture1 2020T3ulricaNo ratings yet

- Economics of The Welfare StateDocument6 pagesEconomics of The Welfare StateIgnacio PHNo ratings yet

- CHAPTER 8 - An Introduction To Asset Pricing ModelsDocument36 pagesCHAPTER 8 - An Introduction To Asset Pricing ModelsArah Ibrahim-MacakilingNo ratings yet

- Equity Research Report SlidesDocument18 pagesEquity Research Report Slidesanton88beNo ratings yet

- Solved SMU Assignment / ProjectDocument3 pagesSolved SMU Assignment / ProjectArvind KNo ratings yet

- Rector Decree and Provision UGMDocument7 pagesRector Decree and Provision UGMT dmrNo ratings yet

- Supply in SportsDocument33 pagesSupply in SportsVladimir MilkhailovNo ratings yet

- Free Cash Flow To Firm DCF Valuation Model Base DataDocument3 pagesFree Cash Flow To Firm DCF Valuation Model Base DataTran Anh Van100% (1)

- Edwin Mansfield - Microeconomics - Selected Readings-W. W. Norton & Company (1971)Document548 pagesEdwin Mansfield - Microeconomics - Selected Readings-W. W. Norton & Company (1971)felipemanuelcamposoficialNo ratings yet

- Zook On The CoreDocument9 pagesZook On The CoreThu NguyenNo ratings yet

- Business Environment Analysis - PDFDocument19 pagesBusiness Environment Analysis - PDFDikshita MahadikNo ratings yet

- Varian9e LecturePPTs Ch08Document44 pagesVarian9e LecturePPTs Ch08Priyadarshi Kirti GouravNo ratings yet

- CH 6 Production Theory Ing-IndoDocument63 pagesCH 6 Production Theory Ing-IndoNovhendraNo ratings yet

- Economic Cycles and Maritime ShippingDocument29 pagesEconomic Cycles and Maritime Shippinganna annaNo ratings yet

- Consumer Behavior: Chapter OutlineDocument34 pagesConsumer Behavior: Chapter Outlineabhinanda_22No ratings yet

- CSEC Economics June 2008 P32Document5 pagesCSEC Economics June 2008 P32Sachin BahadoorsinghNo ratings yet

- The Inside Job Post Viewing Questions - COMPLETEDocument9 pagesThe Inside Job Post Viewing Questions - COMPLETEDavid KaranuNo ratings yet

- A License To Print MoneyDocument3 pagesA License To Print MoneySamuel RinesNo ratings yet

- Material EsbmDocument26 pagesMaterial Esbmmohammad ferozNo ratings yet

- Unit 7 Interactive NotebookDocument18 pagesUnit 7 Interactive NotebookSankalp YeletiNo ratings yet

- Project FinalDocument36 pagesProject Finaljohn mwambuNo ratings yet

Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15

Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15

Uploaded by

Raman ChawlaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15

Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15

Uploaded by

Raman ChawlaCopyright:

Available Formats

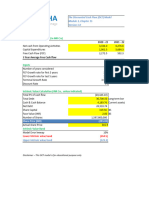

The Discounted Cash Flow (DCF) Model

Module 3, Chapter 15

Version 1.0

Free Cash Flow Estimate (In INR Crs)

2011 - 12 2012 - 13 2013 - 14

Net cash from Operating Activities 367.0 472.0 394.0

Capital Expenditures 156.0 108.0 189.5

Free Cash Flow (FCF) 211.0 364.0 204.5

3 Year Average Free Cash flow 259.8

Inputs Cash flow & Present Value Table

Number of years considered 10 Sl No

FCF Growth rate for first 5 years 18% 1

FCF Growth rate for last 5 years 15% 2

Terminal Growth Rate 3.50% 3

Discount Rate 10% 4

5

Intrinsic Value Calculation (INR Crs, unless indicated) 6

Total PV of cash flow 11,064.55 7

Total Debt 46.00 8

Cash & Cash Balance 177.00 9

Net Debt (131.00) 10

Share Capital 51.00

Face Value (INR) 1.00 Terminal Year

Number of Shares 510,000,000 Terminal Value

Share Price (INR) 219.52 PV of Terminal Value

Intrinsic Value Band

Model Error leeway 10%

Lower Intrinsic value band 197.6

Upper Intrinsic value band 241.5

Disclaimer – This DCF model is for educational purpose only.

ash flow & Present Value Table

Year Cash flow f Cash flow

2014 - 15 306.60 278.73

2015 - 16 361.79 299.00

2016 - 17 426.91 320.75

2017 - 18 503.76 344.07

2018 - 19 594.44 369.10

2019 - 20 683.60 385.87

2020 - 21 786.14 403.41

2021 - 22 904.06 421.75

2022 - 23 1,039.67 440.92

2023 - 24 1,195.62 460.96

erminal Year 2023 - 24

erminal Value 19,037.99

V of Terminal Value 7,339.97

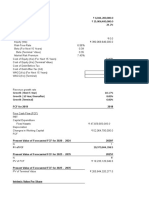

The Discounted Cash Flow (DCF) Model

Module 3, Chapter 15

Version 1.0

Free Cash Flow Estimate (In INR Crs)

2017-18 2018-19 2019-20

Net cash from Operating Activities 794.0 796.0 845.0

Capital Expenditures 133.0 273.0 262.0

Free Cash Flow (FCF) 661.0 523.0 583.0

3 Year Average Free Cash flow 589.0

Inputs Cash flow & Present Value Table

Number of years considered 10 Sl No

FCF Growth rate for first 5 years 18% 1

FCF Growth rate for last 5 years 18% 2

Terminal Growth Rate 3.50% 3

Discount Rate 10% 4

5

Intrinsic Value Calculation (INR Crs, unless indicated) 6

Total PV of cash flow 27,767.99 7

Total Debt 113.00 8

Cash & Cash Balance 190.00 9

Net Debt (77.00) 10

Share Capital 51.00

Face Value (INR) 1.00 Terminal Year

Number of Shares 510,000,000 Terminal Value

Share Price (INR) 545.98 PV of Terminal Value

Intrinsic Value Band

Model Error leeway 10%

Lower Intrinsic value band 491.4

Upper Intrinsic value band 600.6

ash flow & Present Value Table

Year Cash flow f Cash flow

2014 - 15 695.02 631.84

2015 - 16 820.12 677.79

2016 - 17 967.75 727.08

2017 - 18 1,141.94 779.96

2018 - 19 1,347.49 836.68

2019 - 20 1,590.04 897.53

2020 - 21 1,876.24 962.81

2021 - 22 2,213.97 1,032.83

2022 - 23 2,612.48 1,107.95

2023 - 24 3,082.73 1,188.53

erminal Year 2023 - 24

erminal Value 49,086.53

V of Terminal Value 18,924.98

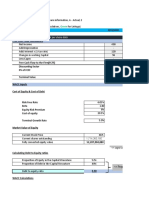

WACC Weighted Avgerage Cost of Capital

Discout Rate = ROCE ~ 24%

Stock Name Weighted No.

2015 2016 2017 2018 2019

Wt 1 2 3 4 5

ROCE 20% 27% 35% 35% 31% 32%

PBT ₹668.00 ₹1,095.50 ₹1,239.00 ₹1,331.20 ₹1,376.00

PAT ₹501.00 ₹746.20 ₹773.79 ₹955.19 ₹979.40

Effective Tax slab 25% 32% 38% 28% 29% 25.50%

PBT Growth 13% 13% 7% 3% 7%

Equity Capital

Face Value

Number of shares #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

P/E 62.00

MCAP

Average Share

Buy Target <

eighted No.

2020 P

₹1,479.18

₹1,101.99

#DIV/0!

#DIV/0!

51.27

62.00

₹68,323.24

₹1,332.62

1012.6

You might also like

- The Warren Buffett Spreadsheet Final-Version - PreviewDocument335 pagesThe Warren Buffett Spreadsheet Final-Version - PreviewHari ganesh RNo ratings yet

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Fixed IncomeDocument112 pagesFixed IncomeNGOC NHINo ratings yet

- Busi 331 Project 1 Marking Guide: HandbookDocument28 pagesBusi 331 Project 1 Marking Guide: HandbookDilrajSinghNo ratings yet

- Giant AssignmentDocument7 pagesGiant AssignmentSenthil KumarNo ratings yet

- Joliffe MetalsDocument2 pagesJoliffe MetalsShayan AminNo ratings yet

- Overview If Railway AccountsDocument40 pagesOverview If Railway AccountsKannan ChakrapaniNo ratings yet

- Discuss Whether Rising Real GDP Per Person Was Sufficient To Ensure That Every Citizen of The UK Was Better Off in 2013 Than 1971Document2 pagesDiscuss Whether Rising Real GDP Per Person Was Sufficient To Ensure That Every Citizen of The UK Was Better Off in 2013 Than 1971Shreya KochharNo ratings yet

- 23 Risk Management and Hedging Strategies PDFDocument24 pages23 Risk Management and Hedging Strategies PDFemmadavisons100% (1)

- HW3Document14 pagesHW3Cheram Delapeña BoholNo ratings yet

- Module 3 Chapter 15 DCF ModelDocument2 pagesModule 3 Chapter 15 DCF ModelMaulik JainNo ratings yet

- Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15Document9 pagesFree Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15MBA grievanceNo ratings yet

- Free Cash Flow Estimate (In INR CRS)Document2 pagesFree Cash Flow Estimate (In INR CRS)Kapil KhannaNo ratings yet

- Module 3 Chapter 15 DCF ModelDocument5 pagesModule 3 Chapter 15 DCF ModelAvinash GanesanNo ratings yet

- Free Cash Flow Estimate (In INR CRS)Document2 pagesFree Cash Flow Estimate (In INR CRS)SaiVamsiNo ratings yet

- UntitledDocument8 pagesUntitledPravin AmirthNo ratings yet

- DCF TATA PowerDocument2 pagesDCF TATA PowerAman MankotiaNo ratings yet

- CiplaDocument9 pagesCiplaShivam GoelNo ratings yet

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNo ratings yet

- The Warren Buffett Spreadsheet - PreviewDocument350 pagesThe Warren Buffett Spreadsheet - PreviewbysqqqdxNo ratings yet

- TATA CONSULTANCY SERVICES ValautionDocument3 pagesTATA CONSULTANCY SERVICES ValautionRohit Kumar 4170No ratings yet

- Chapter09 SMDocument17 pagesChapter09 SMkert1234No ratings yet

- Evaluating The Firm'S Dividend PolicyDocument11 pagesEvaluating The Firm'S Dividend PolicyYash Aggarwal BD20073No ratings yet

- Quantamental Research - ITC LTDDocument1 pageQuantamental Research - ITC LTDsadaf hashmiNo ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- Valuation of Tata SteelDocument3 pagesValuation of Tata SteelNishtha Mehra100% (1)

- Kotak Mahindra Bank Limited Consolidated Financials FY18Document60 pagesKotak Mahindra Bank Limited Consolidated Financials FY18Kunal ObhraiNo ratings yet

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocument5 pagesIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNo ratings yet

- Date of Analysis 8/29/2020: Dicount Rate 10y Fed Note %Document61 pagesDate of Analysis 8/29/2020: Dicount Rate 10y Fed Note %bysqqqdxNo ratings yet

- Criterion Weight Word In-House Press Financial Third PartyDocument9 pagesCriterion Weight Word In-House Press Financial Third PartyArdia salsabilaNo ratings yet

- Shareholder Value Creation-2Document5 pagesShareholder Value Creation-2tanadof294No ratings yet

- Gail (India)Document93 pagesGail (India)Ashley KamalasanNo ratings yet

- Income Value para Real EstateDocument13 pagesIncome Value para Real EstateJuan G ScharffenorthNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsSudhanshu Kumar SinghNo ratings yet

- FCFE CalculationDocument23 pagesFCFE CalculationIqbal YusufNo ratings yet

- PayTM FinancialsDocument43 pagesPayTM FinancialststNo ratings yet

- ADVANCED CORPORATE FINANCE 3rd TermDocument11 pagesADVANCED CORPORATE FINANCE 3rd TermdixitBhavak DixitNo ratings yet

- Description Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 AED (Million)Document3 pagesDescription Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 AED (Million)AamirNo ratings yet

- Student May Add To The List of AssumptionsDocument10 pagesStudent May Add To The List of AssumptionsAbhilash NNo ratings yet

- Cms Info Systems Limited: All You Need To Know AboutDocument8 pagesCms Info Systems Limited: All You Need To Know AboutPanktiNo ratings yet

- Onsite Day Care ValuationDocument2 pagesOnsite Day Care Valuationjindalmanoj06No ratings yet

- MCB LTD Conso Annual Report - 1 - tcm55-52880-86Document1 pageMCB LTD Conso Annual Report - 1 - tcm55-52880-86Dani ShaNo ratings yet

- Real Estate Portfolio Valuation Model v3.4Document11 pagesReal Estate Portfolio Valuation Model v3.4daniellehynes69No ratings yet

- TV18 BroadcastDocument30 pagesTV18 Broadcastrishabh jainNo ratings yet

- Ankush Gupta Financial Management and Valuation MBA DBF DEC 2020 Excel FileDocument8 pagesAnkush Gupta Financial Management and Valuation MBA DBF DEC 2020 Excel FileAnkush GuptaNo ratings yet

- Qatar National Bank April 2011Document6 pagesQatar National Bank April 2011Michael KiddNo ratings yet

- Assignment #2 Investment & Portfolio Management Group 3 (GEN) (G1)Document3 pagesAssignment #2 Investment & Portfolio Management Group 3 (GEN) (G1)ramyNo ratings yet

- Commercial Real Estate Valuation ModelDocument6 pagesCommercial Real Estate Valuation Modelkaran yadavNo ratings yet

- Prataap Snacks Limited: DCF Analysis Valuation Date: 07 March, 2019Document41 pagesPrataap Snacks Limited: DCF Analysis Valuation Date: 07 March, 2019CharanjitNo ratings yet

- Maruti Suzuki Q4FY18 and FY18 - Investor PresentationDocument18 pagesMaruti Suzuki Q4FY18 and FY18 - Investor PresentationdarkyNo ratings yet

- K10 SFMDocument6 pagesK10 SFMSrijan AgarwalNo ratings yet

- Brand CoDocument7 pagesBrand CoCamila VillamilNo ratings yet

- Cash Flow Statement Data 2018 2019 2020Document10 pagesCash Flow Statement Data 2018 2019 2020ficiveNo ratings yet

- DCF ModelDocument6 pagesDCF ModelKatherine ChouNo ratings yet

- FMO M5 Soln.sDocument16 pagesFMO M5 Soln.sVishwas ParakkaNo ratings yet

- Spread SheetDocument2 pagesSpread SheetDwi PermanaNo ratings yet

- Cash Flow Statement Data 2015 2016 2017Document9 pagesCash Flow Statement Data 2015 2016 2017milzamamelNo ratings yet

- DownloadDocument22 pagesDownloadAshwani KesharwaniNo ratings yet

- VALUING SYNERGIES IN M&A-Data Revised Jan 2020Document7 pagesVALUING SYNERGIES IN M&A-Data Revised Jan 2020Aninda Dutta100% (1)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- The Art of Commitment Pacing: Engineering Allocations to Private CapitalFrom EverandThe Art of Commitment Pacing: Engineering Allocations to Private CapitalNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Microsoft Tsi Opera PhiladelphiaDocument3 pagesMicrosoft Tsi Opera PhiladelphiaRaman ChawlaNo ratings yet

- Strike Call OI Put OI Cumulative Call Cumulative Put Total ValueDocument4 pagesStrike Call OI Put OI Cumulative Call Cumulative Put Total ValueRaman ChawlaNo ratings yet

- Mock 6 QDocument48 pagesMock 6 QRaman ChawlaNo ratings yet

- Mock 4 QDocument46 pagesMock 4 QRaman ChawlaNo ratings yet

- Mock 5 QDocument47 pagesMock 5 QRaman ChawlaNo ratings yet

- Space2.0 Final 24feb PDFDocument406 pagesSpace2.0 Final 24feb PDFRaman ChawlaNo ratings yet

- Mock 19 QDocument47 pagesMock 19 QRaman ChawlaNo ratings yet

- Knappily Slide On Indian EconomyDocument28 pagesKnappily Slide On Indian EconomyRaman ChawlaNo ratings yet

- Mock 2 QDocument53 pagesMock 2 QRaman ChawlaNo ratings yet

- Branches of Social SciencesDocument16 pagesBranches of Social SciencesRaman Chawla100% (1)

- ScienceDocument12 pagesScienceRaman ChawlaNo ratings yet

- AV 315 Control System: Raman Chawla SC12B042Document37 pagesAV 315 Control System: Raman Chawla SC12B042Raman ChawlaNo ratings yet

- Fluid Mechanics EquationsDocument8 pagesFluid Mechanics EquationsRaman ChawlaNo ratings yet

- TWP Phase Heat TransferDocument6 pagesTWP Phase Heat TransferRaman ChawlaNo ratings yet

- Advanced Microeconomics I SyllabusFall2016Sep1SRDocument25 pagesAdvanced Microeconomics I SyllabusFall2016Sep1SRgeekorbit67% (3)

- UntitledDocument197 pagesUntitledapi-161028199No ratings yet

- Rostow Modernization Theory Final 1Document11 pagesRostow Modernization Theory Final 1Jade Harris ColorjeNo ratings yet

- MFIN6214 Lecture1 2020T3Document29 pagesMFIN6214 Lecture1 2020T3ulricaNo ratings yet

- Economics of The Welfare StateDocument6 pagesEconomics of The Welfare StateIgnacio PHNo ratings yet

- CHAPTER 8 - An Introduction To Asset Pricing ModelsDocument36 pagesCHAPTER 8 - An Introduction To Asset Pricing ModelsArah Ibrahim-MacakilingNo ratings yet

- Equity Research Report SlidesDocument18 pagesEquity Research Report Slidesanton88beNo ratings yet

- Solved SMU Assignment / ProjectDocument3 pagesSolved SMU Assignment / ProjectArvind KNo ratings yet

- Rector Decree and Provision UGMDocument7 pagesRector Decree and Provision UGMT dmrNo ratings yet

- Supply in SportsDocument33 pagesSupply in SportsVladimir MilkhailovNo ratings yet

- Free Cash Flow To Firm DCF Valuation Model Base DataDocument3 pagesFree Cash Flow To Firm DCF Valuation Model Base DataTran Anh Van100% (1)

- Edwin Mansfield - Microeconomics - Selected Readings-W. W. Norton & Company (1971)Document548 pagesEdwin Mansfield - Microeconomics - Selected Readings-W. W. Norton & Company (1971)felipemanuelcamposoficialNo ratings yet

- Zook On The CoreDocument9 pagesZook On The CoreThu NguyenNo ratings yet

- Business Environment Analysis - PDFDocument19 pagesBusiness Environment Analysis - PDFDikshita MahadikNo ratings yet

- Varian9e LecturePPTs Ch08Document44 pagesVarian9e LecturePPTs Ch08Priyadarshi Kirti GouravNo ratings yet

- CH 6 Production Theory Ing-IndoDocument63 pagesCH 6 Production Theory Ing-IndoNovhendraNo ratings yet

- Economic Cycles and Maritime ShippingDocument29 pagesEconomic Cycles and Maritime Shippinganna annaNo ratings yet

- Consumer Behavior: Chapter OutlineDocument34 pagesConsumer Behavior: Chapter Outlineabhinanda_22No ratings yet

- CSEC Economics June 2008 P32Document5 pagesCSEC Economics June 2008 P32Sachin BahadoorsinghNo ratings yet

- The Inside Job Post Viewing Questions - COMPLETEDocument9 pagesThe Inside Job Post Viewing Questions - COMPLETEDavid KaranuNo ratings yet

- A License To Print MoneyDocument3 pagesA License To Print MoneySamuel RinesNo ratings yet

- Material EsbmDocument26 pagesMaterial Esbmmohammad ferozNo ratings yet

- Unit 7 Interactive NotebookDocument18 pagesUnit 7 Interactive NotebookSankalp YeletiNo ratings yet

- Project FinalDocument36 pagesProject Finaljohn mwambuNo ratings yet