Professional Documents

Culture Documents

Multiple Choice Questions 1 If A Company Uses The Direct Write Off

Multiple Choice Questions 1 If A Company Uses The Direct Write Off

Uploaded by

Hassan Jan0 ratings0% found this document useful (0 votes)

39 views1 page1. The document contains 10 multiple choice questions about accounting concepts related to receivables, bad debts, and notes receivable.

2. The questions cover topics such as the direct write-off method, estimating bad debt expense using percentages of credit sales or aging of accounts, and recognizing interest income on notes receivable.

3. One question asks about calculating net profit margin percentage by dividing net income by net sales.

Original Description:

Original Title

Multiple Choice Questions 1 if a Company Uses the Direct Write Off

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document contains 10 multiple choice questions about accounting concepts related to receivables, bad debts, and notes receivable.

2. The questions cover topics such as the direct write-off method, estimating bad debt expense using percentages of credit sales or aging of accounts, and recognizing interest income on notes receivable.

3. One question asks about calculating net profit margin percentage by dividing net income by net sales.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

39 views1 pageMultiple Choice Questions 1 If A Company Uses The Direct Write Off

Multiple Choice Questions 1 If A Company Uses The Direct Write Off

Uploaded by

Hassan Jan1. The document contains 10 multiple choice questions about accounting concepts related to receivables, bad debts, and notes receivable.

2. The questions cover topics such as the direct write-off method, estimating bad debt expense using percentages of credit sales or aging of accounts, and recognizing interest income on notes receivable.

3. One question asks about calculating net profit margin percentage by dividing net income by net sales.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

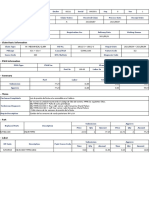

Multiple Choice Questions 1 If a company uses the direct

write off #2344

Multiple Choice Questions1. If a company uses the direct write-off method of accounting for bad

debts,a. It is applying the matching principle.b. It will reduce the accounts receivable account at

the end of the accounting period for estimated uncollectible accounts.c. It will report accounts

receivable in the balance sheet at their net realizable value.d. It will record bad debt expense

only when an account is determined to be uncollectible.2. Which of the following best describes

the objective of estimating bad debt expense with the percentage of credit sales method?a. To

estimate bad debt expense based on a percentage of credit sales made during the periodb. To

estimate the amount of bad debt expense based on an aging of accounts receivablec. To

determine the amount of uncollectible accounts during a given periodd. To facilitate the use of

the direct write-off method3. Which of the following best describes the concept of the aging

method of receivables?a. Accounts receivable should be directly written off when the due date

arrives and the customers have not paid the bill.b. An accurate estimate of bad debt expense

may be arrived at by multiplying historical bad debt rates by the amount of credit sales made

during a period.c. Estimating the appropriate balance for the allowance for doubtful accounts

results in the appropriate value for net accounts receivable on the balance sheet.d. The precise

amount of bad debt expense may be arrived at by multiplying historical bad debt rates by the

amount of credit sales made during a period.4. The aging method is closely related to the:a.

Balance sheetb. Statement of retained earnings c. Statement of cash flowsd. Income

statement5. The percentage of credit sales approach is closely related to the:a. Balance sheetb.

Statement of retained earnings c. Statement of cash flowsd. Income statement6. The process

by which firms package factored receivables as financial instruments or securities and sell them

to investors is known as:a. Credit extensionb. Aging of accounts receivable c. Bundlingd.

Securitization7. Which one of the following statements is true if a company’s collection period

for accounts receivable is unacceptably long? a. The company should expand operations with

its excess cash.b. The company may need to borrow to acquire operating cash.c. The company

may offer trade discounts to lengthen the collection period.d. Cash flows from operations may

be higher than expected for the company’s sales.8. Zenephia Corp. accepted a nine-month

note receivable from a customer on October 1, 2011. If Zenephia has an accounting period

which ends on December 31, 2011, when would it most likely recognize interest income from

the note?a. On October 1, 2011b. On December 31, 2011, only c. On December 31, 2011, and

July 1, 2012d. On July 1, 2012, only9. The ‘‘principal’’ of a note receivable refers to:a. The

present value of the noteb. The amount of cash borrowed c. The financing company that is

lending the moneyd. The amount of interest due10 Net profit margin percentage is calculated

by:a. Dividing net income by (net) salesb. Dividing operating income by (net) salesc. Subtracting

operating income from (net) salesd. Subtracting net income from (net) salesView Solution:

Multiple Choice Questions 1 If a company uses the direct write off

ANSWER

http://paperinstant.com/downloads/multiple-choice-questions-1-if-a-company-uses-the-direct-

write-off/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Exam Practice Question Glori Fried Chicken Rima Puri v2 WZ AnswersDocument4 pagesExam Practice Question Glori Fried Chicken Rima Puri v2 WZ AnswersJœ œNo ratings yet

- Government-To-Citizen Communications - Using Multiple Digital Channels EffectivelyDocument8 pagesGovernment-To-Citizen Communications - Using Multiple Digital Channels EffectivelyLiz Azyan67% (3)

- TheoryofacctsexamDocument7 pagesTheoryofacctsexammarvin barlisoNo ratings yet

- Drill ReceivablesDocument3 pagesDrill ReceivablesGlecel BustrilloNo ratings yet

- The Georgia Ceramic Company Has An Automatic Glaze Sprayer ThatDocument1 pageThe Georgia Ceramic Company Has An Automatic Glaze Sprayer ThatHassan Jan100% (1)

- The Following Transactions Were Taken From The Records of TrevorDocument1 pageThe Following Transactions Were Taken From The Records of TrevorHassan JanNo ratings yet

- ACT Sample BillDocument2 pagesACT Sample BillRonak Khemchandani0% (1)

- Accounting Equation AssignmentDocument6 pagesAccounting Equation AssignmentDipika tasfannum salamNo ratings yet

- Activity in IT202Document3 pagesActivity in IT202Tine Robiso100% (1)

- CH 06Document10 pagesCH 06Gaurav KarkiNo ratings yet

- Trade and Other ReceivablesDocument4 pagesTrade and Other ReceivablesApril Mae LomboyNo ratings yet

- Reviewer1 PDFDocument4 pagesReviewer1 PDFspur iousNo ratings yet

- IAcctg1 Accounts Receivable ActivitiesDocument10 pagesIAcctg1 Accounts Receivable ActivitiesYulrir Alesteyr HiroshiNo ratings yet

- Receivables Theories QuizDocument6 pagesReceivables Theories QuizJoovs JoovhoNo ratings yet

- Test I - Multiple Choice - TheoryDocument6 pagesTest I - Multiple Choice - Theorycute meNo ratings yet

- ReceivablesDocument4 pagesReceivablesyame teeNo ratings yet

- Theories For Accounts Receivable and Allowance For Doubtful AccountsDocument5 pagesTheories For Accounts Receivable and Allowance For Doubtful AccountsIrish D. CudalNo ratings yet

- Theories Chapter 6 12Document195 pagesTheories Chapter 6 12Angel Madelene BernardoNo ratings yet

- College of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDocument7 pagesCollege of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDonalyn BannagaoNo ratings yet

- Chaper 15 & 20Document14 pagesChaper 15 & 20ansari.sl01No ratings yet

- ReSA B42 FAR First PB Exam Questions Answers Solutions-1Document25 pagesReSA B42 FAR First PB Exam Questions Answers Solutions-1Heart EspineliNo ratings yet

- Financial Accounting Review Pre-Board ExaminationDocument7 pagesFinancial Accounting Review Pre-Board ExaminationAnonymous 2Qp0oYNNo ratings yet

- FAR 4.2MC ReceivablesDocument8 pagesFAR 4.2MC ReceivablesAndrea Bercy CoballesNo ratings yet

- Test I - Multiple Choice - TheoryDocument6 pagesTest I - Multiple Choice - Theorycute meNo ratings yet

- FAR 4.2MC ReceivablesDocument8 pagesFAR 4.2MC ReceivableschristineNo ratings yet

- Theories Chapter 6-12Document13 pagesTheories Chapter 6-12u got no jamsNo ratings yet

- FARDocument7 pagesFARRosemarie MoinaNo ratings yet

- 01 (PRELIMS) FAR 2 (Intacc 1 - 2)Document19 pages01 (PRELIMS) FAR 2 (Intacc 1 - 2)Francis AsisNo ratings yet

- Chapter 16 ProblemsDocument4 pagesChapter 16 ProblemsOkiNo ratings yet

- Chapter 13 Intermediate AccoutingDocument8 pagesChapter 13 Intermediate AccoutingMarlind3No ratings yet

- D. None of These.: 1 - Page DR/ Magdy Kamel Tel/ 01273949660Document10 pagesD. None of These.: 1 - Page DR/ Magdy Kamel Tel/ 01273949660magdy kamelNo ratings yet

- MAS HO 013 v2.0 Working Capital MangementDocument7 pagesMAS HO 013 v2.0 Working Capital MangementCarlo C. Cariaso III0% (1)

- Reviewer - ReceivablesDocument5 pagesReviewer - ReceivablesMaria Kathreena Andrea AdevaNo ratings yet

- 6897 - Cash Accounts Receivable and InventoryDocument6 pages6897 - Cash Accounts Receivable and InventoryAljur SalamedaNo ratings yet

- C. Both Statements Are FalseDocument12 pagesC. Both Statements Are FalseShaira Bagunas ObiasNo ratings yet

- Act 6J03 - Comp1 - 1stsem05-06Document13 pagesAct 6J03 - Comp1 - 1stsem05-06d.pagkatoytoyNo ratings yet

- Cash Accounts Receivable and InventoryDocument5 pagesCash Accounts Receivable and InventoryJustine CruzNo ratings yet

- Final Term Examination. Intermediate AccountingDocument8 pagesFinal Term Examination. Intermediate AccountingOrtiz, Trisha Mae S.No ratings yet

- MidtermDocument9 pagesMidtermSohfia Jesse VergaraNo ratings yet

- Cash and Cash Equivalents, Accounts Receivable, Bad DebtsDocument5 pagesCash and Cash Equivalents, Accounts Receivable, Bad DebtsDennis VelasquezNo ratings yet

- RECEIVABLESDocument1 pageRECEIVABLEScasio3627No ratings yet

- Xtra CreditDocument4 pagesXtra CreditKristine Lirose BordeosNo ratings yet

- 06 Short Term Financing ManagementDocument8 pages06 Short Term Financing ManagementLee TeukNo ratings yet

- Toa 2022 Q1 PDFDocument6 pagesToa 2022 Q1 PDFNiña Yna Franchesca PantallaNo ratings yet

- Acct ReviewerDocument13 pagesAcct ReviewerrenNo ratings yet

- TheoriesDocument11 pagesTheoriesJanella PatriziaNo ratings yet

- Types of Major AccountsDocument6 pagesTypes of Major Accountsbbrightvc 一ไบร์ทNo ratings yet

- ReceivablesDocument5 pagesReceivablesHanns Lexter PadillaNo ratings yet

- Acc-106 TG 7Document12 pagesAcc-106 TG 7leca.alegre.upNo ratings yet

- Survey of Accounting Homework Written AssignmentDocument22 pagesSurvey of Accounting Homework Written AssignmentEMZy ChannelNo ratings yet

- Theories and Problem Solving AKDocument19 pagesTheories and Problem Solving AKJob CastonesNo ratings yet

- Cash 1Document15 pagesCash 1Tin PortuzuelaNo ratings yet

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGANo ratings yet

- Financial Accounting Part 1Document11 pagesFinancial Accounting Part 1christineNo ratings yet

- Theory of Accounts (No Ak)Document10 pagesTheory of Accounts (No Ak)Irish Joy AlaskaNo ratings yet

- 2 Mock FAR 2nd LEDocument9 pages2 Mock FAR 2nd LENatalia LimNo ratings yet

- Ia2 Examination 1 Theories Liabilities and Provisions - CompressDocument3 pagesIa2 Examination 1 Theories Liabilities and Provisions - CompressTRECIA AMOR PAMILARNo ratings yet

- 2 - Receivables Theory of AccountsDocument6 pages2 - Receivables Theory of AccountsandreamrieNo ratings yet

- IntAcc 1 Reviewer - Module 2 (Theories)Document8 pagesIntAcc 1 Reviewer - Module 2 (Theories)Lizette Janiya SumantingNo ratings yet

- ReceivablesDocument7 pagesReceivablesstraw berryNo ratings yet

- 06-Receivables TheoryDocument2 pages06-Receivables TheoryRegenLudevese100% (4)

- Mock Qualifying ExamDocument12 pagesMock Qualifying Examzea givonneNo ratings yet

- Long Quiz No 2 - Financial Statements AnalysisDocument3 pagesLong Quiz No 2 - Financial Statements AnalysisCha FeudoNo ratings yet

- Accounting FinalDocument40 pagesAccounting FinalvarunNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- The Following Three Situations Require Adjusting Journal Entries To PrepareDocument1 pageThe Following Three Situations Require Adjusting Journal Entries To PrepareHassan JanNo ratings yet

- The Following Table Shows The Returns and Valuations of SelectedDocument1 pageThe Following Table Shows The Returns and Valuations of SelectedHassan JanNo ratings yet

- The Ford Construction Company Is Considering Acquiring A New EarthmoverDocument1 pageThe Ford Construction Company Is Considering Acquiring A New EarthmoverHassan JanNo ratings yet

- The Following Problem Will Continue From One Chapter To TheDocument1 pageThe Following Problem Will Continue From One Chapter To TheHassan JanNo ratings yet

- The Following General Ledger Accounts and Additional Information Are TakenDocument1 pageThe Following General Ledger Accounts and Additional Information Are TakenHassan JanNo ratings yet

- The Following Is The Complete Mineral Exploration Development and ExtractionDocument1 pageThe Following Is The Complete Mineral Exploration Development and ExtractionHassan JanNo ratings yet

- The Following List of Accounts Is Taken From The DecemberDocument1 pageThe Following List of Accounts Is Taken From The DecemberHassan JanNo ratings yet

- The Following Is An Extract of Errsea S Balances of PropertyDocument1 pageThe Following Is An Extract of Errsea S Balances of PropertyHassan JanNo ratings yet

- The Following Figures Have Been Extracted From The Accounting RecordsDocument1 pageThe Following Figures Have Been Extracted From The Accounting RecordsHassan JanNo ratings yet

- The Following Is A Letter That I Received From ADocument1 pageThe Following Is A Letter That I Received From AHassan JanNo ratings yet

- The Following Information Is Taken From The Records of EastDocument1 pageThe Following Information Is Taken From The Records of EastHassan JanNo ratings yet

- The Following Data For Schwartz Company Represent A Summary ofDocument1 pageThe Following Data For Schwartz Company Represent A Summary ofHassan JanNo ratings yet

- The Following Information Relates To The Defined Benefits Pension SchemeDocument1 pageThe Following Information Relates To The Defined Benefits Pension SchemeHassan JanNo ratings yet

- The Following Information Has Been Extracted From The Draft FinancialDocument1 pageThe Following Information Has Been Extracted From The Draft FinancialHassan JanNo ratings yet

- The Following Data Has Been Estimated For Macquarie Machinery WhoDocument1 pageThe Following Data Has Been Estimated For Macquarie Machinery WhoHassan JanNo ratings yet

- The Florida Citrus Inc Fci Produces and Veils A HighlyDocument1 pageThe Florida Citrus Inc Fci Produces and Veils A HighlyHassan JanNo ratings yet

- The Following Account Balances For The Year Ended 30th JuneDocument1 pageThe Following Account Balances For The Year Ended 30th JuneHassan JanNo ratings yet

- Negotiable Instruments - Definition and AnalysisDocument5 pagesNegotiable Instruments - Definition and Analysisrajagct100% (1)

- El Tofu de LecheDocument14 pagesEl Tofu de LecheFerian AvenidoNo ratings yet

- Claim VIN Information: Currency: USDDocument1 pageClaim VIN Information: Currency: USDLeonardo Albinagorta ParedesNo ratings yet

- Business Taxation Intro To Consumption Taxes: Anie P. Martinez, Cpa, MbaDocument32 pagesBusiness Taxation Intro To Consumption Taxes: Anie P. Martinez, Cpa, MbaAnie MartinezNo ratings yet

- EHRM in Developing CountriesDocument15 pagesEHRM in Developing CountriescannaizerNo ratings yet

- An Analysis of ClickUp AdDocument4 pagesAn Analysis of ClickUp AdAdewumiNo ratings yet

- Mi LED Smart TV 4A Pro 123.2 CM 49 With Android: Grand Total 28499.00Document1 pageMi LED Smart TV 4A Pro 123.2 CM 49 With Android: Grand Total 28499.00Bharti GuptaNo ratings yet

- Sale of Goods Act, 1930: Question Bank Unit:1Document10 pagesSale of Goods Act, 1930: Question Bank Unit:1gargee thakareNo ratings yet

- 众筹商业计划Document10 pages众筹商业计划afmoirvoxNo ratings yet

- Starting Your Own Private School ?Document4 pagesStarting Your Own Private School ?Shallom allNo ratings yet

- Excel Day 3 WorkfilesDocument31 pagesExcel Day 3 WorkfilesVassish Dassagne100% (2)

- Chapter 5Document27 pagesChapter 5Cristine S. DayaoNo ratings yet

- Joint Venture Account PracticalDocument15 pagesJoint Venture Account Practicalasmita23840No ratings yet

- Certificado de Calidad Codo X 45 GasDocument1 pageCertificado de Calidad Codo X 45 GasJKarlos Barrientos ÑufloNo ratings yet

- Bosch Project 2020 PDFDocument1 pageBosch Project 2020 PDFAvi LimerNo ratings yet

- OutcomeofBoardMeeting10082023 10082023173019Document5 pagesOutcomeofBoardMeeting10082023 10082023173019PM LOgsNo ratings yet

- LEARNING MODULE Entrep Lesson 1-2Document19 pagesLEARNING MODULE Entrep Lesson 1-2Cindy BononoNo ratings yet

- Service Bulletin Atr72: Transmittal Sheet Revision No. 12Document17 pagesService Bulletin Atr72: Transmittal Sheet Revision No. 12Pradeep K sNo ratings yet

- IAS 37 Quizzes (Updated Aug 2021) - Attempt ReviewDocument11 pagesIAS 37 Quizzes (Updated Aug 2021) - Attempt ReviewNguyễn Hữu ThọNo ratings yet

- CRM in Icici BankDocument21 pagesCRM in Icici BankSudil Reddy100% (5)

- REVISED SURVEY FORM AND SOP MSME GDocument6 pagesREVISED SURVEY FORM AND SOP MSME GAzzia Morante LopezNo ratings yet

- 4 5866240566815099684Document10 pages4 5866240566815099684Habteweld EdluNo ratings yet

- Icsi Executive PDFDocument1 pageIcsi Executive PDFKirithika HariharanNo ratings yet

- Packing ListDocument1 pagePacking ListJunior NavarroNo ratings yet

- Capacity and Forecasting HomeworkDocument1 pageCapacity and Forecasting HomeworkReynaldo Dimas FachriNo ratings yet