Professional Documents

Culture Documents

The Following Information Relates To Starr Company S Investment in Available

The Following Information Relates To Starr Company S Investment in Available

Uploaded by

Taimur Technologist0 ratings0% found this document useful (0 votes)

26 views1 pageStarr Company purchased various bonds throughout 2016, collecting interest payments and selling some bonds. The document provides details of Starr's purchases and sales of bonds issued by Bradford, Morris, and Whipple Corporations, including transaction dates, amounts, interest rates, and fair values. Journal entries and income statement and balance sheet reporting are required for Starr's bond investment activities during the year.

Original Description:

Original Title

The Following Information Relates to Starr Company s Investment in Available

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentStarr Company purchased various bonds throughout 2016, collecting interest payments and selling some bonds. The document provides details of Starr's purchases and sales of bonds issued by Bradford, Morris, and Whipple Corporations, including transaction dates, amounts, interest rates, and fair values. Journal entries and income statement and balance sheet reporting are required for Starr's bond investment activities during the year.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

26 views1 pageThe Following Information Relates To Starr Company S Investment in Available

The Following Information Relates To Starr Company S Investment in Available

Uploaded by

Taimur TechnologistStarr Company purchased various bonds throughout 2016, collecting interest payments and selling some bonds. The document provides details of Starr's purchases and sales of bonds issued by Bradford, Morris, and Whipple Corporations, including transaction dates, amounts, interest rates, and fair values. Journal entries and income statement and balance sheet reporting are required for Starr's bond investment activities during the year.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

The following information relates to Starr Company s

investment in available #2530

The following information relates to Starr Company’s investment in available- for- sale bonds

for 2016:Jan. 1 Purchased $ 30,000 face value of Bradford Company 8% bonds for $ 29,100.

The market rate of interest is 10%, and interest on the bonds is payable each June 30 and

December 31. 1 Purchased $ 40,000 face value of Morris Company 10% bonds for $ 40,400.

The market rate of interest is 9.8%, and interest on the bonds is payable each June 30 and

December 31.June 30 Collected the interest and the following information is available:Security

Fair ValueBradford Company 8% $ 29,160Morris Company 10% 40,800July 1 Purchased $

25,000 face value of Whipple Corporation 11% bonds for $ 23,000. The market rate of Interest

is 12%, and interest on the bonds is payable each June 30 and December 31. Nov. 30 Sold the

Whipple bonds for $ 22,750 plus accrued interest. Dec. 31 Starr collected the interest, sold the

Morris bonds for $ 40,800, and the following information is also available:Security Fair

ValueBradford Company 8% bonds $ 28,800Required:1. Prepare journal entries to record the

previous information for 2016. Use the effective interest method and round all amounts to the

nearest dollar. Assume that Starr prepares semiannual financial statements. 2. Show the items

of income or loss from investment transactions that Starr reports for each 2016 semiannual

income statement. 3. Show how the investment items are reported on each of the 2016

semiannual balance sheets, assuming that management expects to dispose of all investments

within one year of purchase.View Solution:

The following information relates to Starr Company s investment in available

ANSWER

http://paperinstant.com/downloads/the-following-information-relates-to-starr-company-s-

investment-in-available/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Solution For Chapter 16 Investments (13 E)Document8 pagesSolution For Chapter 16 Investments (13 E)RaaNo ratings yet

- The Chart of Accounts of Clara S Design Service of MontrealDocument1 pageThe Chart of Accounts of Clara S Design Service of MontrealTaimur TechnologistNo ratings yet

- Acc 308 - Week4-4-2 Homework - Chapter 13Document6 pagesAcc 308 - Week4-4-2 Homework - Chapter 13Lilian L100% (1)

- Kuis UTS Genap Lab AKM II DoskoDocument4 pagesKuis UTS Genap Lab AKM II DoskoYokka FebriolaNo ratings yet

- Ch07 Beams10e TBDocument29 pagesCh07 Beams10e TBjeankoplerNo ratings yet

- P7Document2 pagesP7Andreas Brown0% (1)

- FinanceDocument1 pageFinanceflorentina0% (1)

- Solved If A Company Declared Cash Dividends During The Year ofDocument1 pageSolved If A Company Declared Cash Dividends During The Year ofAnbu jaromiaNo ratings yet

- When Market Interest Rates Were 5 Three Companies Issued BondsDocument1 pageWhen Market Interest Rates Were 5 Three Companies Issued BondsMiroslav GegoskiNo ratings yet

- The Chart of Accounts of Angel S Delivery Service of FlinDocument1 pageThe Chart of Accounts of Angel S Delivery Service of FlinTaimur TechnologistNo ratings yet

- The Bookkeeper of Floore Company Records Credit Sales in ADocument1 pageThe Bookkeeper of Floore Company Records Credit Sales in ATaimur TechnologistNo ratings yet

- Solutions ChandraDocument80 pagesSolutions ChandraPriya GowdaNo ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch25Document6 pagesHull OFOD10e MultipleChoice Questions and Answers Ch25Kevin Molly KamrathNo ratings yet

- Solved Refer To The Information For Roman Corporation Below Roman Corporation DecidedDocument1 pageSolved Refer To The Information For Roman Corporation Below Roman Corporation DecidedAnbu jaromiaNo ratings yet

- Solved Refer To The Information For Crafty Corporation Below Crafty Corporation IssuedDocument1 pageSolved Refer To The Information For Crafty Corporation Below Crafty Corporation IssuedAnbu jaromiaNo ratings yet

- 12 Altprob 8eDocument4 pages12 Altprob 8eRama DulceNo ratings yet

- CH 16Document3 pagesCH 16vivienNo ratings yet

- Investments and Fair Value Accounting: Principles of Financial Accounting With Conceptual Emphasis On IFRSDocument137 pagesInvestments and Fair Value Accounting: Principles of Financial Accounting With Conceptual Emphasis On IFRSallfi basirohNo ratings yet

- The Following Information Is Available For Bott Company Additional Information ForDocument1 pageThe Following Information Is Available For Bott Company Additional Information ForTaimur TechnologistNo ratings yet

- Audit 2 - Topic4Document18 pagesAudit 2 - Topic4YUSUF0% (1)

- Sample Final Exam QuestionsDocument28 pagesSample Final Exam QuestionsHuyNo ratings yet

- Intermediate Accounting 1 FinalDocument5 pagesIntermediate Accounting 1 FinalCix SorcheNo ratings yet

- Determine The Bond Issue Proceeds For Each of The BondsDocument1 pageDetermine The Bond Issue Proceeds For Each of The BondsTaimour HassanNo ratings yet

- Solved The Webster Company Has Just Paid A Dividend of 5 25Document1 pageSolved The Webster Company Has Just Paid A Dividend of 5 25Anbu jaromiaNo ratings yet

- 1 Cash Dividends On The 10 Par Value Common Stock PDFDocument2 pages1 Cash Dividends On The 10 Par Value Common Stock PDFHassan JanNo ratings yet

- Accounting Textbook Solutions - 67Document19 pagesAccounting Textbook Solutions - 67acc-expertNo ratings yet

- Chapter 17 In-Class Exercises Intermediate AccountingDocument2 pagesChapter 17 In-Class Exercises Intermediate AccountingFoodlovesJNo ratings yet

- Adjustments For Preparation of Financial Statements (ACCA)Document9 pagesAdjustments For Preparation of Financial Statements (ACCA)team aspirantsNo ratings yet

- Tugas Bab 14 Ak IntermediateDocument2 pagesTugas Bab 14 Ak IntermediateSiti MulyaniNo ratings yet

- The Following Information Relates To The 2014 Debt and EquityDocument1 pageThe Following Information Relates To The 2014 Debt and EquityTaimur TechnologistNo ratings yet

- Value Investing Congress NY 2010 AshtonDocument26 pagesValue Investing Congress NY 2010 Ashtonbrian4877No ratings yet

- Various Dividends Carlyon Company Listed The Following Items in ItsDocument1 pageVarious Dividends Carlyon Company Listed The Following Items in ItsTaimour HassanNo ratings yet

- FR QB 1Document14 pagesFR QB 1Tanya AgarwalNo ratings yet

- 12 Altprob 7eDocument6 pages12 Altprob 7eAarti JNo ratings yet

- ACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersDocument7 pagesACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersMr.XworldNo ratings yet

- Prospectus Supplement 2023Document91 pagesProspectus Supplement 2023hines.trustNo ratings yet

- Olmstead Corporation S Capital Structure Is As Follows The Following Additional InformationDocument1 pageOlmstead Corporation S Capital Structure Is As Follows The Following Additional InformationHassan JanNo ratings yet

- Solved The Following Information Is Available For Bernard Corporation For 2019 Required 1Document1 pageSolved The Following Information Is Available For Bernard Corporation For 2019 Required 1Anbu jaromiaNo ratings yet

- 2023 Fef Annual Letter To Shareholders RoicDocument10 pages2023 Fef Annual Letter To Shareholders RoicCaster XampakhNo ratings yet

- Monday, December 15, 2008Document9 pagesMonday, December 15, 2008Vanessa HaliliNo ratings yet

- Scofield Financial Co Is A Regional Insurance Company That BeganDocument1 pageScofield Financial Co Is A Regional Insurance Company That Begantrilocksp SinghNo ratings yet

- Working 7Document5 pagesWorking 7Hà Lê DuyNo ratings yet

- ACC 3003 - Final Exam RevisionDocument19 pagesACC 3003 - Final Exam Revisionfalnuaimi001100% (1)

- The Following Material Represents The Cover Page and Summary ofDocument2 pagesThe Following Material Represents The Cover Page and Summary oftrilocksp SinghNo ratings yet

- Solved An Analysis of The Transactions of Rutherford Company For The PDFDocument1 pageSolved An Analysis of The Transactions of Rutherford Company For The PDFAnbu jaromiaNo ratings yet

- TEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Document5 pagesTEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Mike HerreraNo ratings yet

- ACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019Document11 pagesACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019nothingNo ratings yet

- Working 4Document8 pagesWorking 4Hà Lê DuyNo ratings yet

- Mishkin Econ13e PPT 02Document26 pagesMishkin Econ13e PPT 02Omar 11No ratings yet

- Select The Best Answer For Each of The Following 1 OnDocument2 pagesSelect The Best Answer For Each of The Following 1 OnFreelance WorkerNo ratings yet

- A1c - SW#3 PDFDocument3 pagesA1c - SW#3 PDFLemuel ReñaNo ratings yet

- Index Providers - Whales Behind The Scenes of ETF'sDocument54 pagesIndex Providers - Whales Behind The Scenes of ETF'sSurendranNo ratings yet

- Question and Answer - 34Document31 pagesQuestion and Answer - 34acc-expertNo ratings yet

- Excercises MA 2023 1Document4 pagesExcercises MA 2023 1fin.minhtringuyenNo ratings yet

- p1 24 Bonds PayableDocument5 pagesp1 24 Bonds PayablePrincess MangudadatuNo ratings yet

- The Consolidated Statement of Financial Position For Mic As atDocument1 pageThe Consolidated Statement of Financial Position For Mic As atTaimur TechnologistNo ratings yet

- SBR Kit 2025 - Mock Exam 1Document30 pagesSBR Kit 2025 - Mock Exam 1Myo NaingNo ratings yet

- HW On Bonds Payable T1 2020-2021Document2 pagesHW On Bonds Payable T1 2020-2021Luna MeowNo ratings yet

- Financial Instruments CASE STUDIES FRDocument5 pagesFinancial Instruments CASE STUDIES FRDaniel AdegboyeNo ratings yet

- CofpDocument5 pagesCofpAdil HassanNo ratings yet

- Graham Railways Inc Is Evaluating Its Operations and Provides TheDocument1 pageGraham Railways Inc Is Evaluating Its Operations and Provides TheFreelance WorkerNo ratings yet

- Toth Company Had The Following Assets and Liabilities On TheDocument1 pageToth Company Had The Following Assets and Liabilities On Thetrilocksp SinghNo ratings yet

- In Each of The Following Independent Cases The Company ClosesDocument1 pageIn Each of The Following Independent Cases The Company ClosesM Bilal SaleemNo ratings yet

- AUD.2024 5. Substantive Tests of InvestmentsDocument4 pagesAUD.2024 5. Substantive Tests of InvestmentskrizmyrelatadoNo ratings yet

- How Would Have a Low-Cost Index Fund Approach Worked During the Great Depression?From EverandHow Would Have a Low-Cost Index Fund Approach Worked During the Great Depression?No ratings yet

- The Directors of Panel A Public Limited Company Are ReviewingDocument2 pagesThe Directors of Panel A Public Limited Company Are ReviewingTaimur TechnologistNo ratings yet

- The Closing Balance Sheet Items Are Given Below For JasonDocument1 pageThe Closing Balance Sheet Items Are Given Below For JasonTaimur TechnologistNo ratings yet

- The Columbus Electronics Company Is Considering Replacing A 1 000 Pound Capacity ForkliftDocument1 pageThe Columbus Electronics Company Is Considering Replacing A 1 000 Pound Capacity ForkliftTaimur TechnologistNo ratings yet

- The Company Lalo Company Headquartered in Vaduz Is A CompanyDocument4 pagesThe Company Lalo Company Headquartered in Vaduz Is A CompanyTaimur TechnologistNo ratings yet

- The Candy Co of Lethbridge Pays Its Workers Twice EachDocument1 pageThe Candy Co of Lethbridge Pays Its Workers Twice EachTaimur TechnologistNo ratings yet

- The Bragg Stratton Company Manufactures A Specialized Motor ForDocument1 pageThe Bragg Stratton Company Manufactures A Specialized Motor ForTaimur TechnologistNo ratings yet

- The Consolidated Statement of Financial Position For Mic As atDocument1 pageThe Consolidated Statement of Financial Position For Mic As atTaimur TechnologistNo ratings yet

- The December 31 2014 Unadjusted Trial Balance For Tucker PhotographersDocument1 pageThe December 31 2014 Unadjusted Trial Balance For Tucker PhotographersTaimur TechnologistNo ratings yet

- The Cash General Ledger Account Balance of Gladstone LTD WasDocument1 pageThe Cash General Ledger Account Balance of Gladstone LTD WasTaimur TechnologistNo ratings yet

- The Cash Flows Below Were Extracted From The Accounts ofDocument1 pageThe Cash Flows Below Were Extracted From The Accounts ofTaimur TechnologistNo ratings yet

- The Accountant For Karma Counselling Services Found Several Errors inDocument1 pageThe Accountant For Karma Counselling Services Found Several Errors inTaimur TechnologistNo ratings yet

- The Chart of Accounts For Angel S Delivery Service of FlinDocument1 pageThe Chart of Accounts For Angel S Delivery Service of FlinTaimur TechnologistNo ratings yet

- The Accounting Records of I Eclaire Delivery Services Show The FollowingDocument1 pageThe Accounting Records of I Eclaire Delivery Services Show The FollowingTaimur TechnologistNo ratings yet

- The Accountants at French Perfumery Decided To Increase The PriceDocument1 pageThe Accountants at French Perfumery Decided To Increase The PriceTaimur TechnologistNo ratings yet

- The American Aluminum Company Is Considering Making A Major InvestmentDocument1 pageThe American Aluminum Company Is Considering Making A Major InvestmentTaimur TechnologistNo ratings yet

- The Accompanying Chart Figure p8 6 Shows The Expected Monthly ProfitDocument1 pageThe Accompanying Chart Figure p8 6 Shows The Expected Monthly ProfitTaimur TechnologistNo ratings yet

- The A M I Company Is Considering Installing A New Process MachineDocument1 pageThe A M I Company Is Considering Installing A New Process MachineTaimur TechnologistNo ratings yet

- The Annual Revenues in Billion Dollars in Financial Year 2001Document1 pageThe Annual Revenues in Billion Dollars in Financial Year 2001Taimur TechnologistNo ratings yet

- CH10Document20 pagesCH10superuser10100% (1)

- CH2.2 - AlkeneDocument48 pagesCH2.2 - AlkeneNur Ain SyuhadaNo ratings yet

- 12 Chemistry Impq CH07 The P Block Elements 02Document21 pages12 Chemistry Impq CH07 The P Block Elements 02Saurabh PatilNo ratings yet

- Electron Configuration PDFDocument14 pagesElectron Configuration PDFsitiNo ratings yet

- The FRM Part I: Formula Guide: Value and Risk ModelsDocument10 pagesThe FRM Part I: Formula Guide: Value and Risk ModelsJavneet KaurNo ratings yet

- Chem Unit 5 Inorganic AnswersDocument13 pagesChem Unit 5 Inorganic Answersareyouthere92No ratings yet

- Last Post Labs (7 and 8)Document6 pagesLast Post Labs (7 and 8)Chell AtaizaNo ratings yet

- Synthetic RubbersDocument3 pagesSynthetic RubbersKamal KishoreNo ratings yet

- Power Generation From Sugar Mills PDFDocument9 pagesPower Generation From Sugar Mills PDFnewuser01No ratings yet

- A Primer On Syndicated Term Loans PDFDocument4 pagesA Primer On Syndicated Term Loans PDFtrkhoa2002No ratings yet

- 1st Year Chemistry Important Mcqs For Exam 2013Document50 pages1st Year Chemistry Important Mcqs For Exam 2013ParshantKumarBajajNo ratings yet

- PHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities September 3, 2020Document3 pagesPHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities September 3, 2020Bojes Wandi100% (1)

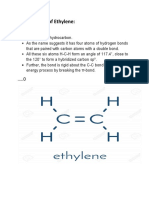

- Structure of EthyleneDocument1 pageStructure of EthyleneCarry OnNo ratings yet

- Acid Base Equilibria QPDocument28 pagesAcid Base Equilibria QPTrance OscNo ratings yet

- Chapter 27 Teaching NotesDocument5 pagesChapter 27 Teaching NotesMrbernardNo ratings yet

- Bonds EngDocument10 pagesBonds EngArka Narayan DashguptaNo ratings yet

- Outstanding Stock 2021-22 List of Government of India Securities Outstanding As On February 08, 2022Document4 pagesOutstanding Stock 2021-22 List of Government of India Securities Outstanding As On February 08, 2022Alpha TraderNo ratings yet

- Basic of Organic ChemistryDocument11 pagesBasic of Organic ChemistryDr. Prashan Kumar ThakurNo ratings yet

- ProteinsDocument25 pagesProteinsapi-260674021No ratings yet

- Edexcel AS Chemistry Unit 2 Jan2013 MSDocument22 pagesEdexcel AS Chemistry Unit 2 Jan2013 MSPakorn WinayanuwattikunNo ratings yet

- 9701 w15 QP 23 PDFDocument8 pages9701 w15 QP 23 PDFAl BeruniNo ratings yet

- Soal Latihan BondDocument3 pagesSoal Latihan BondMohamadRezaSyahputraNo ratings yet

- Hydrogen Deficiency Index Degrees of UnsaturationDocument4 pagesHydrogen Deficiency Index Degrees of UnsaturationDeevanesh Gengatharan100% (1)

- Cromwell v. County of Sac, 96 U.S. 51 (1878)Document10 pagesCromwell v. County of Sac, 96 U.S. 51 (1878)Scribd Government DocsNo ratings yet

- Semi-Annual Interest, Journal Entries)Document3 pagesSemi-Annual Interest, Journal Entries)Jazehl Joy ValdezNo ratings yet

- Australian Journal of Chemistry (1975), 28 (10), 2227-54Document28 pagesAustralian Journal of Chemistry (1975), 28 (10), 2227-54rrgodboleNo ratings yet

- PC ConceptualDocument3 pagesPC Conceptualjraman24No ratings yet

- Introduction To Bonds PayableDocument2 pagesIntroduction To Bonds PayableMarko Zero FourNo ratings yet