Professional Documents

Culture Documents

Solved Depreciation Information For Buckingham LTD Is Given in Be9 4 Using

Solved Depreciation Information For Buckingham LTD Is Given in Be9 4 Using

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Depreciation Information For Buckingham LTD Is Given in Be9 4 Using

Solved Depreciation Information For Buckingham LTD Is Given in Be9 4 Using

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) Depreciation information for Buckingham Ltd is

given in BE9 4 Using

Depreciation information for Buckingham Ltd is given in BE9 4 Using Depreciation information

for Buckingham Ltd. is given in BE9-4. Using the diminishing-balance method and assuming the

depreciation rate is equal to one time the straight-line rate, calculate the depreciation (a) For

2012 and 2013, (b) In total over the […]

Buckingham Ltd purchases a delivery truck on January 1 2012 Buckingham Ltd. purchases a

delivery truck on January 1, 2012, at a cost of $86,000. The truck is expected to have a residual

value of $6,000 at the end of its four-year useful life. Buckingham has a December 31 year […]

Basler Ltd incurs these expenditures in purchasing a truck invoice Basler Ltd. incurs these

expenditures in purchasing a truck: invoice price $42,000; installation of a trailer hitch $1,000;

one-year accident insurance policy $2,000; motor vehicle licence $150; painting and lettering

$750. What is the cost of the truck? Basler Ltd […]

Gildan Activewear Inc reported net sales in U S millions of Gildan Activewear Inc. reported net

sales (in U.S. millions) of $1,311 in 2010 and $1,038 in 2009. The company also reported a

profit of $198 in 2010 and $95 in 2009. Assets at the end of 2010 were $1,321; […]

GET ANSWER- https://accanswer.com/downloads/page/1796/

Surkis Corporation purchased a patent for 180 000 cash on April Surkis Corporation purchased

a patent for $180,000 cash on April 2, 2012. Its legal life is 20 years and its estimated useful life

is 10 years. (a) Prepare the journal entry to record the (1) Purchase of the patent […]

Johnson Limited sells office equipment on September 30 2012 for Johnson Limited sells office

equipment on September 30, 2012, for $42,000 cash. The office equipment originally cost

$144,000 when purchased on January 1, 2009. It has an estimated residual value of $4,000 and

a useful life of five years. Depreciation […]

Tibble Corporation recently determined that the recoverable value of one Tibble Corporation

recently determined that the recoverable value of one of its milling machines is less than its

current carrying amount. In addition, the machine’s useful life is now expected to be three years

less than what the company had […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1796/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- IFRS Edition (2nd) : Plant Assets, Natural Resources, and Intangible AssetsDocument62 pagesIFRS Edition (2nd) : Plant Assets, Natural Resources, and Intangible Assetsmajestic accounting100% (1)

- Predictive Modeling Business ReportDocument69 pagesPredictive Modeling Business Reportpreeti100% (3)

- PROBLEM 10.1 (Teori Akuntansi)Document1 pagePROBLEM 10.1 (Teori Akuntansi)reska darmawatiNo ratings yet

- Solved Jesse Owns A Duplex Used As Residential Rental Property TheDocument1 pageSolved Jesse Owns A Duplex Used As Residential Rental Property TheAnbu jaromiaNo ratings yet

- Solved Tred America Inc Manufactures Tires For Large Auto Companies It UsesDocument1 pageSolved Tred America Inc Manufactures Tires For Large Auto Companies It UsesAnbu jaromiaNo ratings yet

- Soal Kuis Asistensi AK1 Setelah UTSDocument6 pagesSoal Kuis Asistensi AK1 Setelah UTSManggala Patria WicaksonoNo ratings yet

- Solved Lento Inc Owned Machinery With A 30 000 Initial Cost BasisDocument1 pageSolved Lento Inc Owned Machinery With A 30 000 Initial Cost BasisAnbu jaromiaNo ratings yet

- Lecture Note DepreciationDocument7 pagesLecture Note DepreciationRia Athirah100% (2)

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Bug Dan Proxy SimCard Indosat TerbaruDocument2 pagesBug Dan Proxy SimCard Indosat TerbaruFajar MaulanaNo ratings yet

- Solved Pitt Reported The Following Information For 2018 and 2019 Required Compute Pitt SDocument1 pageSolved Pitt Reported The Following Information For 2018 and 2019 Required Compute Pitt SAnbu jaromiaNo ratings yet

- Solved Westjet Airlines LTD Leases Aircraft and When Doing So TheDocument1 pageSolved Westjet Airlines LTD Leases Aircraft and When Doing So TheAnbu jaromiaNo ratings yet

- Solved Nolan Inc Had Taxable Income of 400 000 in 2019 ItsDocument1 pageSolved Nolan Inc Had Taxable Income of 400 000 in 2019 ItsAnbu jaromiaNo ratings yet

- AIS16Exercises SCDocument6 pagesAIS16Exercises SCSarah GherdaouiNo ratings yet

- Solved On January 1 2019 Lemoyne Construction Company Signs A ContractDocument1 pageSolved On January 1 2019 Lemoyne Construction Company Signs A ContractAnbu jaromiaNo ratings yet

- Solved On January 2 2018 David Corporation Purchased A Patent ForDocument1 pageSolved On January 2 2018 David Corporation Purchased A Patent ForAnbu jaromiaNo ratings yet

- Solved Keystone Corporation Issued 1 Million of Five Year 5 Bonds DatedDocument1 pageSolved Keystone Corporation Issued 1 Million of Five Year 5 Bonds DatedAnbu jaromiaNo ratings yet

- Solved Akshay Limited Uses The Average Cost Formula in A Perpetual PDFDocument1 pageSolved Akshay Limited Uses The Average Cost Formula in A Perpetual PDFAnbu jaromiaNo ratings yet

- Solved Skiles Company S Weekly Payroll Amounts To 15 000 and Payday IsDocument1 pageSolved Skiles Company S Weekly Payroll Amounts To 15 000 and Payday IsAnbu jaromiaNo ratings yet

- Exercise On Chapter 2Document2 pagesExercise On Chapter 2Anwar Adem100% (3)

- Solved The Trial Balances of Orton Company Follow With The AccountsDocument1 pageSolved The Trial Balances of Orton Company Follow With The AccountsAnbu jaromiaNo ratings yet

- CH 09Document101 pagesCH 09Armand Muhammad100% (1)

- Solved Java Hut Leased A Specialty Expresso Machine For A 10 YearDocument1 pageSolved Java Hut Leased A Specialty Expresso Machine For A 10 YearAnbu jaromiaNo ratings yet

- "A" Level Accounting: DepreciationDocument7 pages"A" Level Accounting: DepreciationTARMAK MC LYONNo ratings yet

- Solved Crane and Loon Corporations Two Unrelated C Corporations Have TheDocument1 pageSolved Crane and Loon Corporations Two Unrelated C Corporations Have TheAnbu jaromiaNo ratings yet

- Solved Cost and Fair Value For The Trading Investments of KootenayDocument1 pageSolved Cost and Fair Value For The Trading Investments of KootenayAnbu jaromiaNo ratings yet

- CH 09Document98 pagesCH 09Ismadth2918388100% (1)

- Quiz 1Document4 pagesQuiz 1Ming Le YapNo ratings yet

- Basic Lessee Accounting With Difficult PV Calculation in 2009 PDFDocument1 pageBasic Lessee Accounting With Difficult PV Calculation in 2009 PDFAnbu jaromiaNo ratings yet

- Solved Return To The Rona Delivery Truck Example in Exhibit 10 5Document1 pageSolved Return To The Rona Delivery Truck Example in Exhibit 10 5Anbu jaromiaNo ratings yet

- Solved With A Purchase Price of 350 000 A Small Warehouse ProvidesDocument1 pageSolved With A Purchase Price of 350 000 A Small Warehouse ProvidesM Bilal SaleemNo ratings yet

- Solved The Following Information Is Available For Bernard Corporation For 2019 Required 1Document1 pageSolved The Following Information Is Available For Bernard Corporation For 2019 Required 1Anbu jaromiaNo ratings yet

- Recitation #9Document5 pagesRecitation #9wtfNo ratings yet

- Financial - Corporate - Reporting Dec-11Document5 pagesFinancial - Corporate - Reporting Dec-11SHEIKH MOHAMMAD KAUSARUL ALAMNo ratings yet

- Solved Mclelland Inc Reported Net Income of 175 000 For 2019 andDocument1 pageSolved Mclelland Inc Reported Net Income of 175 000 For 2019 andAnbu jaromiaNo ratings yet

- Solved During 2015 Rita Acquired and Placed in Service Two AssetsDocument1 pageSolved During 2015 Rita Acquired and Placed in Service Two AssetsAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- BF 220 Assignment 2 2020 EvDocument5 pagesBF 220 Assignment 2 2020 EvEmmanuel MwapeNo ratings yet

- Tutorial Six Questions: Prepare Answers To Questions 1 and 6Document1 pageTutorial Six Questions: Prepare Answers To Questions 1 and 6Jimoh AladeNo ratings yet

- Solved All of The Following Statements Regarding Leases Are True Except PDFDocument1 pageSolved All of The Following Statements Regarding Leases Are True Except PDFAnbu jaromiaNo ratings yet

- Accounting Test LDocument7 pagesAccounting Test LmukungurutsepearsonNo ratings yet

- Solved Ashley Projects That She Can Get 100 000 Cash Per Year PDFDocument1 pageSolved Ashley Projects That She Can Get 100 000 Cash Per Year PDFAnbu jaromiaNo ratings yet

- Solved Kouchibouguac Inc Reports The Following Costs and Fair Values ForDocument1 pageSolved Kouchibouguac Inc Reports The Following Costs and Fair Values ForAnbu jaromiaNo ratings yet

- Solved Predict GDP Growth in India and Japan For 2017 Utilizing ADocument1 pageSolved Predict GDP Growth in India and Japan For 2017 Utilizing AAnbu jaromiaNo ratings yet

- CH 09Document83 pagesCH 09JesussNo ratings yet

- Sultan Kudarat State University Applied AuditingDocument4 pagesSultan Kudarat State University Applied Auditingjembot dawatonNo ratings yet

- Pset 4Document3 pagesPset 4Ahmed AltohamyNo ratings yet

- Acc 201 CH 9Document7 pagesAcc 201 CH 9Trickster TwelveNo ratings yet

- Solved Watkins Inc Acquires All of The Outstanding Stock of GlenDocument1 pageSolved Watkins Inc Acquires All of The Outstanding Stock of GlenAnbu jaromiaNo ratings yet

- Plant Assets, Natural Resources, and Intangible AssetsDocument82 pagesPlant Assets, Natural Resources, and Intangible AssetsRachelleen RodriguezNo ratings yet

- Running Head: TAXATION LAWDocument8 pagesRunning Head: TAXATION LAWPatrick Panlilio RetuyaNo ratings yet

- Leases - Brief ExercisesDocument5 pagesLeases - Brief ExercisesPeachyNo ratings yet

- Handout 3 - Plant Assets, Natural Resources, and Intangible AssetsDocument81 pagesHandout 3 - Plant Assets, Natural Resources, and Intangible Assetsyoussef abdellatifNo ratings yet

- CH 09Document95 pagesCH 09TIFFANNY SHELIANo ratings yet

- Accounting Principles: Plant Assets, Natural Resources, and Intangible AssetsDocument79 pagesAccounting Principles: Plant Assets, Natural Resources, and Intangible AssetsThế VinhNo ratings yet

- Bab 3 Chapter 12 PDFDocument4 pagesBab 3 Chapter 12 PDFGrifyn IfyNo ratings yet

- Solved Margo A Calendar Year Taxpayer Paid 80 000 For Machinery Seven YearDocument1 pageSolved Margo A Calendar Year Taxpayer Paid 80 000 For Machinery Seven YearAnbu jaromiaNo ratings yet

- Solved A Company Manufacturing Hockey Bags Registered Trademarks For 1 000 Cash PDFDocument1 pageSolved A Company Manufacturing Hockey Bags Registered Trademarks For 1 000 Cash PDFAnbu jaromiaNo ratings yet

- Solved Refer To The Data in Starter 11 1 Show What MissionDocument1 pageSolved Refer To The Data in Starter 11 1 Show What MissionAnbu jaromiaNo ratings yet

- Solved in The Month of November Its First Month of OperationsDocument1 pageSolved in The Month of November Its First Month of OperationsAnbu jaromiaNo ratings yet

- At The Beginning of The Fiscal Year The Borland CompanyDocument1 pageAt The Beginning of The Fiscal Year The Borland CompanyTaimour HassanNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument56 pagesThis Paper Is Not To Be Removed From The Examination HallsDương DươngNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Mastery 3 (MIL)Document2 pagesMastery 3 (MIL)Jude Mandal MetanteNo ratings yet

- Revision Process of MeasurementDocument3 pagesRevision Process of MeasurementAISHAH IWANI BINTI ZULKARNAIN A22DW0732No ratings yet

- Outline of ISF2024Document10 pagesOutline of ISF2024Matias JavierNo ratings yet

- Decree 4725 of 2005: RequirementsDocument1 pageDecree 4725 of 2005: Requirementsapi-541617564No ratings yet

- Mass Spectrometric Studies On Selective Androgen Receptor Modulators (Sarms) Using Electron Ionization and Electrospray Ionization/Collision-Induced DissociationDocument12 pagesMass Spectrometric Studies On Selective Androgen Receptor Modulators (Sarms) Using Electron Ionization and Electrospray Ionization/Collision-Induced DissociationA O 10No ratings yet

- Etabs Structural House DesignDocument11 pagesEtabs Structural House DesignDennis KorirNo ratings yet

- Transportation Engineering ThesisDocument75 pagesTransportation Engineering ThesisMichelleDaarolNo ratings yet

- Lecture Three Actuators ObjectivesDocument5 pagesLecture Three Actuators ObjectivesKenani SaningaNo ratings yet

- 2X100V 500W Audio Amplifier SMPS Power Supply - Electronics Projects CircuitsDocument2 pages2X100V 500W Audio Amplifier SMPS Power Supply - Electronics Projects CircuitsK. RAJA SEKARNo ratings yet

- Effect of Taxes and Subsidies On Market EquilibriumDocument16 pagesEffect of Taxes and Subsidies On Market EquilibriumPrasetyo HartantoNo ratings yet

- KPM ProposalDocument3 pagesKPM Proposalzen.livemeNo ratings yet

- CVP AnalysisDocument39 pagesCVP AnalysisIvy Marie DicoNo ratings yet

- Hdk790exii 79exiiDocument8 pagesHdk790exii 79exiiAndre MarquesNo ratings yet

- FortiClient v5.2.0 Windows Release NotesDocument19 pagesFortiClient v5.2.0 Windows Release NotesnexrothNo ratings yet

- LV059Document136 pagesLV059Boris KoganNo ratings yet

- Request of National Committee On Legal Aid To Exempt Legal Aid Clients From Paying Filing, DocketDocument23 pagesRequest of National Committee On Legal Aid To Exempt Legal Aid Clients From Paying Filing, DocketMarites regaliaNo ratings yet

- Dandi MarchDocument3 pagesDandi March27911No ratings yet

- Sojib VaiDocument2 pagesSojib VaiPeash Mredha80% (5)

- Competency Question For UHP ProjectDocument6 pagesCompetency Question For UHP ProjectAshkar Ahamad100% (1)

- Elitmus Syllabus and Question Paper PatternDocument5 pagesElitmus Syllabus and Question Paper PatternAbhishek MohanNo ratings yet

- 2021 Exam BramhastraDocument5,530 pages2021 Exam BramhastraRed VelvetNo ratings yet

- TMS320x28xx, 28xxx DSP Serial Communication Interface (SCI) Reference GuideDocument52 pagesTMS320x28xx, 28xxx DSP Serial Communication Interface (SCI) Reference GuidesudhacarhrNo ratings yet

- Convolutional Neural Networks in Computer Vision: Jochen LangDocument46 pagesConvolutional Neural Networks in Computer Vision: Jochen LangZichao ZhangNo ratings yet

- AITS Scholarship Criterion NCRPDocument1 pageAITS Scholarship Criterion NCRPVaibhav SinghNo ratings yet

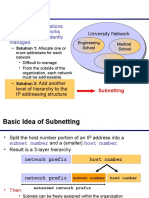

- Lect 2-Intro To SubnettingDocument11 pagesLect 2-Intro To Subnettingapi-358658237No ratings yet

- Well and Testing From Fekete and EngiDocument6 pagesWell and Testing From Fekete and EngiRovshan1988No ratings yet

- The Perfect Wedding Planner - Basic InviteDocument99 pagesThe Perfect Wedding Planner - Basic Invitemihaela neacsu100% (2)

- 79.2 People v. FranklinDocument1 page79.2 People v. FranklinluigimanzanaresNo ratings yet