Professional Documents

Culture Documents

Case Study - Nokia

Case Study - Nokia

Uploaded by

Shikha SidanaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study - Nokia

Case Study - Nokia

Uploaded by

Shikha SidanaCopyright:

Available Formats

FEATURE PHONE MARKET IN INDIA – REMOVE URBAN AS 2ND USER

In India, mobile penetration has moved beyond the urban cities to reach the tier-2, tier3 cities and

other rural parts of the country as well. According to Telecom Regulatory

Authority of India (TRAI), as of June 2017, there were 499 million mobile subscribers in

rural India, and another report points out that rural markets account for 60% of the new

mobile subscription growth in the country.

Now feature phones though have a strong rural Market, but let’s not miss the Urban

Population who too own the Feature phone as the second phone. Recent studies

suggested among the Urban consumers 56% of them also own Feature phone as the

second phone. Having said that, the majority of the feature phones, still owes it to

the rural population. Not only are the rural markets unexplored, but also majority of

the population is rooted there and in future the no is likely to grow, with growing

population.

The Indian feature phone market saw a decline of around 24% year-over-year in the

first quarter of 2020, implying consumers are transitioning to smartphones. With the

Covid-19 pandemic leading people to cut on discretionary spending, the India feature

phone market declined 68% (year-on-year) in the second quarter this year, a

Counterpoint Research report said.

Consumers in this highly cost-sensitive segment tried to save money by reducing

discretionary purchases, said the report. The nationwide lockdown imposed by the

Indian government to combat Covid-19 resulted in zero shipments during April. This was

also the time which saw a huge exodus of migrants from cities as many of them lost

livelihood.

(*Economic Times, Business Standard, India TV News)

RISING POPULARITY OF SMARTPHONES

As per the InMobi research, 90% of India will own a mobile phone by 2022, and

60% will use a smartphone by 2025. A distinctive feature of these trends is that it is

not just restricted to metro cities only. Tier II & III cities of India are bringing an

ever-increasing number of people on the smartphone platform. Spread across all

demographics, India is moving away from traditional means of content consumption

to more convenient and one-to-one interactions made accessible by mobile phone.

Further, for gaming, video-viewing, social media, and shopping, mobile is now the

primary screen for users.

In a nutshell, the consumption trend is triggered by factors such as affordable 4G

smartphones, data plans and awareness programmes that are bridging the digital

divide eventually sewing rural India in the Digital India journey.

Here are some observations that are driving smartphone penetration across rural

India:

1) Rural millennials bringing a seismic shift in purchasing decision

According to Kantar IMRB report, the millennial population of India is approximately

450 million, out of which around 300 million millennials (67% of the total population)

live in rural India. As per the research, the desire to improve their economic status is

a key driver for rural millennials irrespective of their gender. The segment with

higher aspirations, increasing purchasing power, evolving consumption patterns, and

access to the world through Internet have emerged as the fulcrum of rural India that

currently controls the rural economy as shoppers, makers and particularly as trendsetters.

Today, the smartphone penetration in rural and semi-urban demographics has

witnessed a significant shift with an increase in user base to 40-50% from 29% five

years ago. This trend is also attributed to the smartphone wave sweeping across the

rural markets instigated with factors such as affordable device ecosystem, innovative

and trendy features and most importantly, the aspirations of rural millennials.

2) Sneak peek into the mindset of rural millennials

The 300 million rural millennials which represent 36% of the Indian rural population

are at the helm of defining the smartphone purchase decisions across the region.

Rather than aimlessly following brands and names, these millennials, who are

mindful and brand cognizant is settling on choices that elevate their social status

comprising quality, latest and trendy features while affordability being the heart of

the purchasing decision.

As far as psychographics is concerned, this fragment is further partitioned into

minimalists and aspirers. Minimalists are the individuals who own feature phones and

are keen to move up to an entry-level smartphone. Feature phone users and as the

technology is spreading its wing this segment is expected to witness a transition to

an entry-level smartphone.

On the other hand, aspirers are individuals who are eager to adopt innovation and

shift to an upgraded smartphone model offering high-end features and is the latest

and trendy technology in the market. The aspirers essentially look forward to

features such as face unlock, fingerprint sensor, AI dual camera and Waterdrop HD

display, etc. which makes them socially advance and add a style statement to their

persona.

3) Localized marketing approach - A key to success

A ‘one size fits all’ strategy is a recipe for failure, brands must create personal

connections and interaction opportunities that seamlessly help integrate experiences

of rural millennials in their everyday life. Distribution strength, deep market

penetration and understanding the consumers’ aspirations etc through intense

market research while assuring a strong service promise are the key tenets for

winning this consumer. Locally relevant and targeted outreach along with a

compelling proposition of an affordable price point combined with futuristic features

is what rural millennials aspire to own.

Another most important aspect of this market segment is making the populace

comfortable with these new technologies. The power of today’s technology, the new

thrust areas and the opportunities of growth that it offers are key aspects that

require an awareness and education drive. Brands that take this mantle of

responsibility stand out and builds consideration.

Apart from this, with likes of Facebook and Instagram still going strong, rural

millennials are switching to newer networking platform for different experiences and

content. Platforms like TikTok and Helo were popular in the segment and with the

mantra that every user can be a creator from their smartphone, these digital

touchpoints are becoming addictive and highly entertaining eventually providing

leverage for brands to tap these rural millennials. Now that these apps are banned,

creators are moving to platforms such as Instagram and Facebook.

(* Business World)

KEY TRIGGERS TO MOVE FROM FEATURE PHONES TO SMARTPHONES

CHALLENGES ANTICIPATED AND ASSOCIATED WITH THE ADOPTION OF

SMARTPHONE TECHNOLOGY

1) Not a necessity

India is a price sensitive market and hence consumers (especially in tier II, III cities

and rural areas or maybe overall) display a very cautious spending behaviour. One of

the possible reasons is affordability and socio-economic behaviour of Indian

consumers. While urban population is increasingly growing tech savvy, consumers

from smaller towns and rural areas are still marginally exposed to the technological

advancement that India and the world has moved towards. The pace at which this

segment of population is coping up with the advancement is considerably low

because of which they feel more comfortable with the conventional way of

communication. The basic need for a phone till date is to make and take phone calls

for majority of people. Therefore, the rate of migration from feature to smartphone

is slow and hence feature phones continue to account for more than half of the total

Indian mobile phone market.

2) A large investment

With rural India, price always remains the primary concern and this factor has been

one of the key growth drivers for the market. Feature phones serve the purpose of

low-income groups but also holds the aspirational value of owning the phone. Price is

an important point of concern for them and feature phones turn out to be an

attractive buy.

3) Not a digital native

Feature Phones define convenience and also ease of use. Feature phones not only

bring a stronger battery life, an ease of repair, but an overall reasonable data plans

suiting pockets along with the phone. Another aspect, though consumers are using a

feature phone; it does bring a feel of the smartphone too…with basic internet usage,

essential apps like Facebook etc preinstalled consumers don’t seem to miss

upgrading to a smartphone.

ABOUT NOKIA’S C3

1) Rear Camera: 8 MP auto-focus, F2.0, with flash

2) Front Camera: 5 MP, F2.4

3) Display Size: 5.99” (15.2 cm)

4) Display Type: HD + IPS with toughed glass

5) Colours available: Nordic Blue & Sand

6) Operating system: Android 10

7) RAM: 2 GB & 3 GB

8) CPU: Octa-Core 1.6 GHz

9) SIM cards: Dual SIM

10) Keys: Google Assistant button

11) Battery Type: Removable 3040 mAh2

12) Internal Storage: 16 GB & 32 GB

13) Maximum standby time up to: 16.5 days

14)Price: ₹6999 - ₹7999

Below are the specifications that resonate:

COMPETITIVE LANDSCAPE INDIA

The best budget smartphone will come in different sizes and USPs. Thanks to

advancing technologies, 4G smartphones under Rs. 8000 are easily available.

Brands like Samsung, Realme, and Xiaomi offer a range of phones in this segment.

Notch cut out screens, dual rear cameras, big batteries, etc are the norm in this

segment. However, due to Covid-19 many Indian users have boycotted Chinese

products and so this leaves a huge opportunity for brands to enter or grow within the

market.

COMMUNICATION TASK

1) The task is to provide a communication strategy that details out the way forward for

Nokia C3 – building the bridge between futuristic smartphones and run-of-the-mill

feature phones.

2) How do ignite relevance and drive consumption among consumers.

3) And more importantly how do we engage with consumers who are currently

choosing other brands they love like Micromax, Lava, Xiaomi etc. over us.

You might also like

- Law High Court VisitDocument6 pagesLaw High Court VisitShikha Sidana100% (3)

- Capstone Project - Launching A Premium Category Smartphone For The Indian Market PDFDocument11 pagesCapstone Project - Launching A Premium Category Smartphone For The Indian Market PDFSudip Issac SamNo ratings yet

- Choosing The Right Metrics For Listerine Brand Management in Brazil Case Analysis and Case SolutionDocument10 pagesChoosing The Right Metrics For Listerine Brand Management in Brazil Case Analysis and Case SolutionShikha SidanaNo ratings yet

- Mobile Industry IndiaDocument4 pagesMobile Industry IndiasantoshsequeiraNo ratings yet

- Consumer BehAviourDocument37 pagesConsumer BehAviouranon_757894592No ratings yet

- Buying Behavior of Mobile PhoneDocument10 pagesBuying Behavior of Mobile PhoneShashank Kumar BaranwalNo ratings yet

- ME Research Paper 1 FinalDocument20 pagesME Research Paper 1 Finalmohiyuddinsakhib3260No ratings yet

- St. Kabir Institute of Profetional Studies Adevance Marketing ManagementDocument17 pagesSt. Kabir Institute of Profetional Studies Adevance Marketing Managementchodu chamanNo ratings yet

- JETIRTHE2036Document41 pagesJETIRTHE2036sushantnanaware2000No ratings yet

- Royal Enfield KWKWKDocument55 pagesRoyal Enfield KWKWKE01202114-MUHAMMED ISMAIL K BBA CANo ratings yet

- Mobile Phones in IndiaDocument10 pagesMobile Phones in IndiaMohd Danish KirmaniNo ratings yet

- Mobile - The Way of The Future: Tushar Vyas &harish Nair September 2013Document3 pagesMobile - The Way of The Future: Tushar Vyas &harish Nair September 2013Rahul AmrikNo ratings yet

- Smartphones A Must-Buy Even in Slowdown Season: Navadha Pandey New DelhiDocument4 pagesSmartphones A Must-Buy Even in Slowdown Season: Navadha Pandey New DelhiTulsi GovaniNo ratings yet

- Mobile Marketing Groupm ReportDocument86 pagesMobile Marketing Groupm ReporthemanthillipilliNo ratings yet

- 037 - Shadab Ansari - A Study On Parameters of Brand Preference ofDocument95 pages037 - Shadab Ansari - A Study On Parameters of Brand Preference ofShadab AnsariNo ratings yet

- Trendy Low CostDocument5 pagesTrendy Low Costlakshya24gargNo ratings yet

- IJERT-Consumer Buying Behavior of Smart Phones: Cite This PaperDocument13 pagesIJERT-Consumer Buying Behavior of Smart Phones: Cite This PaperPràßhánTh Aɭoŋɘ ɭovɘʀNo ratings yet

- International Institute For Special Education Lucknow: As Part of Completing Post Graduate Diploma in Management)Document26 pagesInternational Institute For Special Education Lucknow: As Part of Completing Post Graduate Diploma in Management)Shiv Pratap SinghNo ratings yet

- Predicting The Usage of M - Commerce in The Digital World Using Multiple Regression Analysis Based On Rural - Urban DivideDocument10 pagesPredicting The Usage of M - Commerce in The Digital World Using Multiple Regression Analysis Based On Rural - Urban DivideLalita MutrejaNo ratings yet

- It'S Never Too Late! - A Case Study On Micromax MobileDocument17 pagesIt'S Never Too Late! - A Case Study On Micromax MobileAkash KannojiaNo ratings yet

- It'S Never Too Late! - A Case Study On Micromax MobileDocument17 pagesIt'S Never Too Late! - A Case Study On Micromax MobileAkash KannojiaNo ratings yet

- Asian Journal of Management Research: Short Communication ISSN 2229 - 3795Document6 pagesAsian Journal of Management Research: Short Communication ISSN 2229 - 3795Ashish KalraNo ratings yet

- Marketing Management Project Drishti PhabletDocument26 pagesMarketing Management Project Drishti PhabletMohitBudholiaNo ratings yet

- Adsmobi Research Insights: Global Smartphone Movement Heads EasttDocument16 pagesAdsmobi Research Insights: Global Smartphone Movement Heads EasttSumit RoyNo ratings yet

- Industry Profiling: Mobile Industry: Under The Guidance of Prof A.K. SharmaDocument45 pagesIndustry Profiling: Mobile Industry: Under The Guidance of Prof A.K. SharmaAnant JohriNo ratings yet

- Consumer Buying Behavior of Smart Phones IJERTV6IS060374 PDFDocument12 pagesConsumer Buying Behavior of Smart Phones IJERTV6IS060374 PDFsanskriti shrivastavaNo ratings yet

- History of Mobile Handset Industry in IndiaDocument8 pagesHistory of Mobile Handset Industry in Indiasanjaya890No ratings yet

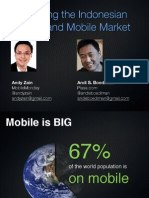

- Monetizing The Indonesian Internet and Mobile Market: Andi S. Boediman Andy ZainDocument45 pagesMonetizing The Indonesian Internet and Mobile Market: Andi S. Boediman Andy ZainAangOjolaliNo ratings yet

- Institute of Management Science University of LucknowDocument74 pagesInstitute of Management Science University of LucknowManjeet SinghNo ratings yet

- Smartphone Market in IndiaDocument3 pagesSmartphone Market in IndiaAnshika YadavNo ratings yet

- Indonesia Market Online Based ReportDocument8 pagesIndonesia Market Online Based Reportabesh_nsuNo ratings yet

- Customer Brand Preference of Mobile Phones at Hyderabad, IndiaDocument9 pagesCustomer Brand Preference of Mobile Phones at Hyderabad, IndiaKameswara Rao PorankiNo ratings yet

- PDF 82561Document16 pagesPDF 82561Jaydev GautamNo ratings yet

- Final Year Project ContentDocument89 pagesFinal Year Project ContentShamsulfahmi Shamsudin0% (1)

- Analysis of Changing Trends in Mobile Handset in Lucknow CitySheeraj FareedDocument101 pagesAnalysis of Changing Trends in Mobile Handset in Lucknow CitySheeraj FareedManjeet SinghNo ratings yet

- Mobile Phone Market in India (2015)Document49 pagesMobile Phone Market in India (2015)Niteysh AK Roy50% (2)

- A Presentation On Micromax Mobile: Roll No. Name of StudentsDocument74 pagesA Presentation On Micromax Mobile: Roll No. Name of StudentsRamesh Maheshwari0% (1)

- Samsung ArrangedDocument45 pagesSamsung ArrangedxyzNo ratings yet

- Thuyet Trinh EcoDocument4 pagesThuyet Trinh EcoLe Vi Thanh (FUG CT)No ratings yet

- Rural India: The Changing ParadigmDocument5 pagesRural India: The Changing ParadigmBhaskar ParasharNo ratings yet

- Mobile CommerceDocument3 pagesMobile CommerceRuturaj PatilNo ratings yet

- Micromax History1Document8 pagesMicromax History1Prashant MishraNo ratings yet

- SEM Notes CaseDocument18 pagesSEM Notes CaseADITYA N GOKHROONo ratings yet

- What Drives Smartphone Purchase Intention Perspective From Technology, Price, and E-Wom As MediatorsDocument7 pagesWhat Drives Smartphone Purchase Intention Perspective From Technology, Price, and E-Wom As MediatorsInternational Journal of Innovative Science and Research Technology100% (1)

- Microeconomics Analysis of The Mobile Handsets Industry in IndiaDocument4 pagesMicroeconomics Analysis of The Mobile Handsets Industry in IndiaVISHU JAGANNATHA GUPTA EPGP 2021-22No ratings yet

- How Micromax Rose To ProminenceDocument24 pagesHow Micromax Rose To ProminenceDhvanil ZaveriNo ratings yet

- Microeconomics - Smart Phones in IndiaDocument11 pagesMicroeconomics - Smart Phones in IndiaSudhanshu SharmaNo ratings yet

- Mobile Africa - 2012Document48 pagesMobile Africa - 2012Tsiggos AlexandrosNo ratings yet

- Preface: Different Features People Considered While Purchasing Mobile PhoneDocument35 pagesPreface: Different Features People Considered While Purchasing Mobile PhoneSujish NairNo ratings yet

- Authored Article - Smartphone Re-Commerce in IndiaDocument4 pagesAuthored Article - Smartphone Re-Commerce in IndiaSanjay MalaraNo ratings yet

- Relatorio - MercadoDocument13 pagesRelatorio - MercadoFernandoGhinzelliNo ratings yet

- Indian Market AnalysisDocument20 pagesIndian Market AnalysisChetan SomashekarNo ratings yet

- Marketing 11Document15 pagesMarketing 11Bishnu Prasad MohantyNo ratings yet

- ICT Penetration IndiaDocument2 pagesICT Penetration IndiaproxygeekNo ratings yet

- Mobile Phones in IndiaDocument9 pagesMobile Phones in IndiaShivajiNo ratings yet

- 5.4 Mobile E-Commerce Market - IndiaDocument2 pages5.4 Mobile E-Commerce Market - IndiaBhoopal PadmanabhanNo ratings yet

- Unlocking The Power of MobileDocument13 pagesUnlocking The Power of MobileErsilia BaraganNo ratings yet

- Oportunidades Mundo DigitalDocument16 pagesOportunidades Mundo DigitalRodrigo Ignacio Soto AvilésNo ratings yet

- Group 1 - FRA Assignment - FinalDocument33 pagesGroup 1 - FRA Assignment - FinalGaurav KeswaniNo ratings yet

- A Study On Customer Satisfaction With Samsung Mobile Phones With Special Reference To Indore CityDocument12 pagesA Study On Customer Satisfaction With Samsung Mobile Phones With Special Reference To Indore Citynavaneetha krishnanNo ratings yet

- Cellular Technologies for Emerging Markets: 2G, 3G and BeyondFrom EverandCellular Technologies for Emerging Markets: 2G, 3G and BeyondNo ratings yet

- Sample Size: " All Random But Keep A Check On The Sample Achieved For Creative TG. If Not NaturallyDocument3 pagesSample Size: " All Random But Keep A Check On The Sample Achieved For Creative TG. If Not NaturallyShikha SidanaNo ratings yet

- MSR Social Media Selection Parameters & Questions (Shikha & Sonali)Document1 pageMSR Social Media Selection Parameters & Questions (Shikha & Sonali)Shikha SidanaNo ratings yet

- Samsung TV - G2Document16 pagesSamsung TV - G2Shikha SidanaNo ratings yet

- Fiscal Policy NigeriaDocument344 pagesFiscal Policy NigeriaShikha SidanaNo ratings yet

- Unit 8 Test Standard ADocument4 pagesUnit 8 Test Standard Awevrteqa123No ratings yet

- New Data From App Annie Confirms IndiaDocument8 pagesNew Data From App Annie Confirms IndiaLaksh NegiNo ratings yet

- Marketing Myopia With ExamplesDocument17 pagesMarketing Myopia With ExamplesChanakaNo ratings yet

- Cyber SecurityDocument117 pagesCyber Securitybeautyofnature142No ratings yet

- Phone ScopeDocument6 pagesPhone Scopeapi-293262389No ratings yet

- Family Emergency Communication Plan - Create Your OwnDocument17 pagesFamily Emergency Communication Plan - Create Your OwnAgustin PeraltaNo ratings yet

- HW20004 NEC SL2100 Brochure 4p USDocument4 pagesHW20004 NEC SL2100 Brochure 4p UShsejgss.signalNo ratings yet

- Chapter 1 Finally 1Document4 pagesChapter 1 Finally 1Alyssa Tibuen CorpuzNo ratings yet

- Nemo Outdoor 7.8.2 Release: Technical Bulletin & Release NotesDocument58 pagesNemo Outdoor 7.8.2 Release: Technical Bulletin & Release NotesAnonymous mj4J6ZWEWNo ratings yet

- "Recharge" The First Indonesia Power Bank Rental AppDocument3 pages"Recharge" The First Indonesia Power Bank Rental Appgak jadiNo ratings yet

- ALTERDROID Differential Fault Analysis of Obfuscated Smartphone MalwareDocument4 pagesALTERDROID Differential Fault Analysis of Obfuscated Smartphone MalwaressigoldNo ratings yet

- All About MIPI C PHY and D PHYDocument8 pagesAll About MIPI C PHY and D PHYAhmed AbdoNo ratings yet

- Wi-Fi Based Remote ID Demo Guide - V1.0-For SGPDocument13 pagesWi-Fi Based Remote ID Demo Guide - V1.0-For SGPYousef JasirNo ratings yet

- English 6 - Q4 - Las 4 RTPDocument4 pagesEnglish 6 - Q4 - Las 4 RTPtrishajilliene nacisNo ratings yet

- Ns-Cspbtcube-W QSG enDocument2 pagesNs-Cspbtcube-W QSG enBabuNo ratings yet

- A Guide To BLE Beacons FINAL 18 Sept 14Document55 pagesA Guide To BLE Beacons FINAL 18 Sept 14Vikesh SohotooNo ratings yet

- Instructions: 3-Axis Stabilized Handheld Gimbal For CameraDocument26 pagesInstructions: 3-Axis Stabilized Handheld Gimbal For Camerapeace_julian3573No ratings yet

- Samsung MobileDocument5 pagesSamsung Mobilehussainshadat262No ratings yet

- XoloDocument36 pagesXoloSHAILESH100% (1)

- IEEE Project Titles 2020Document293 pagesIEEE Project Titles 2020aslanNo ratings yet

- 6 Managing School Operations - Communication StrategyDocument31 pages6 Managing School Operations - Communication StrategyBaby Boss in PinkNo ratings yet

- Audio Manual BalenoDocument72 pagesAudio Manual BalenoShashi SinhaNo ratings yet

- Fitness Tracker Fty18: User'S ManualDocument2 pagesFitness Tracker Fty18: User'S ManualMiklós MeixnerNo ratings yet

- 1625 Assigment 2Document15 pages1625 Assigment 2Ninh Xuan Bao Hung (FGW HCM)No ratings yet

- Worksheet Project GlassDocument3 pagesWorksheet Project GlassArva KatalinNo ratings yet

- Uech2103 - Human Resource ManagementDocument44 pagesUech2103 - Human Resource ManagementNANTHININo ratings yet

- 06 OnScreen B2 Module 6 - 1-5Document5 pages06 OnScreen B2 Module 6 - 1-5Matas ŽeromskisNo ratings yet

- MIL Q2 Module1Document24 pagesMIL Q2 Module1mary jane batohanon78% (9)

- Pricing Strategy of AppleDocument29 pagesPricing Strategy of AppleNarsingh Das AgarwalNo ratings yet

- Graphic Recorder - GR200 Series PDFDocument4 pagesGraphic Recorder - GR200 Series PDFhnphuocNo ratings yet