Professional Documents

Culture Documents

3B Adjusting Entries

3B Adjusting Entries

Uploaded by

Ryoma Echizen0 ratings0% found this document useful (0 votes)

126 views2 pagesThis document provides information to prepare adjusting entries, an adjusted trial balance, and financial statements for a window washing company. It lists unadjusted account balances and adjustments needed for supplies, prepaid insurance, equipment depreciation, a note payable, unearned revenue, wages payable, and accounts receivable. The assistant must record adjusting entries, complete an adjusted trial balance, and prepare financial statements including an income statement, statement of changes in equity, and balance sheet. Closing entries are also required to be prepared.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides information to prepare adjusting entries, an adjusted trial balance, and financial statements for a window washing company. It lists unadjusted account balances and adjustments needed for supplies, prepaid insurance, equipment depreciation, a note payable, unearned revenue, wages payable, and accounts receivable. The assistant must record adjusting entries, complete an adjusted trial balance, and prepare financial statements including an income statement, statement of changes in equity, and balance sheet. Closing entries are also required to be prepared.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

126 views2 pages3B Adjusting Entries

3B Adjusting Entries

Uploaded by

Ryoma EchizenThis document provides information to prepare adjusting entries, an adjusted trial balance, and financial statements for a window washing company. It lists unadjusted account balances and adjustments needed for supplies, prepaid insurance, equipment depreciation, a note payable, unearned revenue, wages payable, and accounts receivable. The assistant must record adjusting entries, complete an adjusted trial balance, and prepare financial statements including an income statement, statement of changes in equity, and balance sheet. Closing entries are also required to be prepared.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

3B Adjusting Entries, the Adjusted Trial Balance Worksheet, Financial Statements,

Closing Entries (and the kitchen sink.)

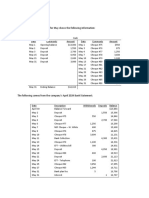

Below is the September 30, 2024 unadjusted trial balance of CleanPanes Window Washers:

Unadjusted TB Adjustments Adjusted TB

DR CR DR CR DR CR

Cash $1,600

Accounts receivable 750

Supplies 400

Prepaid insurance 1,600

Prepaid rent 800

Equipment 20,000

A.D. – Equipment $2,000

Accounts payable 900

Wages payable

Interest payable

Unearned washing revenue 600

Note payable 4,000

Common shares 1,000

Retained earnings 2,550

Dividends 1,000

Washing revenue 38,000

Wages expense 12,000

Interest expense

Depreciation expense

Supplies expense

Maintenance expense 100

Insurance expense

Rent expense 8,800

Income tax expense 2,000

Total $49,050 $49,050

The company’s fiscal year end is September 30, and the following items require adjustment:

a.) A count of supplies reveals $50 were on hand on September 30.

b.) The $1,600 insurance policy was purchased on February 1, 2024.

c.) The equipment was purchased last year. At the time of purchase, the estimated life of the equipment was

10 years with no estimated residual value.

d.) The $4,000 note payable was issued on July 1, 2024 and accrues interest at a 7% annual rate. The note is

expected to be repaid in January of 2025.

e.) On September 1, 2024 the company entered into a 6-month contract to provide window washing for a

local restaurant. The restaurant paid $600 in advance for the service. CleanPanes has washed the

restaurant’s windows properly up to September 30.

f.) The company had an employee who had unpaid wages of $100 on September 30.

g.) As of September 30, the company had completed, but not yet billed $250 worth of work.

h.) The prepaid rent was for the months of August and September. It has all expired. Required:

a.) As necessary, record adjusting journal entries based on items a.) through g.) above.

b.) Using your adjusting journal entries, complete the adjusted trial balance.

c.) Based on the adjusted trial balance, prepare an income statement, statement of changes in equity and a

balance sheet. Assume no common shares were issued during the year.

Prepare closing entries for the company.

You might also like

- Quizzes - Chapter 9 - Acctg Cycle of A Service BusinessDocument12 pagesQuizzes - Chapter 9 - Acctg Cycle of A Service BusinessAmie Jane Miranda50% (4)

- Quizzer - Financial Accounting ProcessDocument8 pagesQuizzer - Financial Accounting ProcessLuisitoNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- $ .0 Unabsorbed Head Office Very Important ArticleDocument161 pages$ .0 Unabsorbed Head Office Very Important ArticleIslam Hamdy100% (1)

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- Accounting Assignment 04A 207Document10 pagesAccounting Assignment 04A 207Aniyah's RanticsNo ratings yet

- RequiredDocument11 pagesRequiredKean Brean GallosNo ratings yet

- Receivables Practice Test1Document1 pageReceivables Practice Test1Ryoma EchizenNo ratings yet

- Farmlease AgreementDocument5 pagesFarmlease AgreementNisco NegrosNo ratings yet

- NDC Vs CIRDocument6 pagesNDC Vs CIRAr Yan SebNo ratings yet

- DO 174-17 Rules Implementing Articles 106 To 109 of The Labor Code, As AmendedDocument13 pagesDO 174-17 Rules Implementing Articles 106 To 109 of The Labor Code, As AmendedNadine BaligodNo ratings yet

- International JW Marriott Hotel Canada Agreement LetterDocument3 pagesInternational JW Marriott Hotel Canada Agreement LetterPrem ChopraNo ratings yet

- Joint Development Agreement THIS JOINT DEVELOPMENT AGREEMENT Is Made and Executed OnDocument32 pagesJoint Development Agreement THIS JOINT DEVELOPMENT AGREEMENT Is Made and Executed Onnagesh gowdaNo ratings yet

- Fedman Development Corp Vs Agcaoili CivProDocument3 pagesFedman Development Corp Vs Agcaoili CivProcrystalNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A SolutionsDocument17 pagesChapter 4 - Complete The Accounting Cycle Practice Set A SolutionsNguyễn Minh ĐứcNo ratings yet

- Work Sheet On Financial AccountingDocument3 pagesWork Sheet On Financial AccountingFantayNo ratings yet

- Acc101 - Chapter 2: Accounting For TransactionsDocument16 pagesAcc101 - Chapter 2: Accounting For TransactionsMauricio AceNo ratings yet

- F23 B01 Midterm Review QuestionsDocument9 pagesF23 B01 Midterm Review QuestionsDaniel OladejoNo ratings yet

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesPhạm Hồng Trang Alice -No ratings yet

- Chapter 3 Practice QuestionsDocument3 pagesChapter 3 Practice QuestionsFamily PicturesNo ratings yet

- Accounting 2301 Final Exam Review ExamplesDocument38 pagesAccounting 2301 Final Exam Review ExamplesVusal GahramanovNo ratings yet

- Multiple Choice QuestionDocument3 pagesMultiple Choice QuestionEka FerranikaNo ratings yet

- Accounting For Managers (B) - Jobaida Khanom Final ExamDocument5 pagesAccounting For Managers (B) - Jobaida Khanom Final ExamTanveer AhmedNo ratings yet

- Chapter 4 Question Review 11th EdDocument9 pagesChapter 4 Question Review 11th EdEmiraslan MhrrovNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Chapter 4 Question ReviewDocument11 pagesChapter 4 Question ReviewUyenNo ratings yet

- Exercise Chapter 3Document7 pagesExercise Chapter 3leen attilyNo ratings yet

- Poa 01 - 1.2223Document3 pagesPoa 01 - 1.2223Phương Anh HàNo ratings yet

- ACC101 Chapter2newDocument19 pagesACC101 Chapter2newCASTOR JAVIERNo ratings yet

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet

- ACC101 Chapter2new EditedDocument19 pagesACC101 Chapter2new EditedCASTOR JAVIERNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Mock 1 Mid-Term Exam AcountabilityDocument6 pagesMock 1 Mid-Term Exam AcountabilityJhon WickNo ratings yet

- Date Description Debit $ Credit $Document7 pagesDate Description Debit $ Credit $Muntasir AhmmedNo ratings yet

- Practise For MidDocument3 pagesPractise For MidIftekhar AhmedNo ratings yet

- Acc 109 P3 Quiz No 2Document2 pagesAcc 109 P3 Quiz No 2Wilmz SalacsacanNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesChu Thị ThủyNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Sample Midterm Exam With SolutionDocument17 pagesSample Midterm Exam With Solutionq mNo ratings yet

- Afar 2Document7 pagesAfar 2Diana Faye CaduadaNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesĐức TiếnNo ratings yet

- Advanced Accounting - Test 1: B. Prepare The Journal Entries To Transfer Dan To Corp. Under TrusteeshipDocument6 pagesAdvanced Accounting - Test 1: B. Prepare The Journal Entries To Transfer Dan To Corp. Under TrusteeshipFrilincia Maria HosianaNo ratings yet

- 221 REQUIREMENT For Summer Class 1Document2 pages221 REQUIREMENT For Summer Class 1Lealyn CuestaNo ratings yet

- Chapter 3new BOOK QuestionsDocument5 pagesChapter 3new BOOK Questionsgameppass22No ratings yet

- 592198Document11 pages592198mohitgaba19No ratings yet

- CH 3Document10 pagesCH 3Mohammed mostafaNo ratings yet

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- Group Assignment On Fundamentals of Accounting IDocument6 pagesGroup Assignment On Fundamentals of Accounting IKaleab ShimelsNo ratings yet

- FM Quiz Set ADocument3 pagesFM Quiz Set AShaira Mae TomasNo ratings yet

- Test Soal AdjustingDocument2 pagesTest Soal AdjustingNicolas ErnestoNo ratings yet

- Principles of Accounting (A B E)Document3 pagesPrinciples of Accounting (A B E)r kNo ratings yet

- Chapter 4 Question ReviewDocument11 pagesChapter 4 Question ReviewNayan SahaNo ratings yet

- Accountancy Auditing 2016Document7 pagesAccountancy Auditing 2016Abdul basitNo ratings yet

- Lecture 1 - Adjusting The Accounts - QDocument3 pagesLecture 1 - Adjusting The Accounts - Q1231402960No ratings yet

- Long Exam Part 1Document11 pagesLong Exam Part 1yuwimiko27No ratings yet

- Individual Assignment 1 ACTDocument4 pagesIndividual Assignment 1 ACTKalkidanNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- ACC101 Chapter2newDocument19 pagesACC101 Chapter2newDEREJENo ratings yet

- Accounting For Transactions: Key Terms and Concepts To KnowDocument19 pagesAccounting For Transactions: Key Terms and Concepts To KnowMaria Nicole OroNo ratings yet

- Accounting For Transactions: Key Terms and Concepts To KnowDocument19 pagesAccounting For Transactions: Key Terms and Concepts To KnowAileenNo ratings yet

- Exam Revision - Chapter 3 4Document6 pagesExam Revision - Chapter 3 4Vũ Thị NgoanNo ratings yet

- 助教課講義 Ch.4Document12 pages助教課講義 Ch.45213adamNo ratings yet

- Exam Revision - 3 & 4 SolDocument6 pagesExam Revision - 3 & 4 SolNguyễn Minh ĐứcNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 1-3B Basic Financial StatementsDocument1 page1-3B Basic Financial StatementsRyoma EchizenNo ratings yet

- Basic Cash Flow Statemen2Document2 pagesBasic Cash Flow Statemen2Ryoma EchizenNo ratings yet

- FarDocument1 pageFarRyoma EchizenNo ratings yet

- Adv Acc 6Document1 pageAdv Acc 6Ryoma EchizenNo ratings yet

- Basic Accounting4Document1 pageBasic Accounting4Ryoma EchizenNo ratings yet

- 2-1B Basic Journal Entries - New Company: March 1Document1 page2-1B Basic Journal Entries - New Company: March 1Ryoma EchizenNo ratings yet

- ELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityDocument1 pageELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityRyoma EchizenNo ratings yet

- 2-4B More Journal Entries, T-Accounts, Trial Balance: February 1 February 3 February 5 February 7 February 8 February 14Document1 page2-4B More Journal Entries, T-Accounts, Trial Balance: February 1 February 3 February 5 February 7 February 8 February 14Ryoma EchizenNo ratings yet

- Basic Accounting2Document1 pageBasic Accounting2Ryoma EchizenNo ratings yet

- 2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyDocument1 page2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyRyoma EchizenNo ratings yet

- Basic Accounting3Document1 pageBasic Accounting3Ryoma EchizenNo ratings yet

- Bank Reconciliation1Document2 pagesBank Reconciliation1Ryoma EchizenNo ratings yet

- 3A Adjusting EntriesDocument2 pages3A Adjusting EntriesRyoma Echizen0% (1)

- Solution:: J's Capital Cash Machinery and Equipment Building Mortgage J's Capital Balance 2,900,000Document1 pageSolution:: J's Capital Cash Machinery and Equipment Building Mortgage J's Capital Balance 2,900,000Ryoma EchizenNo ratings yet

- 3B Adjusting EntriesDocument2 pages3B Adjusting EntriesRyoma EchizenNo ratings yet

- 3 Closing EntriesDocument2 pages3 Closing EntriesRyoma Echizen0% (1)

- Bank ReconciliationDocument2 pagesBank ReconciliationRyoma EchizenNo ratings yet

- Bank Reconciliation2Document2 pagesBank Reconciliation2Ryoma EchizenNo ratings yet

- Consulting Agreement TemplateDocument5 pagesConsulting Agreement TemplateSean Porter100% (1)

- Offer Letter Sunil KumarDocument3 pagesOffer Letter Sunil KumarSunil PatelNo ratings yet

- Dick A Professional Attitude Towards Coaching PDFDocument11 pagesDick A Professional Attitude Towards Coaching PDFAltec AlsingNo ratings yet

- Agreement: PRODUCER"), Filipino, of Legal Age, With Address at - (Please Provide Details On TheDocument10 pagesAgreement: PRODUCER"), Filipino, of Legal Age, With Address at - (Please Provide Details On TheHBENo ratings yet

- Mallo V Southeast Asian CollegeDocument2 pagesMallo V Southeast Asian CollegeCelest AtasNo ratings yet

- Chapter 3 Employment Income A 202Document79 pagesChapter 3 Employment Income A 202ateen rizalmanNo ratings yet

- Electrical ServicesDocument50 pagesElectrical ServicesSundar RajanNo ratings yet

- Topic 2 Leases Part 2.4Document58 pagesTopic 2 Leases Part 2.4Ollid Kline Jayson JNo ratings yet

- Master Use Rcording LicenseDocument2 pagesMaster Use Rcording LicenseHeather Moore100% (1)

- CASE DIGEST (ALFREDO v. BORRASDocument3 pagesCASE DIGEST (ALFREDO v. BORRASVonna TerribleNo ratings yet

- Insurance Law BAR QDocument29 pagesInsurance Law BAR QYour Public ProfileNo ratings yet

- Romelyn G. Gustuir: Question: How Do You Treat The Claim of Philippines Over Sabah? Is ItDocument2 pagesRomelyn G. Gustuir: Question: How Do You Treat The Claim of Philippines Over Sabah? Is ItRomelyn Gocoyo GustuirNo ratings yet

- Yulo V Yang Chiao SengDocument2 pagesYulo V Yang Chiao SengmikkimouuseNo ratings yet

- 1partnership Basic ConceptsDocument18 pages1partnership Basic ConceptsAthelano B. Guieb IIINo ratings yet

- CG Advance PaymentDocument3 pagesCG Advance Paymentr_atneshNo ratings yet

- NegoDocument16 pagesNegolaizaNo ratings yet

- Digest Country BankersDocument2 pagesDigest Country BankersMichelleMich Mangubat DescartinNo ratings yet

- Engagement of ConsultantDocument39 pagesEngagement of ConsultantChandrasekhar GummadiNo ratings yet

- GST Law 2017 Download GST PPT 2017Document34 pagesGST Law 2017 Download GST PPT 2017ShyamNo ratings yet

- CRISTOBAL BONNEVIE V DecisionDocument4 pagesCRISTOBAL BONNEVIE V DecisionKaiserNo ratings yet

- Handbook AmieDocument187 pagesHandbook AmieAman KumarNo ratings yet

- EPC and Lump Sum ContractsDocument1 pageEPC and Lump Sum Contractsjadal khanNo ratings yet

- Oklahoma City Satanic Black Mass PermitDocument2 pagesOklahoma City Satanic Black Mass PermitJeff QuintonNo ratings yet