Professional Documents

Culture Documents

Solved Draw A T Account For Mark Beckham Capital and Post

Solved Draw A T Account For Mark Beckham Capital and Post

Uploaded by

Anbu jaromiaCopyright:

Available Formats

You might also like

- Computation of Taxable Income and Tax After General Reductions For CorporationsDocument35 pagesComputation of Taxable Income and Tax After General Reductions For Corporationsjahcaveman75% (4)

- Deacc506 23241 1Document2 pagesDeacc506 23241 1Sants ShadyNo ratings yet

- Final Upload Buad 280 Practice Exam Midterm 3Document7 pagesFinal Upload Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- Acc 211 MidtermDocument8 pagesAcc 211 MidtermRinaldi Sinaga100% (2)

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Scrum Master Certification Q & ADocument68 pagesScrum Master Certification Q & Aoraappsk0% (1)

- Implications of Market PricingDocument21 pagesImplications of Market PricingOrly Abilar93% (15)

- Solved From The Trial Balance of Girtie Lillis Attorney at Law Given inDocument1 pageSolved From The Trial Balance of Girtie Lillis Attorney at Law Given inAnbu jaromiaNo ratings yet

- Solved Robbins Inc Owns The Following Assets at The Balance SheetDocument1 pageSolved Robbins Inc Owns The Following Assets at The Balance SheetAnbu jaromiaNo ratings yet

- Solved Mchale Company Does Business in Two Customer Segments Retail andDocument1 pageSolved Mchale Company Does Business in Two Customer Segments Retail andAnbu jaromiaNo ratings yet

- Solved From The General Journal in Figure 10 29 Record To TheDocument1 pageSolved From The General Journal in Figure 10 29 Record To TheAnbu jaromiaNo ratings yet

- Solved On June 1 2012 One Planet Cosmetics Corp Was FormedDocument1 pageSolved On June 1 2012 One Planet Cosmetics Corp Was FormedAnbu jaromiaNo ratings yet

- Solved From The Following Trial Balance Figure 4 19 and Adjustment DataDocument1 pageSolved From The Following Trial Balance Figure 4 19 and Adjustment DataAnbu jaromiaNo ratings yet

- Solved From The General Journal in Figure 9 15 Record To TheDocument1 pageSolved From The General Journal in Figure 9 15 Record To TheAnbu jaromiaNo ratings yet

- Solved On September 30 Hilltop Company S Selected Payroll Accounts Are AsDocument1 pageSolved On September 30 Hilltop Company S Selected Payroll Accounts Are AsAnbu jaromiaNo ratings yet

- Solved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500Document1 pageSolved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500Anbu jaromiaNo ratings yet

- Solved On The Basis of The Following Data A Journalize TheDocument1 pageSolved On The Basis of The Following Data A Journalize TheAnbu jaromiaNo ratings yet

- Homeworks 1 and 2Document4 pagesHomeworks 1 and 2danterozaNo ratings yet

- (Answered) Charles Edward Company Established A Subsidiary in A Foreign CountryDocument3 pages(Answered) Charles Edward Company Established A Subsidiary in A Foreign CountryCharlotteNo ratings yet

- Solved Sean Nah The Bookkeeper For Revell Co Received A BankDocument1 pageSolved Sean Nah The Bookkeeper For Revell Co Received A BankAnbu jaromiaNo ratings yet

- Solved The Cost of Piper Music Inc S Inventory at December 31Document1 pageSolved The Cost of Piper Music Inc S Inventory at December 31Anbu jaromiaNo ratings yet

- Fundamentals of Accounting IDocument7 pagesFundamentals of Accounting IDawit TilahunNo ratings yet

- Final Answer Key Buad 280 Practice Exam Midterm 3Document7 pagesFinal Answer Key Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Rockwell Inc Reported The Following Results For The Year EndedDocument1 pageSolved Rockwell Inc Reported The Following Results For The Year EndedAnbu jaromiaNo ratings yet

- Solved Selected Accounts From Betts LTD S General Ledger Are Presented BelowDocument1 pageSolved Selected Accounts From Betts LTD S General Ledger Are Presented BelowAnbu jaromiaNo ratings yet

- Solved The Following Trial Balance That Was Prepared by The BookkeeperDocument1 pageSolved The Following Trial Balance That Was Prepared by The BookkeeperAnbu jaromiaNo ratings yet

- EMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Document4 pagesEMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Sheraz KhalilNo ratings yet

- Talon Inc Includes The Following Selected Accounts in Its GeneralDocument1 pageTalon Inc Includes The Following Selected Accounts in Its GeneralBube KachevskaNo ratings yet

- QUIZ - MicroeconomiaDocument7 pagesQUIZ - MicroeconomiaTANIA ANDREA NAVARRO QUINTERONo ratings yet

- Student NameDocument16 pagesStudent NameishwarsumeetNo ratings yet

- Solved Selected Ratios For Giasson Corporation Are As Follows Instructions A Identify IfDocument1 pageSolved Selected Ratios For Giasson Corporation Are As Follows Instructions A Identify IfAnbu jaromiaNo ratings yet

- These Instructions May Result in A Failing GradeDocument18 pagesThese Instructions May Result in A Failing GradeZenni T XinNo ratings yet

- Solved From The Partial Worksheet For Josh S Supplies in Figure 12 15Document1 pageSolved From The Partial Worksheet For Josh S Supplies in Figure 12 15Anbu jaromiaNo ratings yet

- Assume That You Are The President of Propane Company atDocument1 pageAssume That You Are The President of Propane Company atM Bilal SaleemNo ratings yet

- Accounting Chapter 3 William HakaDocument6 pagesAccounting Chapter 3 William HakaBilal AhmadNo ratings yet

- Solved Review The Transactions Listed in E3 1 For Wolfe LTD Instructions Classify EachDocument1 pageSolved Review The Transactions Listed in E3 1 For Wolfe LTD Instructions Classify EachAnbu jaromiaNo ratings yet

- Solved Production Costs Chargeable To The Finishing Department in June atDocument1 pageSolved Production Costs Chargeable To The Finishing Department in June atAnbu jaromiaNo ratings yet

- Accountancy Extra PointsDocument14 pagesAccountancy Extra PointsRishav KuriNo ratings yet

- In Preparing For Next Year Tony Freedman Has Hired TwoDocument1 pageIn Preparing For Next Year Tony Freedman Has Hired TwoHassan JanNo ratings yet

- Solved Complete The Following Account Category Normal Balance ADocument1 pageSolved Complete The Following Account Category Normal Balance AAnbu jaromiaNo ratings yet

- CH 13Document6 pagesCH 13Zahid AkhtarNo ratings yet

- Chapter 9.docpart 1 FinalDocument15 pagesChapter 9.docpart 1 FinalRabie HarounNo ratings yet

- Correct Response Answer ChoicesDocument11 pagesCorrect Response Answer ChoicesArjay Dela PenaNo ratings yet

- Solved The Trial Balances of Orton Company Follow With The AccountsDocument1 pageSolved The Trial Balances of Orton Company Follow With The AccountsAnbu jaromiaNo ratings yet

- Solved Given The Following Facts About Sammie Bright Calculate His PreliminaryDocument1 pageSolved Given The Following Facts About Sammie Bright Calculate His PreliminaryAnbu jaromiaNo ratings yet

- Solved These Items Are Taken From The Financial Statements of Summit SDocument1 pageSolved These Items Are Taken From The Financial Statements of Summit SAnbu jaromiaNo ratings yet

- Account Receivable PresentationDocument34 pagesAccount Receivable PresentationYakub Immanuel SaputraNo ratings yet

- Multiple Choice Questions 1 Which of The Following Statements Is True A UnderDocument2 pagesMultiple Choice Questions 1 Which of The Following Statements Is True A UnderHassan JanNo ratings yet

- Chapter 3 Quick StudyDocument10 pagesChapter 3 Quick StudyPhạm Hồng Trang Alice -No ratings yet

- PDF Accounting Tools For Business Decision Making 6Th Edition Kimmel Solutions Manual Online Ebook Full ChapterDocument31 pagesPDF Accounting Tools For Business Decision Making 6Th Edition Kimmel Solutions Manual Online Ebook Full Chapterdennis.morris280100% (11)

- Accounting Paper 1 Dec 2015Document11 pagesAccounting Paper 1 Dec 2015Sudhan NairNo ratings yet

- ACTG115 - Ch04 SolutionsDocument14 pagesACTG115 - Ch04 SolutionsxxmbetaNo ratings yet

- Quiz 1Document9 pagesQuiz 1xcrunner61No ratings yet

- FMGT 1100 CH 3 Lecture Notes MatthewDocument16 pagesFMGT 1100 CH 3 Lecture Notes MatthewSophia RosieeNo ratings yet

- Adjustments Short CasesDocument1 pageAdjustments Short CasesMahmoud OkashaNo ratings yet

- Accounting Process With AnsDocument6 pagesAccounting Process With AnsMichael BongalontaNo ratings yet

- Cost and MGT Acct II Group-Assignment TayeDocument4 pagesCost and MGT Acct II Group-Assignment TayeSelamawit AssefaNo ratings yet

- Hhtfa8e ch03 SMDocument119 pagesHhtfa8e ch03 SMharryNo ratings yet

- Computation of Taxable Income and Tax After General Reductions For CorporationsDocument20 pagesComputation of Taxable Income and Tax After General Reductions For CorporationsKiều Thảo Anh100% (1)

- Solved in The Month of November Its First Month of OperationsDocument1 pageSolved in The Month of November Its First Month of OperationsAnbu jaromiaNo ratings yet

- Certified College of Accountancy's Mock Exam: PAPER: Financial Accounting (FA)Document10 pagesCertified College of Accountancy's Mock Exam: PAPER: Financial Accounting (FA)Chaiz MineNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- GIBX-SPAC and GIBXChange and GIBXSWAP Brothers Meet The WorldDocument4 pagesGIBX-SPAC and GIBXChange and GIBXSWAP Brothers Meet The WorldGIBX SPACNo ratings yet

- G12 Principles of MKTG Q2WK2 ABCDwith AnswerKeyDocument9 pagesG12 Principles of MKTG Q2WK2 ABCDwith AnswerKeyElla Marie LagosNo ratings yet

- Modern Biology: SectionDocument3 pagesModern Biology: SectionpkNo ratings yet

- Bfad RequirementsDocument2 pagesBfad RequirementsAleli Bautista67% (3)

- Cleaning Company ProfileDocument1 pageCleaning Company Profilebatousai1900No ratings yet

- Contract of UsufructDocument3 pagesContract of UsufructPatrick Angelo GutierrezNo ratings yet

- Makalah B.inggrisDocument15 pagesMakalah B.inggrisMuhammadnur AzizNo ratings yet

- Phieu Làm Bai TIEU LUAN ML160162Document3 pagesPhieu Làm Bai TIEU LUAN ML160162Nguyễn Thị Mỹ NgọcNo ratings yet

- Gemini Air CargoDocument34 pagesGemini Air CargoMichael PietrobonoNo ratings yet

- Bharati Airtel and Fayol's PrincipalDocument17 pagesBharati Airtel and Fayol's PrincipalAmit Vijay73% (45)

- CEA 2023 NotificationDocument5 pagesCEA 2023 Notificationrama chandra marndiNo ratings yet

- Cost Volume Profit AnalysisDocument18 pagesCost Volume Profit AnalysisLea GaacNo ratings yet

- Formulas To Know For EXAM: Activity & Project Duration FormulasDocument5 pagesFormulas To Know For EXAM: Activity & Project Duration FormulasMMNo ratings yet

- How We Are Getting Digital????????: Presented By: Dr. Ruchi Jain GargDocument59 pagesHow We Are Getting Digital????????: Presented By: Dr. Ruchi Jain GargDrRuchi GargNo ratings yet

- Essentials of Business Statistics Communicating With NumbersDocument19 pagesEssentials of Business Statistics Communicating With NumbersRoendianda Arfen0% (1)

- 94-Article Text-549-1-10-20191123 PDFDocument12 pages94-Article Text-549-1-10-20191123 PDFFitri AniNo ratings yet

- Problem Detail Before After: Su2I Mirror Assy LH Empty Bin Moved With Child Part 28.10.2022 - In-HouseDocument1 pageProblem Detail Before After: Su2I Mirror Assy LH Empty Bin Moved With Child Part 28.10.2022 - In-HousePalani KumarNo ratings yet

- Group 1 - Case 6 - Thomas Green Power Office Poiltics and A Career in CrisisDocument22 pagesGroup 1 - Case 6 - Thomas Green Power Office Poiltics and A Career in CrisishestiyaaNo ratings yet

- Marketing Management SyllabusDocument5 pagesMarketing Management SyllabusHannah jean Enabe100% (1)

- Atta Chakki PlantDocument77 pagesAtta Chakki PlantarifmukhtarNo ratings yet

- Principle - of - Econ - HW1 (Solution)Document8 pagesPrinciple - of - Econ - HW1 (Solution)Md Fiyadul IslamNo ratings yet

- Payslip 20230417170111Document2 pagesPayslip 20230417170111Iragavan IndraNo ratings yet

- Ebcl Part 1Document72 pagesEbcl Part 1Aman GuttaNo ratings yet

- Retail Audit: Essentials of E-RetailingDocument6 pagesRetail Audit: Essentials of E-RetailingShivangi JainNo ratings yet

- Milestone 2 CompressedDocument14 pagesMilestone 2 CompressedjulianayfutalanNo ratings yet

- Flash CourierDocument19 pagesFlash Couriereaglewatch99No ratings yet

- Hoozan Pirozmand ResumeDocument1 pageHoozan Pirozmand Resumelnvraman4570No ratings yet

Solved Draw A T Account For Mark Beckham Capital and Post

Solved Draw A T Account For Mark Beckham Capital and Post

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Draw A T Account For Mark Beckham Capital and Post

Solved Draw A T Account For Mark Beckham Capital and Post

Uploaded by

Anbu jaromiaCopyright:

Available Formats

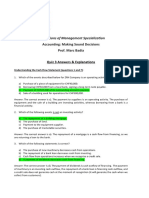

(SOLVED) Draw a T account for Mark Beckham Capital and

post

Draw a T account for Mark Beckham Capital and post Draw a T account for Mark Beckham,

Capital, and post to it all entries from Question 3 that affect it. What is the final balance of the

Capital account? In Question 3 Draw a T account for Mark Beckham Capital […]

From the following accounts journalize the closing entries assume December From the following

accounts, journalize the closing entries (assume December 31). From the following accounts

journalize the closing entries assume December

Explain the four steps of the closing process given the Explain the four steps of the closing

process given the following: May 31 ending balance, before closing Fees Earned

…………………………………….. $ 200 Rent Expense …………………………………… 350 Advertising E

60 T. Molanaro, Capital ……………………………. 3,000 T. Molanaro, Withdrawals ……………………… 4

Post the following adjusting entries that came from the adjustments Post the following adjusting

entries that came from the adjustments section of the following worksheet to the T accounts and

be sure to cross-reference back to the journal. Post the following adjusting entries that came

from the adjustments

GET ANSWER- https://accanswer.com/downloads/page/1971/

Burton Fish is the purchasing agent for Lyle Co One Burton Fish is the purchasing agent for

Lyle Co. One of his suppliers, Grant Co., offers Burton a free vacation to Spain if he buys at

least 50% of Lyle’s supplies from Grant Co. Burton, who is angry because Lyle […]

From the following trial balance Figure 4 20 and adjustment data From the following trial

balance (Figure 4.20) and adjustment data, complete a worksheet for J. Tutle as of March 31,

201X: a. Depreciation expense, store equipment, $1. b. Insurance expired, $1. c. Store supplies

on hand, $7. d. Wages […]

From the following adjustment data calculate the adjustment amount and From the following

adjustment data, calculate the adjustment amount and record appropriate debits or credits: a.

Supplies purchased, $1,000. Supplies on hand, $50. b. Store equipment, $10,000. Accumulated

depreciation, store equipment, before adjustment, $1,100. Depreciation expense, store

equipment, $300. From […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1971/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Computation of Taxable Income and Tax After General Reductions For CorporationsDocument35 pagesComputation of Taxable Income and Tax After General Reductions For Corporationsjahcaveman75% (4)

- Deacc506 23241 1Document2 pagesDeacc506 23241 1Sants ShadyNo ratings yet

- Final Upload Buad 280 Practice Exam Midterm 3Document7 pagesFinal Upload Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- Acc 211 MidtermDocument8 pagesAcc 211 MidtermRinaldi Sinaga100% (2)

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Scrum Master Certification Q & ADocument68 pagesScrum Master Certification Q & Aoraappsk0% (1)

- Implications of Market PricingDocument21 pagesImplications of Market PricingOrly Abilar93% (15)

- Solved From The Trial Balance of Girtie Lillis Attorney at Law Given inDocument1 pageSolved From The Trial Balance of Girtie Lillis Attorney at Law Given inAnbu jaromiaNo ratings yet

- Solved Robbins Inc Owns The Following Assets at The Balance SheetDocument1 pageSolved Robbins Inc Owns The Following Assets at The Balance SheetAnbu jaromiaNo ratings yet

- Solved Mchale Company Does Business in Two Customer Segments Retail andDocument1 pageSolved Mchale Company Does Business in Two Customer Segments Retail andAnbu jaromiaNo ratings yet

- Solved From The General Journal in Figure 10 29 Record To TheDocument1 pageSolved From The General Journal in Figure 10 29 Record To TheAnbu jaromiaNo ratings yet

- Solved On June 1 2012 One Planet Cosmetics Corp Was FormedDocument1 pageSolved On June 1 2012 One Planet Cosmetics Corp Was FormedAnbu jaromiaNo ratings yet

- Solved From The Following Trial Balance Figure 4 19 and Adjustment DataDocument1 pageSolved From The Following Trial Balance Figure 4 19 and Adjustment DataAnbu jaromiaNo ratings yet

- Solved From The General Journal in Figure 9 15 Record To TheDocument1 pageSolved From The General Journal in Figure 9 15 Record To TheAnbu jaromiaNo ratings yet

- Solved On September 30 Hilltop Company S Selected Payroll Accounts Are AsDocument1 pageSolved On September 30 Hilltop Company S Selected Payroll Accounts Are AsAnbu jaromiaNo ratings yet

- Solved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500Document1 pageSolved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500Anbu jaromiaNo ratings yet

- Solved On The Basis of The Following Data A Journalize TheDocument1 pageSolved On The Basis of The Following Data A Journalize TheAnbu jaromiaNo ratings yet

- Homeworks 1 and 2Document4 pagesHomeworks 1 and 2danterozaNo ratings yet

- (Answered) Charles Edward Company Established A Subsidiary in A Foreign CountryDocument3 pages(Answered) Charles Edward Company Established A Subsidiary in A Foreign CountryCharlotteNo ratings yet

- Solved Sean Nah The Bookkeeper For Revell Co Received A BankDocument1 pageSolved Sean Nah The Bookkeeper For Revell Co Received A BankAnbu jaromiaNo ratings yet

- Solved The Cost of Piper Music Inc S Inventory at December 31Document1 pageSolved The Cost of Piper Music Inc S Inventory at December 31Anbu jaromiaNo ratings yet

- Fundamentals of Accounting IDocument7 pagesFundamentals of Accounting IDawit TilahunNo ratings yet

- Final Answer Key Buad 280 Practice Exam Midterm 3Document7 pagesFinal Answer Key Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Rockwell Inc Reported The Following Results For The Year EndedDocument1 pageSolved Rockwell Inc Reported The Following Results For The Year EndedAnbu jaromiaNo ratings yet

- Solved Selected Accounts From Betts LTD S General Ledger Are Presented BelowDocument1 pageSolved Selected Accounts From Betts LTD S General Ledger Are Presented BelowAnbu jaromiaNo ratings yet

- Solved The Following Trial Balance That Was Prepared by The BookkeeperDocument1 pageSolved The Following Trial Balance That Was Prepared by The BookkeeperAnbu jaromiaNo ratings yet

- EMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Document4 pagesEMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Sheraz KhalilNo ratings yet

- Talon Inc Includes The Following Selected Accounts in Its GeneralDocument1 pageTalon Inc Includes The Following Selected Accounts in Its GeneralBube KachevskaNo ratings yet

- QUIZ - MicroeconomiaDocument7 pagesQUIZ - MicroeconomiaTANIA ANDREA NAVARRO QUINTERONo ratings yet

- Student NameDocument16 pagesStudent NameishwarsumeetNo ratings yet

- Solved Selected Ratios For Giasson Corporation Are As Follows Instructions A Identify IfDocument1 pageSolved Selected Ratios For Giasson Corporation Are As Follows Instructions A Identify IfAnbu jaromiaNo ratings yet

- These Instructions May Result in A Failing GradeDocument18 pagesThese Instructions May Result in A Failing GradeZenni T XinNo ratings yet

- Solved From The Partial Worksheet For Josh S Supplies in Figure 12 15Document1 pageSolved From The Partial Worksheet For Josh S Supplies in Figure 12 15Anbu jaromiaNo ratings yet

- Assume That You Are The President of Propane Company atDocument1 pageAssume That You Are The President of Propane Company atM Bilal SaleemNo ratings yet

- Accounting Chapter 3 William HakaDocument6 pagesAccounting Chapter 3 William HakaBilal AhmadNo ratings yet

- Solved Review The Transactions Listed in E3 1 For Wolfe LTD Instructions Classify EachDocument1 pageSolved Review The Transactions Listed in E3 1 For Wolfe LTD Instructions Classify EachAnbu jaromiaNo ratings yet

- Solved Production Costs Chargeable To The Finishing Department in June atDocument1 pageSolved Production Costs Chargeable To The Finishing Department in June atAnbu jaromiaNo ratings yet

- Accountancy Extra PointsDocument14 pagesAccountancy Extra PointsRishav KuriNo ratings yet

- In Preparing For Next Year Tony Freedman Has Hired TwoDocument1 pageIn Preparing For Next Year Tony Freedman Has Hired TwoHassan JanNo ratings yet

- Solved Complete The Following Account Category Normal Balance ADocument1 pageSolved Complete The Following Account Category Normal Balance AAnbu jaromiaNo ratings yet

- CH 13Document6 pagesCH 13Zahid AkhtarNo ratings yet

- Chapter 9.docpart 1 FinalDocument15 pagesChapter 9.docpart 1 FinalRabie HarounNo ratings yet

- Correct Response Answer ChoicesDocument11 pagesCorrect Response Answer ChoicesArjay Dela PenaNo ratings yet

- Solved The Trial Balances of Orton Company Follow With The AccountsDocument1 pageSolved The Trial Balances of Orton Company Follow With The AccountsAnbu jaromiaNo ratings yet

- Solved Given The Following Facts About Sammie Bright Calculate His PreliminaryDocument1 pageSolved Given The Following Facts About Sammie Bright Calculate His PreliminaryAnbu jaromiaNo ratings yet

- Solved These Items Are Taken From The Financial Statements of Summit SDocument1 pageSolved These Items Are Taken From The Financial Statements of Summit SAnbu jaromiaNo ratings yet

- Account Receivable PresentationDocument34 pagesAccount Receivable PresentationYakub Immanuel SaputraNo ratings yet

- Multiple Choice Questions 1 Which of The Following Statements Is True A UnderDocument2 pagesMultiple Choice Questions 1 Which of The Following Statements Is True A UnderHassan JanNo ratings yet

- Chapter 3 Quick StudyDocument10 pagesChapter 3 Quick StudyPhạm Hồng Trang Alice -No ratings yet

- PDF Accounting Tools For Business Decision Making 6Th Edition Kimmel Solutions Manual Online Ebook Full ChapterDocument31 pagesPDF Accounting Tools For Business Decision Making 6Th Edition Kimmel Solutions Manual Online Ebook Full Chapterdennis.morris280100% (11)

- Accounting Paper 1 Dec 2015Document11 pagesAccounting Paper 1 Dec 2015Sudhan NairNo ratings yet

- ACTG115 - Ch04 SolutionsDocument14 pagesACTG115 - Ch04 SolutionsxxmbetaNo ratings yet

- Quiz 1Document9 pagesQuiz 1xcrunner61No ratings yet

- FMGT 1100 CH 3 Lecture Notes MatthewDocument16 pagesFMGT 1100 CH 3 Lecture Notes MatthewSophia RosieeNo ratings yet

- Adjustments Short CasesDocument1 pageAdjustments Short CasesMahmoud OkashaNo ratings yet

- Accounting Process With AnsDocument6 pagesAccounting Process With AnsMichael BongalontaNo ratings yet

- Cost and MGT Acct II Group-Assignment TayeDocument4 pagesCost and MGT Acct II Group-Assignment TayeSelamawit AssefaNo ratings yet

- Hhtfa8e ch03 SMDocument119 pagesHhtfa8e ch03 SMharryNo ratings yet

- Computation of Taxable Income and Tax After General Reductions For CorporationsDocument20 pagesComputation of Taxable Income and Tax After General Reductions For CorporationsKiều Thảo Anh100% (1)

- Solved in The Month of November Its First Month of OperationsDocument1 pageSolved in The Month of November Its First Month of OperationsAnbu jaromiaNo ratings yet

- Certified College of Accountancy's Mock Exam: PAPER: Financial Accounting (FA)Document10 pagesCertified College of Accountancy's Mock Exam: PAPER: Financial Accounting (FA)Chaiz MineNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- GIBX-SPAC and GIBXChange and GIBXSWAP Brothers Meet The WorldDocument4 pagesGIBX-SPAC and GIBXChange and GIBXSWAP Brothers Meet The WorldGIBX SPACNo ratings yet

- G12 Principles of MKTG Q2WK2 ABCDwith AnswerKeyDocument9 pagesG12 Principles of MKTG Q2WK2 ABCDwith AnswerKeyElla Marie LagosNo ratings yet

- Modern Biology: SectionDocument3 pagesModern Biology: SectionpkNo ratings yet

- Bfad RequirementsDocument2 pagesBfad RequirementsAleli Bautista67% (3)

- Cleaning Company ProfileDocument1 pageCleaning Company Profilebatousai1900No ratings yet

- Contract of UsufructDocument3 pagesContract of UsufructPatrick Angelo GutierrezNo ratings yet

- Makalah B.inggrisDocument15 pagesMakalah B.inggrisMuhammadnur AzizNo ratings yet

- Phieu Làm Bai TIEU LUAN ML160162Document3 pagesPhieu Làm Bai TIEU LUAN ML160162Nguyễn Thị Mỹ NgọcNo ratings yet

- Gemini Air CargoDocument34 pagesGemini Air CargoMichael PietrobonoNo ratings yet

- Bharati Airtel and Fayol's PrincipalDocument17 pagesBharati Airtel and Fayol's PrincipalAmit Vijay73% (45)

- CEA 2023 NotificationDocument5 pagesCEA 2023 Notificationrama chandra marndiNo ratings yet

- Cost Volume Profit AnalysisDocument18 pagesCost Volume Profit AnalysisLea GaacNo ratings yet

- Formulas To Know For EXAM: Activity & Project Duration FormulasDocument5 pagesFormulas To Know For EXAM: Activity & Project Duration FormulasMMNo ratings yet

- How We Are Getting Digital????????: Presented By: Dr. Ruchi Jain GargDocument59 pagesHow We Are Getting Digital????????: Presented By: Dr. Ruchi Jain GargDrRuchi GargNo ratings yet

- Essentials of Business Statistics Communicating With NumbersDocument19 pagesEssentials of Business Statistics Communicating With NumbersRoendianda Arfen0% (1)

- 94-Article Text-549-1-10-20191123 PDFDocument12 pages94-Article Text-549-1-10-20191123 PDFFitri AniNo ratings yet

- Problem Detail Before After: Su2I Mirror Assy LH Empty Bin Moved With Child Part 28.10.2022 - In-HouseDocument1 pageProblem Detail Before After: Su2I Mirror Assy LH Empty Bin Moved With Child Part 28.10.2022 - In-HousePalani KumarNo ratings yet

- Group 1 - Case 6 - Thomas Green Power Office Poiltics and A Career in CrisisDocument22 pagesGroup 1 - Case 6 - Thomas Green Power Office Poiltics and A Career in CrisishestiyaaNo ratings yet

- Marketing Management SyllabusDocument5 pagesMarketing Management SyllabusHannah jean Enabe100% (1)

- Atta Chakki PlantDocument77 pagesAtta Chakki PlantarifmukhtarNo ratings yet

- Principle - of - Econ - HW1 (Solution)Document8 pagesPrinciple - of - Econ - HW1 (Solution)Md Fiyadul IslamNo ratings yet

- Payslip 20230417170111Document2 pagesPayslip 20230417170111Iragavan IndraNo ratings yet

- Ebcl Part 1Document72 pagesEbcl Part 1Aman GuttaNo ratings yet

- Retail Audit: Essentials of E-RetailingDocument6 pagesRetail Audit: Essentials of E-RetailingShivangi JainNo ratings yet

- Milestone 2 CompressedDocument14 pagesMilestone 2 CompressedjulianayfutalanNo ratings yet

- Flash CourierDocument19 pagesFlash Couriereaglewatch99No ratings yet

- Hoozan Pirozmand ResumeDocument1 pageHoozan Pirozmand Resumelnvraman4570No ratings yet